Current Report Filing (8-k)

September 19 2019 - 1:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934

Date of

Report (Date of earliest event reported): September 17, 2019

NATURALSHRIMP INCORPORATED

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

000-54030

|

|

74-3262176

|

|

(State

or other jurisdiction of

incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer Identification No.)

|

|

|

|

|

|

|

15150 Preston Road, Suite #300

Dallas, Texas 75248

(Address

of principal executive offices)

Registrant’s

telephone number, including area code: (888) 791-9474

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

[ ]

Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

[ ]

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12)

[ ]

Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

[ ]

Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

None

|

N/A

|

N/A

|

Indicate

by check mark whether the registrant is an emerging growth company

as defined in in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b -2 of this

chapter).

Emerging

growth company [ ]

If an

emerging growth company, indicate by checkmark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. [ ]

Item 1.01 Entry into a Material Definitive Agreement.

$5,000,000 Preferred Stock Equity Financing

On

August 7, 2019, the Company entered into a Securities Purchase

Agreement with GHS Investments, LLC for the purchase of up to 5,000

shares of Series C Preferred Stock (the “Preferred

Stock”) at a stated value of $1,200 per share, or for a total

net proceeds of $5,000,000 in the event the entire 5,000 shares of

Preferred Stock are purchased (the “GHS

SPA”).

On

August 18, 2019, the Company received an initial tranche of

$250,000 under the GHS SPA.

$11,000,000 Common Stock Equity Financing

On

August 23, 2019, the Company entered into an Equity Financing

Agreement (“Equity Financing Agreement”) and

Registration Rights Agreement (“Registration Rights

Agreement”) with GHS Investments LLC, a Nevada limited

liability company (“GHS”). Under the terms of the

Equity Financing Agreement, GHS agreed to provide the Company with

up to $11,000,000 upon effectiveness of a registration statement on

Form S-1 (the “Registration Statement”) filed with the

U.S. Securities and Exchange Commission (the

“Commission”).

Following

effectiveness of the Registration Statement, the Company shall have

the discretion to deliver puts to GHS and GHS will be obligated to

purchase shares of the Company’s common stock, par value

$0.0001 per share (the “Common Stock”) based on the

investment amount specified in each put notice. The maximum amount

that the Company shall be entitled to put to GHS in each put notice

shall not exceed two hundred percent (200%) of the average daily

trading dollar volume of the Company’s Common Stock during

the ten (10) trading days preceding the put, so long as such amount

does not exceed $500,000. Pursuant to the Equity Financing

Agreement, GHS and its affiliates will not be permitted to purchase

and the Company may not put shares of the Company’s Common

Stock to GHS that would result in GHS’s beneficial ownership

equaling more than 4.99% of the Company’s outstanding Common

Stock. The price of each put share shall be equal to eighty percent

(80%) of the Market Price (as defined in the Equity Financing

Agreement). Puts may be delivered by the Company to GHS until the

earlier of thirty-six (36) months after the effectiveness of the

Registration Statement or the date on which GHS has purchased an

aggregate of $11,000,000 worth of Common Stock under the terms of

the Equity Financing Agreement.

The

Registration Rights Agreement provides that the Company shall (i)

use its best efforts to file with the Commission the Registration

Statement within 30 days of the date of the Registration Rights

Agreement; and (ii) have the Registration Statement declared

effective by the Commission within 30 days after the date the

Registration Statement is filed with the Commission, but in no

event more than 90 days after the Registration Statement is

filed.

The

foregoing is only a brief description of the material terms of the

Equity Financing Agreement and Registration Rights Agreement, and

does not purport to be a complete description of the rights and

obligations of the parties thereunder, and such descriptions are

qualified in their entirety by reference to the Equity Financing

Agreement and Registration Rights Agreement filed as Exhibits 10.1,

and 10.2, respectively, to this Current Report on Form

8-K.

Item 9.01 Financial Statement and Exhibits.

|

Exhibit No.

|

|

Description

|

|

|

|

Equity

Financing Agreement dated August 23, 2019 by and between

NaturalShrimp Incorporated and GHS Investments, LLC

|

|

|

|

|

|

|

|

Registration

Rights Agreement dated August 23, 2019 by and between NaturalShrimp

Incorporated and GHS Investments, LLC

|

SIGNATURE

Pursuant to the

requirements of the Securities Exchange Act of 1934, the Registrant

has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

NATURALSHRIMP

INCORPORATED

|

|

|

|

|

|

|

|

Date: September 19,

2019

|

By:

|

/s/ Gerald

Easterling

|

|

|

|

|

Gerald

Easterling

|

|

|

|

|

Chief Executive

Officer

|

|

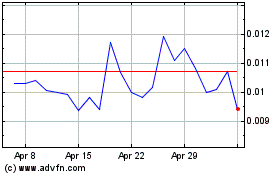

NaturalShrimp (PK) (USOTC:SHMP)

Historical Stock Chart

From Oct 2024 to Nov 2024

NaturalShrimp (PK) (USOTC:SHMP)

Historical Stock Chart

From Nov 2023 to Nov 2024