Northwest Biotherapeutics Inc - Securities Registration: Employee Benefit Plan (S-8)

November 21 2007 - 4:02PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

NORTHWEST BIOTHERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

|

|

94-3306718

|

|

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

7600 Wisconsin Ave, 7th Floor

Bethesda, Maryland

|

|

20814

|

|

|

|

|

(Address of principal

executive offices)

|

|

(Zip Code)

|

Northwest Biotherapeutics, Inc. 2007 Stock Option Plan

(Full title of the plan)

Alton L. Boynton, Chief Executive Officer

7600 Wisconsin Ave, 7th Floor

Bethesda, Maryland 20814

(240) 497-9024

copies to:

David H. Engvall, Esq.

Covington & Burling LLP

1201 Pennsylvania Avenue, NW

Washington, DC 20004

(202) 662-6000

(Name and address and telephone of agent for service)

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proposed maximum

|

|

|

Proposed maximum

|

|

|

|

|

|

|

Title of securities

|

|

|

Amount to be

|

|

|

offering price per

|

|

|

aggregate offering

|

|

|

Amount of

|

|

|

|

to be registered

|

|

|

registered (1)

|

|

|

share (2)

|

|

|

price

|

|

|

registration fee

|

|

|

|

Common Stock (3)

|

|

|

|

5,480,868

|

|

|

|

$

|

2.20

|

|

|

|

$

|

12,057,910

|

|

|

|

$

|

370.18

|

|

|

|

|

(1) This Registration Statement shall also cover any additional shares of the Registrant’s

Common Stock that become issuable in respect of the securities identified in the above table by

reason of any stock dividend, stock split, recapitalization or other similar transaction effected

without the Registrant’s receipt of consideration which results in an increase in the number of

outstanding shares of the Registrant’s Common Stock.

(2) Estimated solely for the purpose of calculating the amount of the registration fee

pursuant to Rule 457(c) of the Securities Act of 1933, the price per share and aggregate

offering price are based upon the average closing bid and ask price of the Common Stock of the

Registrant as listed on the OTC Bulletin Board on November 16, 2007.

(3) Includes associated Common Stock purchase rights.

TABLE OF CONTENTS

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

Item 1 Plan Information.

A prospectus setting forth the information requested by this Item will be sent or given to

participants in the 2007 Stock Option Plan as specified by Rule 428(b)(1) under the Securities Act

of 1933.

Item 2 Registrant Information and Employee Plan Annual Information.

A prospectus setting forth the information requested by this Item will be sent or given to

participants in the 2007 Stock Option Plan as specified by Rule 428(b)(1) under the Securities Act

of 1933.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3 Incorporation of Documents by Reference.

The following documents are hereby incorporated by reference into this Registration Statement:

(a) The Registrant’s Annual Report on Form 10-K for the fiscal year ended December 31, 2006,

filed with the Securities and Exchange Commission (the “Commission”) on April 17, 2007.

(b) The Registrant’s Quarterly Reports on Form 10-Q for the quarters ended March 31, June 30

and September 30, 2007, filed with the Commission on May 15, 2007, August 20, 2007 and November 14,

2007, respectively.

(c) The Common Stock being registered pursuant to this registration statement is part of a

class of securities registered under Section 12 of the Exchange Act. A description of such

securities is contained in the Company’s registration statement under the Exchange Act, including

any amendment or description filed for the purpose of updating such description, and is

incorporated herein by reference.

(d) The Registrant’s Form 8-K filed with the Commission on May 21, 2007.

(e) The Registrant’s Form 8-K filed with the Commission on June 1, 2007.

(f) The Registrant’s Form 8-K filed with the Commission on June 4, 2007.

(g) The Registrant’s Form 8-K filed with the Commission on June 7, 2007.

(h) The Registrant’s Form 8-K filed with the Commission on June 18, 2007.

(i) The Registrant’s Form 8-K filed with the Commission on June 22, 2007.

(j) The Registrant’s Form 8-K filed with the Commission on August 29, 2007.

(k) The Registrant’s Form 8-K filed with the Commission on October 2, 2007.

(l) In addition, all documents subsequently filed by the Registrant pursuant to Sections

13(a), 13(c), 14, and 15(d) of the Exchange Act, prior to the filing of a post-effective amendment

which indicates that all securities offered have been sold or which deregisters all securities then

remaining unsold, shall be deemed to be incorporated by reference into this Registration Statement

and to be a part hereof from the date of filing of such documents.

The class of securities to be offered is Common Stock and associated rights to purchase additional

Common Stock upon the occurrence of certain events.

Item 4 Description of Securities.

Not applicable. The class of securities to be offered is registered under Section 12 of the

Exchange Act.

Item 5 Interests of Named Experts and Counsel.

Not applicable.

Item 6 Indemnification of Directors and Officers.

Our Certificate of Incorporation and By-Laws provide that we must indemnify to the fullest extent

permitted by law any person who was or is a party or is threatened to be made a party to any

threatened, pending or completed action, suit or proceeding, whether civil, criminal,

administrative or investigative (other than an action by or in our right) by reason of the fact

that he or she is or was one of our directors or officers or is or was serving at our request as a

director or officer of another corporation, partnership, joint venture, trust, employee benefit

plan or other enterprise. The rights to indemnification set forth above are not exclusive of any

other rights to which such person may be entitled under any statute, provision of our Certificate

of Incorporation or By-Laws, agreements, vote of stockholders or disinterested directors or

otherwise.

Our Certificate of Incorporation and By-Laws generally follow the language of Section 145 of the

Delaware General Corporation Law (the “DGCL”) and specify certain circumstances in which a finding

is required that the person seeking indemnification acted in good faith, for purposes of

determining whether indemnification is available. Under our Certificate of Incorporation and

By-Laws, determinations of good faith for purposes of determining whether indemnification is

available are made (1) by our board of directors by a majority vote of a quorum consisting of

directors who were not parties to such action, suit or proceeding, or (2) if such a quorum is not

obtainable, or, if a quorum of disinterested directors so directs, by

independent legal counsel in a written opinion or (3) by the stockholders. We believe that

indemnification under our Certificate of Incorporation and By-Laws covers negligence and gross

negligence on the part of indemnified parties.

Pursuant to Section 145 of the DGCL, we generally have the power to indemnify our current and

former directors, officers, employees and agents against expenses and liabilities that they incur

in connection with any suit to which they are, or are threatened to be made, a party by reason of

their serving in such positions so long as they acted in good faith and in a manner they reasonably

believed to be in, or not opposed to, our best interests, and with respect to any criminal action,

they had no reasonable cause to believe their conduct was unlawful. The statute expressly provides

that the power to indemnify authorized thereby is not exclusive of any rights granted under any

bylaw, agreement, vote of stockholders or disinterested directors or otherwise. We also have the

power to purchase and maintain insurance for such persons.

The above discussion of our Certificate of Incorporation and By-Laws and Section 145 of the DGCL is

not intended to be exhaustive and is qualified in its entirety by each of those documents and that

statute.

The Registrant has been advised, however, that it is the position of the Commission that, insofar

as such provision in the Registrant’s Certificate of Incorporation may be invoked for liabilities

rising under the Securities Act, such provision is against public policy and is therefore

unenforceable.

Item 7 Exemption from Registration Claimed.

Not applicable.

Item 8 Exhibits.

|

|

|

|

|

5.1

|

|

Opinion of Counsel.

|

|

|

|

|

|

10.1

|

|

Northwest Biotherapeutics, Inc. 2007 Stock Option Plan (Incorporated by reference to

Exhibit 10.5 of the Registrant’s Current Report on Form 8-K filed with the Commission on June

22, 2007).

|

|

|

|

|

|

10.2

|

|

Form of Stock Option Agreement under the Northwest Biotherapeutics, Inc. 2007 Stock Option Plan.

|

|

|

|

|

|

23.1

|

|

Consent of Counsel (Included in Exhibit 5.1).

|

|

|

|

|

|

23.2

|

|

Consent of Independent Registered Public Accounting Firm.

|

|

|

|

|

|

24.1

|

|

Power of Attorney (included as part of the signature page to this Registration Statement).

|

Item 9 Undertakings.

The undersigned Registrant hereby undertakes:

1. To file, during any period in which offers or sales are being made, a post-effective

amendment to this Registration Statement to include any material information with respect to the

plan of distribution not previously disclosed in this Registration Statement or any material change

to such information in this Registration Statement;

2. That, for the purpose of determining any liability under the Securities Act of 1933, each

such post-effective amendment shall be deemed to be a new Registration Statement relating to the

securities offered therein, and the offering of such securities at that time shall be deemed to be

the initial

bona fide

offering thereof;

3. To remove from registration by means of a post-effective amendment any of the securities

being registered which remain unsold at the termination of the Plan;

4. That, for purposes of determining any liability under the Securities Act of 1933, each

filing of the Company’s annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange

Act of 1934 that is incorporated by reference in the Registration Statement shall be deemed to be a

new Registration Statement relating to the securities offered therein, and the offering of such

securities at that time shall be deemed to be the initial

bona fide

offering thereof; and

5. Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be

permitted to directors, officers and controlling persons of the Company pursuant to the foregoing

provisions, or otherwise, the Company has been advised that in the opinion of the Securities and

Exchange Commission such indemnification is against public policy as expressed in the Act and is,

therefore, unenforceable. In the event that a claim for indemnification against such liabilities

(other than the payment by the Company of expenses incurred or paid by a director, officer or

controlling person of the Company in the successful defense of any action, suit or proceeding) is

asserted by such director, officer or controlling person in connection with the securities being

registered, the Company will, unless in the opinion of its counsel the matter has been settled by

controlling precedent, submit to a court of appropriate jurisdiction the question whether such

indemnification by it is against public policy as expressed in the Act and will be governed by the

final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act, as amended, the Registrant certifies that it

has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and

has duly caused this Registration Statement to be signed on its behalf by the undersigned,

thereunto duly authorized, in the City of Bethesda, Maryland, on

November 20, 2007.

|

|

|

|

|

|

|

November 20, 2007

|

NORTHWEST BIOTHERAPEUTICS, INC.

|

|

|

|

By /s/ Alton L. Boynton

|

|

|

|

Alton L. Boynton

|

|

|

|

President & Chief Executive Officer

|

|

|

|

POWER OF ATTORNEY

We, the undersigned directors and officers of Northwest Biotherapeutics, Inc. (the “Company”)

hereby severally constitute and appoint Alton L. Boynton, as our true and lawful attorney and

agent, to do any and all things in our names in the capacities indicated below which said

Alton L. Boynton may deem necessary or advisable to enable the Company to comply with the Securities Act of

1933, and any rules, regulations and requirements of the Securities and Exchange Commission, in

connection with the registration of shares of Common Stock to be granted and shares of Common Stock

to be issued upon the exercise of stock options to be granted under the Northwest Biotherapeutics,

Inc. 2007 Stock Option Plan, including specifically, but not limited to, power and authority to

sign for us in our names in the capacities indicated below the registration statement and any and

all amendments (including post-effective amendments) thereto; and we hereby approve, ratify and

confirm all that said Alton L. Boynton shall do or cause to be done by virtue thereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been

signed by the following persons in the capacities and on the dates indicated.

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ R. Steve Harris

|

|

By:

|

|

/s/ Alton L. Boynton

|

|

|

|

R. Steve Harris

|

|

|

|

Alton L. Boynton

|

|

|

|

Director

|

|

|

|

President and Chief Executive Officer

|

|

|

|

|

|

|

|

(Principal Executive Officer) and Director

|

|

|

|

November 20, 2007

|

|

|

|

November 20, 2007

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Linda F. Powers

|

|

By:

|

|

/s/ Anthony P. Deasey

|

|

|

|

Linda F. Powers

|

|

|

|

Anthony P. Deasey

|

|

|

|

Chairperson of the Board

|

|

|

|

Senior Vice President of

|

|

|

|

|

|

|

|

Finance and Chief Financial

Officer

|

|

|

|

|

|

|

|

(Principal Financial Officer

|

|

|

|

|

|

|

|

and Principal Accounting

|

|

|

|

|

|

|

|

Officer) and Director

|

|

|

|

November 20, 2007

|

|

|

|

November 20, 2007

|

Exhibit Index

|

|

|

|

|

4.1

|

|

Northwest Biotherapeutics, Inc. 2007 Stock Option Plan (Incorporated by reference to

Exhibit 10.5 of the Registrant’s Current Report on Form 8-K filed with the Commission on June

22, 2007).

|

|

|

|

|

|

5.1

|

|

Opinion of Counsel.

|

|

|

|

|

|

10.1

|

|

Northwest Biotherapeutics, Inc.

2007 Stock Option Plan (Incorporated by reference to Exhibit 10.5 of

the Registrant’s Current Report on Form 8-K filed with the

Commission on June 22, 2007).

|

|

10.2

|

|

Form of Stock Option Agreement under the Northwest Biotherapeutics, Inc. 2007 Stock Option

Plan.

|

|

|

|

|

|

23.1

|

|

Consent of Counsel (Included in Exhibit 5.1).

|

|

|

|

|

|

23.2

|

|

Consent of Independent Registered Public Accounting Firm.

|

|

|

|

|

|

24.1

|

|

Power of Attorney (included as part of the signature page to this Registration Statement).

|

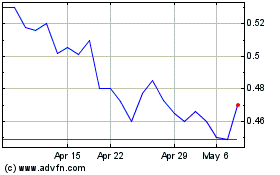

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From Jul 2023 to Jul 2024