UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q/A

(Amendment No. 1)

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

For the quarterly period ended September 30, 2015 |

|

or |

| |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

Commission File Number: 333-192156

World Media & Technology Corp.

(Exact Name of Registrant as Specified in its Charter)

Nevada | | 46-1204713 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| | |

600 Brickell Ave., Suite 1775, Miami, Florida | | 33131 |

(Address of Principal Executive Offices) | | (Zip Code) |

Registrant's telephone number including area code: (347) 717-4966

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files. Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | ¨ |

Non-accelerated filer | ¨ | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Applicable Only to Corporate Issuers:

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date:

Class | | Outstanding as of March 11, 2016 |

Common Stock, $0.001 par value | | 28,581,000 |

EXPLANATORY NOTE

The sole purpose of this amendment to our Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2015, originally filed with the Securities and Exchange Commission on March 11, 2016 (the "Original Form 10-Q"), is to furnish the exhibits required by Item 601(b)(101) (Interactive Data File) of Regulation S-K. No other changes have been made to the Original Form 10-Q and the Original Form 10-Q has not been updated to reflect events occurring subsequent to the original filing date.

WORLD MEDIA & TECHNOLOGY CORP.

TABLE OF CONTENTS

| | Page |

| PART I - FINANCIAL INFORMATION | |

| | |

Item 1. | Financial Statements. | 3 |

Item 2. | Management's Discussion and Analysis of Financial Condition and Results of Operations. | 4 |

Item 3. | Quantitative and Qualitative Disclosures About Market Risk. | 9 |

Item 4. | Controls and Procedures. | 9 |

| | |

| PART II - OTHER INFORMATION | |

| | |

Item 1. | Legal Proceedings. | 10 |

Item 1A. | Risk Factors. | 10 |

Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds. | 10 |

Item 3. | Defaults Upon Senior Securities. | 10 |

Item 4. | Mine Safety Disclosures. | 10 |

Item 5. | Other Information. | 10 |

Item 6. | Exhibits. | 11 |

SIGNATURES | | 12 |

PART 1 – FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

WORLD MEDIA & TECHNOLOGY CORP.

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTH PERIODS ENDED SEPTEMBER 30, 2015

AND

THE THREE MONTH PERIOD ENDED SEPTEMBER 30, 2014

AND

THE PERIOD FROM MAY 2014 (INCEPTION) TO SEPTEMBER 30, 2014

(Unaudited)

Index to the Financial Statements

Contents | | Page |

| | | |

Condensed Consolidated Balance Sheets at September 30, 2015 (unaudited) and December 31, 2014 (As restated) (unaudited) | | F-1 |

| | | |

Condensed Consolidated Statements of Operations for the Three and Nine Month Periods Ended September 30, 2015, the Three Month Period Ended September 30, 2014, and the Period from May 2014 (Inception) to September 30, 2014 (unaudited) | | F-2 |

| | | |

Condensed Consolidated Statement of Changes in Stockholders' Equity (Deficit) for the Period from May 2014 (Inception) to December 31, 2014 (as restated) and the Nine Month Period Ended September 30, 2015 (unaudited) | | F-3 |

| | | |

Condensed Consolidated Statements of Cash Flows for the Nine Month Period Ended September 30, 2015 (unaudited) and the Period from May 2014 (Inception) to September 30, 2014 (unaudited) | | F-4 |

| | | |

Notes to the Condensed Consolidated Unaudited Financial Statements | | F-5 |

WORLD MEDIA & TECHNOLOGY CORP.

(FORMERLY HALTON UNIVERSAL BRANDS INC.)

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

| | | September 30, 2015 | | | December 31, 2014 | |

| | | | | | (As restated) | |

ASSETS |

|

Current Assets | | | | | | |

Cash and cash equivalents | | $ | 3,019,028 | | | $ | 54 | |

Accounts receivable | | | 357,752 | | | | - | |

Deposits with suppliers | | | 121,171 | | | | 340,226 | |

| | | | | | | | | |

Current Assets | | | 3,497,951 | | | | 340,280 | |

| | | | | | | | | |

Total Assets | | $ | 3,497,951 | | | $ | 340,280 | |

| | | | | | | | | |

LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) |

| | | | | | | | | |

Current Liabilities | | | | | | | | |

Accounts payable and Accrued Liabilities | | | 40,107 | | | | 950 | |

Customer deposits | | | 100,235 | | | | - | |

Payable to related parties | | | 1,130,100 | | | | 925,388 | |

| | | | | | | | | |

Total current liabilities | | | 1,270,442 | | | | 926,338 | |

| | | | | | | | | |

Stockholders' Equity (Deficit) | | | | | | | | |

Net Common stock, $0.001 par value; 75,000,000 shares authorized, 28,581,000 and 15,220,000 shares issued and outstanding as of September 30, 2015 and December 31, 2014 respectively. | | | 28,581 | | | | 15,220 | |

Additional paid in capital | | | 5,651,973 | | | | 1,984,834 | |

Subscription due from parent company | | | - | | | | (2,000,000 | ) |

Accumulated (deficit) | | | (3,453,045 | ) | | | (586,112 | ) |

Total Shareholders' Equity (Deficit) | | | 2,227,509 | | | | (586,058 | ) |

| | | | | | | | | |

Total Liabilities and Stockholders' Equity (Deficit) | | $ | 3,497,951 | | | $ | 340,280 | |

See Accompanying Notes to Condensed Consolidated Unaudited Financial Statements

WORLD MEDIA & TECHNOLOGY CORP.

(FORMERLY HALTON UNIVERSAL BRANDS INC.)

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | Three months ended September 30, 2015 | | | Three months ended September 30, 2014 | | | Nine months ended September 30, 2015 | | | Period from May 2014 (Inception) to September 30, 2014 | |

| | | | | |

Revenues | | | | | | | | | | | | |

Airtime | | $ | 418,329 | | | $ | - | | | $ | 418,329 | | | $ | - | |

Product Sales | | | 612,500 | | | | | | | | 612,500 | | | | | |

| | | | 1,030,829 | | | | - | | | | 1,030,829 | | | | - | |

| | | | | | | | | | | | | | | | | |

Cost of goods sold | | | (792,607 | ) | | | - | | | | (792,607 | ) | | | - | |

Gross Margins | | | 238,222 | | | | - | | | | 238,222 | | | | - | |

| | | | | | | | | | | | | | | | | |

Operating expenses: | | | | | | | | | | | | | | | | |

Management fees – related party | | | 360,000 | | | | - | | | | 360,000 | | | | - | |

Sales and general administrative | | | (180,508 | ) | | | - | | | | 258,790 | | | | - | |

Research & development expenses | | | 36,790 | | | | 141,797 | | | | 1,066,025 | | | | 432,782 | |

Total operating expenses | | | 216,282 | | | | 141,797 | | | | 1,684,815 | | | | 432,782 | |

| | | | | | | | | | | | | | | | | |

Net Operating Income (Loss) | | | 21,940 | | | | (141,797 | ) | | | (1,446,593 | ) | | | (432,782 | ) |

| | | | | | | | | | | | | | | | | |

Loss from equity investments | | | (22,000 | ) | | | - | | | | (52,323 | ) | | | - | |

Interest Income | | | 5,028 | | | | - | | | | 8,191 | | | | - | |

Impairment of equity method investments | | | (1,376,208 | ) | | | - | | | | (1,376,208 | ) | | | - | |

Net income (loss) | | $ | (1,371,240 | ) | | $ | (141,797 | ) | | $ | (2,866,933 | ) | | $ | (432,782 | ) |

| | | | | | | | | | | | | | | | | |

Weighted average shares outstanding | | | 28,581,000 | | | | 7,095,000 | | | | 22,291,804 | | | | 7,095,000 | |

Net loss per share - Basic and fully diluted | | | (0.05 | ) | | | (0.02 | ) | | | (0.13 | ) | | | (0.06 | ) |

See Accompanying Notes to Condensed Consolidated Unaudited Financial Statements

WORLD MEDIA & TECHNOLOGY CORP.

(FORMERLY HALTON UNIVERSAL BRANDS INC.)

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS' EQUITY (DEFICIT)

| | | | | | | | | Additional | | | Subscription | | | Accumulated | | | | |

| | | Common stock issued | | | paid-in | | | due from | | | Surplus | | | | |

| | | Shares | | | Amount | | | Capital | | | Parent | | | (Deficit) | | | Total | |

| | | | | | | | | | | | | | | | | | | |

Balance at May 5, 2014, Inception | | | 7,095,000 | | | $ | 7,095 | | | $ | (7,095 | ) | | $ | - | | | $ | - | | | $ | - | |

Recapitalization of WRMT | | | 125,000 | | | | 125 | | | | (71 | ) | | | | | | | | | | | 54 | |

Share subscription payable by parent on acquisition | | | 8,000,000 | | | | 8,000 | | | | 1,992,000 | | | | | | | | | | | | 2,000,000 | |

Share subscription due from parent | | | | | | | | | | | | | | | (2,000,000 | ) | | | | | | | (2,000,000 | ) |

Net operating loss for period | | | | | | | | | | | | | | | | | | | (586,112 | ) | | | (586,112 | ) |

Balance at December 31, 2014 | | | 15,220,000 | | | $ | 15,220 | | | $ | 1,984,834 | | | $ | (2,000,000 | ) | | $ | (586,112 | ) | | $ | (586,058 | ) |

Shares issued for cash | | | 12,000,000 | | | | 12,000 | | | | 2,988,000 | | | | | | | | | | | | 3,000,000 | |

Cash received from parent for subscription due | | | | | | | | | | | | | | | 2,000,000 | | | | | | | | 2,000,000 | |

Shares issued as partial consideration for equity method investment in PayNovi Limited | | | 1,361,000 | | | | 1,361 | | | | 679,139 | | | | | | | | | | | | 680,500 | |

Net loss for period | | | | | | | | | | | | | | | | | | | (2,866,933 | ) | | | (2,866,933 | ) |

Balance at September 30, 2015 | | | 28,581,000 | | | $ | 28,581 | | | $ | 5,651,973 | | | $ | - | | | $ | (3,453,045 | ) | | $ | 2,227,509 | |

See Accompanying Notes to Condensed Consolidated Unaudited Financial Statements

WORLD MEDIA & TECHNOLOGY CORP.

(FORMERLY HALTON UNIVERSAL BRANDS INC.)

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | For the Nine Months Ended | |

| | | September 30, 2015 | | | Period from May 2014 (Inception ) to September 30, 2014 | |

| | | | | | | |

Cash Flows from Operating Activities: | | | | | | |

Net profit (loss) for the period | | $ | (2,866,933 | ) | | $ | (432,782 | ) |

Adjustments to reconcile net loss to net cash used in operations | | | | | | | | |

Loss on equity investments in period | | | 52,323 | | | | - | |

Impairment of equity method investments | | | 1,376,208 | | | | - | |

| | | | | | | | | |

Changes in assets and liabilities, net of acquisition and disposals: | | | | | | | | |

Accounts receivable | | | (357,752 | ) | | | - | |

Deposits with suppliers | | | 219,055 | | | | - | |

Accounts payable & accrued liabilities | | | 39,156 | | | | - | |

Customer deposits | | | 100,235 | | | | - | |

Net cash (used in) operating activities | | | (1,437,708 | ) | | | (432,782 | ) |

| | | | | | | | | |

Net cash used in investing activities | | | - | | | | - | |

| | | | | | | | | |

Cash Flows From Financing Activities: | | | | | | | | |

Net cash provided by related parties | | | (543,318 | ) | | | 432,782 | |

Cash received from parent for subscription due | | | 2,000,000 | | | | - | |

Cash received for the issuance of shares | | | 3,000,000 | | | | - | |

Net cash provided by financing activities | | | 4,456,682 | | | | 432,782 | |

| | | | | | | | | |

Net increase in cash and cash equivalents | | | 3,018,974 | | | | - | |

| | | | | | | | | |

Cash and cash equivalents, beginning of the period | | | 54 | | | | - | |

Cash and cash equivalents, end of the period | | $ | 3,019,028 | | | $ | - | |

| | | | | | | | | |

SUPPLEMENTAL CASH FLOW DISCLOSURE: | | | | | | | | |

Cash paid for interest | | $ | - | | | $ | - | |

Cash paid for taxes | | $ | - | | | $ | - | |

SUPPLEMENTAL DISCLOSURE OF NONCASH ACTIVITIES: | | | | | | | | |

Investment in PayNovi Ltd. | | | | | | | | |

1,361,000 common shares issued | | $ | 680,500 | | | $ | - | |

3,937,005 common shares issued by Power Clouds Inc. | | $ | 748,030 | | | $ | - | |

| | | $ | 1,428,530 | | | $ | - | |

See Accompanying Notes to Condensed Consolidated Unaudited Financial Statements

WORLD MEDIA & TECHNOLOGY CORP.

(FORMERLY HALTON UNIVERSAL BRANDS INC.)

FOR THE THREE AND NINE MONTH PERIODS ENDED SEPTEMBER 30, 2015, THE THREE MONTH PERIOD

ENDED SEPTEMBER 30, 2014, AND THE PERIOD FROM MAY 2014 (INCEPTION) TO SEPTEMBER 30, 2014

NOTES TO THE CONDENSED CONSOLIDATED UNAUDITED FINANCIAL STATEMENTS

Note 1 – Organization and Operations

World Media & Technology Corp. ("the Company", "WRMT", "we", "us" or "our") was incorporated under the laws of the State of Nevada on October 22, 2010 under the name Halton Universal Brands Inc. ("HNVB"). The Company was originally a brokerage, consulting and marketing firm specializing in brand consulting and new product strategy consulting for emerging brands. The Company focused on natural food products, specialty food products, and mass-market grocery items that were manufactured in North America and sought new market penetration in Eastern Europe. It offered services that fell into three major categories: strategic management consulting, sales brokerage, and marketing. Its main areas of focus were serving manufacturers and distributors in the grocery, specialty food, and health supplement channels.

Effective October 29, 2014:

| 1) | Power Clouds, Inc. (formerly World Assurance Group, Inc.) ("PWCL") acquired 7,095,000 shares of World Media & Technology Corp. (formerly Halton Universal Brands Inc.) ("WRMT"), representing 98% of WRMT's issued and outstanding share capital, for cash consideration of $378,000, |

| | |

| 2) | WRMT discontinued its previously existing brokerage and brand consultancy business, and |

| | |

| 3) | WRMT acquired the SPACE technology business and related assets from PWCL for consideration of $557,898 funded by way of debt from PWCL (collectively "the October 29, 2014 transactions"). |

We have accounted for the October 29, 2014 transactions as a reverse merger of PWCL's SPACE technology business and related assets into WRMT. This reverse merger has been accounted for as a reverse capitalization with PWCL's SPACE technology business, the legally acquired business, being treated as the acquirer of WRMT for accounting and financial reporting purposes. Consequently, the accompanying consolidated financial statements reflect the operations of PWCL's SPACE technology business since Inception (May 2014) and for WRMT from the effective date of the reverse merger on October 29, 2014. The purchase of 7,095,000 shares of WRMT by PWCL has been retroactively presented in the Statement of Changes in Stockholders' Equity (Deficit) and the footnotes to these consolidated financial statements to be effective as of the date of the inception of PWCL's SPACE technology business.

PWCL's SPACE technology business was originally formed in May 2014 ("Inception") as a business division of PWCL to undertake the design, manufacturing and marketing of wearable technology products and services and the provision of Mobile Virtual Network Operator ("MVNO") wireless services.

In November 2014, the board of directors and majority stockholder, PWCL, authorized a name change of the Company from Halton Universal Brands, Inc. to World Media & Technology Corp. The name change went effective with FINRA on December 22, 2014 and the ticker was changed to WRMT as a result of the name change.

On March 5, 2015, WRMT incorporated Space Wireless Corp. in Florida, a wholly owned subsidiary of WRMT.

Investment in PayNovi Ltd.

On March 30, 2015, the Company entered into a Common Stock Purchase Agreement (the "SPA") by and among PWCL, PayNovi Ltd., an Irish limited liability company (the "PayNovi") and Anch Holdings Ltd., an Irish limited liability company (the "Seller"). Pursuant to the terms of the SPA, the Seller agreed to sell to the Company, and the Company agreed to purchase from the Seller, 350 shares of PayNovi's common stock, which represents 35% of PayNovi's total issued and outstanding shares as of the Closing Date, for a Purchase Price consisting of 1,361,000 shares of WRMT's common stock, which represents 5% of WRMT's total issued and outstanding shares as of the Closing Date, and 3,937,005 shares of PWCL's common stock, which represents 5% of PWCL's total issued and outstanding shares of the Closing Date, being issued to the Seller.

PayNovi operates in the mobile and online payments market and offers products such as mobile wallet, prepaid cards and online payment programs, as a white label, to its partners. WRMT has taken a minority shareholding in PayNovi to gain a strategic position in the mobile payments space but also as a part of a strategy to ultimately offer mobile wallet capabilities as part its SPACE wireless offerings in order to gain a competitive advantage over other providers.

We are accounting for this investment under the equity method as we own 35% of PayNovi and exercise significant influence over the company.

On September 30, 2015 the Company took an impairment charge of $1,376,208 to reduce the carrying value of this investment to zero based on the losses incurred by the PayNovi business during the six months since this investment and the limited activities of PayNovi current business operations.

Note 2 – Summary of Significant Accounting Policies

Basis of Presentation

The Company's consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America ("U.S. GAAP").

Basis of consolidation

The consolidated financial statements for the nine months ended September 30, 2015 include 100% of the assets, liabilities, revenues, expenses and cash flows of World Media & Technology Corp. The Company also consolidated the financial statements of its wholly owned operating subsidiary Space Wireless Inc. All intercompany accounts and transactions have been eliminated in consolidation. The results of subsidiaries acquired or disposed of during the respective periods are included in the consolidated statements of operations from the effective date of acquisition or up to the effective date of disposal, as appropriate.

Condensed Consolidated Unaudited Interim Financial Statements

The accompanying condensed consolidated unaudited interim financial statements and related notes have been prepared in accordance with accounting principles generally accepted in the United States of America ("U.S. GAAP") for interim financial information, and with the rules and regulations of the United States Securities and Exchange Commission ("SEC") to Form 10-Q and Article 8 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete financial statements. The condensed consolidated unaudited interim financial statements furnished reflect all adjustments (consisting of normal recurring accruals) which are, in the opinion of management, necessary to a fair statement of the results for the interim periods presented. Unaudited interim results are not necessarily indicative of the results for the full fiscal year. These condensed consolidated unaudited interim financial statements should be read in conjunction with the financial statements of the Company for the year ended December 31, 2014 and notes thereto contained in the information as part of the Company's Annual Report on Form 10-K/A, which was filed with the Securities and Exchange Commission on August 18, 2015.

Use of Estimates and Assumptions

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions thataffect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses duringthe reporting period.

The Company's significant estimates and assumptions include the fair value of financial instruments; income tax rate, income tax provision and valuation allowance of deferred tax assets; and the assumption that the Company will continue as a going concern. Those significant accounting estimates or assumptions bear the risk of change due to the fact that there are uncertainties attached to those estimates or assumptions, and certain estimates or assumptions are difficult to measure or value.

Management bases its estimates on historical experience and on various assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources.

Management regularly reviews its estimates utilizing currently available information, changes in facts and circumstances, historical experience and reasonable assumptions. After such reviews, and if deemed appropriate, those estimates are adjusted accordingly.

Actual results could differ from those estimates.

Cash Equivalents

The Company considers all highly liquid investments with maturity of three months or less to be cash and cash equivalents.

Fair value of financial instruments

The Company follows paragraph 825-10-50-10 of the FASB Accounting Standards Codification for disclosures about fair value of its financial instruments and paragraph 820-10-35-37 of the FASB Accounting Standards Codification ("Paragraph 820-10-35-37") to measure the fair value of its financial instruments. Paragraph 820-10-35-37 establishes a framework for measuring fair value inaccounting principles generally accepted in the United States of America (U.S. GAAP), and expands disclosures about fair value measurements.

To increase consistency and comparability in fair value measurements and related disclosures, Paragraph 820-10-35-37 establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value into three (3) broad levels. The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. The three (3) levels of fair value hierarchy defined by Paragraph 820-10-35-37 are described below:

Level 1 Quoted market prices available in active markets for identical assets or liabilities as of the reporting date.

Level 2 Pricing inputs other than quoted prices in active markets included in Level 1 that are either directly or indirectly observable as of the reporting date.

Level 3 Pricing inputs that are generally observable inputs and not corroborated by market data.

Financial assets are considered Level 3 when their fair values are determined using pricing models, discounted cash flow methodologies or similar techniques and at least one significant model assumption or input is unobservable.

The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. If the inputs used to measure the financial assets and liabilities fall within more than one level described above, the categorization is based on the lowest level input that is significant to the fair value measurement of the instrument. The carrying amount of the Company's financial assets and liabilities, such as cash, prepaid expenses, accounts payable and accrued expenses, approximate their fair value because of the short maturity of those instruments.

Transactions involving related parties cannot be presumed to be carried out on an arm's-length basis, as the requisite conditions of competitive, free-market dealings may not exist. Representations about transactions with related parties, if made, shall not imply that the related party transactions were consummated on terms equivalent to those that prevail in arm's-length transactions unless such representations can be substantiated.

It is not however practical to determine the fair value of advances from stockholders, if any, due to their related party nature.

Investment in partnerships, unincorporated joint ventures or limited liability companies

The Company follows subtopic 323-30 of the FASB Accounting Standards Codification for investments in partnerships, unincorporated joint ventures or limited liability companies.

The Company uses the equity method of accounting for investments in associate companies. An associate is an entity over which the investor has significant influence by owning over 20% of the common stock but less than 50%. A subsidiary is not an associate and an interest in a joint venture is not an associate.

The investment is initially recognized at cost. After the acquisition date, a change in the Company's share of the associate's net assets adjusts the carrying amount of investment. A change in the Company's share of the associates profit or loss is recognized in the Company's profit or loss while any change in the Company's share of the associate's other comprehensive income is recognized in the Company's other comprehensive income. Distributions received from an associate reduce the carrying amount of the investment.

On March 30, 2015, the Company acquired a 35% shareholding in PayNovi Ltd. A limited liability company registered in Ireland. The initial consideration was the issuance of 1,361,000 common shares of the Company and the issuance of 3,937,005 common shares of Power Clouds Inc., our former parent company and former majority shareholder. The Company recorded an initial investment of $1,428,530 being the market value of the shares issued on the closing date. (See Note 4 below for further details).

For the three and nine months ending September 30, 2015, we recorded a loss from equity method investments of $22,000 and $52,323, respectively.

On September 30, 2015, the Company took an impairment charge of $1,376,208 to reduce the carrying value of this investment to zero based on the losses incurred by the PayNovi business during the six months since this investment and the limited activities of PayNovi current business operations.

Related parties

The Company follows subtopic 850-10 of the FASB Accounting Standards Codification for the identification of related parties and disclosure of related party transactions.

Pursuant to Section 850-10-20 the Related parties include: (a). affiliates of the Company; (b). entities for which investments in their equity securities would be required, absent the election of the fair value option under the Fair Value Option Subsection of Section 825–10–15, to be accounted for by the equity method by the investing entity; (c). trusts for the benefit of employees, such as pensionand profit-sharing trusts that are managed by or under the trusteeship of management; (d). principal owners of the Company; (e). management of the Company; (f). other parties with which the Company may deal if one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests; and (g). other parties that can significantly influence the management or operating policies of the transacting parties or that have an ownership interest in one of the transacting parties and can significantly influence the other to an extent that one or more of the transacting parties might be prevented from fully pursuing its own separate interests.

The financial statements shall include disclosures of material related party transactions, other than compensation arrangements, expense allowances, and other similar items in the ordinary course ofbusiness. However, disclosure of transactions that are eliminated in the preparation of financial statements is not required in those statements. The disclosures shall include: (a). the nature of the relationship(s) involved; (b). a description of the transactions, including transactions to which no amounts or nominal amounts were ascribed, for each of the periods for which income statements are presented, and such other information deemed necessary to an understanding of the effects of the transactions on the financial statements; (c). the dollar amounts of transactions for each of the periods for which income statements are presented and the effects of any change in the method of establishing the terms from that used in the preceding period; and (d). amounts due from or to related parties as of the date of each balance sheet presented and, if not otherwise apparent, the terms and manner of settlement.

Commitments and contingencies

The Company follows subtopic 450-20 of the FASB Accounting Standards Codification to report accounting for contingencies. Certain conditions may exist as of the date the financial statements areissued, which may result in a loss to the Company but which will only be resolved when one or more future events occur or fail to occur. The Company assesses such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Company or un-asserted claims that may result in such proceedings, the Company evaluates the perceived merits of any legal proceedings or un-asserted claims as well as the perceived merits of the amount of relief sought or expected to be sought therein.

If the assessment of a contingency indicates that it is probable that a material loss has been incurred and the amount of the liability can be estimated, then the estimated liability would be accrued in the Company's consolidated financial statements. If the assessment indicates that a potential material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, then the nature of the contingent liability, and an estimate of the range of possible losses, if determinable and material, would be disclosed.

Loss contingencies considered remote are generally not disclosed unless they involve guarantees, in which case the guarantees would be disclosed. Management does not believe, based upon information available at this time that these matters will have a material adverse effect on the Company's financial position, results of operations or cash flows. However, there is no assurance that such matters will not materially and adversely affect the Company's business, financial position, and results of operations or cash flows.

Revenue Recognition

The Company applies paragraph 605-10-S99-1 of the FASB Accounting Standards Codification for revenue recognition. The Company recognizes revenue when it is realized or realizable and earned. The Company considers revenue realized or realizable and earned when all of the following criteria are met: (i) persuasive evidence of an arrangement exists, (ii) the product has been shipped or the services have been rendered to the customer, (iii) the sales price is fixed or determinable, and (iv) collectability is reasonably assured.

The Company derives its revenues from sales of products and services to end users via distribution partners, with revenues being generated upon delivery of the products and/or the services to the distribution partners. Persuasive evidence of an arrangement is demonstrated via invoice; service is considered provided when the service is delivered to the customers; and the sales price to the customer is fixed upon acceptance of the purchase order and there is no separate sales rebate, discount, or volume incentives.

The Company derives its revenues from two business types that each have specific revenue recognition policies relating to their operations. Revenue recognition for each business type are outlined below.

Product Sales:

The Company designs, manufactures and sells it own range of integrated mobile technology products such as LUMINA Glasses, SPACE Wireless smartphones and SPACE Wireless Space Stations home networking system. These products are manufactured by third party factories in China. They are then shipped directly to distribution partners for onward delivery to end users. Title to the products passes to the distributors on shipment from the factory and sales invoices are issued to the respective distributor at agreed wholesale prices. Distributors are responsible for providing initial warranty support to end users and hold spare unit inventory to service any claims. Distributors have the option to return faulty units once per quarter and the Company issues credit notes once for any returns. Revenues recorded by the Company reflect the net amount of sale less an credits for returns in the period.

Airtime:

The Company also provides mobile telecom services ("airtime") to consumers via exclusive sales agreements with regional third party distributors across the world. Services are initially paid for by the Company to its service providers and then billed on to the relevant distributor at an agreed fixed mark-up on the cost of the airtime actually used by end users. Revenues recorded by the Company only include airtime that has already been consumed by end users, has a known sales value, and payment can reasonably be assured. Revenues do not reflect any prepayments for unused airtime by end customers. Therefore, no accrual for unused minutes or deferred revenues are required by the Company as the distribution partners are responsible for any unused calling plan minutes and there is no obligation on WRMT to deliver minutes beyond actual usage.

Accounts Receivable

The Company records accounts receivable at the net value of the face amount of customer invoices less any allowance for doubtful accounts. We evaluate our accounts receivable periodically based on specific identification of any accounts receivable for which we deem the net realizable value to be less than the gross amount of accounts receivable recorded; in these cases, we establish an allowance for doubtful accounts for those balances. In determining our need for an allowance for doubtful accounts, we consider historical experience, analysis of past due amounts, client creditworthiness and any other relevant available information. However, our actual experience may vary from our estimates. If the financial condition of our clients were to deteriorate, resulting in their inability or unwillingness to pay our fees, we may need to record additional allowances or write-offs in future periods. The Company mitigates this risk by collecting retainers from our clients prior to performing significant services.

The Company records an allowance for doubtful accounts, if any, as a reduction in revenue to the extent the provision relates to fee adjustments and other discretionary pricing adjustments. To the extent the provision relates to a client's inability to make required payments on accounts receivables, the provision is recorded in operating expenses. As of September 30, 2015 there was no allowance for doubtful accounts, and we did not record any bad debt expense during the period from Inception (May 2014) through September 30, 2015.

Concentration

Revenues

For the three and nine months ended September 30, 2015 and 2014, the following customers represented more than 10% of the Company's revenues:

| | Three Months Ended | |

| | | September 30, 2015 | | | September 30, 2014 | |

| | | $ | | | % | | | $ | | | % | |

Customer A | | | 169,089 | | | | 16 | | | | - | | | | - | |

Customer B | | | 861,740 | | | | 84 | | | | - | | | | - | |

Concentration total | | | 1,030,829 | | | | 100 | | | | - | | | | - | |

| | | Nine Months Ended |

| | | September 30, 2015 | | | September 30, 2014 |

| | | $ | | | % | | | $ | | | % | |

Customer A | | | 169,089 | | | | 16 | | | | - | | | | - | |

Customer B | | | 861,740 | | | | 84 | | | | - | | | | - | |

Concentration total | | | 1,030,829 | | | | 100 | | | | - | | | | - | |

Accounts Receivable

As at September 30, 2015 and December 31, 2014, the following customers represented more than 10% of the Company's outstanding accounts receivable balances.

| | | As at September 30, 2015 | | | As at December 31, 2014 |

| | | $ | | | % | | | $ | | | % | |

Customer A | | | 191,972 | | | | 54 | | | | - | | | | - | |

Customer B | | | 165,780 | | | | 46 | | | | - | | | | - | |

Concentration total | | | 357,752 | | | | 100 | | | | - | | | | - | |

Deposits with Suppliers

Deposits with suppliers is comprised of advance payments made to third parties, primarily for inventory for which we have not yet taken title. When we take title to inventory for which deposits are made, the related amount is classified as inventory, and then recognized as a cost of revenues upon sale.

Sales, Marketing and Advertising

We use a variety of marketing, sales and support activities to generate and cultivate ongoing customer demand for our products and services, acquire new customers. We currently sell exclusively through indirect channels. As a result, our sales support efforts are limited to training the indirect channels on the merits of our products over competitive options. We incur promotional costs by way of distributor conferences and sponsoring distributor events with their downstream retail channels and end customers. We will closely track and monitor customer acquisition costs to assess how we are deploying our marketing, sales and customer support spending. Marketing costs are accounted in operating expenses as they are incurred.

Indirect Sales

Our indirect sales channel will operate through a number of direct sales organizations that help broaden the adoption of our products and services without the need for a large direct field sales force.

Customer Support

While our intuitive and easy-to-use user interface serves to reduce our customers' need for support, we provide online and phone customer support as well as post-sale implementation support, to help customers configure and use our solution. We track and measure our customer satisfaction and our support costs closely across all channels to provide a high level of customer service in a cost-efficient manner. The Company outsources customer support to specialist service providers who already experience economies of scale from providing such services to multiple organizations.

Research and Development

The Company follows subtopic 730-10 of the FASB Accounting Standards Codification for research and development costs.

Research and development costs are charged to expense when incurred. Our research and development has been primarily focused on bringing the first product Lumina Glasses to market in 2015. The research and development expenses throughout 2014 included the design, parts sourcing and prototyping of the Lumina Glasses. We expect to continue to outsource the main development activities and use expert consultants where required to ensure consistent iterations of products and related services.

For the three and nine months ending September 30, 2015, we incurred $36,790 and $1,066,025 respectively, in research and development costs and $432,782 in research and development costs during the period from May 2014 (inception) to September 30, 2014.

Intellectual Property

Our success and ability to compete effectively are dependent in part upon our proprietary technology. We rely on a combination of copyright, trademark and trade secret laws, as well as non-disclosure agreements and other contractual restrictions, to establish and protect our proprietary rights. Employees are required to execute confidentiality and non-use agreements that transfer any rights they may have in copyrightable works or patentable technologies to us. In addition, prior to entering into discussions with potential business partners or customers regarding our business and technologies, we generally require that such parties enter into nondisclosure agreements with us. If these discussions result in a license or other business relationships, we also generally require that the agreement setting forth the parties' respective rights and obligations include provisions for the protection of our intellectual property rights. The steps taken by us may not be adequate to prevent the misappropriation of our proprietary rights or technology.

We do not currently have any patents or patent applications in process. Any future patent applications with respect to our technology may not be granted, and, if granted, patents may be challenged or invalidated. In addition, issued patents may not provide us with any competitive advantages and may be challenged by third parties. Our practice is to affix copyright notices on our product literature in order to assert copyright protection for these works.

Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to duplicate aspects of our products or to obtain and use information that we regard as proprietary. Our steps to protect our proprietary technology may not be adequate to prevent misappropriation of such technology, and may not preclude competitors from independently developing products with functionality or features similar to our products. If we fail to protect our proprietary technology, our business, financial condition and results of operations could be harmed significantly.

Consumer technology markets have been characterized by substantial litigation regarding patent and other intellectual property rights. Litigation, which could result in substantial cost to and diversion of our efforts, may be necessary to enforce trademarks issued to us or to determine the enforceability, scope and validity of the proprietary rights of others. Adverse determinations in any litigation or interference proceeding could subject us to costs related to changing names and a loss of established brand recognition.

Income Tax Provision

The Company accounts for income taxes under Section 740-10-30 of the FASB Accounting Standards Codification, which requires recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements or tax returns.

Under this method, deferred tax assets and liabilities are based on the differences between the financial statement and tax bases of assets and liabilities using enacted tax rates in effect for the year in which the differences are expected to reverse. Deferred tax assets are reduced by a valuation allowance to the extent management concludes it is more likely than not that the assets will not be realized. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the statements of operations in the period that includes the enactment date.

The Company adopted the provisions of paragraph 740-10-25-13 of the FASB Accounting Standards Codification. Paragraph 740-10-25-13 addresses the determination of whether tax benefits claimed or expected to be claimed on a tax return should be recorded in the financial statements. Under paragraph 740-10-25-13, the Company may recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized inthe financial statements from such a position should be measured based on the largest benefit that has a greater than fifty percent (50%) likelihood of being realized upon ultimate settlement. Paragraph 740-10-25-13 also provides guidance on de-recognition, classification, interest and penalties on income taxes, accounting in interim periods and requires increased disclosures.

The estimated future tax effects of temporary differences between the tax basis of assets and liabilities are reported in the accompanying balance sheets, as well as tax credit carry-backs and carry-forwards. The Company periodically reviews the recoverability of deferred tax assets recorded on its balance sheets and provides valuation allowances as management deems necessary.

Management makes judgments as to the interpretation of the tax laws that might be challenged upon an audit and cause changes to previous estimates of tax liability. In addition, the Company operates within multiple taxing jurisdictions and is subject to audit in these jurisdictions. In management's opinion, adequate provisions for income taxes have been made for all years. If actual taxable income by tax jurisdiction varies from estimates, additional allowances or reversals of reserves may be necessary.

Uncertain Tax Positions

The Company did not take any uncertain tax positions and had no unrecognized tax liabilities or benefits in accordance with the provisions of Section 740-10-25 at September 30, 2015 and December 31, 2014.

Net income (loss) per common share

Net income (loss) per common share is computed pursuant to section 260-10-45 of the FASB Accounting Standards Codification. Basic net income (loss) per common share is computed by dividing net income (loss) by the weighted average number of shares of common stock outstanding during the period. Diluted net income (loss) per common share is computed by dividing net income (loss) by the weighted average number of shares of common stock and potentially outstanding shares of common stock during the period to reflect the potential dilution that could occur from common shares issuable through contingent shares issuance arrangement, stock options or warrants.

There were no potentially dilutive shares issued or outstanding during the three and nine months ended September 30, 2015 or the period from May 2014 (inception) to September 30, 2014.

Subsequent events

The Company follows the guidance in Section 855-10-50 of the FASB Accounting Standards Codification for the disclosure of subsequent events. The Company will evaluate subsequent events through the date when the consolidated financial statements were issued. Pursuant to ASU 2010-09 of the FASB Accounting Standards Codification, the Company as an SEC filer considers its financial statements issued when they are widely distributed to users, such as through filing them on EDGAR.

Reclassification

Certain amounts from prior periods may have been reclassified to conform to the current period presentation. There is no effect on net loss, cash flows or stockholders' equity (deficit) as a result of these reclassifications.

Recently issued accounting pronouncements

The Company has reviewed all recently issued, but not yet effective, accounting pronouncements and does not believe the future adoption of any such pronouncements may be expected to cause a material impact on its financial condition or the results of its operations.

Note 3 – Acquisition of Halton Universal Brands Inc. (HNVB)

During the year ended December 31, 2014, we acquired Halton Universal Brands, Inc. ("HNVB") through a deemed reverse merger and terminated the HNVB business. Through the acquisition of HNVB, we acquired $54 in fair value of net assets (cash).

Halton Universal Brands, Inc. ("HNVB") was incorporated under the laws of the State of Nevada on October 22, 2010. The Company was a brokerage, consulting and marketing firm specializing in brand consulting and new product strategy consulting for emerging brands. The Company focused on natural food products, specialty food products, and mass-market grocery items that are manufactured in North America and seek new market penetration in Eastern Europe. It offered services that fall into three major categories: strategic management consulting, sales brokerage, and marketing. Its main areas of focus were serving manufacturers and distributors in the grocery, specialty food, and health supplement channels.

Note 4 – Stock Purchase Agreement with PayNovi.

On March 30, 2015, the Company entered into a Common Stock Purchase Agreement (the "SPA") by and among PWCL, PayNovi Ltd., an Irish limited liability company (the "PayNovi") and Anch Holdings Ltd., an Irish limited liability company (the "Seller"). Pursuant to the terms of the SPA, the Seller agreed to sell to the Company, and the Company agreed to purchase from the Seller, 350 shares of PayNovi's common stock, which represents 35% of PayNovi's total issued and outstanding shares as of the Closing Date, for a Purchase Price consisting of 1,361,000 shares of WRMT's common stock, which represents 5% of WRMT's total issued and outstanding shares as of the Closing Date, and 3,937,005 shares of PWCL's common stock, which represents 5% of PWCL's total issued and outstanding shares of the Closing Date, being issued to the Seller. The SPA provides for certain additional rights and obligations of the parties, including PayNovi agreeing to certain provisions relating to public disclosure, confidentiality, consents and filings, and transfer and additional issuance restrictions. The closing of the issuance of all of the shares occurred on March 31, 2015. The description of the SPA above is qualified in its entirety by reference to the full text of the SPA filed as an Exhibit hereto.

PayNovi operates in the mobile and online payments market and offers products such as mobile wallet, prepaid cards and online payment programs, as a white label, to its partners. WRMT has taken a minority shareholding in PayNovi to gain a strategic position in the mobile payments space but also as a part of a strategy to ultimately offer mobile wallet capabilities as part its SPACE wireless offerings in order to gain a competitive advantage over other providers.

Consideration for the investment was as follows:

| | | FAIR MARKET VALUE OF SHARES ISSUED ON DATE OF TRANASACTION EFFECTIVE MARCH 30, 2015 | |

| | | | |

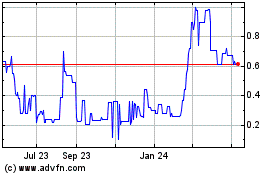

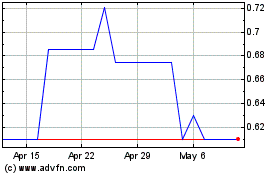

1,316,000shares of WRMT's common stock @ $0.50 per share closing price on March 30, 2015 | | $ | 680,500 | |

3,937,005 shares of PWCL's common stock @ $0.145 per share closing price on March 30, 2015 | | | 748,030 | |

Total investment | | $ | 1,428,530 | |

In accordance with ASC 323-10 , the total initial investment of $1,428,530 representing the fair market value of the shares issues as consideration for the acquisition of the investment in PayNovi was recorded as an equity method investment.

The fair market value of the PWCL shares issued of $748,030 is recorded within due to related parties.

During the period from our initial investment in PayNovi on March 30, 2015 through September 30, 2015, we recognized a loss on equity investments of $52,323 reflecting 35% of the net loss incurred by PayNovi during the same period.

On September 30, 2015 the Company took an impairment charge of $1,376,208 to reduce the carrying value of this investment to zero based on the losses incurred by the PayNovi business during the six months since this investment and the limited activities of PayNovi current business operations.

Therefore the carrying value of our equity method investments in the balance sheet has been reduced to reflect the impact of the loss as outlined below.

| | | AS AT SEPTEMBER 30, 2015 | |

| | | | |

Balance as at March 31, 2015 | | $ | 1,428,530 | |

Loss on equity investment in the period | | | (30,323 | ) |

Balance as at June 30, 2015 | | $ | 1,398,207 | |

Gain (loss) on equity investment in the period | | | (22,000 | ) |

Impairment of equity method investments | | | (1,376,207 | ) |

Balance as at September 30, 2015 | | $ | - | |

Note 5 – Stockholders' Equity(Deficit)

Shares Authorized

Upon formation, the total number of shares of all classes of stock which the Company is authorized to issue is seventy-five million (75,000,000) shares of common stock, par value $0.001 per share.

Common stock

Effective October 29, 2014:

| 1) | Power Clouds, Inc. (formerly World Assurance Group, Inc.) ("PWCL") acquired 7,095,000 shares of World Media & Technology Corp. (formerly Halton Universal Brands Inc.) ("WRMT"), representing 98% of WRMT's issued and outstanding share capital, for cash consideration of $378,000, |

| | |

| 2) | WRMT discontinued its previously existing brokerage and brand consultancy business, and |

| | |

| 3) | WRMT acquired the SPACE technology business and related assets from PWCL for consideration of $557,898 funded by way of debt from PWCL (collectively "the October 29, 2014 transactions"). |

We have accounted for the October 29, 2014 transactions as a reverse merger of PWCL's SPACE technology business and related assets into WRMT. This reverse merger has been accounted for as a reverse capitalization with PWCL's SPACE technology business, the legally acquired business, being treated as the acquirer of WRMT for accounting and financial reporting purposes. Consequently, the accompanying financial statements reflect the operations of PWCL's SPACE technology business since Inception (May 2014) and for WRMT from the effective date of the reverse merger on October 29, 2014. The purchase of 7,095,000 shares of WRMT by PWCL has been retroactively presented in the Statement of Changes in Stockholders' Equity (Deficit) and the footnotes to these financial statements to be effective as of the date of the inception of PWCL's SPACE technology business.

Recapitalization of WRMT

As at October 29, 2014, 125,000 shares of WRMT's common stock were owned by shareholders who did not sell their stock to PWCL. Under reverse merger accounting, these shares are accounted for as if they had been issued by the existing PWCL technology business as consideration to acquire control of WRMT.

Unregistered Sales of Equity Securities

On October 29, 2014, the Company sold 8,000,000 shares of its common stock at $0.25 per share for $2 million to its parent company, PWCL. During the nine months ended September 30, 2015, the Company received $2 million in cash due from PWCL for the issuance of 8,000,000 common shares on October 29, 2014. The issuance of Common Stock was made pursuant to the exemption from the registration requirements of the Securities Act of 1933, as amended (the "Securities Act"), provided by Section 4(2) of the Securities Act.

On March 25, 2015, the Company sold 12,000,000 shares of the Company's common stock to Mr. Fabio Galdi, the Company's Chief Executive Officer, for $3 million or $0.25 per share. Payment has been received for the sale of these shares. This represents a 44% beneficial ownership interest in the Company held directly by Mr. Fabio Galdi. The issuance of Common Stock was made pursuant to the exemption from the registration requirements of the Securities Act, provided by Section 4(2) of the Securities Act.

On March 31, 2015, the Company issued 1,361,000 shares of the Company's common stock, valued at $680,500 based on the $0.50 per share closing price on March 30, 2015, to Anch Holdings, Ltd. as partial consideration for a 35% equity ownership interest in PayNovi (See Note 4 above for more details). The issuance of Common Stock was made pursuant to the exemption from the registration requirements of the Securities Act, provided by Section 4(2) of the Securities Act.

SEC Form S-1 Registration Statement:

On September 30, 2015, the Securities and Exchange Commission (SEC) declared the Company's Registration Statement on Form S-1 effective. The Registration Statement registered 13,812,850 shares of WRMT's common stock held by Power Clouds Inc. (PWCL), the Company's former parent company and former majority shareholder. PWCL's Board approved a share dividend consisting of 13,812,850 of the 15,095,000 common shares PWCL held in WRMT. Shareholders of PWCL received one (1) share of WRMT common stock for every six (6) PWCL shares of common stock held as of the record date, which was October 1, 2015. PWCL maintains a 4.5% ownership position in the Company following the share dividend distribution. For more information, please see the Company's SEC Form S-1/A filed on September 2, 2015 and the Company's Prospectus, Form 424B3, filed on October 7, 2015.

Note 6 – Related Party Transactions

On October 29, 2014, the Company issued 8,000,000 shares of the Company's restricted common stock to our former parent company, Power Clouds Inc. (PWCL) in exchange for $2,000,000. Over 50% of PWCL is beneficially owned and controlled by Fabio Galdi, our CEO.

The Company subleases facilities with World Global Network Corp. ("WGN") and under its real estate sublease with WGN will be recharged rent and a cost allocation for the property at a fixed rate of $5,000 per month. In December of 2014, WGN was sold by PWCL to World Capital Holding (FZC), a company beneficially owned and controlled by Fabio Galdi, the Company's CEO. In February 2015, WGN changed its name from World Global Group, Inc. to World Global Network Corp. In June of 2015, our CEO sold his interest in WGN to an unrelated third party and WGN is therefore no longer a related party. The terms and conditions of the sublease from WGN to the Company remain in full force and effect. The Company recognized $15,000 and $30,000 of rental expense in respect of this lease during the three and nine months ended September 30, 2015, respectively.

On March 25, 2015, the Company sold 12,000,000 shares of the Company's common stock to Mr. Fabio Galdi, the Company's Chief Executive Officer, for $3 million or $0.25 per share. Payment has been received for the sale of these shares.

Payable to Related Parties

Amounts due to related party as at September 30, 2015 and December 31, 2014 are as follows:

| | | September 30, 2015 | | | December 31, 2014 | |

World Global Assets Pte Ltd (WGA) – owned by our CEO | | | 770,100 | | | | 915,388 | |

World Global Network Corp. (WGN) – owned indirectly by our CEO until June 15, 2015, as of June 15, 2015 WGN is no longer a related party | | | - | | | | 10,000 | |

Due to directors and officers | | | 360,000 | | | | - | |

Total due to related parties | | $ | 1,130,100 | | | $ | 925,388 | |

These amounts are due on demand, carry no terms and accrue no interest.

Balance due to PWCL

During March 2015, PWCL, our previous parent company, issued 200,000 common shares of PWCL's to Awaysim Limited, a third party, for services related to the setup of the airtime offerings of the Company. The fair market value of the PWCL common shares issued was $38,000.

On March 31, 2015, Power Clouds Inc ("PWCL"), our former parent company issued 3,937,005 shares of its common stock to Anch Holdings Ltd., an Irish limited liability company (the "Seller") pursuant a Common Stock Purchase Agreement (the "SPA") by and among the Company, PWCL, PayNovi Ltd., an Irish limited liability company (the "PayNovi") and Anch Holdings Ltd., an Irish limited liability company (the "Seller"). Pursuant to the terms of the SPA, the Seller agreed to sell to the Company, and the Company agreed to purchase from the Seller, 350 shares of PayNovi's common stock, which represents 35% of PayNovi's total issued and outstanding shares as of the Closing Date, for a Purchase Price consisting of 1,361,000 shares of WRMT's common stock, which represents 5% of WRMT's total issued and outstanding shares as of the Closing Date, and 3,937,005 shares of PWCL's common stock, which represents 5% of PWCL's total issued and outstanding shares of the Closing Date, being issued to the Seller. The $748,030 reflecting the fair market value of the shares issued by PWCL on March 31, 2015 is included in the amounts due to related parties balance of as at September 30, 2015.

On September 30, 2015, PWCL distributed 13,812,850 shares to its shareholders as a dividend that resulted in PWCL reducing its ownership in the Company to 1,282,150 shares or 4.5% of the issued share capital. As part of this transaction, PWCL assigned $798,031, which included the $748,030 fair market value of shares issued for the acquisition of PayNovi Ltd., to World Global Assets pte Ltd, a company controlled by Fabio Galdi, our CEO.

Balance due to World Global Assets Pte Ltd. ("WGA")

Amounts due to WGA as at September 30, 2015 and December 31, 2014 are as follows:

| | AS AT SEPTEMBER 30, 2015 | |

| | | | |

Balance as at December 31, 2014 | | | 915,388 | |

Working capital provided in the payment of Company operating expenses | | | 830,997 | |

Payments made on behalf of WGA | | | (1,774,316 | ) |

Transfer of balance due to PWCL on spinout | | | 798,031 | |

Balance as at September 30, 2015 | | $ | 770,100 | |

The outstanding balance is interest free and repayable on demand.

Balance due to World Global Network Corp. ("WGN")

The balance at December 31, 2014 represented $10,000 payable under a sublease with WGN for our corporate offices at 600 Brickell Ave., Suite 1775, Miami, Florida. Under the terms of the sublease with WGN, the Company will be recharged rent and a cost allocation for the property at a fixed rate of $5,000 per month.

We had no amounts due to WGN as at September 30, 2015.

Due to Directors and Officers

As at September 30, 2015 and 2014 the Company owed $360,000 and $0 to Fabio Galdi, its CEO. These amounts represent unpaid management services provided and expenses incurred on behalf of the Company in the respective period.

Family Relationships

There are no family relationships among our officers and directors, other than Fabio Galdi and Alfonso Galdi, who are brothers.

Note 7 – Subsequent Events

The Company has evaluated all events that occurred after the balance sheet date through the date when the consolidated financial statements were issued on March 11, 2016 to determine if they must be reported. The Management of the Company determined that there were no reportable subsequent events to be disclosed.

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Forward-Looking Statements and Associated Risks.

The following discussion should be read in conjunction with the consolidated financial statements and the notes to those statements included elsewhere in this Quarterly Report on Form 10-Q. This Quarterly Report on Form 10-Q contains certain statements that are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. Certain statements contained in the MD&A are forward-looking statements that involve risks and uncertainties. The forward-looking statements are not historical facts, but rather are based on current expectations, estimates, assumptions and projections about our industry, business and future financial results. Our actual results could differ materially from the results contemplated by these forward-looking statements due to a number of factors, including those discussed in other sections of this Quarterly Report on Form 10-Q.

Restatement of Previously Issued Financial Statements

As discussed further in Note 2, Summary of Significant Accounting Policies - Restatement of Previously Issued Financial Statements, in the Notes to Financial Statements included this Quarterly Report, we have restated our financial statements for the period from May 2014 (Inception) to December 31, 2014.

The following section highlights significant factors impacting the Operations and Financial Condition of the Company for the three and nine month periods ended September 30, 2015 and for the three month period ended September 30, 2014 and the period from May 2014 (inception) to September 30, 2014. The following discussion should be read in conjunction with Part 1, Item 1 "Financial Statements".

Our Business

Organizational History

World Media & Technology Corp. ("the Company", "WRMT", "we", "us" or "our") was incorporated under the laws of the State of Nevada on October 22, 2010 under the name Halton Universal Brands Inc. ("HNVB"). The Company was originally a brokerage, consulting and marketing firm specializing in brand consulting and new product strategy consulting for emerging brands. The Company focused on natural food products, specialty food products, and mass-market grocery items that were manufactured in North America and sought new market penetration in Eastern Europe. It offered services that fell into three major categories: strategic management consulting, sales brokerage, and marketing. Its main areas of focus were serving manufacturers and distributors in the grocery, specialty food, and health supplement channels.

Effective October 29, 2014:

1) | Power Clouds, Inc. (formerly World Assurance Group, Inc.) ("PWCL") acquired 7,095,000 shares of World Media & Technology Corp. (formerly Halton Universal Brands Inc.) ("WRMT"), representing 98% of WRMT's issued and outstanding share capital, for cash consideration of $378,000, |

| |

2) | WRMT discontinued its previously existing brokerage and brand consultancy business, and |

| |

3) | WRMT acquired the SPACE technology business and related assets from PWCL for consideration of $557,898 funded by way of debt from PWCL (collectively "the October 29, 2014 transactions"). |

We accounted for the October 29, 2014 transactions as a reverse merger of PWCL's SPACE technology business and related assets into WRMT. This reverse merger has been accounted for as a reverse capitalization with PWCL's SPACE technology business, the legally acquired business, being treated as the acquirer of WRMT for accounting and financial reporting purposes. Consequently, the accompanying financial statements reflect the operations of PWCL's SPACE technology business since Inception (May 2014) and for WRMT from the effective date of the reverse merger on October 29, 2014. The purchase of 7,095,000 shares of WRMT by PWCL has been retroactively presented in the Statement of Changes in Stockholders' Equity (Deficit) and the footnotes to these financial statements to be effective as of the date of the inception of PWCL's SPACE technology business.

PWCL's SPACE technology business was originally formed in May 2014 ("Inception") as a business division of PWCL to undertake the design, manufacturing and marketing of wearable technology products and services and the provision of Mobile Virtual Network Operator ("MVNO") wireless services.

In November 2014, the board of directors and majority stockholder, PWCL, authorized a name change of the Company from Halton Universal Brands, Inc. to World Media & Technology Corp. The name change went effective with FINRA on December 22, 2014 and the ticker symbol was changed to WRMT as a result of the name change.

On March 5, 2015, WRMT incorporated Space Wireless Corp. in Florida, a wholly owned subsidiary of WRMT.

Investment in PayNovi Ltd.

On March 30, 2015, the Company entered into a Common Stock Purchase Agreement (the "SPA") by and among PWCL, PayNovi Ltd., an Irish limited liability company (the "PayNovi") and Anch Holdings Ltd., an Irish limited liability company (the "Seller"). Pursuant to the terms of the SPA, the Seller agreed to sell to the Company, and the Company agreed to purchase from the Seller, 350 shares of PayNovi's common stock, which represents 35% of PayNovi's total issued and outstanding shares as of the Closing Date, for a Purchase Price consisting of 1,361,000 shares of WRMT's common stock, which represents 5% of WRMT's total issued and outstanding shares as of the Closing Date, and 3,937,005 shares of PWCL's common stock, which represents 5% of PWCL's total issued and outstanding shares of the Closing Date, being issued to the Seller.

PayNovi operates in the mobile and online payments market and offers products such as mobile wallet, prepaid cards and online payment programs, as a white label, to its partners. WRMT has taken a minority shareholding in PayNovi to gain a strategic position in the mobile payments space but also as a part of a strategy to ultimately offer mobile wallet capabilities as part its SPACE wireless offerings in order to gain a competitive advantage over other providers.

We are accounting for this investment under the equity method as we own 35% of PayNovi and we exercise significant influence over the company.

On September 30, 2015 the Company took an impairment charge of $1,376,208 to reduce the carrying value of this investment to zero based on the losses incurred by the PayNovi business during the six months since this investment and the limited activities of PayNovi's current business operations.

Going Concern

The Company's consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets and satisfaction of liabilities in the normal course of business. The consolidated financial statements do not include any adjustment relating to recoverability and classification of recorded amounts of assets and liabilities that might be necessary should the Company be unable to continue as a going concern.

As reflected in the accompanying consolidated financial statements, while the Company had a working capital surplus of $2,227,510 and stockholders' equity of $2,227,509 as of September 30, 2015. However, the Company also incurred a net loss of $2,866,933 and used $1,437,708 cash in operating activities during the nine months ended September 30, 2015. This raises doubt about the Company's ability to continue as a going concern if the company ultimately does not generate sustainable positive income from operations. The Company achieved a net income of $4,968 for the three-month period ended September 30, 2015.

Our current monthly cash used in operating activities is now approximately $100,000 per month. Based on this monthly cash burn, we anticipate that our present cash balances may sustain us until early 2017 before additional funding may be required. This anticipation assumes that we do not reach profitable operations in the interim, which would reduce our monthly cash requirements. It also assumes that we do not make any payments to WGA a company owned by our CEO or use cash for non-operating activities or unplanned investment expenditure. Neither of the above items can be determined at this time and there is no assurance therefore that the Company will have sufficient funds to execute its intended business plan.

Thus far, our management has relied on Mr. Fabio Galdi, our CEO, and WGA, a company that Mr. Galdi is the owner of for equity investments for maintaining ongoing operations. Without continued investment from our largest shareholder, Mr. Galdi, we may not have the necessary capital required to execute our business plan and grow our business.

In the event that any new funding required is not realized, the business plan may need to be reduced or curtailed. There are currently no written agreements that obligate our largest shareholders, PWCL and Mr. Galdi, to continue funding us, nor do we have any agreements with prospective investors.

If we are unable to develop sufficient revenues to sustain our operations or receive funding, we may need to curtail or abandon our operations.

Results of Operations

For the three and nine months ended September 30, 2015 compared to the three-month period ended September 30, 2014 and the period from May 2014 (inception) to September 30, 2014.

| | For the Three Months Ended | | | | | | | For the Nine Months Ended | | | | | |

| | | September 30, 2015 | | | September 30, 2014 | | | Percentage Increase / (Decrease) | | | September 30, 2015 | | | September 30, 2014 | | | Increase / (Decrease) | |

Operating costs | | $ | 216,282 | | | $ | 141,797 | | | | 53 | % | | $ | 1,684,815 | | | $ | 432,782 | | | | 289 | % |

Income (Loss) from Operations | | | 21,940 | | | | (141,797 | ) | | | 115 | % | | | (1,446,593 | ) | | | (432,782 | ) | | | 244 | % |

Impairment of equity method investments | | | (1,376,208 | ) | | | - | | | | 100 | % | | | (1,376,208 | ) | | | - | | | | 100 | % |

Net Income (Loss) | | $ | (1,371,240 | ) | | $ | (141,797 | ) | | | 867 | % | | $ | (2,866,933 | ) | | $ | (432,782 | ) | | | 562 | % |

Operating costs and expenses

Our operating expenses relate to our operating activities with respect to the SPACE Computer business and continuing development of SPACE products and services.

Sales and general administrative expenses comprise primarily consulting fees incurred in the product literature and launch expenses for the SPACE computer products, management fees, regulatory expenses, depreciation, Internet services, travel, entertainment, automotive and office expenses. We incurred no sales and general administrative expenses during the period from May 2014 (inception) to September 30, 2014. We expect our operating expenses to increase in line with sales activities over the remainder of 2016 and 2017 as we launch our products and services. As such, our previous results of operations will not be indicative of our future results of operations.

Research and development costs relate primarily to the costs incurred in developing the SPACE Computer wearable computers, binocular media display glasses, wireless devices and the necessary platforms and wireless connectivity to provide its customers with an all-encompassing, out-of-the-box, unique, fully-connected, rich, infotainment experience which are expensed under ASC 730.

In the three months to September 30, 2015, our research and development costs decreased by 75% over the quarter ended September 30, 2014, from $141,797 to $36,790. Our research and development activities where reduced as the SPACE Phone and SPACE Station products launched and moved into revenue generation.

For the nine months ended September 30, 2015, our research and development expenses increased by 146%, from $432,782 to $1,066,025, compared to the period from May 2014 (inception) to September 30, 2014. This increase reflected the continued expenditure on research and development in the first half of 2015 over the prior year as we neared the launch of SPACE Phone and SPACE Station products.

We believe that the research and development expenditure will decline over the remainder of the year as product shipments have begun in the quarter ended September 30, 2015.

Loss on equity investments

During the period from the acquisition of our investment in PayNovi Ltd. on March 30, 2015 through September 30, 2015, we recognized a loss on equity investments of $52,323 relating to our investment in PayNovi Ltd. This represents 35% of the net loss recorded by PayNovi Ltd. in the three months to September 30, 2015. PaynNovi has not yet launched its services and has not yet generated any revenues. The loss incurred reflects operating costs in bringing services to market. PayNovi Ltd. is currently integrating services from its supply partners in order to launch services in the 4th quarter of 2015. We therefore expect to record losses in line with the current quarter for the rest of 2015 until PayNovi Ltd. generates sufficient revenues for it to become profitable.

Loss on equity investments

On September 30, 2015, the Company took an impairment charge of $1,376,208 to reduce the carrying value of this investment to zero based on the losses incurred by the PayNovi business during the six months since this investment and the limited activities of PayNovi's current business operations.

Net Loss

We generated a net loss of $1,371,240 and $141,797 for the three months ended September 30, 2015 and 2014 respectively.

We incurred a net loss of $2,866,933 for the nine months ended September 30, 2015 and a net loss of $432,782 for the period from May 2014 (inception) to September 30, 3014 due to the factors discussed above.

Liquidity and Capital Resources

Working Capital

| | | September 30, 2015 | | | December 31, 2014 | | | Percentage Increase/ | |

| | | | | | (as restated) | | | (Decrease) | |

Current Assets | | | 3,497,952 | | | | 340,280 | | | | 927 | % |

Current Liabilities | | | 1,270,442 | | | | 926,338 | | | | 37 | % |

Working Capital Surplus (Deficit) | | | 2,227,510 | | | | (586,058 | ) | | | 485 | % |

The increase in current assets is primarily due to an increase in cash during the period due to the receipt of $2 million in equity from Power Clouds Inc. our previous parent company, $3 million in cash from Fabio Galdi, our CEO, and a repayment of a net $943,319 in related party debt to World Global Assets Pte. Ltd., a sister company, for working capital cash provided by it from May 2014 (inception) to September 30, 2015. We expect that the cash balance will decrease further in the next quarter to support operating expenses during the ramp up of sales of recently launched SPACE products and services.