Filed pursuant to Rule 424(b)(5)

Registration Statement No. 333-239817

PROSPECTUS SUPPLEMENT

(To Prospectus Dated July 17, 2020)

$30,000,000 plus 6,250,000 Commitment Shares

Class A Common Stock

Pursuant to this prospectus supplement and the accompanying prospectus, we are offering up to $30.0 million aggregate amount plus 6,250,000 shares of shares of our Class A common stock, par value $0.0001 per share (“common stock”) to Aspire Capital Fund, LLC (“Aspire Capital”) under a common stock purchase agreement entered into on July 31, 2020 (the “Purchase Agreement”).

The shares of common stock offered under the Purchase Agreement include (i) 6,250,000 shares of common stock to be issued to Aspire Capital in consideration for entering into the Purchase Agreement (the “Commitment Shares”), and (ii) additional shares of common stock in an aggregate offering price of up to $30.0 million which may be sold from time to time to Aspire Capital over the 24-month term of the Purchase Agreement (the “Purchase Shares”). The purchase price for the Purchase Shares will be based upon one of two formulas set forth in the Purchase Agreement depending on the type of purchase notice we submit to Aspire Capital from time to time.

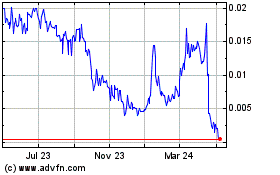

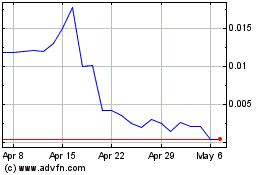

Our common stock is currently quoted on the OTCQB under the symbol “IPIX.” On July 31, 2020, the last reported sales price of our common stock was $0.2251 per share.

Investing in our securities involves a high degree of risk. You should read “Risk Factors” beginning on page S-3 of this prospectus supplement and the reports we file with the Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934, as amended, incorporated by reference in this prospectus supplement, to read about factors to consider before purchasing our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is August 4, 2020.

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus are part of a registration statement on Form S-3 (File No. 333-239817) that we filed with the Securities and Exchange Commission (the “SEC”) and that was declared effective by the SEC on July 17, 2020. Under this shelf registration process, we may, from time to time, offer common stock, preferred stock, warrants and units, of which this offering is a part.

This document is in two parts. The first part is this prospectus supplement, which describes the terms of this offering of common stock and also adds, updates and changes information contained in the accompanying prospectus and the documents incorporated herein by reference. The second part is the accompanying prospectus, which provides more general information about our common stock and other securities that do not pertain to this offering. To the extent that the information contained in this prospectus supplement conflicts with any information in the accompanying prospectus or any document incorporated by reference, the information in this prospectus supplement shall control. The information in this prospectus supplement may not contain all of the information that is important to you. You should read this entire prospectus supplement, the accompanying prospectus and the documents incorporated by reference carefully before deciding whether to invest in our securities.

You should rely only on the information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus, along with the information contained in any free writing prospectus that we have authorized for use in connection with this offering. If the description of the offering varies between this prospectus supplement and the accompanying prospectus, you should rely on the information in this prospectus supplement. We have not authorized anyone to provide you with different or additional information. You should assume that the information appearing in this prospectus supplement, the accompanying prospectus, the documents incorporated by reference in this prospectus supplement and the accompanying prospectus, and in any free writing prospectus that we have authorized for use in connection with this offering is accurate only as of the respective dates of those documents. Our business, financial condition, results of operations and prospects may have changed since those dates.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in this prospectus supplement or the accompanying prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties and covenants were accurate only as of the date when made; therefore, such representations, warranties and covenants should not be relied on as accurate representations of the current state of our affairs.

References to the “Company,” “Innovation Pharmaceuticals,” “IPIX,” “we,” “our” and “us” in this prospectus supplement are to Innovation Pharmaceuticals Inc., a Nevada corporation, and its consolidated subsidiaries, unless the context otherwise requires. This document includes trade names and trademarks of other companies. All such trade names and trademarks appearing in this document are the property of their respective holders.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus and the documents we have incorporated by reference contain forward-looking statements within the meaning of the federal securities laws that involve risks and uncertainties that could cause actual results to differ materially from projections or estimates contained herein or therein. Forward-looking statements convey our current expectations or forecasts of future events. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

All statements other than statements of historical fact are “forward-looking statements” for purposes of these provisions. Statements that include the use of terminology such as “may,” “will,” “expects,” “believes,” “plans,” “estimates,” “potential,” or “continue,” or the negative thereof or other and similar expressions are forward-looking statements. In addition, in some cases, you can identify forward-looking statements by words or phrases such as “trend,” “potential,” “opportunity,” “believe,” “comfortable,” “expect,” “anticipate,” “current,” “intention,” “estimate,” “position,” “assume,” “outlook,” “continue,” “remain,” “maintain,” “sustain,” “seek,” “achieve,” and similar expressions.

These forward-looking statements include, but are not limited to, any statements regarding our future financial performance, results of operations or sufficiency of capital resources to fund our operating requirements; statements relating to potential licensing, partnering or similar arrangements concerning our drug compounds; statements concerning our future drug development plans and projected timelines for the initiation and completion of preclinical and clinical trials; the potential for the results of ongoing preclinical or clinical trials; other statements regarding our future product development and regulatory strategies, including with respect to specific indications such as, among others, COVID-19; and any other statements which are other than statements of historical fact and any statement of assumptions underlying any of the foregoing are forward-looking statements. The forward-looking statements in this prospectus supplement, the accompanying prospectus and the documents we have incorporated by reference speak only as of the date hereof (or thereof, as applicable), and caution should be taken not to place undue reliance on any such forward-looking statements, which are qualified in their entirety by this cautionary statement.

Forward-looking statements are subject to numerous assumptions, events, risks, uncertainties and other factors, including those that may be outside of our control and that change over time. As a result, actual results and/or the timing of events could differ materially from those expressed in or implied by the forward-looking statements and future results could differ materially from historical performance. Such assumptions, events, risks, uncertainties and other factors include, among others, those described under the section herein entitled “Risk Factors” and elsewhere in this prospectus supplement and the accompanying prospectus, as well as in reports and documents we file with the SEC and include, without limitation, the following:

|

|

·

|

our ability to continue as a going concern and our capital needs;

|

|

|

|

|

|

|

·

|

our ability to fund and successfully progress internal research and development efforts;

|

|

|

|

|

|

|

·

|

our ability to create effective, commercially-viable drugs;

|

|

|

|

|

|

|

·

|

our ability to effectively and timely conduct clinical trials;

|

|

|

|

|

|

|

·

|

our ability to ultimately distribute our drug candidates;

|

|

|

|

|

|

|

·

|

our ability to achieve certain future regulatory, development and commercialization milestones under our license agreement with Alfasigma S.p.A.;

|

|

|

|

|

|

|

·

|

the development of treatments or vaccines relating to the COVID-19 pandemic by other entities;

|

|

|

|

|

|

|

·

|

compliance with regulatory requirements; and

|

|

|

|

|

|

|

·

|

other risks referred to in the section of this prospectus supplement entitled “Risk Factors” and in the SEC filings incorporated by reference in this prospectus supplement.

|

All forward-looking statements included in this document are made as of the date hereof, based on information available to us as of the date hereof, and we assume no obligation to update any forward-looking statements, except as may be required by applicable law.

|

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights certain information about Innovation Pharmaceuticals Inc., this offering and information appearing elsewhere in this prospectus supplement, in the accompanying prospectus and in the documents we incorporate by reference. This summary is not complete and does not contain all of the information that you should consider before making an investment decision. To fully understand this offering and its consequences to you, you should read this entire prospectus supplement and the accompanying prospectus carefully, including the factors described under the heading “Risk Factors” in this prospectus supplement beginning on page S-3 and page 1 of the accompanying prospectus, together with any free writing prospectus we have authorized for use in connection with this offering and the financial statements and all other information incorporated by reference in this prospectus supplement and the accompanying prospectus. Unless otherwise indicated, “common stock” means our Class A common stock, par value $0.0001 per share.

Innovation Pharmaceuticals Inc. Overview

We are a clinical stage biopharmaceutical company developing innovative therapies with dermatology, oncology, anti-inflammatory and antibiotic applications. We own the rights to numerous drug compounds, including Brilacidin, our lead drug in a new class of compounds called defensin-mimetics, and Kevetrin (thioureidobutyronitrile), our lead anti-cancer compound.

The Company was incorporated as Econoshare, Inc. on August 1, 2005 in the State of Nevada. On December 6, 2007, the Company acquired Cellceutix Pharma, Inc., a privately owned corporation formed under the laws of the State of Delaware on June 20, 2007. Following the acquisition, the Company changed its name to Cellceutix Corporation. Effective June 5, 2017, the Company amended its Articles of Incorporation and changed its name from Cellceutix Corporation to Innovation Pharmaceuticals Inc.

Our principal executive offices are located at 301 Edgewater Place - Suite 100, Wakefield, MA 01880, and our telephone number is (978) 921-4125. Our website is www.ipharminc.com. The information contained on or that can be accessed through our website (other than the specified SEC filings incorporated by reference in this prospectus) is not incorporated in, and is not a part of, this prospectus supplement or the accompanying prospectus, and you should not rely on any such information in connection with your investment decision to purchase our securities.

|

|

The Offering

The following summary is provided solely for your convenience and is not intended to be complete. You should read the full text and more specific details contained elsewhere in this prospectus supplement and the accompanying prospectus. For a more detailed description of our common stock, see “Description of Our Capital Stock” in the accompanying prospectus.

|

|

|

|

|

|

Issuer

|

|

Innovation Pharmaceuticals Inc.

|

|

|

|

|

|

Shares of Class A common stock offered

|

|

Up to $30 million shares of Class A common stock, par value $0.0001 per share

|

|

|

|

|

|

Shares of Class A common stock to be outstanding after this offering

|

|

Up to 468.0 million shares assuming issuance of the 6.25 million Commitment Shares and the sale of 133.3 million shares at a price of $0.2251 per share, which was the closing price on the OTCQB on July 31, 2020. Actual shares issued will vary depending on the sales prices under this offering. (1)

|

|

|

|

|

|

Manner of Offering

|

|

Issuance of 6.25 million Commitment Shares to Aspire Capital in consideration for entering into the Purchase Agreement and additional Purchase Shares to Aspire Capital from time to time, subject to certain minimum stock price requirements, and daily and other caps, for an aggregate offering price of up to $30.0 million. See “The Aspire Transaction” and “Plan of Distribution.”

|

|

|

|

|

|

Use of proceeds

|

|

Any proceeds from Aspire Capital, the selling stockholder, that we receive under the Purchase Agreement are expected be used for working capital and general corporate purposes. See “Use of Proceeds” on page S-4.

|

|

|

|

|

|

OTCQB symbol

|

|

IPIX

|

|

|

|

|

|

Risk factors

|

|

An investment in our common stock involves risks, and prospective investors should carefully consider the matters discussed under “Risk Factors” beginning on page S-3 of this prospectus supplement and the reports we file with the SEC pursuant to the Securities Exchange Act of 1934, as amended, incorporated by reference in this prospectus supplement and the accompanying prospectus before making an investment in our common stock.

|

|

_______________

|

|

|

|

(1) The number of shares of common stock to be outstanding after this offering is based on 328.5 million shares of common stock outstanding as of July 31, 2020 and excludes approximately 26.8 million shares issuable as of March 31, 2020 upon the exercise of outstanding incentive stock options, the vesting of restricted stock units, or the conversion of amounts outstanding under a convertible loan held by the Company’s Chief Executive Officer.

|

RISK FACTORS

An investment in our securities involves a high degree of risk. Before making an investment decision, you should consider carefully the risks discussed under the sections captioned “Risk Factors” set forth in the documents and reports filed by us with the SEC, that are incorporated by reference into this prospectus supplement, including in our most recent Annual Report on Form 10-K, as revised or supplemented by our most recent Quarterly Reports on Form 10-Q, each of which are on file with the SEC and are incorporated herein by reference, as well as any risks described in our other filings with the SEC, before deciding whether to buy our securities. Our business, financial condition or results of operations could be materially adversely affected by any of these risks. The trading price of our securities could decline due to any of these risks, and you may lose all or part of your investment. In addition, please read “Cautionary Note Regarding Forward-Looking Statements” in this prospectus supplement, where we describe additional uncertainties associated with our business and the forward-looking statements included or incorporated by reference in this prospectus supplement. Please note that additional risks not presently known to us or that we currently deem immaterial may also impair our business and operations.

Sales of our common stock to Aspire Capital may cause substantial dilution to our existing stockholders and the sale of the shares of our common stock acquired by Aspire Capital could cause the price of our common stock to decline.

This prospectus supplement relates to the 6,250,000 Commitment Shares and an aggregate amount of up to $30.0 million of shares of common stock that we may issue and sell to Aspire Capital from time to time pursuant to the Purchase Agreement. It is anticipated that shares offered to Aspire Capital in this offering will be sold over a period of up to 24 months from the date of this prospectus supplement. The number of shares ultimately offered for sale to Aspire Capital under this prospectus supplement is dependent upon the number of shares we elect to sell to Aspire Capital under the Purchase Agreement. Depending upon market liquidity at the time, sales of shares of our common stock under the Purchase Agreement may cause the trading price of our common stock to decline.

Aspire Capital may ultimately purchase all, some or none of the shares of common stock remaining that, together with the 6,250,000 Commitment Shares, is the subject of this prospectus supplement. After Aspire Capital has acquired shares under the Purchase Agreement, it may sell all, some or none of those shares. Sales to Aspire Capital by us pursuant to the Purchase Agreement under this prospectus supplement may result in substantial dilution to the interests of other holders of our common stock. The sale of a substantial number of shares of our common stock to Aspire Capital in this offering, or anticipation of such sales, could make it more difficult for us to sell equity or equity-related securities in the future at a time and at a price that we might otherwise wish to effect sales. However, we have the right to control the timing and amount of any sales of our shares to Aspire Capital and the Purchase Agreement may be terminated by us at any time at our discretion without any cost to us.

We have a right to sell up to 1,000,000 Purchase Shares per day under our Purchase Agreement with Aspire Capital, which total may be increased by mutual agreement up to an additional 5,000,000 Purchase Shares per day. The extent to which we rely on Aspire Capital as a source of funding will depend on a number of factors, including the prevailing market price of our common stock and the extent to which we are able to secure working capital from other sources.

Management will have broad discretion as to the use of the proceeds from this offering, and we may not use the proceeds effectively.

Our management will have broad discretion in the application of the proceeds from sales of our common stock to Aspire Capital, and could spend the proceeds in ways that do not improve our results of operations or enhance the value of our common stock. Our failure to apply these funds effectively could have a material adverse effect on our business and cause the price of our common stock to decline.

Future sales of a significant number of our shares of common stock in the public markets, or the perception that such sales could occur, could depress the market price of our shares of common stock.

Sales of a substantial number of our shares of common stock in the public markets, or the perception that such sales could occur, could depress the market price of our shares of common stock and impair our ability to raise capital through the sale of additional equity securities. A substantial number of shares of common stock are being offered by this prospectus supplement, and we cannot predict if and when Aspire Capital may sell such shares in the public markets. We cannot predict the number of these shares that might be sold nor the effect that future sales of our shares of common stock would have on the market price of our shares of common stock.

The Company has no history of paying dividends on its common stock, and we do not anticipate paying dividends in the foreseeable future.

The Company has not previously paid dividends on its common stock. We currently anticipate that we will retain all of our available cash, if any, for use as working capital and for other general corporate purposes. Any payment of future dividends will be at the discretion of our Board of Directors and will depend upon, among other things, our earnings, financial condition, capital requirements, level of indebtedness, statutory and contractual restrictions applicable to the payment of dividends and other considerations that our Board of Directors deems relevant. Investors must rely on sales of their common stock after price appreciation, which may never occur, as the only way to realize a return on their investment.

USE OF PROCEEDS

We may receive up to $30.0 million in aggregate gross proceeds under the Purchase Agreement from sales of Purchase Shares we may make to Aspire Capital after the date of this prospectus supplement, We intend to use any proceeds that we receive from Aspire Capital, the selling stockholder, under the Purchase Agreement for general working capital purposes. The amounts and timing of expenditures will depend on a number of factors, such as the timing, scope, progress and results of our research and development efforts, the timing and progress of any partnering efforts, and the competitive environment for our product candidates. As of the date of this prospectus supplement, we cannot specify with certainty the particular uses of the proceeds from this offering. Accordingly, we will retain broad discretion over the use of such proceeds. Until we use the proceeds for any purpose, we expect to invest them in short-term investments. Pending the use of the proceeds of this offering received from time to time in connection with purchases under the Purchase Agreement described above, we intend to invest the net proceeds in cash and cash equivalents, including short-term, interest-bearing, investment-grade securities.

DILUTION

If you invest in this offering, your ownership interest will be diluted to the extent of the difference between the public offering price per share and the as adjusted net tangible book value per share after giving effect to this offering. We calculate net tangible book value per share by dividing the net tangible book value, which is tangible assets less total liabilities, by the number of outstanding shares of our common stock. Dilution represents the difference between the portion of the amount per share paid by purchasers of shares in this offering and the as-adjusted net tangible book value per share of our common stock immediately after giving effect to this offering. Our net tangible book deficit as March 31, 2020 was approximately $(4.5) million, or $(0.0168) per share.

After giving effect to (i) the issuance of 6,250,000 Commitment Shares, and (ii) the assumed sale of 133.3 million shares of common stock in the aggregate amount of $30 million at an assumed offering price of $0.2251 per share, which was the closing price of our common stock on July 31, 2020, and after deducting the estimated offering expenses payable by us of $30,000, our as adjusted net tangible book value as of March 31, 2020 would have been approximately $25.5 million, or $0.0628 per share of common stock. This represents an immediate increase in net tangible book value of $0.08 per share to existing stockholders and immediate dilution in net tangible book value of $0.1623 per share to investors participating in this offering. The following table illustrates this dilution on a per share basis:

|

Assumed average offering price per share

|

|

|

|

|

$

|

0.2251

|

|

|

Net tangible book deficit per share as of March 31, 2020

|

|

$

|

(0.0168

|

)

|

|

|

|

|

|

Increase per share attributable to the offering

|

|

$

|

0.08

|

|

|

|

|

|

|

As adjusted net tangible book value per share as of March 31, 2020, after giving effect to this offering

|

|

|

|

|

|

$

|

0.0628

|

|

|

Dilution per share to new investors purchasing shares in this offering

|

|

|

|

|

|

$

|

0.1623

|

|

The foregoing dilution information assumes an offering price equal to the closing price for our common stock on July 31, 2020 and is based on 266.7 million shares of our common stock outstanding as of March 31, 2020. The actual price at which we sell shares in this offering may be higher or lower than this assumed price and our total shares may continue to change, and is expected to continue to change. An increase of $0.10 per share in the price at which the shares are sold from the assumed offering price of $0.2251 per share shown in the table above, assuming all of our common stock in the aggregate amount of $30 million is sold at that price, would increase our adjusted net tangible book value per share after the offering to $0.0698 per share and would increase the dilution in net tangible book value per share to new investors in this offering to $0.2553 per share, after deducting estimated aggregate offering expenses payable by us. This information is supplied for illustrative purposes only.

The foregoing table and discussion is based on 266.74 million shares of common stock outstanding as of March 31, 2020 and excludes approximately 26.8 million shares issuable upon the exercise of outstanding incentive stock options, the vesting of restricted stock units, or the conversion of amounts outstanding under a convertible loan held by the Company’s Chief Executive Officer as of March 31, 2017.

THE ASPIRE TRANSACTION

General

On July 31, 2020, we entered into a Common Stock Purchase Agreement (the “Purchase Agreement”) with Aspire Capital Fund, LLC, an Illinois limited liability company (“Aspire Capital”), which provides that, upon the terms and subject to the conditions and limitations set forth therein, Aspire Capital is committed to purchase up to an aggregate of $30.0 million of shares of our common stock (the “Purchase Shares”) from time to time over the term of the Purchase Agreement. As consideration for entering into the Purchase Agreement, we agreed to issue 6,250,000 shares of our common stock to Aspire Capital (the “Commitment Shares”).

We are filing this prospectus supplement with regard to the offering of our common stock consisting of (i) the Commitment Shares and (ii) additional shares of our common stock in an aggregate amount of up to $30.0 million of shares of our common stock that we may sell to Aspire Capital pursuant to the Purchase Agreement.

Purchase of Shares under the Purchase Agreement

On August 4, 2020, the conditions necessary for purchases under the Purchase Agreement to commence were satisfied. On any business day over the 24-month term of the Purchase Agreement, we have the right, in our sole discretion, to present Aspire Capital with a purchase notice (each, a “Purchase Notice”) directing Aspire Capital to purchase up to 1,000,000 Purchase Shares per business day, provided that Aspire Capital will not be required to buy Purchase Shares pursuant to a Purchase Notice that was received by Aspire Capital on any business day on which the last closing trade price of our common stock on the OTCQB (or alternative national exchange in accordance with the Purchase Agreement) is below $0.10 (the “Floor Price”). We and Aspire Capital also may mutually agree to increase the number of shares that may be sold to as much as an additional 5,000,000 Purchase Shares per business day. The purchase price per Purchase Share pursuant to such Purchase Notice (the “Purchase Price”) is the lower of:

|

|

(i)

|

the lowest sale price for our common stock on the date of sale; or

|

|

|

|

|

|

|

(ii)

|

the average of the three lowest closing sale prices for our common stock during the 12 consecutive business days ending on the business day immediately preceding the purchase date.

|

The applicable Purchase Price will be determined prior to delivery of any Purchase Notice.

In addition, on any date on which we submit a Purchase Notice to Aspire Capital for at least 1,000,000 Purchase Shares, we also have the right, in our sole discretion, to present Aspire Capital with a volume-weighted average price purchase notice (each, a “VWAP Purchase Notice”) directing Aspire Capital to purchase an amount of our common stock equal to up to 30% of the aggregate shares of common stock traded on the next business day (the “VWAP Purchase Date”), subject to a maximum number of shares determined by us (the “VWAP Purchase Share Volume Maximum”). The purchase price per Purchase Share pursuant to such VWAP Purchase Notice (the “VWAP Purchase Price”) shall be the lesser of the closing sale on the VWAP Purchase Date or 95% of the volume weighted average price for our common stock traded on (i) the VWAP Purchase Date if the aggregate shares to be purchased on that date does not exceed the VWAP Purchase Share Volume Maximum, or (ii) the portion of such business day until such time as the aggregate shares to be purchased will equal the VWAP Purchase Share Volume Maximum.

The number of Purchase Shares covered by and timing of each Purchase Notice are determined by the Company, at our sole discretion. Aspire Capital has no right to require any sales by us, but is obligated to make purchases from us as we direct in accordance with the Purchase Agreement. There are no limitations on use of proceeds, financial or business covenants, restrictions on future fundings, rights of first refusal, participation rights, penalties or liquidated damages in the Purchase Agreement. We did not pay any additional amounts to reimburse or otherwise compensate Aspire Capital in connection with the transaction. The Purchase Agreement may be terminated by us at any time, at our discretion, without any penalty or cost to us.

Events of Default

Aspire Capital may terminate the Purchase Agreement upon the occurrence of any of the following events of default:

|

|

·

|

the effectiveness of any registration statement that is required to be maintained effective pursuant to the terms of the registration rights agreement between us and Aspire Capital lapses for any reason (including, without limitation, the issuance of a stop order) or is unavailable for sale of our shares of Common Stock in accordance with the terms of the registration rights agreement, and such lapse or unavailability continues for a period of 10 consecutive business days or for more than an aggregate of 30 business days in any 365-day period, which is not in connection with a post-effective amendment to any such registration statement or the filing of a new registration statement; provided, however, that in connection with any post-effective amendment to such registration statement or filing of a new registration statement that is required to be declared effective by the SEC, such lapse or unavailability may continue for a period of no more than 30 consecutive business days, which such period shall be extended for an additional 30 business days if the Company receives a comment letter from the SEC in connection therewith;

|

|

|

|

|

|

|

·

|

the suspension from trading or failure of our Common Stock to be listed on our principal market for a period of three consecutive business days;

|

|

|

|

|

|

|

·

|

the delisting of our Common Stock from our principal market, provided our Common Stock is not immediately thereafter trading on the New York Stock Exchange, the NYSE American, the Nasdaq Global Select Market, the Nasdaq Global Market, The Nasdaq Capital Market, or the OTCQB or OTCQX market places of the OTC Markets;

|

|

|

|

|

|

|

·

|

our transfer agent’s failure to issue to Aspire Capital shares of our Common Stock which Aspire Capital is entitled to receive under the Purchase Agreement within five business days after an applicable purchase date;

|

|

|

|

|

|

|

·

|

any breach by us of our representations or warranties (as of the dates made), covenants or other term or condition under the Purchase Agreement or any related transaction agreements which could have a material adverse effect on us, subject to a cure period of five business days;

|

|

|

|

|

|

|

·

|

if we become insolvent; or

|

|

|

|

|

|

|

·

|

any participation or threatened participation in insolvency or bankruptcy proceedings by or against us.

|

So long as an Event of Default has occurred and is continuing, or if any event which, after notice and/or lapse of time, would become an Event of Default, has occurred and is continuing, or so long as the closing price of our common stock is below the Floor Price, we may not require and Aspire Capital has no obligation to purchase any shares of our common stock under the Purchase Agreement.

The Purchase Agreement will be automatically terminated in the event of any participation in insolvency or bankruptcy proceedings by or against us.

Our Termination Rights

We may terminate the Purchase Agreement at any time, in our discretion, without any cost or penalty.

No Short-Selling or Hedging by Aspire Capital

Aspire Capital has agreed that neither it nor any of its agents, representatives and affiliates shall engage in any direct or indirect short-selling or hedging of our Common Stock during any time prior to the termination of the Purchase Agreement.

Effect of Performance of the Purchase Agreement on Our Stockholders

The Purchase Agreement does not limit the ability of Aspire Capital to sell any or all of the shares it currently owns or receives in this offering. It is anticipated that shares sold to Aspire Capital in this offering will be sold to Aspire Capital over a period of up to 24 months from the date of the Purchase Agreement. The subsequent resale by Aspire Capital of our Common Stock may cause the market price of our Common Stock to decline or to be highly volatile. Aspire Capital may ultimately purchase all, some or none of the shares of common stock remaining that, together with the 6,250,000 Commitment Shares, is the subject of this prospectus supplement. Aspire Capital may resell all, some or none of the Commitment Shares and any Purchase Shares it acquires. Therefore, sales to Aspire Capital by us pursuant to the Purchase Agreement and this prospectus supplement also may result in substantial dilution to the interests of other holders of our Common Stock. However, we have the right to control the timing and amount of any sales of our shares to Aspire Capital and the Purchase Agreement may be terminated by us at any time at our discretion without any cost to us.

Amount of Potential Proceeds to be Received under the Purchase Agreement

Under the Purchase Agreement, we may sell Purchase Shares having an aggregate offering price of up to $30.0 million to Aspire Capital from time to time. The number of shares ultimately offered for sale to Aspire Capital in this offering is dependent upon the number of shares we elect to sell to Aspire Capital under the Purchase Agreement. In addition, Aspire Capital will not be required to buy Purchase Shares pursuant to a Purchase Notice that was received by Aspire Capital on any business day on which the last closing trade price of our common stock on the OTCQB (or alternative national exchange in accordance with the Purchase Agreement) is below $0.10. The following table sets forth the amount of proceeds we would receive from Aspire Capital from the sale of shares at varying purchase prices:

|

Assumed Average

Purchase Price

|

|

|

Proceeds from the

Sale of Shares to

Aspire Capital Under

the Purchase

Agreement Registered

in this Offering

|

|

|

Number of Shares to

be Issued in this

Offering at the Assumed

Average Purchase Price (1)

|

|

|

Percentage of Outstanding

Shares After Giving

Effect to the Purchased

Shares Issued to

Aspire Capital (2)

|

|

|

$

|

0.12

|

|

|

$

|

30,000,000

|

|

|

|

250,000,000

|

|

|

|

42.8

|

%

|

|

$

|

0.2251

|

|

|

$

|

30,000,000

|

|

|

|

133,274,100

|

|

|

|

28.5

|

%

|

|

$

|

0.50

|

|

|

$

|

30,000,000

|

|

|

|

60,000,000

|

|

|

|

15.2

|

%

|

|

$

|

1.00

|

|

|

$

|

30,000,000

|

|

|

|

30,000,000

|

|

|

|

8.2

|

%

|

|

$

|

2.50

|

|

|

$

|

30,000,000

|

|

|

|

12,000,000

|

|

|

|

3.5

|

%

|

|

$

|

5.00

|

|

|

$

|

30,000,000

|

|

|

|

6,000,000

|

|

|

|

1.8

|

%

|

______________

|

(1)

|

Includes the total number of Purchase Shares (but not Commitment Shares) which we would have sold under the Purchase Agreement at the corresponding assumed purchase price set forth in the adjacent column, up to an aggregate purchase price of $30,000,000.

|

|

(2)

|

The denominator is based on 328,498,596 shares outstanding as of July 31, 2020, plus the 6,250,000 Commitment Shares and the number of shares set forth in the adjacent column which we would have sold to Aspire Capital. The numerator is based on the number of shares which we may issue to Aspire Capital under the Purchase Agreement (that are the subject of this offering) at the corresponding assumed purchase price set forth in the adjacent column.

|

Information With Respect to Aspire Capital

Aspire Capital Partners LLC (“Aspire Partners”) is the Managing Member of Aspire Capital Fund LLC (“Aspire Fund”). SGM Holdings Corp (“SGM”) is the Managing Member of Aspire Partners. Mr. Steven G. Martin (“Mr. Martin”) is the president and sole shareholder of SGM, as well as a principal of Aspire Partners. Mr. Erik J. Brown (“Mr. Brown”) is the president and sole shareholder of Red Cedar Capital Corp (“Red Cedar”), which is a principal of Aspire Partners. Mr. Christos Komissopoulos (“Mr. Komissopoulos”) is president and sole shareholder of Chrisko Investors Inc. (“Chrisko”), which is a principal of Aspire Partners. Mr. William F. Blank, III (“Mr. Blank”) is president and sole shareholder of WML Ventures Corp. (“WML Ventures”), which is a principal of Aspire Partners. Each of Aspire Partners, SGM, Red Cedar, Chrisko, WML Ventures, Mr. Martin, Mr. Brown, Mr. Komissopoulos and Mr. Blank may be deemed to be a beneficial owner of common stock held by Aspire Fund. Each of Aspire Partners, SGM, Red Cedar, Chrisko, WML Ventures, Mr. Martin, Mr. Brown, Mr. Komissopoulos and Mr. Blank disclaims beneficial ownership of the common stock held by Aspire Fund.

PLAN OF DISTRIBUTION

Aspire Capital is an “underwriter” within the meaning of the Securities Act.

Neither we nor Aspire Capital can presently estimate the amount of compensation that any agent will receive. We know of no existing arrangements between Aspire Capital, any other shareholder, broker, dealer, underwriter, or agent relating to the sale or distribution of the shares offered by this prospectus supplement. At the time a particular offer of shares is made, a prospectus supplement, if required, will be distributed that will set forth the names of any agents, underwriters, or dealers and any other required information.

We will pay all of the expenses incident to the registration, offering, and sale of the shares to Aspire Capital. We have agreed to indemnify Aspire Capital and certain other persons against certain liabilities in connection with the offering of shares of common stock offered hereby, including liabilities arising under the Securities Act or, if such indemnity is unavailable, to contribute amounts required to be paid in respect of such liabilities. Aspire Capital has agreed to indemnify us against liabilities under the Securities Act that may arise from certain written information furnished to us by Aspire Capital specifically for use in this prospectus or, if such indemnity is unavailable, to contribute amounts required to be paid in respect of such liabilities.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers, and controlling persons, we have been advised that in the opinion of the SEC this indemnification is against public policy as expressed in the Securities Act and is therefore, unenforceable.

Aspire Capital and its affiliates have agreed not to engage in any direct or indirect short selling or hedging of our common stock during the term of the Purchase Agreement.

We have advised Aspire Capital that it is required to comply with Regulation M promulgated under the Securities Exchange Act of 1934, as amended. With certain exceptions, Regulation M precludes the selling shareholder, any affiliated purchasers, and any broker-dealer or other person who participates in the distribution from bidding for or purchasing, or attempting to induce any person to bid for or purchase any security which is the subject of the distribution until the entire distribution is complete. Regulation M also prohibits any bids or purchases made in order to stabilize the price of a security in connection with the distribution of that security. All of the foregoing may affect the marketability of the shares offered hereby this prospectus.

We may suspend the sale of shares to Aspire Capital pursuant to this prospectus for certain periods of time for certain reasons, including if the prospectus is required to be supplemented or amended to include additional material information.

This offering will terminate on the date that all shares offered by this prospectus have been sold to Aspire Capital.

LEGAL MATTERS

Gary R. Henrie, Esq., Alpine, Wyoming, will pass upon the validity of the common stock offered hereby.

EXPERTS

The consolidated balance sheet of Innovation Pharmaceuticals Inc. as of June 30, 2019, the related consolidated statements of operations, changes in stockholders’ equity (deficiency), and cash flows for the year ended June 30, 2019, have been audited by Pinnacle Accountancy Group of Utah, an independent registered public accounting firm, as stated in its report incorporated herein by reference, which report contains an explanatory paragraph that states that the Company’s losses since inception, accumulation of a significant deficit, negative cash flows from operations and lack of revenues raise substantial doubt about its ability to continue as a going concern. Such consolidated financial statements have been incorporated herein by reference in reliance on the report of such firm given upon their authority as experts in accounting and auditing.

The consolidated balance sheet of Innovation Pharmaceuticals Inc. as of June 30, 2018, and the related consolidated statements of operations, stockholders’ deficit and cash flows for the year ended June 30, 2018 have been audited by Baker Tilly Virchow Krause, LLP, an independent registered public accounting firm, as stated in its report, which is incorporated herein by reference. Such financial statements are incorporated herein by reference in reliance on the report of such firm given upon their authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public from commercial retrieval services and at the website maintained by the SEC at www.sec.gov. The reports and other information filed by us with the SEC are also available at our website. The address of our website is www.ipharminc.com. Information contained on our website or that can be accessed through our website is not incorporated by reference into this prospectus supplement or the accompanying prospectus.

INFORMATION INCORPORATED BY REFERENCE

The SEC allows us to incorporate information into this prospectus supplement “by reference,” which means that we can disclose important information to you by referring you to another document that we file separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus supplement, except for any information superseded by information contained directly in this prospectus supplement. These documents contain important information about the Company and its financial condition, business and results.

We are incorporating by reference the filings listed below and any additional documents that we may file with the SEC pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act of 1934, as amended, on or after the date we file this prospectus supplement and prior to the termination of the offering, except we are not incorporating by reference any information furnished (but not filed) under Item 2.02 or Item 7.01 of any Current Report on Form 8-K and corresponding information furnished under Item 9.01 as an exhibit thereto:

|

|

·

|

our Annual Report on Form 10-K for the fiscal year ended June 30, 2019, filed with the SEC on September 30, 2019;

|

|

|

|

|

|

|

·

|

our Quarterly Reports on Forms 10-Q for the fiscal quarters ended September 30, 2019, December 31, 2019 and March 31, 2020, filed with the SEC on November 13, 2019, February 13, 2020, and May 14, 2020, respectively;

|

|

|

|

|

|

|

·

|

our Current Reports on Forms 8-K filed with the SEC on July 22, 2019, September 20, 2019, December 24, 2019, December 26, 2019 and August 4, 2020; and

|

|

|

|

|

|

|

·

|

the description of our common stock contained in our Form 8-A filed on April 27, 2015, including any amendments or reports filed for the purpose of updating the description.

|

We will provide, without charge, to each person to whom a copy of this prospectus supplement has been delivered, including any beneficial owner, a copy of any and all of the documents referred to herein that are summarized in this prospectus supplement, if such person makes a written or oral request directed to:

Innovation Pharmaceuticals Inc.

301 Edgewater Place - Suite 100

Wakefield, Massachusetts 01880

(978) 921-4125

Attention: Corporate Secretary

PROSPECTUS

Innovation Pharmaceuticals Inc.

$60,000,000 of

Class A Common Stock

Preferred Stock

Warrants

Units

We may offer and sell, from time to time, in one or more offerings, any combination of securities that we describe in this prospectus, either individually or in units, having a total initial offering price not exceeding $60,000,000. We may also offer shares of common stock upon conversion of preferred stock, or common stock or preferred stock upon the exercise of warrants.

We may sell the securities directly to you, through agents we select, or through underwriters and dealers we select, on a continuous or delayed basis. If we use agents, underwriters or dealers to sell the securities, we will name them and describe their compensation in a prospectus supplement. The price to the public of such securities and the net proceeds we expect to receive from such sale will also be set forth in a prospectus supplement.

This prospectus describes some of the general terms that may apply to these securities and the general manner in which they may be offered. Each time we sell securities we will provide a prospectus supplement that will contain specific information about the terms of the securities we are offering and the specific manner in which we will offer the securities. The prospectus supplement may add to, update or change the information in this prospectus. You should read this prospectus and any prospectus supplement carefully before you invest in our securities. This prospectus may not be used to sell securities unless accompanied by a prospectus supplement.

Our Class A common stock is currently quoted on the OTCQB under the symbol “IPIX”.

Investing in our securities involves a high degree of risk. See the section entitled “Risk Factors” on page 1 of this prospectus and in the documents we filed with the Securities and Exchange Commission that are incorporated in this prospectus by reference for certain risks and uncertainties you should consider.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

This prospectus is dated July 17, 2020.

TABLE OF CONTENTS

_________________

We have not authorized anyone to provide you with information different from that contained or incorporated by reference in this prospectus or any accompanying prospectus supplement or free writing prospectus, and we take no responsibility for any other information that others may give you. This prospectus is not an offer to sell, nor is it a solicitation of an offer to buy, the securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus or any prospectus supplement or free writing prospectus is accurate as of any date other than the date on the front cover of those documents, or that the information contained in any document incorporated by reference is accurate as of any date other than the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

As permitted by the rules and regulations of the Securities and Exchange Commission (the “SEC”), the registration statement of which this prospectus forms a part includes additional information not contained in this prospectus. You may read the registration statement and the other reports we file with the SEC at the SEC’s website as described below under the heading “Where You Can Find More Information.” Before investing in our securities, you should read this prospectus and any accompanying prospectus supplement or free writing prospectus, as well as the additional information described under “Where You Can Find More Information” and “Documents Incorporated by Reference.”

References to the “Company,” “Innovation Pharmaceuticals,” “IPIX,” “we,” “our” and “us” in this prospectus are to Innovation Pharmaceuticals Inc., a Nevada corporation, and its consolidated subsidiaries, unless the context otherwise requires.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the SEC utilizing a shelf registration process. Under the shelf registration process, we may offer, from time to time, the securities or combinations of the securities described in this prospectus with a total offering price of up to $60,000,000 in one or more offerings at prices and on terms to be determined by market conditions at the time of each offering. Unless otherwise indicated, “common stock” means our Class A common stock, par value $0.0001 per share.

This prospectus provides you with a general description of the securities we may offer. Each time we offer a type or series of securities, we will provide a prospectus supplement or free writing prospectus that will contain specific information about the terms of the offering.

A prospectus supplement or free writing prospectus may include a discussion of risks or other special considerations applicable to us or the offered securities. A prospectus supplement or free writing prospectus may also add, update or change information contained in this prospectus. If there is any inconsistency between the information in this prospectus and any related prospectus supplement or free writing prospectus, you must rely on the information in the prospectus supplement or free writing prospectus. Please carefully read both this prospectus and the related prospectus supplement or free writing prospectus in their entirety together with additional information described under the heading “Where You Can Find More Information” in this prospectus. This prospectus may not be used to offer or sell any securities unless accompanied by a prospectus supplement or free writing prospectus.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus forms part of a registration statement on Form S-3 filed by us with the SEC under the Securities Act of 1933, as amended (the “Securities Act”). As permitted by the SEC, this prospectus does not contain all the information set forth in the registration statement filed with the SEC. For a more complete understanding of this offering, you should refer to the complete registration statement, including the exhibits thereto, on Form S-3 that may be obtained as described below. Statements contained or incorporated by reference in this prospectus or any prospectus supplement about the contents of any contract or other document are not necessarily complete. If we have filed any contract or other document as an exhibit to the registration statement or any other document incorporated by reference in the registration statement of which this prospectus forms a part, you should read the exhibit for a more complete understanding of the document or matter involved. Each statement regarding a contract or other document is qualified in its entirety by reference to the actual document.

We file annual, quarterly and special reports, proxy statements and other information with the SEC. Our SEC filings are available to the public from commercial retrieval services and at the website maintained by the SEC at www.sec.gov. The reports and other information filed by us with the SEC are also available at our website. The address of the Company’s website is www.ipharminc.com. Information contained on our website or that can be accessed through our website is not incorporated by reference into this prospectus.

DOCUMENTS INCORPORATED BY REFERENCE

The SEC allows us to incorporate information into this prospectus “by reference,” which means that we can disclose important information to you by referring you to another document that we file separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus, except for any information superseded by information contained directly in this prospectus. These documents contain important information about the Company and its financial condition, business and results.

We are incorporating by reference the Company’s filings listed below and any additional documents that we may file with the SEC pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act on or after the date hereof and prior to the termination of any offering, except we are not incorporating by reference any information furnished (but not filed) under Item 2.02 or Item 7.01 of any Current Report on Form 8-K and corresponding information furnished under Item 9.01 as an exhibit thereto:

|

|

·

|

our Annual Report on Form 10-K for the fiscal year ended June 30, 2019, filed with the SEC on September 30, 2019;

|

|

|

|

|

|

|

·

|

our Quarterly Reports on Forms 10-Q for the fiscal quarters ended September 30, 2019, December 31, 2019 and March 31, 2020, filed with the SEC on November 13, 2019, February 13, 2020 and May 14, 2020, respectively;

|

|

|

|

|

|

|

·

|

our Current Reports on Forms 8-K filed with the SEC on July 22, 2019, September 20, 2019, December 24, 2019 and December 26, 2019; and

|

|

|

|

|

|

|

·

|

the description of our common stock contained in our Form 8-A filed on April 27, 2015, including any amendments or reports filed for the purpose of updating the description.

|

We will provide, without charge, to each person, including any beneficial owner, to whom a copy of this prospectus has been delivered a copy of any and all of the documents referred to herein that are summarized in this prospectus, if such person makes a written or oral request directed to:

Innovation Pharmaceuticals Inc.

301 Edgewater Place - Suite 100

Wakefield, MA 01880

(978) 921-4125

Attention: Corporate Secretary

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, any accompanying prospectus supplement or free writing prospectus, and the documents we have incorporated by reference contain forward-looking statements within the meaning of the federal securities laws that involve risks and uncertainties that could cause actual results to differ materially from projections or estimates contained herein. Forward-looking statements convey our current expectations or forecasts of future events. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

All statements other than statements of historical fact are “forward-looking statements” for purposes of these provisions. Statements that include the use of terminology such as “may,” “will,” “expects,” “believes,” “plans,” “estimates,” “potential,” or “continue,” or the negative thereof or other and similar expressions are forward-looking statements. In addition, in some cases, you can identify forward-looking statements by words or phrases such as “trend,” “potential,” “opportunity,” “believe,” “comfortable,” “expect,” “anticipate,” “current,” “intention,” “estimate,” “position,” “assume,” “outlook,” “continue,” “remain,” “maintain,” “sustain,” “seek,” “achieve,” and similar expressions.

These forward-looking statements include, but are not limited to, any statements regarding our future financial performance, results of operations or sufficiency of capital resources to fund our operating requirements; statements relating to potential licensing, partnering or similar arrangements concerning our drug compounds; statements concerning our future drug development plans and projected timelines for the initiation and completion of preclinical and clinical trials; the potential for the results of ongoing preclinical or clinical trials; other statements regarding our future product development and regulatory strategies, including with respect to specific indications such as, among others, COVID-19; and any other statements which are other than statements of historical fact and any statement of assumptions underlying any of the foregoing are forward-looking statements. The forward-looking statements in this prospectus, in any related prospectus supplement or free writing prospectus and in any incorporated documents speak only as of the date hereof (or thereof, as applicable), and caution should be taken not to place undue reliance on any such forward-looking statements, which are qualified in their entirety by this cautionary statement.

Forward-looking statements are subject to numerous assumptions, events, risks, uncertainties and other factors, including those that may be outside of our control and that change over time. As a result, actual results and/or the timing of events could differ materially from those expressed in or implied by the forward-looking statements and future results could differ materially from historical performance. Such assumptions, events, risks, uncertainties and other factors include, among others, those described under the section herein entitled “Risk Factors” and elsewhere in this prospectus or in any related prospectus supplement or free writing prospectus, as well as in reports and documents we file with the SEC and include, without limitation, the following:

|

|

·

|

our ability to continue as a going concern and our capital needs;

|

|

|

|

|

|

|

·

|

our ability to fund and successfully progress internal research and development efforts;

|

|

|

|

|

|

|

·

|

our ability to create effective, commercially-viable drugs;

|

|

|

|

|

|

|

·

|

our ability to effectively and timely conduct clinical trials;

|

|

|

|

|

|

|

·

|

our ability to ultimately distribute our drug candidates;

|

|

|

|

|

|

|

·

|

our ability to achieve certain future regulatory, development and commercialization milestones under our license agreement with Alfasigma S.p.A.;

|

|

|

|

|

|

|

·

|

the development of treatments or vaccines relating to the COVID-19 pandemic by other entities;

|

|

|

|

|

|

|

·

|

compliance with regulatory requirements; and

|

|

|

|

|

|

|

·

|

other risks referred to in the section of this prospectus entitled “Risk Factors” and in the SEC filings incorporated by reference in this prospectus.

|

All forward-looking statements included in this document are made as of the date hereof, based on information available to us as of the date hereof, and we assume no obligation to update any forward-looking statements, except as may be required by applicable law.

RISK FACTORS

An investment in our securities involves a high degree of risk. In addition to all of the other information contained or incorporated by reference into this prospectus and the accompanying prospectus supplement, you should carefully consider the risk factors incorporated by reference from our most recent Annual Report on Form 10-K, as updated by our subsequent filings under the Exchange Act, including Forms 10-Q and 8-K, and the risk factors contained or incorporated by reference into the accompanying prospectus supplement before acquiring any of the securities. The risks described in these documents are not the only ones we face, but those that we consider to be material. There may be other unknown or unpredictable economic, business, competitive, regulatory or other factors that could have material adverse effects on our future results. If any of these risks actually occurs, our business, financial condition or results of operations could be harmed. This could cause the trading price of our common stock to decline, resulting in a loss of all or part of your investment. Please also read carefully the section above titled “Cautionary Note Regarding Forward-Looking Statements.”

ABOUT THE COMPANY

We are a clinical stage biopharmaceutical company developing innovative therapies with dermatology, oncology, anti-inflammatory and antibiotic applications. We own the rights to numerous drug compounds, including Brilacidin, our lead drug in a new class of compounds called defensin-mimetics, and Kevetrin (thioureidobutyronitrile), our lead anti-cancer compound.

The Company was incorporated as Econoshare, Inc. on August 1, 2005 in the State of Nevada. On December 6, 2007, the Company acquired Cellceutix Pharma, Inc., a privately owned corporation formed under the laws of the State of Delaware on June 20, 2007. Following the acquisition, the Company changed its name to Cellceutix Corporation. Effective June 5, 2017, the Company amended its Articles of Incorporation and changed its name from Cellceutix Corporation to Innovation Pharmaceuticals Inc.

Our principal executive offices are located at 301 Edgewater Place - Suite 100, Wakefield, MA 01880, and our telephone number is (978) 921-4125. Our website is www.ipharminc.com. The information contained on or that can be accessed through our website (other than the specified SEC filings incorporated by reference in this prospectus) is not incorporated in, and is not a part of, this prospectus, and you should not rely on any such information in connection with your investment decision to purchase our securities.

USE OF PROCEEDS

Unless otherwise specified in the applicable prospectus supplement, we intend to use the net proceeds from the sale of the securities described in this prospectus for general corporate and operations purposes. The applicable prospectus supplement will provide more details on the use of proceeds of any specific offering.

DILUTION

We will set forth in a prospectus supplement and/or a free writing prospectus the following information, as required, regarding any dilution of the equity interests of investors purchasing securities in an offering under this prospectus:

|

|

·

|

the net tangible book value per share of our equity securities before and after the offering;

|

|

|

|

|

|

|

·

|

the amount of the change in such net tangible book value per share attributable to the cash payments made by purchasers in the offering; and

|

|

|

|

|

|

|

·

|

the amount of the immediate dilution from the public offering price which will be absorbed by such purchasers.

|

DESCRIPTION OF OUR CAPITAL STOCK

The following summary describes the material terms of our capital stock and is subject to, and qualified in its entirety by, our Amended and Restated Articles of Incorporation and Amended and Restated Bylaws that are included as exhibits to certain of the documents incorporated by reference herein and by the provisions of applicable Nevada law. We refer you to the foregoing documents and to Nevada law for a detailed description of the provisions summarized below.

Common Stock

We are authorized to issue 600,000,000 shares of Class A common stock, par value $0.0001 per share, and 100,000,000 Class B common stock, par value $0.0001 per share. As of July 7, 2020, there were 328,317,492 shares of our Class A common stock outstanding and 1,818,180 shares of our Class B common stock outstanding. Leo Ehrlich, our Chief Executive Officer, holds all of the outstanding shares of Class B common stock and a vested option to purchase 16,181,820 shares of Class B common stock.

Holders of shares of our Class A common stock are entitled to cast one vote on all matters submitted to a vote of the stockholders for each share of Class A common stock held, and holders of shares of our Class B common stock are entitled to cast ten votes on all matters submitted to a vote of the stockholders for each share of Class B common stock held. Subject to any limitations provided by law, the holders of shares of our Class A common stock and Class B common stock vote together as a single class, together with the holders of any shares of the preferred stock which are entitled to vote, and not as a separate class. None of our capital stock has cumulative voting rights, and accordingly the holders of a majority of the voting power entitled to vote in any election of directors can elect all of the directors standing for election.

The holders of shares of our Class B common stock at their election have the right, at any time or from time to time, to convert any or all of their shares of Class B common stock into shares of Class A common stock, on a one for one basis, by delivery to the Company of the certificates representing such shares of Class B common stock duly endorsed for such conversion. Any shares of the Class B common stock that are transferred will automatically convert into shares of the Class A Common Stock, on a one to one basis, effective as of the date on which certificates representing such shares are presented for transfer on the books of the Company. The Board of Directors of the Company has sole discretion to issue the Class B common stock.

Subject to preferences that may be applicable to any then outstanding preferred stock, holders of Class A common stock and Class B common stock are entitled to receive ratably those dividends, if any, as may be declared from time to time by the board of directors out of legally available funds. In the event of our liquidation, dissolution or winding up, holders of Class A common stock and Class B common stock will be entitled to share ratably in the net assets legally available for distribution to stockholders after the payment of all of our debts and other liabilities and the satisfaction of any liquidation preference granted to the holders of any outstanding shares of preferred stock.

Holders of Class A common stock and Class B common stock do not have preemptive or conversion rights or other subscription rights, other than the conversion rights of the Class B common stock described above, and there are no redemption or sinking fund provisions applicable to the Class A common stock or Class B common stock. All outstanding shares of Class A common stock and Class B common stock are, and the shares of Class A common stock offered by us in any offering utilizing this prospectus, when issued and paid for, will be fully paid and nonassessable. The rights, preferences and privileges of the holders of Class A common stock and Class B common stock are subject to, and may be adversely affected by, the rights of the holders of shares of any series of preferred stock which we may designate in the future.

Preferred Stock

We are authorized to issue up to 10,000,000 shares of preferred stock in one or more series, with such designations, preferences and relative, participating, option and other special rights, qualifications, limitations or restrictions as determined by our board of directors, without any further vote or action by our stockholders, including dividend rights, conversion rights, voting rights, redemption rights and terms of redemption and liquidation preferences.

As of July 7, 2020, there were no shares of preferred stock issued or outstanding. On May 9, 2012, our board of directors designated an aggregate of 500,000 shares of preferred stock as Series A Convertible Preferred Stock, of which no shares are currently issued or outstanding. On October 5, 2018, our board of directors designated an aggregate of 20,000 shares of preferred stock as Series B Convertible Preferred Stock, of which no shares are currently issued or outstanding.

Our board of directors may fix the number of shares constituting any series and the designations of these series by adopting a certificate of designation relating to each series including, but not limited to:

|

|

·

|

the maximum number of shares in the series and the distinctive designation thereof;

|

|

|

|

|

|

|

·

|

the terms on which dividends will be paid, if any;

|

|

|

|

|

|

|

·

|

the terms on which the shares will be redeemed, if at all;

|

|

|

|

|

|

|

·

|

the liquidation preference, if any;

|

|

|

|

|

|

|

·

|

the terms of any retirement or sinking fund for the purchase or redemption of the shares of the series;

|

|

|

|

|

|

|

·

|

the terms and conditions, if any, on which the shares of the series will be convertible into, or exchangeable for, shares of any other class or classes of capital stock;

|

|

|

|

|

|

|

·

|

the voting rights, if any, on the shares of the series;

|

|

|

|

|

|

|

·

|

any securities exchange or market on which the shares will be listed; and

|

|

|

|

|

|

|

·

|

any other preferences and relative, participating, operation or other special rights or qualifications, limitations or restrictions of the shares.

|

Our issuance of preferred stock may have the effect of delaying or preventing a change in control. Our issuance of preferred stock could decrease the amount of earnings and assets available for distribution to the holders of Class A and Class B common stock or could adversely affect the rights and powers, including voting rights, of the holders of Class A and Class B common stock. The issuance of preferred stock could have the effect of decreasing the market price of our Class A and Class B common stock.

Certain Anti-Takeover Effects

Certain provisions of our Amended and Restated Articles of Incorporation and Amended and Restated Bylaws may be deemed to have an anti-takeover effect.

Advance Notice Requirements for Stockholder Proposals and Director Nominations. Our Amended and Restated Bylaws provide advance notice procedures for stockholders seeking to bring business before meetings of our stockholders or to nominate candidates for election as directors at our stockholder meetings and specify certain requirements regarding the form and content of a stockholder’s notice. These provisions might preclude our stockholders from bringing matters before our stockholder meetings or from making nominations for directors at our stockholder meetings if the proper procedures are not followed.

Additional Authorized Shares of Capital Stock. The additional shares of authorized common stock and preferred stock available for issuance under our Amended and Restated Articles of Incorporation could be issued at such times, under such circumstances and with such terms and conditions as to impede a change in control.

Effect of Preferred Stock. Our board of directors is authorized to approve the issuance of preferred stock without stockholder approval and to determine the number of shares, the designations and the relative preferences, rights, restrictions and qualifications of any class or series of preferred stock. As a result, our board of directors could, without stockholder approval, authorize the issuance of preferred stock with voting, dividend, redemption, liquidation, sinking fund, conversion and other rights that could proportionately reduce, minimize or otherwise adversely affect the voting power and other rights of holders of capital stock or other classes or series of preferred stock or that could have the effect of delaying, deferring or preventing a change in control.

DESCRIPTION OF WARRANTS

We may issue warrants for the purchase of Class A common stock or preferred stock in one or more series. We may issue warrants independently or together with common stock or preferred stock, and the warrants may be attached to or separate from these securities. While the terms summarized below will apply generally to any warrants that we may offer, we will describe the particular terms of any series of warrants in more detail in the applicable prospectus supplement. The terms of any warrants offered under a prospectus supplement may differ from the terms described below.