false

Q3

--12-31

0001605481

0001605481

2023-01-01

2023-09-30

0001605481

2023-11-13

0001605481

2023-09-30

0001605481

2022-12-31

0001605481

us-gaap:RelatedPartyMember

2023-09-30

0001605481

us-gaap:RelatedPartyMember

2022-12-31

0001605481

2023-07-01

2023-09-30

0001605481

2022-07-01

2022-09-30

0001605481

2022-01-01

2022-09-30

0001605481

us-gaap:CommonStockMember

2021-12-31

0001605481

NGLD:ObligationToIssueSharesMember

2021-12-31

0001605481

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001605481

us-gaap:RetainedEarningsMember

2021-12-31

0001605481

2021-12-31

0001605481

us-gaap:CommonStockMember

2022-03-31

0001605481

NGLD:ObligationToIssueSharesMember

2022-03-31

0001605481

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001605481

us-gaap:RetainedEarningsMember

2022-03-31

0001605481

2022-03-31

0001605481

us-gaap:CommonStockMember

2022-06-30

0001605481

NGLD:ObligationToIssueSharesMember

2022-06-30

0001605481

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001605481

us-gaap:RetainedEarningsMember

2022-06-30

0001605481

2022-06-30

0001605481

us-gaap:CommonStockMember

2022-12-31

0001605481

NGLD:ObligationToIssueSharesMember

2022-12-31

0001605481

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001605481

us-gaap:RetainedEarningsMember

2022-12-31

0001605481

us-gaap:CommonStockMember

2023-03-31

0001605481

NGLD:ObligationToIssueSharesMember

2023-03-31

0001605481

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001605481

us-gaap:RetainedEarningsMember

2023-03-31

0001605481

2023-03-31

0001605481

us-gaap:CommonStockMember

2023-06-30

0001605481

NGLD:ObligationToIssueSharesMember

2023-06-30

0001605481

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001605481

us-gaap:RetainedEarningsMember

2023-06-30

0001605481

2023-06-30

0001605481

us-gaap:CommonStockMember

2022-01-01

2022-03-31

0001605481

NGLD:ObligationToIssueSharesMember

2022-01-01

2022-03-31

0001605481

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-03-31

0001605481

us-gaap:RetainedEarningsMember

2022-01-01

2022-03-31

0001605481

2022-01-01

2022-03-31

0001605481

us-gaap:CommonStockMember

2022-04-01

2022-06-30

0001605481

NGLD:ObligationToIssueSharesMember

2022-04-01

2022-06-30

0001605481

us-gaap:AdditionalPaidInCapitalMember

2022-04-01

2022-06-30

0001605481

us-gaap:RetainedEarningsMember

2022-04-01

2022-06-30

0001605481

2022-04-01

2022-06-30

0001605481

us-gaap:CommonStockMember

2022-07-01

2022-09-30

0001605481

NGLD:ObligationToIssueSharesMember

2022-07-01

2022-09-30

0001605481

us-gaap:AdditionalPaidInCapitalMember

2022-07-01

2022-09-30

0001605481

us-gaap:RetainedEarningsMember

2022-07-01

2022-09-30

0001605481

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0001605481

NGLD:ObligationToIssueSharesMember

2023-01-01

2023-03-31

0001605481

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0001605481

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0001605481

2023-01-01

2023-03-31

0001605481

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0001605481

NGLD:ObligationToIssueSharesMember

2023-04-01

2023-06-30

0001605481

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0001605481

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0001605481

2023-04-01

2023-06-30

0001605481

us-gaap:CommonStockMember

2023-07-01

2023-09-30

0001605481

NGLD:ObligationToIssueSharesMember

2023-07-01

2023-09-30

0001605481

us-gaap:AdditionalPaidInCapitalMember

2023-07-01

2023-09-30

0001605481

us-gaap:RetainedEarningsMember

2023-07-01

2023-09-30

0001605481

us-gaap:CommonStockMember

2023-01-01

2023-09-30

0001605481

us-gaap:CommonStockMember

2022-09-30

0001605481

NGLD:ObligationToIssueSharesMember

2022-09-30

0001605481

us-gaap:AdditionalPaidInCapitalMember

2022-09-30

0001605481

us-gaap:RetainedEarningsMember

2022-09-30

0001605481

2022-09-30

0001605481

us-gaap:CommonStockMember

2023-09-30

0001605481

NGLD:ObligationToIssueSharesMember

2023-09-30

0001605481

us-gaap:AdditionalPaidInCapitalMember

2023-09-30

0001605481

us-gaap:RetainedEarningsMember

2023-09-30

0001605481

us-gaap:RestrictedStockMember

2023-01-01

2023-09-30

0001605481

us-gaap:RestrictedStockMember

2022-01-01

2022-09-30

0001605481

NGLD:ChairmanOfTheBoardChiefFinancialOfficerCFOAndFormerChiefExecutiveOfficerCEOAndPresidentMember

us-gaap:RelatedPartyMember

2023-09-30

0001605481

NGLD:ChairmanOfTheBoardChiefFinancialOfficerCFOAndFormerChiefExecutiveOfficerCEOAndPresidentMember

us-gaap:RelatedPartyMember

2022-12-31

0001605481

NGLD:CompanyControlledByTheChairmanOfTheBoardCFOAndFormerCEOAndPresidentMember

us-gaap:RelatedPartyMember

2023-09-30

0001605481

NGLD:CompanyControlledByTheChairmanOfTheBoardCFOAndFormerCEOAndPresidentMember

us-gaap:RelatedPartyMember

2022-12-31

0001605481

NGLD:ChairmanOfTheBoardCFOAndFormerCEOAndPresidentMember

2023-07-01

2023-09-30

0001605481

NGLD:ChairmanOfTheBoardCFOAndFormerCEOAndPresidentMember

2022-07-01

2022-09-30

0001605481

NGLD:ChairmanOfTheBoardCFOAndFormerCEOAndPresidentMember

2023-01-01

2023-09-30

0001605481

NGLD:ChairmanOfTheBoardCFOAndFormerCEOAndPresidentMember

2022-01-01

2022-09-30

0001605481

srt:DirectorMember

2023-07-01

2023-09-30

0001605481

srt:DirectorMember

2022-07-01

2022-09-30

0001605481

srt:DirectorMember

2023-01-01

2023-09-30

0001605481

srt:DirectorMember

2022-01-01

2022-09-30

0001605481

NGLD:CEOPresidentAndDirectorMember

2023-07-01

2023-09-30

0001605481

NGLD:CEOPresidentAndDirectorMember

2022-07-01

2022-09-30

0001605481

NGLD:CEOPresidentAndDirectorMember

2023-01-01

2023-09-30

0001605481

NGLD:CEOPresidentAndDirectorMember

2022-01-01

2022-09-30

0001605481

NGLD:VPOfOperationsMember

2023-07-01

2023-09-30

0001605481

NGLD:VPOfOperationsMember

2022-07-01

2022-09-30

0001605481

NGLD:VPOfOperationsMember

2023-01-01

2023-09-30

0001605481

NGLD:VPOfOperationsMember

2022-01-01

2022-09-30

0001605481

NGLD:TargetMineralsIncMember

2023-09-30

0001605481

NGLD:OlinghouseProjectAgreementMember

2023-01-01

2023-09-30

0001605481

NGLD:PalmettoProjectAgreementMember

2023-01-01

2023-09-30

0001605481

NGLD:LeaseAgreementMember

NGLD:TarsisResourcesUSIncMember

2017-08-01

2017-08-02

0001605481

NGLD:LeaseAgreementMember

NGLD:TarsisResourcesUSIncMember

2017-08-02

0001605481

NGLD:LazyClaimsAgreementMember

2017-08-02

0001605481

NGLD:LazyClaimsAgreementMember

2023-07-01

2023-09-30

0001605481

NGLD:LazyClaimsAgreementMember

2023-01-01

2023-09-30

0001605481

NGLD:LazyClaimsAgreementMember

2022-07-01

2022-09-30

0001605481

NGLD:LazyClaimsAgreementMember

2022-01-01

2022-09-30

0001605481

NGLD:LazyClaimsAgreementMember

2023-09-30

0001605481

NGLD:LazyClaimsAgreementMember

2022-09-30

0001605481

NGLD:LomanClaimsMember

2019-12-31

0001605481

NGLD:LomanClaimsMember

2019-12-01

2019-12-31

0001605481

NGLD:LomanClaimsMember

2023-07-01

2023-09-30

0001605481

NGLD:LomanClaimsMember

2023-01-01

2023-09-30

0001605481

NGLD:LomanClaimsMember

2022-07-01

2022-09-30

0001605481

NGLD:LomanClaimsMember

2022-01-01

2022-09-30

0001605481

NGLD:AgaiPahPropertyAgreementMember

NGLD:MSMResourceLLCMember

2021-05-18

2021-05-19

0001605481

NGLD:AgaiPahPropertyAgreementMember

NGLD:MSMResourceLLCMember

2021-05-19

0001605481

NGLD:AgaiPahPropertyAgreementMember

NGLD:MSMResourceLLCMember

2023-01-01

2023-09-30

0001605481

NGLD:AgaiPahPropertyAgreementMember

NGLD:MSMResourceLLCMember

2021-11-04

2021-11-06

0001605481

NGLD:AgaiPahPropertyAgreementMember

NGLD:MSMResourceLLCMember

2022-06-20

2022-06-20

0001605481

NGLD:AgaiPahPropertyAgreementMember

NGLD:MSMResourceLLCMember

2023-07-01

2023-09-30

0001605481

NGLD:AgaiPahPropertyAgreementMember

NGLD:MSMResourceLLCMember

2022-07-01

2022-09-30

0001605481

NGLD:AgaiPahPropertyAgreementMember

NGLD:MSMResourceLLCMember

2022-01-01

2022-09-30

0001605481

NGLD:AgaiPahPropertyAgreementMember

NGLD:BelshazzarHoldingsLLCMember

2021-06-03

2021-06-04

0001605481

NGLD:BelshazzarPropertyAgreementMember

NGLD:BelshazzarHoldingsLLCMember

2021-06-03

2021-06-04

0001605481

NGLD:AgaiPahPropertyAgreementMember

NGLD:BelshazzarHoldingsLLCMember

2023-01-01

2023-09-30

0001605481

NGLD:AgaiPahPropertyAgreementMember

NGLD:BelshazzarHoldingsLLCMember

2021-06-04

0001605481

NGLD:BelshazzarPropertyAgreementMember

NGLD:BelshazzarHoldingsLLCMember

2021-11-06

2021-11-06

0001605481

NGLD:BelshazzarPropertyAgreementMember

NGLD:BelshazzarHoldingsLLCMember

2022-06-20

2022-06-20

0001605481

NGLD:BelshazzarPropertyAgreementMember

NGLD:BelshazzarHoldingsLLCMember

2023-07-01

2023-09-30

0001605481

NGLD:BelshazzarPropertyAgreementMember

NGLD:BelshazzarHoldingsLLCMember

2023-01-01

2023-09-30

0001605481

NGLD:BelshazzarPropertyAgreementMember

NGLD:BelshazzarHoldingsLLCMember

2022-07-01

2022-09-30

0001605481

NGLD:BelshazzarPropertyAgreementMember

NGLD:BelshazzarHoldingsLLCMember

2022-01-01

2022-09-30

0001605481

NGLD:SwalesPropertyAgreementMember

NGLD:WrightParksIIIMember

2021-12-26

2021-12-27

0001605481

NGLD:SwalesPropertyAgreementMember

NGLD:WrightParksIIIMember

2021-12-27

0001605481

NGLD:SwalesPropertyAgreementMember

NGLD:WrightParksIIIMember

2022-01-15

2022-01-15

0001605481

NGLD:SwalesPropertyAgreementMember

NGLD:WrightParksIIIMember

2023-03-14

2023-03-14

0001605481

NGLD:SwalesPropertyAgreementMember

NGLD:WrightParksIIIMember

2023-07-01

2023-09-30

0001605481

NGLD:SwalesPropertyAgreementMember

NGLD:WrightParksIIIMember

2023-01-01

2023-09-30

0001605481

NGLD:SwalesPropertyAgreementMember

NGLD:WrightParksIIIMember

2022-07-01

2022-09-30

0001605481

NGLD:SwalesPropertyAgreementMember

NGLD:WrightParksIIIMember

2022-01-01

2022-09-30

0001605481

NGLD:OlinghouseProjectAgreementMember

NGLD:TargetMineralsIncMember

2021-12-16

2021-12-17

0001605481

NGLD:OlinghouseProjectAgreementMember

NGLD:TargetMineralsIncMember

2021-12-17

0001605481

NGLD:OlinghouseProjectAgreementMember

2021-12-18

2021-12-18

0001605481

NGLD:OlinghouseProjectAgreementMember

NGLD:TargetMineralsIncMember

NGLD:VolumeWeightedAveragePriceMember

2021-12-17

0001605481

NGLD:OlinghouseProjectAgreementMember

NGLD:TargetMineralsIncMember

NGLD:VolumeWeightedAveragePriceMember

2021-12-16

2021-12-17

0001605481

NGLD:OlinghouseProjectAgreementMember

2022-12-20

2022-12-23

0001605481

NGLD:PalmettoProjectAgreementMember

2022-01-25

2022-01-27

0001605481

NGLD:PalmettoProjectAgreementMember

NGLD:SmoothrockVentureLLCMember

2022-01-25

2022-01-27

0001605481

NGLD:PalmettoProjectAgreementMember

NGLD:SmoothrockVentureLLCMember

2022-02-05

2022-02-07

0001605481

NGLD:WalkerRiverResourcesCorpMember

2023-09-30

0001605481

NGLD:WalkerRiverResourcesCorpMember

2022-12-31

0001605481

NGLD:WalkerRiverResourcesCorpMember

2023-07-01

2023-09-30

0001605481

NGLD:WalkerRiverResourcesCorpMember

2022-07-01

2022-09-30

0001605481

NGLD:WalkerRiverResourcesCorpMember

2023-01-01

2023-09-30

0001605481

NGLD:WalkerRiverResourcesCorpMember

2022-01-01

2022-09-30

0001605481

us-gaap:IPOMember

2023-07-01

2023-09-30

0001605481

NGLD:AgentWarrantsMember

2023-01-01

2023-09-30

0001605481

NGLD:AgentWarrantsMember

2023-09-30

0001605481

NGLD:FinalTranchesMember

2023-09-30

0001605481

NGLD:FinalTranchesMember

2023-01-01

2023-09-30

0001605481

us-gaap:CommonStockMember

us-gaap:IPOMember

2023-01-01

2023-09-30

0001605481

us-gaap:IPOMember

2023-01-01

2023-09-30

0001605481

srt:DirectorMember

2021-12-30

2021-12-30

0001605481

srt:DirectorMember

2021-12-30

0001605481

srt:DirectorMember

2023-09-30

0001605481

srt:OfficerMember

2023-02-24

2023-02-24

0001605481

srt:OfficerMember

2023-02-24

0001605481

srt:OfficerMember

2023-07-05

2023-07-05

0001605481

srt:OfficerMember

2023-09-30

0001605481

srt:OfficerMember

2023-01-01

2023-09-30

0001605481

NGLD:ConsultantMember

2023-02-24

2023-02-24

0001605481

NGLD:ConsultantMember

2023-02-24

0001605481

NGLD:ConsultantMember

2023-07-05

2023-07-05

0001605481

NGLD:ConsultantMember

2023-09-30

0001605481

NGLD:ConsultantMember

2023-01-01

2023-09-30

0001605481

us-gaap:ShareBasedCompensationAwardTrancheThreeMember

NGLD:JulyTwentySevenTwentyTwentyThreeMember

2023-01-01

2023-09-30

0001605481

us-gaap:ShareBasedCompensationAwardTrancheThreeMember

NGLD:JulyTwentySevenTwentyTwentyThreeMember

2023-09-30

0001605481

us-gaap:ShareBasedCompensationAwardTrancheThreeMember

NGLD:AugustTwentyEightTwentyTwentyThreeMember

2023-01-01

2023-09-30

0001605481

us-gaap:ShareBasedCompensationAwardTrancheThreeMember

NGLD:AugustTwentyEightTwentyTwentyThreeMember

2023-09-30

0001605481

us-gaap:ShareBasedCompensationAwardTrancheThreeMember

NGLD:SeptemberTwentyThreeTwentyTwentyThreeMember

2023-01-01

2023-09-30

0001605481

us-gaap:ShareBasedCompensationAwardTrancheThreeMember

NGLD:SeptemberTwentyThreeTwentyTwentyThreeMember

2023-09-30

0001605481

us-gaap:ShareBasedCompensationAwardTrancheThreeMember

2023-09-30

0001605481

us-gaap:ShareBasedCompensationAwardTrancheThreeMember

2023-01-01

2023-09-30

0001605481

NGLD:DirectorAndChiefExecutiveOfficerMember

2023-07-01

2023-09-30

0001605481

NGLD:DirectorAndChiefExecutiveOfficerMember

2022-07-01

2022-09-30

0001605481

NGLD:DirectorAndChiefExecutiveOfficerMember

2023-01-01

2023-09-30

0001605481

NGLD:DirectorAndChiefExecutiveOfficerMember

2022-01-01

2022-09-30

0001605481

srt:OfficerMember

2023-07-01

2023-09-30

0001605481

srt:OfficerMember

2022-07-01

2022-09-30

0001605481

srt:OfficerMember

2022-01-01

2022-09-30

0001605481

NGLD:ConsultantsMember

2023-07-01

2023-09-30

0001605481

NGLD:ConsultantsMember

2022-07-01

2022-09-30

0001605481

NGLD:ConsultantsMember

2023-01-01

2023-09-30

0001605481

NGLD:ConsultantsMember

2022-01-01

2022-09-30

0001605481

2022-01-01

2022-12-31

0001605481

NGLD:ExercisePriceRangeOneMember

2023-09-30

0001605481

NGLD:ExercisePriceRangeOneMember

2023-01-01

2023-09-30

0001605481

NGLD:ExercisePriceRangeTwoMember

2023-09-30

0001605481

NGLD:ExercisePriceRangeTwoMember

2023-01-01

2023-09-30

0001605481

NGLD:ExercisePriceRangeThreeMember

2023-09-30

0001605481

NGLD:ExercisePriceRangeThreeMember

2023-01-01

2023-09-30

0001605481

NGLD:ExercisePriceRangeFourMember

2023-09-30

0001605481

NGLD:ExercisePriceRangeFourMember

2023-01-01

2023-09-30

0001605481

2021-01-01

2021-12-31

0001605481

NGLD:PublicRelationsServicesAgreementMember

2023-01-01

2023-09-30

0001605481

NGLD:PublicRelationsServicesAgreementMember

2023-09-30

0001605481

NGLD:WarmSpringsAgreementMember

2023-09-30

0001605481

NGLD:WarmSpringsAgreementMember

2023-01-01

2023-09-30

0001605481

NGLD:MarketingAgreementMember

2023-09-30

0001605481

NGLD:MarketingAgreementMember

2023-07-01

2023-09-30

0001605481

us-gaap:CommonStockMember

us-gaap:SubsequentEventMember

2023-11-14

2023-11-14

0001605481

us-gaap:CommonStockMember

us-gaap:IPOMember

us-gaap:SubsequentEventMember

2023-11-14

2023-11-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

NGLD:Integer

utr:sqft

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

(Mark

One)

☒

quarterly REPORT under SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the quarterly period ended: September 30, 2023

or

☐

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from ______ to ______

Commission

File No. 000-55600

NEVADA

CANYON GOLD CORP.

(Exact

Name of Registrant as Specified in its Charter)

| Nevada |

|

46-5152859 |

| (State

or other Jurisdiction of |

|

(I.R.S.

Employer |

| Incorporation

or Organization) |

|

Identification

No.) |

| 5655

Riggins Court, Suite 15 |

|

|

| Reno,

NV |

|

89502 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

(888)

909-5548

Registrant’s

telephone number, including area code

n/a

(Former

name, former address and former fiscal year,

if

changed since last report)

Securities

registered pursuant to Section 12(b) of the Act: None

Securities

registered pursuant to Section 12(g) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.0001 par value |

|

NGLD |

|

OTC

Pink |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Yes

☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files)..

Yes

☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting

company. See the definitions of “large accelerated file,” “accelerated filer” and “smaller reporting company”

in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

| Non-accelerated

filer ☒ |

Smaller

reporting company ☒ |

| |

Emerging

growth company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

☐ No ☒

APPLICABLE

ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS

DURING THE PRECEDING FIVE YEARS:

Indicate

by check mark whether the registrant has filed all documents and reports required to be filed by Section l2, 13 or 15(d) of the Securities

Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes

☐ No ☐

APPLICABLE

ONLY TO CORPORATE ISSUERS

Indicate

the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: As of November

13, 2023 the number of shares outstanding of the issuer’s common stock, par value $0.0001 per share, is 24,619,854.

table

of contents

Part

I – FINANCIAL INFORMATION

Item

1. Financial Statements

Nevada

Canyon Gold Corp.

Condensed

Consolidated Balance Sheets

(Unaudited)

| | |

September 30, 2023 | | |

December 31, 2022 | |

| | |

| | |

| |

| ASSETS | |

| | | |

| | |

| Current Assets | |

| | | |

| | |

| Cash | |

$ | 4,681,387 | | |

$ | 1,007,018 | |

| Cash in escrow | |

| 5,301,782 | | |

| - | |

| Prepaid expenses | |

| 473,365 | | |

| 4,829 | |

| Total Current Assets | |

| 10,456,534 | | |

| 1,011,847 | |

| | |

| | | |

| | |

| Investment in equity securities | |

| 41,637 | | |

| 156,805 | |

| Mineral property interests | |

| 760,395 | | |

| 720,395 | |

| TOTAL ASSETS | |

$ | 11,258,566 | | |

$ | 1,889,047 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

$ | 812,743 | | |

$ | 844,963 | |

| Related party payables | |

| 460,000 | | |

| 477,031 | |

| Total Liabilities | |

| 1,272,743 | | |

| 1,321,994 | |

| | |

| | | |

| | |

| Commitments and Contingencies (Notes 5 and 10) | |

| - | | |

| - | |

| | |

| | | |

| | |

| Stockholders’ Equity | |

| | | |

| | |

| Preferred Stock: Authorized 10,000,000 preferred shares, $0.0001 par, none issued and outstanding as of September 30, 2023 and December 31, 2022 | |

| - | | |

| - | |

| Common Stock: Authorized 100,000,000 common shares, $0.0001 par, 17,588,126 and 11,077,394 issued and outstanding as of September 30, 2023 and December 31, 2022, respectively | |

| 1,758 | | |

| 1,107 | |

| Additional paid-in capital | |

| 8,741,746 | | |

| 3,073,447 | |

| Obligation to issue shares | |

| 5,569,667 | | |

| - | |

| Accumulated deficit | |

| (4,327,348 | ) | |

| (2,507,501 | ) |

| Total Stockholders’

Equity (Deficit) | |

| 9,985,823 | | |

| 567,053 | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | |

$ | 11,258,566 | | |

$ | 1,889,047 | |

The

accompanying notes are an integral part of these condensed consolidated financial statements

Nevada

Canyon Gold Corp.

Condensed

Consolidated Statements of Operations

(Unaudited)

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

For the three months ended

September 30, | | |

For the nine months ended

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Consulting fees | |

$ | 121,042 | | |

$ | 4,500 | | |

$ | 300,535 | | |

$ | 26,226 | |

| Director and officer compensation | |

| 424,150 | | |

| 316,862 | | |

| 1,147,656 | | |

| 675,053 | |

| Exploration | |

| 21,023 | | |

| 20,758 | | |

| 21,556 | | |

| 20,758 | |

| General and administrative | |

| 69,922 | | |

| 4,237 | | |

| 144,954 | | |

| 14,978 | |

| Professional fees | |

| 23,794 | | |

| 13,258 | | |

| 100,114 | | |

| 69,590 | |

| Transfer agent and filing fees | |

| 3,169 | | |

| 1,935 | | |

| 11,759 | | |

| 11,735 | |

| Total operating expenses | |

| 663,100 | | |

| 361,550 | | |

| 1,726,574 | | |

| 818,340 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense) | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| - | | |

| (1,623 | ) | |

| - | | |

| (1,623 | ) |

| Amortization of debt discount | |

| - | | |

| (396,143 | ) | |

| - | | |

| (697,535 | ) |

| Fair value gain (loss) on equity investments | |

| (20,206 | ) | |

| (40,737 | ) | |

| (115,168 | ) | |

| 163,113 | |

| Foreign exchange loss | |

| (4 | ) | |

| (15 | ) | |

| - | | |

| (982 | ) |

| Interest income | |

| 8,082 | | |

| 4,397 | | |

| 21,895 | | |

| 5,285 | |

| Realized gain on equity investments | |

| - | | |

| - | | |

| - | | |

| 211,530 | |

| Total other income (expense) | |

| (12,128 | ) | |

| (434,121 | ) | |

| (93,273 | ) | |

| (320,212 | ) |

| Net loss | |

$ | (675,228 | ) | |

$ | (795,671 | ) | |

$ | (1,819,847 | ) | |

$ | (1,138,552 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) per common share - basic and diluted | |

$ | (0.07 | ) | |

$ | (0.30 | ) | |

$ | (0.23 | ) | |

$ | (0.42 | ) |

| Weighted average number of common shares outstanding : | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

| 9,109,468 | | |

| 2,680,093 | | |

| 7,759,985 | | |

| 2,680,093 | |

The

accompanying notes are an integral part of these condensed consolidated financial statements

Nevada

Canyon Gold Corp.

Condensed

Consolidated Statement of Stockholders’ Equity

(Unaudited)

| | |

Shares | | |

Amount | | |

Shares | | |

Capital | | |

Deficit | | |

Equity | |

| | |

Common Stock | | |

Obligation to Issue | | |

Additional Paid-in | | |

Accumulated | | |

Total

Stockholders’ | |

| | |

Shares | | |

Amount | | |

Shares | | |

Capital | | |

Deficit | | |

Equity | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance, December 31, 2021 | |

| 8,685,093 | | |

$ | 868 | | |

$ | - | | |

$ | 1,190,522 | | |

$ | (951,446 | ) | |

$ | 239,944 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock-based compensation - directors and CEO | |

| - | | |

| - | | |

| - | | |

| 44,774 | | |

| - | | |

| 44,774 | |

| Net income for the three months ended March 31, 2022 | |

| - | | |

| - | | |

| - | | |

| - | | |

| 436,387 | | |

| 436,387 | |

| Balance, March 31, 2022 | |

| 8,685,093 | | |

| 868 | | |

| - | | |

| 1,235,296 | | |

| (515,059 | ) | |

| 721,105 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock-based compensation - directors and CEO | |

| - | | |

| - | | |

| - | | |

| 313,417 | | |

| - | | |

| 313,417 | |

| Net loss for the three months ended June 30, 2022 | |

| - | | |

| - | | |

| - | | |

| - | | |

| (779,268 | ) | |

| (779,268 | ) |

| Balance, June 30, 2022 | |

| 8,685,093 | | |

| 868 | | |

| - | | |

| 1,548,713 | | |

| (1,294,327 | ) | |

| 255,254 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock-based compensation - directors and CEO | |

| - | | |

| - | | |

| - | | |

| 316,862 | | |

| - | | |

| 316,862 | |

| Net loss for the three months ended September 30, 2022 | |

| - | | |

| - | | |

| - | | |

| - | | |

| (795,671 | ) | |

| (795,671 | ) |

| Balance, September 30, 2022 | |

| 8,685,093 | | |

$ | 868 | | |

$ | - | | |

$ | 1,865,575 | | |

$ | (2,089,998 | ) | |

$ | (223,555 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, December 31, 2022 | |

| 11,077,394 | | |

$ | 1,107 | | |

$ | - | | |

$ | 3,073,447 | | |

$ | (2,507,501 | ) | |

$ | 567,053 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock-based compensation - consultants | |

| - | | |

| - | | |

| 38,889 | | |

| - | | |

| - | | |

| 38,889 | |

| Stock-based compensation - officer | |

| - | | |

| - | | |

| 58,333 | | |

| - | | |

| - | | |

| 58,333 | |

| Stock-based compensation - directors and CEO | |

| - | | |

| - | | |

| - | | |

| 243,733 | | |

| - | | |

| 243,733 | |

| Net loss for the three months ended March 31, 2023 | |

| - | | |

| - | | |

| - | | |

| - | | |

| (475,074 | ) | |

| (475,074 | ) |

| Balance, March 31, 2023 | |

| 11,077,394 | | |

| 1,107 | | |

| 97,222 | | |

| 3,317,180 | | |

| (2,982,575 | ) | |

| 432,934 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock-based compensation - consultants | |

| - | | |

| - | | |

| 116,667 | | |

| - | | |

| - | | |

| 116,667 | |

| Stock-based compensation - officer | |

| - | | |

| - | | |

| 175,000 | | |

| - | | |

| - | | |

| 175,000 | |

| Stock-based compensation - directors and CEO | |

| - | | |

| - | | |

| - | | |

| 246,440 | | |

| - | | |

| 246,440 | |

| Net loss for the three months ended June 30, 2023 | |

| - | | |

| - | | |

| - | | |

| - | | |

| (669,545 | ) | |

| (669,545 | ) |

| Balance,June 30, 2023 | |

| 11,077,394 | | |

| 1,107 | | |

| 388,889 | | |

| 3,563,620 | | |

| (3,652,120 | ) | |

| 301,496 | |

| Balance | |

| 11,077,394 | | |

| 1,107 | | |

| 388,889 | | |

| 3,563,620 | | |

| (3,652,120 | ) | |

| 301,496 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares issued for cash | |

| 5,537,260 | | |

| 554 | | |

| - | | |

| 4,429,254 | | |

| - | | |

| 4,429,808 | |

| Shares to be issued for cash in escrow | |

| - | | |

| - | | |

| 5,569,667 | | |

| - | | |

| - | | |

| 5,569,667 | |

| Share issuance costs | |

| - | | |

| - | | |

| - | | |

| (182,236 | ) | |

| - | | |

| (182,236 | ) |

| Shares issued on exercise of warrants | |

| 1,250 | | |

| - | | |

| - | | |

| 1,500 | | |

| - | | |

| 1,500 | |

| Stock-based compensation - consultants | |

| - | | |

| - | | |

| - | | |

| 116,667 | | |

| - | | |

| 116,667 | |

| Stock-based compensation - officer | |

| - | | |

| - | | |

| - | | |

| 175,000 | | |

| - | | |

| 175,000 | |

| Stock-based compensation - directors and CEO | |

| - | | |

| - | | |

| - | | |

| 249,149 | | |

| - | | |

| 249,149 | |

| Vested shares distributed | |

| 972,222 | | |

| 97 | | |

| (388,889 | ) | |

| 388,792 | | |

| | | |

| - | |

| Net loss for the three months ended September 30, 2023 | |

| - | | |

| - | | |

| - | | |

| - | | |

| (675,228 | ) | |

| (675,228 | ) |

| Net

income loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (675,228 | ) | |

| (675,228 | ) |

| Balance,September 30, 2023 | |

| 17,588,126 | | |

$ | 1,758 | | |

$ | 5,569,667 | | |

$ | 8,741,746 | | |

$ | (4,327,348 | ) | |

$ | 9,985,823 | |

| Balance | |

| 17,588,126 | | |

$ | 1,758 | | |

$ | 5,569,667 | | |

$ | 8,741,746 | | |

$ | (4,327,348 | ) | |

$ | 9,985,823 | |

The

accompanying notes are an integral part of these condensed consolidated financial statements

Nevada

Canyon Gold Corp.

Condensed

Consolidated Statements of Cash Flow

(Unaudited)

| | |

2023 | | |

2022 | |

| | |

For

the nine months ended

September 30, | |

| | |

2023 | | |

2022 | |

| OPERATING

ACTIVITIES: | |

| | | |

| | |

| Cash

flows used in operating activities | |

| | | |

| | |

| Net

loss | |

$ | (1,819,847 | ) | |

$ | (1,138,552 | ) |

| Adjustment

to reconcile net loss to net cash used

in operating activities: | |

| | | |

| | |

| Amortization

of debt discount | |

| - | | |

| 697,535 | |

| Fair

value loss (gain) on equity investments | |

| 115,168 | | |

| (163,113 | ) |

| Foreign

exchange loss | |

| - | | |

| 982 | |

| Realized

gain on equity investments | |

| - | | |

| (211,530 | ) |

| Stock

based compensation - directors and CEO | |

| 739,322 | | |

| 675,053 | |

| Stock

based compensation - consultants | |

| 272,223 | | |

| - | |

| Stock

based compensation - officer | |

| 408,333 | | |

| - | |

| Changes

in operating assets and liabilities: | |

| | | |

| | |

| Prepaid

expenses | |

| (291,651 | ) | |

| (70,566 | ) |

| Accounts

payable | |

| (12,220 | ) | |

| (26,122 | ) |

| Accrued

interest payable | |

| - | | |

| (63,473 | ) |

| Related

party payables | |

| (17,031 | ) | |

| (27,000 | ) |

| Net

cash used in operating activities | |

| (605,703 | ) | |

| (326,786 | ) |

| |

| | | |

| | |

| INVESTING

ACTIVITIES: | |

| | | |

| | |

| Sale

of equity investments | |

| - | | |

| 614,658 | |

| Acquisition

of mineral property interests | |

| (60,000 | ) | |

| (410,000 | ) |

| Net

cash provided by (used in) investing activities | |

| (60,000 | ) | |

| 204,658 | |

| |

| | | |

| | |

| FINANCING

ACTIVITIES: | |

| | | |

| | |

| Cash

received on subscription to shares | |

| 4,429,808 | | |

| 400 | |

| Share

issuance cash costs | |

| (182,236 | ) | |

| - | |

| Escrowed

cash received on subscription to shares | |

| 5,569,667 | | |

| - | |

| Share

issuance cash costs on shares to be issued | |

| (176,885 | ) | |

| - | |

| Cash

received on exercise of warrants | |

| 1,500 | | |

| - | |

| Net

cash provided by financing activities | |

| 9,641,854 | | |

| 400 | |

| |

| | | |

| | |

| Effects

of foreign currency exchange on cash | |

| - | | |

| (982 | ) |

| |

| | | |

| | |

| Net

increase (decrease) in cash and restricted cash | |

| 8,976,151 | | |

| (122,710 | ) |

| Cash

and restricted cash, at beginning of period | |

| 1,007,018 | | |

| 1,420,864 | |

| Cash

and restricted cash, at end of period | |

$ | 9,983,169 | | |

$ | 1,298,154 | |

| | |

| | | |

| | |

| NONCASH

INVESTING AND FINANCING ACTIVITIES: | |

| | | |

| | |

| Mineral

interests acquired with related parties payables, net | |

$ | 40,000 | | |

$ | - | |

The

accompanying notes are an integral part of these condensed consolidated financial statements

NEVADA

CANYON GOLD CORP.

NOTES

TO THE CONDENSED

CONSOLIDATED

FINANCIAL STATEMENTS

SEPTEMBER

30, 2023

(UNAUDITED)

NOTE

1 - NATURE OF BUSINESS

Nevada

Canyon Gold Corp. (the “Company”) was incorporated under the laws of the state of Nevada on February 27, 2014. On July 6,

2016, the Company changed its name from Tech Foundry Ventures, Inc. to Nevada Canyon Gold Corp. On December 15, 2021, the Company incorporated

two subsidiaries, Nevada Canyon LLC and Canyon Carbon LLC. Both subsidiaries were incorporated under the laws of the state of Nevada.

The Company is involved in acquiring and exploring mineral properties and royalty interests in Nevada and Idaho.

Going

Concern

The

Company’s condensed consolidated financial statements are prepared using accounting principles generally accepted in the United

States of America (“US GAAP”) applicable to a going concern, which contemplates the realization of assets and liquidation

of liabilities in the normal course of business. The Company is in the business of acquiring and exploring mineral properties and royalty

interests and has not generated or realized any revenues from these business operations. The ability of the Company to continue as a

going concern is dependent on the Company obtaining adequate capital to fund operating losses until it becomes profitable.

As

of September 30, 2023, the Company’s management has assessed the Company’s ability to continue as a going concern. Management’s

assessment is based on various factors, including historical and projected financial performance, liquidity, and other relevant circumstances.

As of the date of these condensed consolidated financial statements, the Company has sufficient cash including escrowed cash to meet

its working capital requirements and fund its exploration programs and general day-to-day operations for at least the next 12 months.

This assessment takes into account the Company’s current cash balances as a result of the sale of the Company’s common shares

under offering statement on Form 1-A (the “Offering”), and expected future cash inflows from the Offering and future financing

the management is planning to undertake.

While

the Company believes it has the financial resources to continue its operations for the next 12 months, it is important to note that there

are inherent uncertainties in projecting future cash flows, and there can be no assurance that these projections will be realized. The

Company continues to closely monitor its financial position, market conditions, and other factors that may impact its ability to continue

as a going concern. Management’s assessment is based on the information available as of the date of this report. If unforeseen

events, adverse market conditions, or other factors negatively affect the Company’s financial position in the future, there may

be a need to adjust the going concern assessment. The financial statements do not include any adjustments that might result from the

outcome of this uncertainty. In the event that the Company’s ability to continue as a going concern becomes doubtful, adjustments

to the carrying values of assets and liabilities, as well as additional disclosures, would be necessary.

In

prior reporting periods, the Company concluded that substantial doubt regarding its ability to continue as a going concern existed. The

cash received from sale of its common stock in the three month period ended September 30, 2023 (Note 7), alleviated the substantial doubt.

NOTE

2 - BASIS OF PRESENTATION

The

condensed consolidated financial statements of the Company have been prepared in accordance with US GAAP for interim financial information

and the rules and regulations of the Securities and Exchange Commission (“SEC”). They do not include all information and

footnotes required by US GAAP for complete financial statements. Except as disclosed herein, there have been no material changes in the

information disclosed in the notes to the consolidated financial statements for the year ended December 31, 2022, included in the Company’s

Annual Report on Form 10-K, as amended, filed with the SEC. The condensed consolidated financial statements should be read in conjunction

with those consolidated financial statements included in Form 10-K, as amended. In the opinion of management, all adjustments considered

necessary for fair presentation, consisting solely of normal recurring adjustments, have been made. Operating results for the three and

nine months ended September 30, 2023 are not necessarily indicative of the results that may be expected for the year ending December

31, 2023.

Recent

Accounting Pronouncements

The

Company has implemented all new accounting pronouncements that are in effect and that may impact its financial statements and does not

believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial

position or results of operations.

NOTE

3 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Earnings

per Share

The

Company’s basic earnings per share (“EPS”) is calculated by dividing its net income (loss) available to common stockholders

by the weighted average number of common shares outstanding for the period, excluding unvested portion of restricted stock. Shares that

have been distributed but not yet vested and thus excluded from the weighted average shares calculation, were 4,003,333 and 6,005,000

at September 30, 2023 and 2022, respectively (Note 7).

The

Company’s diluted EPS is calculated by dividing its net income (loss) available to common shareholders by the diluted weighted

average number of shares outstanding during the period. The diluted weighted average number of shares outstanding is the basic weighted

number of shares adjusted for any potentially dilutive debt or equity. Restricted stock with performance conditions is only included

in the diluted EPS calculation to the extent that performance conditions have been met at the measurement date. Dilutive effect of the

restricted stock is determined using the treasury stock method.

NOTE

4 – RELATED PARTY TRANSACTIONS

Amounts

due to related parties at September 30, 2023 and December 31, 2022:

SCHEDULE OF RELATED PARTY TRANSACTIONS

| | |

September 30, 2023 | | |

December 31, 2022 | |

| Amounts due to a Chairman of the board, Chief Financial Officer (“CFO”) and former Chief Executive Officer (“CEO”) and President (a) | |

$ | 100,000 | | |

$ | 117,031 | |

| Amounts due to a company controlled by the Chairman of the board, CFO, and former CEO and President (a) | |

| 360,000 | | |

| 360,000 | |

| Total related party payables | |

$ | 460,000 | | |

$ | 477,031 | |

During

the three- and nine-month periods ended September 30, 2023 and 2022, the Company had the following transactions with its related parties:

SCHEDULE OF TRANSACTIONS WITH ITS RELATED PARTIES

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

Three months ended September 30, | | |

Nine months ended September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Director compensation incurred to the Chairman of the board, CFO and former CEO and President | |

$ | 83,188 | | |

$ | 105,797 | | |

$ | 246,851 | | |

$ | 225,392 | |

| Director compensation incurred to a director | |

| 41,490 | | |

| 52,766 | | |

| 123,118 | | |

| 112,415 | |

| Director compensation incurred to CEO, President, and director | |

| 124,471 | | |

| 158,299 | | |

| 369,353 | | |

| 337,246 | |

| Officer compensation incurred to VP of Operations | |

| 175,000 | | |

| - | | |

| 408,333 | | |

| - | |

| Total related party transactions | |

$ | 424,149 | | |

$ | 316,862 | | |

$ | 1,147,655 | | |

$ | 675,053 | |

See

Note 5 - Mineral Property Interests for further information on related party transactions and Note 7 - Stockholders’

Equity for further information regarding stock issued to related parties.

NOTE

5 – MINERAL PROPERTY INTERESTS

As

of September 30, 2023, the Company’s mineral property interests are comprised of the Lazy Claims Property, the Loman Property,

and the Agai-Pah Property located in Mineral County, Nevada, the Swales Property located in Elko County, Nevada, and the Belshazzar Property

located in Quartzburg mining district, Boise County, Idaho. In addition, the Company acquired an option to acquire 100% interest of Target

Minerals, Inc’s (“Target”) 1% production royalty on the Olinghouse Project, located in the Olinghouse Mining District,

Washoe County, Nevada, and acquired 2% net smelter returns royalty (“NSR”) on the Palmetto Project (the “Project”),

located in Esmeralda County, Nevada.

Lazy

Claims Property

On

August 2, 2017, the Company entered into an exploration lease agreement (the “Lazy Claims Agreement”) with Tarsis Resources

US Inc. (“Tarsis”), a Nevada corporation, to lease the Lazy Claims, consisting of three claims. The term of the Lazy Claims

Agreement is ten years, and is subject to extension for additional two consecutive 10-year terms. Full consideration of the Lazy Claims

Agreement consists of the following: an initial cash payment of $1,000 to Tarsis, paid upon the execution of the Lazy Claims Agreement,

with $2,000 payable to Tarsis on each subsequent anniversary of the effective date. The Company agreed to pay Tarsis a 2% production

royalty (the “Lazy Claims Royalty”) based on the gross returns from the production and sale of minerals from the Lazy Claims.

Should the Lazy Claims Royalty payments to Tarsis be in excess of $2,000 per year, the Company will not be required to pay a $2,000 annual

minimum payment.

During

the three and nine months ended September 30, 2023 and 2022, the Company paid $2,543 (2022 - $2,543) for its mineral property interests

in Lazy Claims, of which $2,000 (2022 - $2,000) represented annual minimum payment required under the Lazy Claims Agreement and $543

(2022 - $543) was associated with the annual mining claim fees payable to the Bureau of Land Management (the “BLM”). These

fees were recorded as part of the Company’s exploration expenses.

Loman

Property

In

December 2019, the Company acquired 27 mining claims for a total of $10,395. The claims were acquired by the Company from a third-party.

During

the three and nine months ended September 30, 2023 and 2022, the Company paid $4,791 (2022 - $4,791) in annual mining claim fees payable

to the BLM. These fees were recorded as part of the Company’s exploration expenses.

Agai-Pah

Property

On

May 19, 2021, the Company entered into exploration lease with option to purchase agreement (the “Agai-Pah Property Agreement”)

with MSM Resource, L.L.C., a Nevada limited liability Corporation on the Agai-Pah Property, consisting of 20 unpatented mining claims

totaling 400 acres, located in sections 32 & 33, T4N, R34E, MDM, Mineral County, Nevada about 10 miles northeast of the town of Hawthorne

(the “Agai-Pah Property”). Alan Day, the managing member of MSM, is the CEO, President, and director of the Company.

The

term of the Agai-Pah Property Agreement commenced on May 19, 2021, and continues for ten years, subject to the Company’s right

to extend the Agai-Pah Property Agreement for two additional terms of ten years each, and subject to the Company’s option to purchase

the Property.

Full

consideration of the Agai-Pah Property Agreement consists of the following: (i) an initial cash payment of $20,000 to be paid within

90 days from the execution of the Agai-Pah Property Agreement on May 19, 2021 (the “Effective Date”), and (ii) annual payments

of $20,000 to be paid on the anniversary of the Effective Date while the Agai-Pah Property Agreement remains in effect. The Company has

the exclusive option and right to acquire 100% ownership of the Agai-Pah Property (the “Agai-Pah Purchase Option”). To exercise

the Agai-Pah Purchase Option, the Company will be required to pay $750,000 (the “Agai-Pah Purchase Price”). The Agai-Pah

Purchase Price can be paid in either cash and/or equity of the Company, or a combination thereof, at the election of MSM. The annual

payments paid by the Company to MSM, shall not be applied or credited against the Purchase Price.

The

Company made the initial cash payment of $20,000 on November 6, 2021, pursuant to a verbal extension granted to the Company by MSM, made

the first $20,000 anniversary payment on June 20, 2022, and made the second anniversary payment on August 10, 2023.

During

the three and nine months ended September 30, 2023 and 2022, the Company paid $3,552 (2022 - $3,552) in annual mining claim fees payable

to the BLM. These fees were recorded as part of the Company’s exploration expenses.

Belshazzar

Property

On

June 4, 2021, the Company entered into exploration lease with option to purchase agreement (the “Belshazzar Property Agreement”)

with Belshazzar Holdings, L.L.C., a Nevada Limited Liability Corporation on the Belshazzar Property, consisting of ten unpatented lode

mining claims and seven unpatented placer mineral claims totaling 200 acres, within Quartzburg mining district, in Boise County, Idaho

(the “Belshazzar Property”). Alan Day, the managing member of Belshazzar, is the CEO, President, and director of the Company.

The

term of the Belshazzar Property Agreement commenced on June 4, 2021, and continues for ten years, subject to the Company’s right

to extend the Belshazzar Property Agreement for two additional terms of ten years each, and subject to the Company’s option to

purchase the Belshazzar Property.

Full

consideration of the Belshazzar Property Agreement consists of the following: (i) an initial cash payment of $20,000 to be paid within

90 days from the execution of the Belshazzar Property Agreement on June 4, 2021 (the “effective date”), and (ii) annual payments

of $20,000 to be paid on the anniversary of the Effective Date while the Belshazzar Property Agreement remains in effect. The Company

has the exclusive option and right to acquire 100% ownership of the Belshazzar Property (the “Belshazzar Purchase Option”).

To exercise the Belshazzar Purchase Option, the Company will be required to pay $800,000 (the “Belshazzar Purchase Price”).

The Belshazzar Purchase Price can be paid in either cash and/or equity of the Company, or a combination thereof, at the election of BH.

The annual payments paid by the Company to BH, shall not be applied or credited against the Belshazzar Purchase Price. The Belshazzar

Property is subject to a 1% Gross Returns Royalty payable to the property owner, from the commencement of commercial production subject

to certain terms.

The

Company made the initial cash payment of $20,000 on November 6, 2021, pursuant to a verbal extension granted to the Company by BH, made

the first $20,000 anniversary payment on June 20, 2022, and made the second anniversary payment on August 10, 2023.

During

the three and nine months ended September 30, 2023 and 2022, the Company paid $2,825 (2022 - $2,660) in annual mining claim fees payable

to the BLM. These fees were recorded as part of the Company’s exploration expenses.

Swales

Property

On

December 27, 2021, the Company entered into exploration lease with option to purchase agreement (the “Swales Property Agreement”)

with Mr. W. Wright Parks III., (“Mr. Parks”) on the Swales Property, consisting of 40 unpatented lode mining claims totaling

800 acres, within Swales Mountain Mining District in Elko County, Nevada (the “Swales Property”).

The

term of the Swales Property Agreement commenced on December 27, 2021, and continues for ten years, subject to the Company’s right

to extend the Swales Property Agreement for two additional terms of ten years each, and subject to the Company’s option to purchase

the Swales Property.

Full

consideration of the Swales Property Agreement consists of the following: (i) an initial cash payment of $20,000 to be paid within 90

days from the execution of the Swales Property Agreement on December 27, 2021 (the “effective date”), and (ii) annual payments

of $20,000 to be paid on the anniversary of the Effective Date while the Swales Property Agreement remains in effect. The Company has

the exclusive option and right to acquire 100% ownership of the Swales Property (the “Swales Purchase Option”). To exercise

the Swales Purchase Option, the Company will be required to pay $750,000 (the “Swales Purchase Price”). The Swales Purchase

Price can be paid in either cash and/or equity of the Company, or a combination thereof, at the election of Mr. Parks. The annual payments

paid by the Company to Mr. Parks, shall not be applied or credited against the Swales Purchase Price.

The

Company made the initial cash payment of $20,000 on January 15, 2022, and made the first $20,000 anniversary payment on March 14, 2023,

which was initially accrued at December 31, 2022.

During

the three and nine months ended September 30, 2023 and 2022, the Company paid $7,092 (2022 - $7,092) in annual mining claim fees payable

to the BLM. These fees were recorded as part of the Company’s exploration expenses

Olinghouse

Project

On

December 17, 2021, the Company’s wholly-owned subsidiary, Nevada Canyon, LLC, entered into an Option to Purchase Agreement (the

“Olinghouse Agreement”) with Target Minerals, Inc (“Target”), a private Nevada company, to acquire

100% interest of Target’s 1% production royalty on the Olinghouse Project, located in the Olinghouse Mining District, Washoe County,

Nevada.

The

Company has the exclusive right and option (the “Olinghouse Purchase Option”), exercisable at any time during the Olinghouse

Option Period, as further defined below, at its sole discretion, to acquire 100% of a 1% production royalty from the net smelter returns

on all minerals and products produced from certain properties comprising the Olinghouse Project.

The

term of the Olinghouse Purchase Option shall be the later of one year, or 60 days after the date on which the Company delivers to Target

a written notice to exercise the Olinghouse Purchase Option, subject to further extension if Target’s conditions to closing are

not fully satisfied or otherwise waived by the Company. Full consideration of the Olinghouse Agreement consists of the following: (i)

an initial cash option payment of $200,000 payable upon execution of the Agreement, which the Company paid on December 18, 2021, and

(ii) purchase price (the “Olinghouse Purchase Price”) which shall be paid by the Company to Target in either cash or common

shares of the Company, the determination of which shall be as follows:

| |

● |

if

the Company’s 10-day volume weighted average price (“VWAP”) Calculation is less than $1.25 per share, the Olinghouse

Purchase Price shall be paid in cash; or |

| |

|

|

| |

● |

if

the Company’s 10-day VWAP Calculation is more than $1.25 per share, the Olinghouse Purchase Price shall be paid in the form

of 2,000,000 Shares of the Company’s common stock. |

On

December 23, 2022, the Company and Target agreed to extend the Olinghouse Purchase Option for an additional one-year term, expiring on

December 17, 2023, for a one-time cash payment of $40,000.

During

the three- and nine-month periods ended September 30, 2023 and 2022, the Company did not incur any additional expenses associated with

the Olinghouse Project.

Palmetto

Project

On

January 27, 2022, Nevada Canyon, LLC entered into a Royalty Purchase Agreement with Smooth Rock Ventures, LLC, a wholly-owned subsidiary

of Smooth Rock Ventures Corp. (“Smooth Rock”), to acquire a 2% net smelter returns royalty on the Palmetto Project. Alan

Day, the Company’s CEO, President, and director, is also a director and CEO of Smooth Rock.

To

acquire the 2% NSR on the Palmetto Project, Nevada Canyon agreed to pay Smooth Rock a one-time cash payment of $350,000, which was paid

on February 7, 2022.

During

the three- and nine-month periods ended September 30, 2023 and 2022, the Company did not incur any additional expenses associated with

the Palmetto Project.

NOTE

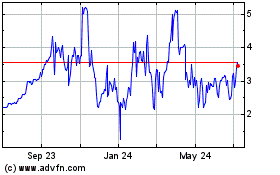

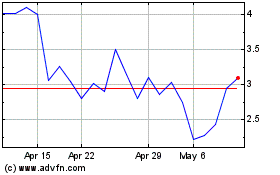

6 – INVESTMENT IN EQUITY SECURITIES

As

at September 30, 2023 and December 31, 2022, the Company’s equity investments consist of 511,750 common shares of Walker River

Resources Corp. (“WRR”).

At

September 30, 2023 and December 31, 2022, the fair value of the equity investment was $41,637 and $156,805, respectively, based on the

market price of WRR Shares at September 30, 2023 and December 31, 2022, respectively. Fair value is measured using Level 1 inputs in

the fair value hierarchy. During the three-month period ended September 30, 2023 the revaluation of the equity investment in WRR resulted

in a $20,206 loss on the change in fair value of the equity investments (September 30, 2022 - $40,737). During the nine-month period

ended September 30, 2023 the revaluation of the equity investment in WRR resulted in a $115,168 loss on the change in fair value of the

equity investments (September 30, 2022 - $163,113 gain).

The

Company did not sell any WRR Shares during the three- and nine-month periods ended September 30, 2023. During the three-month period

ended September 30, 2022, the Company did not sell any WRR Shares. During the nine-month period ended September 30, 2022, the Company

sold 1,171,083 WRR Shares for net proceeds of $614,658. The Company recorded a net realized gain of $211,530 on the sale of WRR Shares.

NOTE

7 – STOCKHOLDERS’ EQUITY

The

Company was formed with one class of common stock, $0.0001 par value and is authorized to issue 100,000,000 common shares and one class

of preferred stock, $0.0001 par value and is authorized to issue 10,000,000 preferred shares. Voting rights are not cumulative and, therefore,

the holders of more than 50% of the common stock could, if they chose to do so, elect all of the directors of the Company.

Units

issued under offering statement on Form 1-A

During

the three-month period ended September 30, 2023, the Company issued a total of 5,537,260 units of its common stock pursuant to its offering

statement on Form 1-A (the “Offering”), which the Company filed with the U.S. Securities and Exchange Commission (the “SEC”)

on June 17, 2022, and which was qualified on September 27, 2022. Each unit is comprised of one common share (a “Common Share”),

and one common share purchase warrant (a “Warrant”) to purchase one additional common share (a “Warrant Share”)

at an exercise price of $1.20 per Warrant Share, expiring 24 months from the issuance date.

The

Units were issued in three separate tranches as follows:

SCHEDULE OF UNITS ISSUED IN THREE SEPARATE TRANCHES

Effective

date | |

Number

of units issued | | |

Gross

proceeds | | |

Share

issuance costs – cash | | |

Share

issuance costs – agent warrants | | |

Net

proceeds | |

| July

27, 2023 | |

| 432,914 | | |

$ | 346,331 | | |

$ | 26,178 | | |

$ | 3,404 | | |

$ | 320,153 | |

| August

28, 2023 | |

| 2,886,124 | | |

| 2,308,899 | | |

| 86,960 | | |

| 22,690 | | |

| 2,221,939 | |

| September 23, 2023 | |

| 2,218,222 | | |

| 1,774,578 | | |

| 69,098 | | |

| 17,439 | | |

| 1,705,480 | |

| Total | |

| 5,537,260 | | |

$ | 4,429,808 | | |

$ | 182,236 | | |

$ | 43,533 | | |

$ | 4,247,572 | |

The

Company paid a total of $225,769 in share issuance costs of which $43,533 were associated with issuance of 55,373 agent warrants (the

“Agent Warrants”). The Agent Warrants are exercisable at $1.20 and expire 5 years from the issuance date. The fair value

of the Agent Warrants was determined using Black-Scholes Option Pricing Model with the following assumptions: expected life of 5 years,

risk-free interest rate of 4.67%, expected dividend yield - $Nil, and expected share price volatility of 216%.

As

of September 30, 2023, the Company received subscriptions for an additional 6,962,083 units for total gross proceeds of $5,569,666 (the

“Final Tranches”), which were recorded as obligation to issue shares. The share issuance costs associated with the Final

Tranches totaling $176,885 were recorded as deferred share issuance costs and were included in prepaid expenses. The Company agreed to

issue 69,621 Agent Warrants relating to the Final Tranches, which are valued at $54,734. These Agent Warrants were issued subsequent

to September 30, 2023.

During

the nine-month period ended September 30, 2023, the Company issued 1,250 Common Shares for total proceeds to the Company of $1,500 on

exercise of a Warrant issued as part of the Offering.

Share-based

compensation

During

the three- and nine-month periods ended September 30, 2023 and 2022, the Company recognized share-based compensation as follows:

SCHEDULE OF RECOGNIZED SHARE-BASED COMPENSATION

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

Three months ended September 30, | | |

Nine months ended September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Directors and CEO | |

$ | 249,149 | | |

$ | 316,862 | | |

$ | 739,322 | | |

$ | 676,053 | |

| Officer – VP of Operations | |

| 175,000 | | |

| - | | |

| 408,333 | | |

| - | |

| Consultants | |

| 116,667 | | |

| - | | |

| 272,223 | | |

| - | |

| Total | |

$ | 540,816 | | |

$ | 316,862 | | |

$ | 1,419,878 | | |

$ | 676,053 | |

Directors:

On

December 30, 2021, the Company distributed a total of 6,005,000 shares of common stock to the Company’s directors (the

“Director Shares”). The Director Shares are subject to the terms and conditions included in 3-year lock-up and vesting

agreements (the “Lock-up Agreements”), which contemplate that the Director Shares will vest in equal annual installments

over a 3-year term during which term the shareholders agreed not to sell, directly or indirectly, or enter into any other transactions

involving the Company’s common shares regardless if the shares have vested or not.

The

fair value of the shares was determined to be approximately $2,924,796 or $0.4938 per share based on the trading price of the Company’s

common stock on the issue date adjusted for the restrictions under the Lock-up Agreements. The shares vest over a three-year time period.

As

stated above, the Company distributed all of the awarded shares prior to vesting. As at September 30, 2023, 2,001,667 shares have vested

and 4,003,333 shares are unvested. As of September 30, 2023, unvested compensation related to the Director Shares of $1,237,620 will

be recognized over the next 1.25 years.

Officer

– VP of Operations:

On

February 24, 2023, the Company entered into a consulting agreement with the Company’s newly appointed Vice President of Operations

(the “VP Agreement”). The Company agreed to issue 2,000,000 shares of its common stock for the services. The shares vest

ratably over a two-year period, beginning March 1, 2023, and vested shares are distributed quarterly. The fair value of the shares was

$1,400,000 or $0.70 per share based on the trading price of the Company’s common stock on the date the service period began.

On

July 5, 2023, the Company issued 333,333 shares as these shares had vested as of June 30, 2023, and on September 30, 2023, the Company

issued a further 250,000 shares, which vested as of that date. As at September 30, 2023, the Company had distributed a total of 583,333

shares under the VP Agreement.

Unvested

compensation related to the shares to be issued under the VP Agreement of $991,667 will be recognized over the next 1.42 years.

Consultants:

On

February 24, 2023, the Company entered into two separate consulting agreements with consultants (the “Consulting Agreements”)

in exchange for a total of 2,000,000 shares of its common stock. All shares vest ratably over a three-year period, beginning March 1,

2023, and vested shares are distributed quarterly . The fair value of the shares was $1,400,000 or $0.70 per share based on the trading

price of the Company’s common stock on the date the service period began.

On

July 5, 2023, the Company issued a total of 222,222 shares as these shares had vested as of June 30, 2023, and on September 30, 2023,

the Company issued a further 166,667 shares, which vested as of that date. As at September 30, 2023, the Company had distributed a total

of 388,889 shares under the Consulting Agreements.

Unvested

compensation related to the Shares to be issued under the Consulting Agreements of $1,127,778 will be recognized over the next 2.42 years.

Warrants

The

changes in the number of warrants outstanding during the nine-month periods ended September 30, 2023 and for the year ended December 31, 2022, are as follows:

SCHEDULE OF CHANGES IN NUMBER OF WARRANTS OUTSTANDING

| | |

Nine months ended

September 30, 2023 | | |

Year ended

December 31, 2022 | |

| | |

Number of warrants | | |

Weighted

average exercise price | | |

Number of warrants | | |

Weighted average exercise price | |

| Warrants outstanding, beginning | |

| - | | |

$ | n/a | | |

| - | | |

$ | n/a

| |

| Warrants issued - offering | |

| 5,537,260 | | |

$ | 1.20 | | |

| - | | |

$ | n/a | |

| Warrants issued - agent | |

| 55,373 | | |

$ | 1.20 | | |

| - | | |

$ | n/a | |

| Warrants exercised | |

| (1,250 | ) | |

$ | 1.20 | | |

| - | | |

$ | n/a

| |

| Warrants outstanding, ending | |

| 5,591,383 | | |

$ | 1.20 | | |

| - | | |

$ | n/a | |

Details

of warrants outstanding as at September 30, 2023, are as follows:

SCHEDULE OF WARRANTS OUTSTANDING

Number of warrants exercisable | | |

Expiry date | |

Exercise price | |

| | 431,664 | | |

July 27, 2025 | |

$ | 1.20 | |

| | 2,886,124 | | |

August 28, 2025 | |

$ | 1.20 | |

| | 2,218,222 | | |

September 23, 2025 | |

$ | 1.20 | |

| | 55,373 | (1) | |

July 27, 2028 | |

$ | 1.20 | |

| | 5,591,383 | | |

| |

| | |

At

September 30, 2023, the weighted average life of the warrants was 1.96 years.

Options

During

the nine-month period ended September 30, 2023 and for the year ended December 31, 2022, the Company did not have any options issued

and exercisable.

NOTE

8 – CONVERTIBLE NOTES PAYABLE

During

the year ended December 31, 2021, the Company received $980,000 in

cash proceeds under the convertible promissory notes financing, in addition, the Company’s existing debt holder agreed to

convert $15,064 the Company owed on account of unsecured, non-interest-bearing

note payable due on demand into a convertible promissory note for a total of $20,000.

The convertible promissory notes (the “Notes”) were due in twelve months after their issuances (the “Maturity

Date”) and accrued interest at a rate of 15% per annum. During the three- and

nine-month periods ended September 30, 2022, the Company recorded $396,143 and $697,535 in

amortization of debt discount on the Notes, respectively. The balance of the Notes at December 31, 2022 was $Nil as all of the notes

were paid or converted into shares of the Company’s common stock during the year ended December 31, 2022.

NOTE

9 – PREPAID EXPENSES

Prepaid

expenses at September 30, 2023 and December 31, 2022:

SCHEDULE OF PREPAID EXPENSES

| | |

September

30, 2023 | | |

December

31, 2022 | |

| Prepaid

advertising and investor relations services | |

$ | 280,978 | | |

$ | 367 | |

| Deferred

share issuance costs | |

| 176,885 | | |

| - | |

| Prepaid

conference fees | |

| 9,950 | | |

| - | |

| Prepaid

filing fees | |

| 3,177 | | |

| 1,462 | |

| Prepaid

consulting fees | |

| 2,375 | | |

| 3,000 | |

| Total | |

$ | 473,365 | | |

$ | 4,829 | |

NOTE

10 – CONTRACTUAL AGREEMENTS

On

February 3, 2023, the Company entered into a public relations services agreement (the “Agreement”) with Think Ink Marketing

Data & Email Services, Inc. (“Think Ink”) to develop an investor outreach program. The Agreement is for a six-month term.

During the nine-month period ended September 30, 2023 the Company paid $60,000, of which $40,000 were recognized as general and administrative

expenses, and $20,000 were recorded as prepaid expenses.

On

April 5, 2023, the Company entered into a consulting services agreement (the “Consulting Agreement”) with Warm Springs Consulting

LLC. (“Warm Springs”) to develop registry-verified carbon credits for voluntary and compliance markets in the State of Nevada

and the Western United States. The Agreement is for a nine-month term, and the Company agreed to an initial budget of $115,525, of which

$82,615 was paid during the nine-month period ended September 30, 2023 and was expensed during the same period as part of professional

fees.

On

August 18, 2023, the Company entered into a marketing agreement with i2i Marketing Group, LLC. (the “i2i Agreement”). The

i2i Agreement is for an initial three-month term, continuing on a month-to-month basis thereafter. During the three month period ended

September 30, 2023, the Company prepaid $300,000 pursuant to the i2i Agreement and recognized $44,925 in general and administrative expense.

At September 30, 2023, the prepaid balance associated with this agreement is $255,075.

NOTE

11 – SUBSEQUENT EVENT

Subsequent

to September 30, 2023, the Company issued 69,675 Common Shares for total proceeds of $83,610 on exercise of warrants issued as part

of the Offering.

Item

2. Management’s Discussion and Analysis of Financial Conditions and Results of Operations

Forward

Looking Statements

This

Quarterly Report on Form 10-Q, including “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

in Item 2 of Part I of this report include forward-looking statements within the meaning of Section 27A of the Securities Exchange Act

of 1934, as amended, and the Private Securities Litigation Reform Act of 1995 (collectively, the “Reform Act”). The Reform

Act provides a safe harbor for forward-looking statements to encourage companies to provide prospective information about themselves

so long as they identify these statements as forward-looking and provide meaningful cautionary statements identifying important factors

that could cause actual results to differ from the projected results. All statements, other than statements of historical fact that we

make in this Quarterly Report on Form 10-Q are forward-looking. The words “anticipates,” “believes,” “expects,”

“intends,” “will continue,” “estimates,” “plans,” “projects,” the negative

of these terms and similar expressions are intended to identify forward-looking statements. However, the absence of these words does

not mean the statement is not forward-looking.

Forward-looking

statements involve risks, uncertainties or other factors which may cause actual results to differ materially from the future results,

performance or achievements expressed or implied by the forward-looking statements. These statements are based on our management’s

beliefs and assumptions, which in turn are based on currently available information. Certain risks, uncertainties or other important

factors are detailed in this Quarterly Report on Form 10-Q and may be detailed from time to time in other reports we file with the Securities

and Exchange Commission, including on Forms 8-K and 10-K.

Examples

of forward-looking statements in this Quarterly Report on Form 10-Q include, but are not limited to, our expectations regarding our ability

to generate operating cash flows and to fund our working capital and capital expenditure requirements. Important assumptions relating

to the forward-looking statements include, among others, assumptions regarding demand for our future products, the timing and cost of

capital expenditures, competitive conditions and general economic conditions. These assumptions could prove inaccurate. Although we believe