true

FY

0001572565

P0Y

0001572565

2023-01-01

2023-12-31

0001572565

2023-12-31

0001572565

2024-06-28

0001572565

2022-12-31

0001572565

INQD:SeriesAConvertiblePreferredStockMember

2023-12-31

0001572565

INQD:SeriesAConvertiblePreferredStockMember

2022-12-31

0001572565

2022-01-01

2022-12-31

0001572565

INQD:SeriesAConvertiblePreferredStockMember

us-gaap:PreferredStockMember

2021-12-31

0001572565

us-gaap:CommonStockMember

2021-12-31

0001572565

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001572565

INQD:StockPayableMember

2021-12-31

0001572565

us-gaap:RetainedEarningsMember

2021-12-31

0001572565

2021-12-31

0001572565

INQD:SeriesAConvertiblePreferredStockMember

us-gaap:PreferredStockMember

2022-12-31

0001572565

us-gaap:CommonStockMember

2022-12-31

0001572565

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001572565

INQD:StockPayableMember

2022-12-31

0001572565

us-gaap:RetainedEarningsMember

2022-12-31

0001572565

INQD:SeriesAConvertiblePreferredStockMember

us-gaap:PreferredStockMember

2022-01-01

2022-12-31

0001572565

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0001572565

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-12-31

0001572565

INQD:StockPayableMember

2022-01-01

2022-12-31

0001572565

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0001572565

INQD:SeriesAConvertiblePreferredStockMember

us-gaap:PreferredStockMember

2023-01-01

2023-12-31

0001572565

us-gaap:CommonStockMember

2023-01-01

2023-12-31

0001572565

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-12-31

0001572565

INQD:StockPayableMember

2023-01-01

2023-12-31

0001572565

us-gaap:RetainedEarningsMember

2023-01-01

2023-12-31

0001572565

INQD:SeriesAConvertiblePreferredStockMember

us-gaap:PreferredStockMember

2023-12-31

0001572565

us-gaap:CommonStockMember

2023-12-31

0001572565

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001572565

INQD:StockPayableMember

2023-12-31

0001572565

us-gaap:RetainedEarningsMember

2023-12-31

0001572565

INQD:AlamoCBDLLCMember

us-gaap:CommonStockMember

2017-08-04

2017-08-04

0001572565

us-gaap:SeriesAPreferredStockMember

2023-01-01

2023-12-31

0001572565

us-gaap:SeriesAPreferredStockMember

2022-01-01

2022-12-31

0001572565

us-gaap:ConvertibleDebtSecuritiesMember

2023-01-01

2023-12-31

0001572565

us-gaap:ConvertibleDebtSecuritiesMember

2022-01-01

2022-12-31

0001572565

us-gaap:WarrantMember

2023-01-01

2023-12-31

0001572565

us-gaap:WarrantMember

2022-01-01

2022-12-31

0001572565

us-gaap:EmployeeStockOptionMember

2023-01-01

2023-12-31

0001572565

us-gaap:EmployeeStockOptionMember

2022-01-01

2022-12-31

0001572565

us-gaap:FairValueInputsLevel1Member

2023-12-31

0001572565

us-gaap:FairValueInputsLevel2Member

2023-12-31

0001572565

us-gaap:FairValueInputsLevel3Member

2023-12-31

0001572565

us-gaap:FairValueInputsLevel1Member

2022-12-31

0001572565

us-gaap:FairValueInputsLevel2Member

2022-12-31

0001572565

us-gaap:FairValueInputsLevel3Member

2022-12-31

0001572565

INQD:BoardOfDirectorsMember

2023-04-12

2023-04-12

0001572565

INQD:BoardOfDirectorsMember

2023-04-12

0001572565

us-gaap:WarrantMember

2023-04-12

0001572565

2023-04-12

0001572565

INQD:ElectrumPartnersLLCMember

2023-01-01

2023-12-31

0001572565

INQD:HempThreeSixtyNineMember

2023-01-01

2023-12-31

0001572565

INQD:MetaBioGenixMember

2023-01-01

2023-12-31

0001572565

2020-05-11

0001572565

INQD:SeriesAConvertiblePreferredStockMember

2020-05-11

0001572565

INQD:PromissoryNoteMember

INQD:ElectrumPartnersLLCMember

2021-10-01

2021-10-01

0001572565

us-gaap:RestrictedStockMember

INQD:ElectrumPartnersLLCMember

2020-09-28

2020-09-28

0001572565

INQD:SeriesAConvertiblePreferredStockMember

2021-11-08

0001572565

INQD:SupplementalAgreementMember

INQD:SeriesAConvertiblePreferredStockMember

2021-11-08

2021-11-08

0001572565

INQD:AccreditedInvestorsMember

us-gaap:CommonStockMember

2021-11-08

2021-11-08

0001572565

INQD:AccreditedInvestorsMember

us-gaap:CommonStockMember

2021-11-08

0001572565

INQD:TenPercentageFixedConvertiblePromissoryNoteMember

2023-11-09

2023-11-09

0001572565

INQD:TenPercentageFixedConvertiblePromissoryNoteMember

2022-08-09

2022-08-09

0001572565

INQD:SeriesAConvertiblePreferredStockMember

2021-12-31

0001572565

INQD:SeriesAConvertiblePreferredStockMember

2020-01-01

2020-12-31

0001572565

INQD:SeriesAConvertiblePreferredStockMember

2020-12-31

0001572565

2021-08-27

2021-08-27

0001572565

us-gaap:SeriesAPreferredStockMember

2021-08-27

2021-08-27

0001572565

2021-11-08

2021-11-08

0001572565

us-gaap:SeriesAPreferredStockMember

2021-01-01

2021-12-31

0001572565

us-gaap:CommonStockMember

2021-01-01

2021-12-31

0001572565

us-gaap:DerivativeMember

2021-01-01

2021-12-31

0001572565

us-gaap:PrivatePlacementMember

2022-01-01

2022-12-31

0001572565

srt:MinimumMember

us-gaap:PrivatePlacementMember

2022-12-31

0001572565

srt:MaximumMember

us-gaap:PrivatePlacementMember

2022-12-31

0001572565

us-gaap:PrivatePlacementMember

2023-01-01

2023-12-31

0001572565

us-gaap:PrivatePlacementMember

2023-12-31

0001572565

srt:MinimumMember

us-gaap:PrivatePlacementMember

2023-12-31

0001572565

srt:MaximumMember

us-gaap:PrivatePlacementMember

2023-12-31

0001572565

INQD:ConsultingServicesMember

2023-01-01

2023-12-31

0001572565

us-gaap:PrivatePlacementMember

2022-02-16

2022-02-16

0001572565

us-gaap:PrivatePlacementMember

2022-03-16

2022-03-16

0001572565

us-gaap:PrivatePlacementMember

2022-02-16

0001572565

us-gaap:PrivatePlacementMember

2022-03-16

0001572565

us-gaap:PrivatePlacementMember

INQD:SubscriptionAgreementsMember

INQD:AccreditedInvestorsMember

2022-05-12

0001572565

us-gaap:PrivatePlacementMember

2022-08-01

2022-08-01

0001572565

us-gaap:PrivatePlacementMember

2022-08-01

0001572565

us-gaap:PrivatePlacementMember

2022-08-12

2022-08-12

0001572565

us-gaap:PrivatePlacementMember

2022-11-09

2022-11-09

0001572565

us-gaap:PrivatePlacementMember

2022-08-12

0001572565

us-gaap:PrivatePlacementMember

2022-11-09

0001572565

2023-02-01

2023-02-28

0001572565

2021-08-04

2021-08-04

0001572565

INQD:LeslieBocskorMember

2021-08-04

2021-08-04

0001572565

INQD:BenjaminRoteMember

2021-08-04

2021-08-04

0001572565

INQD:DennisForchicMember

2021-08-04

2021-08-04

0001572565

INQD:LeslieBocskorMember

INQD:OneYearAnniversaryMember

2021-08-04

2021-08-04

0001572565

INQD:BenjaminRoteMember

INQD:OneYearAnniversaryMember

2021-08-04

2021-08-04

0001572565

INQD:DennisForchicMember

INQD:OneYearAnniversaryMember

2021-08-04

2021-08-04

0001572565

INQD:RickGutshallMember

2021-08-04

2021-08-04

0001572565

INQD:RickGutshallMember

2021-08-04

0001572565

INQD:LangColemanMember

2021-08-04

2021-08-04

0001572565

INQD:LangColemanMember

2021-08-04

0001572565

INQD:MichaelBlicharskiMember

2022-01-01

2022-12-31

0001572565

INQD:KeithCrouchAndMichaelBlicharskiMember

2022-01-01

2022-12-31

0001572565

INQD:KeithCrouchAndMichaelBlicharskiMember

2022-12-31

0001572565

INQD:AdvisorsMember

us-gaap:CommonStockMember

2023-01-01

2023-12-31

0001572565

INQD:AdvisorsMember

us-gaap:CommonStockMember

2023-12-31

0001572565

2021-01-01

2021-12-31

0001572565

INQD:ConsultingAgreementMember

srt:MaximumMember

2022-12-20

0001572565

INQD:ConsultingAgreementMember

2022-12-20

0001572565

INQD:ConsultingAgreementMember

2022-12-20

2022-12-20

0001572565

2022-02-16

0001572565

us-gaap:WarrantMember

2022-02-16

2022-02-16

0001572565

2022-08-12

0001572565

us-gaap:WarrantMember

2022-08-12

2022-08-12

0001572565

INQD:InvestorWarrantMember

2023-12-31

0001572565

srt:MinimumMember

2023-01-01

2023-12-31

0001572565

srt:MaximumMember

2023-01-01

2023-12-31

0001572565

srt:MinimumMember

2022-01-01

2022-12-31

0001572565

srt:MaximumMember

2022-01-01

2022-12-31

0001572565

2020-12-31

0001572565

2020-01-01

2020-12-31

0001572565

us-gaap:WarrantMember

2021-12-31

0001572565

us-gaap:WarrantMember

2022-01-01

2022-12-31

0001572565

us-gaap:WarrantMember

2022-12-31

0001572565

us-gaap:WarrantMember

2023-01-01

2023-12-31

0001572565

us-gaap:WarrantMember

2023-12-31

0001572565

INQD:AdvisoryAgreementMember

INQD:PacificCapitalMarketsLlcMember

us-gaap:SubsequentEventMember

2024-02-27

2024-02-27

0001572565

INQD:AdvisoryAgreementMember

us-gaap:SubsequentEventMember

2024-06-19

2024-06-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

INQD:Days

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

10-K/A

(Mark

One)

☒

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES AND EXCHANGE ACT OF 1934

For

the fiscal year ended December 31, 2023

OR

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES AND EXCHANGE ACT OF 1934

For

the transition period from ______________ to ______________

Commission

file number: 000-55594

INDOOR

HARVEST CORP

(Exact

name of registrant as specified in its charter)

| Texas |

|

45-5577364

|

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

No.) |

| |

|

|

7401

W. Slaughter Lane #5078

Austin,

Texas |

|

78739 |

| (Address

of principal executive offices) |

|

(Zip

code) |

Registrant’s

telephone number, including area code:

512-309-1776

Securities

registered pursuant to Section 12(b) of the Act: None

Securities

registered pursuant to Section 12(g) of the Act: Common Stock, par value $0.001 per share

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2)

has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes ☐ No ☒

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| |

|

|

|

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

|

|

| |

|

Emerging

growth company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act.) Yes ☐ No ☒

The

aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant on December 31st 2023 was $3,105,704,

based upon the closing price of $ 0.001 of the registrant’s common stock on that date as reported on OTC Markets Group Inc.

As

of June 28, 2024, there were 3,205,704,056 shares issued and outstanding.

Explanatory

Note

This

Amendment NO. 2 to our Annual Report on Form-10K for the year ended December 31, 2023, amends in its entirety the Annual Report on

Form 10-K that was originally filed on July 1st, 2024 (the “Annual Report”), to:

| |

● |

comply with (17 CFR 240), WHICH REQUIRES ANNUAL FINANCIAL STATEMENTS included in annual reports on Form 10-K to be reviewed by an independent public accountant using professional standards and procedures for conducting such reviews, as established by PCAOB, |

| |

|

|

| |

● |

to update financial statements and various other disclosures throughout this quarterly report, |

| |

|

|

| |

● |

to include the required certifications of the Company’s Principal Executive Officer and Principal Financial and Accounting Officer as required by Sections 302 and 906 of the Sarbanes-Oxley Act, and, |

| |

|

|

| |

● |

to include exhibit 101, for XBRL (eXtensible Business Reporting Language) files. |

This Amendment No. 1 revises the original filing of

the Original Report and does not otherwise reflect events that may have occurred subsequent to the original filing date.

TABLE

OF CONTENTS

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS AND INFORMATION

This

Annual Report on Form 10-K, the other reports, statements, and information that we have previously filed or that we may subsequently

file with the Securities and Exchange Commission, or SEC, and public announcements that we have previously made or may subsequently make

include, may include, incorporate by reference or may incorporate by reference certain statements that may be deemed to be “forward-

looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and are intended to enjoy the benefits

of that act. Unless the context is otherwise, the forward-looking statements included or incorporated by reference in this Form 10-K

and those reports, statements, information and announcements address activities, events or developments that Indoor Harvest, Corp. (hereinafter

referred to as “we,” “us,” “our,” “our Company” or “Indoor Harvest”) expects

or anticipates, will or may occur in the future. Any statements in this document about expectations, beliefs, plans, objectives, assumptions

or future events or performance are not historical facts and are forward-looking statements. These statements are often, but not always,

made through the use of words or phrases such as “may,” “should,” “could,” “predict,”

“potential,” “believe,” “will likely result,” “expect,” “will continue,”

“anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,”

“would” and “outlook,” and similar expressions. Accordingly, these statements involve estimates, assumptions

and uncertainties, which could cause actual results to differ materially from those expressed in them. Any forward-looking statements

are qualified in their entirety by reference to the factors discussed throughout this document. All forward-looking statements concerning

economic conditions, rates of growth, rates of income or values as may be included in this document are based on information available

to us on the dates noted, and we assume no obligation to update any such forward-looking statements. It is important to note that our

actual results may differ materially from those in such forward-looking statements due to fluctuations in interest rates, inflation,

government regulations, economic conditions and competitive product and pricing pressures in the geographic and business areas in which

we conduct operations, including our plans, objectives, expectations and intentions and other factors discussed elsewhere in this Report.

Certain

risk factors could materially and adversely affect our business, financial conditions and results of operations and cause actual results

or outcomes to differ materially from those expressed in any forward-looking statements speaks only as of the date on which it is made

and we do not undertake any obligation to update any forward-looking statement or statements to reflect events or circumstances after

the date on which such statement is made or to reflect the occurrence of unanticipated events. The risks and uncertainties we currently

face are not the only ones we face. New factors emerge from time to time, and it is not possible for us to predict which will arise.

There may be additional risks not presently known to us or that we currently believe are immaterial to our business. In addition, we

cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual

results to differ materially from those contained in any forward-looking statements. If any such risks occur, our business, operating

results, liquidity and financial condition could be materially affected in an adverse manner. Under such circumstances, you may lose

all or part of your investment.

The

industry and market data contained in this report are based either on our management’s own estimates or, where indicated, independent

industry publications, reports by governmental agencies or market research firms or other published independent sources and, in each

case, are believed by our management to be reasonable estimates. However, industry and market data is subject to change and cannot always

be verified with complete certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering

process and other limitations and uncertainties inherent in any statistical survey of market shares. We have not independently verified

market and industry data from third-party sources. In addition, consumption patterns and customer preferences can and do change. As a

result, you should be aware that market share, ranking and other similar data set forth herein, and estimates and beliefs based on such

data, may not be verifiable or reliable.

PART

I

Item

1. Business.

Organization

Indoor

Harvest Corp (the “Company”) is a Texas corporation formed on November 23, 2011. Our principal executive office was located

at 7401 W. Slaughter Lane #5078, Austin, Texas 78739 for the year ended 2019. From inception until about August 4, 2017, in summary,

the Company pursued a business of certain engineering, procurement and construction related services as to the indoor and vertical farming

industry and production platforms, mechanical systems and custom designed build outs for both Controlled Environment Agriculture (“CEA”)

and Building Integrated Agriculture (“BIA”), for two unique industries, produce and cannabis.

In

mid-2016, the Company began efforts to separate its produce and cannabis related pursuits due to ongoing feedback from both clients and

potential institutional investors. It was determined that the Company’s involvement in the cannabis industry was creating conflicts

for clients and potential institutional investors wishing to work with the Company from the produce industry due to the public perception

and political issues surrounding the cannabis industry. By late-2016, the Company had decided to cease actively selling its products

and services to the vertical farming industry and to focus on utilizing the Company’s developed technology and methods for the

cannabis industry.

On

August 3, 2017, we formed Alamo Acquisition, LLC, a wholly owned Texas limited liability company (“Alamo Acquisition Sub”).

On August 4, 2017, the Company ceased actively supporting business development of vertical farms for produce production and consummated

a business acquisition (the “Alamo Acquisition”) pursuant to which Alamo Acquisition Sub acquired all of the outstanding

membership interests of Alamo CBD, LLC (“Alamo CBD”), a Texas limited liability company. Upon closing of the Alamo Acquisition,

the membership interests of Alamo CBD were exchanged for 7,584,008 shares of Indoor Harvest’s common stock, the parent company

of Alamo Acquisition Sub. Alamo CBD continued as our surviving wholly-owned subsidiary, and Alamo Acquisition Sub ceased to exist.

On

August 14, 2019, the Company established a wholly owned subsidiary, IHC Consulting, Inc. (“IHC”), in the State of New York

of the United States of America. IHC Consulting will provide consulting and other services to the Company and others on a contracted

basis.

Description

of Business

Indoor

Harvest, through its brand name Indoor Harvest®, was focused on leveraging technology and planning on Vertical Farming, Building

Integrated Agriculture, Controlled Environment Agriculture and Aeroponic Cultivation technology with other synergistic enterprises in

the Cannabis industry prior to 2020.

The

2022 business strategy is to position the Company as an integrated consolidation platform for plant-based industry companies focused

on hemp, other hemp-related products, CBD, and other plant-based companies with the potential to be part of a bigger opportunity while

sharing intellectual capital, technology, expanded business networks, along with access to new capital markets and liquidity for investors.

Our

operational expenditures will be focused on our plans to create shareholder value through an M&A and strategic partnership strategy,

while managing the necessary costs related to being a fully reporting company with the SEC.

Industry

and Regulatory Overview

The

United States federal government regulates drugs through the CSA (21 U.S.C. § 811), which places controlled substances, including

cannabis, in a schedule. Cannabis is classified as a Schedule I drug, which is viewed as highly addictive and having no medical value.

The United States Federal Drug Administration (“FDA”) has not approved the sale of cannabis for any medical application.

Doctors may not prescribe cannabis for medical use under federal law, however, they can recommend its use under the First Amendment.

In 2010, the United States Veterans Affairs Department clarified that veterans using medicinal cannabis will not be denied services or

other medications that are denied to those using illegal drugs.

State

legalization efforts conflict with the CSA, which makes cannabis use and possession illegal on a national level. On August 29, 2013,

the U.S. Department of Justice (“DOJ”) issued a memorandum (the “Cole Memo”) providing that where states and

local governments enact laws authorizing cannabis-related use, and implement strong and effective regulatory and enforcement systems,

the federal government will rely upon states and local enforcement agencies to address cannabis activity through the enforcement of their

own state and local narcotics laws.

On

January 4, 2018, the DOJ suspended the Cole Memo and replaced it with a new Memorandum titled with the subject “Marijuana Enforcement”

from Attorney General Jeff Sessions which provides that each U.S. Attorney has the discretion to determine which types of cannabis-related

cases should be federally prosecuted, thus ending the broad safe harbor provided under the Cole Memo.

In

November 2018, Attorney General Sessions resigned and left the DOJ. As a nominee, Attorney General William Barr testified before the

U.S. Senate and wrote to Congress that, as Attorney General, he would not seek to prosecute cannabis companies that relied on the Cole

Memo and are complying with state law.

As

of April 25, 2019, 34 states, the District of Columbia and Guam allow their citizens to use medical cannabis through de-criminalization.

Within this list of jurisdictions, voters in the States of Alaska, California, Colorado, D.C., Maine, Massachusetts, Nevada, Oregon,

Vermont, and Washington have legalized cannabis for adult recreational use.

The

Company continues to follow and monitor the actions and statements of the Trump administration, the DOJ and Congress’ positions

on federal law and cannabis policy. As the possession and use of cannabis is illegal under the CSA, we could be deemed to be aiding and

abetting illegal activities through the equipment we intend to sell in the U.S. and directly violating federal law if we should begin

producing cannabis under State law. Under federal law, and more specifically the CSA, the possession, use, cultivation, and transfer

of cannabis is illegal. Our equipment could be used by persons or entities engaged in the business of possession, use, cultivation, and/or

transfer of cannabis.

As

a result, law enforcement authorities, in their attempt to regulate the illegal use of cannabis, could seek to bring an action or actions

against us, including, but not limited to, a claim of aiding and abetting another’s criminal activities or directly violating the

CSA. The federal aiding and abetting statute provides that anyone who “commits an offense against the United States or aids, abets,

counsels, commands, induces or procures its commission, is punishable as a principal” (18 U.S.C. §2(a).) Enforcement of federal

law regarding cannabis would likely result in the Company being unable to proceed with our business plans, could expose us to potential

criminal liability and could subject our properties to civil forfeiture which could lead to an entire loss of any investment in the Company.

Any changes in banking, insurance or other business services may also affect our ability to operate our business.

Although the

Company, from 2020 and going forward, intends to focus on plant-based opportunities, hemp businesses, and other ancillary industry companies, changes in the regulatory and legal environment could impact banking, financial,

and other business services crucial to the operations of the business.

Nothing

herein is a legal opinion or a complete or up to date statement on laws, regulations, or policies, especially given the shifting legal

and regulatory landscape.

Changes

in Business Operations

2023

was a continuation of our 2020 restructuring, reorganizing, and repositioning of the business. The Company believes it is positioned

to start executing its business strategy and leveraging the public company to create shareholder value. The recent long-term commitments

of the new management team coupled with a robust business network to support our business initiatives have laid the foundation for the

future. We will be working on branding and continuing to build our team in 2024, once we have our new plans funded.

The current business strategy is to position the Company as an integrated

consolidation platform for opportunities based on the management’s relationships and experience.

On

February 14, 2022, the Company announced a non-binding letter of intent with Electrum Partners, LLC (EP) to acquire certain assets of

EP for an aggregate payment at closing and of a purchase price that will be mutually agreed by the parties based on an independent valuation

of the purchased assets.

On

March 1, 2023, the Company announced an Asset Purchase agreement to acquire certain business assets, including the rights to further

develop business opportunities in various stages of due diligence

Intellectual

Property

The

Company relies on a strategy of a combination of patent law, trademark laws, trade secrets, confidentiality provisions and other contractual

provisions to protect our proprietary rights, which are primarily our brand names, product designs and marks. This does not mean these

efforts are up to date or fully effective. The following summarizes certain filings. The Company is currently studying the legal aspects

of these, including recent and past communications from counsel and the patent office, and makes no promise or representation as to this

information which is subject to correction and update.

The

Company’s primary trademark is “Indoor Harvest.” This trademark was registered (Registration Number 4,795,471) in the

United States on August 18, 2015.

The

Company filed a patent application (Serial Number 14/120,275) with the United States patent office related to an invention titled: “modular

aeroponic system and related methods.” The inventor is Chad Sykes, who assigned the patent application to the Company.

We

will research the status of our filings and restructure or update as needed this year.

Plan

of Expanded Operations

The

current business strategy is to position the Company as an integrated consolidation platform for plant-based industry companies focused

on hemp, other hemp-related products, CBD, and other plant-based companies with the potential to be part of a bigger opportunity while

sharing intellectual capital, technology, expanded business networks, along with access to new capital markets and liquidity for investors.

Sales

and Marketing

We

will be working on branding and building our team in 2023, once we have our new plans funded.

Competition

and Market Position

The

current business strategy is to position the Company as an integrated consolidation platform for plant-based industry companies focused

on hemp, other hemp-related products, CBD, and other plant-based companies with the potential to be part of a bigger opportunity while

sharing intellectual capital, technology, expanded business networks, along with access to new capital markets and liquidity for investors.

This may be done by asset acquisitions, mergers, joint ventures, or other strategic initiatives.

OTC

Markets

OTC

Markets offer small companies almost comparable benefits of the NYSE or Nasdaq markets, a liquid, secondary trading market, visibility,

access to capital, a public market valuation and the ability for small companies to build their brand and reputation across the network,

at nearly half the cost of an NYSE listing.

We

are positioning to compete with other plant-based and hemp related science and consumer product companies trading on the OTC Markets.

Employees

As

of December 31, 2023, we have 0 full-time employees and use a variety of advisors and consultants.

Governmental

Regulation and Certification

Except

as set forth below, we are not aware of any material governmental regulations or approvals for any of our products or services.

As

the possession and use of cannabis is illegal under the CSA, we could be deemed to be aiding and abetting illegal activities through

the equipment we intend to sell, lease and license in the U.S. to grow cannabis. Additionally, we would be violating federal law should

we begin to manufacture and dispense cannabis under the TCUP. Under federal law, and more specifically the CSA, the possession, use,

cultivation, and transfer of cannabis is illegal. Our equipment could be used by persons or entities engaged in the business of possession,

use, cultivation, and/or transfer of cannabis. As a result, law enforcement authorities, in their attempt to regulate the illegal use

of cannabis, could seek to bring an action or actions against us, including, but not limited, to a claim of aiding and abetting another’s

criminal activities or directly violating federal law by manufacturing or distributing cannabis. The federal aiding and abetting statute

provides that anyone who “commits an offense against the United States or aids, abets, counsels, commands, induces or procures

its commission, is punishable as a principal.” However, we do not believe that our plans to license and sell technology as described

herein violates federal law and we believe that we would prevail if any such action were brought against us although there can be no

assurance of this.

Cannabis

is a Schedule-I controlled substance and is illegal under federal law. Even in such states that have legalized the use of cannabis, its

use remains a violation of federal law. Since federal law criminalizing the use of cannabis preempts state laws that legalize its use,

strict enforcement of federal law regarding cannabis would likely result in our inability to proceed with our business plan, notably

with respect to our plans for cannabis cultivation, production and research. In addition, our assets, including real property, cash,

equipment and other goods, could be subject to asset forfeiture because cannabis is still illegal at the federal level should we begin

to manufacture and distribute cannabis under the TCUP.

In

February 2017, the Trump administration made announcements that there could be “greater enforcement” of federal laws regarding

cannabis. To this end, on January 4, 2018, the DOJ suspended certain Obama era protections set forth previously in the Cole Memo, as

such term is defined above, which was replaced with a new Memorandum titled with the subject “Marijuana Enforcement” from

Attorney General Jeff Sessions which provides that each U.S. Attorney has the discretion to determine which types of cannabis-related

cases should be federally prosecuted, thus ending the broad safe harbor provided under the Cole Memo. Any such enforcement actions could

have a material adverse effect on our business and results of operations. In November 2018, Attorney General Sessions resigned and left

the DOJ. As a nominee, Attorney General William Barr testified before the U.S. Senate and wrote to Congress that, as Attorney General,

he would not seek to prosecute cannabis companies that relied on the Cole Memo and are complying with state law. The Company plans to

continue to follow and monitor the actions and statements of the Trump administration, the DOJ and Congress’ positions on federal

law and cannabis policy.

The

regulatory environment on a Federal, State, and Local level remains opaque and ever changing. This aspect of business risk is in flux

and our disclosure should not be deemed a legal opinion or interpreted as fully addressing the myriad regulatory challenges inherent

in the industry.

Emerging

Growth Company Status

We

are an “emerging growth company” as defined in Section 2(a)(19) of the Securities Act, as modified by the Jumpstart Our Business

Startups Act of 2012 (the “JOBS Act”). As such, we are eligible to take advantage of certain exemptions from various reporting

requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited

to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley

Act”), reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions

from the requirements of holding a non-binding advisory vote on executive compensation and stockholder approval of any golden parachute

payments not previously approved. We intend to take advantage of all of these exemptions.

In

addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended

transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards, and delay

compliance with new or revised accounting standards until those standards are applicable to private companies. We have elected to take

advantage of the benefits of this extended transition period.

We

could be an emerging growth company until the last day of the first fiscal year following the fifth anniversary of our first common equity

offering, although circumstances could cause us to lose that status earlier if our annual revenues exceed $1.0 billion, if we issue more

than $1.0 billion in non-convertible debt in any three-year period or if we become a “large accelerated filer” as defined

in Rule 12b-2 under the Exchange Act.

Additional

Information

We

are a public company and file annual, quarterly and special reports and other information with the SEC. We are not required to, and do

not intend to, deliver an annual report to security holders. Our filings are available, at no charge, to the public at http://www.sec.gov.

The company’s website is www.indoorharvest.com,

ITEM

1A. Risk Factors.

We

are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

and are not required to provide the information under this item.

ITEM

1B. Unresolved Staff Comments.

Smaller

reporting companies are not required to provide the information required by this item.

Item

2. Properties.

Our

Offices

Our

headquarters are pending.

Item

3. Legal Proceedings.

From

time to time, the Company may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business.

Litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may

harm our business. The Company may be subject to one or more claims or suits but to our best and current knowledge, there are no current

suits at this time.

Item

4. Mine Safety Disclosures.

Not

applicable.

PART

II

Item

5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Trading

History

Our

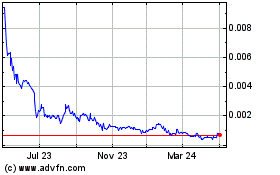

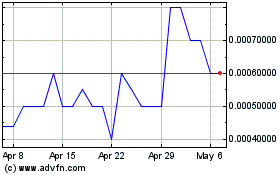

common stock is quoted on the OTC Markets under the symbol “INQD”. As of December 31, 2023, there were 3,105,704,056

outstanding shares of common stock and approximately 103 shareholders of record. The number of record holders was determined from

the records of our transfer agent and does not include beneficial owners of common stock whose shares are held in the names of bank,

brokers and other nominees.

Dividends

We

have not paid any cash dividends on our common stock to date. Any future decisions regarding dividends will be made by our Board of Directors.

We do not anticipate paying dividends in the foreseeable future but expect to retain earnings to finance the growth of our business.

Our Board of Directors has complete discretion on whether to pay dividends. Even if our Board of Directors decides to pay dividends,

the form, frequency and amount will depend upon our future operations and earnings, capital requirements and surplus, general financial

condition, contractual restrictions and other factors that the Board of Directors may deem relevant.

There

are no restrictions in our articles of incorporation or bylaws that prevent us from declaring dividends. The Texas Statutes, however,

prohibit us from declaring dividends where, after giving effect to the distribution of the dividend:

| |

● |

We

would not be able to pay our debts as they become due in the usual course of business; or |

| |

|

|

| |

● |

Our

total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of stockholders

who have preferential rights superior to those receiving the distribution, unless otherwise permitted under our articles of incorporation. |

Securities

Authorized for Issuance under Equity Compensation Plans

We

do not have in effect any compensation plans under which our equity securities are authorized for issuance.

Common

Stock

As

of December 31, 2023 and 2022, there were 3,105,704,056 and 2,693,190,084 shares of common stock issued and outstanding.

The

holders of our common stock have equal ratable rights to dividends from funds legally available if and when declared by our Board of

Directors and are entitled to share ratably in all of our assets available for distribution to holders of common stock upon liquidation,

dissolution or winding up of our affairs. Our common stock does not provide the right to a preemptive, subscription or conversion rights

and there are no redemption or sinking fund provisions or rights. Our common stockholders are entitled to one non-cumulative vote per

share on all matters on which stockholders may vote.

All

shares of common stock now outstanding are fully paid for and non-assessable. We refer you to our certificate of incorporation, bylaws

and the applicable statutes of the State of Texas for a more complete description of the rights and liabilities of holders of our securities.

Holders

of shares of our common stock do not have cumulative voting rights, which means that the holders of more than 50% of the outstanding

shares, voting for the election of directors, can elect all of the directors to be elected, if they so choose, and, in that event, the

holders of the remaining shares will not be able to elect any of our directors.

Holders

of Common Stock

We

have 103 shareholders of record for our common stock, as of December 31, 2023.

Preferred

Stock

The

Company has designated 15,000,000 shares of Series A Preferred Stock with a par value of $0.01.

The

stated value of each issued share of Series A Convertible Preferred Stock shall be deemed to be $1.00, as the same may be equitably adjusted

whenever there may occur a stock dividend, stock split, combination, reclassification or similar event affecting the Series A Convertible

Preferred Stock. There are no dividends payables on the Series A Convertible Preferred Stock. Each holder of outstanding shares of Series

A Convertible Preferred Stock shall be entitled to cast the number of votes for the Series A Convertible Preferred Stock in an amount

equal to the number of whole shares of common stock into which the shares of Series A Convertible Preferred Stock held by such holder

are convertible as of the record date for determining stockholders entitled to vote on such matter

The

Series A Preferred Stock also had a “down-round” protection feature provided to the investors if the Company subsequently

issued or sold any shares of common stock, stock options, or convertible securities at a price less than the conversion price of $1.00

per common share. The conversion price was automatically adjustable down to the price of the instrument being issued. As a result of

conversions during the year ended December 31, 2020, the Series A Preferred Stock conversion price was reset to $0.00006 per share.

As

of December 31, 2020, the 13 preferred shareholders holding 750,000 preferred shares can convert to 12.5 billion shares of common stock,

which was significantly more than the outstanding common stock at that time. As of December 31, 2020, there are currently 2,401,396,041

shares outstanding. The Company has increased its authorized shares to 10 billion shares in May of 2020, addressing the potential Company

control issue if conversion of all the preferred shares were to occur at the same time.

Upon

any liquidation, dissolution or winding-up of the Company under Texas law, whether voluntary or involuntary, the holders of the shares

of Series A Convertible Preferred Stock shall be paid an amount equal to the aggregate stated value of their shares of Series A Convertible

Preferred Stock, before any payment shall be paid to the holders of common stock, or any other stock ranking on liquidation junior to

the Series A Convertible Preferred Stock, an amount for each share of Series A Convertible Preferred Stock held by such holder equal

to the sum of the Stated Value thereof.

As

at December 31, 2020, there were 750,000 shares of Series A Convertible Preferred Stock issued and outstanding.

On

August 27, 2021, Indoor Harvest Corp (the “Company”) completed an initiative when it entered into a Modification Agreement

(the “Modification”) in cooperation with the current Series A Preferred shareholders to modify their conversion privileges

to align and support current management team initiatives and shareholder interests. The modification agreement provides the Preferred

shareholders the ability to convert into common shares at a conversion price at the lower of $0.40 (per the original agreement), or the

subsequent per share pricing of a future equity raise greater than Five Hundred Thousand ($500,000) Dollars. This Modification is forecasted

to support anti- dilutive measures potentially to the benefit of our shareholders and may allow the Company to proceed with plans relating

to funding needs.

On

November 8, 2021, the Company finalized a Supplemental agreement with the Series A Preferred shareholders to convert their holdings into

common shares of the Company at $0.0125 in alignment and support of the current management team’s initiatives with the goal of

benefiting shareholders. This agreement was pursued for the benefit of the Company’s common shareholders to mitigate the potential

risk of diluting their shareholding in the event that the Company undertakes additional financing transactions to fund the Company’s

expansion initiatives.

Pursuant

to the Preferred Shareholder’s Supplemental Agreement dated November 8, 2021 (the “Supplemental Agreement”) by and

between the Company and holders of its Series A Preferred shares, under which holders of the Series A Preferred shares agreed to convert

all of the Series A Preferred shares into common shares of the Company effective November 8, 2021, the Company has issued an aggregate

of sixty (60) million restricted common shares. The restricted common shares issued are subject to Rule 144 required holding periods.

Transfer

Agent and Registrar

VStock

Transfer, LLC at 18 Lafayette Place, Woodmere, New York 11598 is the registrar and transfer agent for our common stock. Their telephone

number is (212) 828-8436.

Warrants

There

are 761,003,846 million warrants outstanding as of December 31, 2023.

Options

There

are 1,024 million outstanding options to purchase our securities as of December 31, 2023. These options are held by the current management

team, board of directors, and consultants.

Recent

Sales of Unregistered Securities

During

the year ended December 31, 2022, we issued shares of our common stock that were not registered under the Securities Act, and were not

previously disclosed in a Current Report on Form 8-K or on a Quarterly Reports on Form 10-Q as follows:

During

the year ended December 31, 2021, the Company issued 174,513,889 shares of common stock as follows:

| |

● |

16,513,889

shares for conversion of debt of $35,875. |

| |

|

|

| |

● |

60,000,000

shares for conversion of 750,000 Series A Convertible Preferred stock |

| |

|

|

| |

● |

98,000,000

shares in private placement offerings |

During

the year ended December 31, 2022, the Company issued 117,280,154 shares of common stock as follows:

| |

● |

116,446,154

shares of common stock for the private placements at $0.005 and $0.0065 per share for cash of $600,000. |

| |

● |

834,000

shares for consulting service valued at $5,000. |

During

the year ended December 31, 2023, the Company issued 412,513,972 shares of common stock as follows:

| ● | 412,513,972

shares of common stock for the private placements at $0.0065, $0.005, $0.001, $0.000375 per share for cash of $1,212,911. |

Private

Placement

On

February 16, 2022 and March 16, 2022, the Company initiated a private placement offering for the sale of up to 150,000,000 shares of

the Company’s common stock, at price of $0.006 per share, for total consideration to the Company of $900,000. On May 12, 2022,

the issuance price was updated to $0.005 per share.

On

March 24, 2022, the Company entered into an agreement with F.E.A. Strategies Group, LLC. as advisory assistance on suitable investment

strategies to raise growth capital for the Company. The Company agreed to settle 50% of the advisory fee with 834,000 shares of restricted

common stock valued at $5,000 for services rendered.

On

August 1, 2022, the Company initiated a private placement offering for the sale of up to 123,076,923 shares of the Company’s common

stock, at price of $0.0065 per share and an equal number of Warrants with an exercise price of $0.013 for total consideration to the

Company of $800,000. On August 12, 2022 and November 9, 2022, the number of shares was updated to 153,846,154 (for total consideration

to the Company of $1,000,000) and 200,000,000 shares (for total consideration to the Company of $1,300,000) an equal number of Warrants

with an exercise price of $0.013, respectively.

During

the year ended December 31, 2023, in connection with the mentioned private placement offerings, the company received $1,258,911 in

cash proceeds. Out of the $1,258,911, there are $45,000 balances of shares to be issued.

As

of December 31, 2023, and 2022, there were 3,105,704,056 and 2,693,190,084 shares of Common Stock issued and outstanding, respectively.

We

relied upon Section 4(a)(2) of the Securities Act of 1933, as amended for the above issuances to U.S. citizens or residents. We believe

that Section 4(a)(2) of the Securities Act of 1933 was available because:

| |

● |

None

of these issuances involved underwriters, underwriting discounts or commissions. |

| |

|

|

| |

● |

Restrictive

legends were and will be placed on all certificates issued as described above. |

| |

|

|

| |

● |

The

distribution did not involve general solicitation or advertising. |

| |

|

|

| |

● |

The

distributions were made only to investors who were sophisticated enough to evaluate the risks of the investment. |

In

connection with the above transactions, although some of the investors may have also been accredited, we provided the following to all

investors:

| |

● |

Access

to all our books and records. |

| |

|

|

| |

● |

Access

to documents relating to our operations. |

| |

|

|

| |

● |

The

opportunity to obtain any additional information, including information relating to all of our agreements with third parties which

were only oral and not written, to the extent we possessed such information, and including all information necessary to verify the

accuracy of the information to which the investors were given access. |

Prospective

investors were invited to review at our offices at any reasonable hour, after reasonable advance notice, any materials available to us

concerning our business. Prospective Investors were also invited to visit our offices.

Item

6. Selected Financial Data.

Not

required.

Item

7. Management’s Discussion and Analysis Of Financial Condition and Results Of Operations.

The

discussion of our financial condition and results of operations and business and related within this document should be read in conjunction

with our financial statements and the related notes, and other financial information included in this filing. Our Management’s

Discussion and Analysis contains not only statements that are historical facts, but also statements that are forward-looking. Forward-looking

statements are, by their very nature, uncertain and risky. Consequently, and because forward-looking statements are inherently subject

to risks and uncertainties, the actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking

statements. You are urged to carefully review and consider the various disclosures made by us in this report as we attempt to advise

interested parties of the risks and factors that may affect our business, financial condition, and results of operations and prospects.

Forward-Looking

Statements

The

following discussion of our financial condition and results of operations should be read in conjunction with our audited financial statements

and the related notes, and other financial information included in this filing.

Our

Management’s Discussion and Analysis contains not only statements that are historical facts, but also statements that are forward-looking.

Forward-looking statements are, by their very nature, uncertain and risky. These risks and uncertainties include international, national,

and local general economic and market conditions; our ability to sustain, manage, or forecast growth; our ability to successfully make

and integrate acquisitions; new product development and introduction; existing government regulations and changes in, or the failure

to comply with, government regulations; adverse publicity; competition; the loss of significant customers or suppliers; fluctuations

and difficulty in forecasting operating results; change in business strategy or development plans; business disruptions; the ability

to attract and retain qualified personnel; the ability to protect technology; the risk of foreign currency exchange rate; and other risks

that might be detailed from time to time in our filings with the Securities and Exchange Commission.

You

are urged to carefully review and consider the various disclosures made by us in this report and in our other reports as we attempt to

advise interested parties of the risks and factors that may affect our business, financial condition, and results of operations and prospects.

Overview

The

current business strategy continues to be to position the Company as an integrated consolidation platform for plant-based industry companies

focused on hemp, other hemp-related products, CBD, and other plant-based businesses with the potential to be part of a bigger opportunity

while sharing intellectual capital, technology, expanded business networks, along with access to new capital markets and liquidity for

investors.

The

company spent the majority of 2021 reorganizing, restructuring, and repositioning the business. In 2022, those efforts have allowed the

company to begin moving forward on its business strategy of developing and acquiring operating businesses, beginning with the letter

of intent announced with Electrum Partners, LLC.

The

Company was funded through a convertible note structure from 2017 into 2019, which allowed the Company to keep being active while we restructure,

reposition and recapitalize the company. We continue to seek funding from other capital sources as we position the company for future

growth.

As

part of the restructuring and recapitalization effort, the Company plans to regularly increases the number of shares of common stock

the Company is authorized to issue. We believe this will enable the Company to raise additional capital by allowing funding sources to

be able to convert debt to shares, a common form of funding, and to utilize shares as currency for future M&A transactions or related

strategic initiatives.

Raising

new capital is critical to the Company going forward and is a primary focus to support the current acquisition and growth strategy.

The

current business strategy continues to be to position the Company as an integrated consolidation platform for plant-based industry companies

focused on hemp, other hemp-related products, CBD, and other plant-based businesses with the potential to be part of a bigger opportunity

while sharing intellectual capital, technology, expanded business networks, along with access to new capital markets and liquidity for

investors.

Our

operational expenditures will primarily focus on review of existing assets, vetting potential merger or acquisition targets and related

due diligence costs, as well as the necessary costs related to being a fully reporting company with the SEC.

On

March 5, 2020, The Company entered into a material definitive agreement with Fincann Corp., a New York corporation (the “Fincann”).

Fincann provides banking related strategies or solutions for the cannabis-related industry through a growing consortium of financial

institutions, to help marijuana-related businesses (MRBs) to access essential banking services without complicated workarounds.

On

February 14, 2022, the Company entered into a non-binding letter of intent with Electrum Partners, LLC (EP) to acquire certain assets

of EP for an aggregate payment at closing and of a purchase price that will be mutually agreed by the parties based on an independent

valuation of the purchased assets.

On

March 1, 2023, the Company announced an Asset Purchase agreement to acquire certain business assets, including intellectual property,

goodwill, and the rights to certain business opportunities in various stages of due diligence from EP.

On

April 12, 2023, the company’s board of directors approved to issue a convertible note of $312,500 with 20% discount, at rate of

6% per annum and maturity date shall be ninety days after issuance of note (April 12, 2023). The Company’s board of directors also

deems it in the best interest of the Company to issue to investor 31,250,000 shares of common stock with exercise price of $0.01 per

share subject to adjustment and for term of five years. Pursuant to the agreement, the Company obtained $180,500 in cash after distribution

attorney and brokers fees.

The

Company is in the process of establishing a headquarters.

We

are an “emerging growth company” (“EGC”) that is exempt from certain financial disclosure and governance requirements

for up to five years as defined in the Jumpstart Our Business Startups Act (“the JOBS Act”), that eases restrictions on the

sale of securities; and increases the number of shareholders a company must have before becoming subject to the SEC’s reporting

and disclosure rules. We have elected to use the extended transition period for complying with new or revised accounting standards under

Section 102(b)(2) of the JOBS Act, that allows us to delay the adoption of new or revised accounting standards that have different effective

dates for public and private companies until those standards apply to private companies. Because of this election, our financial statements

may not be comparable to companies that comply with public company effective dates.

Results

of Operations

The

following summary of our results of operations should be read in conjunction with our consolidated financial statements for the years

ended December 31, 2023 and 2022, which are included herein.

For

the year ended December 31, 2023 compared to the year ended December 31, 2022

Our

operating results for the years ended December 31, 2023 and 2022 and the changes between those periods for the respective items are summarized

as follows:

| | |

Years Ended | | |

| | |

| |

| | |

December 31, | | |

| | |

| |

| | |

2023 | | |

2022 | | |

Change | | |

% | |

| Revenue | |

$ | - | | |

$ | - | | |

$ | - | | |

| - | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Professional fees | |

| 1,566,940 | | |

| 1,567,352 | | |

| (412 | ) | |

| 0 | % |

| General and administrative expenses | |

| 400,473 | | |

| 1,803,461 | | |

| (1,402,988 | ) | |

| (78 | )% |

| Total operating expenses | |

| 1,967,414 | | |

| 3,370,813 | | |

| (1,403,399 | ) | |

| (42 | )% |

| Loss from operations | |

| (1,967,414 | ) | |

| (3,370,813 | ) | |

| 1,403,399 | | |

| (42 | )% |

| Other expense | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 3,373 | | |

| 7,216 | | |

| (3,843 | ) | |

| (53 | )% |

| Amortization of OID | |

| (312,500 | ) | |

| - | | |

| (312,500 | ) | |

| 100 | % |

| Interest Expense | |

| (360,788 | ) | |

| - | | |

| (360,788 | ) | |

| 100 | % |

| Impairment loss | |

| (624,289 | ) | |

| - | | |

| (624,289 | ) | |

| 100 | % |

| Total other expense | |

| (1,294,204 | ) | |

| 7,216 | | |

| 1,301,420 | | |

| 18035 | % |

| Net loss | |

$ | (3,261,618 | ) | |

$ | (3,363,597 | ) | |

$ | 101,979 | | |

| (3 | )% |

Revenues

During

the years ended December 31, 2023 and 2022, the Company generated no revenue.

Operating

Expenses

Total

operating expenses for the years ended December 31, 2023 and 2022 were $1,967,414 and $3,370,813 respectively, for an aggregate decrease

in expenses of $1,403,399 or 42%. The aggregate decrease is primarily related to General and Administrative Expenses.

Other

Expense

Total

other expense for the year ended December 31, 2023 and 2022 were $(1,294,204) and $7,216, for an increase of $1,301,420 or 18035%. The increase

was primarily related to the amortization of convertible notes discount of $312,500 and impairment loss of $624,289.

Net

Income

As

a result of the factors discussed above, net loss for the year ended December 31, 2023 was a loss of $3,261,618 as compared to a net loss

of $3,363,597 for the year ended December 31, 2022, which reflects a decrease of $101,979 or 3%.

Liquidity

and Capital Resources

The

following table provides selected financial data about our Company as of December 31, 2023 and December 31, 2022, respectively.

Working

Capital

| | |

December 31, | | |

December 31, | | |

| | |

| |

| | |

2023 | | |

2022 | | |

Change | | |

% | |

| Current assets | |

$ | 37,417 | | |

$ | 433,904 | | |

$ | (396,487 | ) | |

| (91 | )% |

| Current liabilities | |

$ | 1,327,085 | | |

$ | 233,378 | | |

$ | 1,093,707 | | |

| 469 | % |

| Working capital (deficiency) | |

$ | (1,289,667 | ) | |

$ | 200,526 | | |

$ | (1,490,193 | ) | |

| (743 | )% |

Cash

Flows

| | |

Years Ended | | |

| | |

| |

| | |

December 31, | | |

| | |

| |

| | |

2023 | | |

2022 | | |

Change | | |

% | |

| Cash used in operating activities | |

$ | (518,942 | ) | |

$ | (877,619 | ) | |

$ | 358,677 | | |

| (41 | )% |

| Cash used in investing activities | |

$ | (479,289 | ) | |

$ | (305,000 | ) | |

$ | (174,289 | ) | |

| 57 | % |

| Cash provided by financing activities | |

$ | 772,000 | | |

$ | 1,176,000 | | |

$ | (404,000 | ) | |

| (34 | )% |

| Net Change in Cash During Period | |

$ | (226,231 | ) | |

$ | (6,619 | ) | |

$ | (219,612 | ) | |

| 3318 | % |

As

of December 31, 2023, our Company’s cash balance was $0 and total assets were $37,417. As of December 31, 2022, our Company’s

cash balance was $226,231 and total assets were $578,904. The decrease in total assets was primarily the result of a decrease in financing

activities.

As

of December 31, 2023, our Company had total liabilities of $1,327,085, compared with total liabilities of $233,378 as at December

31, 2022. The increase in total liabilities was primarily related to accrued expense and issuance of convertible notes into fiscal

year end.

As

of December 31, 2023, our Company had a working capital deficiency of $1,289,667 compared with working capital of $200,526 as of December

31, 2022. The increase in working capital deficiency was primarily attributed to a decrease in financing activities and increase in cash used in investing activities.

Cash

Flow from Operating Activities

Net

cash used in operating activities for the year ended December 31, 2023 and 2022 were $(518,942) and $(877,619), respectively, for a

decrease of $358,677. The decrease in net cash used in operating activities is primarily related to business development activities and

operating expenses due to less activities in operations and decreased stock option compensation to advisors and directors.

Cash

Flow from Investing Activities

During

the year ended December 31, 2023 and 2022, the Company utilized $(479,289) and $(305,000), respectively, in investing activities.

Cash

Flow from Financing Activities

Net

cash provided by financing activities for the year ended December 31, 2023 and 2022 were $772,000 and $1,176,000, respectively, for an

decrease of $404,000. During the year December 31, 2023, the Company received $522,000 through private placements stock subscriptions.

During the year December 31, 2022, the Company received $1,176,000 through private placements

stock subscriptions.

Off-Balance

Sheet Arrangements

We

have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition,

changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that

is material to stockholders

Critical

Accounting Policies and Estimates

For

a discussion of our accounting policies and related items, please see the Notes to the Financial Statements, included in Item 8.

Item

7A. Quantitative and Qualitative Disclosures About Market Risk.

Not

required.

Item

8. Financial Statements and Supplementary Data.

The

consolidated financial statements and Reports of Independent Registered Public Accounting Firms are listed in the “Index to Consolidated

Financial Statements” on page F-1 and included on pages F-2 through F-23.

Item

9 – Changes in and Disagreements With Accountants on Accounting and Financial Disclosures.

On

November 15, 2019, the Company replaced Thayer O’Neal Company with WWC, P.C. as our independent principal accountant to audit the

Company’s financial statements.

Item

9A – Controls and Procedures.

Evaluation

of Disclosure Controls and Procedures

The

Company’s Chief Executive Officer (the principal executive officer and principal financial officer) have evaluated the effectiveness

of the Company’s disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act) as of

December 31, 2023. Based upon such evaluation, Chief Executive Officer (the principal executive officer and principal financial officer)

have concluded that, as of December 31, 2023, the Company’s disclosure controls and procedures were not effective.

Management’s

Report on Internal Control over Financial Reporting

Under

the supervision and with the participation of our management, including our Chief Executive Officer (the principal executive officer

and principal financial officer), we conducted an evaluation of the effectiveness of our internal control over financial reporting as

of December 31, 2023, based on the framework stated by the Committee of Sponsoring Organizations of the Treadway Commission’s 2013

Framework.

Our

management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined

in Rules 13a-15(f) and 15d-15(f) of the Exchange Act. Our internal control system was designed to provide reasonable assurance regarding

the reliability of financial reporting and the preparation of financial statements for external purposes, in accordance with generally

accepted accounting principles. Because of inherent limitations, a system of internal control over financial reporting may not prevent

or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls

may become inadequate due to change in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Based

on its evaluation as of December 31, 2023, our management concluded that our internal controls over financial reporting were not effective

as of December 31, 2023 due to the material weaknesses set forth below. A material weakness is a deficiency, or a combination of control

deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of

the Company’s annual or interim financial statements will not be prevented or detected on a timely basis.

Because

of the Company’s limited resources, there are limited controls over financial information processing. The Company determined that

its internal control over financial reporting was not effective as of December 31, 2023. The basis for the conclusions that such internal

control was ineffective included the following considerations:

| |

● |

We

currently have insufficient written policies and procedures for accounting and financial reporting with respect to the requirements

and application of US GAAP and SEC disclosure requirements. |

| |

|

|

| |

● |

Additionally,

there is a lack of formal process and timeline for closing the books and records at the end of each reporting period and such weaknesses

restrict the Company’s ability to timely gather, analyze and report information relative to the financial statements. |

| |

|

|

| |

● |

Our

Company’s management is composed of a small number of individuals resulting in a situation where limitations on segregation

of duties exist. |

Material

risks associated with the above issues include the following:

| |

● |

Because

the Company currently has insufficient written policies and procedures with regard to financial reporting, this could cause the Company

to be inefficient and potentially encounter errors in preparing its financial reports due to the lack of a written policy for the

company to follow. |

| |

|

|

| |

● |

Because

there is a lack of formal process and timeline, this cold lead the Company not to be able to timely prepare its financial statements

and could cause it to either file a report late or to a file a report which may contain some errors. |

| |

|

|

| |

● |

Because

the Company’s management is composed of a small number of persons, there is a lack of segregation of duties. |

This

report does not include an attestation report of the Company’s independent registered public accounting firm regarding internal

control over financial reporting. We were not required to have, nor have we, engaged the Company’s independent registered public

accounting firm to perform an audit of internal control over financial reporting pursuant to the rules of the Securities and Exchange

Commission that permit us to provide only management’s report in this annual report.

Changes

in Internal Controls over Financial Reporting

There

has been no change in our internal control over financial reporting identified in connection with the evaluation required by paragraph

(d) of Rule 13a-15 or 15d-15 under the Exchange Act that occurred during the quarter ended December 31, 2023 that has materially affected

or is reasonably likely to materially affect our internal control over financial reporting.

Item

9B. Other Information.

None.

PART

III

Item

10. Directors, Executive Officers and Corporate Governance.

The

following sets forth our Officers and Directors as of December 31, 2023. The Board of Directors elects our Executive Officers annually.

Our Directors shall be elected for the term of one year, and until their successors are elected and qualified, or until their earlier

resignation or removal. Our Officers also shall be elected for the term of one year, and until a successor is elected and qualified,

or until an earlier resignation or removal. Our Directors and Executive Officers are as follows:

| Name |

|

Position

|

|

Age

|

| Leslie

Bocskor |

|

Chief

Executive and Chief Financial Officer |

|

58 |

| |

|

|

|

|

| Keith

Crouch |

|

Director

|

|

47 |

| Michael

Blicharski |

|

Director

|

|

42

|

Effective

May 11, 2020, the Company (Registrant) mutually and amicably completed a change of officers, as to the principal accounting officer and

principal executive officer, the person serving in the capacity of interim CEO and interim CFO. Mr. Cook, serving as both up to such