NEW YORK, NY -- June 4, 2024 -- InvestorsHub NewsWire

-- iQSTEL Inc. (OTC-QX: IQST)

(www.iQSTEL.com) a US-based, multinational, fully

reporting and audited publicly listed telecommunications and

technology company preparing for a Nasdaq up-listing today

announced increasing it's revenue forecast for FY-2024 to $290

million revenue. The forecast increase is based both on

anticipated organic growth and the revenue contribution from the

recent QXTEL acquisition.

iQSTEL reported $144.5 million in audited revenue for

FY-2023. The $290 million revenue forecast for FY-2024

announced today represents a year to year revenue increase of more

than 100%.

At this time, the $290 million FY-2024 revenue

forecast does not include any contribution from the recently

announced acquisition of Lynk Telecom anticipated to

close not later than July 1, 2024. The company may revise its

forecast higher following the Lynk Telecom acquisition closing.

Based on preliminary accounting, the company realized $54

million in revenue for the combined months of April and May.

This represents substantial revenue growth over iQSTEL's $51.4

million in revenue for the first three months of this year

reported in the recently published, auditor reviewed, Q1 FY-2024 report.

Organic Growth Driving Overall Revenue

Growth

While the revenue from acquisitions is adding to revenue growth,

it is important to highlight the organic growth that is fueling the

more substantial overall growth.

iQSTEL executed acquisitions in 2022 and 2021 and reported

annual revenue growth of approximately 44% each year. In 2023, the

company executed no acquisitions and reported revenue growth of

approximately 55% driven completely by organic sales expansion.

The company's increased organic growth in 2023 demonstrates the

effectiveness of our ability to integrate acquired operations. By

making acquired businesses part of iQSTEL's overall product

portfolio, we are able to drive increased organic growth through

cross selling and collective sales efficiencies.

Accordingly, our sales forecast announced today does not just

reflect the simple addition of acquired revenue, but the projected

organic growth anticipated from the effective integration of

acquired operations. Based on our history of successfully

integrating previously acquired operations and increasing overall

organic growth, we believe our current organic growth projections

are sound.

Bottom Line Growth Projections

In addition to the $290 million FY-2024 revenue

forecast, iQSTEL is forecasting $7.5 million in gross

profit for FY-2024 compared to $4.6 million reported in

FY-2023. The company reported $1.3 million in gross

profit for Q1 FY-2024. Management has a positive operating income

of seven digits forecast for FY-2024.

We are pleased with the bottom line projections for the current

fiscal year but want to highlight the even larger expectation for

the bottom line beyond this fiscal year.

The revenue growth from the recent acquisitions and the organic

revenue growth that will subsequently result from the recent

acquisitions will be realized before the downstream bottom line

benefits of the increased revenue is fully realized. The

operational efficiencies from streamlining multiple operations

takes more time to flow to the bottom line than do the benefits of

increased revenue. We expect even greater bottom line benefit next

year resulting from the revenue growth we achieve this year.

Mr. Iglesias commented, "The Company is experiencing exponential

revenue growth this year. We are literally skyrocketing in FY-2024.

We are well on track to more than double the company's revenue in

FY-2024. Following a recent planning session

in Washington at the International Telecom Week (ITW)

Conference, we believe the company is on the path to becoming in a

telecommunications powerhouse. Our exceptional recent performance

is coinciding with our homestretch push to finalize a Nasdaq

uplisting.

About IQSTEL (updated):

iQSTEL Inc. (OTC-QX: IQST)

(www.iQSTEL.com) is a US-based, multinational publicly

listed company preparing for a Nasdaq up-listing with an

FY2023 $144 million revenue, and with a $290 Million

Dollar Revenue forecast and a Positive Operating Income of 7

digits forecast for FY-2024. iQSTEL's mission is to serve basic

human needs in today's modern world by making the necessary tools

accessible regardless of race, ethnicity, religion, socioeconomic

status, or identity. iQSTEL recognizes that in today's modern

world, the pursuit of the human hierarchy of needs (physiological,

safety, relationship, esteem and self-actualization) is

marginalized without access to ubiquitous communications, the

freedom of virtual banking, clean affordable mobility and

information and content. iQSTEL has 4 Business Divisions delivering

accessibly to the necessary tools in today's pursuit of basic human

needs: Telecommunications, Fintech, Electric Vehicles and

Metaverse.

- The Enhanced Telecommunications Services Division

(Communications) includes VoIP, SMS, International

Fiber-Optic, Proprietary Internet of Things (IoT), and a

Proprietary Mobile Portability Blockchain Platform.

- The Fintech Division (Financial Freedom) includes

remittances services, top up services, Master Card Debit Card, a US

Bank Account (No SSN required), and a Mobile App.

- The Electric Vehicles (EV) Division (Mobility) offers Electric

Motorcycles and plans to launch a Mid Speed Car.

- The Artificial Intelligence (AI)-Enhanced Metaverse

Division (information and content) includes an enriched and

immersive white label proprietary AI-Enhanced Metaverse platform to

access products, services, content, entertainment, information,

customer support, and more in a virtual 3D interface.

The company continues to grow and expand its suite of products

and services both organically and through mergers and acquisitions.

iQSTEL has completed 12 acquisitions since June 2018 and

continues to develop an active pipeline of potential future

acquisitions.

Safe Harbor Statement: Statements in this news release may be

"forward-looking statements". Forward-looking statements include,

but are not limited to, statements that express our intentions,

beliefs, expectations, strategies, predictions, or any other

information relating to our future activities or other future

events or conditions. These statements are based on current

expectations, estimates, and projections about our business based

partly on assumptions made by management. These statements are not

guarantees of future performance and involve risks, uncertainties,

and assumptions that are difficult to predict. Therefore, actual

outcomes and results may and are likely to differ materially from

what is expressed or forecasted in forward-looking statements due

to numerous factors. Any forward-looking statements speak only as

of the date of this news release, and iQSTEL Inc. undertakes no

obligation to update any forward-looking statement to reflect

events or circumstances after the date of this news release. This

press release does not constitute a public offer of any securities

for sale. Any securities offered privately will not be or have not

been registered under the Act and may not be offered or sold

in the United States absent registration or an applicable

exemption from registration requirements.

Company Website

www.iqstel.com

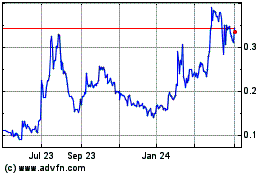

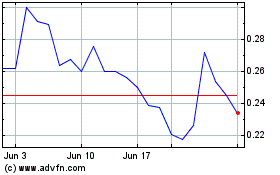

iQSTEL (QX) (USOTC:IQST)

Historical Stock Chart

From Nov 2024 to Dec 2024

iQSTEL (QX) (USOTC:IQST)

Historical Stock Chart

From Dec 2023 to Dec 2024