false

0001832161

0001832161

2024-02-23

2024-02-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): February 23, 2024

KeyStar

Corp.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

000-56290 |

|

85-0738656 |

(State

or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification

No.) |

| 78

SW 7th Street, Suite

500, Miami,

Florida |

|

33130 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (866) 783-9435

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act: None.

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 1.01 |

Entry into a Material Definitive Agreement. |

KeyStar

Corp., a Nevada corporation (the “Company”) disclosed in a Form 8-K filed with the SEC on January 17, 2023 that Mr.

John Linss (“Linss”) resigned as a member of the Company’s board of directors and as its Chief Executive Officer,

Principal Executive Officer, President and Chief Technology Officer pursuant to the terms of a Separation Agreement and Release dated

and effective January 10, 2023. The Separation Agreement and Release provided for the purchase, at a future date mutually agreed upon

by the parties, of 3,313,333 shares of the Company’s Series C Preferred Stock (the “Shares”) for a purchase

price of $2,000,000. Linss holds 2,980,000 of the Shares in his name, and the other 333,333 Shares are held in the name of Corespeed,

LLC. Linss is the sole member of Corespeed, LLC and the beneficial owner of the Shares held by Corespeed, LLC.

The

Company also disclosed in a Form 8-K filed with the SEC on March 2, 2023 that on February 27, 2023, the Company entered into Stock Redemption

and Purchase Agreements with Linss and Corespeed, LLC (together, the “Purchase Agreements”) for the purchase of the

Shares. The Company paid $300,000 at the closing and entered into a promissory note (the “Note”) with Linss for the

remaining $1,700,000 of the purchase price. The Note bears interest at a rate of 5% per annum, does not include early prepayment penalties,

and requires the following payments: (i) no less than $850,000.00, in aggregate, of one or more payments is due by the 12-month anniversary

of the Note; and (ii) a balloon payment for the balance of the Note is due by the earlier of the 24-month anniversary of the Note or

five days after the Company’s common stock is listed for public trading on either the Nasdaq Stock Market, the New York Stock Exchange,

or the NYSE American.

On

February 23, 2024, the Company and Linss entered into a First Amendment to Promissory Note dated February 19, 2024 (the “Note

Amendment”) which amended the repayment terms of the Note. Pursuant to the Note Amendment, the Note will be repaid as follows:

(i) $425,000.00 of the indebtedness will be paid on or before February 27, 2024 (which it was); (ii) commencing on April 1, 2024, and

continuing on the first day of each calendar month thereafter, equal monthly payments of principal and interest (based on a two (2) year

amortization) in the amount of Fifty-Nine Thousand Six Hundred Sixty-Five and 09/100 Dollars ($59,665.09) shall be due and payable; and

(iii) the balance of the indebtedness will be paid on the Maturity Date.

The

“Maturity Date” is defined as the earliest of: (a) April 1, 2026; (b) upon the occurrence of an Uplisting (as hereafter

defined), the fifth day after the occurrence of the Uplisting; or (c) upon the occurrence of a Change of Control (as hereafter defined),

the fifth day after the occurrence of the Change of Control. The term “Uplisting” means the listing of shares of the

Maker’s common stock on The New York Stock Exchange, The NYSE American, The Nasdaq Global Market, The Nasdaq Global Select Market,

The Nasdaq Capital Market or any successor or substantially equivalent national securities exchange. The term “Change of Control”

means the consummation of: (a) a sale, transfer, exclusive license or other disposition, in one transaction or a series of related transactions,

of all or substantially all of the Maker’s and its subsidiaries’ assets, taken as a whole (except where such sale, transfer,

license or other disposition is to a wholly-owned subsidiary of the Maker); (b) the merger or consolidation of the Maker with or into

another entity, except any merger or consolidation in which the holders of capital stock of the Maker immediately prior to such merger

or consolidation continue to hold a majority of the voting power of the capital stock of the Maker or the surviving or acquiring entity,

(or, if the surviving or acquiring entity is a wholly owned subsidiary of another party immediately following such merger or consolidation,

the parent entity of such surviving or acquiring entity); (c) the transfer (whether by merger, consolidation or otherwise), in one transaction

or a series of related transactions, to a person or group of affiliated persons (other than an underwriter of the Maker’s securities),

of the Maker’s securities if, after such consummation, such person or group of affiliated persons would hold 50% or more of the

outstanding voting stock of the Maker (or the surviving or acquiring entity, or the parent entity of such surviving or acquiring entity);

or (d) a liquidation, voluntary or involuntary dissolution or winding up of the Maker.

The

foregoing summary of the Note Amendment is qualified in its entirety by reference to the full text of the Note Amendment which is attached

hereto as Exhibit 10.1, and incorporated herein by reference. You are urged to read said exhibit attached hereto in its entirety.

| Item 2.03 |

Creation of a Direct Financial Obligation or an Obligation

under an Off-Balance Sheet Arrangement of a Registrant. |

The

disclosures set forth in Item 1.01 are incorporated by reference into this Item 2.03.

| Item 5.02 |

Departure of Directors or Certain Officers; Election

of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

The

disclosures set forth in Item 1.01 are incorporated by reference into this Item 5.02.

| Item 9.01 |

Financial Statements and Exhibits |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

February 28, 2024 |

KEYSTAR

CORP. |

| |

|

|

| |

By: |

/s/

Bruce Cassidy |

| |

|

Bruce

Cassidy, Interim CEO |

Exhibit

10.1

FIRST

Amendment to PROMISSORY Note

This

First Amendment to Promissory Note is made February 19, 2024 (“Amendment Effective Date”), by and between KEYSTAR CORP.,

a Nevada corporation (the “Maker”), and JOHN LINSS, a Nevada resident (the “Holder”) (this “First

Amendment”). The Maker and the Holder hereby agree that the Promissory Note, dated February 27, 2023, made by the Maker in favor

of the Holder in the original principal amount of One Million Seven Hundred Thousand and 00/100 Dollars ($1,700,000.00) (as amended,

restated supplemented or otherwise modified from time to time, the “Note”) shall be and hereby is amended pursuant to the

terms of this First Amendment. Furthermore, the Maker and the Holder agree as follows:

1.

Section 2 of the Note is hereby deleted in its entirety and replaced with the following:

2.

Maker will pay the indebtedness, which includes all accrued interest, evidenced by this Note (the “Indebtedness”)

as provided herein. Absent the occurrence and continuation of an Event of Default (as hereinafter defined), the Indebtedness will be

paid as follows:

| |

a. |

A

total of $425,000.00 of the Indebtedness will be paid on or before February 27, 2024; |

| |

|

|

| |

b. |

Commencing

on April 1, 2024, and continuing on the first day of each calendar month thereafter, equal monthly payments of principal and interest

(based on a two (2) year amortization) in the amount of Fifty-Nine Thousand Six Hundred Sixty-Five and 09/100 Dollars ($59,665.09)

shall be due and payable; and |

| |

|

|

| |

c. |

The

balance of the Indebtedness will be paid on the Maturity Date. |

As

used herein, the term “Maturity Date” means the earliest of (a) April 1, 2026, (b) upon the occurrence of an Uplisting

(as hereafter defined), the fifth day after the occurrence of the Uplisting, or (c) upon the occurrence of a Change of Control (as hereafter

defined), the fifth day after the occurrence of the Change of Control; and the term “Uplisting” means the listing

of shares of the Maker’s common stock on The New York Stock Exchange, The NYSE American, The Nasdaq Global Market, The Nasdaq Global

Select Market, The Nasdaq Capital Market or any successor or substantially equivalent national securities exchange; and the term “Change

of Control” means the consummation of: (a) a sale, transfer, exclusive license or other disposition, in one transaction or

a series of related transactions, of all or substantially all of the Maker’s and its subsidiaries’ assets, taken as a whole

(except where such sale, transfer, license or other disposition is to a wholly-owned subsidiary of the Maker); (b) the merger or consolidation

of the Maker with or into another entity, except any merger or consolidation in which the holders of capital stock of the Maker immediately

prior to such merger or consolidation continue to hold a majority of the voting power of the capital stock of the Maker or the surviving

or acquiring entity, (or, if the surviving or acquiring entity is a wholly owned subsidiary of another party immediately following such

merger or consolidation, the parent entity of such surviving or acquiring entity); (c) the transfer (whether by merger, consolidation

or otherwise), in one transaction or a series of related transactions, to a person or group of affiliated persons (other than an underwriter

of the Maker’s securities), of the Maker’s securities if, after such consummation, such person or group of affiliated persons

would hold 50% or more of the outstanding voting stock of the Maker (or the surviving or acquiring entity, or the parent entity of such

surviving or acquiring entity); or (d) a liquidation, voluntary or involuntary dissolution or winding up of the Maker.

3.

The Maker hereby reconfirms and reaffirms all representations and warranties, agreements and covenants made by it pursuant to the terms

and conditions of the Note and the other documents executed in connection therewith.

4.

The Maker hereby represents and warrants to the Holder that (i) the Maker has the legal power and authority to execute and deliver this

First Amendment, (ii) the chairman of the Maker executing this First Amendment has been duly authorized to execute and deliver the same

and bind the Maker with respect to the provisions hereof, (iii) the execution and delivery hereof by the Maker and the performance and

observance by the Maker of the provisions hereof and of the Note and all documents executed or to be executed herewith or therewith do

not violate or conflict with the organizational agreements of the Maker or any law applicable to the Maker or result in a breach of any

provision of or constitute a default under any other agreement, instrument or document binding upon or enforceable against the Maker,

and (iv) this First Amendment, the Note and the documents executed or to be executed by the Maker in connection herewith or therewith

constitute valid and binding obligations of the Maker in every respect, enforceable in accordance with their respective terms.

5.

The Maker represents and warrants that (i) after giving effect to this First Amendment, no Event of Default exists under the Note, nor

will any occur as a result of the execution and delivery of this First Amendment or the performance or observance of any provision hereof

and (ii) it presently has no known claims or actions of any kind at law or in equity against the Holder arising out of or in any way

relating to the Note.

6.

On the Amendment Effective Date, the Maker shall pay to the Holder all of the Holder’s costs and expenses incurred in connection

with the negotiation, preparation and closing of the First Amendment and in administering and/or enforcing any of the Holder’s

rights and remedies with respect to the Note and the other Loan Documents, including without limitation the Holder’s attorneys’

fees and expenses.

7.

Each reference to the Note that is made in the Note or any other document executed or to be executed in connection therewith shall hereafter

be construed as a reference to the Note as amended hereby.

8.

The agreements contained in this First Amendment are limited to the specific agreements made herein. Except as amended hereby, all of

the terms and conditions of the Note and the other documents executed in connection therewith shall remain in full force and effect.

This First Amendment amends the Note and is not a novation thereof.

9.

This First Amendment shall be governed by, and shall be construed and enforced in accordance with, the laws of the State of Nevada without

regard to the principles of the conflicts of law thereof.

[INTENTIONALLY

LEFT BLANK]

IN

WITNESS WHEREOF, the undersigned hereby have executed this First Amendment on the day and year first written above.

| |

MAKER: |

| |

|

| |

KeyStar

Corp., a Nevada corporation |

| |

|

|

| |

By: |

/s/

Bruce A. Cassidy |

| |

Name: |

Bruce

A. Cassidy |

| |

Title: |

Executive

Chairman |

| |

|

|

| |

HOLDER: |

| |

|

|

| |

/s/

John Linss |

| |

John Linss |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

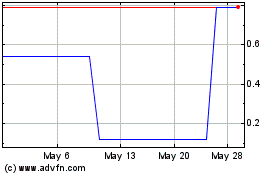

Keystar (PK) (USOTC:KEYR)

Historical Stock Chart

From Jun 2024 to Jul 2024

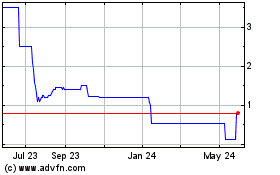

Keystar (PK) (USOTC:KEYR)

Historical Stock Chart

From Jul 2023 to Jul 2024