0001517389false--02-29FY2024false0.00175000000199857081998570800015173892023-03-012024-02-290001517389jfil:IndefiniteExpiresOfOperatingLossMember2024-02-290001517389jfil:ExpireInTwoThousandThirtyEightMember2024-02-290001517389jfil:ExpireInTwoThousandThirtySevenMember2024-02-290001517389jfil:ExpireInTwoThousandThirtySixMember2024-02-290001517389jfil:ExpireInTwoThousandThirtyFiveMember2024-02-290001517389jfil:ExpireInTwoThousandThirtyFourMember2024-02-290001517389jfil:DecemberFourTwoThousandFifteenMemberus-gaap:EmploymentContractsMembersrt:PresidentMember2023-03-012024-02-290001517389jfil:MrVangMember2022-03-012023-02-280001517389us-gaap:RetainedEarningsMember2024-02-290001517389us-gaap:AdditionalPaidInCapitalMember2024-02-290001517389us-gaap:CommonStockMember2024-02-290001517389us-gaap:RetainedEarningsMember2023-03-012024-02-290001517389us-gaap:RetainedEarningsMember2023-02-280001517389us-gaap:AdditionalPaidInCapitalMember2023-02-280001517389us-gaap:CommonStockMember2023-02-280001517389us-gaap:RetainedEarningsMember2022-03-012023-02-2800015173892022-02-280001517389us-gaap:RetainedEarningsMember2022-02-280001517389us-gaap:AdditionalPaidInCapitalMember2022-02-280001517389us-gaap:CommonStockMember2022-02-2800015173892022-03-012023-02-2800015173892023-02-2800015173892024-02-2900015173892024-05-0700015173892024-08-31iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended February 29, 2024

OR

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 333-173456

Jubilant Flame International, LTD. |

(Exact name of Registrant as specified in its charter) |

Nevada

(State of other jurisdiction of incorporation or organization)

Room 508, T1N Vi Park, 360 Xin Long Road, Shanghai China, 201101

(Address of principal executive offices, including zip code)

+86 21 64748888

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

Emerging growth company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

There was no active public trading market for the common stock. Based on recorded trades as of August 31, 2023, the aggregate market value of 10,813,993 common stocks held by non-affiliates was $275,757.

As of May 7, 2024, there are 19,985,708 shares of common stock issued and outstanding.

TABLE OF CONTENTS

JUBILANT FLAME INTERNATIONAL, LTD.

FORWARD LOOKING STATEMENTS

This Annual Report contains forward-looking statements. Forward-looking statements are projections of events, revenues, income, future economic performance or management’s plans and objectives for our future operations. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” and the risks set out below, any of which may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. These risks include, by way of example and not in limitation:

| · | the uncertainty of profitability based upon our history of losses; |

| | |

| · | risks related to start up operations and implementing our business plan; |

| | |

| · | risks related to inventory management and limited revenue |

| | |

| · | risks related to failure to obtain adequate financing on a timely basis and on acceptable terms to continue as going concern; |

| | |

| · | risks related to our international operations and currency exchange fluctuations; and |

| | |

| · | other risks and uncertainties related to our business plan and business strategy. |

This list is not an exhaustive list of the factors that may affect any of our forward-looking statements. These and other factors should be considered carefully, and readers should not place undue reliance on our forward-looking statements. Forward looking statements are made based on management’s beliefs, estimates and opinions on the date the statements are made and we undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles. All references to “common stock” refer to the common shares in our capital stock.

As used in this annual report, the terms “we”, “us”, “our”, the “Company”, the ‘‘Registrant”, and “Jubilant Flame” mean Jubilant Flame International, LTD. unless otherwise indicated.

Description of Business

Jubilant Flame International, LTD was organized in the state of Nevada on September 29, 2009 under the name Liberty Vision, Inc. The Company provided web development and marketing services for clients through a wholly owned subsidiary until December 5, 2012, when the Company disposed of its subsidiary to a shareholder for a nominal sum. On December 16, 2012, the Company changed its name to Jiu Feng Investment Hong Kong, LTD. On August 18, 2015, the Company changed its name to Jubilant Flame International, Ltd.

Previously, the Company was engaged in the business of developing and marketing medical products, including Bone-Induction Artificial Bone and Vacuum Sealing Drainage under a license from BioMark. Starting the fourth quarter of fiscal year ended February 28, 2018, the Company has started a new line of business to promote and sell a new cosmetics product “Acropass” series in United States.

The Company purchases the Acropass inventory from Rubyfield Holdings Limited, a Chinese company owned by the CEO of the Company (“Rubyfield”). Under a Resale Agreement between the Company and Rubyfield, the Company agrees to purchase Acropass products from Rubyfield.

The Company also has a Master Service Agreement (the “MSA”) with a third party (“Manager”). Pursuant to MSA, the Manager agrees to provide branding services, social media management services, ad campaign services, and manage and operate the Company’s online shopping platform in the United States and the Company’s Amazon account with respect to the sales of the Acropass products the Company has purchased from Rubyfield.

In the beginning of 2020, the Company ceased the marketing and selling of cosmetic products in the United States.

From the third quarter of year ended February 29, 2020, the company started to provide technical support services for development of new nutrition material and product to customers. The technical support focuses on a nutrition food series which is selling in the USA market. Currently, the nutrition food series include SEA-BUCKTHORN and Organic Sprouting Powder. The company’s technology background directors provide excellent technical service to manufacturers in the USA.

Principal Products and Service

By the third quarter of year ended February 29, 2020, the Company had purchased two type of Acropass products for resale in the United States from Rubyfield – Acropass Trouble Care for acne treatment and Acropass Ageless Lifter for wrinkle treatment (collectively, “Acropass Products”). The Acropass Products are made of hydrocolloid patches with dissolving microstructures. The microstructures contain hyaluronic acid and epidermal growth factor. Hyaluronic Acid is a natural moisturizing agent that delivers nutrients to skin cells and blocks water evaporation from the skin, enabling the skin to maintain adequate amounts of water. EGF protects the skin’s innate natural growth and robustness by preventing the appearance of skin aging and sagging. Both ingredients work together to improve the appearance of skin elasticity and reduces the appearance of wrinkles and acne.

The Company does not manufacture the Acropass Products and purchases the Acropass Products directly from Rubyfield for resale.

In the beginning of 2020, the Company ceased the marketing and selling of cosmetic products in the United States.

From the third quarter of year ended February 29, 2020, the company started to provide technical support services in connection with nutritionally oriented food that include Sea-Buckthourn and Organic Spouting Powder. The company’s technology background directors make our service match customers needs well.

Marketing and Distribution Methods

We do not have any brick-and-mortar stores and sells the Acropass Products directly to our customers on our own website or via Amazon. We hired the Manager to manage the sales and distribution of our products, but we did not engage any distributors to distribute our products. Based on our sales and inventories, we ordered additional inventory from Rubyfield under the Resale Agreement. Rubyfield then shipped the inventory from China to the Manager in the United States and the Manager fulfills our customers’ orders on the website and via Amazon.

Because we were essentially an online business, we directly targeted our customers by promoting our products on our website or via social media, internet advertisement and media reviews. On our products shopping website, http://www.acropass-shop.com/, we had detailed product descriptions, promotional videos and photos to educate our customers about our products and address potential concerns and questions from our customers.

In addition to our website, we also utilized social medical platforms to market our products. we had established a Facebook account that allows us to promote our skin care products and interact with our existing and potential customers. We also had presence on Instagram and Twitter and regularly launch social media campaign on different platforms until we ceased the marketing and selling of cosmetic products in the United States. In the beginning of 2020, the Company ceased the marketing and selling of cosmetic products in the United States.

As we just started our technical support service for development of nutrition food to manufacturers, our service expanding reply on referral currently.

Competition

The skin care product in the United States is very competitive. Brand recognition, quality of products, packaging, ingredients, celebrity effects and price are some of the many factors that impact consumers’ choices among competing products and brands. Marketing, promotion, merchandising, branding, and positive customer and media review have a significant impact on consumers’ buying decisions. We compete against a number of companies, most of which have substantially greater resources than we do.

Our principal competitors consist of well-known, multinational manufacturers and marketers, most of which design, manufacture, market and sell their products under multiple brand names. We also faced competition from smaller independent brands, skin care specialty websites, as well as some retailers. In the beginning of 2020, the Company ceased the marketing and selling of cosmetic products in the United States.

The company’s technical support service to nutrition food industry is unique. SEA-BUCKTHORN is highly beneficial to the heart disease, diabetes, and boost the immune system treatment. Organic Sprouting Powder contains high level of plant protein. We believe we will gain recognition among our targeted customers.

Principal Supplier

Rubyfield is the principal and sole supplier of the Company’s Acropass Products. The Company entered into a Resale Agreement with Rubyfield, pursuant to which the Company agrees to purchase Acropass Products from Rubyfield. The Resale Agreement expires on December 31, 2019 and the Company didn’t renew the agreement upon the expiration.

Intellectual Property

Through a Resale Agreement with Rubyfield, the Company has the rights to distribute Acropass Products in the United States. The Company does not own any intellectual property nor did the Company enter into any license arrangement with Raphas or Rubyfield with respect to Acropass Products or their intellectual property.

In addition to the promotional material provided by Rubyfield under the Resale Agreement, the Company created promotional material related to Acropass Products, including videos, photographs and marketing material. The Company owns the intellectual property rights to such promotional material.

From the third quarter of year ended February 28,2020, the company started new business line to provide technical support services of development of new healthy material and product to customers. The company believes its technology background directors may develop new intellectual property in this new service business area. The company has not generated revenue from this new business line.

Government Regulation

We do not need governmental approval to market and distribute our products in the United States but our products are regulated by the Federal Food, Drug, and Cosmetic Act (FD&C Act) and the Fair Packaging and Labeling Act (FPLA) because they are considered cosmetics. FDA regulates cosmetics under the authority of these laws. Our products registered in the FDA volunteer registration program.

The FD&C Act defines cosmetics by their intended use, as “articles intended to be rubbed, poured, sprinkled, or sprayed on, introduced into, or otherwise applied to the human body...for cleansing, beautifying, promoting attractiveness, or altering the appearance” (FD&C Act, sec. 201(i)). The FD&C Act prohibits the marketing of adulterated or misbranded cosmetics in interstate commerce. “Adulteration” refers to violations involving product composition--whether they result from ingredients, contaminants, processing, packaging, or shipping and handling. “Misbranding” refers to violations involving improperly labeled or deceptively packaged products. Under the FD&C Act, a product also may be misbranded due to failure to provide material facts. This means, for example, any directions for safe use and warning statements needed to ensure a product’s safe use.

In addition, under the authority of the FPLA, FDA requires a list of ingredients for cosmetics marketed on a retail basis to consumers (Title 21, Code of Federal Regulations. Cosmetics that fail to comply with the FPLA are considered misbranded under the FD&C Act. This requirement does not apply to cosmetics distributed solely for professional use, institutional use (such as in schools or the workplace), or as free samples.

FDA can take action against cosmetics on the market that are in violation of these laws, as well as companies and individuals who market such products.

FDA’s legal authority over cosmetics is different from their authority over other medical products they regulate. Under the law, cosmetic products and ingredients do not need FDA premarket approval, with the exception of color additives. However, FDA can pursue enforcement action against products on the market that are not in compliance with the law, or against firms or individuals who violate the law.

We have followed best practices guidelines to comply with all regulatory requirements.

Research and Development

The Company has not conducted any research and development activities related to Acropass Products.

Employees

Our officers and directors are responsible for planning, developing and operational duties, and will continue to do so throughout the early stages of our growth. Currently, we have five employees. In the future, when our business plans require, we will add additional staff who may be full or part time employees or consultants.

Reports to Securities Holders

We prepare an annual report that includes audited financial information. We will make our financial information equally available to any interested parties or investors through compliance with the disclosure rules for a small business issuer under the Securities Exchange Act of 1934. We are subject to disclosure filing requirements including filing Form 10-K annually and Form 10-Q quarterly. In addition, we will file Form 8-K current reports and proxy materials and other information from time to time as required. We do not intend to voluntarily file the above reports in the event that our obligation to file such reports is suspended under the Exchange Act. The public may read and copy any materials that we file with the Securities and Exchange Commission, (“SEC”), at the SEC’s Public Reference Room at 100 F Street NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

1A RISK FACTORS

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 2 PROPERTIES

We do not own any real property. Our business is presently operated from office provided by our CEO, Ms. Yan Li at 10F., Yunfeng Building, No. 478 Wuzhong Rd, Shanghai, China 201103, without paying any rent.

ITEM 3 LEGAL PROCEEDINGS

Currently, the Company is not involved in any pending litigation or legal proceeding.

ITEM 4 MINE SAFETY DISCLOSURES

Not applicable to our Company.

PART II

ITEM 5 MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Market Information

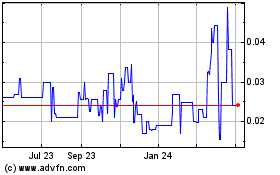

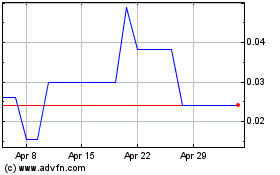

Our common stock is currently quoted on the OTCQB Bulletin Board under the symbol “JFIL”. Because we are quoted on the OTCQB Bulletin Board, our securities may be less liquid, receive less coverage by security analysts and news media, and generate lower prices than might otherwise be obtained if they were listed on a national securities exchange. Although there is trading in our common stock from time to time, there is no established market for our common stock. In the past year, it has traded the price per share has been in the $0.018 to $0.043 range during the year ended February 28, 2023. These prices reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transaction values.

Holders

As of February 28, 2024, there were 79 total record holders of 19,985,708 shares of the Company’s common stock. We believe we have additional shareholders who hold their shares on a beneficial basis in “street name.”

Dividends

The Company has not paid any cash dividends to date and does not anticipate paying dividends in the foreseeable future. It is the intention of management to utilize all available funds for the development of the Company’s business.

Securities Authorized for Issuance Under Equity Compensation Plans

None.

Recent sales of unregistered security

Between December 2015 and February 29, 2024, the Company issued 900,000 shares of common stock to its CEO, Ms. Yan Li, under her employment agreement, 550,000 shares to its current CFO, Mr. Lei Wang, 200,000 shares to its current Secretary/Treasurer, Mr. Kecheng Xu, 300,000 shares to its new board director Brian Cheng, 150,000 shares to its new board director Mario Papazoglou for compensation purposes. The issuance of shares to officers were made in reliance upon the exemption from securities registration afforded by Section 4(2) of the 1933 Act. (See Item 11 – Executive Compensation – Employment Agreements and Related Transactions.)

Issuer Purchases of Equity Securities

We did not repurchase any of our equity securities during the years ended February 29, 2024 and February 28, 2023.

ITEM 6 SELECTED FINANCIAL DATA

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 7 MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with our audited financial statements and notes thereto included herein. In connection with, and because we desire to take advantage of, the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, we caution readers regarding certain forward-looking statements in the following discussion and elsewhere in this report and in any other statement made by, or on our behalf, whether or not in future filings with the Securities and Exchange Commission. Forward-looking statements are statements not based on historical information and which relate to future operations, strategies, financial results or other developments. Forward looking statements are necessarily based upon estimates and assumptions that are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control and many of which, with respect to future business decisions, are subject to change. These uncertainties and contingencies can affect actual results and could cause actual results to differ materially from those expressed in any forward-looking statements made by, or our behalf. We disclaim any obligation to update forward-looking statements.

Results of Operations

Sales

From last quarter of the fiscal year ended February 28, 2018, we started to promote and sell our new cosmetic products in the United States market. We purchase the Acropass Products and other Products from an affiliated company in China. In the beginning of 2020, the Company ceased the marketing and selling of cosmetic products in the United States. From the third quarter of year ended February 29, 2020, the company started to provide technical support services in connection with nutritionally oriented food that include Sea-Buckthourn and Organic Spouting Powder. We recognized Nil of revenue during the fiscal year ended February 29, 2024 and February 28, 2023 respectively. The result was primarily due to slow down in new business line.

Operating expense

The major components of our expenses for the fiscal years ended February 29, 2024 and February 28, 2023 are outlined in the table below:

| | Year Ended | | | Year Ended | |

| | 29-Feb | | | 28-Feb | |

| | 2024 | | | 2023 | |

| | | | | | |

Transfer agent | | | 7,027 | | | | 4,611 | |

Edgar filing fees | | | 3,099 | | | | 4,799 | |

OTC service fee | | | 14,415 | | | | 14,055 | |

Office expense | | | 1,302 | | | | 1,080 | |

Legal fees | | | 2,522 | | | | - | |

Accounting and audit fees | | | 39,000 | | | | 37,000 | |

Total cost and operating expenses | | | 67,365 | | | | 61,545 | |

Our operating expenses increased by $5,820 for the year ended February 29, 2024, compared to the fiscal year ended February 28, 2023. The increase was mainly due to a increase of $2,522 in legal service fee and an increase of 2,000 in accounting and audit expense.

Other income

Other income is Nil and Nil for the year ended February 29, 2024 and February 28, 2023, respectively.

Net Loss

During the years ended February 29, 2024 and February 28, 2023, the Company realized a net loss of $67,365 and $61,545 , respectively.

Liquidity and Capital Resources

Working Capital | | As of February 29, 2024 | | | As of February 28, 2023 | |

| | | | | | |

Current Assets | | $ | 12,595 | | | $ | 14,247 | |

Current Liabilities | | | 1,309,508 | | | | 1,243,795 | |

Working Capital Deficit | | $ | (1,296,913 | ) | | $ | (1,229,548 | ) |

The increase in the Company’s working capital deficit between the fiscal years ended February 29, 2024 and February 28, 2023 was mainly due to the increase of total $61,653 due to related party and the increase of total $4,060 accrued expense.

Cash Flows

The table below, for the periods indicated, provides selected cash flow information:

| | Year Ended February 29, 2024 | | | Year Ended February 28, 2023 | |

Cash used in operating activities | | $ | (63,890 | ) | | $ | (40,130 | ) |

Cash used in investing activities | | $ | - | | | $ | - | |

Cash provided by financing activities | | $ | 61,653 | | | $ | 40,130 | |

Net increase (decrease)in cash | | $ | (2,237 | ) | | $ | - | |

Cash Flows from Operating Activities

During the fiscal year ended February 29, 2024, we incurred a net loss of $67,365, compare to a net loss of $61,545 during the fiscal year ended February 28, 2023. During the fiscal year ended February 29, 2024, we used $63,890 in operating activities compared to $40,130 during the fiscal year ended February 28, 2023, the operating cash use increase is mainly due to small increase of professional fee due.

Cash Flows from Investing Activities

We did not spend funds in investing activities during the year ended February 29, 2024 and February 28, 2023.

Cash Flows from Financing Activities

During the year ended February 29, 2024, we generated $61,653 in financing activities compared to $40,130 during the year ended February 28, 2023, the decrease is due to proceed decrease from the CEO.

Going Concern

The audit report of the Company’s independent registered accounting firm includes a matter of emphasis related to our ability to continue as a going concern.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to stockholders.

ITEM 7A QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 8 FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

JUBILANT FLAME INTERNATIONAL, LTD.

FOR THE YEARS ENDED FEBRUARY 29, 2024 AND FEBRUARY 28, 2023

Index to Financial Statements

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of Jubilant Flame International, Ltd.

Opinion on the Financial Statements

We have audited the accompanying balance sheets of Jubilant Flame International, Ltd. (“the Company”), as of February 29, 2024 and February 28, 2023, and the related statements of operations, changes in stockholders’ deficit and cash flows for each of the two years in the period ended February 29, 2024 and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of February 29, 2024 and February 28, 2023, and the results of its operations and its cash flows for each of the two years in the period ended February 29, 2024, in conformity with accounting principles generally accepted in the United States of America.

Going Concern

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As described in Note 3 to the financial statements, the Company has suffered recurring losses from operations and has working capital and stockholders’ deficit that raise substantial doubt about its ability to continue as a going concern. Management’s plans regarding these matters are also described in Note 3. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatements of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

Critical Audit Matter

Critical audit matters are matters arising from the current period audit of the financial statements that were communicated or required to be communicated to the audit committee and that: (1) relate to accounts or disclosures that are material to the financial statements and (2) involved our especially challenging, subjective, or complex judgments. We determined that there are no critical audit matters.

/s/ KCCW Accountancy Corp.

We have served as the Company’s auditor since 2023.

Diamond Bar, California

May 7, 2024

JUBILANT FLAME INTERNATIONAL, LTD

BALANCE SHEETS

| | February 29, | | | February 28, | |

| | 2024 | | | 2023 | |

ASSETS | | | | | | |

Current assets | | | | | | |

Cash | | $ | 1,345 | | | $ | 3,582 | |

Prepaid expenses | | | 11,250 | | | | 10,665 | |

Total current assets | | | 12,595 | | | | 14,247 | |

Total Assets | | $ | 12,595 | | | $ | 14,247 | |

| | | | | | | | |

LIABILITIES AND STOCKHOLDERS’ DEFICIT | | | | | | | | |

| | | | | | | | |

Current liabilities | | | | | | | | |

Accounts payable – related parties | | $ | 47,643 | | | $ | 47,643 | |

Accrued expense | | | 32,640 | | | | 28,580 | |

Accrued officer compensation | | | 535,500 | | | | 535,500 | |

Loan payable - related parties | | | 693,725 | | | | 632,072 | |

Total current liabilities | | | 1,309,508 | | | | 1,243,795 | |

Total Liabilities | | | 1,309,508 | | | | 1,243,795 | |

| | | | | | | | |

Commitment and Contingencies | | | - | | | | - | |

| | | | | | | | |

Stockholders’ Deficit | | | | | | | | |

Common stock, $0.001 par value per share 75,000,000 shares authorized; 19,985,708 and 19,985,708 shares issued and outstanding respectively | | | 19,986 | | | | 19,986 | |

Additional paid in capital | | | 2,469,045 | | | | 2,469,045 | |

Accumulated deficit | | | (3,785,944 | ) | | | (3,718,579 | ) |

Total Stockholders’ Deficit | | | (1,296,913 | ) | | | (1,229,548 | ) |

Total Liabilities and Stockholders’ Deficit | | $ | 12,595 | | | $ | 14,247 | |

The accompanying notes are an integral part of these financial statements.

JUBILANT FLAME INTERNATIONAL, LTD

STATEMENTS OF OPERATIONS

| | Year Ended | | | Year Ended | |

| | February 29, | | | February 28, | |

| | 2024 | | | 2023 | |

| | | | | | |

Sales of goods | | $ | - | | | $ | - | |

Total sales | | | - | | | | - | |

Cost and Operating Expenses: | | | - | | | | - | |

Cost of goods sold | | | - | | | | - | |

Operating, selling, general and administrative | | | 67,365 | | | | 61,545 | |

Total operating expenses | | | 67,365 | | | | 61,545 | |

Other income: | | | | | | | | |

Other income | | | - | | | | - | |

Other income, net | | | - | | | | - | |

| | | | | | | | |

Loss from operations | | | (67,365 | ) | | | (61,545 | ) |

Provision for income tax | | | - | | | | - | |

| | | | | | | | |

Net loss | | $ | (67,365 | ) | | $ | (61,545 | ) |

| | | | | | | | |

Net loss per share | | | | | | | | |

(Basic and fully diluted) | | $ | (0.00 | ) | | $ | (0.00 | ) |

| | | | | | | | |

Weighted average number of common shares outstanding | | | 19,985,708 | | | | 19,985,708 | |

The accompanying notes are an integral part of these financial statements.

JUBILANT FLAME INTERNATIONAL, LTD

STATEMENTS OF CHANGES IN STOCKHOLDERS’ DEFICIT

| | | | | Additional | | | | | | Total | |

| | Common Stock | | | Paid in | | | Accumulated | | | Stockholders’ | |

| | Shares | | | Amount | | | Capital | | | Deficit | | | Deficit | |

Balances at February 28, 2022 | | | 19,985,708 | | | $ | 19,986 | | | $ | 2,469,045 | | | $ | (3,657,034 | ) | | $ | (1,168,003 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net loss | | | | | | | | | | | | | | | (61,545 | ) | | | (61,545 | ) |

| | | | | | | | | | | | | | | | | | | | |

Balances at February 28, 2023 | | | 19,985,708 | | | | 19,986 | | | | 2,469,045 | | | | (3,718,579 | ) | | | (1,229,548 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net loss | | | | | | | | | | | | | | | (67,365 | ) | | | (67,365 | ) |

| | | | | | | | | | | | | | | | | | | | |

Balances at February 29, 2024 | | | 19,985,708 | | | $ | 19,986 | | | $ | 2,469,045 | | | $ | (3,785,944 | ) | | $ | (1,296,913 | ) |

The accompanying notes are an integral part of these financial statements.

JUBILANT FLAME INTERNATIONAL, LTD

STATEMENTS OF CASH FLOWS

| | Year Ended | | | Year Ended | |

| | February 29, | | | February 28, | |

| | 2024 | | | 2023 | |

Cash flows from operating activities | | | | | | |

Net loss | | $ | (67,365 | ) | | $ | (61,545 | ) |

Adjustments to reconcile net loss to net cash used in operating activities | | | | | | | | |

Changes in Current Assets and Liabilities | | | | | | | | |

Prepaid expense | | | (585 | ) | | | (165 | ) |

Accounts payable and accrued liabilities | | | 4,060 | | | | 21,580 | |

Net cash used in operating activities | | | (63,890 | ) | | | (40,130 | ) |

| | | | | | | | |

Cash flows from financing activities | | | | | | | | |

Net proceeds from related party loans | | | 61,653 | | | | 40,130 | |

Net cash provided by financing activities | | | 61,653 | | | | 40,130 | |

| | | | | | | | |

Net decrease in cash | | | (2,237 | ) | | | - | |

| | | | | | | | |

Cash at beginning of year | | | 3,582 | | | | 3,582 | |

| | | | | | | | |

Cash at end of year | | $ | 1,345 | | | $ | 3,582 | |

| | | | | | | | |

Supplemental Disclosures | | | | | | | | |

Cash paid for interest | | $ | - | | | $ | - | |

Cash paid for income taxes | | $ | - | | | $ | - | |

The accompanying notes are an integral part of these financial statements.

JUBILANT FLAME INTERNATIONAL, LTD

NOTES TO FINANCIAL STATEMENTS

NOTE 1 – ORGANIZATION AND OPERATIONS

Jubilant Flame International, Ltd. (the “Company”), was formed on September 29, 2009 under the name Liberty Vision, Inc. The Company provided web development and marketing services for clients. On August 18, 2015, the Company changed its name to Jubilant Flame International, Ltd.

From the fourth quarter of the fiscal year ended February 28, 2018, the Company started to market and sell cosmetics products imported from Asia, Acropass Series products, in the United States market. The Company purchased the inventory from a related party company in China. The Company contracted with a third party to operate the online shopping platform and marketing campaign in the United States until January 2020. In the beginning of 2020, the Company ceased the marketing and selling of cosmetic products in the United States.

From the third quarter of the year ended February 29, 2020, the Company began its new business line of providing technical support services for development of new nutrition food products to sell to customers in USA. The Company has not generated revenue from this new business by the year ended at February 29, 2024.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The Company’s financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

Use of Estimates and Assumptions

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Management bases its estimates on historical experience and on various assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources.

The Company’s significant estimates include income tax provisions and valuation allowances of deferred tax assets; the fair value of financial instruments and the assumption that the company will continue as a going concern. Those significant accounting estimates or assumptions bear the risk of change due to the fact that there are uncertainties attached to those estimates or assumptions, and certain estimates or assumptions are difficult to measure or value.

Management regularly reviews its estimates utilizing currently available information, changes in facts and circumstances, historical experience and reasonable assumptions. After such reviews, and if deemed appropriate, those estimates are adjusted accordingly. Actual results could differ from those estimates.

Cash and Cash Equivalents

The Company considers all highly liquid investments with a maturity of three months or less to be cash and cash equivalents.

Carrying Value, Recoverability and Impairment of Long-Lived Assets

The Company has adopted paragraph 360-10-35-17 of the FASB Accounting Standards Codification for its long-lived assets. The Company’s long-lived assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable.

The Company assesses the recoverability of its long-lived assets by comparing the projected undiscounted net cash flows associated with the related long-lived asset or group of long-lived assets over their remaining estimated useful lives against their respective carrying amounts. Impairment, if any, is based on the excess of the carrying amount over the fair value of those assets. Fair value is generally determined using the asset’s expected future discounted cash flows or market value, if readily determinable. If long-lived assets are determined to be recoverable, but the newly determined remaining estimated useful lives are shorter than originally estimated, the net book values of the long-lived assets are depreciated over the newly determined remaining estimated useful lives.

The Company considers the following to be some examples of important indicators that may trigger an impairment review: (i) significant under-performance or losses of assets relative to expected historical or projected future operating results; (ii) significant changes in the manner or use of assets or in the Company’s overall business strategy; (iii) significant negative industry or economic trends; (iv) increased competitive pressures; (v) a significant decline in the Company’s stock price for a sustained period of time; and (vi) regulatory changes. The Company evaluates acquired assets for potential impairment indicators at least annually and more frequently upon the occurrence of such events.

The impairment charges, if any, are included in operating expense in the accompanying statements of income and comprehensive income (loss).

Recent Accounting Pronouncements

The Company has implemented all new accounting pronouncements that are in effect as of the date of the issuance of these financial statements.

In August 2020, the FASB issued ASU 2020-06, Debt — Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging—Contracts in Entity’s Own Equity (Subtopic 815-40): Accounting for Convertible Instruments and Contracts in an Entity’s Own Equity (“ASU 2020-06”). ASU 2020-06 simplifies the accounting for convertible debt by eliminating the beneficial conversion and cash conversion accounting models. Upon adoption of ASU 2020-06, convertible debt, unless issued with a substantial premium or an embedded conversion feature that is not clearly and closely related to the host contract, will no longer be allocated between debt and equity components. This modification will reduce the issue discount and result in less non-cash interest expense in financial statements. ASU 2020-06 also updates the earnings per share calculation and requires entities to assume share settlement when the convertible debt can be settled in cash or shares. For contracts in an entity’s own equity, the type of contracts primarily affected by ASU 2020-06 are freestanding and embedded features that are accounted for as derivatives under the current guidance due to a failure to meet the settlement assessment by removing the requirements to (i) consider whether the contract would be settled in registered shares, (ii) consider whether collateral is required to be posted, and (iii) assess shareholder rights. ASU 2020-06 is effective for fiscal years beginning after December 15, 2023. Early adoption is permitted, but only if adopted as of the beginning of such fiscal year. The Company is currently evaluating the impact that the standard will have on its financial statements.

In May 2021, the FASB issued ASU 2021-04, Earnings Per Share (Topic 260), Debt — Modifications and Extinguishments (Subtopic 470-50), Compensation — Stock Compensation (Topic 718), and Derivatives and Hedging — Contracts in Entity’s Own Equity (Subtopic 815-40): Issuer’s Accounting for Certain Modifications or Exchanges of Freestanding Equity-Classified Written Call Options (“ASU 2021-04”). ASU 2021-04 provides guidance as to how an issuer should account for a modification of the terms or conditions or an exchange of a freestanding equity-classified written call option (i.e., a warrant) that remains classified after modification or exchange as an exchange of the original instrument for a new instrument. An issuer should measure the effect of a modification or exchange as the difference between the fair value of the modified or exchanged warrant and the fair value of that warrant immediately before modification or exchange and then apply a recognition model that comprises four categories of transactions and the corresponding accounting treatment for each category (equity issuance, debt origination, debt modification, and modifications unrelated to equity issuance and debt origination or modification). ASU 2021-04 was effective for fiscal years beginning December 15, 2021, including interim periods within those fiscal years. The Company concluded that the standard has no material impact on its financial statements.

Recent Accounting Pronouncements Not Yet Adopted

The Company has considered all recently issued accounting pronouncements and does not believe the adoption of such pronouncements will have a material impact on its financial statements.

Fair Value of Financial Instruments

The Company measures assets and liabilities at fair value based on expected exit price as defined by the authoritative guidance on fair value measurements, which represents the amount that would be received on the sale date of an asset or paid to transfer a liability, as the case may be, in an orderly transaction between market participants. As such, fair value may be based on assumptions that market participants would use in pricing an asset or liability. The authoritative guidance on fair value measurements establishes a consistent framework for measuring fair value on either a recurring or nonrecurring basis whereby inputs, used in valuation techniques, are assigned a hierarchical level.

The following are the hierarchical levels of inputs to measure fair value:

| · | Level 1: Observable inputs that reflect quoted prices (unadjusted) for identical assets or liabilities in active markets. |

| · | Level 2: Inputs reflect quoted prices for identical assets or liabilities in markets that are not active; quoted prices for similar assets or liabilities in active markets; inputs other than quoted prices that are observable for the assets or liabilities; or inputs that are derived principally from or corroborated by observable market data by correlation or other means. |

| · | Level 3: Unobservable inputs reflecting the Company’s assumptions incorporated in valuation techniques used to determine fair value. These assumptions are required to be consistent with market participant assumptions that are reasonably available. |

The carrying amounts of the Company’s financial assets and liabilities, such as cash, accounts payable, due to related party and loan payable, approximate their fair values because of the current nature of these instruments.

Commitments and Contingencies

Liabilities for loss contingencies arising from claims, assessments, litigation, fines and penalties and other sources are recorded when it is probable that a liability has been incurred and the amount of the assessment can be reasonably estimated.

Income Taxes

Deferred income tax assets and liabilities are provided for based upon differences between financial reporting and tax bases of assets and liabilities and are measured using the enacted tax rates and laws that will be in effect when the differences are expected to reverse. Deferred tax assets are reduced by a valuation allowance to the extent management concludes it is more likely than not that the assets will not be realized. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the statements of operations in the period that includes the enactment date.

Revenue Recognition

Sales

The Company recognizes eCommerce sales revenue, net of sales taxes and estimated sales returns, upon delivery to the customer. Additionally, estimated sales returns are calculated using historical experience of actual returns as a percent of sales. No sales or estimated sales returns was recorded for the year ended February 29, 2024 and February 28, 2023.

Cost of Sales

Cost of sales includes actual product cost, the cost of transportation to the Company’s distribution facilities. No cost of sales was recorded for the year ended February 29, 2024 and February 28, 2023.

Operating, Selling, General and Administrative Expenses

Operating, selling, general and administrative expenses include all operating costs of the Company.

Net Loss Per Common Share

Basic net loss per share is computed by dividing net loss by the weighted average number of shares of common stock outstanding during the period. Diluted net loss per share is computed by dividing net loss by the weighted average number of shares of common stock and potentially outstanding shares of common stock during each period.

Since the company has incurred losses for all periods, the impact of the common stock equivalents would be anti- dilutive and therefore are not included in the calculation.

NOTE 3 – GOING CONCERN

The financial statements have been prepared on a going concern basis which assumes the Company will be able to realize its assets and discharge its liabilities in the normal course of business for the foreseeable future. As of February 29, 2024, the Company had a working capital deficit of $1,296,913. The Company currently has limited profitable trading activities and has an accumulated deficit of $3,785,944 as of February 29, 2024.

From the third quarter of the year ended February 29, 2020, the Company began its new business line of providing technical support services for development of new nutrition food products to sell to customers. The Company has not generated revenue from this new business line. This raises substantial doubt about the Company’s ability to continue as a going concern.

The Company may raise additional capital through the sale of its equity securities, through an offering of debt securities, or through borrowings from financial institutions or related parties. By doing so, the Company hopes to generate sufficient capital to execute its new business plan in the nutrition food technical service sector on an ongoing basis. Management believes that actions presently being taken to obtain additional funding provide the opportunity for the Company to continue as a going concern. There is no guarantee the Company will be successful in achieving these objectives. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

NOTE 4 – RELATED PARTY TRANSACTIONS

In support of the Company’s efforts and cash requirements, it must rely on advances from related parties until such time that the Company can support its operations or attains adequate financing through sales of its equity or traditional debt financing. There is no formal written commitment for continued support by shareholders. The advances are considered temporary in nature and have not been formalized by a promissory note.

The CEO confirmed the personal commitment to provide financial support for the next twelve-months from the balance sheet date.

As of February 29, 2024, the Company had a $693,725 advance payment from its CEO, Ms. Yan Li. This compares with an outstanding balance of $632,072 for Ms. Yan Li as of February 28, 2023. The advances are non-interest bearing, due upon demand and unsecured. The company business is operated from an office provided by the CEO.

A related party company is providing accounting service to the Company at an estimated annual service fee of $19,000.

From November 2017, the Company began purchasing cosmetic and sprout products from two related parties controlled by our CEO. The Company purchased a total of $47,643 of inventory from two related parties which was sold during the year ended February 29, 2020, the accounts payable balance of which is outstanding as of February 29, 2024 and February 28, 2023.

NOTE 5 – ACCRUED OFFICER COMPENSATION AND STOCK COMPENSATION

On December 15, 2015, the Company entered into an employment agreement with its president, Ms. Yan Li. The agreement was retroactively effective as of December 4, 2015, for a term of 36 months (measured from December 4, 2015). Pursuant to the agreement, Ms. Yan shall receive an annual salary of $100,500 and 100,000 shares of the Company’s common stock.

As of February 29, 2024, a total of $535,500 has been accrued as accrued officer compensation payable to its president compared to $535,500 as of February 28, 2023.

NOTE 6 – INCOME TAX

At February 29, 2024, the Company had unused federal and state net operating loss carryforwards available of approximately $1,155,724, which may be applied against future taxable income, if any, and which expire in various years.

This loss carry-forward expires according to the following schedule:

Year Ending February 29, 2024 | | Amount | |

| | | |

2034 | | $ | 54,197 | |

2035 | | | - | |

2036 | | | 539,420 | |

2037 | | | 107,453 | |

2038 | | | 118,828 | |

Indefinite | | | 335,826 | |

Total | | $ | 1,155,724 | |

The following is a reconciliation of the tax provision as calculated at the statutory tax rate to the provision as recognized for the years ended February 29, 2024 and February 28, 2023:

| | 2024 | | | 2023 | |

Tax provision at statutory rates | | $ | (14,147 | ) | | $ | (12,925 | ) |

Effect of permanent and Temporary difference(s) | | | 853 | | | | 4,532 | |

Change in valuation allowance | | | 13,294 | | | | 8,393 | |

Provision for income tax | | $ | - | | | $ | - | |

There were permanent differences and temporary differences to reconcile the tax provision for the years ended February 29, 2024 and February 28 2023, other than the change in valuation allowance of $13,294 and $8,393, respectively. All tax years from inception remain open for examination by the tax authorities.

In addition to tax loss carry forward, unrecognized deferred tax assets as of February 29, 2024 and February 28, 2023, primarily related to accrued expense not deductible until paid for income tax purposes amounted to $853 and $4,532, respectively.

NOTE 7 – STOCKHOLDERS’ DEFICIT

Common Stock

The Company has authorized share capital of 75,000,000 shares of common stock authorized with a par value of $0.001 per share.

No stock compensation expense had been recorded for both year ended at February 29, 2024 and February 28, 2023.

NOTE 8 – SUBSEQUENT EVENTS

In accordance with ASC 855-10, “Subsequent Events”, the Company has analyzed its operations subsequent to February 29, 2024 to May 7, 2024, the date when the financial statements were issued. Management of the Company determined that there were no reportable events that occurred during that subsequent period to be disclosed or recorded.

ITEM 9 CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

None.

ITEM 9A CONTROLS AND PROCEDURES

We maintain disclosure controls and procedures that are designed to ensure that information required to be disclosed in our Exchange Act reports is recorded, processed, summarized and reported within the time periods specified in the U.S. Securities and Exchange Commission rules and forms, and that such information is accumulated and communicated to our management as appropriate, to allow timely decisions regarding required disclosure.

Pursuant to Rule 13a-15(b) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), we carried out an evaluation, with the participation of our Chief Executive Officer and Chief Financial Officer, the sole officers, of the effectiveness of the design and operation of our disclosure controls and procedures. Based on management’s evaluation as of the end of the period covered by this Annual Report, our chief executive officer and chief financial officer have concluded that our disclosure controls and procedures (as defined in Rules 13a-15(e) under the Exchange Act) were ineffective as of the end of the period covered by this annual report.

Management’s Annual Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting (as defined in Rules 13a-15(f) and 15d-15(f) of the Exchange Act). Our internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with accounting principles generally accepted in the United States.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Therefore, even those systems determined to be effective can provide only reasonable assurance of achieving their control objectives. Furthermore, smaller reporting companies face additional limitations. Smaller reporting companies employ fewer individuals and find it difficult to properly segregate duties. Smaller reporting companies tend to utilize general accounting software packages that lack a rigorous set of software controls.

Our management, with the participation of the Chief Executive Officer and Chief Financial Officer evaluated the effectiveness of the Company’s internal control over financial reporting as of February 29, 2024. In making this assessment, our management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) in Internal Control — Integrated Framework. Based on that evaluation, our management concluded that, as of February 29, 2024, our internal controls over financial reporting were ineffective because: (1) the Company lacks a functioning audit committee and there is a lack of independent directors on the board of directors, resulting in ineffective oversight in the establishment and monitoring of required internal controls and procedures; (2) due to the lack of employees, the Company has inadequate segregation of duties consistent with control objectives; and (3) the Company has ineffective controls over its period end financial disclosure and reporting processes. The aforementioned material weaknesses were identified by our Chief Executive Officer in connection with the review of our financial statements as of February 29, 2024. Because of our overall limited financial resources, we cannot estimate when we may begin to remediate any of the foregoing deficiencies and the time frame in which they will be remediated if and when begun.

This Annual Report does not include an attestation report of the Company’s registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by the Company’s registered public accounting firm pursuant to the rules of the Securities and Exchange Commission that exempt smaller reporting companies from such requirement.

Changes in internal controls

There have been no changes in our internal control over financial reporting identified in connection with the evaluation described above that occurred during our last fiscal quarter that has materially affected, or is reasonable likely to materially affect, our internal control over financial reporting.

ITEM 9B OTHER INFORMATION.

None

PART III

ITEM 10 DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

The following table presents information with respect to our officers, directors and significant employees as of the date of this Report:

Name | | Age | | Position |

Yan Li | | 58 | | President, Chief Executive Officer and Director |

Lei Wang | | 51 | | Chief Financial Officer and Director |

Kecheng Xu | | 37 | | Secretary, Treasurer and Director |

Marino Papazoglou | | 66 | | Director |

Brian Cheng | | 65 | | Director |

Each director serves until our next annual meeting of stockholders or until his or her successor is elected and qualified, unless he or she resigns earlier or is removed. The Board of Directors elects the officers of the Company and their terms of office are at the discretion of the Board of Directors, unless they resign. At the present time, members of the board of directors are not compensated for their services on the board of directors.

There are no family relationships among our officers and directors.

Biographical Information Regarding Officers and Directors

Ms. Yan Li is a permanent resident of Canada and has been living in Vancouver since 2008. Ms. Li is our President and Chief Executive Officer and is a member of the Board of Directors. Ms. Yan Li also manages and is a board member of several private companies, including: Jiu Feng Investment Ltd from 2008 to date; Jiu Feng Investment Management Shanghai Ltd from 2000 to date; Shanghai Xiu Ling Hanhe Landscaping Engineering Ltd from 1999 to date; Biomark China Inc from 2008 to date; and JF-NAIC from 2012 to date. Ms. Li holds a bachelor degree in financial and bank management from the Shanghai Financial Economical University.

Lei Wang is a resident of the USA. Mr. Wang has been our Chief Financial Officer and a member of the Board of Directors since August 30, 2017. Mr. Wang has over 20 years of accounting and audit work experience at public and private companies, including reconciliation supervisor at financial administration office of Prairie View A&M University from 2011 to 2013; auditor at a CPA firm in Houston from 2013 to 2016; the owner of financial and accounting service firm Wang LSC Consulting LLC from 2017 to date. Mr. Wang holds a master degree in accounting from Texas A&M university and is a licensed CPA member in Texas, USA.

Kecheng Xu is a resident of China. Mr. Xu has been our Secretary, Treasurer and a member of the Board of Directors of the Company since August 30, 2017. Mr. Xu has over 6 years financial work experience at private sector, including: Jiu Feng Investment Management Shanghai Ltd from 2012 to date and Equity investment manager at TFTR Investment Co. Ltd from 2016 to date. Mr. Xu holds a Financial MBA from Shanghai Advanced Institute of Finance (SJTU), and received a bachelor degree in Economics from the University of British Columbia in Canada.

Marino Papazoglou is a resident of the USA, Mr. Papazoglou has been the CEO & President of International Specialty Supply, a global leader of Sprout Seeds, Equipment and Natural Powder Ingredients since 2018. Mr. Papazoglou has held executive leadership positions in the Food Ingredients, Food Products and Specialty Chemicals industries and has extensive experience accomplishing challenging business objectives worldwide.

Mr. Papazoglou has a Bachelor of Science Chemistry Degree from State University of New York and a Master in Business Administration from New York Institute of Technology.

Brian Cheng is a resident of the USA, Mr. Cheng currently is holding a dual position as the Chief Technical Officer and broad member of BioMark Technologies Inc. and was formerly the Asian business/technical manager of Sensient for 8 years. Prior to his commercial experience, he also served 19 years in Monsanto as an organic chemist and 7 years in Mallinckrodt Pharmaceutical as the Operation Excellent manager. Brian has an extensive experience in pharmaceutical and medicinal products experience. Currently he has more than 20 patents granted and 10 pending patents. Mr. Cheng obtained his bachelor degrees in Chemistry from Indiana University and a master degree in chemistry from Washington University.

Corporate Governance; Audit Committee and Other Committees

We do not have a separately-designated standing audit committee, and we do not have an “audit committee financial expert” as defined by SEC regulation. The Company’s Board of Directors performs some of the same functions of an audit committee, such as recommending a firm of independent certified public accountants to audit the financial statements; reviewing the auditors’ independence, the financial statements and their audit report; and reviewing management’s administration of the system of internal accounting controls. The Company does not currently have a written audit committee charter or similar document.

We do not have any other committees of the board of directors, such as compensation or nomination committees. The functions of these types of committees are currently carried out by the Board of Directors.

Involvement in Certain Legal Proceedings

To the best of our knowledge, none of our directors or executive officers, during the past ten years, has been involved in any legal proceeding of the type required to be disclosed under applicable SEC rule.

Compliance with Section 16(a) of the Securities Exchange Act

Section 16(a) of the Exchange Act requires our directors and executive officers, and persons who own more than 10% of our equity securities that are registered pursuant to Section 12 of the Securities Exchange Act, to file with the SEC initial reports of ownership and reports of changes in ownership of our equity securities. Officers, directors and greater than 10% stockholders are required by SEC regulations to furnish us with copies of all Section 16(a) reports they file.

Code of Ethics

We have not yet adopted a code of ethics that applies to our principal executive officers, principal financial officer, principal accounting officer or controller, or persons performing similar functions.

ITEM 11 EXECUTIVE COMPENSATION

Compensation of Officers

The following summary compensation table sets forth information concerning compensation for services rendered in all capacities during fiscal year end February 29, 2024 awarded to, earned by or paid to our executive officers.

Summary Compensation Table

(a) | | (b) | | (c) | | | (d) | | | (e) | | | (f) | | | (g) | | | (h) | | | (i) | | | (j) | |

| | | | | | | | | | | | | | | | | | | Change in | | | | | | | |

| | | | | | | | | | | | | | | | | | | Pension | | | | | | | |

| | | | | | | | | | | | | | | | | | | Value & | | | | | | | |

| | | | | | | | | | | | | | | | Non- | | | Non- | | | | | | | |

| | | | | | | | | | | | | | | | Equity | | | qualified | | | | | | | |

| | | | | | | | | | | | | | | | Incentive | | | Deferred | | | All | | | | |

| | | | | | | | | | | | | | | | Plan | | | Compen- | | | Other | | | | |

| | | | | | | | | | Stock | | | Option | | | Compen- | | | sation | | | Compen- | | | | |

Name and Principal | | | | Salary | | | Bonus | | | Awards | | | Awards | | | sation | | | Earnings | | | sation | | | Totals | |

Position | | Year | | ($) | | | ($) | | | ($) | | | ($) | | | (S) | | | ($) | | | ($) | | | ($) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Yan Li President, CEO | | 2023 | | | - | 1 | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Lei Wang , CFO | | 2023 | | | - | 2 | | | - | | | | - | | | | - | | | | - | | | | - | | | | 19,000 | | | | 1,9000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Kecheng Xu Secretary, Treasurer, Director | | 2023 | | | - | 3 | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Brian Cheng, Director | | 2023 | | | - | 4 | | | | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Marino Papazoglou, Director | | 2023 | | | - | 5 | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

___________

1 | On December 15, 2015, the Company entered into employment agreements with its president and CEO, Ms. Yan Li, the agreements were retroactively effective as of December 4, 2015, for a term of 36 months (measured from December 4, 2015). Pursuant to the agreement, Ms. Yan shall receive an annual salary of $100,500 and 100,000 shares of the Company’s common stock. On January 15, 2019, Ms. Li’s compensation agreement was renewed by the Board. Ms. Li was granted 200,000 shares each year for a term of three years based on board resolution. The granted shares have a value of $0.036 per shares based on stock market price on the stock grant date. No stock compensation was recorded at the end of year February 29, 2024. |

2 | On August 30, 2017 Lei Wang became our Chief Financial Officer. Mr. Wang receives no salary compensation. Mr. Wang was paid stock compensation from time to time based on business progress. On January 15, 2019, Mr. Cheng was granted 100,000 stock compensation shares each year for a term of three year at the time of his appointment. The granted shares have a value of $0.036 per share based on stock market price on the stock grant date. No stock compensation was recorded at the end of year February 28, 2023. The company accrued a separate legal entity controlled by Mr. Wang for service fee of $19,000 during year end of February 29, 2024. |

| |

3 | Mr. Kecheng Xu became he Secretary, Treasurer and a director of the Company on August 30, 2017. Mr. Xu receives no salary compensation. Mr. Xu was paid stock compensation from time to time based on business progress. Mr. Xu was granted 50,000 shares of restricted common stock at the time of his appointment. The restricted stock has a value of $525 base on stock market price of $0.0105 per share one the stock grant date. On January 15, 2019, Mr. Xu was granted 50,000 stock compensation shares each year for a term of three years based on board meeting resolution. The granted shares have a value of $0.036 per shares based on stock market price one the stock grant date. No stock compensation was recorded at the end of year February 29, 2024. |

| |

4. | Mr. Brian Cheng became board director of the Company on January 15, 2019. Mr.Cheng receives no salary compensation. Mr. Cheng was paid stock compensation from time to time based on business progress. On January 15, 2019, Mr. Cheng was granted 100,000 stock compensation shares each year for a term of three year at the time of his appointment. The granted shares have a value of $0.036 per share based on stock market price on the stock grant date. No stock compensation was recorded at the end of year February 29, 2024. |

5. | Mr. Marino Papazoglou became board director of the Company on January 15, 2019. Mr. Papazoglou receives no salary compensation. Mr.Papazoglou was paid stock compensation from time to time based on business progress. On January 15, 2019, Mr. Papazoglou was granted 50,000 stock compensation shares each year for a term of three year at the time of his appointment. The granted shares have a value of $0.036 per share based on stock market price on the stock grant date. No stock compensation was recorded at the end of year February 29, 2024. |

Employment Agreements and Related Arrangements

On December 15, 2015, the Company entered into employment agreements with its president and chief executive officer, Ms. Yan Li. Ms. Yan’s agreement is retroactively effective as of December 4, 2015, for a term of 36 months (measured from December 4, 2015). Pursuant to the agreement, Ms. Li received an annual salary of $100,500 and 100,000 shares of the Company’s common stock. The Company valued the stock compensation under both agreements at $2.10 per share based on the quoted market price of shares of common stock on the effective date of the agreements.

Our current Chief Financial Officer, Secretary/Treasurer and other two directors receive no salary compensation instead been paid stock compensation from time to time based on the performance of the Company.

On January 15, 2019, the company granted its five directors granted 500,000 shares each year for a term of three years based on board resolution. The granted shares have a value of $0.036 per shares based on stock market price on the stock grant date.

Retirement, Resignation or Termination Plans

We sponsor no plan, whether written or verbal, that would provide compensation or benefits of any type to an executive upon retirement, or any plan that would provide payment for retirement, resignation, or termination as a result of a change in control of our company or as a result of a change in the responsibilities of an executive following a change in control of our company.

Directors’ Compensation

The persons who served as members of our board of directors, three of them are also our executive officers, did not receive separate compensation for their services as directors in fiscal years ended February 28, 2023 and February 28, 2022.

Option Exercises and Stock Vested

There were no options issued, outstanding, exercised or vested during the years ended February 29, 2024 and February 28, 2023. There were no unvested stock awards outstanding at the same dates.

Pension Benefits and Nonqualified Deferred Compensation

The Company does not maintain any qualified retirement plans or non-nonqualified deferred compensation plans for its employees or directors.

ITEM 12 SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The following table sets forth certain information regarding beneficial ownership of our common stock as of May 7, 2024: (i) by each of our directors, (ii) by each of the Named Executive Officers, (iii) by all of our executive officers and directors as a group, and (iv) by each person or entity known by us to beneficially own more than ten percent (10%) of any class of our outstanding shares. As of May 7, 2024, there were 19,985,708 shares of our common stock outstanding. We have determined beneficial ownership in accordance with the rules of the SEC, and the information is not necessarily indicative of beneficial ownership for any other purpose. Except as indicated by the footnotes below, we believe, based on information furnished to us, that the persons named in the table below have sole voting and sole investment power with respect to all shares of common stock that they beneficially owned, subject to applicable community property laws.

Name and address of beneficial owner (1) | | Amount and Nature of Beneficial Ownership | | | Percentage of Beneficial Ownership | |

Yan Li, President, Chief Executive Officer & Director | | | 6,713,215 | | | | 33.6 | % |

Lei Wang, Chief Financial Officer & Director | | | 550,000 | | | | 2.8 | % |

Kecheng Xu, Treasurer, Secretary and Director | | | 228,500 | | | | 1.1 | % |

Brian Cheng, Director | | | 300,000 | | | | 1.5 | % |

Marino Papazoglou, Director | | | 150,000 | | | | 0.8 | % |

All executive officers and directors as a group (Persons) | | | 7,941,715 | | | | 39.8 | % |

__________

(1) | Room 508, T1N Vi Park, 360 Xin Long Road, Shanghai China, 201101 |

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

During the fiscal years ended February 29, 2024 and February 28, 2023, Ms. Yan Li, our President, CEO, and a director, personally paid $61,653 and $40,130, respectively, for various expenses on behalf of Jubilant Flame International Ltd. The Company did not enter into any loan agreement with respect to those advances.

On December 15, 2015, the Company entered into employment agreements with its president, Ms. Yan Li, the agreements were retroactively effective as of December 4, 2015, for a term of 36 months (measured from December 4, 2015). Pursuant to the agreement, Ms. Yan shall receive an annual salary of $100,500 and 100,000 shares of the Company’s common stock. On January 15, 2019, Ms. Li’s compensation agreement was renewed by the board. Ms. Li was granted 200,000 shares each year for a term of three years based on board resolution. The granted shares have a value of $0.036 per shares based on stock market price at stock grant date.