FY

2024

--05-31

false

0001088413

1

1

4

4

3

3

5

5

10

6

5

6

5

10

6

5

10

48

52

5

3.00

4.00

1.25

http://fasb.org/us-gaap/2024#PrimeRateMember

http://fasb.org/us-gaap/2024#PrimeRateMember

false

false

false

false

00010884132023-06-012024-05-31

thunderdome:item

iso4217:USD

00010884132024-05-31

0001088413glgi:OneCustomerMember2022-06-012023-05-31

0001088413glgi:OneCustomerMember2023-06-012024-05-31

xbrli:pure

0001088413us-gaap:CostOfGoodsTotalMemberus-gaap:CustomerConcentrationRiskMember2022-06-012023-05-31

0001088413us-gaap:CostOfGoodsTotalMemberus-gaap:CustomerConcentrationRiskMember2023-06-012024-05-31

0001088413us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberglgi:ThreeToFourCustomersMember2022-06-012023-05-31

0001088413us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberglgi:ThreeToFourCustomersMember2023-06-012024-05-31

0001088413us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembersrt:MaximumMember2022-06-012023-05-31

0001088413us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembersrt:MaximumMember2023-06-012024-05-31

0001088413us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembersrt:MinimumMember2022-06-012023-05-31

0001088413us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembersrt:MinimumMember2023-06-012024-05-31

00010884132022-06-012023-05-31

utr:Y

0001088413glgi:The401kPlanMember2022-06-012024-05-31

0001088413glgi:The401kPlanMember2022-06-012023-05-31

0001088413glgi:The401kPlanMember2023-06-012024-05-31

iso4217:USDxbrli:shares

0001088413glgi:WarrantsExercisableIntoCommonStockMember2016-09-01

xbrli:shares

0001088413glgi:Series2003PreferredStockMember2003-09-30

0001088413glgi:Series2003PreferredStockMember2023-06-012024-05-31

0001088413glgi:Series2003PreferredStockMember2003-09-012003-09-30

0001088413us-gaap:DomesticCountryMember2024-05-31

00010884132023-05-31

0001088413glgi:GreenPlasticPalletsMember2023-05-31

0001088413glgi:GreenPlasticPalletsMember2024-05-31

0001088413glgi:GreenPlasticPalletsMember2022-06-012023-05-31

0001088413glgi:GreenPlasticPalletsMember2023-06-012024-05-31

0001088413glgi:TriEndaHoldingsLLCMember2023-05-31

0001088413glgi:TriEndaHoldingsLLCMember2024-05-31

0001088413glgi:TriEndaHoldingsLLCMember2022-06-012023-05-31

0001088413glgi:TriEndaHoldingsLLCMember2023-06-012024-05-31

0001088413glgi:TriEndaHoldingsLLCMember2022-06-012023-05-31

0001088413glgi:TriEndaHoldingsLLCMember2023-06-012024-05-31

0001088413glgi:ManufacturingFacilitiesLeaseMemberglgi:GreystoneRealEstateLLCMember2022-08-012022-08-01

0001088413glgi:ManufacturingFacilitiesLeaseMemberglgi:GreystoneRealEstateLLCMember2022-08-01

0001088413glgi:GreystoneRealEstateLLCMember2022-06-012023-05-31

0001088413glgi:GreystoneRealEstateLLCMember2023-06-012024-05-31

0001088413glgi:OfficeSpaceLeaseMemberglgi:YorktownMember2022-06-012023-05-31

0001088413glgi:OfficeSpaceLeaseMemberglgi:YorktownMember2023-06-012024-05-31

0001088413glgi:OfficeSpaceLeaseMemberglgi:YorktownMember2017-01-012017-01-01

0001088413glgi:OfficeSpaceLeaseMemberglgi:YorktownMember2017-01-01

0001088413glgi:GrindingAndPelletizingEquipmentMemberglgi:YorktownMember2022-06-012023-05-31

0001088413glgi:GrindingAndPelletizingEquipmentMemberglgi:YorktownMember2023-06-012024-05-31

0001088413us-gaap:SubsequentEventMember2024-06-01

0001088413glgi:PalletsMember2022-06-012023-05-31

0001088413glgi:PalletsMember2023-06-012024-05-31

0001088413us-gaap:SalesRevenueProductLineMemberus-gaap:CustomerConcentrationRiskMemberglgi:DistributorsMember2022-06-012023-05-31

0001088413us-gaap:SalesRevenueProductLineMemberus-gaap:CustomerConcentrationRiskMemberglgi:DistributorsMember2023-06-012024-05-31

0001088413us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMemberglgi:EndUserCustomersMember2022-06-012023-05-31

0001088413us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMemberglgi:EndUserCustomersMember2023-06-012024-05-31

0001088413us-gaap:SalesRevenueSegmentMemberus-gaap:GeographicConcentrationRiskMemberglgi:CanadaAndMexicoMember2022-06-012023-05-31

0001088413us-gaap:SalesRevenueSegmentMemberus-gaap:GeographicConcentrationRiskMemberglgi:CanadaAndMexicoMember2023-06-012024-05-31

0001088413glgi:RelatedPartyLeaseAgreementMember2024-01-01

utr:M

0001088413glgi:GreystoneAndGRELeaseAgreementMember2024-05-31

0001088413glgi:OfficeSpaceLeaseMember2024-05-31

0001088413glgi:TwoBuildingsMember2024-05-31

0001088413glgi:EquipmentTwoMember2024-05-31

0001088413glgi:EquipmentOneMember2024-05-31

0001088413glgi:EquipmentOneMember2022-06-012023-05-31

0001088413glgi:EquipmentOneMember2023-06-012024-05-31

0001088413glgi:LeaseAgreementDated12282017Member2022-12-292022-12-29

0001088413glgi:ThreeLeaseAgreementsWithFiveYearTermsMember2022-10-172022-10-17

0001088413glgi:ThreeLeaseAgreementsWithFiveYearTermsMember2024-05-31

0001088413glgi:NoncancellableLeasesMember2023-05-31

0001088413glgi:NoncancellableLeasesMember2024-05-31

0001088413srt:MinimumMember2021-08-23

00010884132021-08-23

0001088413glgi:TermLoanBMember2024-02-05

0001088413glgi:IBCLoanAgreementMember2024-05-31

0001088413glgi:TermLoanBMember2022-07-29

0001088413glgi:IBCLoanAgreementMember2022-07-292022-07-29

0001088413us-gaap:RevolvingCreditFacilityMember2024-05-31

0001088413us-gaap:RevolvingCreditFacilityMember2022-07-29

0001088413glgi:TermLoanBMember2023-05-05

0001088413glgi:CreditToPurchaseEquipmentMember2022-07-292022-07-29

0001088413glgi:LoanToPayOffNotePayableMember2022-07-292022-07-29

0001088413glgi:IBCLoanAgreementMember2022-07-29

0001088413glgi:TermLoanAMember2022-07-29

0001088413glgi:OtherDebtMember2023-05-31

0001088413glgi:OtherDebtMember2024-05-31

0001088413glgi:TermLoanPayableDueAugust102028Member2023-05-31

0001088413glgi:TermLoanPayableDueAugust102028Member2024-05-31

0001088413glgi:TermLoanPayableDueAugust102028Member2022-06-012023-05-31

0001088413glgi:TermLoanPayableDueAugust102028Member2024-05-312024-05-31

0001088413glgi:TermLoanPayableDueMarch192025Member2023-05-31

0001088413glgi:TermLoanPayableDueMarch192025Member2024-05-31

0001088413glgi:TermLoanPayableDueMarch192025Member2022-06-012023-05-31

0001088413glgi:TermLoanPayableDueMarch192025Member2024-05-312024-05-31

0001088413glgi:RevolvingLoanPayableDueJuly292024Member2023-05-31

0001088413glgi:RevolvingLoanPayableDueJuly292024Member2024-05-31

0001088413glgi:RevolvingLoanPayableDueJuly292024Member2022-06-012023-05-31

0001088413glgi:RevolvingLoanPayableDueJuly292024Membersrt:MaximumMember2022-06-012023-05-31

0001088413glgi:RevolvingLoanPayableDueJuly292024Membersrt:MinimumMember2022-06-012023-05-31

0001088413glgi:TermLoansBDueJuly292027Member2023-05-31

0001088413glgi:TermLoansBDueJuly292027Member2024-05-31

0001088413glgi:TermLoansBDueJuly292027Member2022-06-012023-05-31

0001088413glgi:TermLoansBDueJuly292027Member2023-06-012024-05-31

0001088413glgi:TermLoansBDueJuly292027Membersrt:MaximumMember2022-06-012023-05-31

0001088413glgi:TermLoansBDueJuly292027Membersrt:MaximumMember2023-06-012024-05-31

0001088413glgi:TermLoansBDueJuly292027Membersrt:MinimumMember2022-06-012023-05-31

0001088413glgi:TermLoansBDueJuly292027Membersrt:MinimumMember2023-06-012024-05-31

0001088413glgi:TermLoansADueJuly292027Member2023-05-31

0001088413glgi:TermLoansADueJuly292027Member2024-05-31

0001088413glgi:TermLoansADueJuly292027Member2022-06-012023-05-31

0001088413glgi:TermLoansADueJuly292027Member2023-06-012024-05-31

0001088413glgi:TermLoansADueJuly292027Membersrt:MaximumMember2022-06-012023-05-31

0001088413glgi:TermLoansADueJuly292027Membersrt:MaximumMember2023-06-012024-05-31

0001088413glgi:TermLoansADueJuly292027Membersrt:MinimumMember2022-06-012023-05-31

0001088413glgi:TermLoansADueJuly292027Membersrt:MinimumMember2023-06-012024-05-31

0001088413us-gaap:FireMember2024-02-012024-02-28

0001088413us-gaap:FireMember2024-02-28

0001088413us-gaap:BuildingMemberus-gaap:FireMember2024-02-28

0001088413glgi:ProductionEquipmentNotBeenPlacedIntoServiceMember2024-05-31

0001088413us-gaap:FurnitureAndFixturesMember2023-05-31

0001088413us-gaap:FurnitureAndFixturesMember2024-05-31

0001088413us-gaap:LeaseholdImprovementsMember2023-05-31

0001088413us-gaap:LeaseholdImprovementsMember2024-05-31

0001088413glgi:PlantBuildingsAndLandMember2023-05-31

0001088413glgi:PlantBuildingsAndLandMember2024-05-31

0001088413us-gaap:MachineryAndEquipmentMember2023-05-31

0001088413us-gaap:MachineryAndEquipmentMember2024-05-31

0001088413glgi:Series2003PreferredStockMember2023-06-012024-05-31

0001088413us-gaap:FurnitureAndFixturesMembersrt:MaximumMember2024-05-31

0001088413us-gaap:FurnitureAndFixturesMembersrt:MinimumMember2024-05-31

0001088413us-gaap:LeaseholdImprovementsMembersrt:MaximumMember2024-05-31

0001088413us-gaap:LeaseholdImprovementsMembersrt:MinimumMember2024-05-31

0001088413us-gaap:MachineryAndEquipmentMembersrt:MaximumMember2024-05-31

0001088413us-gaap:MachineryAndEquipmentMembersrt:MinimumMember2024-05-31

0001088413glgi:PlantBuildingMember2024-05-31

00010884132022-07-292022-07-29

00010884132022-05-31

0001088413us-gaap:NoncontrollingInterestMember2024-05-31

0001088413us-gaap:ParentMember2024-05-31

0001088413us-gaap:RetainedEarningsMember2024-05-31

0001088413us-gaap:AdditionalPaidInCapitalMember2024-05-31

0001088413us-gaap:CommonStockMember2024-05-31

0001088413us-gaap:PreferredStockMember2024-05-31

0001088413us-gaap:NoncontrollingInterestMember2023-06-012024-05-31

0001088413us-gaap:ParentMember2023-06-012024-05-31

0001088413us-gaap:RetainedEarningsMember2023-06-012024-05-31

0001088413us-gaap:AdditionalPaidInCapitalMember2023-06-012024-05-31

0001088413us-gaap:CommonStockMember2023-06-012024-05-31

0001088413us-gaap:PreferredStockMember2023-06-012024-05-31

0001088413us-gaap:NoncontrollingInterestMember2023-05-31

0001088413us-gaap:ParentMember2023-05-31

0001088413us-gaap:RetainedEarningsMember2023-05-31

0001088413us-gaap:AdditionalPaidInCapitalMember2023-05-31

0001088413us-gaap:CommonStockMember2023-05-31

0001088413us-gaap:PreferredStockMember2023-05-31

0001088413us-gaap:NoncontrollingInterestMember2022-06-012023-05-31

0001088413us-gaap:ParentMember2022-06-012023-05-31

0001088413us-gaap:RetainedEarningsMember2022-06-012023-05-31

0001088413us-gaap:AdditionalPaidInCapitalMember2022-06-012023-05-31

0001088413us-gaap:CommonStockMember2022-06-012023-05-31

0001088413us-gaap:PreferredStockMember2022-06-012023-05-31

0001088413us-gaap:NoncontrollingInterestMember2022-05-31

0001088413us-gaap:ParentMember2022-05-31

0001088413us-gaap:RetainedEarningsMember2022-05-31

0001088413us-gaap:AdditionalPaidInCapitalMember2022-05-31

0001088413us-gaap:CommonStockMember2022-05-31

0001088413us-gaap:PreferredStockMember2022-05-31

0001088413us-gaap:RelatedPartyMember2023-05-31

0001088413us-gaap:RelatedPartyMember2024-05-31

0001088413us-gaap:NonrelatedPartyMember2023-05-31

0001088413us-gaap:NonrelatedPartyMember2024-05-31

00010884132024-08-30

00010884132023-11-30

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended _________May 31, 2024

☐ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________ to______________

Commission file number 000-26331

| GREYSTONE LOGISTICS, INC. |

| (Exact name of registrant as specified in its charter) |

|

Oklahoma

|

|

75-2954680

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

| 1613 East 15th Street, Tulsa, Oklahoma 74120 |

| (Address of principal executive offices) (Zip Code) |

| (918) 845-6227 |

| (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Securities registered pursuant to Section 12(g) of the Act:

| Common Stock, $0.0001 par value |

| (Title of class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

Accelerated filer ☐ |

| Non-accelerated filer ☒ |

Smaller reporting company ☒ |

| |

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

☐ Yes ☒ No

As of November 30, 2023 (the last business day of the registrant’s most recently completed second fiscal quarter), the aggregate market value of the voting common stock held by non-affiliates of the registrant, computed by (reference to the price at which the registrant’s common stock was last sold on such date, was approximately $11,479,202 ($0.95 per share).

As of August 30, 2024, there were 28,279,701 shares of the registrant’s common stock, $0.0001 par value per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

GREYSTONE LOGISTICS, INC.

FORM 10-K

TABLE OF CONTENTS

PART I

Item 1. Business.

Organization

Greystone Logistics, Inc. ("Greystone" or the "Company") was incorporated in Delaware on February 24, 1969, under the name Permaspray Manufacturing Corporation. It subsequently changed its name to Browning Enterprises Inc. in April 1982, to Cabec Energy Corp. in June 1993, to PalWeb Corporation in April 1999 and to Greystone Logistics, Inc. in March 2005, as further described below. In December 1997, Greystone acquired all of the issued and outstanding stock of Plastic Pallet Production, Inc., a Texas corporation ("PPP"), and since that time, Greystone has primarily been engaged in the business of manufacturing and selling plastic pallets.

Effective September 8, 2003, Greystone acquired substantially all of the assets of Greystone Plastics, Inc., an Iowa corporation, through the purchase of such assets by Greystone's newly formed, wholly-owned subsidiary, Greystone Manufacturing, L.L.C., an Oklahoma limited liability company ("GSM"). Greystone Plastics, Inc. was a manufacturer of plastic pallets used in the beverage industry.

Effective March 18, 2005, the Company caused its newly formed, wholly owned subsidiary, Greystone Logistics, Inc., an Oklahoma corporation, to be merged with and into the Company. In connection with such merger and as of the effective time of the merger, the Company amended its certificate of incorporation by changing its name from PalWeb Corporation to Greystone Logistics, Inc., pursuant to the terms of the certificate of ownership and merger filed by Greystone with the Secretary of State of Oklahoma.

Current Business

Products

Greystone's primary business is the manufacturing of plastic pallets utilizing recycled plastic and selling the pallets through its wholly owned subsidiary, GSM. Greystone sells its pallets through a network of independent contractor distributors and direct sales by its President and sales department. As of May 31, 2024, Greystone had an aggregate in-house production capacity of approximately 225,000 pallets per month from 14 injection molding machines of which 12 are located in Bettendorf, IA and 2 located in Palmyra, MO. In addition, Greystone outsources production for pallets produced by injection molding machines as necessary to accommodate overflow. Greystone's injection molding machine production as of May 31, 2024 consists of the following:

| |

·

|

37” X 32” rackable pallet,

|

| |

·

|

40” X 32” rackable pallet,

|

| |

·

|

37” X 37” rackable pallet,

|

| |

·

|

48” X 48” rackable pallet,

|

| |

·

|

48” X 40” rackable pallet,

|

| |

·

|

48” X 44” rackable pallet,

|

| |

·

|

48” X 40” nestable pallet with or without detachable runners,

|

| |

·

|

45” X 45” nestable pallet with or without detachable bottom deck,

|

| |

·

|

24” X 40” display pallet,

|

| |

·

|

48” X 40” monoblock (one-piece) pallet,

|

| |

·

|

Half-barrel keg stackable pallet,

|

| |

·

|

Slim keg stackable pallet,

|

| |

·

|

36” X 36” rackable pallet,

|

| |

·

|

48” X 45” monoblock pallet,

|

| |

·

|

48” X 45” drum pallet, and

|

| |

·

|

48” X 40” mid duty pallet.

|

In April 2023, Greystone opened a facility in Jasper, IN, through the purchase of equipment, including robotics, that uses an extrusion process to produce plastic pallets. Recycled plastic will be used in the process consistent with Greystone’s green standards. The pallets created from this extrusion process are robotically welded producing pallets in unusual sizes, including 30”X30”, 60”X60” and also 96” X 48” designs.

The principal raw materials used in manufacturing Greystone's plastic pallets are in abundant supply, and some of these materials may be obtained from recycled plastic containers. At the present time, these materials are being purchased from local and national suppliers. If available, materials may also be purchased from international suppliers.

Pallet Industry

Pallets are devices used for moving and storing freight. A pallet is used as a base for assembling, storing, stacking, handling, and transporting goods as a unit load. A pallet is constructed to facilitate the placement of a lift truck’s forks between the levels of a platform so it may be moved easily.

Pallets are used worldwide for the transportation of goods and they are primarily made of wood. An estimated 80-90 percent of all U.S. commerce is carried on pallets, which amounts to an estimated 2.6 billion pallets in circulation daily in the United States. The manufacture of wood pallets is estimated to consume more than 45 percent of total U.S. hardwood lumber production. “Pallets move the world,” says Dr. Marshall S. “Mark” White, an emeritus professor at Virginia Tech University and director of the William H. Sardo Jr. Pallet and Container Research Laboratory and Center for Packaging and Unit Load Design.

The largest industry users of pallets such as the food, chemical, pharmaceutical, beverage and dairy industries are populated with large public or private entities for which profitable financial performance is paramount. The trend for pallets is expected to expand because of overall pallet demand resulting from growth in the U.S. economy and the current U.S. government administration’s efforts to move manufacturing capacity back to the U.S. The operating issues presented by wood pallets have been tolerated to date as there has been no viable alternative in sufficient size for replacement. A report on the market for pallets in North America by Zoe Biller, an industry analyst for Freedonia Group, provided the following on wood and plastic pallets:

Wood: Although not highlighted in her report, Biller estimates that about 60% of wooden pallets are used and about 40% are new. Those percentages could shift in favor of new pallets going forward because the industry has been reporting a shortage of quality used pallets, known as cores, for the last year or so. “The core shortage appears to be real and it is going to be part of what’s going on going forward,” Biller said. “But it should correct itself in the long term as end users buy new pallets that replenish the pool.”

Nearly five years ago, Costco announced that it was going entirely to a block pallet. Biller believes Costco’s decision is a symptom of the overall trend towards block pallets rather than a driver. “Costco is part of a broader trend towards pallets that are easier to use, especially in an automated system or with pallet jacks,” Biller said. Block pallets fit both of those bills. She adds, “There’s also a bigger trend to turn products and processes that aren’t a core business to a third party and pallet management is definitely part of that trend.”

Plastic: The move towards plastic appears to be driven by companies that can control their pallet pools and take advantage of plastics’ longevity as well as “growing sanitation concerns related to wood pallets,” Biller said. “Food safety regulations may have something to do with it going forward.” Asked if she was surprised by any of the results, Biller said she was surprised by how far the pallet market declined during the recession. “A big part of the market advance is the need to bring the number of pallets available for use to required levels,” she said.

According to Bob Trebilcock of Modern Materials Handling Magazine, one important bullet point for pallet users from the Freedonia report’s executive summary was that plastic pallets have seen their strongest advances in percentage terms ever and will continue to record above average growth.

According to Persistence Market Research, rising demand for alternative pallet types is anticipated to boost the growth of plastic pallets in the global pallets market.

In a June 2018 article, Persistence Market Research published an article that non-wood pallets are likely to experience a massive increase in demand across the globe. Among these, plastic pallets are expected to be the most attractive option. The major reason behind the increase in popularity of and demand for plastic pallets is due to the ease with which these can be cleaned. In addition, they are made of recycled materials. This is a very attractive benefit for companies working towards becoming more environmentally friendly. This factor is creating a positive impact on the plastic pallets market.

Another factor which is driving the growth of plastic pallets is the adoption of pallets by new users. The pallet utilization in various regions across the globe is typically low compared to the size of their manufacturing, warehousing, and construction sectors. However, in the coming years, greater numbers of potential pallet users will strive to become more competitive on a global scale by improving operating efficiencies and reducing product damage in shipments through the use of plastic pallets.

The increase in trade volume especially in the Middle East and African regions is also anticipated to fuel the growth of the plastic pallets market. Gulf Cooperation Council countries, located in between the Far East and Europe, can be considered as the gateway to the world’s most progressive markets such as India and China. The transport and logistics sector in the Middle East region is showing substantial growth rates with a long-term positive outlook. The plastic pallets market is thus expected to witness significant growth and is a vital link in supply chain and storage.

With a huge incremental opportunity, the global pallets market is projected to grow at more than 5% Compound Annual Growth Rate (“CAGR”) during the period of assessment.

During the period 2012 – 2016, the global pallets market expanded at a CAGR of 4.7%. However, during the forecast period – that is between 2018 and 2025 – the market is anticipated to grow at a CAGR of 5.4% owing to increasing demand for better and safe transportation coupled with the rise in demand for pallets from various industries like food, agriculture, chemicals etc. The global pallets market is projected to represent an incremental opportunity of more than $25 billion between 2018 and 2025.

Types of Pallets

The most common size pallet is the 48” x 40” 4-way pallet, known as the GMA (Grocery Manufacturer Association) pallet, “GMA 48 x 40 Pallet,” or “GMA Block Pallet.” The GMA pallet acts as a commodity in the pallet industry, as price is often determined by availability. As wood pallets move through their life cycle from a new pallet to a used pallet, they are repaired and put back in service until they are sent to a landfill or used as wood compost.

Pallets are the primary interface between the packaged product and today’s highly automated material handling equipment. Although pallets are not the most glamorous part of the warehouse, they are important because users have expectations based on specifications and wood pallets lack critical manufacturing details that determine performance. The end user becomes frustrated when these pallets do not perform to expectation. Shipments can be damaged or rejected entirely resulting in significant product and revenue losses. This angst is aggravated when new multi-million-dollar automated systems are in use.

Employees

As of May 31, 2024, Greystone had full-time equivalents (“FTE’s” is a unit of measure that translates number of weekly hours worked by all employees where 40 hours per week is a single person) of approximately 190 full time employees. A temporary personnel service provides additional production personnel on an as needed basis of which there were FTE’s of approximately 69 employees as of May 31, 2024.

Marketing and Customers

Greystone's primary focus is to provide quality plastic pallets to its existing customers while continuing its marketing efforts to broaden its customer base. Greystone's existing customers are primarily located in the United States and engaged in the beverage, pharmaceutical and other industries. Greystone has generated, and plans to continue to generate, interest in its pallets by attending trade shows sponsored by industry segments that would benefit from Greystone's products. Greystone hopes to gain wider product acceptance by marketing the concept that the widespread use of plastic pallets could greatly reduce the destruction of trees on a worldwide basis. Greystone sells to customers through contract distributors or by direct contract through its President and other employees.

Greystone’s customers generally either have a recurring need for pallets such as a distributor and an end-user who acquires pallets for a closed loop distribution system or end users who acquire pallets for internal warehouse use. The latter group of customers may or may not have a recurring demand for pallets each year. Accordingly, revenues from customers that qualify as substantial in any one year may vary. During fiscal years 2024 and 2023, Greystone derived a substantial portion of its revenue from three customers. These customers accounted for approximately 81% and 73% of total sales in fiscal years 2024 and 2023, respectively. Greystone’s recycled plastic pallets are designed to meet the respective customer’s needs and are the only pallets approved for use by these customers. There is no assurance that Greystone will retain these customers’ business at the same level, or at all. The loss of a material amount of business from one of these customers could have a material adverse effect on Greystone.

Competition

Greystone's primary competitors are a large number of small, privately held firms that sell wood pallets in very limited geographic locations. Greystone believes that it can compete with manufacturers of wood pallets by emphasizing the cost savings realized over the longer life of its plastic pallets, as well as the environmental benefits (principally elimination from landfill and recycling) of its plastic pallets as compared to wood pallets. Greystone also competes with three large and approximately ten small manufacturers of plastic pallets. Some of Greystone's competitors may have substantially greater financial and other resources than Greystone and, therefore, may be able to commit greater resources than Greystone in the areas of product development, manufacturing and marketing. However, Greystone believes that its proprietary designs coupled with the competitive pricing of its products gives Greystone an advantage over other plastic pallet manufacturers.

Government Regulation

Although Greystone recycles approximately 60 million pounds of post-consumer plastic per year which would otherwise be destined for the landfill, business operations of Greystone are subject to existing and potential federal, state and local environmental laws and regulations pertaining to the handling and disposition of wastes (including solid and hazardous wastes) or otherwise relating to the protection of the environment. In addition, both the plastics industry and Greystone are subject to existing and potential federal, state, local and foreign legislation designed to reduce solid wastes by requiring, among other things, plastics to be degradable in landfills, minimum levels of recycled content, various recycling requirements, disposal fees and limits on the use of plastic products.

Patents and Trademarks

Greystone seeks to protect its technical advances by pursuing national and international patent protection for its products and methods when appropriate.

Management Plastic Pallet Summation

For over 30 years, both timber prices and landfill fees have increased and have compelled businesses to modify the way pallets are managed. Businesses can evaluate and improve their pallet management systems and reduce associated waste by utilizing recycled plastic pallets.

According to the U.S. Environmental Protection Agency, deforestation is a significant contributor to global carbon dioxide gas emissions. Deforestation leads to CO2 emissions because the carbon sequestered in trees is emitted into the atmosphere and not counter-balanced by re-growth of new trees. Additionally, estimates are that up to 20 percent of total pallet wood waste ends up in land fill.

ESG, an acronym for environmental, social and governance, consists of three broad categories or areas of interest of what is termed “socially responsible investors.” Within each ESG category are various specific related concerns that may or may not be pertinent in a given situation depending on the specific investment being examined. The environmental category concerns include pollution or waste material that a company produces and factors related to climate change. The environmental circumstances surrounding deforestation imply that continued and growing interest in ESG compliance will lead companies to strongly consider the change to plastic pallets. Use of recycled plastics to produce pallets, as Greystone does, demonstrates commitment to ESG by reducing plastic disposition to landfills.

Greystone’s management believes that the gradual shifting trend from wood to 100 percent recyclable plastic pallets will continue, with the primary limiting factors being a front-end higher price and some regulatory limits to certain applications of pallet use. The savings come in recyclability and significantly longer life which lowers the cost per trip dramatically. Greystone intends to continue to conduct research on pallet design for strength and coefficient of friction, on the materials used to make the plastic pallets as required to meet market demands and to improve its existing products. Plastic pallets reduce wood waste, are hygienic, weigh less which lowers fuel consumption and transport costs and are fully recyclable.

Item 1A. Risk Factors.

Our business could be affected by changes in the availability of raw materials.

Greystone uses a proprietary mix of raw materials to produce its plastic pallets. Such raw materials are generally readily available, and some may be obtained from a broad range of recycled plastic suppliers and unprocessed waste plastic. At the present time, these materials are being purchased from local and national suppliers. If available, these materials may also be purchased from international suppliers. The availability of Greystone's raw materials could change at any time for various reasons. For example, the market demand for Greystone's raw materials could suddenly increase, or the rate at which plastic materials are recycled could decrease, affecting both availability and price. Additionally, the laws and regulations governing the production of plastics and the recycling of plastic containers could change and, as a result, affect the supply of Greystone's raw materials. Any interruption in the supply of raw materials or components could have a material adverse effect on Greystone. Furthermore, certain potential alternative suppliers may have pre-existing exclusive relationships with Greystone's competitors and others that may preclude Greystone from obtaining raw materials from such suppliers.

Greystone's business could be affected by competition and rapid technological change.

Greystone currently faces competition from many companies that produce wooden pallets at prices that are substantially lower than the prices Greystone and other companies that manufacture plastic pallets charge for their plastic pallets. It is anticipated that the plastic pallet industry will be subject to intense competition and rapid technological change. Greystone could potentially face additional competition from recycling and plastics companies, many of which have substantially greater financial and other resources than Greystone and, therefore, are able to spend more than Greystone in areas such as product development, manufacturing and marketing. Competitors may develop products that render Greystone's products or proposed products uneconomical or result in products being commercialized that may be superior to Greystone's products. In addition, alternatives to plastic pallets could be developed, which would have a material adverse effect on Greystone.

We are dependent on a few large customers.

Greystone derives a large portion of its revenue from a few large customers and expects that this trend will continue in the foreseeable future. Three customers currently account for approximately 81% of its total sales in fiscal year 2024 (73% in fiscal year 2023). There is no assurance that Greystone will retain these customers’ business at the same level, or at all. The loss of a material amount of business from one of these customers would have a material adverse effect on Greystone.

We may not be able to effectively protect Greystone's patents and proprietary rights.

Greystone relies upon a combination of patents and trade secrets to protect its proprietary technology, rights and know-how. There can be no assurance that such patent rights will not be infringed upon, that Greystone's trade secrets will not otherwise become known to or independently developed by competitors, that non-disclosure agreements will not be breached, or that Greystone would have adequate remedies for any such infringement or breach. Litigation may be necessary to enforce Greystone's proprietary rights or to defend Greystone against third-party claims of infringement. Such litigation could result in substantial cost to, and a diversion of effort by, Greystone and its management and may have a material adverse effect on Greystone. Greystone's success and potential competitive advantage is dependent upon its ability to exploit the technology under these patents. There can be no assurance that Greystone will be able to exploit the technology covered by these patents or that Greystone will be able to do so exclusively.

Our business could be affected by changes or new legislation regarding environmental matters.

Greystone's business is subject to changing federal, state and local environmental laws and regulations pertaining to the discharge of materials into the environment, the handling and disposition of waste (including solid and hazardous waste) or otherwise relating to the protection of the environment. As is the case with manufacturers in general, if a release of hazardous substances occurs on or from Greystone's properties or any associated off-site disposal location, or if contamination from prior activities is discovered at any of Greystone's properties, Greystone may be held liable. No assurances can be given that additional environmental issues will not require future expenditures. In addition, the plastics industry is subject to existing and potential federal, state, local and foreign legislation designed to reduce solid wastes by requiring, among other things, plastics to be degradable in landfills, minimum levels of recycled content, various recycling requirements and disposal fees and limits on the use of plastic products. Also, various consumer and special interest groups have lobbied from time to time for the implementation of these and other similar measures. Although Greystone believes that the legislation promulgated to date and such initiatives to date have not had a material adverse effect on it, there can be no assurance that any such future legislative or regulatory efforts or future initiatives would not have a material adverse effect.

Our business could be subject to potential product liability claims.

The testing, manufacturing and marketing of Greystone's products and proposed products involve inherent risks related to product liability claims or similar legal theories that may be asserted against Greystone, some of which may cause Greystone to incur significant defense costs. Although Greystone currently maintains product liability insurance coverage that it believes is adequate, there can be no assurance that the coverage limits of its insurance will be adequate under all circumstances or that all such claims will be covered by insurance. In addition, these policies generally must be renewed every year. While Greystone has been able to obtain product liability insurance in the past, there can be no assurance it will be able to obtain such insurance in the future on all of its existing or future products. A successful product liability claim or other judgment against Greystone in excess of its insurance coverage, or the loss of Greystone's product liability insurance coverage could have a material adverse effect upon Greystone.

Greystone currently depends on certain key personnel.

Greystone is dependent on the experience, abilities and continued services of its current management. In particular, Warren Kruger, Greystone's President and CEO, has played a significant role in the development, management and financing of Greystone. The loss or reduction of services of Warren Kruger or any other key employee could have a material adverse effect on Greystone. In addition, there is no assurance that additional managerial assistance will not be required, or that Greystone will be able to attract or retain such personnel.

Greystone's executive officers and directors control a large percentage of Greystone's outstanding common stock and all of Greystone's 2003 preferred stock, which entitles them to certain voting rights, including the right to elect a majority of Greystone's Board of Directors.

Greystone's executive officers and directors (and their affiliates), in the aggregate, own approximately 44.7% of Greystone's outstanding common stock and have approximately 49.6% of the voting power. Therefore, Greystone's executive officers and directors can have significant influence with respect to the outcome of matters submitted to Greystone's shareholders for approval (including the election and removal of directors and any merger, consolidation or sale of all or substantially all of Greystone's assets) and to control Greystone's management and affairs. In addition, two of Greystone's directors (including one who also serves as Greystone’s chief executive officer) own all of Greystone's outstanding 2003 preferred stock, with each owning 50%. The terms and conditions of Greystone's 2003 preferred stock provide that such holder has the right to elect a majority of Greystone's Board of Directors. Such concentration of ownership may have the effect of delaying, deferring or preventing a change in control, impeding a merger, consolidation, takeover or other business combination or discouraging a potential acquirer from making a tender offer or otherwise attempting to obtain control, which in turn could have an adverse effect on the market price of Greystone's common stock.

Our common stock is a “penny stock” under SEC rules. It may be more difficult to sell securities classified as “penny stock.”

Our common stock is a “penny stock” under applicable SEC rules (generally defined as non-exchange traded stock with a per-share price below $5.00). Unless we successfully list our common stock on a national securities exchange, or maintain a per-share price above $5.00, these rules impose additional sales practice requirements on broker-dealers that recommend the purchase or sale of penny stocks to persons other than those who qualify as “established customers” or “accredited investors.” For example, broker-dealers must determine the appropriateness for non-qualifying persons of investments in penny stocks. Broker-dealers must also provide, prior to a transaction in a penny stock not otherwise exempt from the rules, a standardized risk disclosure document that provides information about penny stocks and the risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, disclose the compensation of the broker-dealer and its salesperson in the transaction, furnish monthly account statements showing the market value of each penny stock held in the customer’s account, provide a special written determination that the penny stock is a suitable investment for the purchaser, and receive the purchaser’s written agreement to the transaction.

Legal remedies available to an investor in “penny stocks” may include the following:

| |

●

|

If a “penny stock” is sold to the investor in violation of the requirements listed above, or other federal or states securities laws, the investor may be able to cancel the purchase and receive a refund of the investment.

|

| |

●

|

If a “penny stock” is sold to the investor in a fraudulent manner, the investor may be able to sue the persons and firms that committed the fraud for damages.

|

These requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a security that becomes subject to the penny stock rules. The additional burdens imposed upon broker-dealers by such requirements may discourage broker-dealers from effecting transactions in our securities, which could severely limit the market price and liquidity of our securities. These requirements may restrict the ability of broker-dealers to sell our common stock and may affect your ability to sell our common stock.

Many brokerage firms will discourage or refrain from recommending investments in penny stocks. Most institutional investors will not invest in penny stocks. In addition, many individual investors will not invest in penny stocks due, among other reasons, to the increased financial risk generally associated with these investments.

For these reasons, penny stocks may have a limited market and, consequently, limited liquidity. We can give no assurance at what time, if ever, our common stock will not be classified as a “penny stock” in the future.

Substantial future sales of shares of our common stock could cause the market price of our common stock to decline.

The market price of shares of our common stock could decline as a result of substantial sales of our common stock, particularly sales by our directors, executive officers and significant stockholders, a large number of shares of our common stock becoming available for sale or the perception in the market that holders of a large number of shares intend to sell their shares.

Greystone’s stock trades in a limited public market and is subject to price volatility. There can be no assurance that an active trading market will develop or be sustained.

There has been a limited public trading market for Greystone's common stock and there can be no assurance that an active trading market will develop or be sustained. The trading price of Greystone's common stock could be subject to significant fluctuations in response to variations in quarterly operating results or even mild expressions of interest on a given day. Accordingly, Greystone's common stock should be expected to experience substantial price changes in short periods of time. Even if Greystone is performing according to its plan and there is no legitimate company-specific financial basis for this volatility, it must still be expected that substantial percentage price swings will occur in Greystone's common stock for the foreseeable future. In addition, the limited market for Greystone's common stock may restrict Greystone's shareholders ability to liquidate their shares.

Greystone does not expect to declare or pay any dividends on its common stock in the foreseeable future.

Greystone has not declared or paid any dividends on its common stock. Greystone currently intends to retain future earnings to fund the development and growth of its business, to repay indebtedness and for general corporate purposes, and, therefore, does not anticipate paying any cash dividends on its common stock in the foreseeable future. Pursuant to the terms and conditions of certain loan documentation with International Bank of Commerce and the terms and conditions of Greystone's 2003 preferred stock, Greystone is restricted in its ability to pay dividends to holders of its common stock.

Greystone may issue additional equity securities, which would lead to further dilution of Greystone's issued and outstanding stock.

The issuance of additional common stock or securities convertible into common stock would result in further dilution of the ownership interest in Greystone held by existing shareholders. Greystone is authorized to issue, without shareholder approval, an additional 20,700,000 shares of preferred stock, $0.0001 par value per share, in one or more series, which may give other shareholders dividend, conversion, voting and liquidation rights, among other rights, which may be superior to the rights of holders of Greystone's common stock. In addition, Greystone is authorized to issue, without shareholder approval, over 4.9 billion additional shares of its common stock and securities convertible into common stock.

We may not have sufficient insurance coverage and an interruption of our business or loss of a significant amount of property could have a material adverse effect on our financial condition and operations.

We currently do not maintain any insurance policies against loss of key personnel. We do maintain insurance coverage for business interruption as well as product liability claims. In addition, we do maintain director and officer insurance coverage. If any event were to occur which required our insurance coverage to be applicable as well as a loss of key personnel, our business, financial performance, and financial position may be materially and adversely affected.

We could become involved in claims or litigations that may result in adverse outcomes.

From time-to-time we may be involved in a variety of claims or litigations. Such proceeding may initially be viewed as immaterial but could prove to be material. Litigations are inherently unpredictable and excessive verdicts do occur. Given the inherent uncertainties in litigation, even when we can reasonably estimate the amount of possible loss or range of loss and reasonably estimable loss contingencies, the actual outcome may change in the future due to new developments or changes in approach. In addition, such claims or litigations could involve significant expense and diversion of management’s attention and resources from other matters.

Security breaches of confidential customer and employee information may adversely affect our business.

Our business requires the collection, transmission and retention of large volumes of customer and employee data, including personally identifiable information, in various information technology systems that are maintained internally and by third parties with whom we contract to provide services. The integrity and protection of that employee data is critical to us. Our customers and employees have a high expectation that we and our service providers will adequately protect their personal information. The information, security and privacy requirements imposed by governmental regulation are increasingly demanding. Our systems may not be able to satisfy these changing requirements and customer and employee expectations or may require significant additional investments or time in order to do so. Efforts to hack or breach security measures, failures of systems or software to operate as designed or intended, viruses, operator error or inadvertent releases of data all threaten our information systems and records. A breach in the security of our service providers’ information technology systems could lead to an interruption in the operation of our systems, resulting in operational inefficiencies and a loss of profits. A significant theft, loss or misappropriation of, or access to, customers’ or other proprietary data or other breach of our information technology systems could result in fines, legal claims or proceedings, including regulatory investigations and actions, or liability for failure to comply with privacy and information security laws, which could disrupt our operations, damage our reputation and expose us to claims from customers and employees, any of which could have a material adverse effect on our financial condition and results of operations.

As a result of being a public company, we are subject to additional reporting and corporate governance requirements that require additional management time, resources, and expense.

As a public company we are obligated to file with the SEC annual and quarterly information and other reports that are specified in the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We are also subject to other reporting and corporate governance requirements under the Sarbanes-Oxley Act of 2002, as amended, and the rules and regulations promulgated thereunder, all of which impose significant compliance and reporting obligations upon us and require us to incur additional expense in order to fulfill such obligations.

If we fail to maintain effective internal control over financial reporting, the price of our securities may be adversely affected.

Our internal control over financial reporting may have weaknesses and conditions that could require correction or remediation, the disclosure of which may have an adverse impact on the price of our common stock. We are required to establish and maintain appropriate internal control over financial reporting. Failure to establish those controls, or any failure of those controls once established, could adversely affect our public disclosures regarding our business, prospects, financial condition or results of operations. In addition, management’s assessment of internal control over financial reporting may identify weaknesses and conditions that need to be addressed in our internal control over financial reporting or other matters that may raise concerns for investors. Any actual or perceived weaknesses and conditions that need to be addressed in our internal control over financial reporting or disclosure of management’s assessment of our internal control over financial reporting may have an adverse impact on the price of our common stock.

We are required to comply with certain provisions of Section 404 of the Sarbanes-Oxley Act and if we fail to continue to comply, our business could be harmed and the price of our securities could decline.

Rules adopted by the SEC pursuant to Section 404 of the Sarbanes-Oxley Act require an annual assessment of internal control over financial reporting, and for certain issuers an attestation of this assessment by the issuer’s independent registered public accounting firm. The standards that must be met for management to assess the internal control over financial reporting as effective are evolving and complex, and require significant documentation, testing, and possible remediation to meet the detailed standards. We expect to incur significant expenses and to devote resources to Section 404 compliance on an ongoing basis. It is difficult for us to predict how long it will take or costly it will be to complete the assessment of the effectiveness of our internal control over financial reporting for each year and to remediate any deficiencies in our internal control over financial reporting. As a result, we may not be able to complete the assessment and remediation process on a timely basis. In the event that our Chief Executive Officer or Principal Financial Officer determines that our internal control over financial reporting is not effective as defined under Section 404, we cannot predict how regulators will react or how the market prices of our securities will be affected; however, we believe that there is a risk that investor confidence and the market value of our securities may be negatively affected.

Shares eligible for future sale may adversely affect the market.

From time to time, certain of our stockholders may be eligible to sell all or some of their shares of common stock by means of ordinary brokerage transactions in the open market pursuant to Rule 144 promulgated under the Securities Act, subject to certain limitations. In general, pursuant to Rule 144, non-affiliate stockholders may sell freely after six months, subject only to the current public information requirement. Affiliates may sell after six months, subject to the Rule 144 volume, manner of sale (for equity securities), current public information, and notice requirements. Of the approximately 28,000,000 shares of our common stock outstanding as of May 31, 2024, approximately 15,000,000 shares are tradable without restriction. Given the limited trading of our common stock, resale of even a small number of shares of our common stock pursuant to Rule 144 or an effective registration statement may adversely affect the market price of our common stock.

We do not have any long-term contracts with our suppliers or with our customers, and we do not have many written contracts with our customers, and if we can’t maintain these relationships or if we or our suppliers experience manufacturing problems or delays, our financial results will be negatively affected.

We do not have any long-term contracts with our suppliers or with our customers for our current or planned products. We also do not have many written contracts with our customers. There can be no assurance that these suppliers will continue to sell to us on prior or current terms, or at all and likewise there can also be no assurance that our customers will continue to purchase from us or that we can obtain customers to purchase our planned products. We may not be able to maintain our relationships with our suppliers and customers, or we may be unable to find alternate suppliers or customers in a timely fashion. Should this occur, our revenues and results of operations will be negatively affected. Additionally, we or our suppliers may encounter unforeseen delays or shortfalls in manufacturing, and our suppliers’ production processes may have to change to accommodate any significant future expansion of our manufacturing capacity, which may increase our or our suppliers’ manufacturing costs, delay production of our current and planned products, reduce our product gross margin and adversely impact our business. If we are unable to keep up with demand for our current and planned products by maintaining our relationships with our suppliers or successfully manufacturing and shipping our products in a timely manner, our revenue could be impaired, market acceptance for our current and planned products could be adversely affected and our customers might instead purchase our competitors’ products. In addition, developing manufacturing procedures for new products may require developing specific production processes for those products. Developing such processes could be time consuming and any unexpected difficulty in doing so can delay the introduction of a product.

An unexpected interruption in our warehousing facilities or if there is a lack of capacity at our warehousing facilities, it could reduce our sales and margins.

We store products in our warehouses that we then ship to customers or distributors. If we run out of capacity, we won’t be able to store as many products and may not be able to maintain all products in an efficient manner. Additionally, if there is any unexpected interruption to our warehousing facilities, for any reason, such as loss of certifications or licenses, as a result of weather, terrorism or acts of war, fire, earthquake, or other national disaster, a work stoppage or other labor-related disruption, electrical outages, or other events, it could result in significant reductions to our sales and margins and could have a material adverse effect on our business, financial condition or results of operations.

Any interruption to our distribution channels for our products could adversely affect our sales and results of operations.

Any interruption to our distribution channels for our products for any reason, such as disruption of distribution channels as a result of weather, terrorism or acts of war, fire, earthquake, or other national disaster, a work stoppage or other labor-related disruption, could adversely affect our sales and results of operations.

Item 1B. Unresolved Staff Comments.

None.

Item 1C. Cybersecurity.

Governance

While the Company does not employ a Chief Information Officer or consider cybersecurity threats to be a material risk to the business strategy, results of operations or financial position of the Company, the Board of Directors discusses risks and threats most applicable to the Company and inquires of management regarding design and effectiveness of controls in place to address the prevention, detection, mitigation and remediation of cybersecurity incidents.

Risk Management and Strategy

Due to the size of the Company, our information technology (“IT”) environment does not utilize overly complicated systems or processes. The Company does not sell products or conduct business in an online environment. We utilize a third party managed services provider (“Provider”) for security applications, monitoring, and updates to our information technology environment. The Chief Financial Officer serves as the relationship manager for and has regularly scheduled meetings with the Provider to evaluate whether the services provided meet the Company’s needs, review hardware and software obsolescence, and identify any new threats that need to be addressed. The Company uses multi-factor authentication for applications wherever possible to provide access security and we maintain a secure physical environment.

Through the Provider, automated security tools are used to monitor all Windows-based systems and provide defense against cyberattacks perpetrated on or against these systems and to protect internal systems from known and unknown cybersecurity threats. These security tools include:

Advanced, next-generation endpoint security software, detects attempted attacks on internal Windows-based systems and analyzes the attack providing context for said attacks to analysis teams. This data is then used to mitigate the attack and resolve the incident.

Privilege management software provides application context to reviewers to aid in the preemptive identification of malicious activities on a system. When administrative permissions are requested, details regarding the requesting process are forwarded to our provider for review and analysis before granting administrative privileges, limiting an attacker’s ability to affect and compromise systems in the environment.

The Company employs email security tools provided and managed by our Provider to protect against email-based attacks. These tools include an email security gateway and an additional automated email filtering security. These tools provide advanced, AI-powered phishing detection and remediation for all Microsoft 365 email users in the environment.

The Company utilizes various third-party service organizations for critical areas of operations, including stockholder transfer agent services, accounting software, financial reporting software and regulatory filings, and mineral management software. The Company obtains System and Organization Controls (“SOC”) reports for each vendor and ensures that internal controls are designed and implemented to adequately meet the applicable user controls identified within the SOC report for each vendor.

The Company requires all devices used by employees to be protected with the security measures listed above. It is also Company policy that all devices be used by the employee only and any use by non-employees is prohibited.

To date, the Company has not experienced a cybersecurity incident that resulted in a material adverse effect on our business strategy, results of operations or financial condition; however, there can be no guarantee that we will not experience such an incident in the future.

Item 2. Properties.

Greystone’s operations are performed at:

| |

●

|

Two primary buildings for a total of 120,000 square feet of manufacturing and warehouse space located on approximately 3 acres of land in Bettendorf, Iowa. These buildings are leased from Greystone Real Estate, L.L.C. (“GRE”) which is owned by Robert B. Rosene, Jr., a director of Greystone. The manufacturing and warehouse space is sufficiently equipped and designed to accommodate the manufacturing of plastic pallets and is also used for grinding, processing and pelletizing recycled plastic. The lease has a primary term through July 31, 2032, with an option by Greystone to extend for 5 years, and initially provides for monthly rent of $44,500 with escalations of 5% every 5 years.

|

| |

●

|

Three buildings owned by Greystone located within a 30-mile radius of its primary facility for an additional 95,000 square feet of warehouse space. These buildings are currently used for warehousing inventory and grinding operations.

|

| |

●

|

Facility in Palmyra, MO, housing two of Greystone’s injection molding machines. Production in this facility is outsourced to the lessor.

|

| |

●

|

Facility in Jasper, IN, housing Greystone’s extrusion processing machines. Production in this facility will be outsourced to the lessor.

|

| |

●

|

Office location in Tulsa, OK, which is approximately 3,000 sq ft, and is leased from a related party.

|

We believe that these facilities are adequate for our current and near-term needs.

Item 3. Legal Proceedings.

From time to time, we may be involved in various claims and legal actions arising in the ordinary course of business. To the knowledge of our management, there are no legal proceedings currently pending against us which we believe would have a material effect on our business, financial position or results of operations and, to the best of our knowledge, there are no such legal proceedings contemplated or threatened.

Item 4. Mine Safety Disclosures.

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information

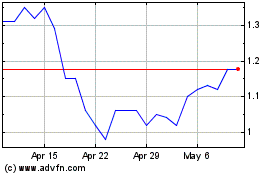

Greystone's common stock is traded on the OTCQB under the symbol "GLGI." The following table sets forth the range of high and low per share bid quotations for Greystone's common stock during the time periods indicated. Quotations reflect inter-dealer prices, without retail mark-up, markdown or commission and may not represent actual transactions. The source of the foregoing quotations was the Financial Industry Regulatory Composite Feed or other qualified inter dealer quotation medium as provided by OTC Market Group, Inc.:

|

Quarter Ended

|

|

High

|

|

Low

|

|

August 31, 2022

|

|

$0.85

|

|

$0.70

|

|

November 30, 2022

|

|

$0.87

|

|

$0.69

|

|

February 28, 2023

|

|

$0.72

|

|

$0.44

|

|

May 31, 2023

|

|

$0.82

|

|

$0.57

|

|

August 31, 2023

|

|

$1.18

|

|

$0.75

|

|

November 30, 2023

|

|

$1.11

|

|

$0.90

|

|

February 29, 2024

|

|

$2.35

|

|

$0.82

|

|

May 31, 2024

|

|

$1.41

|

|

$0.98

|

Holders

As of May 31, 2024, Greystone had approximately 182 common stockholders of record.

Dividends

Greystone paid no cash dividends to its common stockholders during the last two fiscal years and does not plan to pay any cash dividends in the near future. The loan agreement dated July 29, 2022 (the “IBC Loan Agreement”), as amended, among Greystone, GSM and International Bank of Commerce (“IBC”) prohibits Greystone from declaring or paying any dividends to its common stockholders without IBC’s prior written consent. See Note 5 to the consolidated financial statements for additional information. In addition, accrued preferred stock dividends must be paid before a dividend on common stock may be declared or paid, as set forth in the Certificate of Designation, Preferences, Rights and Limitations relating to the preferred stock. See Note 11 to the consolidated financial statements and “Liquidity and Capital Resources” in Item 7 of this Form 10-K for additional information.

Greystone paid dividends on its 2003 preferred stock in the amounts of $721,640 and $446,644 during fiscal years 2024 and 2023, respectively.

Item 6. [Reserved].

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

Cautionary Statement Regarding Forward-Looking Information

This Annual Report on Form 10-K includes "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements concern Greystone's plans, expectations and objectives for future operations. All statements, other than statements of historical facts, included in this Form 10-K that address activities, events or developments that Greystone expects, believes or anticipates will or may occur in the future are forward-looking statements. The words "believe," "plan," "intend," "anticipate," "estimate," "project," and similar expressions are intended to identify forward-looking statements. These forward-looking statements include, among others, such things as:

| |

•

|

expansion and growth of Greystone's business and operations;

|

| |

•

|

future financial performance;

|

| |

•

|

future acquisitions and developments;

|

| |

•

|

potential sales of products;

|

| |

•

|

future financing activities; and

|

These forward-looking statements are based on assumptions that Greystone believes are reasonable based on current expectations and projections about future events and industry conditions and trends affecting Greystone's business. However, whether actual results and developments will conform to Greystone's expectations and predictions is subject to a number of risks and uncertainties that could cause actual results to differ materially from those contained in the forward-looking statements, including those factors discussed under the section of this Form 10-K entitled "Risk Factors." In addition, Greystone's historical financial performance is not necessarily indicative of the results that may be expected in the future and Greystone believes that such comparisons cannot be relied upon as indicators of future performance.

Results of Operations

General

The consolidated financial statements include Greystone and its two wholly owned subsidiaries, Greystone Manufacturing, L.L.C. (“GSM”), and Plastic Pallet Production, Inc. (“PPP”), and one variable interest entity, Greystone Real Estate, L.L.C. (“GRE”). Effective July 29, 2022, GRE was no longer deemed to be a beneficiary of Greystone and, accordingly, was deconsolidated on the effective date as discussed further in Note 1 to the consolidated financial statements.

Greystone's primary business is the manufacturing of plastic pallets utilizing recycled plastic and selling the pallets through one of its wholly owned subsidiaries, GSM.

As of May 31, 2024 and 2023, Greystone had FTE’s of approximately 190 and 179 employees, respectively. Temporary personnel from a personnel service entity are utilized as needed. There were FTE’s of approximately 69 and 109 temporary personnel as of May 31, 2024 and 2023, respectively. Greystone's in-house production capacity for its injection molding machines capable of producing pallets is approximately 225,000 plastic pallets per month, or 2,700,000 per year. Production levels will vary proportionately as a result of the pallet design, machine downtime or customer restrictions for maintaining stringent sizing on certain pallets.

Year Ended May 31, 2024 Compared to Year Ended May 31, 2023

Sales

Sales were $61,780,715 for fiscal year 2024 compared to $60,758,962 for fiscal year 2023 representing an increase of $1,021,753, or about 2%. Fiscal year 2023 was a turn-around period to recover from declining sales as customers shied away from inflationary pricing during the pandemic period. As raw material pricing returned to relatively normal historic levels during the second quarter of fiscal year 2023, the Company focused its efforts on rebuilding relations with existing customers as well as seeking new customers.

Greystone’s major customers, varying from three to four, accounted for approximately 81% and 73% of total sales in fiscal years 2024 and 2023, respectively. Customers that account for significant sales may vary in any one year. Generally, customers purchasing substantial quantities to replace or add pallets to their inventory consistently comprise a significant portion of sales. Any customer(s) needing a substantial quantity of pallets to fulfill a specific need may vary from year to year.

Cost of Sales

Cost of sales was $50,065,085 (81% of sales) and $51,427,409 (85% of sales) in fiscal years 2024 and 2023, respectively. The decrease in the ratio of cost of sales to sales (the “ratio”) in fiscal year 2024 from fiscal year 2023 was the result of several factors, including a decline in the price of raw materials toward relatively historic levels.

Selling, General and Administrative Expenses

Selling, general and administrative (SGA) expenses were $5,168,607, (8.4% of sales) for fiscal year 2024 compared to $5,100,170 (8.4% of sales) for fiscal year 2023, representing an increase of $68,437.

Gain on Involuntary Conversion

Gain on involuntary conversion was $593,647 for fiscal year 2024. In February 2024, one of the Company’s storage warehouses caught fire with damage to finished goods inventory valued at $1,326,752 and the building with a net book value of $161,850. The Company recorded an insurance receivable of $2,058,602 as an estimate for damage to the inventory and building, which resulted in a gain from the involuntary conversion of $593,647. The insurer and Company are currently reviewing and finalizing the claim value for the inventory. The Company will record any additional consideration once a settlement has been reached, which may increase the gain recorded in future periods.

Other Income (Expenses)

During fiscal years 2023, Greystone received $4,911,863, reimbursement from the Department of Treasury for refundable tax credits against certain employment taxes pursuant to the Employee Retention Credit (“ERC”) under the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”). There were no such credits recognized in 2024.

As a result of the deconsolidation of GRE in 2023, the Company recognized a gain of $569,997 in fiscal year 2023 which was attributable to a deferred gain from Greystone’s sell and leaseback of the building to GRE in the prior years.

Other income for fiscal years 2024 and 2023 included:

| |

|

2024

|

|

|

2023

|

|

|

Interest income

|

|

$ |

57,826 |

|

|

$ |

317,797 |

|

|

Gain (loss) on disposition of property, plant and equipment

|

|

|

- |

|

|

|

(2,972 |

) |

|

Other

|

|

|

151,253 |

|

|

|

10,774 |

|

|

Total Other Income

|

|

$ |

209,079 |

|

|

$ |

325,599 |

|

Interest expense was $1,291,054 in fiscal year 2024 compared to $1,189,034 in fiscal year 2023 for an increase of $99,903. This increase is primarily attributable to the increase in the prime rate of interest which was 8.50% at May 31, 2024, compared to 8.25% at May 31, 2023.

Provision for Income Taxes

The provision for income taxes was $1,031,204 in fiscal year 2024 compared to $2,461,700 in fiscal year 2023. The effective tax rate differs from federal statutory rates due to state income taxes, charges which have no income tax benefit, changes in the valuation allowance, and changes in state income tax rates.

Based upon a review of its income tax filing positions, Greystone believes that its positions would be sustained upon an audit by the Internal Revenue Service and does not anticipate any adjustments that would result in a material change to its financial position. Therefore, no reserves for uncertain income tax positions have been recorded.

Net Income

Net income was $5,027,491 in fiscal year 2024 compared to $6,388,108 in fiscal year 2023 for a decrease of $1,360,617 for the reasons discussed above.

Net Income Attributable to Common Stockholders

After deducting preferred dividends and income attributable to non-controlling interests, the net income attributable to common stockholders was $4,440,265, or $0.16 per share, in fiscal year 2024 compared to $5,842,828, or $0.21 per share, in fiscal year 2023 for the reasons discussed above.

Liquidity and Capital Resources

General

A summary of Greystone’s cash flows for the year ended May 31, 2024, was as follows:

|

Cash provided by operating activities

|

|

$ |

12,394,969 |

|

|

Cash used in investing activities

|

|

$ |

(2,801,377 |

) |

|

Cash used in financing activities

|

|

$ |

(4,490,902 |

) |

The cash provided by operations included payments of approximately $3,756,000 on long term loans, financing leases, and revolving loans.