IHS Shares Drop to All-Time Low After Losing Nigeria Contract Renewal

September 11 2023 - 12:40PM

Dow Jones News

By Will Feuer

Shares of IHS Holding dropped for a second consecutive trading

day after the operator of telecommunications infrastructure lost

out on a Nigerian contract renewal from MTN Group.

New York-listed shares tumbled almost 23% to $4.59 on Monday, on

pace to close at an all-time low. The selloff extends a decline

that began on Friday. Shares are down more than 25% so far this

year.

MTN said last week that it had selected a subsidiary of American

Tower to manage some 2,500 network sites in Nigeria, the contracts

for which are due to expire in 2024 and 2025. IHS confirmed Friday

that it currently manages the sites.

MTN said American Towers' ATC Nigeria Wireless Infrastructure

Solutions will start providing the services for the affected sites

in 2025.

IHS said that in the second quarter, the management of the

roughly 2,500 towers generated revenue of about $45 million. The

company's total revenue that quarter was $546.2 million.

MTN said the move will diversify its site portfolio.

MTN commands a 26% stake in IHS, and recently teamed up with

hedge fund Wendel to argue that the two firms, which collectively

own about 45% of IHS' shares, should have more say in who sits on

the tower operator's board.

The move to not renew the contracts with IHS appears to be

driven by the corporate-governance dispute, analysts at TD Cowen

said in a research note. They said the selloff in IHS shares

reflects investor concerns over what more damage MTN can do to IHS,

but the analysts said they don't believe MTN can do much more from

here.

Write to Will Feuer at Will.Feuer@wsj.com

(END) Dow Jones Newswires

September 11, 2023 12:25 ET (16:25 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

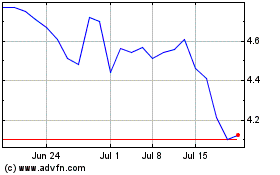

MTN (PK) (USOTC:MTNOY)

Historical Stock Chart

From Nov 2024 to Dec 2024

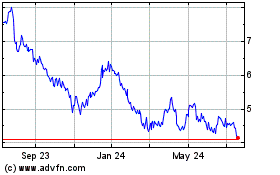

MTN (PK) (USOTC:MTNOY)

Historical Stock Chart

From Dec 2023 to Dec 2024