UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

Check the appropriate box:

| ☐ | Preliminary

Information Statement |

| ☐ | Confidential,

for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| ☒ | Definitive

Information Statement |

ILUSTRATO PICTURES INTERNATIONAL, INC.

(Name of Registrant As Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee

paid previously with preliminary materials. |

| ☐ | Fee

computed on table in exhibit required by Item 25(b) of Schedule 14A (17 CFR 240.14a-101) per Item 1 of this Schedule and Exchange Act

Rules 14c-5(g) and 0-11 |

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Regulation

14C

of the Securities Exchange Act of 1934, as amended

ILUSTRATO PICTURES INTERNATIONAL, INC.

26 Broadway, Suite 934

New York, New York 10004

(917) 522-3202

March 4, 2024

WE ARE

NOT ASKING YOU FOR A PROXY AND

YOU

ARE REQUESTED NOT TO SEND US A PROXY

NOTICE IS HEREBY GIVEN that, on February 19, 2024,

the members of the board of directors of Ilustrato Pictures International, Inc., a Nevada corporation (the “Company,” “we”

or “us”), and on February 19, 2024, the holders of approximately 93.5% of the voting stock (the “Consenting Shareholders”)

of the Company, approved an amendment to our Articles of Incorporation (the “Amendment”) described below without a meeting

of shareholders, in accordance with the Nevada Revised Statutes. The Amendment will increase the authorized share capital of the Company

from 2,000,000,000 shares of common stock, $0.001 par value per share (the “Common Stock”) to 3,500,000,000 shares of Common

Stock. The authorized number of preferred shares is not affected by the Amendment.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE

REQUESTED NOT TO SEND US A PROXY.

No action is required by you. The enclosed

Information Statement is being furnished to all holders of record of the shares of the Common Stock of the Company, as of the close of

business on the record date, February 19, 2024 (the “Record Date”).

Section 78.320 of the Nevada Revised Statutes

provides that any action required to be taken at any annual or special meeting of stockholders of a corporation, or any action which may

be taken at any annual or special meeting of such stockholders, may be taken without a meeting, without prior notice and without a vote,

if a consent or consents in writing, setting forth the action so taken, shall be signed by the holders of outstanding stock, having not

less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled

to vote thereon were present and voted. Because the Consenting Stockholders have voted in favor of the Amendment and have sufficient voting

power to approve the increase in authorized share capital, no other stockholder consents will be solicited in connection with the Amendment

described in this Information Statement. The Board is not soliciting your proxy, and proxies are not requested from stockholders.

On the Record Date, there were 1,864,531,857 shares

of Common Stock outstanding. The Company also has the following shares of Preferred Stock:

| (i) | 10,000,000

Class A shares authorized and issued, with voting rights of 500 shares of Common Stock for every one Class A share; |

| (ii) | 100,000,000

Class B shares authorized and 4,064,000 issued, with voting rights of 100 shares of Common Stock for every one Class B share; |

| (iii) | 10,000,000

Class C shares authorized and 0 issued, with voting rights of 100 shares of Common Stock for every one Class C share; |

| (iv) | 60,741,000

Class D shares authorized and issued, with voting rights of 100 shares of Common Stock for every Class D share; |

| (v) | 5,000,000

Class E shares authorized and 3,172,175 issued, with no voting rights; and |

| (vi) | 50,000,000

Class F shares authorized and 1,065,750 issued, with no voting rights. |

The purpose of the Information Statement is to

notify our shareholders that the Amendment has been approved by the Consenting Shareholders. You are urged to read the Information Statement

in its entirety for a description of the actions taken by the Consenting Shareholders of the Company. The Amendment will become

effective on a date that is not earlier than twenty-one (21) calendar days after this Information Statement is first mailed to our shareholders.

This Information Statement is being mailed on

or about March 4, 2024 to shareholders of record on the Record Date. We have asked or will ask brokers and other custodians, nominees,

and fiduciaries to forward this Information Statement to the beneficial owners of our common stock held of record by such persons.

THIS

IS NOT A NOTICE OF A MEETING OF SHAREHOLDERS AND NO SHAREHOLDERS’ MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

| |

Sincerely, |

| |

|

| |

/s/ Nicolas Link |

| |

Nicolas Link |

| |

Chief Executive Officer |

ILUSTRATO PICTURES INTERNATIONAL, INC.

26 Broadway, Suite 934

New York, New York 10004

(917) 522-3202

INFORMATION STATEMENT

PURSUANT TO SECTION 14(C)

OF THE SECURITIES EXCHANGE ACT OF 1934

AND RULE 14C-2 THEREUNDER

NO VOTE OR OTHER ACTION OF THE COMPANY’S

SHAREHOLDERS IS REQUIRED IN

CONNECTION WITH THIS INFORMATION STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

This Information Statement is being furnished

to the holders of record of the shares of the common stock, with a par value of $0.001 per share (the “Common Stock”), of

Ilustrato Pictures International, Inc., a Nevada corporation (the “Company”), as of the close of business on the record date,

February 19, 2024 (the “Record Date”). The purpose of the Information Statement is to notify our shareholders that on February

19, 2024, the Company received the written consent in lieu of a meeting (the “Board Consent”) from the members of the board

of directors of the Company (the “Board”) and on February 19, 2024, the Company received a written consent in lieu of a meeting

from the holders of approximately 93.5% of the voting stock (the “Consenting Shareholders”) of the Company.

The Board and the Consenting Shareholders adopted

resolutions that authorized an amendment (“Amendment”) to the Company’s Articles of Incorporation (the “Articles”)

to effect an increase in the authorized share capital of the Company from 2,000,000,000 shares of common stock, $0.001 par value per share

(the “Common Stock”) to 3,500,000,000 shares of Common Stock (the “Authorized Share Increase”).

The Authorized Share Increase will become effective

on a date that is not earlier than twenty-one (21) calendar days after this Information Statement is first mailed to our shareholders.

Because the Consenting Shareholders have voted

in favor of the Authorized Share Increase, and have sufficient voting power to approve such actions, no other consents will be solicited

in connection with the transactions described in this Information Statement. The Board is not soliciting proxies in connection with the

adoption of these actions, and proxies are not requested from shareholders.

This Information Statement is being mailed on

or about March 4, 2024 to shareholders of record on the Record Date. We have asked or will ask brokers and other custodians, nominees

and fiduciaries to forward this Information Statement to the beneficial owners of our common stock held of record by such persons.

Section 78.320 of the Nevada Revised Statutes

provides that any action required to be taken at any annual or special meeting of stockholders of a corporation, or any action which may

be taken at any annual or special meeting of such stockholders, may be taken without a meeting, without prior notice and without a vote,

if a consent or consents in writing, setting forth the action so taken, shall be signed by the holders of outstanding stock, having not

less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled

to vote thereon were present and voted. Because the Consenting Stockholders have voted in favor of the Amendment and have sufficient voting

power to approve the Authorized Share Increase, no other stockholder consents will be solicited in connection with the Amendment described

in this Information Statement. The Board is not soliciting your proxy, and proxies are not requested from stockholders.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE

REQUESTED NOT TO SEND US A PROXY

SUMMARY INFORMATION

The purpose of the Amendment is to effect the

Authorized Share Increase. The following Summary Information regarding the Amendment. This summary does not contain all of the information

that may be important to you. You should read in their entirety this Information Statement and the other documents included or referred

to in this Information Statement in order to fully understand the matters discussed in this Information Statement.

| Why am I receiving this Information Statement? |

It is for your information only. The Authorized

Share Increase was approved on February 19, 2024, by written consent of the Board, and on February 19, 2024, by written consent of the

Consenting Shareholders. Under these circumstances, federal securities laws require us to furnish you with this Information Statement

at least 21 calendar days before effecting the action.

|

| Who is Entitled to Notice? |

Each holder of record of outstanding shares of

our Common Stock on the Record Date is entitled to notice of the actions taken pursuant to the written consent of the shareholders.

|

| Why Did the Company Seek Shareholder Approval? |

The approval of a majority of the voting power

of the shareholders of the Company is required to approve the Amendment in order to implement the Authorized Share Increase pursuant to

Section 78.390 of the Nevada Revised Statutes.

|

| Why was the Amendment adopted? |

The Amendment was adopted for the purpose of increasing

the authorized shares of Common Stock. The Amendment was approved by the Company for the reasons and benefits described below.

|

|

Am I being asked to approve the

Authorized Share Increase? |

No. The Authorized Share Increase has already

been approved by the holders of a majority of our voting power and the unanimous written consent of our Board of Directors. No further

shareholder approval is required.

|

| What will the Amendment do? |

Our Articles of Incorporation authorizes for issuance 2,000,000,000 shares of Common Stock, of which 1,864,531,857 shares of Common Stock are outstanding as of the Record Date. The Amendment will increase our authorized capital stock from 2,000,000,000 to 3,500,000,000 shares of Common Stock. |

AUTHORIZED SHARE INCREASE

The Company is currently authorized to issue up

to 2,000,000,000 shares of Common Stock, and 235,741,000 shares of Preferred Stock, of which 10,000,000 are designed as Class A,

100,000,000 shares as Class B, 10,000,000 shares as Class C, 60,741,000 as Class D, 5,000,000 as Class E and 50,000,000 as Class

F.

As of the Record Date, we had 1,864,531,857 shares

of Common Stock issued and outstanding and 10,000,000 shares of Class A issued and outstanding, 4,064,000 Class B issued and outstanding,

0 Class C issued and outstanding, 60,741,000 Class D issued and outstanding, 3,172,175 Class E issued and outstanding and 1,605,750 Class

F issued and outstanding.

The Amendment will not affect the terms of the

outstanding Common Stock or the rights of the holders of the Common Stock.

The purpose of the Authorized Share Increase is

to make available additional shares of Common Stock for issuance of all the current obligations of the Company to issue Common Stock,

including the outstanding convertible securities, and for general corporate purposes without the requirement of further action by the

shareholders of the Company. The Class A preferred stock is convertible by the holder thereof on the basis of three to one – if

the holder would convert all the outstanding shares of Class A to common stock, we would need to issue 30,000,000 shares of common stock.

The Class B and Class F are convertible on the basis of hundred to one – if the holders would convert all the outstanding shares

of Class B and Class F, we would need to issue 566,975,000 shares of common stock. The Class D is convertible at the rate of five hundred

to one – we would need to issue 30,370,500,000 shares of common stock. If the holders of outstanding convertible debentures would

convert to common stock, we would need approximately 146,533,661 shares of common stock, and if the holders of outstanding warrants would

convert to common stock, we would need approximately an additional 50,850,000 shares of common stock.

Following the Authorized Share Increase, the Company

intends to treat shareholders holding the Common Stock in “street name,” through a bank, broker or other nominee, in the same

manner as registered shareholders whose shares are registered in their names. Shareholders who hold their shares with such a bank, broker

or other nominee and who have any questions in this regard are encouraged to contact their nominees.

Certain Risk Factors Associated with the Authorized Share Increase

In evaluating the Authorized Share Increase, the

Board also took into consideration negative factors associated with authorized share increases. These factors included the negative perception

of authorized share increases by some investors, analysts and other stock market participants, as well as various other risks and uncertainties

that surround the implementation of an authorized share increase, including the risk that there can be no assurance that the market price

per share of the Common Stock after the Authorized Share Increase will remain unchanged. In the long term the price per share depends

on many factors, including our performance, prospects and other factors, some of which are unrelated to the number of shares outstanding.

If the Authorized Share Increase is consummated and the trading price of the Common Stock declines, the percentage decline as an absolute

number and as a percentage of the Company’s overall market capitalization may be greater than would occur in the absence of the

Authorized Share Increase. The history of similar authorized share increases for companies in similar circumstances is varied.

Upon the Authorized Share Increase, the Company

will have the ability to issue additional shares of Common Stock. This will result in the dilution of the ownership interests of our then

current stockholders. In addition to issuing shares of Common Stock to the holders of outstanding convertible debentures and preferred

stock, we will have the ability to issue shares of stock in connection with hiring or retaining employees or consultants, future acquisitions,

futures sales for capital raising or for other business purposes. The future issuance of any addition shares of our Common Stock may create

downward pressure on the trading price of the Common Stock. We may need to raise additional capital in the near future to meet our working

capital needs, and there can no assurance that we will not be required to issue additional shares, warrants or other convertible securities

in the future in conjunction with the capital raising efforts, including at a price (or exercise prices) below the price you paid for

your stock.

The Board, however, has determined that the potential

benefit of the Authorized Share Increase outweighs the potential disadvantages associated with the increase in the authorized shares of

Common Stock. The Board believes that such increase is necessary so that the holders of outstanding securities can convert and obtain

shares of Common Stock. would provide greater flexibility to pursue corporate transactions and relationships which have the potential

to facilitate the Company’s growth and development and its ability to compete successfully. If we fail to facilitate growth and

development, we may not be able to generate revenues or achieve profitability, and our shareholders may lose their entire investment in

us.

The text of the proposed Amendment which

contains the Authorized Share Increase is attached hereto as Appendix A.

Appraisal Rights

Under the Nevada Revised Statutes, our shareholders are not entitled

to dissenters’ or appraisal rights with respect to the proposed Authorized Share Increase and the change to our Articles of Incorporation

and we will not independently provide our shareholders with any such rights.

THE AMENDMENT TO OUR ARTICLES OF INCORPORATION

HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION, NOR HAS THE SECURITIES AND EXCHANGE COMMISSION PASSED

UPON THE FAIRNESS OR MERIT OF THE AMENDMENT NOR UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED IN THIS INFORMATION STATEMENT

AND ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The

table below provides information regarding the beneficial ownership of our Common Stock as of February 19, 2024, of (i) our sole director

Nicolas Link, (ii) each of Nicolas Link, John-Paul Backwell and Krishnan Krishnamoorthy and Carsten Kjems Falk (the named executive officers),

(iii) all of our current directors and executive officers as a group, and (iv) each person (or group of affiliated persons) known to us

who owns more than 5% of our outstanding Common Stock.

The

beneficial ownership of our Common Stock is determined in accordance with the rules of the SEC. Under these rules, a person is deemed

to be a beneficial owner of a security if that person directly or indirectly has or shares voting power, which includes the power to vote

or to direct the voting of the security, or investment power, which includes the power to dispose of or to direct the disposition of the

security. The person is also deemed to be a beneficial owner of any security of which that person has a right to acquire beneficial ownership

within 60 days. Under the SEC rules, more than one person may be deemed to be a beneficial owner of the same securities, and a person

may be deemed to be a beneficial owner of securities as to which he or she may not have any pecuniary interest.

The

percentage of shares of Common Stock beneficially owned is based on 1,864,531,857 shares of Common Stock outstanding as of February 19,

2024.

Unless

otherwise indicated below each person has sole voting and investment power with respect to the shares beneficially owned.

| Name and address of Beneficial Owner |

Title of Class |

Number of Shares Beneficially Owned |

Percentage of Class |

| |

5% or greater stockholders |

|

|

|

FB Technologies Global, Inc.(1)

Dubai, U.A.E. |

Common Stock

Class A Preferred(2)

Class B Preferred(2)

Class D Preferred(2) |

4,000,000

10,000,000

3,560,000

60,629,000 |

Less than 1%

100%

87.6%

99.8% |

| |

Directors and Named Executive Officers |

|

|

|

Nicolas Link(1)

Dubai, U.A.E. |

Class F Preferred(3) |

250,000 |

15.6% |

|

John-Paul Backwell

Cheshire, U.K. |

Class F Preferred(3) |

200,000 |

12.5% |

|

Krishnan Krishnamoorthy

Dubai, U.A.E. |

Class F Preferred(3) |

35,000 |

2.1% |

|

Carsten Kjems Falk

Frederiksberg, Denmark |

Class F Preferred(3) |

25,000 |

1.5% |

| Louise Bennett |

Class F Preferred(3) |

200,000 |

12.5% |

| |

All officers and directors as a group (5 persons)(4) |

74,864,000 |

93.5% |

| (1) |

Nicolas Link, the Chairman of the Board of the Company and principal executive officer, has sole voting and dispositive power of such shares. |

| (2) |

The Class A Preferred Stock vote on a 500 to 1 basis and are convertible on the basis of 3 to 1; the Class B Preferred Stock vote and convert on a 100 to 1 basis and the Class D Preferred Stock vote and convert on a 500 to 1 basis. |

| (3) |

The holders of Class F Preferred Stock do not have voting rights but can convert on a 100 to 1 basis. |

| (4) |

Total percentage voting rights for all officers and directors as a group. |

DISTRIBUTION AND COST

We will pay all costs associated with the distribution

of this Information Statement, including the costs of printing and mailing. If hard copies of the materials are requested, we will send

only one Information Statement and other corporate mailings to shareholders who share a single address unless we received contrary instructions

from any shareholder at that address. This practice, known as “householding”, is designed to reduce our printing and postage

costs. However, the Company will deliver promptly upon written or oral request a separate copy of this Information Statement to a shareholder

at a shared address to which a single copy of this Information Statement was delivered. You may make such a written or oral request by

sending a written notification stating (a) your name, (b) your shared address, and (c) the address to which the Company should direct

the additional copy of this Information Statement, to Ilustrato Pictures International, Inc. at the address above. Additionally, if current

shareholders with a shared address received multiple copies of this Information Statement or other corporate mailings and would prefer

the Company to mail one copy of future mailings to shareholders at the shared address, notification of such request may also be made in

the same manner by mail or telephone to the Company’s principal executive offices.

INCORPORATION BY REFERENCE

The SEC allows us to “incorporate by reference”

information into this Information Statement, which means that we can disclose important information to you by referring you to other documents

that we have filed separately with the SEC. The information incorporated by reference is deemed to be part of this Information

Statement. This Information Statement incorporates by reference the following documents:

| 1. | Our Amendment No. 6 to General Form for Registration of Securities

on Form 10, filed with the SEC on December 13, 2023; |

| 2. | Our Quarterly Report on Form 10-Q for the quarter ended September

30, 2023, filed with the SEC on November 24, 2023; |

| 3. | Our Quarterly Report on Form 10-Q/A for the quarter ended

June 30, 2023, filed with the SEC on September 13, 2023; |

| 4. | Our Current Report on Form 8-K filed with the SEC on August

25, 2023; |

| 5. | Our Quarterly Report on Form 10-Q for the quarter ended June

30, 2023, filed with the SEC on August 21, 2023; |

| 6. | Our Current Report on Form 8-K filed with the SEC on August

4, 2023; and |

| 7. | Our Quarterly Report on Form 10-Q for the quarter ended March

31, 2023, filed with the SEC on May 22, 2023. |

WHERE

YOU CAN FIND MORE INFORMATION

You may read and copy any reports, statements

or other information filed by us at the public reference facilities maintained by the SEC in Room 1590, 100 F Street, N.E.,

Washington, D.C. 20549. The SEC maintains a website that contains reports, proxy and information statements and other information,

including those filed by us, at http://www.sec.gov. You may also access the SEC filings and obtain other information about us through

the website, which is https://www.otcmarkets.com/stock/ILUS. The information contained on the website is not incorporated by reference

in, or in any way part of, this Information Statement.

OTHER MATTERS

The Board knows of no other matters other than

those described in this Information Statement which have been approved or considered by the holders of a majority of the shares of the

Company’s voting stock.

IF YOU HAVE ANY QUESTIONS REGARDING THIS INFORMATION

STATEMENT, PLEASE CONTACT:

Ilustrato Pictures International, Inc.

26 Broadway, Suite 934

New York, New York 10004

(917) 522-3202

Email: ir@ilus-group.com

Attn: Corporate Secretary

PLEASE NOTE THAT THIS IS NOT A REQUEST FOR

YOUR VOTE OR A PROXY STATEMENT, BUT RATHER AN INFORMATION STATEMENT DESIGNED TO INFORM YOU OF CERTAIN TRANSACTIONS ENTERED INTO BY THE

COMPANY.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE

REQUESTED NOT TO SEND US A PROXY.

| |

By Order of the Board of Directors |

| |

|

| |

/s/ Nicolas Link |

| |

Nicolas Link |

| |

Chief Executive Officer |

Exhibit

A

ATTACHMENT TO

ARTICLES OF AMENDMENT

TO

ARTICLES OF INCORPORATION

OF

ILUSTRATO PICTURES INTERNATIONAL, INC.

Article IV of the Articles of Incorporation of

this corporation is hereby amended so that, as amended, the first sentence of said Article shall be read as follows:

ARTICLE IV SHARES:

The amount of our authorized capital

stock shall consists of three billion and five hundred million (3,500,000,000) shares of Common Stock, $0.001 par value per share,

and two hundred thirty-five million seven hundred forty one thousand (235,741,000) shares of Preferred Stock, $0.001 par value per share.

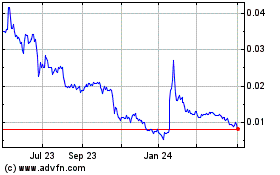

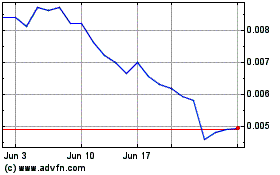

Ilustrato Pictures (PK) (USOTC:ILUS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ilustrato Pictures (PK) (USOTC:ILUS)

Historical Stock Chart

From Nov 2023 to Nov 2024