Current Report Filing (8-k)

December 29 2021 - 2:44PM

Edgar (US Regulatory)

0001530746

false

0001530746

2021-12-28

2021-12-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 OR 15(d) of The Securities Exchange Act of 1934

Date of

Report (Date of earliest event reported): December

26, 2021

|

Kaya Holdings, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Delaware

|

|

333-177532

|

|

90-0898007

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

916 Middle River Drive, Suite 316,

Fort Lauderdale, FL

|

|

|

33304

|

|

|

(Address of principal executive offices)

|

|

|

(Zip Code)

|

|

|

Registrant’s telephone number including area code: (954) 892-6911

|

|

(Former name or former address if changed since last report.)

|

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of Company under any of the following

provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12(b))

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

None

|

|

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☒

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

As used in

this Current Report on Form 8-K, and unless otherwise indicated, the terms “the Company,” “KAYS,”

“we,” “us” and “our” refer to Kaya Holdings, Inc. and its subsidiaries.

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

(a)

Resignation of Jordi Arimany

On December

26, 2021 our board of directors accepted the resignation of Jordi Arimany as a director of the Company effective as of September 8, 2021.

Mr. Arimany’s resignation was as a result of his relocation to South Africa.

(b)

Appointment of Mitchell Chupak

On December 26, 2021,

our board of directors appointed Mitchell Chupak to fill the vacancy created by the resignation of Jordi Arimany.

The following is a

brief description of Mr. Chupak’s background and business experience

Mitchell Chupak. 67, has resided in Israel since 1972,

where since 1997, he has been the Director of Development for the Jaffa Institute, the largest not for profit social service agency serving

southern portions of Tel-Aviv-Jaffa, Israel and its suburbs. During his over 25 years at the Jaffa Institute, Mr. Chupak has grown the

organization extensively and is responsible for development of major social services, educational and community projects for which he

secured millions of dollars in funding. He developed funding sources worldwide and enlisted the aid of major donors in the United States,

Canada, Europe, Australia, and South America.

In 2005, Mr. Chupak created the Israel Fundraisers

Forum to assist other non-profit organizations better understand methods of fundraising. The forum, with which he has been associated

since its founding, promotes professionalism in fundraising and development and assists both organizations and individual fundraisers

to improve methods of the profession.

We believe that Mr. Chupak’s spectrum of experience

in both management and funding, will add value our board of directors.

As is the case with all of our independent directors,

Mr. Chupak will be compensated with an annual grant of common stock, currently fixed at 100,000 shares annually.

|

Item 8.01

|

Other Information.

|

On December 27, 2021, KAYS entered into an Exchange

Agreement (the “Exchange Agreement”) with the current holders of its 100,000 outstanding shares of Series C Convertible

Preferred Stock (the “Series C Preferred Stock”), Craig Frank, our Chairman and Chief Executive Officer and BMN Consultants,

Inc. (“BMN”), to restructure their preferred holdings. Each of Mr. Frank and BMN held 50,000 shares of the Series C

Preferred Stock, each share of which was convertible at the option of the holder into 28.88665 shares of our common stock (an aggregate

of 2,888,665 shares) and voted on as “as converted” basis together with the holders of shares of our common stock as

single class, unless required otherwise by Delaware law. As of December 27, 2021, Mr. Frank and BMN each held 8.2% (a total of 16.4%)

of the voting power of the Company’s outstanding voting stock by reason of their holding the Series C Preferred Stock.

As of the date of the Exchange Agreement, the Company

owed each of Tudog Consulting, LLC (“Tudog”), a limited liability company owned by Mr. Frank and BMN, approximately

$588,000 in accrued but unpaid compensation (a total of $1,176,000). Pursuant to the Exchange Agreement, Tudog and BMN agreed to each

waive approximately $338,000 of the compensation due them and to defer payment of the remaining $250,000 due to each of them to January

1, 2025. As a result liabilities of approximately $676,000 will be removed from the Company’s balance sheet and $500,000 will be

reclassified as long-term debt on the Company’s balance sheet.

In addition, pursuant to the Exchange Agreement, Mr.

Frank and BMN each exchanged their shares of the Series C Preferred Stock for the issuance to each of them or their designees, of 20 shares

of a newly-designated class of Series D Convertible Preferred Stock, (the “Series D Preferred Stock”). Each share of

the Series D Preferred Stock is convertible at the option of the holder at any time and from time to time, into one percent (1%) of the

Company’s “Fully Diluted Capitalization” at the date of conversion. “Fully Diluted Capitalization”

means the number of issued and outstanding shares of KAYS’ common stock, assuming the conversion or exercise of all of the Company's

outstanding convertible or exercisable securities, including shares of convertible preferred stock and all outstanding vested or unvested

options or warrants to purchase shares common stock, but excluding debt securities convertible into common stock.

The Series D Preferred Stock votes on as “as

converted” basis together with the holders of shares of our common stock as single class, unless required otherwise by Delaware

law. Accordingly, holders of the Series D Preferred Stock will hold 1% of the voting power of the Company’s outstanding voting stock

for each shares of the Series Preferred Stock held or a total of 40% of such voting power.

The above transactions were approved by the “independent”

directors of the Company at a meeting held on December 26, 2021.

The above descriptions of the Series D Preferred Stock

and the Exchange Agreement are qualified in their entirety by reference to the copies of the Certificate of Designation of the Series

D Preferred Stock and the Exchange Agreement, which are filed as Exhibits 3.1 and 10.1 to this Current Report on Form 8-K.

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

Dated: December 29, 2021

|

KAYA HOLDINGS, INC.

|

|

|

|

|

|

|

By:

|

/s/ Craig Frank

|

|

|

|

Craig Frank,

Chief Executive Officer

|

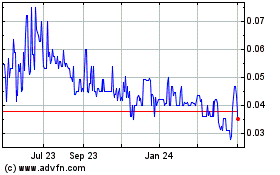

Kaya (QB) (USOTC:KAYS)

Historical Stock Chart

From Dec 2024 to Jan 2025

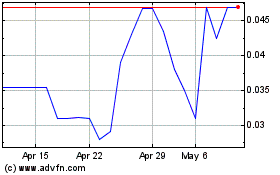

Kaya (QB) (USOTC:KAYS)

Historical Stock Chart

From Jan 2024 to Jan 2025