UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

|

X

|

|

QUARTERLY

REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

|

|

|

|

|

|

|

For

the quarterly period ended September 30, 2008

|

|

|

|

|

|

|

|

TRANSITION

REPORT UNDER SECTION 13 OR 15(d) OF THE EXCHANGE

ACT

|

For the

transition period from __________ to __________

Commission

File Number

000-53167

Millstream Ventures,

Inc.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

87-0405708

|

|

(State

or other jurisdiction of incorporation or organization)

|

|

(IRS

Employer Identification No.)

|

|

P.O.

Box 581072, Salt Lake City, UT

|

|

84158

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

(801)

860-2302

(Registrant’s

telephone number, including area code)

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

past 12 months (or for such shorter period that the registrant was required to

file such reports), and (2) has been subject to such filing requirements for the

past 90 days. Yes [X] No [ ]

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

definitions of “large accelerated filer,” “accelerated filer,” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

|

|

Large

Accelerated filer

|

|

|

Accelerated

filer

|

|

|

|

|

|

|

|

|

Non-accelerated

filer (Do not check if a smaller reporting company)

|

|

X

|

Smaller

reporting company

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act). Yes [X] No

[ ]

Indicate

the number of shares outstanding of each of the issuer’s classes of common

equity, as of the latest practicable date.

21,118,203 shares of $0.001

par value common stock on October 27, 2008

Part I -

Financial Information

Item 1 -

Financial Statements

|

Index

to Unaudited Financial Statements

|

|

Page

|

|

Unaudited

Balance Sheets -- September 30, 2008 and March 31, 2008

|

|

3

|

|

Unaudited

Statements of Operations -- Three months and six months ended September

30, 2008 and

2007,

and from the inception of the development stage (May 26, 2005) through

September 30, 2008

|

|

4

|

|

Unaudited

Statements of Cash Flows -- Six months ended September 30, 2008 and 2007,

and from

the

inception of the development stage (May 26, 2005) through September 30,

2008

|

|

5

|

|

Notes

to unaudited financial statements

|

|

6

|

|

Millstream

Ventures, Inc.

|

|

(A

Development Stage Enterprise)

|

|

Balance

Sheets

|

|

|

|

|

|

|

|

|

|

|

|

|

September

30,

|

|

|

March

31,

|

|

|

|

|

2008

|

|

|

2008

|

|

|

|

|

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Current

Assets:

|

|

|

|

|

|

|

|

Cash

|

|

$

|

27

|

|

$

|

6,467

|

|

Prepaid

expense

|

|

|

-

|

|

|

2,500

|

|

|

|

|

|

|

|

|

|

Total

Assets

|

|

$

|

27

|

|

$

|

8,967

|

|

|

|

|

|

|

|

|

|

Liabilities

and Stockholders' Equity (Deficit):

|

|

|

|

|

|

|

|

Current

Liabilities:

|

|

|

|

|

|

|

|

Accounts

payable

|

|

$

|

510

|

|

$

|

95

|

|

Accounts

payable – related party (note 4)

|

|

|

544

|

|

|

619

|

|

Notes

payable – related party (note 4)

|

|

|

10,000

|

|

|

-

|

|

Accrued

interest, note payable – related party (note 4)

|

|

|

495

|

|

|

-

|

|

Contingent

liability – related party (note 4)

|

|

|

20,000

|

|

|

-

|

|

Total

Liabilities

|

|

|

31,549

|

|

|

714

|

|

|

|

|

|

|

|

|

|

Stockholders'

Equity (Deficit) (note 2):

|

|

|

|

|

|

|

|

Preferred

stock, $.001 par value, 10,000,000 shares authorized,

|

|

|

|

|

|

|

no

shares issued and outstanding

|

|

|

-

|

|

|

-

|

|

|

Common

stock, $.001 par value, 200,000,000 shares authorized,

|

|

|

|

|

21,118,203

shares issued and outstanding

|

|

|

21,118

|

|

|

21,118

|

|

Paid-in

capital

|

|

|

(8,603)

|

|

|

11,397

|

|

|

Accumulated

deficit ($388,919 deficit eliminated on March 31, 2001

|

|

|

|

|

as

part of a quasi-reorganization)

|

|

|

(4,920)

|

|

|

(4,920)

|

|

Deficit

accumulated since inception of development stage

|

|

|

(39,117)

|

|

|

(19,342)

|

|

Total

Stockholders' Equity (Deficit)

|

|

|

(31,522)

|

|

|

8,253

|

|

|

|

|

|

|

|

|

|

Total

Liabilities and Stockholders' Equity (Deficit)

|

|

$

|

27

|

|

$

|

8,967

|

|

|

|

|

|

|

|

|

See

accompanying notes to the financial statements.

3

|

Millstream

Ventures, Inc.

|

|

(A

Development Stage Enterprise)

|

|

Unaudited

Statements of Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From

the

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Inception

of the

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Development

|

|

|

|

For

the Three Months Ended

|

|

For

the Six Months Ended

|

|

Stage

(May 26,

|

|

|

|

September

30,

|

|

September

30,

|

|

2005)

through

|

|

|

|

2008

|

|

2007

|

|

2008

|

|

2007

|

|

September

30, 2008

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$

|

-

|

|

$

|

-

|

|

$

|

-

|

|

$

|

-

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Management

fees – related

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

party

(note 4)

|

|

|

2,344

|

|

|

-

|

|

|

7,088

|

|

|

-

|

|

|

9,094

|

|

Legal

and accounting fees

|

|

2,010

|

|

|

1,088

|

|

|

10,384

|

|

|

1,088

|

|

|

21,318

|

|

Other

general and

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

administrative expenses

|

|

615

|

|

|

750

|

|

|

1,808

|

|

|

980

|

|

|

8,210

|

|

Total

Expenses

|

|

|

4,969

|

|

|

1,838

|

|

|

19,280

|

|

|

2,068

|

|

|

38,622

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other

Expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest

expense

|

|

|

411

|

|

|

-

|

|

|

495

|

|

|

-

|

|

|

495

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

loss

|

|

$

|

(5,380)

|

|

$

|

(1,838)

|

|

$

|

(19,775)

|

|

$

|

(2,068)

|

|

$

|

(39,117)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

loss per common share

|

|

$

|

(0.00)

|

|

$

|

(0.00)

|

|

$

|

($0.00)

|

|

$

|

(0.00)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average

common

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

shares

outstanding

|

|

|

21,118,203

|

|

|

1,118,203

|

|

|

21,118,203

|

|

|

1,118,203

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See

accompanying notes to the financial statements.

4

|

Millstream

Ventures, Inc.

|

|

(A

Development Stage Enterprise)

|

|

Unaudited

Statements of Cash Flows

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From

the Inception

|

|

|

|

|

|

|

|

|

|

of

the Development

|

|

|

|

For

the Six Months Ended

|

|

Stage

(May 26,

|

|

|

|

September

30,

|

|

2005)

through

|

|

|

|

2008

|

|

2007

|

|

September

30, 2008

|

|

Cash

Flow from Operating Activities:

|

|

|

|

|

|

|

|

|

|

|

Net

loss

|

|

$

|

(19,775)

|

|

$

|

(2,068)

|

|

$

|

(39,117)

|

|

Adjustments

to reconcile net loss to net

|

|

|

|

|

|

|

|

|

|

|

cash

used in operating activities:

|

|

|

|

|

|

|

|

|

|

|

Common

stock issued for services

|

|

|

-

|

|

|

-

|

|

|

100

|

|

Changes

in assets and liabilities:

|

|

|

|

|

|

|

|

|

|

|

Prepaid

expense

|

|

|

2,500

|

|

|

(2,742)

|

|

|

-

|

|

Accounts

receivable – related party

|

|

|

-

|

|

|

344

|

|

|

-

|

|

Accounts

payable

|

|

|

415

|

|

|

(534)

|

|

|

(6,500)

|

|

Accounts

payable – related party

|

|

|

(75)

|

|

|

-

|

|

|

544

|

|

Accrued

interest, notes payable – related party

|

|

|

495

|

|

|

-

|

|

|

495

|

|

Net

Cash Used in Operating Activities

|

|

|

(16,440)

|

|

|

(5,000)

|

|

|

(44,478)

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

Flow from Financing Activities:

|

|

|

|

|

|

|

|

|

|

|

Cash

contributed by related party

|

|

|

-

|

|

|

5,000

|

|

|

5,000

|

|

Proceeds

from notes payable – related party

|

|

10,000

|

|

|

-

|

|

|

15,000

|

|

Proceeds

from issuance of common stock

|

|

-

|

|

|

-

|

|

|

15,000

|

|

Net

Cash Provided from Financing Activities

|

|

10,000

|

|

|

5,000

|

|

|

35,000

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

Decrease in Cash

|

|

|

(6,440)

|

|

|

-

|

|

|

(9,478)

|

|

Cash

at Beginning of Period

|

|

|

6,467

|

|

|

-

|

|

|

9,505

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

at End of Period

|

|

$

|

27

|

|

$

|

-

|

|

$

|

27

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental

Cash Flow Information

|

|

|

|

|

|

|

|

|

|

|

Cash

paid for interest

|

|

$

|

-

|

|

$

|

-

|

|

$

|

-

|

|

Cash

paid for income taxes

|

|

$

|

-

|

|

$

|

-

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

See

accompanying notes to the financial statements.

5

Millstream

Ventures, Inc.

(a

development stage enterprise)

Notes to

Unaudited Financial Statements

September

30, 2008

Note 1:

Basis of Presentation

The

accompanying unaudited financial statements of Millstream Ventures, Inc. (the

“Company”) were prepared pursuant to the rules and regulations of the United

States Securities and Exchange Commission. Certain information and footnote

disclosures normally included in financial statements prepared in accordance

with accounting principles generally accepted in the United States of America

have been condensed or omitted pursuant to such rules and regulations.

Management of the Company (“Management”) believes that the following

disclosures are adequate to make the information presented not misleading. These

financial statements should be read in conjunction with the audited financial

statements and the notes thereto included in the Company’s Form 10-12G/A

report.

These

unaudited financial statements reflect all adjustments, consisting only of

normal recurring adjustments that, in the opinion of Management, are necessary

to present fairly the financial position and results of operations of the

Company for the periods presented. Certain inconsequential

reclassifications have been made in prior periods presented to conform to

current period presentation. Operating results for the six months

ended September 30, 2008, are not necessarily indicative of the results that may

be expected for the year ending March 31, 2009.

Note 2:

Summary of Significant Accounting Policies

Organization

– The

Company was incorporated in the State of Utah on April 7, 1983 as Carbon

Technologies, Inc. for the purpose of engaging in the carbon fiber technology

business. Subsequently, the Company became inactive and on May 26, 2005, as part

of a reorganization and change of control, the Company’s corporate domicile was

moved to Nevada. The Company currently operates as a development stage

enterprise seeking to enter into a reverse acquisition with an existing business

or otherwise acquire an operating entity.

Quasi-reorganization

– During 2001 the Company’s stockholders approved a quasi-reorganization which

resulted in the capital accounts of the Company being adjusted with the effect

that the paid-in capital account was reduced by the balance in the accumulated

deficit account in the amount of $388,919. No other accounts were affected by

this adjustment. Subsequent operating results were recorded in the accumulated

deficit account until the Company’s reorganization on May 26, 2005. Subsequent

thereto, operating results have been recorded in a separate account entitled

deficit accumulated since inception of the development stage.

Net Loss per Common

Share

– The computation of net loss per common share is based on the

weighted average number of shares outstanding during the periods presented. No

potentially dilutive securities or derivative instruments are

outstanding.

Income Taxes

– The

Company’s net operating loss carry forward at September 30, 2008 of

approximately $33,400 will be applied against future taxable income and expire

in various years through 2028. The Company has no deferred taxes arising from

temporary differences between income for financial reporting and income for tax

purposes. The Company’s utilization of its net operating loss carry forward is

unlikely as a result of its intended development stage activities.

Use of Estimates

–

The preparation of financial statements in conformity with accounting principles

generally accepted in the United States of America requires management to make

estimates and assumptions that affect the reported amounts of assets and

liabilities and disclosures of contingent assets and liabilities at the date of

the financial statements and the reported amounts of revenues and expenses

during the reporting period. Actual results could differ from those

estimates.

Millstream

Ventures, Inc.

(a

development stage enterprise)

Notes to

Unaudited Financial Statements (continued)

September

30, 2008

Note 3 –

Going Concern

The

Company’s financial statements have been prepared using accounting principles

generally accepted in the United States of America applicable to a going

concern, which contemplate the realization of assets and liquidation of

liabilities in the normal course of business. Since the inception as a

development stage enterprise on May 26, 2005, the Company has incurred losses

that total $39,117 at September 30, 2008. Through September 30, 2008, the

Company had received $10,000 in loans bearing interest at 18% per annum from its

sole officer and director (“Executive”). In October 2008, the Company received

$16,000 from a stockholder pursuant to a promissory note (“Stockholder Note”)

(see Note 5), proceeds from which were used to repay the Executive’s cash

advances plus interest. The Company believes that the remaining

Stockholder Note proceeds will be sufficient to fund the Company’s operations

through December 2008. The Company’s ability to continue as a going concern will

depend on receiving addition capital subsequent thereto. Sources of such capital

will most likely come from one or more stockholders of the

Company. The accompanying financial statements do not include any

adjustments that may result from the outcome of the uncertainty surrounding the

Company’s future need for capital or the need to obtain one or more officers and

directors to manage the affairs of the Company.

Note 4 –

Related Party Transactions

Accounting and Management

Services

– The Executive regularly performs accounting and management

services for the Company pursuant to an Employment Agreement. For the

six months ended September 30, 2008, the Company incurred $7,088 in management

fees of which $544 remain unpaid as of September 30, 2008.

Notes Payable

– At

September 30, 2008, the Executive had made cash advances to the Company in the

amount of $10,000, with interest accruing at the rate of 18% per annum. On

September 30, 2008, accrued interest amounted to $495. In October 2008, all

outstanding principal and interest were repaid to the Executive.

Contingent Liability

– The Company entered into an Employment Agreement with the Executive that

provided a “buyout” provision whereby upon termination, the Company could elect

to purchase 20,000,000 shares of its common stock owned by the Executive for

$25,000, and the Executive could require the Company to purchase this same

number of shares for $20,000. The Executive has elected to terminate the

Employment Agreement and both parties have agreed to modify the terms of the

buyout provision to allow the Executive the right to compel the Company to

purchase these shares through March 31, 2009. The Company has recorded a

contingent current liability of $20,000 with an offsetting decrease to paid-in

capital, in accordance with the provisions of Statement of Financial Accounting

Standards No. 150, “

Accounting

for Certain Financial Instruments with Characteristics of both Liabilities and

Equity

.”

Note 5 –

Subsequent Events

Notes Payable

– In

October 2008, the Company received $16,000 from a stockholder pursuant to a

promissory note (“Stockholder Note”). The Stockholder Note is not collateralized

by any assets of the Company, is not convertible into any equity interest in the

Company, bears interest at the rate of 18% per annum, and is due upon 15 days

written notice by the holder of the Stockholder Note. Proceeds from the loan

were subsequently used to repay $10,000 principal and $564 in interest due to

the Executive.

Employment Agreement

– In October 2008, the Executive gave notice to the Company of his intent to

terminate a month –to-month Employment Agreement, replacing it with a Service

Agreement to provide the Company accounting services on an as-needed

basis. The Executive also entered into an agreement with the Company

to modify the terms of the buyout provision to allow the Executive the right to

compel the Company to purchase 20,000,000 shares of its common stock through

March 31, 2009.

Item 2 -

Management’s Discussion and Analysis of Financial Condition and Results of

Operations

Special Note Regarding

Forward-Looking Statements

This

Form 10-Q Report contains

certain forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995 with respect to the Plan of Operations provided

below, including information regarding the Company’s financial condition,

results of operations, business strategies, operating efficiencies or synergies,

competitive positions, growth opportunities, and the plans and objectives of

management. The statements made as part of the Plan of Operations that are not

historical facts are hereby identified as "forward-looking

statements."

Plan of

Operations

Overview:

Millstream

Ventures, Inc. (the “Company”) was originally incorporated in the State of Utah

on April 7, 1983 as Carbon Technologies, Inc. for the purpose of engaging in the

carbon fiber technology business. Subsequently, the Company became inactive and

on May 26, 2005, as part of a reorganization and change of control, the

Company’s corporate domicile was moved to Nevada. The Company currently operates

as a development stage enterprise seeking to enter into a reverse acquisition

with an existing business or otherwise acquire an operating entity.

The

Company has now focused its efforts on seeking to acquire a foreign or domestic

private business opportunity (“Target Company”). The Company will attempt to

locate and negotiate with a Target Company for the merger of that entity into

the Company. In certain instances, a Target Company may wish to become a

subsidiary of the Company or may wish to contribute assets to the Company rather

than merge. No assurances can be given that the Company will be successful in

locating or negotiating with a Target Company. The Company will provide a method

for a Target Company to become a reporting (“public”) company whose securities

are qualified for trading in the United States secondary market.

The

acquisition of a Target Company will normally involve the transfer to the

stockholders of the Target Company of the majority of the issued and outstanding

common stock of the Company, and the substitution by the Target Company of its

own management and board of directors.

The

Company's plan of operations is subject to numerous risk factors including, but

not limited to the following:

|

1-

|

The

Company will, in all likelihood, sustain operating expenses without

corresponding revenues. This will result in the Company incurring a net

operating loss which will increase continuously until the Company can

consummate a business combination with a Target Company. There is no

assurance that the Company can identify such a Target Company and

consummate such a business combination. There is also no assurance that

the Company will be able to finance its operations while it searches for a

Target Company.

|

|

2-

|

The

Company is in competition with a large number of established and

well-financed entities, including venture capital firms that are active in

the merger and acquisition of a Target Company. Nearly all such entities

have significantly greater financial resources, technical expertise, and

managerial capabilities than the Company. Moreover, the Company will also

compete with numerous other small public companies in seeking merger or

acquisition candidates.

|

|

3-

|

At

the present time, the Company has not identified any particular industry

or specific business within an industry for evaluation and there is no

assurance that the Company will be able to negotiate a business

combination on terms favorable to the Company. The Company has not

established any criteria with respect to the Target Company’s length of

operating history or a specified level of earnings, assets, net worth or

other criteria. Accordingly, the Company may enter into a business

combination with a Target Company having no significant operating history

and no potential for immediate

earnings.

|

|

4-

|

The

Company's sole officer and director, Denny Nestripke, (“Executive”) has

given notice to the Company of his intent to terminate a written month to

month employment agreement with the Company at the end of October 2008.

The Executive has however, agreed to continue to provide accounting and

similar services to the Company. Consequently, the Company is seeking to

find one or more individuals to serve in the capacity of director and as

the president, secretary and treasurer. The Company believes that a

replacement for the Executive is likely, but no individual or individuals

have been identified and no assurance can be given that someone will

accept such positions. At the present time the Company is contacting its

stockholders to determine if anyone is interested in holding such a

position.

|

|

5-

|

The

Company's Executive is under no restriction and it is highly unlikely that

any successor will be limited in their participation in other business

ventures which may compete directly with the Company. The Company has

adopted a policy that it will not seek to acquire a Target Company in

which any member of its management serves as an officer, director or

partner, or in which they or their family members own or hold any

ownership interest.

|

|

6-

|

A

business combination involving the issuance of the Company's common stock

will, in all likelihood, result in stockholders of the Target Company

obtaining a significant and substantial controlling interest in the

Company. The issuance of previously authorized and unissued common stock

of the Company would result in a reduction in the percentage of shares

owned by the present stockholders of the

Company.

|

|

7-

|

The

Company entered into an employment agreement with the Executive that

provided a “buyout” provision whereby upon termination, the Company could

elect to purchase 20,000,000 shares of its common stock from the Executive

for $25,000 and the Executive could require the Company to purchase this

same number of shares for $20,000. The Company does not have the capital

to make payment of either amount and therefore, both parties have agreed

to modify the terms of the buyout provision to extend through March 31,

2009.

|

|

8-

|

There

is no assurance that as a result of the acquisition of a Target Company, a

viable trading market for the Company’s common stock will develop. If no

market develops, stockholders of the Company’s common stock will not be

able to sell their shares publicly, making an investment of limited or

little, if any, value.

|

|

9-

|

The

selection of a Target Company will be at the sole discretion of management

of the Company. The Executive has given notice to the Company of his

intent to terminate at the end of October 2008. Future management of the

Company has not been identified. The Company’s Executive does not have

expertise in investment banking activities and there is no assurance that

future management will have any expertise in this area either. Regardless

of this fact, stockholder approval will not be sought in the selection of

a Target Company.

|

Liquidity and Capital

Resources:

During

the Company’s fiscal year ended March 31, 2008, the Company issued 20,000,000

shares of its common stock to its Executive for $15,000 cash and in payment of a

$5,000 obligation. During the six months ended September 30, 2008, the Company’s

Executive provided an additional $10,000 to the Company. During October 2008,

the Company obtained a $16,000 loan from a stockholder pursuant to note

(“Stockholder Note). The Stockholder Note is not collateralized by

any assets of the Company, is not convertible into any equity interest in the

Company, bears interest at the rate of 18% per annum and is due upon 15 days

written notice by the holder of the Stockholder Note. Proceeds from the

Stockholder Note were used to repay Executive $10,000 in principal plus $564 in

interest owed to him for cash advances made to the Company during the six months

ended September 30, 2008. The Company believes that the remaining proceeds from

the Stockholder Note will be sufficient to fund the Company’s operations through

December 2008.

In order

for the Company to continue its plan of operations to seek a Target Company,

capital beyond that obtained through the Stockholder Note, will be required.

“Recurring Costs” will include management fees, accounting fees, legal fees,

auditor fees (including fees to review interim financial information),

stockholder related cost, and fees associated with maintaining the Company’s

current standing with regulatory agencies. The Company estimates the Recurring

Costs to be approximately $5,000 every three months. Additional costs will be

incurred as the Company searches for a Target Company and engages professionals

in that effort. Inasmuch as management for the Company will soon change, present

management is hesitant to make any estimate as to the amount of such

costs.

The

Company will aggressively seek to obtain additional capital, either through

loans or through the issuance of shares of its common or preferred stock. At the

present time, the terms, conditions, amounts, price, and other particulars

relating to these potential sources of capital cannot be determined.

Furthermore, the actual success achieved by the Company in its capital raising

activities, cannot be assured or the likelihood thereof determined.

The

Company has not negotiated the terms of any capital raising activity except for

the Stockholder Note. Future capital raising activity may be substantially

limited given current market conditions and will in all likelihood be restricted

to existing stockholders or other individuals or entities knowledgeable of the

reverse acquisition marketplace. Even though the Company’s common stock is

currently listed on the Over the Counter Bulletin Board, its trading activity is

virtually nonexistent. Inasmuch as the Company’s common stock does not have an

established market value, the ability of the Company to obtain financing will be

limited and will be on terms less favorable than if an established market for

its common stock existed.

In its

capital raising activities, the Company may also provide additional incentives

such as stock options, warrants, or registration rights. The Company may

obligate itself contractually with respect to such incentives or may agree to

such incentives on a non-obligatory basis. Regardless of the terms agreed upon

between the Company and any investor, the need for future capital to continue

its plan of operations is inevitable.

The

Company has contingently obligated itself to purchase 20,000,000 shares of its

common stock owned by the Executive for $20,000. The Company also has the right

to purchase 20,000,000 shares of its common stock from the Executive for

$25,000. These dollar and share amounts were not negotiated at arm’s length and

may not be indicative of transactions in the Company’s common stock between

independent parties.

Current

unsettled economic conditions will impact the Company’s ability to locate any

investors. Changes in national as well as global economic conditions, including

changes in financial and equity markets, interest rates, and the perception by

investors, real or imaginary, may impede our Company’s access to, or increase

the cost of, financing operations. The Company’s lack of operations and assets

does not bode well when compared to other entities that have identifiable assets

and liquidity.

The

financial statements contained in this interim report have been prepared

assuming that the Company will continue as a going concern. However, the Company

has not engaged in any revenue producing activities and is dependent on debt

financing or the sale of its equity securities for capital. As a result, the

possibility exists that the Company will not be able to continue as a going

concern. Nevertheless, management believes that sufficient funding is available

to meet its operating needs during the next twelve months. The financial

statements do not include any adjustments that might result from the outcome of

this uncertainty.

The

acquisition of a Target Company will result in substantial dilution for the

Company's current stockholders. Inasmuch as the Company only has its equity

securities, consisting of common and preferred stock, as a capital resource to

provide consideration for the acquisition of a Target Company, the issuance of a

substantial portion of the Company’s equity securities is the most likely method

for the Company to consummate a business combination. The issuance of any shares

of the Company's common stock will dilute the ownership percentage that current

stockholders have in the Company.

Results of

Operations:

During

the three months ended September 30, 2007, the Company was not undertaking those

measures that would make the Company a desirable candidate for a Target Company.

Consequently, a comparison of the results of operations for the three months

ended September 30, 2007 with the three months ended September 30, 2008, is not

meaningful. During its current fiscal year, ending March 31, 2009, the Company

has aggressively sought to establish itself as a public shell

company.

The

Company’s current Executive accepted his position on February 25, 2008 and on

April 1, 2008 signed an employment agreement with the Company. Since that time,

the Company has taken an aggressive posture in furthering its ability to enter

into a business combination with a Target Company. The steps taken included the

restructuring of the capitalization of the Company; in filing a Form 10

registration statement with the Securities and Exchange Commission and a

subsequent quarterly report; and in locating a FINRA firm to make a market in

the Company’s common stock. These efforts required approximately substantially

less capital during the three months ended September 30, 2008 when compared to

the three months ended June 30, 2008 (approximately $5,000 compared to $14,000,

respectively).

In

February 2008, Denny W. Nestripke accepted the position of the Company's sole

officer and director and entered into an employment agreement whereby he agreed

to serve in those positions through June 30, 2008 and on a month to month basis

thereafter. In October 2008, Mr. Nestripke gave notice to the Company of his

intent to terminate the employment agreement and he has notified certain

stockholders of those intentions. Subsequent to October 30, 2008, Mr. Nestripke

will serve in management of the Company on a day-to-day basis until a yet

unidentified individual or individuals is(are) found willing to serve in those

capacities. Expenses relating to the search of new management are thought to be

minimal; however, a realistic estimate of such costs cannot be made at the

present time.

Furthermore,

the operations conducted by the Company through the end of September 2008 have

been primarily procedural. In the future the Company’s search for a Target

Company will result in expenses being incurred that are different in nature

inasmuch as they will require an assessment of the Target Company, which may

include travel and other means of extensive investigative research. There can be

no assurance that the Company will receive any benefits from these expenses. The

Company may also incur fees from third parties retained to investigate a Target

Company. In the event that a Target Company is located, a mutually beneficial

agreement may not be reached between the Company and the Target Company.

Regardless of the manner in which expenses are incurred, until such time as an

acquisition agreement is entered into with a Target Company, the Company does

not anticipate generating any revenue. If and when such an agreement is reached,

still no assurance exists that any income will accrue to the Company or that a

revenue stream will develop.

The

current uncertainty in the financial markets may make the ability for the

Company to locate a Target Company substantially more difficult. The Company

does not propose to restrict its search for a business opportunity to any

particular industry or geographical area and may, therefore, attempt to acquire

any business in any industry. Nevertheless, even this broad range of possible

business activities may not be sufficient to attract a Target Company during

times of uncertainty and financial liquidity concerns. If and when a business

opportunity is selected, such business opportunity may not be in an industry

that is following general business trends.

Off-balance sheet

arrangements:

The

Company does not have any off-balance sheet arrangements and it is not

anticipated that the Company will enter into any off-balance sheet

arrangements.

Item 3 -

Quantitative and Qualitative Disclosures About Market Risk.

Not

required by smaller reporting company.

Item 4T -

Controls and Procedures.

Evaluation of Disclosure

Controls and Procedures

Our

management, consisting of our president and chief financial officer, evaluated

the effectiveness of our disclosure controls and procedures as of the end of the

period covered by this report. Based on that evaluation, management concluded

that our disclosure controls and procedures as of the end of the period covered

by this report were effective such that the information required to be disclosed

by us in reports filed under the Exchange Act (i) is recorded, processed,

summarized and reported within the time periods specified in the SEC’s rules and

forms and (ii) is accumulated and communicated to our management, including

our president and chief financial officer, as appropriate to allow timely

decisions regarding disclosure. A controls system cannot provide absolute

assurance, however, that the objectives of the controls system are met, and no

evaluation of controls can provide absolute assurance that all control issues

and instances of fraud, if any, within the Company have been

detected.

Changes in Internal Control

over Financial Reporting

There

have been no changes in our internal controls over financial reporting that

occurred during the period covered by the report.

Part

II - Other

Information

Item 5 –

Other Information

On

October 14, 2008, Millstream Ventures, Inc. (the “Company”) borrowed $16,000

from 1

st

Orion

Corp., a stockholder of the Company, and issued a promissory note for the

repayment of this amount. The note bears interest at 18% per annum

and principal and interest are due and payable upon demand, but not later than

March 31, 2010.

On

October 22, 2008, the Company entered into an amendment to the Employment

Agreement with Mr. Nestripke, which converted the employment agreement into a

part-time service agreement in which Mr. Nestripke would be an independent

contractor providing accounting and related services for the Company on an

as-needed basis. The amended agreement will be effective November 1,

2008, and may be terminated by either party upon 30 days’ notice, or immediately

in the event of a reverse acquisition with an operating business. The

amendment provides that the option of Mr. Nestripke to require the Company to

purchase his stock will not be exercised by him until the earlier of the

following: (i) March 31, 2009; (ii) the termination of the amended

agreement by the Company; or (iii) the closing of a reverse acquisition

transaction with an operating business.

Item

6 - Exhibits

|

Exhibit

Table

|

|

Title

of Document

|

|

Locaton

|

|

10.1

|

|

18%

Promissory Note

|

|

This

filing

|

|

10.2

|

|

Amendment

to Employment Agreement

|

|

This

filing

|

|

31.1

and 31.2

|

|

Rule

13a-14(a)/15d-14a(a) Certification -- CEO & CFO

|

|

This

filing

|

|

32.1

and 32.2

|

|

Section

1350 Certification -- CEO & CFO

|

|

This

filing

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has

duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

|

|

|

|

|

|

Millstream

Ventures, Inc.

|

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dated:

|

|

October

27, 2008

|

|

By:

|

/s/

Denny W. Nestripke

|

|

|

|

|

|

|

Denny

W. Nestripke

|

|

|

|

|

|

|

Chief

Executive Officer

|

|

|

|

|

|

|

Chief

Financial Officer

|

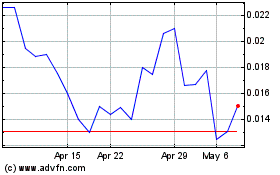

Movement Industries (PK) (USOTC:MVNT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Movement Industries (PK) (USOTC:MVNT)

Historical Stock Chart

From Feb 2024 to Feb 2025