RBS Continues Search for New CEO as McEwan Joins National Australia Bank -- Update

July 19 2019 - 2:47AM

Dow Jones News

By Robb M. Stewart

One of Australia's biggest banks has reached outside its ranks

for a new chief executive, hiring the outgoing boss of Royal Bank

of Scotland PLC (RBS.LN) to help rebuild its reputation.

National Australia Bank Ltd. (NAB.AU) on Friday said it had

appointed New Zealand-born Ross McEwan, who helped return Royal

Bank of Scotland to profitability and dividend payments, as its

next CEO and managing director.

Mr. McEwan announced his resignation from Royal Bank of Scotland

in April. He will take over at Australia's biggest business lender

and one of the country's largest mortgage providers no later than

April 2020, which is the end of his 12-month notice period.

RBS confirmed that Mr. McEwan will stay in place until next year

so that an orderly handover can take place. RBS Chairman Howard

Davies congratulated Mr. McEwan on his new role and said the bank

continues to search for a successor.

The effective date of Mr. McEwan's departure will be confirmed

in due course, Mr. Davies said.

Philip Chronican, NAB's chairman-elect and interim CEO since the

resignation in March of Andrew Thorburn, said the Australia and New

Zealand-focused bank had secured a senior executive with deep

experience in international markets and long-standing knowledge of

Australian banking.

"RBS has been through many of the same challenges which NAB now

faces around culture, trust and reputation," Mr. Chronican said,

adding Mr. McEwan had been hired on an "appropriate remuneration

package" when compared with domestic and international peers and

other industries.

Mr. Thorburn and Chairman Ken Henry agreed in early February to

step down after the pair were singled out for criticism in a

government-ordered judicial review that revealed misconduct across

Australia's financial industry. The bank a month later settled on

Mr. Chronican, a director, as its next chairman as it continued an

internal and external search for a successor to Mr. Thorburn, who

had been in the role four and a half years and had led a shift in

focus back on its core businesses with the sale of operations

including in the U.S. and U.K.

Former high court judge Kenneth Hayne, who led a yearlong

investigation into the financial industry, was highly critical of

Mr. Thorburn and Mr. Henry in a three-volume final report released

in February that highlighted widespread charging of

fees-for-no-service and other misconduct. NAB stands apart from the

country's other three major banks, Mr. Hayne wrote, adding he

wasn't confident lessons had been learned from past misconduct or

that the bank was willing to accept responsibility.

In May, NAB cut its dividend for the first time in a decade to

shore up its balance sheet as customer compensation costs continue

to climb. The bank's consumer banking and wealth operations have

come under pressure as it and peers in Australia have been squeezed

by heightened competition and a weakening property market.

"It is a privilege to return to Australia and lead NAB at a

crucial time," Mr. McEwan said.

He said it was essential that he protect and accelerate NAB's

efforts to transform itself, and there were areas where the bank

could extend its lead, such as in business banking, agriculture and

health lending. "We must also meet and exceed the expectations of

our many stakeholders," he said.

Early this year, Royal Bank of Scotland resumed dividend

payments to shareholders after a decade in which the world's

biggest bank by assets on the eve of the 2008 financial crisis was

hard hit and bailed out, forcing it to shrink and simplify.

Mr. McEwan joined Royal Bank of Scotland as CEO of its U.K.

retail arm in 2012 from Commonwealth Bank of Australia (CBA.AU),

where he had been head of retail banking services for five years.

He had previously been responsible for Commonwealth Bank's branch

network, contact centers and third-party mortgage brokers.

NAB said Mr. McEwan will be paid 2.5 million Australian dollars

(US$1.8 million) a year, including his superannuation pension, and

would be entitled to reward including an annual bonus of up to 150%

of his fixed salary split between cash and performance rights

vesting over four years.

--Oliver Griffin contributed to this story.

Write to Robb M. Stewart at robb.stewart@wsj.com.

(END) Dow Jones Newswires

July 19, 2019 02:32 ET (06:32 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

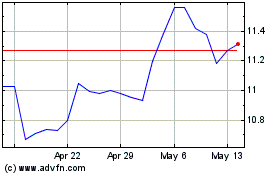

National Australia Bank (PK) (USOTC:NABZY)

Historical Stock Chart

From Dec 2024 to Jan 2025

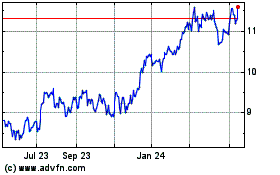

National Australia Bank (PK) (USOTC:NABZY)

Historical Stock Chart

From Jan 2024 to Jan 2025