National Australia Bank Reports 3Q Profit Drop -- Update

August 13 2020 - 7:38PM

Dow Jones News

By Alice Uribe

SYDNEY--National Australia Bank Ltd. warned the outlook remains

highly uncertain after volatile markets and low interest rates

combined to drive a decline in third-quarter earnings.

The bank saw its closely watched net interest margin stay

broadly stable, though it flagged further remediation costs, adding

that the "amounts and timing remain uncertain."

"The Covid-19 pandemic continues to challenge our customers and

our bank, with varied impacts across industries and communities.

The outlook remains highly uncertain," NAB said.

NAB, the country's fourth-largest bank by market value and the

biggest business lender, recorded an unaudited net profit of 1.50

billion Australian dollars (US$1.07 billion) for the three months

through June. No comparable figure was disclosed, but it compares

with a profit of A$1.70 billion reported by the bank a year

ago.

Cash earnings, a measure adjusted for fair value and hedging

movements and is the basis for calculating dividend payouts, was

A$1.55 billion, which NAB said fell by 7.0% against the same

quarter a year earlier.

Compared with its first-half quarterly average and excluding

large notable items, cash earnings increased by 24%, NAB said.

Third-quarter revenue was also up 10% on the average of the first

half on higher markets and treasury, and the bank said expenses for

the quarter rose 2%.

"Achieving our target of broadly flat fiscal 2020 expenses is

now increasingly challenging, in part reflecting Covid-19 related

effects such as additional customer support and workout resources,"

the bank said.

It noted that this is also expected to impact cost growth in

fiscal 2021.

NAB in April launched a A$3.5 billion capital raising, while

also slashing its interim dividend by 64% as it responded to

upheaval caused by the coronavirus pandemic. Its peers, Westpac and

ANZ, both deferred making decisions on their interim dividends,

while Commonwealth Bank of Australia this week said its final

dividend would be A$0.98.

NAB said Friday that action to strengthen its balance sheet is

allowing it to support customers and keep the bank safe.

Credit impairment charges fell by 2% to A$570 million compared

with the first-half quarterly average. There was a rise in the

ratio of impaired assets and loans overdue by 90 days or more

against gross loans and acceptances by 9 basis points to 106%.

NAB said this was primarily due to increased delinquencies in

its Australian home loan portfolio, where customers were not part

of its pandemic-related loan deferral program.

NAB reported a 51% drop in cash earnings for the six months

through March to A$1.44 billion. The result was dragged down by

A$1.04 billion in one-off charges, including higher credit

impairment charges and mark-to-market losses on its liquids

portfolio within Markets and Treasury.

Write to Alice Uribe at alice.uribe@wsj.com

(END) Dow Jones Newswires

August 13, 2020 19:23 ET (23:23 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

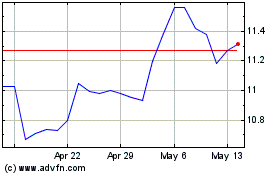

National Australia Bank (PK) (USOTC:NABZY)

Historical Stock Chart

From Dec 2024 to Jan 2025

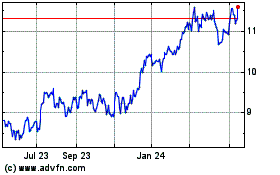

National Australia Bank (PK) (USOTC:NABZY)

Historical Stock Chart

From Jan 2024 to Jan 2025