File No. 024-12409

As filed with the Securities and Exchange

Commission on June 20, 2024

PART II - INFORMATION REQUIRED IN OFFERING CIRCULAR

Preliminary Offering Circular dated June

20, 2024

An offering statement pursuant

to Regulation A relating to these securities has been filed with the United States Securities and Exchange Commission (the “SEC”).

Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor

may offers to buy be accepted before the offering statement filed with the SEC is qualified. This Preliminary Offering Circular shall

not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in

which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may

elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion

of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular

was filed may be obtained.

OFFERING CIRCULAR

Maison Luxe,

Inc.

500,000,000 Shares of Common Stock

By this Offering Circular, Maison Luxe, Inc.,

a Nevada corporation, is offering for sale a maximum of 500,000,000 shares of its common stock (the Offered Shares), at a fixed price

of $[0.001-0.005] per share, pursuant to Tier 1 of Regulation A of the United States Securities and Exchange Commission (the SEC). A minimum

purchase of $5,000 of the Offered Shares is required in this offering, with any additional purchase required to be in an amount of at

least $1,000. This offering is being conducted on a best-efforts basis, which means that there is no minimum number of Offered Shares

that must be sold by us for this offering to close; thus, we may receive no or minimal proceeds from this offering. All proceeds from

this offering will become immediately available to us and may be used as they are accepted. Purchasers of the Offered Shares will not

be entitled to a refund and could lose their entire investments.

This offering will commence within two days of

its qualification by the SEC. This offering will terminate at the earliest of (a) the date on which the maximum offering has been sold,

(b) the date which is one year from this offering circular being qualified by the SEC and (c) the date on which this offering is earlier

terminated by us, in our sole discretion. (See “Plan of Distribution”).

|

Title of

Securities Offered |

|

Number

of Shares |

|

Price to Public |

|

Commissions (1) |

|

Proceeds to Company (2) |

| Common Stock |

|

500,000,000 |

|

$._____[0.001-0.005] |

|

$-0- |

|

$______[500,000-2,500,000] |

| (1) |

Does not account for the payment of expenses of this offering

estimated at $7,500. See “Plan of Distribution.” |

| (2) |

We

may offer the Offered Shares through registered broker-dealers and we may pay finders. However, information as to any such

broker-dealer or finder shall be disclosed in an amendment to this Offering Circular. |

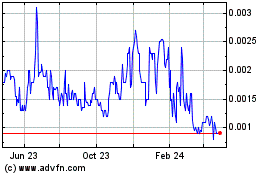

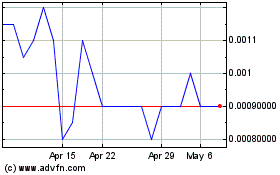

Our common stock is quoted in the over-the-counter

under the symbol “MASN” in the OTC Pink marketplace of OTC Link. On June 6, 2024, the closing price of our common stock was

$0.0009 per share.

Investing in the Offered Shares is speculative

and involves substantial risks, including the superior voting rights of our outstanding shares of Series A Super Voting Preferred Stock

(the “Series A Preferred Stock”), which effectively preclude current and future owners of our common stock, including the

Offered Shares, from influencing any corporate decision. The Series A Preferred Stock has 500 times that number of votes on all matters

submitted to the holders of our common stock and votes together with the holders of our common stock as a single class. Our Chief Executive

Officer, Anil Idnani, as the owner of all outstanding shares of the Series A Preferred Stock, will, therefore, be able to control the

management and affairs of our company, as well as matters requiring the approval by our shareholders, including the election of directors,

any merger, consolidation or sale of all or substantially all of our assets, and any other significant corporate transaction. (See “Risk Factors—Risks Related to a Purchase of the Offered Shares”).

You should purchase Offered Shares only if

you can afford a complete loss of your investment. See “Risk Factors,” beginning on page 4, for a discussion of certain risks

that you should consider before purchasing any of the Offered Shares.

THE SEC DOES NOT PASS UPON THE MERITS OF, OR

GIVE ITS APPROVAL TO, ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING

CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE SEC. HOWEVER,

THE SEC HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

The use of projections or forecasts in this

offering is prohibited. No person is permitted to make any oral or written predictions about the benefits you will receive from an investment

in Offered Shares.

No sale may be made to you in this offering

if you do not satisfy the investor suitability standards described in this Offering Circular under “Plan of Distribution—State Law Exemption” and “Offerings to Qualified Purchasers—Investor Suitability Standards” (page 13). Before making

any representation that you satisfy the established investor suitability standards, we encourage you to review Rule 251(d)(2)(i)(C) of

Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

This Offering Circular follows the disclosure

format of Form S-1, pursuant to the General Instructions of Part II(a)(1)(ii) of Form 1-A.

The date of this Offering Circular is ________________,

2024.

TABLE OF CONTENTS

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

The information contained in this Offering Circular

includes some statements that are not historical and that are considered forward-looking statements. Such forward-looking statements include,

but are not limited to, statements regarding our development plans for our business; our strategies and business outlook; anticipated

development of our company; and various other matters (including contingent liabilities and obligations and changes in accounting policies,

standards and interpretations). These forward-looking statements express our expectations, hopes, beliefs and intentions regarding the

future. In addition, without limiting the foregoing, any statements that refer to projections, forecasts or other characterizations of

future events or circumstances, including any underlying assumptions, are forward-looking statements. The words anticipates, believes,

continue, could, estimates, expects, intends, may, might, plans, possible, potential, predicts, projects, seeks, should, will, would and

similar expressions and variations, or comparable terminology, or the negatives of any of the foregoing, may identify forward-looking

statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained in this

Offering Circular are based on current expectations and beliefs concerning future developments that are difficult to predict. We cannot

guarantee future performance, or that future developments affecting our company will be as currently anticipated. These forward-looking

statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual

results or performance to be materially different from those expressed or implied by these forward-looking statements.

All forward-looking statements attributable to

us are expressly qualified in their entirety by these risks and uncertainties. These risks and uncertainties, along with others, are also

described below in the Risk Factors section. Should one or more of these risks or uncertainties materialize, or should any of our assumptions

prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. You should not

place undue reliance on any forward-looking statements and should not make an investment decision based solely on these forward-looking

statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future

events or otherwise, except as may be required under applicable securities laws.

OFFERING CIRCULAR SUMMARY

The following summary highlights material information

contained in this Offering Circular. This summary does not contain all of the information you should consider before purchasing our common

stock. Before making an investment decision, you should read this Offering Circular carefully, including the Risk Factors section and

the unaudited consolidated financial statements and the notes thereto. Unless otherwise indicated, the terms we, us and our refer and

relate to Maison Luxe, Inc., a Nevada corporation, including its sole subsidiary, Maison Luxe, Inc., a Wyoming corporation.

Our Company

Our company was incorporated in 2002 in the State

of Nevada, under the name MK Automotive, Inc. Our corporate name changed to Clikia Corp., in July 2017. From 2002 through 2015, our company

was engaged in the retail and commercial automotive diagnostic, maintenance and repair services businesses, and, from December 2015 through

January 2017, we pursued the commercial exploitation of Squuak.com, a social media and content sharing tool and platform. From January

2017 through April 2019, we operated an over-the-top (OTT) video streaming subscription service. From April 2019 through May 2020, we

pursued a plan of business that called for our company to establish a private jet charter operation, an aircraft maintenance business,

an aircraft sales and brokerage operation and an online aircraft parts store. Ultimately, these business efforts were unsuccessful, for

differing reasons.

In April 2020, our company experienced a change

in control, pursuant to which Mr. Anil Idnani became our controlling shareholder and sole officer and director. Following such change-in-control

transaction, in May 2020, we acquired all of the assets, including the going business (collectively, the “Maison Luxe Business”),

of Maison Luxe, LLC, a Delaware limited liability. Through our wholly-owned subsidiary, Maison Luxe, Inc., we own and operate the Maison

Luxe Business. (See “Business”)

The business known as

“Maison Luxe” was founded in January 2020, with the vision of becoming an industry leader in luxury retail. Maison Luxe focuses

its efforts primarily within the fine time pieces and jewelry segments both on a wholesale and B2C (business-to-consumer) basis.

The Maison Luxe Business

currently exploits three primary sales channels through which it sells its luxury retail items: (1) private client direct sales; (2)

sales to wholesalers; and (3) sales to retail stores. Future sales efforts will remain reliant upon such sales channels, with an expanding

presence in available social media sales channels and a more robust e-commerce sales channel through the Maison Luxe website. (See “Business”)

Offering Summary

| Securities Offered |

|

500,000,000 shares of common stock, par value $0.00001 |

| Offering Price |

|

$[0.001-0.005] per Offered Share. |

| Shares Outstanding Before This Offering |

|

248,586,409

shares issued and outstanding as of the date hereof. |

| Shares Outstanding After This Offering |

|

748,586,409

shares issued and outstanding, assuming the sale of all Offered Shares are sold. |

| Minimum Number of Shares to Be Sold in This Offering |

|

None |

| Disparate Voting Rights |

|

Our outstanding shares of Series A Super Voting Preferred Stock (the Series A Preferred Stock) possess superior voting rights, which effectively preclude current and future owners of our common stock, including the Offered Shares, from influencing any corporate decision. The Series A Preferred Stock has 500 times that number of votes on all matters submitted to the holders of our common stock and votes together with the holders of our common stock as a single class. Our Chief Executive Officer, Anil Idnani, as the owner of all outstanding shares of the Series A Preferred Stock, will, therefore, be able to control the management and affairs of our company, including matters requiring the approval of our shareholders, including the election of directors, any merger, consolidation or sale of all or substantially all of our assets, and any other significant corporate transaction. (See “Risk Factors” and “Security Ownership of Certain Beneficial Owners and Management”). |

| Investor Suitability Standards |

|

The Offered Shares may only be purchased by investors residing in a state in which this Offering Circular is duly qualified who have either (a) a minimum annual gross income of $70,000 and a minimum net worth of $70,000, exclusive of automobile, home and home furnishings, or (b) a minimum net worth of $250,000, exclusive of automobile, home and home furnishings. |

| Market for our Common Stock |

|

Our common stock is quoted in the over-the-counter market under the symbol “MASN” in the OTC Pink marketplace of OTC Link. |

| Termination of this Offering |

|

This offering will terminate at the earliest of (a) the date on which the maximum offering has been sold, (b) the date which is one year from this offering circular being qualified by the SEC and (c) the date on which this offering is earlier terminated by us, in our sole discretion. |

| Use of Proceeds |

|

We will apply the proceeds of this offering for inventory, sales and marketing expenses, general and administrative expenses, payroll expenses and working capital. (See Use of Proceeds). |

| Risk Factors |

|

An investment in the Offered Shares involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investments. You should carefully consider the information included in the Risk Factors section of this Offering Circular, as well as the other information contained in this Offering Circular, prior to making an investment decision regarding the Offered Shares. |

| Corporate Information |

|

Our principal executive offices are located at 1 Bridge Plaza, 2nd Floor, Fort Lee, New Jersey 07024; our telephone number is 551-486-3980; our corporate website is located at www.maisonluxeny.com. No information found on our company’s website is part of this Offering Circular. |

Continuing Reporting Requirements Under Regulation A

As a Tier 1 issuer under Regulation

A, we will be required to file with the SEC a Form 1-Z (Exit Report Under Regulation A) upon the termination of this offering. We will

not be required to file any other reports with the SEC following this offering.

However, during the pendency

of this offering and following this offering, we intend to file quarterly and annual financial reports and other supplemental reports

with OTC Markets, which will be available at www.otcmarkets.com.

All of our future periodic

reports, whether filed with OTC Markets or the SEC, will not be required to include the same information as analogous reports required

to be filed by companies whose securities are listed on the NYSE or NASDAQ, for example.

RISK FACTORS

An investment in the Offered

Shares involves substantial risks. You should carefully consider the following risk factors, in addition to the other information contained

in this Offering Circular, before purchasing any of the Offered Shares. The occurrence of any of the following risks might cause you to

lose a significant part of your investment. The risks and uncertainties discussed below are not the only ones we face, but do represent

those risks and uncertainties that we believe are most significant to our business, operating results, prospects and financial condition.

Some statements in this Offering Circular, including statements in the following risk factors, constitute forward-looking statements.

(See “Cautionary Statement Regarding Forward-Looking Statements”).

Risks Related to Our Company

We have incurred losses

in prior periods, and losses in the future could cause the quoted price of our common stock to decline or have a material adverse effect

on our financial condition, our ability to pay our debts as they become due, and on our cash flows. We have incurred losses

in prior periods. For the nine months ended December 31, 2023, we incurred a loss from operations of $751,815 (unaudited) and reported

a net profit of $ 1,264,126 (unaudited) and, as of that date, we had an accumulated deficit of $ 10,666,709 (unaudited). For the year

ended March 31, 2023, we incurred a net loss of $6,661,261 (unaudited) and, as of that date, we had an accumulated deficit of $11,930,835

(unaudited). Any losses in the future could cause the quoted price of our common stock to decline or have a material adverse effect on

our financial condition, our ability to pay our debts as they become due, and on our cash flows.

There is doubt about

our ability to continue as a viable business. We have not earned a profit from our operations during recent financial periods.

There is no assurance that we will ever earn a profit from our operations in future financial periods.

We may be unable to

obtain sufficient capital to implement the full plan of business of Maison Luxe Business. Currently, we do not have sufficient

financial resources with which to establish our full plan of business. There is no assurance that we will be able to obtain sources of

financing, in order to satisfy our working capital needs.

We do not have a successful

operating history; we do not have a long-term operating history with respect to our recently acquired Maison Luxe Business. We

are without a long-term history of operations in the luxury retail business, which makes an investment in our common stock speculative

in nature. Because of this lack of operating history, it is difficult to forecast our future operating results. Additionally, our operations

will be subject to risks inherent in the establishment of a new business, including, among other factors, efficiently deploying our capital,

developing and implementing our marketing campaigns and strategies and developing awareness and acceptance of the Maison Luxe Business.

Our performance and business prospects will suffer, in particular, if we are unable to:

| |

· |

obtain access to inventory on acceptable terms; |

| |

· |

achieve market acceptance of the Maison Luxe Business; |

| |

· |

establish long-term customer relationships. |

There are risks and

uncertainties encountered by early-stage companies. As an early-stage company, we are unable to offer assurance that we will

be able to overcome the lack of brand recognition of the Maison Luxe Business and our lack of capital.

We may not be successful

in establishing our business model. We are unable to offer assurance that we will be successful in establishing the Maison

Luxe Business. Should we fail to implement successfully the business plan of the Maison Luxe Business, you can expect to lose your entire

investment in our common stock.

We may never earn a

profit. Because we lack a successful operating history with respect to our luxury retail business, we are unable to offer

assurance that we will ever earn a profit therefrom.

If we are unable to

manage future expansion effectively, our business may be adversely impacted. In the future, we may experience rapid growth

in our aviation services, which could place a significant strain on our company’s infrastructure, in general, and our internal controls

and other managerial, operating and financial resources, in particular. If we are unable to manage future expansion effectively, our business

would be harmed. There is, of course, no assurance that we will enjoy rapid development in our business.

We currently depend

on the efforts of our sole executive officer’s serving without current compensation; the loss of this executive officer could disrupt

our operations and adversely affect the development of the Maison Luxe Business. Our success in establishing the Maison Luxe

Business will depend, primarily, on the continued service of our sole officer, Anil Idnani. We have not entered into an employment agreement

with Mr. Inani. The loss of service of Mr. Idnani, for any reason, could seriously impair our ability to execute our business plan, which

could have a materially adverse effect on our business and future results of operations. We have not purchased any key-man life insurance.

If we are unable to

recruit and retain key personnel, our business may be harmed. If we are unable to attract and retain key personnel, our business

may be harmed. Our failure to enable the effective transfer of knowledge and facilitate smooth transitions with regard to our key employees

could adversely affect our long-term strategic planning and execution.

Our business plan is

not based on independent market studies. We have not commissioned any independent market studies with respect to the industry

in which the Maison Luxe Business operates. Rather, our plans for implementing our aviation services and achieving profitability are based

on the experience, judgment and assumptions of our sole executive officer. If these assumptions prove to be incorrect, we may not be successful

in establishing the Maison Luxe Business.

Our Board of Directors

may change our policies without shareholder approval. Our policies, including any policies with respect to investments, leverage,

financing, growth, debt and capitalization, will be determined by our Board of Directors or officers to whom our Board of Directors delegates

such authority. Our Board of Directors will also establish the amount of any dividends or other distributions that we may pay to our shareholders.

Our Board of Directors or officers to which such decisions are delegated will have the ability to amend or revise these and our other

policies at any time without shareholder vote. Accordingly, our shareholders will not be entitled to approve changes in our policies,

which policy changes may have a material adverse effect on our financial condition and results of operations.

Risks Related to Our Business

The Maison Luxe Business

may not achieve wide market acceptance. Without significant funds with which to market its luxury retail goods, our recently

acquired Maison Luxe Business may not succeed in attracting sufficient customer interest and follow-on sales to generate a profit. There

is no assurance that, even with adequate funds with which to market its luxury retail goods, the Maison Luxe Business will ever earn a

profit from its operations.

We will remain in an

illiquid financial position and face a cash shortage, unless and until we obtain needed capital. Currently, we are in an

illiquid financial position and will remain in such a position, unless the Maison Luxe Business generates greater operating revenues and/or

we obtain needed capital through this offering, of which there is no assurance. There is no assurance that we will ever achieve adequate

liquidity.

We may not compete successfully

with other businesses in the luxury retail goods industry. The Maison Luxe Business competes, directly or indirectly, with

local, national and international purveyors of luxury retail goods. The Maison Luxe Business may not be successful in competing against

its competitors, many of whom have longer operating histories, significantly greater financial stability and better access to capital

markets and credit than we do. We also expect to face numerous new competitors offering goods and related services comparable to those

offered by the Maison Luxe Business. There is no assurance that we will be able to compete successfully against our competition.

Risks Related to Compliance and Regulation

We will not have reporting

obligations under Sections 14 or 16 of the Securities Exchange Act of 1934, nor will any shareholders have reporting requirements of Regulation

13D or 13G, nor Regulation 14D. So long as our common shares are not registered under the Exchange Act, our directors and

executive officers and beneficial holders of 10% or more of our outstanding common shares will not be subject to Section 16 of the Exchange

Act. Section 16(a) of the Exchange Act requires executive officers and directors and persons who beneficially own more than 10% of a registered

class of equity securities to file with the SEC initial statements of beneficial ownership, reports of changes in ownership and annual

reports concerning their ownership of common shares and other equity securities, on Forms 3, 4 and 5, respectively. Such information about

our directors, executive officers and beneficial holders will only be available through periodic reports we file with OTC Markets.

Our common stock is not registered

under the Exchange Act and we do not intend to register our common stock under the Exchange Act for the foreseeable future; provided,

however, that we will register our common stock under the Exchange Act if we have, after the last day of any fiscal year, more than either

(1) 2,000 persons; or (2) 500 shareholders of record who are not accredited investors, in accordance with Section 12(g) of the Exchange

Act.

Further, as long as our common

stock is not registered under the Exchange Act, we will not be subject to Section 14 of the Exchange Act, which, among other things, prohibits

companies that have securities registered under the Exchange Act from soliciting proxies or consents from shareholders without furnishing

to shareholders and filing with the SEC a proxy statement and form of proxy complying with the proxy rules.

The reporting required by

Section 14(d) of the Exchange Act provides information to the public about persons other than the company who is making the tender offer.

A tender offer is a broad solicitation by a company or a third party to purchase a substantial percentage of a company's common stock

for a limited period of time. This offer is for a fixed price, usually at a premium over the current market price, and is customarily

contingent on shareholders tendering a fixed number of their shares.

In addition, as long as our

common stock is not registered under the Exchange Act, our company will not be subject to the reporting requirements of Regulation 13D

and Regulation 13G, which require the disclosure of any person who, after acquiring directly or indirectly the beneficial ownership of

any equity securities of a class, becomes, directly or indirectly, the beneficial owner of more than 5% of the class.

There may be deficiencies

with our internal controls that require improvements. Our company is not required to provide a report on the effectiveness

of our internal controls over financial reporting. We are in the process of evaluating whether our internal control procedures are effective

and, therefore, there is a greater likelihood of undiscovered errors in our internal controls or reported financial statements as compared

to issuers that have conducted such independent evaluations.

Risks Related to Our Organization and Structure

As a non-listed company

conducting an exempt offering pursuant to Regulation A, we are not subject to a number of corporate governance requirements, including

the requirements for independent board members. As a non-listed company conducting an exempt offering pursuant to Regulation

A, we are not subject to a number of corporate governance requirements that an issuer conducting an offering on Form S-1 or listing on

a national stock exchange would be. Accordingly, we are not required to have (a) a board of directors of which a majority consists of

independent directors under the listing standards of a national stock exchange, (b) an audit committee composed entirely of independent

directors and a written audit committee charter meeting a national stock exchange's requirements, (c) a nominating/corporate governance

committee composed entirely of independent directors and a written nominating/ corporate governance committee charter meeting a national

stock exchange's requirements, (d) a compensation committee composed entirely of independent directors and a written compensation committee

charter meeting the requirements of a national stock exchange, and (e) independent audits of our internal controls. Accordingly, you may

not have the same protections afforded to shareholders of companies that are subject to all of the corporate governance requirements of

a national stock exchange.

Our holding company

structure makes us dependent on our current subsidiary, and future subsidiaries, for our cash flow and subordinates the rights of our

shareholders to the rights of creditors of our current subsidiary, and future subsidiaries, in the event of an insolvency or liquidation

of any such subsidiary. Our company, Maison Luxe, Inc., will act as a holding company and, accordingly, substantially all

of our operations will be conducted through subsidiaries. Such subsidiaries will be separate and distinct legal entities. As a result,

our cash flow will depend upon the earnings of our subsidiaries. In addition, we will depend on the distribution of earnings, loans or

other payments by our subsidiaries. No subsidiary will have any obligation to provide our company with funds for our payment obligations.

If there is an insolvency, liquidation or other reorganization of any of our subsidiaries, our shareholders will have no right to proceed

against their assets. Creditors of those subsidiaries will be entitled to payment in full from the sale or other disposal of the assets

of those subsidiaries before our company, as a shareholder, would be entitled to receive any distribution from that sale or disposal.

Risks Related to a Purchase of the Offered

Shares

There is no minimum

offering and no person has committed to purchase any of the Offered Shares. We have not established a minimum offering hereunder,

which means that we will be able to accept even a nominal amount of proceeds, even if such amount of proceeds is not sufficient to permit

us to achieve any of our business objectives. In this regard, there is no assurance that we will sell any of the Offered Shares or that

we will sell enough of the Offered Shares necessary to achieve any of our business objectives. Additionally, no person is committed to

purchase any of the Offered Shares.

The outstanding shares

of our Series A Super Voting Preferred Stock effectively preclude current and future owners of our common stock from influencing any corporate

decision. Our Chief Executive Officer, Anil Idnani, owns 100% of the outstanding shares of our Series A Preferred Stock.

The Series A Preferred Stock has 500 times that number of votes on all matters submitted to the holders of our common stock and votes

together with the holders of our common stock as a single class. Mr. Idnani will, therefore, be able to control the management and affairs

of our company, as well as matters requiring the approval by our shareholders, including the election of directors, any merger, consolidation

or sale of all or substantially all of our assets, and any other significant corporate transaction. His control of the outstanding Series

A Preferred Stock may also delay or prevent a future change of control of our company at a premium price, if he opposes it.

We have outstanding

convertible debt instruments that could negatively affect the market price of our common stock. Certain of our outstanding

convertible debt instruments could negatively affect the market price of our common stock, should their respective exercise prices, at

the time of exercise, be lower than the then-market price of our common stock. We are unable, however, to predict the actual effect that

the conversion of any such convertible debt instruments would have on the market price of our common stock.

We may seek additional

capital that may result in shareholder dilution or that may have rights senior to those of our common stock. From time to

time, we may seek to obtain additional capital, either through equity, equity-linked or debt securities. The decision to obtain additional

capital will depend on, among other factors, our business plans, operating performance and condition of the capital markets. If we raise

additional funds through the issuance of equity, equity-linked or debt securities, those securities may have rights, preferences or privileges

senior to the rights of our common stock, which could negatively affect the market price of our common stock or cause our shareholders

to experience dilution.

You may never realize

any economic benefit from a purchase of Offered Shares. Because the market for our common stock is volatile, there is no

assurance that you will ever realize any economic benefit from your purchase of Offered Shares.

We do not intend to

pay dividends on our common stock. We intend to retain earnings, if any, to provide funds for the implementation of our business

strategy. We do not intend to declare or pay any dividends in the foreseeable future. Therefore, there can be no assurance that holders

of our common stock will receive cash, stock or other dividends on their shares of our common stock, until we have funds which our Board

of Directors determines can be allocated to dividends.

Our shares of common

stock are Penny Stock, which may impair trading liquidity. Disclosure requirements pertaining to penny stocks may reduce

the level of trading activity in the market for our common stock and investors may find it difficult to sell their shares. Trades of our

common stock will be subject to Rule 15g-9 of the SEC, which rule imposes certain requirements on broker-dealers who sell securities subject

to the rule to persons other than established customers and accredited investors. For transactions covered by the rule, broker-dealers

must make a special suitability determination for purchasers of the securities and receive the purchaser's written agreement to the transaction

prior to sale. The SEC also has rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks

generally are equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges

or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in that security is provided

by the exchange or system). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt

from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level

of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny

stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market

value of each penny stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation

information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in

writing before or with the customer's confirmation.

Our common stock is

thinly traded and its market price may become highly volatile. There is currently only a limited market for our common stock.

A limited market is characterized by a relatively limited number of shares in the public float, relatively low trading volume and a small

number of brokerage firms acting as market makers. The market for low priced securities is generally less liquid and more volatile than

securities traded on national stock markets. Wide fluctuations in market prices are not uncommon. No assurance can be given that the market

for our common stock will continue. The price of our common stock may be subject to wide fluctuations in response to factors such as the

following, some of which are beyond our control:

| |

· |

quarterly variations in our operating results; |

| |

· |

operating results that vary from the expectations of investors; |

| |

· |

changes in expectations as to our future financial performance, including financial estimates by investors; |

| |

· |

reaction to our periodic filings, or presentations by executives at investor and industry conferences; |

| |

· |

changes in our capital structure; |

| |

· |

announcements of innovations or new services by us or our competitors; |

| |

· |

announcements by us or our competitors of significant contracts, acquisitions, strategic partnerships, joint ventures or capital commitments; |

| |

· |

lack of success in the expansion of our business operations; |

| |

· |

announcements by third parties of significant claims or proceedings against our company or adverse developments in pending proceedings; |

| |

· |

additions or departures of key personnel; |

| |

· |

asset impairment; |

| |

· |

temporary or permanent inability to offer products or services; and |

| |

· |

rumors or public speculation about any of the above factors. |

The terms of this offering

were determined arbitrarily. The terms of this offering were determined arbitrarily by us. The offering price for the Offered

Shares does not necessarily bear any relationship to our company's assets, book value, earnings or other established criteria of valuation.

Accordingly, the offering price of the Offered Shares should not be considered as an indication of any intrinsic value of such securities.

(See “Dilution”).

Future sales of our

common stock, or the perception in the public markets that these sales may occur, could reduce the market price of our common stock. Our

sole officer and a Director holds shares of our restricted common stock, but is currently able to sell his shares in the market. In general,

our officers and directors and major shareholders, as affiliates, under Rule 144 may not sell more than one percent of the total issued

and outstanding shares in any 90-day period, and must resell the shares in an unsolicited brokerage transaction at the market price. The

availability for sale of substantial amounts of our common stock under Rule 144 or otherwise could reduce prevailing market prices for

our common stock.

As of the date of this Offering

Circular, there is a total of approximately 12,000,000 shares of our common stock underlying the currently convertible portions of convertible

debt instruments and pursuant to agreements. All such shares constitute an overhang on the market for our common stock and, if and when

issued, will be issued without transfer restrictions, pursuant to certain exemptions from registration, and could reduce prevailing market

prices for our common stock. Also, in the future, we may also issue securities in connection with our obtaining needed capital or an acquisition

transaction. The amount of shares of our common stock issued in connection with any such transaction could constitute a material portion

of our then-outstanding shares of common stock.

You will suffer dilution

in the net tangible book value of the Offered Shares you purchase in this offering. If you acquire any Offered Shares, you

will suffer immediate dilution, due to the lower book value per share of our common stock compared to the purchase price of the Offered

Shares in this offering. (See “Dilution”).

As an issuer of penny

stock, the protection provided by the federal securities laws relating to forward looking statements does not apply to us. Although

federal securities laws provide a safe harbor for forward-looking statements made by a public company that files reports under the federal

securities laws, this safe harbor is not available to issuers of penny stocks. As a result, we will not have the benefit of this safe

harbor protection in the event of any legal action based upon a claim that the material provided by us contained a material misstatement

of fact or was misleading in any material respect because of our failure to include any statements necessary to make the statements not

misleading. Such an action could hurt our financial condition.

DILUTION

Dilution in net tangible book

value per share to purchasers of our common stock in this offering represents the difference between the amount per share paid by purchasers

of the Offered Shares in this offering and the net tangible book value per share immediately after completion of this offering. In this

offering, dilution is attributable primarily to our negative net tangible book value per share.

If you purchase Offered Shares

in this offering, your investment will be diluted to the extent of the difference between your purchase price per Offered Share and the

net tangible book value of our common stock after this offering. Our pro forma net tangible book value as of December 31, 2023, was $(1,659,776)

(unaudited), or $(0.009) (unaudited) per share. Net tangible book value per share is equal to total assets minus the sum of total liabilities

and intangible assets divided by the total number of shares outstanding.

The tables below illustrate

the dilution to purchasers of Offered Shares in this offering, on a pro forma basis, assuming 100%, 75%, 50% and 25% of the Offered Shares

are sold at an offering price of $0.003, which represents the midpoint of the offering price range stated herein.

| Assuming the Sale of 100% of the Offered Shares |

|

| Assumed offering price per share |

$ 0.003 |

| Net tangible book value per share as of December 31, 2023 (unaudited) |

$ (0.009) |

| Increase in net tangible book value per share after giving effect to this offering |

$ 0.009 |

| Pro forma net tangible book value per share as of December 31, 2023 (unaudited) |

$ (0.000) |

| Dilution in net tangible book value per share to purchasers of Offered Shares in this offering |

$ 0.003 |

| Assuming the Sale of 75% of the Offered Shares |

|

| Assumed offering price per share |

$ 0.003 |

| Net tangible book value per share as of December 31, 2023 (unaudited) |

$ (0.009) |

| Increase in net tangible book value per share after giving effect to this offering |

$ 0.008 |

| Pro forma net tangible book value per share as of December 31, 2023 (unaudited) |

$ (0.001) |

| Dilution in net tangible book value per share to purchasers of Offered Shares in this offering |

$ 0.004 |

| Assuming the Sale of 50% of the Offered Shares |

|

| Assumed offering price per share |

$ 0.003 |

| Net tangible book value per share as of December 31, 2023 (unaudited) |

$ (0.009) |

| Increase in net tangible book value per share after giving effect to this offering |

$ 0.007 |

| Pro forma net tangible book value per share as of December 31, 2023 (unaudited) |

$ (0.002) |

| Dilution in net tangible book value per share to purchasers of Offered Shares in this offering |

$ 0.005 |

| Assuming the Sale of 25% of the Offered Shares |

|

| Assumed offering price per share |

$ 0.003 |

| Net tangible book value per share as of December 31, 2023 (unaudited) |

$ (0.009) |

| Increase in net tangible book value per share after giving effect to this offering |

$ 0.005 |

| Pro forma net tangible book value per share as of December 31, 2023 (unaudited) |

$ (0.004) |

| Dilution in net tangible book value per share to purchasers of Offered Shares in this offering |

$ 0.007 |

USE OF PROCEEDS

The table below sets forth

the proceeds we would derive from the sale of all of the Offered Shares, assuming the sale of 25%, 50%, 75% and 100% of the Offered Shares,

assuming the payment of no sales commissions or finder’s fees and before the payment of expenses associated with this offering of

approximately $7,500, and assuming an offering price of $0.003, which represents the midpoint of the offering price range stated herein.

There is, of course, no guaranty that we will be successful in selling any of the Offered Shares.

| |

|

Use of Proceeds for Assumed Percentage

of Remaining Shares Sold in This Offering |

|

| |

|

25% |

|

|

50% |

|

|

75% |

|

|

100% |

|

| Inventory |

|

$ |

75,000 |

|

|

$ |

150,000 |

|

|

$ |

225,000 |

|

|

$ |

500,000 |

|

| Sales and Marketing Expense |

|

|

75,000 |

|

|

|

150,000 |

|

|

|

225,000 |

|

|

|

500,000 |

|

| Salary Expense |

|

|

75,000 |

|

|

|

150,000 |

|

|

|

225,000 |

|

|

|

500,000 |

|

| General and Administrative Expense |

|

|

75,000 |

|

|

|

150,000 |

|

|

|

225,000 |

|

|

|

500,000 |

|

| Working Capital |

|

|

75,000 |

|

|

|

150,000 |

|

|

|

225,000 |

|

|

|

500,000 |

|

| TOTAL |

|

$ |

375,000 |

|

|

$ |

750,000 |

|

|

$ |

1,125,000 |

|

|

$ |

1,500,000 |

|

We reserve the right to change

the foregoing use of proceeds, should our management believe it to be in the best interest of our company. The allocations of the proceeds

of this offering presented above constitute the current estimates of our management and are based on our current plans, assumptions made

with respect to the Maison Luxe Business, general economic conditions and our future revenue and expenditure estimates.

Investors are cautioned that

expenditures may vary substantially from the estimates presented above. Investors must rely on the judgment of our management, who will

have broad discretion regarding the application of the proceeds of this offering. The amounts and timing of our actual expenditures will

depend upon numerous factors, including market conditions, cash generated by our operations (if any), business developments and the rate

of our growth. We may find it necessary or advisable to use portions of the proceeds of this offering for other purposes.

In the event we do not obtain

the entire offering amount hereunder, we may attempt to obtain additional funds through private offerings of our securities or by borrowing

funds. Currently, we do not have any committed sources of financing.

PLAN OF DISTRIBUTION

In General

Our company is offering a

maximum of 500,000,000 Offered Shares on a best-efforts basis, at a fixed price of $[0.001-0.005] per Offered Share; any funds derived

from this offering will be immediately available to us for our use. There will be no refunds. This offering will terminate at the earliest

of (a) the date on which the maximum offering has been sold, (b) the date which is one year from this offering being qualified by the

SEC or (c) the date on which this offering is earlier terminated by us, in our sole discretion.

There is no minimum number

of Offered Shares that we are required to sell in this offering. All funds derived by us from this offering will be immediately available

for use by us, in accordance with the uses set forth in the Use of Proceeds section of this Offering Circular. No funds will be placed

in an escrow account during the offering period and no funds will be returned, once an investor's subscription agreement has been accepted

by us.

We intend to sell the Offered

Shares in this offering through the efforts of our Chief Executive Officer, Anil Idnani. Mr. Idnani will not receive any compensation

for offering or selling the Offered Shares. We believe that Mr. Idnani is exempt from registration as a broker-dealers under the provisions

of Rule 3a4-1 promulgated under the Securities Exchange Act of 1934 (the Exchange Act). In particular, Mr. Idnani:

| |

· |

is not subject to a statutory disqualification, as that term is defined in Section 3(a)(39) of the Securities Act; and |

| |

· |

is not to be compensated in connection with his participation by the payment of commissions or other remuneration based either directly or indirectly on transactions in securities; and |

| |

· |

is not an associated person of a broker or dealer; and |

| |

· |

meets the conditions of the following: |

| |

· |

primarily performs, and will perform at the end of this offering, substantial duties for us or on our behalf otherwise than in connection with transactions in securities; and |

| |

· |

was not a broker or dealer, or an associated person of a broker or dealer, within the preceding 12 months; and |

| |

· |

did not participate in selling an offering of securities for any issuer more than once every 12 months other than in reliance on paragraphs (a)(4)(i) or (iii) of Rule 3a4-1 under the Exchange Act. |

As of the date of this Offering

Circular, we have not entered into any agreements with selling agents for the sale of the Offered Shares. However, we reserve the right

to engage FINRA-member broker-dealers. In the event we engage FINRA-member broker-dealers, we expect to pay sales commissions of up to

8.0% of the gross offering proceeds from their sales of the Offered Shares. In connection with our appointment of a selling broker-dealer,

we intend to enter into a standard selling agent agreement with the broker-dealer pursuant to which the broker-dealer would act as our

non-exclusive sales agent in consideration of our payment of commissions of up to 8.0% on the sale of Offered Shares effected by the broker-dealer.

Procedures for Subscribing

If you are interested in subscribing

for Offered Shares in this offering, please submit a request for information by e-mail to Mr. Idnani at: anil@maisonluxeny.com; all relevant

information will be delivered to you by return e-mail.

Thereafter, should you decide

to subscribe for Offered Shares, you are required to follow the procedures described therein, which are:

| |

· |

Electronically execute and deliver to us a subscription agreement via e-mail to: anil@maisonluxeny.com; and |

| |

· |

Deliver funds directly by check or by wire or electronic funds transfer via ACH to our specified bank account. |

Right to Reject Subscriptions.

After we receive your complete, executed subscription agreement and the funds required under the subscription agreement have been transferred

to us, we have the right to review and accept or reject your subscription in whole or in part, for any reason or for no reason. We will

return all monies from rejected subscriptions immediately to you, without interest or deduction.

Acceptance of Subscriptions.

Upon our acceptance of a subscription agreement, we will countersign the subscription agreement and issue the Offered Shares subscribed.

Once you submit the subscription agreement and it is accepted, you may not revoke or change your subscription or request your subscription

funds. All accepted subscription agreements are irrevocable.

This Offering Circular will

be furnished to prospective investors upon their request via electronic PDF format and will be available for viewing and download 24 hours

per day, 7 days per week on our website at www.maisonluxeny.com, as well as on the SEC's website, www.sec.gov.

An investor will become a

shareholder of our company and the Offered Shares will be issued, as of the date of settlement. Settlement will not occur until an investor's

funds have cleared and we accept the investor as a shareholder.

By executing the subscription

agreement and paying the total purchase price for the Offered Shares subscribed, each investor agrees to accept the terms of the subscription

agreement and attests that the investor meets certain minimum financial standards. (See State Qualification and Investor Suitability Standards

below).

An approved trustee must process

and forward to us subscriptions made through IRAs, Keogh plans and 401(k) plans. In the case of investments through IRAs, Keogh plans

and 401(k) plans, we will send the confirmation and notice of our acceptance to the trustee.

Minimum Purchase Requirements

You must initially purchase

at least $5,000.00 of the Offered Shares in this offering. If you have satisfied the minimum purchase requirement, any additional purchase

must be in an amount of at least $1,000.

State Law Exemption and Offerings to Qualified

Purchasers

State Law Exemption.

This Offering Circular does not constitute an offer to sell or the solicitation of an offer to purchase any Offered Shares in any jurisdiction

in which, or to any person to whom, it would be unlawful to do so. An investment in the Offered Shares involves substantial risks and

possible loss by investors of their entire investments. (See “Risk Factors”).

The Offered Shares have not

been qualified under the securities laws of any state or jurisdiction. Currently, we plan to sell the Offered Shares in Colorado, Connecticut,

Delaware, Georgia, New York and Puerto Rico. However, we may, at a later date, decide to sell Offered Shares in other states. In the case

of each state in which we sell the Offered Shares, we will qualify the Offered Shares for sale with the applicable state securities regulatory

body or we will sell the Offered Shares pursuant to an exemption from registration found in the applicable state's securities, or Blue

Sky, law.

Certain of our offerees may

be broker-dealers registered with the SEC under the Exchange Act, who may be interested in reselling the Offered Shares to others. Any

such broker-dealer will be required to comply with the rules and regulations of the SEC and FINRA relating to underwriters.

Investor Suitability

Standards. The Offered Shares may only be purchased by investors residing in a state in which this Offering Circular is duly qualified

who have either (a) a minimum annual gross income of $70,000 and a minimum net worth of $70,000, exclusive of automobile, home and home

furnishings, or (b) a minimum net worth of $250,000, exclusive of automobile, home and home furnishings.

Issuance of Offered Shares

Upon settlement, that is,

at such time as an investor’s funds have cleared and we have accepted an investor’s subscription agreement, we will either

issue such investor’s purchased Offered Shares in book-entry form or issue a certificate or certificates representing such investor’s

purchased Offered Shares.

Transferability of the Offered Shares

The Offered Shares will be

generally freely transferable, subject to any restrictions imposed by applicable securities laws or regulations.

Advertising, Sales and Other Promotional Materials

In addition to this Offering

Circular, subject to limitations imposed by applicable securities laws, we expect to use additional advertising, sales and other promotional

materials in connection with this offering. These materials may include information relating to this offering, articles and publications

concerning industries relevant to our business operations or public advertisements and audio-visual materials, in each case only as authorized

by us. In addition, the sales material may contain certain quotes from various publications without obtaining the consent of the author

or the publication for use of the quoted material in the sales material. Although these materials will not contain information in conflict

with the information provided by this Offering Circular and will be prepared with a view to presenting a balanced discussion of risk and

reward with respect to the Offered Shares, these materials will not give a complete understanding of our company, this offering or the

Offered Shares and are not to be considered part of this Offering Circular. This offering is made only by means of this Offering Circular

and prospective investors must read and rely on the information provided in this Offering Circular in connection with their decision to

invest in the Offered Shares.

DESCRIPTION OF SECURITIES

General

Our authorized capital

stock consists of 1,700,000,000 shares of common stock, $.00001 par value per share, and 5,000,000 shares of Series A Super Voting Preferred

Stock, $.00001 par value per share. As of the date of this Offering Circular, there were 248,586,409 shares of our common stock issued

and outstanding, held by 66 holders of record; and 2,000,000 shares of Series A Super Voting Preferred Stock issued and outstanding.

Common Stock

General. The

holders of our common stock currently have (a) equal ratable rights to dividends from funds legally available therefore, when, as and

if declared by our Board of Directors; (b) are entitled to share ratably in all of our assets available for distribution to holders of

common stock upon liquidation, dissolution or winding up of the affairs of our company; (c) do not have preemptive, subscriptive or conversion

rights and there are no redemption or sinking fund provisions or rights applicable thereto; and (d) are entitled to one non-cumulative

vote per share on all matters on which shareholders may vote. Our Bylaws provide that, at all meetings of the shareholders for the election

of directors, a plurality of the votes cast shall be sufficient to elect. On all other matters, except as otherwise required by Nevada

law or our Articles of Incorporation, as amended, a majority of the votes cast at a meeting of the shareholders shall be necessary to

authorize any corporate action to be taken by vote of the shareholders.

Non-cumulative Voting.

Holders of shares of our common stock do not have cumulative voting rights, which means that the holders of more than 50% of the outstanding

shares, voting for the election of directors, can elect all of the directors to be elected, if they so choose, and, in such event, the

holders of the remaining shares will not be able to elect any of our directors. As of the date of this Offering Circular, our sole officer

and a Director, Anil Idnani, owns a total of 53,045,699 shares, or approximately 43.78%, of our outstanding common stock.

In addition, Mr. Idnani owns

all of the issued and outstanding shares of Series A Super Voting Preferred Stock and thereby controls all corporate matters relating

to our company. (See “Security Ownership of Certain Beneficial Owners and Management” and “Certain Transactions—Change in Control Transactions”).

Pre-emptive Rights.

As of the date of this Offering Circular, no holder of any shares of our common stock or Series A Super Voting Preferred Stock has pre-emptive

or preferential rights to acquire or subscribe for any unissued shares of any class of our capital stock not disclosed herein.

Dividend Policy.

We have never declared or paid any dividends on our common stock. We currently intend to retain future earnings, if any, to finance the

expansion of our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future.

Shareholder Meetings.

Our bylaws provide that special meetings of shareholders may be called only by our Board of Directors, the chairman of the board, or our

president, or as otherwise provided under Nevada law.

Series A Super Voting Preferred Stock

Voting. Holders

of the Series A Super Voting Preferred Stock (the Series A Preferred Stock) have 500 times that number of votes on all matters submitted

to the shareholders that each shareholder of our common stock is entitled to vote at each meeting of shareholders with respect to all

matters presented to the shareholders for their action or consideration. Holders of the Series A Preferred Stock shall vote together with

the holders of our common stock as a single class.

Our Chief Executive Officer

and a Director, Anil Idnani owns all of the issued and outstanding shares of Series A Preferred Stock and thereby controls all corporate

matters of our company. (See “Security Ownership of Certain Beneficial Owners and Management” and “Certain Transactions—Change in Control Transactions”).

Dividends. Holders

of Series A Preferred Stock shall not be entitled to receive dividends paid on our common stock. Dividends paid to holders of the Series

A Preferred Stock are at the discretion of our Board of Directors.

Liquidation Preference.

Upon the liquidation, dissolution and winding up of our company, whether voluntary or involuntary, holders of the Series A Preferred Stock

are not entitled to receive any of our assets.

No Conversion.

The shares of Series A Preferred Stock are not convertible into shares of our common stock.

Convertible Promissory Notes

As of December 31, 2023, we

had outstanding convertible promissory notes. The table below sets forth information with respect to such convertible promissory notes.

| Date of Note Issuance |

Principal Amount at Issuance |

Current Balance |

Current Accrued Interest |

Maturity Date |

Conversion Terms |

|

Name of Noteholder and Name of Person with Investment Control |

| 2/24/2017 |

$3,400 |

$19,641 |

$1,392 |

2/24/2018 |

60% of market price during the valuation period up to 9.9% of outstanding number of shares on date of conversion |

|

Schooner Equities, LLC (Kenneth Brand) |

| 1/8/2021 |

$150,000 |

$116,545 |

$41,045 |

1/8/2022 |

50% of market price during the valuation period up to 9.9% of outstanding number of shares on date of conversion |

|

A2G, LLC (Alexander Benz) |

| 5/4/2021 |

$200,000 |

$208,640 |

$-0- |

5/4/2022 |

50% of market price during the valuation period up to 9.9% of outstanding number of shares on date of conversion |

|

A2G, LLC (Alexander Benz) |

| 1/3/2022* |

$300,000 |

$232,000 |

$150,000 OID |

1/3/2023 |

$.01, up to 4.99% of outstanding number of shares on date of conversion |

|

Cimarron Capital, Inc. (Peter Aiello) |

| 1/3/2022* |

$200,000 |

$192,000 |

$100,000 OID |

1/3/2023 |

$.01, up to 4.99% of outstanding number of shares on date of conversion |

|

Christine Arenella |

| 10/4/2022 |

$25,000 |

$18,500 |

-0- |

10/12/2023 |

50% of market price during the valuation period up to 9.9% of outstanding number of shares on date of conversion. |

|

A2G, LLC (Alexander Benz) |

* Subsequent to December 31, 2023, in March

2024, this note was extinguished pursuant to a settlement agreement (the “Settlement Agreement”) between our company, as

the borrower, and Cimarron Capital, Inc. and Christine Arenella (collectively, the “Lenders”). Under the Settlement Agreement,

we are required to make monthly payments of $10,000 to the Lenders through March 2025 and, then, for the following 12 months, monthly

payments of $12,000 to the Lenders, for total payments of $264,000. See “Financial Condition, Liquidity and Capital Resources”

under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for a more complete description

of the Settlement Agreement.

Transfer Agent

Pacific Stock Transfer Company

is the transfer agent for our common stock. Pacific Stock Transfer’s address is 6725 Via Austi Parkway, Suite 300, Las Vegas, Nevada

89119; its telephone number is 800-785-7782; its website is www.pacificstocktransfer.com. No information found on Pacific Stock Transfer’s

website is part of this Offering Circular.

BUSINESS

Corporate Information

Our corporate office is located

at 1 Bridge Plaza North, 2nd Floor, Fort Lee, New Jersey 07024; our telephone number is 551-486-3980; and our website is located at: www.maisonluxeny.com.

No information found on our company’s website is part of this Offering Circular.

History

Our company was incorporated

in 2002 in the State of Nevada, under the name MK Automotive, Inc. Our corporate name changed to Clikia Corp., in July 2017. From 2002

through 2015, our company was engaged in the retail and commercial automotive diagnostic, maintenance and repair services businesses,

and, from December 2015 through January 2017, we pursued the commercial exploitation of Squuak.com, a social media and content sharing

tool and platform. From January 2017 through April 2019, we operated an over-the-top (OTT) video streaming subscription service. From

April 2019 through May 2020, we pursued a plan of business that called for our company to establish a private jet charter operation, an

aircraft maintenance business, an aircraft sales and brokerage operation and an online aircraft parts store. Ultimately, these business

efforts were unsuccessful, for differing reasons.

In April 2020, our company

experienced a change in control, pursuant to which Mr. Anil Idnani became our controlling shareholder and sole officer and director. Following

such change-in-control transaction, in May 2020, we acquired all of the assets, including the going business (collectively, the “Maison

Luxe Business”), of Maison Luxe, LLC, a Delaware limited liability. Through our wholly-owned subsidiary, Maison Luxe, Inc., we own

and operate the Maison Luxe Business.

In April 2021, our corporate

name changed to “Maison Luxe, Inc.” and our trading symbol changed to “MASN.”

The Maison Luxe Business

Our company’s sole officer

and a Director, Mr. Anil Idnani, founded the Maison Luxe Business with the vision of offering highly desired luxury retail consumer items

that are responsibly-sourced and affordable to the end customer. Because of the dynamics and structure within the luxury retail industry,

customers who desire luxury items are unable to avail themselves of such items, due to the unreliable nature of sellers and exorbitant

prices. It is this void in the marketplace that Mr. Idnani identified as a business opportunity and established the Maison Luxe Business

to provide customers with the experience of purchasing luxury items as a standard.

Mr. Idnani’s vision

for Maison Luxe comes from his vast background in the luxury trade through his involvement in his family-owned and operated travel retail

businesses, which were established over 30 years ago. As part of his responsibilities, Mr. Idnani developed an expertise in fine timepieces

and jewelry, developing relationships with store fronts in duty-free ports in areas, such as Alaska and the U.S. Virgin Islands. In order

to stay current with the brands and consumer needs, Mr. Idnani will continue to attend trade shows, both abroad and domestic, to develop

additional knowledge and industry relationships with many of the most prestigious luxury brands available.

The business known as “Maison

Luxe” was founded in January 2020, with the vision of becoming an industry leader in luxury retail. Maison Luxe focuses its efforts

primarily within the fine time pieces and jewelry segments both on a wholesale and B2C (business-to-consumer) basis.

The Maison Luxe Business currently

exploits three primary sales channels through which it sells its luxury retail items: (1) private client direct sales; (2) sales to wholesalers;

and (3) sales to retail stores. Future sales efforts will remain reliant upon such sales channels, with an expanding presence in available

social media sales channels and a more robust e-commerce sales channel through the Maison Luxe website.

Maison Luxe has been able

to achieve relatively high volume and transactional sales due, in large measure, to its relationships with vendors, private clients and

wholesalers. In addition, Maison Luxe has established an e-commerce platform through its website.

Maison Luxe only sources its

items from reputable vendors that are well known to Mr. Idnani. Mr. Idnani chooses to stock items that are only in high demand and valuable

with potential market appreciation. Maison Luxe aims to provide a quality experience to its customers, by always keeping inventory up

to date and with a well-curated, post-sale process. Through its high-quality customer service efforts, customers are able address questions

or concerns with purchased products or to inquire of product availability. Maison Luxe is not sponsored by, associated with or affiliated

with any of its advertised brands or their subsidiaries.

Investment in Impossible Diamond, Inc.

During the first half of 2021,

we invested a total of $200,000 in Impossible Diamond, Inc. (“Impossible Diamond”), a New York City based start-up firm with

a patented process (U.S. Patent No. 11,371,162–System and Method for Generating Synthetic Diamonds via Atmospheric Carbon Capture

and related U.S. Patent Nos. 11,585,011, 11,585,012, 11,713,250 and 11,760,643) to transform air pollution into synthetic diamonds.

Impossible Diamond describes

its patented process as follows:

| 1. | Step 1: A thermochemical process is used to capture CO2, which is then purified and pumped into

high-pressure cylinders for storage. |

| 2. | Step 2: Captured CO2 is combined with green hydrogen to produce high-purity Atmospheric Methane™. |

| 3. | Step 3: Atmospheric Methane™ is pumped into specialized CVD growing chambers, where the diamond

start to take shape, one ambitious atom at a time. |

| 4. | Step 4: Once the diamond material has been grown, it is rough cut into small cubes. Advanced software

maps the material and produces a cutting plan. From there, the stones are cut and polished using traditional methods. |

Based on recent sales of

equity securities by Impossible Diamond, we believe our investment in Impossible Diamond to be worth approximately between $1 million

and $1.1 million. However, there is no assurance that we would realize such value were we to attempt to sell our equity investment. Currently,

it is management’s intention to hold our investment in Impossible Diamond.

Intellectual Property

We regard our trademarks,

service marks and business know-how as having significant value and as being an important factor in the marketing of our luxury retail

products. Our policy is to establish, enforce and protect our intellectual property rights using the intellectual property laws.

Facilities

Our sole officer and director

provides our company with the office space required for our current operations at no charge. Our business office is located at 1 Bridge

Plaza, 2nd Floor, Fort Lee, New Jersey. We do not own any real property.

Employees

We currently have three employees,

including our Chief Executive Officer, Anil Idnani, who oversees our business development, corporate administration and business operations.

Mr. Idnani also oversees record keeping and financial reporting functions. We intend to hire a small number of employees, at such times

as business conditions warrant. We have used, and, in the future, expect to use, the services of certain outside consultants and advisors

as needed, on a consulting basis.

Website

Our company’s corporate

website can be found at www.maisonluxeny.com. We make available free of charge at this website all of our reports filed with OTCMarkets.com,

including our annual reports, quarterly reports and other informational reports. These reports are made available on our website as soon

as reasonably practicable after their filing with OCTMarkets.com. No information found on our company’s website is part of this

Offering Circular.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Basis of Presentation

In May 2020, we acquired the

Maison Luxe Business, which business has become the sole business of our company. This section presents information, and narrative descriptions

thereof, concerning the operating results of (a) our company for the periods and as of the dates indicated, (b) Maison Luxe LLC for the

period and as of the date indicated and, (c) where appropriate, pro forma financial information, which assumes our company’s acquisition

of the Maison Luxe Business had occurred on certain prior dates, as indicated.

Cautionary Statement

The following discussion and

analysis should be read in conjunction with our unaudited financial statements and related notes, beginning on page F-1 of this Offering

Circular.

Our actual results may differ

materially from those anticipated in the following discussion, as a result of a variety of risks and uncertainties, including those described

under Cautionary Statement Regarding Forward-Looking Statements and Risk Factors. We assume no obligation to update any of the forward-looking

statements included herein.

Principal Factors Affecting Our Financial Performance

Our future operating results

will be primarily affected by the following factors:

| |

· |

obtain access to inventory on acceptable terms; |

| |

· |

achieve market acceptance of the Maison Luxe Business; |

| |

· |

establish long-term customer relationships. |

We expect to incur operating

losses through at least the first quarter of calendar year 2025. Further, because of our lack of capital and the current lack of brand

name awareness of the Maison Luxe Business, we cannot predict the levels of our future revenues.

Results of Operations

For the Nine Months

Ended December 31, 2023 (“Interim 2024”) and 2022 (“Interim 2023”). For Interim 2024, we generated $6,274,232

(unaudited) in sales revenues, cost of sales of $6,320,886 (unaudited) and a gross loss of $46,654 (unaudited). We incurred $705,161 (unaudited)

in general and administrative expenses, resulting in a loss from operations of $751,815 (unaudited). We had other income of $2,015,941

(unaudited), which was comprised of $2,823,391 (unaudited) in gain on debt extinguishment, which was offset by $12,500 in amortization

of debt discount, $686,834 (unaudited) in changes in fair value of derivative liabilities and $108,116 (unaudited) in interest expense,

resulting in net profit of $1,264,126 (unaudited).

For Interim 2023, we generated

$7,533,838 (unaudited) in sales revenues, cost of sales of $8,554,159 (unaudited) and a gross loss of $1,020,321 (unaudited). We incurred

$5,290,750 (unaudited) in general and administrative expenses, resulting in a loss from operations of $6,311,071 (unaudited). We had other

expense of $868,196 (unaudited), which was comprised of $19,000 (unaudited) in derivative expense, $210,417 in amortization of debt discount,

$431,329 (unaudited) in changes in fair value of derivative liabilities and $207,450 (unaudited) in interest expense, resulting in a net

loss of $7,179,267 (unaudited).

The reduced revenues during

Interim 2024 are primarily attributable to a softer U.S. economy. However, during Interim 2024, we were able to significantly reduce our