UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

6-K

Report of Foreign Private Issuer Pursuant to Rule

13a-16 or

15d-16 of the Securities Exchange Act of 1934

For the month of May 2024

Commission File Number: 333-155412

JBS S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of registrant’s name into English)

Av. Marginal Direita do Tietê

500, Bloco I, 3rd Floor

São Paulo, SP, Brazil

(Address of principal executive offices)

(Indicate by check mark

whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F: ☒ Form 40-F: ☐

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: May 14, 2024

| |

JBS S.A. |

| |

|

|

| |

By: |

/s/ Guilherme Perboyre Cavalcanti |

| |

Name: |

Guilherme Perboyre Cavalcanti |

| |

Title: |

Chief Financial and Investment Relations Officer |

Exhibit 99.1

COMMUNICATION ON CORPORATE DEMAND

JBS S.A. (B3: JBSS3, OTCQX: JBSAY, “JBS”),

under the provisions of Article 33 and Exhibit I of CVM Resolution 80, of March 29, 2022, as amended by Resolutions 59/21, 162/22, 168/22,

173/22, 180/23, and 183/23, which determines the disclosure, by JBS, of “Communication on Corporate Demand,” hereby informs

its shareholders and the market about the existence of an arbitration procedure (“Arbitration Procedure”), as described below.

Parties involved

in the Arbitration

Procedure: |

Applicants: GIC Private Limited; California Public

Employees Retirement System; National Pension Service; Teachers’ Retirement System of the State of Illinois; Caisse de depot et placement

du Quebec; Virginia Retirement System; LRI Invest S.A. (formerly known as Warburg Invest Luxembourg S.A.); Bank of Korea; Public Employee

Retirement System of Idaho (PERSI; Fundação Calouste Gulbenkian; Railways Pension Trustee Company Limited; Xtrackers SICAV;

SSGA MSCI ACWI EX-USA Index Non-Lending Daily Trust, um Massachusetts Statutory Trust; GIC Private Limited; GIC Private Limited; PT-Master;

Helaba Invest Kapitalanlagegesellschaft Mbh On Behalf Of Hi-Aktien Schwellenlander 1-Fonds (formerly known as SGSS DEUTSCHLAND KAPITALANLAGEGESELLSCHAFT

MBH ON BEHALF OF AKTIEN SCHWELLENLANDER.

Defendants: JBS, J&F Investimentos

S.A., Joesley Mendonça Batista; Wesley Mendonça Batista.

|

| Procedure no.: |

CAM 252/23 (Market Arbitration Chamber) |

Amount

Involved: |

The Applicants estimate the total disputed amount

to be R$756,894,581.40 (seven hundred and fifty-six million, eight hundred and ninety-four thousand, five hundred and eighty-one reais

and forty centavos).

|

| Main Facts: |

On September 25, 2023, the Applicants filed a

claim due to alleged losses suffered as a result of alleged unlawful and fraudulent acts committed by the Defendants in violation of Law

6,404, of December 15, 1976, Law 12,846, of August 01, 2013, the Civil Code, CVM resolutions, and statutory rules.

JBS consulted its legal department, which considers

the claim to be groundless and with a low risk of loss.

On October 20, 2023, JBS, preliminarily, filed

an exception of lis pendens, requiring that the President of CAM reject the request for the initiation of arbitration CAM 252/23,

as well as the suspension of the deadline for presenting its response to the arbitration request until a definitive decision is made regarding

this exception.

Also, on October 20, 2023, CAM’s Secretariat informed

about the suspension of the deadline for presenting the Responses to the Request for Arbitration CAM 252/23.

On May 9, 2024, the President of CAM reopened

the deadline for the presentation of the Response to the Request for Arbitration by the Defendants.

|

Request or

Provision Sought: |

The Applicants seek compensation and indemnification

for the shareholders.

|

São Paulo, May 10, 2024.

Guilherme Perboyre Cavalcanti

Investor Relations Officer

Exhibit 99.2

JBS S.A.

By-Laws

CNPJ/MF (Corporate Taxpayer

Registration) No. 02.916.265/0001-60

NIRE (State Registration Number)

35.300.330.587

CHAPTER I

NAME, HEAD OFFICE, PURPOSE

AND TERM

Article 1 JBS S.A. (“Company”)

is a company governed by these Articles of Incorporation and by the laws in force.

Article 2 The Company

is headquartered in the City of São Paulo, State of São Paulo, at Avenida Marginal Direita do Tietê, 500, Bloco I,

3° andar, CEP (Zip Code) 05118-100.

Sole Paragraph The Company

may open, close and amend the address of subsidiaries, agencies, warehouses, distribution centers, offices and any other establishments

in the country or abroad by resolution of the Executive Board, subject to the provisions of Article 26, item IV, of these Articles of

Incorporation.

Article 3 The Company’s

corporate purpose is: (a) administrative office; (b) operation on its own account of cattle slaughtering and refrigeration, industrialization,

distribution and commercialization of in natura or industrialized food products and products and by-products of animal and vegetable origin

and their derivatives (including, without limitation, cattle, pigs, sheep and fish in general; (c) processing, preservation and production

of canned vegetables, canned foods, fats, animal feed, canned goods, import and export of derivative products; (d) industrialization of

products for pets, nutritional additives for animal feed, balanced feed and prepared feed for animals; (e) purchase, sale, rearing, fattening

and slaughtering of cattle, in its own establishment and that of third parties; (f) slaughterhouse with cattle slaughter and meat preparation

for third parties; (g) industry, trade, import, export of bovine tallow, meet meal, bone meal and feed; (h) purchase and sale, distribution

and representation of foodstuffs, uniforms and clothing with provision of clothing services in general; (i) processing, wholesale marketing,

import and export of hides and calfskins, horns, bones, hooves, mane, wool, raw hair and bristles, feathers and animal protein; (j) distribution

and commercialization of drinks, candies and barbecue utensils; (k) industrialization, distribution and commercialization of sanitizing-household

hygiene products; (l) industrialization, distribution, commercialization, import, export, improvement, representation of perfumery products

and toiletries, cleaning products and personal and domestic hygiene, cosmetics and personal use products; (m) import and export, provided

that they are related to the activities contained in items “b”, “d”, and “k” of the Company’s corporate

purpose; (n) industrialization, leasing and sales of machines and equipment in general and the assembly of electrical panels, provided

that they are related to the activities contained in items “b”, “d”, “i”, “j”, “k”,

“l” and “m” of the Company’s corporate purpose and to the extent necessary to carry out them, this activity not

being able to represent more than 0.5% of the Company’s annual revenue; (o) trading of chemical products, provided they are related to

the activities set out in items “b”, “d”, “i”, “j”, “k”, “l” and

“m” of the Company’s corporate purpose; (p) industrialization, commercialization, import and export of plastics, plastic products,

scraps in general, corrective fertilizers, organic and mineral fertilizers for agriculture, removal and biological treatment of organic

waste, provided that they are related to the activities contained in items “b”, “d”, “i”, “j”,

“k”, “l” and “m” of the Company’s corporate purpose and to the extent necessary to carry out them;

(q) printing, manufacture of cans, preparation of steel coils (tin and plated) and varnishing of steel sheets, provided that they are

related to the activities contained in items “b”, “d”, “i”, “j”, “k”, “l”

and “m” of the Company’s corporate purpose; (r) closed warehouse and good warehouse for third parties, except general warehouses

and mobile storage; (s) general warehouses, in accordance with Federal Decree No. 1,102, of November 21, 1903, for the storage and conservation

of perishable goods belonging to third parties; (t) municipal, intercity, interstate and international road transport of cargo in general;

(u) production, generation and commercialization of electric energy, and cogeneration of energy and storage of hot water for heating with

or without authorization from the relevant Public Authorities; (v) production, sale, import and export of biofuel, biodiesel, glycerin,

organic residue resulting from the biodiesel manufacturing process (sludge), soluble alcohol, additives, vegetable oils, organic additives

for mixing, recycled oil, esters, chemical products and derivatives; (w) the industrialization, distribution, commercialization and storage

of chemical products in general; (x) production, trade of biodiesel from animal fat, vegetable oil and by-products and bioenergy, import;

(y) commercialization of agricultural raw materials in general; (z) industrialization, distribution, commercialization and storage of

products and by-products of animal and vegetable origin and their derivatives, glycerin and by-products of animal and vegetable origin;

(aa) intermediation and agencying of services and business in general, except real estate; (ab) provision of services of laboratory analysis,

testing and technical analysis; (ac) manufacture of margarine and other vegetable fats and non-edible animal oils; (ad) manufacture of

ice cream and other edible ices; (ae) wholesale of other chemical and petrochemical products not previously specified; (af) manufacture

of additives for industrial use; (ag) manufacture of refined vegetable oils, except corn oil; (ah) manufacture of synthetic soaps and

detergents; (ai) wheat milling and production of derivatives; (aj) manufacture of organic chemicals not previously specified; (ak) processing,

industrialization, distribution, trading, import, export, commission, consignment and representation of milk and its derivatives; (al)

processing, industrialization, distribution, trade, import, export, commission, consignment and representation of food products of any

kind; (am) distribution, trading, import, export, commission, consignment and representation of agricultural products, machinery, equipment,

parts and inputs necessary for the manufacture and sale of the Company’s products; (an) distribution, trading, import, export, commission,

consignment and representation of vinegar, beverages in general, candies and canned food; (ao) provision of services and technical assistance

to rural livestock farmers; (ap) participation in other companies in the country and abroad, as a partner, shareholder or associate; (ar)

production, generation and commercialization of electric energy; (aq) industrialization of hides, calfskins and their derivatives, their

preparation and finishing, industrialization of upholstery and other leather items; (air) road transport of dangerous goods; (as) exploitation

of the branch of industrialization, commercialization, export and import of ingredients and products for food and the representation of

products in general; (at) recovery of plastic materials; (au) recovery of materials not otherwise specified; (av) treatment and disposal

of non-hazardous waste; (aw) hazardous waste disposal treatment; (ax) manufacture of plastic artifacts for other uses not previously specified;

(ay) wholesale trade in slaughtered poultry and derivatives; (az) raising other poultry, except for cutting; (aaa) egg production; (aab)

production of day-old chicks; (aac) manufacture of medicines for veterinary use; and (aad) manufacture of tanned, varnished, metallic,

suede, tanned, plated leather; (aae) leather regeneration, dyeing and painting; (aaf) loading and unloading; and (aag) electricity monitoring.

Sole Paragraph The Company

may explore other branches that have affinity with the object expressed in Article 3, as well as participate in other companies, in the

country or abroad.

Article 4 The Company’s

term of duration is indefinite.

CHAPTER II

CAPITAL

Article 5 The capital

is R$ 23,631,071,304.24 (twenty three billion, six hundred and thirty-one million, seventy-one thousand, three hundred and four Brazilian

Reais and twenty-four cents), fully subscribed and paid, divided into 2,218,116,370 (two billion, two hundred and eighteen million, one

hundred and sixteen thousand, three hundred and seventy) common shares, all nominative, registered and without par value.

Article 6 The Company

is authorized to increase its capital, regardless of amendment to the articles of incorporation, by up to 1,375,853,183 (one billion,

three hundred and seventy-five million, eight hundred and fifty and three thousand, one hundred and eighty-three) common shares, nominative,

registered and without par value.

Paragraph 1 Within the

limit authorized in this Article, the Company may, upon resolution of the Board of Directors, increase the capital regardless of amendment

to the article of incorporation, subject to the provisions of Paragraph 2 of Article 166 of Law 6,404, of December 15, 1976, as amended

(“Corporation Law”). The Board of Directors will fix the number, price, and payment term and the other conditions of

the share issue.

Paragraph 2 Within the

limit of the authorized capital, the Board of Directors may deliberate on the issuance of subscription bonus and bonds convertible into

common shares.

Paragraph 3 Within the

limit of the authorized capital and pursuant to the plan approved by the Annual Meeting, the Company may grant stock options to managers,

employees or individuals who provide services to it, or to managers, employees or individuals who provide services to companies under

its control, excluding the preemptive rights of shareholders in the granting and exercise of the stock options.os, or to managers, employees

or individuals rendering services to companies under its control, excluding the preemptive rights of shareholders in the granting and

exercise of the call options.

Paragraph 4 The Company

is prohibited from issuing beneficiary parties.

Paragraph 5 The Company

may not issue preferred shares.

Paragraph 6 Whenever

the Board of Directors approves the capital increase within the limit of the authorized capital, the consolidation of Articles 5 and 6

of the Articles of Incorporation shall be included in the agenda of the subsequent Annual Meeting.

Article 7 The capital

will be represented exclusively by common shares and each common share will give the right to one vote in the deliberations of the Annual

Meeting.

Article 8 All the Company’s

shares are registered, held in a deposit account at a financial institution authorized by the Brazilian Securities and Exchange Commission

(“CVM”) designated by the Board of Directors, in the name of their holders, without the issuance of certificates.

Sole Paragraph The cost

of transfer and annotation may be charged directly to the shareholder by the registration institution, as may be defined in the share

registration contract.

Article 9 At the discretion

of the Board of Directors, may be excluded or reduced the preemptive right in the issuance of shares, bonds convertible into shares and

subscription bonus, whose placement is made by sale on the stock exchange or by public subscription, or through exchange for shares, in

a public offer for the acquisition of control, under the terms established by law, within the limit of the authorized capital.

CHAPTER III

ANNUAL MEETING

Article 10 The Annual

Meeting shall meet, ordinarily, once a year and, extraordinarily, when convened under the terms of the Brazilian Corporation Law and these

Articles of Incorporation.

Paragraph 1 The Annual

Meeting shall be called by the Chairman of the Board of Directors or, in the cases provided for by law, by shareholders or by the Audit

Committee, by means of a published notice, the first call shall be made at least 15 (fifteen) days in advance, and the second one at least

8 (eight) days in advance.

Paragraph 2 The resolutions

of the Annual Meeting will be taken by majority of votes present.

Paragraph 3 The Annual

Meeting may only resolute on the matters of the agenda, set forth in the respective call, subject to the exceptions set forth in the Brazilian

Corporation Law.

Paragraph 4 At the Annual

Meetings, the shareholders must present, at least, 72 (seventy-two) hours in advance, in addition to the identity document and/or relevant

corporate acts proving the legal representation, as the case may be: (i) proof issued by the registration institution, at most, 5 (five)

days before the date of the Annual Meeting; (ii) the mandate with notarized signature of the grantor; and/or (iii) regarding shareholders

participating in the fungible custody of registered shares, the statement containing the respective shareholding participation, issued

by the competent body.

Paragraph 5 The minutes

of Annual Meetings must be drawn up in the book of Minutes of Annual Meetings in the form of a summary of the facts occurred and published

with omission of signatures.

Artigo 11 The Annual

Meeting will be installed and presided by the Chairman of the Board of Directors or, in his absence or impediment, installed and presided

by another Director, Officer or shareholder appointed in writing by the Chairman of the Board of Directors. The Chairman of the Board

of the Annual Meeting will appoint up to 2 (two) Secretaries.

Article 12 It is up to the

Annual Meeting, in addition to the attributions provided for by law:

| I. | elect and dismiss the members of the Board of Directors and

the Audit Committee; |

| II. | set the annual global compensation of the managers, as well

as of the members of the Audit Committee and the Statutory Audit Committee; |

| III. | reform the Articles of Incorporation; |

| IV. | deliberate about the dissolution, liquidation, merger, spin-off,

incorporation of the Company, or of any company in the Company; |

| V. | attribute bonus shares and decide on eventual grouping and

unfolding of shares; |

| VI. | approve stock purchase option plans destined to managers,

employees or natural persons who provide services to the Company or to controlled company of the Company; |

| VII. | deliberate, according to the proposal presented by the management,

about the allocation of the year’s profit and the distribution of dividends; |

| VIII. | elect and dismiss the liquidator, as well as the Audit Committee

that will operate during the liquidation period; |

| IX. | deliberate about any matter submitted to it by the Board

of Directors. |

CHAPTER IV

MANAGEMENT BODIES

Section I - Common Provisions

to the Management Bodies

Article 13 The Company shall

be managed by the Board of Directors and the Executive Board.

Paragraph 1 The investiture

of the Company’s management members in their respective positions shall be made by means of an instrument of investiture drawn up in a

proper book, which shall contain provisions expressly subject to the arbitration clause provided for in article 50 of these Articles of

Incorporation, signed by the manager taking office, waived any guarantee of management.

Paragraph 2 The managers

shall remain in their positions until their substitutes take office, unless otherwise resolved by the Annual Meeting or by the Board of

Directors, as the case may be.

Article 14 The Annuaal

Meeting shall set the overall amount of compensation of the managers, and the Company’s management shall be responsible for setting the

individual compensation of the Directors, the members of the Statutory Audit Committee and the Executive Board,

Article 15 Except as

provided in these Articles of Incorporation, any of the management bodies shall validly meet with the presence of the majority of their

respective members and shall pass resolutions by the vote of an absolute majority of those present.

Sole Paragraph The prior

call of the meeting as a condition of its validity is only waived if all its members are present. Members of the management body who express

their vote through the delegation made in favor of another member of the respective body, by prior written vote or by written vote transmitted

by electronic mail or any other means of communication, are considered present.

Section II - Board of Directors

Article 16 The Board

of Directors shall be composed of at least 5 (five) and at most 11 (eleven) members, all elected and removable by the Annual Meeting,

with a unified mandate of 2 (two) years, considering each year as the period between 2 (two) Annual Meetings, reelection being permitted.

Paragraph 1 At the Annual

Meeting whose purpose is to deliberate on the election of the members of the Board of Directors, the shareholders must first establish

the effective number of members of the Board of Directors to be elected.

Paragraph 2 As per

the New Market Regulation of B3 S.A. - Brasil, Bolsa e Balcão (respectively, “Novo Mercado Regulation and

“B3”), considering the the members of the Board of Directors, at least two (2) or twenty percent (20%), whichever is

greater, must be independent directors, and the characterization of the nominees to the Board of Directors as independent directors

must be deliberated at the Annual Meeting that elects them.

Paragraph 3 When, as

a result of the calculation of the percentage referred to in the paragraph above, the result generates a fractional number, the Company

must proceed with the rounding up to the immediately higher whole number.

Paragraph 4 For the purposes

of verifying the classification of the independent director, it is not considered an independent director that: (i) is a direct

or indirect controlling shareholder of the Company; (ii) has exercised voting rights at the Board of Directors’ meetings bound

by a shareholders’ agreement whose purpose is matters related to the Company; (iii) is a spouse, partner or relative, direct or

not, up to the second degree of the controlling shareholder, the Company’s manager or the manager of the controlling shareholder; and

(iv) has been, in the last 3 (three) years, an employee or officer of the Company or its controlling shareholder. For the purposes

of verifying the classification of the independent director, the situations described below must be analyzed in order to verify whether

they imply a loss of independence of the independent director due to the characteristics, magnitude and extent of the relationship: (i)

it is related up to the second degree of the controlling shareholder, the Company’s manager or the controlling shareholder’s manager;

(ii) has been, in the last 3 (three) years, an employee or officer of affiliated companies, controlled or under common control;

(iii) has business relationships with the Company, its controlling shareholder or affiliated companies, controlled or under common

control; (iv) holds a position in a company or entity that has commercial relations with the Company or with its controlling shareholder

who has decision-making power in conducting the activities of said company or entity; or (v) receives other remuneration from the

Company, its controlling shareholder, affiliated companies, controlled or under common control, in addition to that relating to the performance

as a member of the Board of Directors or committees of the Company, its controlling shareholder, its affiliated companies, controlled

or under common control, except for cash proceeds arising from participation in the Company’s share capital and benefits arising from

supplementary pension plans. Furthermore, an independent director is considered, however, to be the one elected pursuant to Article 141,

Paragraphs 4 and 5 of the Joint Stock Company Law, in case there is a controlling shareholder.

Paragraph 5 After the

mandate ends, the members of the Board of Directors shall remain in their positions until the new elected members take office.

Paragraph 6 The Annual

Meeting may elect one or more alternate members to the Board of Directors.

Paragraph 7 The member

of the Board of Directors or alternate may not have access to information or participate in meetings of the Board of Directors related

to matters in which they have an interest that conflicts with the interests of the Company.

Paragraph 8 The Board

of Directors, for better performance of its functions, may create committees or working groups with defined objectives, which shall act

as auxiliary bodies, without deliberative powers, always with the aim of advising the Board of Directors, being composed of people appointed

by it among the management members and/or other persons directly or indirectly related to the Company.

Paragraph 9 In cases

of vacancy of the position of director, the respective alternate, if any, shall take his/her place; if there is no alternate, his replacement

will be appointed by the remaining directors, and will serve until the first Annual Meeting.

Article 17 The Board

of Directors shall have 1 (one) Chairman and 1 (one) Vice-President, who will be elected by the majority of votes of those present, at

the first meeting of the Board of Directors that takes place immediately after such members take office, or always that there is a resignation

or vacancy in those positions.

Paragraph 1 The Chairman

of the Board of Directors shall call and preside the meetings of the body and the Annual Meetings, except, in the case of Annual Meetings,

the cases in which he/she indicates in writing another director, officer or shareholder to preside over the works, subject to the provisions

of article 11 of these Articles of Incorporation.

Paragraph 2 In the resolutions

of the Board of Directors, the Chairman of the body, in addition to his own vote, shall have the casting vote, in the event of a tie in

the vote due to an eventual composition of an even number of members of the Board of Directors. Each director will be entitled to 1 (one)

vote in the resolutions of the body, and the resolutions of the Board of Directors will be taken by a majority of its members.

Paragraph 3 The Vice-President

shall exercise the functions of the Chairman in his/her absences and temporary impediments, regardless of any formality. In the event

of absence or temporary impediment of the Chairman and Vice-President, the functions of the Chairman will be performed by another member

of the Board of Directors appointed by the other members of the Board of Directors.

Paragraph 4 The positions

of Chairman of the Board of Directors and Chief Executive Officer or main executive of the Company may not be accumulated by the same

person, except for the cases provided for in the Novo Mercado Regulation.

Article 18 The Board

of Directors shall meet, (i) at least once per quarter; and (ii) at special meetings, at any time. The meetings of the Board of Directors

shall be held upon a call of the Chairman of the Board of Directors or any other member, in writing, at least 7 (seven) days in advance,

and indicating the date, time, place, detailed agenda and documents to be considered at that meeting, if any. Any director may, upon written

request to the Chairman, include items on the agenda. The Board of Directors may unanimously deliberate to include any other matter on

the agenda of the meeting. The meetings of the Board of Directors may be held by conference call, video conference or by any other means

of communication that allows for the identification of the member and simultaneous communication with all other people present at the

meeting.

Paragraph 1 Calls for

meetings shall be made by means of a written notice delivered by email or any other means of communication to each member of the Board

of Directors at least 7 (seven) days in advance, unless the majority of its members members in office set a shorter period, but not less

than 48 (forty-eight) hours.

Paragraph 2 All resolutions

of the Board of Directors shall be recorded in the minutes drawn up in the book of Minutes of the Board of Directors’ Meetings, and a

copy of said minutes will be delivered to each member after the meeting.

Paragraph 3 Regardless

of any formalities, a meeting will be considered regularly called when all the members of the Board of Directors attend it.

Article 19 It is incumbent

upon the Board of Directors, in addition to other attributions conferred upon it by law or by the Articles of Incorporation:

| I. | establish the general orientation of the Company’s

business, considering the safety of people, social development and respect for the environment; |

| II. | electing and dismissing the Officers, as well as specifying

their attributions, subject to the provisions of these Articles of Incorporation; |

| III. | set the remuneration, indirect benefits and other incentives

for the Officers, within the overall limit of management remuneration approved by the Annual Meeting; |

| IV. | inspect the management of the Officers; examine the Company’s

books and papers at any time; request information about contracts entered into or about to enter into and about any other acts; |

| V. | choose and dismiss the independent auditors, as well as calling

them to provide any clarifications deemed necessary on any matter; |

| VI. | exam the Management Report, the Executive Board’s accounts

and the Company’s financial statements and deliberate on their submission to the Annual Meeting; |

| VII. | approve and review the Company’s annual budget, capital

budget and business plan, which must be reviewed and approved annually, as well as formulating a capital budget proposal to be submitted

to the Annual Meeting for profit retention purposes; |

| VIII. | deliberate about the calling of the Annual Meeting, when

deemed convenient or in the case of article 132 of the Brazilian Corporation Law; |

| IX. | submit to the Annual Meeting a proposal for allocation of

net income for the year, as well as to resolve on the advisability of drawing up semi-annual balance sheets, or in shorter periods, and

the payment of dividends or interest on shareholders’ equity arising from these balance sheets, as well as to resolve on the payment

of interim or intercalary dividends to the retained earnings or profit reserves account existing in the last annual or semi-annual balance

sheet; |

| X. | present to the Annual Meeting a proposal for reforming the

Articles of Incorporation; |

| XI. | present to the Annual Meeting a proposal for dissolution,

merger, spin-off or incorporation of the Company and the incorporation, by the Company, of other companies; |

| XII. | manifest itself previously about any subject to be submitted

to the Annual Meeting; |

| XIII. | authorize the issuance of shares of the Company, within the

limits authorized in article 6 of these Articles of Incorporation, setting the price, the payment term and the conditions for the issuance

of the shares, and may also exclude the preemptive right or reduce the term for its exercise in the issuance of shares, subscription

bonus and convertible bonds whose placement is made through sale on the stock exchange, by public subscription or in a public offering

for the acquisition of Control, under the terms established by law; |

| XIV. | deliberate on the issue: (i) of subscription bonus

and bonds convertible into common shares, as provided for in paragraph 2 of article 6 of these Articles of Incorporation, specifying

the limit of the capital increase resulting from the conversion of bonds, in value of the share capital or in number of shares; or (ii)

of simple bonds, not convertible into shares, with or without security interest, establishing, by delegation of the Annual Meeting,

when issuing any of the bonds referred to in this item XIV, the time and conditions of maturity, amortization or redemption, the time

and conditions for payment of interest, profit sharing and reimbursement premium, if any, and the method of subscription or placement,

as well as the types of bonds; |

| XV. | deliberate about the negotiation with bonds issued by the

Company for the purpose of cancellation or remaining in treasury and respective alienation, observing the pertinent legal provisions; |

| XVI. | grant stock options to managers, employees or natural persons

who provide services to the Company or to companies controlled by the Company, without preemptive rights for shareholders, under the

terms of plans approved at the Annual Meeting; |

| XVII. | deliberate about the negotiation with shares issued by the

Company for the purpose of cancellation or remaining in treasury and respective alienation, observing the pertinent legal provisions; |

| XVIII. | decide about the payment or credit of interest on equity

to shareholders, under the terms of the applicable legislation; |

| XIX. | approve the execution, amendment or termination of any contracts,

agreements or arrangements between the Company or its controlled companies and any related parties in amounts equal to or over R$ 100,0000,000.00

(one hundred million Brazilian Reais) considered individually or cumulatively, in the period of the last 12 (twelve) months and any other

transactions with related parties indicated in the Related-Party Policy; |

| XX. | approve the hiring of the institution providing share registration

services; |

| XXI. | deliberate on any matter submitted to it by the Executive

Board, as well as to call the members of the Executive Board for joint meetings, whenever deemed convenient; |

| XXII. | institute Committees, establishing the respective regulations

and competencies, electing and dismissing their members and following up the activities developed by the Committees; |

| XXIII. | dispose, observing the rules in these Articles of Incorporation

and in the legislation in force, about the order of its work and adopt or enact regulations for its operation; |

| XXIV. | approve policies for (a) disclosure of information to the

market, (b) trading in the Company’s securities, (c) compensation, (d) appointment of members of the Board of Directors, Committees

and Executive Board, (e) management of risks, and (f) transactions with related parties, or equivalent formal documents; and |

| XXV. | establish the amount of the Executive Board’s authority

to: |

| (a) | the issuance of any credit instruments to raise funds, be

it “bonds”, “notes”, “promissory notes”, “certificate of receivables” “commercial

papers”, or others of common use in the market, as well as to fix their issuance and redemption conditions; |

| (b) | the acquisition or alienation of equity interests, joint

ventures or strategic alliances with third parties; |

| (c) | the acquisition or alienation of permanent assets and real

estate; |

| (d) | the constitution of real encumbrances and the provision of

sureties, guarantees and assurances for its own obligations and/or those of its controlled company; |

| (e) | to contract indebtedness, in the form of a loan or issue

of securities or assumption of debt, or any other legal business that affects the Company’s capital structure; |

| (f) | the provision of guarantees, by the Company, in lease agreements

in favor of its employees and/or employees of company directly or indirectly controlled by the Company, for the duration of their labor

contract; |

| (g) | the execution of any contract, agreement or other instrument

that (i) prevents the Company or its controlled companies from carrying out its unilateral termination with notice of less than 90 (ninety)

days; or that (ii) requires payment of any type of penalty or pecuniary obligation for the Company or its subsidiaries, including but

not limited to fine, loss of profits, take or pay clause or that establishes the commitment of the Company or its controlled companies

to remain with the obligation to pay maturing installments whose value is equal to or superior than the equivalent of 3 (three) months

of the pecuniary obligations ordinarily established by the same instrument; and |

| XXVI. | express itself in favor or contrary to any public offer for

the acquisition of shares that has as its object the shares issued by the Company, by means of a prior reasoned opinion, disclosed within

15 (fifteen) days of the publication of the notice of the public offering of acquisition of shares, which should address, at least (i)

the convenience and opportunity of the public offering for the acquisition of shares in the interest of the Company and its shareholders,

including in relation to the price and potential impacts on the liquidity of the securities values owned by it; (ii) the strategic

plans disclosed by the offeror in relation to the Company; and (iii) possible alternatives to accepting the public offer for the

acquisition of shares available on the market. |

Section III - Executive

Board

Article 20 The Executive

Board, whose members shall be elected and removable from office at any time by the Board of Directors, shall consist of at least 2 (two)

and at most 7 (seven) members, of which shall be designated Chief Executive Officer, Management and Control Officer, Finance Officer,

Investor Relations Officer, and the other Officers with no specific designation. The positions of Chief Executive Officer and Investor

Relations Officer must be obligatory filled. The officers will have a unified mandate of 3 (three) years, being that the period between

2 (two) Annual Annual Meetings, reelection being allowed.

Paragraph 1 Except in

the case of a vacancy in the office, the election of the Executive Board will take place up to 30 (thirty) business days after the date

of the Annual Meeting.

Paragraph 2 In case of

resignation or dismissal of the Chief Executive Officer, or, in the case of the Investor Relations Officer, when such fact implies in

noncompliance with the minimum number of Officers, the Board of Directors shall be summoned to elect a substitute to complete the mandate

of the replaced Officer.

Paragraph 3 In the event

of vacancy in the office of any member of the Executive Board, the duties performed by the replaced member shall be assigned to another

member of the Executive Board chosen by the remaining Officers.

Article 21 Without prejudice

to the cases in which specific authorization is required by the Brazilian Corporation Law or by these Articles of Incorporation, it is

incumbent upon the Chief Executive Officer, on an exclusive basis, with the possibility of delegating the following activities by means

of an ad hoc power of attorney: (i) execute and cause to be executed the resolutions of the Annual Meetings and of the Board of

Directors; (ii) establish goals and objectives for the Company; (iii) supervise the preparation and execution of the annual budget, the

budget of capital and the business plan of the Company; (iv) coordinate, manage, direct and supervise all of the Company’s business and

operations, in Brazil and abroad; (v) coordinate the activities of the other Executive Officers of the Company and of its subsidiaries,

in Brazil and abroad, taking in consideration the specific atributions provided for in these Articles of Incorporation; (vi) direct, at

the highest level, the Company’s public relations and guide institutional advertising; (vii) call and preside over meetings of the Executive

Board; (viii) represent the Company in person, or through a proxy appointed by the Company at meetings or other corporate acts of companies

in which the Company participates; and (ix) other attributions that are, from time to time, determined by the Board of Directors.

Article 22 It is incumbent

upon the Officer of Management and Control: (i) to coordinate, manage, direct and supervise the areas of Accounting, Information Technology,

Accounts Receivable/Credit, Accounts Payable and Administrative; and (ii) other attributions that are, from time to time, determined by

the Chief Executive Officer.

Article 23 It is incumbent

upon the Finance Officer: (i) to coordinate, manage, direct and supervise the Company’s Finance area; (ii) to direct and guide the preparation

of the annual budget and the capital budget; (iii) to direct and guide the Company’s treasury activities, including the raising and management

of resources, as well as the hedge policies pre-defined by the Chief Executive Officer; and (iv) other attributions that are, from

time to time, determined by the Chief Executive Officer.

Article 24 It is incumbent

upon the Investor Relations Officer: (i) to coordinate, manage, direct and supervise the Company’s Investor Relations area; (ii) to represent

the Company before shareholders, investors, market analysts, the Securities Commission, the Stock Exchanges, the Central Bank of Brazil

and other control bodies and other institutions related to activities carried out in the capital market, in Brazil and abroad; and (iii)

other attributions that are, from time to time, determined by the Chief Executive Officer.

Article 25 It is incumbent

upon the Officers without specific designation, if elected, to assist the Chief Executive Officer in the coordination, management, direction

and supervision of the Company’s business, in accordance with the attributions assigned to them, from time to time, determined by the

Chief Executive Officer.

Article

26 The Executive Board has all the powers to perform the acts necessary for the regular operation of the Company and the achievement

of the Company’s purpose, however special they may be, including to waive rights, compromise and agree, subject to the relevant

legal or statutory provisions. In compliance with the Executive Board’s authority values established

by the Board of Directors in the cases provided for in article 19 of these Articles of Incorporation, the Executive Board is responsible

for managing and direct the Company’s business, especially:

| I. | to comply and enforce these Articles and the resolutions

of the Board of Directors and the Annual Meeting; |

| II. | prepare, annually, the Management Report, the Executive Board’s

accounts and the Company’s financial statements, along with the report of the independent auditors, as well as the proposal for

the allocation of profits calculated in the previous year, for consideration by the Board of Directors and the Annual Meeting; |

| III. | propose, to the Board of Directors, the annual budget, the

capital budget and the Company’s business plan, which must be reviewed and approved annually; |

| IV. | deliberate about the installation and closing of branches,

warehouses, distribution centers, offices, sections, agencies, representations on its own behalf or on behalf of third parties, anywhere

in the country or abroad; |

| V. | decide on any matter that is not of the exclusive competence

of the Annual Meeting or of the Board of Directors; and |

| VI. | call the Annual Meeting, in case of vacancy of all the positions

in the Board of Directors. |

Article 27 The Executive

Board shall validly meet with the presence of 2 (two) Officers, one of them always being the Chief Executive Officer, and shall deliberate

by the vote of the majority of those present, with the casting vote being attributed to the Chief Executive Officer in the event of a

tie in the vote.

Article 28 The Executive

Board will meet whenever called by the Chief Executive Officer or by the majority of its members. The meetings of the Executive Board

may be held by conference call, video conference or by any other means of communication that allows the identification and simultaneous

communication between the Officers and all other persons present at the meeting.

Sole Paragraph Regardless

of any formalities, a meeting will be considered regularly called when all the members of the Executive Board attend it.

Article 29 Calls for

meetings shall be made by means of a written notice delivered by email at least 48 (forty-eight) hours in advance, which shall include

the agenda, date, time and place of the meeting.

Article 30 All the resolutions

of the Executive Board will be included in the minutes drawn up in the book of minutes of the Executive Board’s Meetings and signed by

the Officers present.

Article 31 The Company

will always be represented, in all acts, by the isolated signature of the Chief Executive Officer or by the signature of 2 (two) Officers

jointly or by the signature of one or more attorneys-in-fact specially appointed for this purpose in accordance with paragraph 1 below.

Paragraph 1 All powers

of attorney shall be granted by the Chief Executive Officer individually, or, in his absence, by 2 (two) Officers jointly, by means of

a mandate with specific powers and for a determined term, except in the cases of ad judicia powers of attorney, in which case the

mandate may be for an undetermined term, by means of a public or private instrument.

Paragraph 2 The acts

of any Officers, attorneys, representatives and employees that involve or concern operations or businesses outside the corporate purpose

and corporate interests or that are practiced in breach of these Articles of Incorporation are expressly prohibited, being null and void

in relation to the Company, except when expressly approved by the Board of Directors.

CHAPTER V

AUDIT COMMITTEE

Article 32 The Audit

Committee will operate on a permanent basis, with the powers and duties assigned to it by law.

Article 33 The Audit

Committee shall be composed of at least 3 (three) and at most 5 (five) effective members and substitutes in equal number, shareholders

or not, elected and removed at any time by the Annual Meeting.

Paragraph 1 The members

of the Audit Committee will have a unified mandate of 1 (one) year, and may be reelected.

Paragraph 2 The Audit

Committee members, at their first meeting, will elect their Chairman.

Paragraph 3 The investiture

of the Audit Committee members, effective and alternate, is subject to the signing of an instrument of investiture drawn up in the proper

book, which shall include their submission to the arbitration clause referred to in article 48 of these Articles of Incorporation.

Paragraph 4 The Audit

Committee members will be replaced, in their absences and impediments, by the respective substitute.

Paragraph 5 In the event

of vacancy in the position of Audit Committee member, the respective substitute shall take his place; if there is no substitute, the Annual

Meeting shall be call to elect a member for the vacant position.

Article 34 The Audit

Committee will meet whenever necessary, having all the attributions assigned to it by law.

Paragraph 1 Regardless

of any formalities, a meeting will be considered regularly called when all the members of the Audit Committee attend it.

Paragraph 2 The Audit

Committee resolves by absolute majority vote, with the majority of its present members.

Paragraph 3 All the resolutions

of the Audit Committee will be contained in minutes drawn up in the respective book of Minutes and Decisions of the Audit Committee and

signed by the Directors who are present.

Article 35 The remuneration

of the members of the Audit Committee shall be determined by the Annual Meeting that elects them, in compliance with Paragraph 3 of Article

162 of the Brazilian Corporation Law.

CHAPTER VI

STATUTORY AUDIT COMMITTEE

Article 36 The Statutory

Audit Committee is an advisory body attached to the Board of Directors and shall be composed of at least 3 (three) and at most

5 (five) members, elected by the Board of Directors, as follows: (i) the majority of the SAC members must be independent members, (ii

) at least 1 (one) of the members must be an independent member of the Company’s Board of Directors, who does not take part in the

Executive Board, as defined in the Novo Mercado Regulation, and (iii) at least 1 (one) of the members must have recognized experience

in corporate accounting matters.

Paragraph 1 The same

member of the Audit Committee may accumulate the characteristics referred to in items (ii) and (iii) of the caput.

Paragraph 2 The activities

of the audit committee coordinator are specified in its Internal Regulation, approved by the Board of Directors.

Article 37 It is incumbent

upon the Statutory Audit Committee, among other matters:

| I. | give its opinion on the hiring and dismissal of independent external auditors for the preparation of an

independent external audit or any other service; |

| II. | evaluate the quarterly information, interim statements, and financial statements; |

| III. | monitoring the activities of the internal audit, of the Company’s internal controls area, and of the area

that prepares the Company’s financial statements; |

| IV. | evaluate and monitor the Company’s risk exposures, and may require detailed information on policies and

procedures relating to management compensation, use of company assets, and expenses incurred on behalf of the Company; |

| V. | evaluate, monitor, and recommend to management as to the correction or improvement of the Company’s internal

policies relating to the preparation and audit of the financial statements; and |

| VI. | have means for receiving and processing information about non-compliance with legal and regulatory provisions

applicable to the Company, in addition to internal regulations and codes, including the provision of specific procedures for protecting

the provider and the confidentiality of the information. |

Sole Paragraph The rules

concerning the composition, attributions, operation, and compensation of the members of the Statutory Audit Committee, among other aspects,

will be regulated in its own internal regulations, to be approved by the Board of Directors, observing the provisions of the applicable

regulations.

CHAPTER VII

DISTRIBUTION OF PROFITS

Article 38 The fiscal

year begins on January 1st and ends on December 31st of each year.

Sole Paragraph At the

end of each fiscal year, the Executive Board will prepare the Company’s financial statements, in compliance with the relevant legal provisions.

Article 39 Together with

the financial statements for the year, the Board of Directors shall present to the Annual Meeting a proposal on the allocation of the

net income for the year, calculated after deducting the shares referred to in article 190 of the Brazilian Corporation Law, pursuant to

the provisions of paragraph 1 of this article, adjusted for the purposes of calculating dividends pursuant to article 202 of the same

law, subject to the following order of deduction:

| (a) | 5% (five percent) will be applied, before any other allocation,

in the constitution of the legal reserve, which will not exceed 20% (twenty percent) of the capital. In the fiscal year in which the

balance of the legal reserve plus the amounts of the capital reserves referred to in paragraph 1 of article 182 of the Brazilian Corporation

Law exceeds 30% (thirty percent) of the share capital, the allocation of part from the net income for the year to the legal reserve shall

not be mandatory; |

| (b) | a portion, as proposed by the management bodies, may be allocated

to the formation of a reserve for contingencies and reversal of the same reserves formed in previous years, pursuant to article 195 of

the Brazilian Corporation Law; |

| (c) | From the balance of net income remaining after the allocations

of the legal reserve and reserve for contingencies as determined in letters (a) and (b) above, a portion intended for the payment of

a minimum mandatory dividend, in each year, to 25% (twenty-five percent); |

| (d) | In the fiscal year in which the amount of the minimum mandatory

dividend, calculated pursuant to letter (c) above, exceeds the realized portion of the net income for the fiscal year, the Annual Meeting

may, upon proposal of the management bodies, allocate the excess to the constitution of a reserve of profits to be realized, subject

to the provisions of article 197 of the Brazilian Corporation Law; and |

| (e) | The profits that remain after the legal deductions and minimum

dividends referred to in subparagraph (c) of this article 37 will be allocated in an annual installment, not exceeding 90% (ninety percent)

of the net income adjusted to the formation of the Statutory Reserve of Investment, which will have the purpose of financing the investment

in operational assets and/or repurchase of own shares (to be held in treasury or to be canceled), this reserve not being able to exceed

the share capital. |

Paragraph 1 The Annual

Meeting may attribute to the members of the Board of Directors and the Executive Board a profit share, not exceeding 10% (ten percent)

of the remainder of the result for the year, limited to the global annual remuneration of the managers, after deducting the losses accrued

and the provision for income tax and social contribution, pursuant to article 152, paragraph 1 of the Brazilian Corporation Law.

Paragraph 2 The distribution

of profit shares in favor of the members of the Board of Directors and the Executive Board may only occur in the fiscal years in which

the shareholders are assured the payment of the minimum mandatory dividend provided for in these Articles of Incorporation.

Article 40 By proposal

of the Executive Board, approved by the Board of Directors, ad referendum of the Annual Meeting, the Company may pay or credit

interest to the shareholders, as remuneration of the shareholders’ equity, in compliance with the applicable legislation. The eventual

amounts thus disbursed may be imputed to the amount of the mandatory dividend provided for in these Articles of Incorporation.

Paragraph 1 In the event

of crediting interest to shareholders during the fiscal year and attributing them to the amount of the mandatory dividend, shareholders

will be compensated with the dividends to which they are entitled, with the payment of any remaining balance being assured. In the event

that the amount of dividends is less than what was credited to them, the Company will not be able to charge the shareholders for the excess.

Paragraph 2 The effective

payment of interest on equity, having been credited during the fiscal year, will be made by resolution of the Board of Directors, in the

course of the fiscal year or in the following fiscal year, but never after the dividend payment dates.

Article 41 The Company

may prepare half-yearly balance sheets, or in shorter periods, and declare, by resolution of the Board of Directors:

| (a) | the payment of dividends or interest on equity, on account

of the profit calculated in the semi-annual balance sheet, imputed to the amount of the mandatory dividend, if any; |

| (b) | the distribution of dividends in periods shorter than 6 (six)

months, or interest on own capital, imputed to the amount of the mandatory dividend, if any, provided that the total dividends paid in

each semester of the fiscal year does not exceed the amount of capital reserves; and |

| (c) | the payment of interim dividends or interest on equity, to

the account of accumulated profits or profit reserve existing in the last annual or half-year balance sheet, imputed to the amount of

the mandatory dividend, if any. |

Article 42 The Annual

Meeting may resolute on the capitalization of profit or capital reserves, including those established in interim balance sheets, with

due regard for the applicable legislation.

Article 43 Dividends

not received or claimed shall prescribe within 3 (three) years from the date on which they were in the shareholder’s provision, and shall

revert to the Company.

CHAPTER VIII

ALIENATION OF SHAREHOLDER

CONTROL,

CANCELLATION OF REGISTRATION

AS A PUBLICLY-HELD COMPANY,

EXIT FROM THE NOVO MERCADO

AND

PROTECTION OF SHAREHOLDER

BASE DISPERSION

Section I - Alienation of

Company’s Control

Article 44 The direct

or indirect alienation of the Company’s control, either through a single transaction or through successive transactions, shall be contracted

under the condition that the acquirer of control undertakes to carry out a public offer for the acquisition of shares having by object

the shares issued by the Company held by the other shareholders, observing the conditions and terms provided for in the legislation and

regulations in force and in the Novo Mercado Regulation, in order to ensure equal treatment with that given to the seller.

Section II - Cancellation

of Registration as a Publicly-Held Company

and Exit from Novo Mercado

Article 45 With the entry

of the Company on B3’s Novo Mercado, the Company, its shareholders, including controlling shareholders, managers and members of the Audit

Committee are subject to the provisions of the Novo Mercado Regulation.

Article 46 In the public

offer for the acquisition of shares to be carried out, mandatorily, by the controlling shareholder or by the Company for the cancellation

of the registration as a publicly-held company, the minimum price to be offered shall correspond to the fair price determined in the appraisal

report, respecting the applicable legal and regulatory rules.

Section III - Protection

of Dispersion of the Shareholder Base

Article 47 Any Buyer

(as defined in paragraph 11 of this article), who acquires or becomes the holder of shares issued by the Company or other rights, including

usufruct or fideicommissum on shares issued by the Company in an amount equal to or superior than 20% (twenty percent) of its share capital

must carry out a public offer for the acquisition of shares for the acquisition of all shares issued by the Company, in compliance with

the provisions of the applicable CVM regulations, the B3 regulations and the terms of this article. The Buyer must request the registration

of said offer within 30 (thirty) days from the acquisition date or from the event that resulted in the ownership of shares or rights in

an amount equal to or superior than 20% (twenty percent) of the Company’s share capital.

Paragraph 1 The public

offer for the acquisition of shares shall be (i) addressed without distinction to all the Company’s shareholders; (ii) carried out in

an auction to be held at B3; (iii) launched at the price determined in accordance with the provisions of paragraph 2 of this article;

and (iv) paid in cash, in national currency, against the acquisition in the offering of shares issued by the Company.

Paragraph 2 The acquisition

price in the public offer for the acquisition of each share issued by the Company may not be lower than the higher value between: (i)

135% (one hundred and thirty-five percent) of the fair price determined in the appraisal report; (ii) 135% (one hundred and thirty-five

percent) of the share issue price verified in any capital increase carried out by means of a public distribution occurred within the period

of 24 (twenty-four) months prior to the date on which it becomes mandatory the carrying out of the public offer for the acquisition of

shares under the terms of this article, which amount shall be duly updated by the IPCA from the date of issue of shares to increase the

Company’s capital until the moment of financial settlement of the public offer for the acquisition of shares in the terms of this article;

(iii) 135% (one hundred and thirty-five percent) of the average unit quotation of the shares issued by the Company during the period

of 90 (ninety) days prior to the execution of the offer, weighted by the trading volume on the stock exchange where there is a greater

volume of trading of shares issued by the Company; and (iv) 135% (one hundred and thirty-five percent) of the highest unit price

paid by the Buyer, at any time, for a share or lot of shares issued by the Company. If the CVM regulation applicable to the offer provided

for in this case determines the adoption of a calculation criterion for setting the acquisition price of each share in the Company in

the offer that results in a higher acquisition price, that price shall prevail in the execution of the offer provided for that price of

acquisition calculated pursuant to CVM regulations.

Paragraph 3 The fulfillment

of the public offer for the acquisition of shares mentioned in the head provision of this article shall not exclude the possibility of

another shareholder of the Company, or, if applicable, the Company itself, to formulate a competing offer, pursuant to the applicable

regulations.

Paragraph 4 The Buyer

will be obliged to comply with any requests or requirements of the CVM, formulated based on the applicable legislation, related to the

public offering for the acquisition of shares, within the maximum terms prescribed in the applicable regulations.

Paragraph 5 In the event

that the Buyer does not comply with the obligations imposed by this article, even with regard to meeting the maximum deadlines: (i) for

fulfillment or requesting the registration of the public offering for the acquisition of shares; or (ii) to comply with any CVM requests

or requirements, the Company’s Board of Directors will call an Special Meeting, in which the Buyer may not vote to resolute on the suspension

of the exercise of the Buyer’s rights that did not comply with any imposed obligation by this article, as provided for in article 120

of the Brazilian Corporation Law, without prejudice to the Buyer’s liability for losses and damages caused to other shareholders as a

result of non-compliance with the obligations imposed by this article.

Paragraph 6 The provisions

of this article do not apply in the event that a person becomes the holder of shares issued by the Company in an amount superior than

20% (twenty percent) of the total shares issued by him/her as a result of: (i) legal succession, under the condition that the shareholder

alienates the excess of shares within 30 (thirty) days from the relevant event; (ii) the merger of another company by the Company; (iii)

the merger of shares of another company by the Company; or (iv) the subscription of the Company’s shares, carried out in a single primary

issue, which has been approved at the Annual Meeting of the Company’s shareholders, called by its Board of Directors, and whose capital

increase proposal has determined the fixing of the price issue of shares based on a fair price obtained from an economic and financial

appraisal report of the Company carried out by a specialized company with proven experience in the appraisal of publicly-held companies.

Furthermore, the provisions of this article do not apply to current shareholders who already own 20% (twenty percent) or more of the total

shares issued by the Company and its successors on the effective date of adhesion and listing of the Company on the Novo Mercado, applying

exclusively to those investors who acquire shares and become shareholders of the Company after such Annual Meeting.

Paragraph 7 For the purposes

of calculating the percentage of 20% (twenty percent) of the total shares issued by the Company described in the head provision of this

article, it will be not computed the involuntary increases in shareholding resulting from the cancellation of treasury shares or reduction

of the share capital of the Company with the cancellation of shares.

Paragraph 8 The Annual

Meeting may exempt the Buyer from the obligation to make the public offering for acquisition of shares provided for in this article, if

it is of the Company’s interest.

Paragraph 9 The

shareholders holding at least twenty percent (20%) of the shares issued by the Company may request the Company’s managers to

call a special shareholders’ meeting to resolve on a new appraisal of the Company for purposes of reviewing the acquisition

price, pursuant to the procedures provided for in article 4-A of the Brazilian Corporation Law and in compliance with the provisions

of the applicable CVM regulations, B3’s regulations, and the terms of this Chapter. The costs of preparing the appraisal

report shall be borne entirely by the Buyer.

Paragraph 10 If the above-mentioned

special meeting decides to carry out a new evaluation and the appraisal report determines an amount higher than the initial value of the

public offering for the acquisition of shares, the Buyer may withdraw from it, and in this case, it is obligated to observe, as applicable,

the procedure provided for in articles 23 and 24 of CVM Instruction 361/02, and to alienate the excess of participation within 3 (three)

months from the date of the same special meeting.

Paragraph 11 For purposes

of interpretation of this article, the terms beginning with capital letters below shall have the following meanings:

“Purchaser”

means any person, including, without limitation, any natural or legal person, investment fund, condominium, securities portfolio, universality

of rights, or other form of organization, resident, domiciled or headquartered in Brazil or abroad, or Shareholder Group.

“Shareholder Group”

means the group of persons: (i) bound by voting contracts or agreements of any nature, either directly or through companies controlled,

controlling or under common control; or (ii) between which there is a control relationship; or (iii) under common control.

Section IV - Common Provisions

Article 48 The formulation

of a single public offer for the acquisition of shares is allowed, aiming at more than one of the purposes provided for in this Chapter

VII of these Articles of Incorporation, in the Novo Mercado Regulation or in the regulations issued by CVM, provided that it is possible

to reconcile the procedures of all types of public offering for the acquisition of shares and there is no prejudice to the recipients

of the offer and authorization from CVM is obtained, when required by applicable law.

Article 49 The shareholders

responsible for fulfilling the public offerings for the acquisition of shares provided for in this Chapter VII of these Articles of Incorporation,

in the Novo Mercado Regulation or in the regulations issued by CVM may ensure that they are fulfilled through any shareholder or third

party. The Company or the shareholder, as the case may be, is not exempt from the obligation to carry out the public offer for the acquisition

of shares until it is concluded in compliance with the applicable rules.

CHAPTER IX

ARBITRAL JUDGE

Article 50 The Company,

its shareholders, managers, members of the Audit Committee, effective and alternate, if any, undertake to resolve, by means of arbitration,

before the Market Arbitration Chamber, in the form of its regulation, any dispute that may arise among them, related to or arising from

its condition as issuer, shareholders, managers, and members of the Audit Committee, in particular, arising from the provisions contained

in Law 6,385/76, in the Brazilian Corporation Law, in the Articles of Incorporation of the Company, pursuant to the rules issued by the

National Monetary Council, the Central Bank of Brazil or the CVM, in addition to those contained in the Novo Mercado Regulation, other

B3 regulations and the Novo Mercado Participation Agreement.

Paragraph 1 Without prejudice

to the validity of this arbitration clause, the request for urgent measures by the Parties, before the Arbitration Court is constituted,

it shall be sent to the Judiciary Power, pursuant to item 5.1.3 of the Arbitration Regulation of the Market Arbitration Chamber.

Paragraph 2 Brazilian

law shall be the only one applicable to the merits of any and all disputes, as well as to the execution, interpretation and validity of

this arbitration clause. The Arbitration Court will be composed of arbitrators chosen in the manner provided for in the Arbitration Regulations

of the Market Arbitration Chamber. The arbitration proceeding will take place in the City of São Paulo, State of São Paulo,

where the arbitration sentence is to be rendered. The arbitration shall be administered by the Market Arbitration Chamber itself, and

shall be conducted and judged according to the relevant provisions of the Arbitration Rules.

CHAPTER X

LIQUIDATION OF THE COMPANY

Article 51 The Company

will go into liquidation in the cases determined by law, and the Annual Meeting is responsible for electing the liquidator or liquidators,

as well as the Audit Committee that shall function during this period, in compliance with the legal formalities.

CHAPTER XI

FINAL AND TRANSITORY PROVISIONS

Article 52 The cases

not provided for in these Articles of Incorporation shall be resolved by the Annual Meeting and regulated in accordance with the provisions

of the Brazilian Corporation Law, with due regard for the Novo Mercado Regulation.

Article 53 The Company

shall comply with the shareholders’ agreements filed at its headquarters, the registration of transfer of shares and the counting of votes

cast at a Annual Meeting or at a meeting of the Board of Directors contrary to its terms being prohibited.

Article 54 The Company

shall make available to its shareholders and third parties, at its headquarters, the contracts with related parties, shareholders’ agreements

and option programs for the acquisition of shares or other securities issued by the Company.

Article 55 The Corporation

and any of its subsidiaries, whether direct or indirect, are prohibited from selling any option contracts (directly or indirectly), or

even signing option contracts in which it is the launcher, with the exception of companies that have this activity in their corporate

purpose. Call options are defined as those that give their holder the right to buy the underlying asset on a certain date at a

certain price; and as puts, those that provide their holders with the right to sell the underlying asset on a certain date for

a certain price. For the purposes of this article, option contracts will be those that directly or indirectly, expressly or implicitly,

provide any advantage to the Corporation in return for market volatility, that is, when there is a risk of fluctuation in the price of

the underlying asset covered by the contract. Among which, but not limited to, any operations in which the underlying asset covered by

the contract is subject to the dollar rate, price of gold, commodities, government bonds, exchange rate variation and interest rate variation.

Sole Paragraph The prohibition

referred to in the head provision above is not applicable to the execution of a contract, agreement or other instrument of assumption

of rights and obligations in the context of financial transactions upon issue, by the Company and any of its subsidiaries, whether direct

or indirect, which entail the issuance of debt securities, including, but not limited to, promissory notes, bonds, commercial papers,

notes, bonds, as provided for in these Articles of Incorporation.

*-*-*-*-*-*-*-*

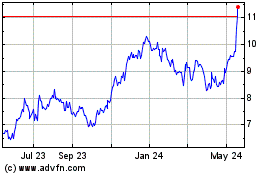

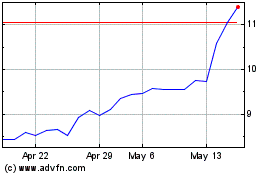

JBS (QX) (USOTC:JBSAY)

Historical Stock Chart

From Apr 2024 to May 2024

JBS (QX) (USOTC:JBSAY)

Historical Stock Chart

From May 2023 to May 2024