International Stem Cell Corp - Current report filing (8-K)

July 31 2008 - 6:02AM

Edgar (US Regulatory)

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date of

report (Date of earliest event reported):

July 30,

2008

INTERNATIONAL

STEM CELL CORPORATION

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

000-51891

|

|

20-4494098

|

|

(State

or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS

Employer Identification

Number)

|

2595

Jason Court, Oceanside, California 92056

(Address

of principal executive offices, including zip code)

(760)

940-6383

(Registrant’s

telephone number, including area code)

(Former

name or former address, if changed since last report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions:

o

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

o

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

o

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b)

o

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CAR

240.13e-4(c))

ITEM

1.01 ENTRY INTO A MATERIAL

DEFINITIVE AGREEMENT.

On July

30, 2008, to obtain funding for working capital, International Stem Cell

Corporation (the “Company”) entered into a series of subscription

agreements (the “Agreement”) with a total of two accredited investors (the

“Investors”) for the sale of a total of 150,000 Units, each Unit consisting

of one share of Series B Preferred Stock (“Preferred”) and two Warrants

(“Warrants”) to purchase Common Stock for each $1.00 invested. The

total purchase price received by the Company was $150,000

thousand. The Preferred is convertible into shares of common stock at

the initial conversion ratio of two shares of common stock for each share of

Preferred converted (which was established based on an initial conversion price

of $0.50 per share), and the warrants will exercisable at $0.50 per share until

five years from the issuance of the warrants. The Preferred and Warrants contain

anti-dilution clauses whereby, (subject to the exceptions contained in those

instruments) if the Company issues equity securities or securities convertible

into equity at a price below the respective conversion price of the Preferred or

the exercise price of the Warrant, such conversion and exercise prices shall be

adjusted downward to equal the price of the new securities. The Preferred has a

priority (senior to the shares of common stock, but junior to the shares of

Series A Preferred Stock) on any sale or liquidation of the Company equal to the

purchase price of the Units, plus a liquidation premium of 6% per year. If the

Company elects to declare a dividend in any year, it must first pay to the

Preferred a dividend equal to the amount of the dividend the Preferred holder

would receive if the Preferred were converted just prior to the dividend

declaration. Each share of Preferred has the same voting rights as the number of

shares of Common Stock into which it would be convertible on the record date.

ITEM

3.02 UNREGISTERED

SALE OF EQUITY SECURITIES

The Units

discussed in Item 1.01 securities were offered and sold to the Investors in a

private placement transaction made in reliance upon exemptions from registration

pursuant to Section 4(2) under the Securities Act of 1933 and Rule 506

promulgated thereunder. The Investors are accredited investors as defined in

Rule 501 of Regulation D promulgated under the Securities Act of 1933. The terms

of the purchase, conversion and exercise rights and use of proceeds are

discussed in Item 1.01

ITEM

3.03 MATERIAL

MODIFICATION IN RIGHTS OF SECURITY HOLDERS

On May 9,

2008, the Company filed with the Secretary of State of the State of Delaware a

Certificate of Designation of Rights, Preferences, Privileges and Restrictions,

which authorized five million shares of Preferred. The rights and

preferences of the Preferred are discussed in Item

1.01. The Certificate of Designation is filed as Exhibit

4.1

ITEM

9.01 Financial

Statements and Exhibits.

(d)

EXHIBITS

|

Exhibit No.

|

|

Exhibit Description

|

|

|

|

|

|

4.1

|

|

Certificate

of designation or rights, preferences, privileges and restrictions of

Series B Preferred Stock of International Stem Cell Corporation

(incorporated by reference to Exhibit 4.1 of the Registrants form 8-K

filed on May 12, 2008)

|

|

|

|

|

|

10.1

|

|

Form

of Subscription Agreement (incorporated by reference to Exhibit 10.1 of

the Registrants form 8-K filed on May 12,

2008)

|

|

|

|

|

|

10.2

|

|

Form

of Warrant Certificate (incorporated by reference to Exhibit 10.2 of the

Registrants form 8-K filed on May 12,

2008)

|

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has

duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

|

International

Stem Cell Corporation

|

|

|

|

|

|

|

|

|

By:

|

/s/

William B.

Adams

|

|

|

|

|

William

B. Adams

|

|

|

|

Chief

Financial Officer

|

|

|

|

|

|

|

|

|

Dated:

July 30, 2008

|

|

|

Exhibit No.

|

Exhibit Description

|

|

|

|

|

4.1

|

Certificate

of designation or rights, preferences, privileges and restrictions of

Series B Preferred Stock of International Stem Cell Corporation

(incorporated by reference to Exhibit 4.1 of the Registrants form 8-K

filed on May 12, 2008)

|

|

|

|

|

10.1

|

Form

of Subscription Agreement (incorporated by reference to Exhibit 10.1 of

the Registrants form 8-K filed on May 12, 2008)

|

|

|

|

|

10.2

|

Form

of Warrant Certificate (incorporated by reference to Exhibit 10.2 of the

Registrants form 8-K filed on May 12,

2008)

|

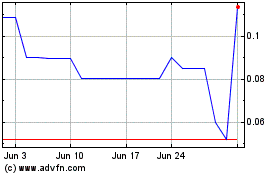

International Stem Cell (QB) (USOTC:ISCO)

Historical Stock Chart

From Jun 2024 to Jul 2024

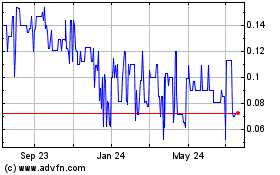

International Stem Cell (QB) (USOTC:ISCO)

Historical Stock Chart

From Jul 2023 to Jul 2024