0001088413

false

FY

P5Y

P0Y52M

P0Y48M

P10Y

P5Y

0001088413

2022-06-01

2023-05-31

0001088413

2022-11-30

0001088413

2023-08-18

0001088413

2023-05-31

0001088413

2022-05-31

0001088413

us-gaap:RelatedPartyMember

2023-05-31

0001088413

us-gaap:RelatedPartyMember

2022-05-31

0001088413

2021-06-01

2022-05-31

0001088413

us-gaap:PreferredStockMember

2021-05-31

0001088413

us-gaap:CommonStockMember

2021-05-31

0001088413

us-gaap:AdditionalPaidInCapitalMember

2021-05-31

0001088413

us-gaap:RetainedEarningsMember

2021-05-31

0001088413

us-gaap:ParentMember

2021-05-31

0001088413

us-gaap:NoncontrollingInterestMember

2021-05-31

0001088413

2021-05-31

0001088413

us-gaap:PreferredStockMember

2022-05-31

0001088413

us-gaap:CommonStockMember

2022-05-31

0001088413

us-gaap:AdditionalPaidInCapitalMember

2022-05-31

0001088413

us-gaap:RetainedEarningsMember

2022-05-31

0001088413

us-gaap:ParentMember

2022-05-31

0001088413

us-gaap:NoncontrollingInterestMember

2022-05-31

0001088413

us-gaap:PreferredStockMember

2021-06-01

2022-05-31

0001088413

us-gaap:CommonStockMember

2021-06-01

2022-05-31

0001088413

us-gaap:AdditionalPaidInCapitalMember

2021-06-01

2022-05-31

0001088413

us-gaap:RetainedEarningsMember

2021-06-01

2022-05-31

0001088413

us-gaap:ParentMember

2021-06-01

2022-05-31

0001088413

us-gaap:NoncontrollingInterestMember

2021-06-01

2022-05-31

0001088413

us-gaap:PreferredStockMember

2022-06-01

2023-05-31

0001088413

us-gaap:CommonStockMember

2022-06-01

2023-05-31

0001088413

us-gaap:AdditionalPaidInCapitalMember

2022-06-01

2023-05-31

0001088413

us-gaap:RetainedEarningsMember

2022-06-01

2023-05-31

0001088413

us-gaap:ParentMember

2022-06-01

2023-05-31

0001088413

us-gaap:NoncontrollingInterestMember

2022-06-01

2023-05-31

0001088413

us-gaap:PreferredStockMember

2023-05-31

0001088413

us-gaap:CommonStockMember

2023-05-31

0001088413

us-gaap:AdditionalPaidInCapitalMember

2023-05-31

0001088413

us-gaap:RetainedEarningsMember

2023-05-31

0001088413

us-gaap:ParentMember

2023-05-31

0001088413

us-gaap:NoncontrollingInterestMember

2023-05-31

0001088413

GLGI:PlantBuildingMember

2023-05-31

0001088413

us-gaap:MachineryAndEquipmentMember

srt:MinimumMember

2023-05-31

0001088413

us-gaap:MachineryAndEquipmentMember

srt:MaximumMember

2023-05-31

0001088413

us-gaap:LeaseholdImprovementsMember

srt:MinimumMember

2023-05-31

0001088413

us-gaap:LeaseholdImprovementsMember

srt:MaximumMember

2023-05-31

0001088413

us-gaap:FurnitureAndFixturesMember

srt:MinimumMember

2023-05-31

0001088413

us-gaap:FurnitureAndFixturesMember

srt:MaximumMember

2023-05-31

0001088413

us-gaap:MachineryAndEquipmentMember

2023-05-31

0001088413

us-gaap:MachineryAndEquipmentMember

2022-05-31

0001088413

GLGI:PlantBuildingsAndLandMember

2023-05-31

0001088413

GLGI:PlantBuildingsAndLandMember

2022-05-31

0001088413

us-gaap:LeaseholdImprovementsMember

2023-05-31

0001088413

us-gaap:LeaseholdImprovementsMember

2022-05-31

0001088413

us-gaap:FurnitureAndFixturesMember

2023-05-31

0001088413

us-gaap:FurnitureAndFixturesMember

2022-05-31

0001088413

us-gaap:ServiceMember

us-gaap:MachineryAndEquipmentMember

2023-05-31

0001088413

GLGI:NotesPayableOneMember

2023-05-31

0001088413

GLGI:NotesPayableOneMember

2022-05-31

0001088413

GLGI:NotesPayableTwoMember

2023-05-31

0001088413

GLGI:NotesPayableTwoMember

2022-05-31

0001088413

GLGI:NotesPayableThreeMember

2023-05-31

0001088413

GLGI:NotesPayableThreeMember

2022-05-31

0001088413

GLGI:NotesPayableFourMember

2023-05-31

0001088413

GLGI:NotesPayableFourMember

2022-05-31

0001088413

GLGI:NotesPayableFiveMember

2023-05-31

0001088413

GLGI:NotesPayableFiveMember

2022-05-31

0001088413

GLGI:NotesPayableSixMember

2023-05-31

0001088413

GLGI:NotesPayableSixMember

2022-05-31

0001088413

GLGI:NotesPayableSevenMember

2023-05-31

0001088413

GLGI:NotesPayableSevenMember

2022-05-31

0001088413

GLGI:NotesPayableEightMember

2023-05-31

0001088413

GLGI:NotesPayableEightMember

2022-05-31

0001088413

GLGI:OtherNotePayableMember

2023-05-31

0001088413

GLGI:OtherNotePayableMember

2022-05-31

0001088413

srt:MinimumMember

GLGI:NotesPayableOneMember

2023-05-31

0001088413

srt:MinimumMember

GLGI:NotesPayableOneMember

2022-05-31

0001088413

GLGI:NotesPayableOneMember

2022-06-01

2023-05-31

0001088413

GLGI:NotesPayableOneMember

2021-06-01

2022-05-31

0001088413

srt:MinimumMember

GLGI:NotesPayableTwoMember

2023-05-31

0001088413

srt:MinimumMember

GLGI:NotesPayableTwoMember

2022-05-31

0001088413

GLGI:NotesPayableTwoMember

2022-06-01

2023-05-31

0001088413

GLGI:NotesPayableTwoMember

2021-06-01

2022-05-31

0001088413

srt:MinimumMember

GLGI:NotesPayableThreeMember

2023-05-31

0001088413

srt:MinimumMember

GLGI:NotesPayableThreeMember

2022-05-31

0001088413

srt:MaximumMember

GLGI:NotesPayableThreeMember

2023-05-31

0001088413

srt:MaximumMember

GLGI:NotesPayableThreeMember

2022-05-31

0001088413

srt:MinimumMember

GLGI:NotesPayableFourMember

2023-05-31

0001088413

srt:MinimumMember

GLGI:NotesPayableFourMember

2022-05-31

0001088413

GLGI:NotesPayableFourMember

2022-06-01

2023-05-31

0001088413

GLGI:NotesPayableFourMember

2021-06-01

2022-05-31

0001088413

GLGI:NotesPayableFiveMember

2022-06-01

2023-05-31

0001088413

GLGI:NotesPayableFiveMember

2021-06-01

2022-05-31

0001088413

GLGI:NotesPayableSixMember

2022-06-01

2023-05-31

0001088413

GLGI:NotesPayableSixMember

2021-06-01

2022-05-31

0001088413

GLGI:NotesPayableSevenMember

2022-06-01

2023-05-31

0001088413

GLGI:NotesPayableSevenMember

2021-06-01

2022-05-31

0001088413

GLGI:NotesPayableEightMember

2022-06-01

2023-05-31

0001088413

GLGI:NotesPayableEightMember

2021-06-01

2022-05-31

0001088413

us-gaap:PrimeRateMember

2023-05-31

0001088413

GLGI:IBCLoanAgreementMember

GLGI:RestatedLoanAgreementMember

2022-07-29

0001088413

GLGI:IBCLoanAgreementMember

GLGI:RestatedLoanAgreementMember

2022-07-27

2022-07-29

0001088413

GLGI:IBCLoanAgreementMember

GLGI:RestatedLoanAgreementMember

srt:MaximumMember

2022-07-29

0001088413

GLGI:IBCLoanAgreementMember

GLGI:RestatedLoanAgreementMember

2023-05-31

0001088413

GLGI:IBCLoanAgreementMember

2022-07-27

2022-07-29

0001088413

GLGI:IBCLoanAgreementMember

GLGI:RestatedLoanAgreementMember

us-gaap:PreferredStockMember

2023-05-31

0001088413

GLGI:IBCLoanAgreementMember

GLGI:GuarantyMember

2023-05-31

0001088413

GLGI:ThreeLeaseAgreementsWithFiveYearTermsMember

2022-06-01

2023-05-31

0001088413

GLGI:ThreeLeaseAgreementsWithFiveYearTermsMember

2023-05-31

0001088413

GLGI:SaleAndLeasebackAgreementMember

GLGI:YorktownProductionEquipmentMember

2022-12-28

2022-12-29

0001088413

GLGI:EquipmentOneMember

2023-05-31

0001088413

GLGI:EquipmentTwoMember

2023-05-31

0001088413

GLGI:TwoBuildingsMember

2023-05-31

0001088413

GLGI:EquipmentFourMember

2023-05-31

0001088413

GLGI:CanadaandMexicoMember

2022-06-01

2023-05-31

0001088413

GLGI:CanadaandMexicoMember

2021-06-01

2022-05-31

0001088413

GLGI:PalletsMember

2022-06-01

2023-05-31

0001088413

GLGI:PalletsMember

2021-06-01

2022-05-31

0001088413

GLGI:EndUserCustomersMember

us-gaap:RevenueFromContractWithCustomerMember

us-gaap:CustomerConcentrationRiskMember

2022-06-01

2023-05-31

0001088413

GLGI:EndUserCustomersMember

us-gaap:RevenueFromContractWithCustomerMember

us-gaap:CustomerConcentrationRiskMember

2021-06-01

2022-05-31

0001088413

GLGI:DistributorsMember

us-gaap:RevenueFromContractWithCustomerMember

us-gaap:CustomerConcentrationRiskMember

2022-06-01

2023-05-31

0001088413

GLGI:DistributorsMember

us-gaap:RevenueFromContractWithCustomerMember

us-gaap:CustomerConcentrationRiskMember

2021-06-01

2022-05-31

0001088413

GLGI:YorktownsGrindingAndPelletizingEquipmentMember

GLGI:WeeklyMember

2022-06-01

2023-05-31

0001088413

GLGI:YorktownsGrindingAndPelletizingEquipmentMember

2022-06-01

2023-05-31

0001088413

GLGI:YorktownsGrindingAndPelletizingEquipmentMember

2021-06-01

2022-05-31

0001088413

GLGI:GreystoneRealEstateLLCMember

2022-06-01

2023-05-31

0001088413

GLGI:LeaseAgreementMember

2022-08-01

0001088413

GLGI:LeaseAgreementMember

2022-08-01

2022-08-01

0001088413

GLGI:TriendaHoldingsLlcMember

2022-06-01

2023-05-31

0001088413

GLGI:TriendaHoldingsLlcMember

2021-06-01

2022-05-31

0001088413

GLGI:GreenPlasticPalletsMember

2022-06-01

2023-05-31

0001088413

GLGI:GreenPlasticPalletsMember

2021-06-01

2022-05-31

0001088413

GLGI:TriendaHoldingsLlcMember

2023-05-31

0001088413

GLGI:TaxYear2004Member

2023-05-31

0001088413

GLGI:TaxYear2004Member

2022-06-01

2023-05-31

0001088413

GLGI:TaxYear2005Member

2023-05-31

0001088413

GLGI:TaxYear2005Member

2022-06-01

2023-05-31

0001088413

us-gaap:TaxYear2023Member

2023-05-31

0001088413

2021-06-01

2021-06-30

0001088413

us-gaap:ConvertiblePreferredStockMember

2003-09-01

2003-09-30

0001088413

us-gaap:ConvertiblePreferredStockMember

2003-09-30

0001088413

us-gaap:ConvertiblePreferredStockMember

2022-06-01

2023-05-31

0001088413

GLGI:WarrenFKrugerMember

2016-09-01

0001088413

GLGI:RobertBRoseneJrMember

2016-09-01

0001088413

GLGI:ThreeCustomerMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2022-06-01

2023-05-31

0001088413

GLGI:ThreeCustomerMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2021-06-01

2022-05-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

10-K

☒

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended May 31, 2023

☐

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from _______________ to______________

Commission

file number 000-26331

GREYSTONE

LOGISTICS, INC.

(Exact

name of registrant as specified in its charter)

| Oklahoma |

|

75-2954680 |

| (State

or other jurisdiction of incorporation or organization) |

|

(I.R.S.

Employer Identification No.) |

1613

East 15th Street, Tulsa, Oklahoma 74120

(Address

of principal executive offices) (Zip Code)

(918)

583-7441

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| N/A

|

|

N/A |

|

N/A

|

Securities

registered pursuant to Section 12(g) of the Act:

Common

Stock, $0.0001 par value

(Title

of class)

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐ Yes

☒ No

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

☐

Yes ☒ No

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

☒ Yes

☐ No

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files).

☒ Yes

☐ No

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

|

Accelerated

filer ☐ |

| Non-accelerated

filer ☒ |

|

Smaller

reporting company ☒ |

| |

|

Emerging

growth company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As

of November 30, 2022 (the last business day of the registrant’s most recently completed second fiscal quarter), the aggregate market

value of the voting common stock held by non-affiliates of the registrant, computed by (reference to the price at which the registrant’s

common stock was last sold on such date, was approximately $11,638,000 ($0.745 per share).

As

of August 18, 2023, there were 28,279,701 shares of the registrant’s common stock, $0.0001 par value per share, outstanding.

DOCUMENTS

INCORPORATED BY REFERENCE

None.

GREYSTONE

LOGISTICS, INC.

FORM

10-K

TABLE

OF CONTENTS

PART

I

Item

1. Business.

Organization

Greystone

Logistics, Inc. (“Greystone” or the “Company”) was incorporated in Delaware on February 24, 1969, under the name

Permaspray Manufacturing Corporation. It subsequently changed its name to Browning Enterprises Inc. in April 1982, to Cabec Energy Corp.

in June 1993, to PalWeb Corporation in April 1999 and to Greystone Logistics, Inc. in March 2005, as further described below. In December

1997, Greystone acquired all of the issued and outstanding stock of Plastic Pallet Production, Inc., a Texas corporation (“PPP”),

and since that time, Greystone has primarily been engaged in the business of manufacturing and selling plastic pallets.

Effective

September 8, 2003, Greystone acquired substantially all of the assets of Greystone Plastics, Inc., an Iowa corporation, through the purchase

of such assets by Greystone’s newly formed, wholly-owned subsidiary, Greystone Manufacturing, L.L.C., an Oklahoma limited liability

company (“GSM”). Greystone Plastics, Inc. was a manufacturer of plastic pallets used in the beverage industry.

Effective

March 18, 2005, the Company caused its newly formed, wholly owned subsidiary, Greystone Logistics, Inc., an Oklahoma corporation, to

be merged with and into the Company. In connection with such merger and as of the effective time of the merger, the Company amended its

certificate of incorporation by changing its name from PalWeb Corporation to Greystone Logistics, Inc., pursuant to the terms of the

certificate of ownership and merger filed by Greystone with the Secretary of State of Oklahoma.

Current

Business

Products

Greystone’s

primary business is the manufacturing of plastic pallets utilizing recycled plastic and selling the pallets through its wholly owned

subsidiary, GSM. Greystone sells its pallets through a network of independent contractor distributors and direct sales by its President

and sales department. As of May 31, 2023, Greystone had an aggregate in-house production capacity of approximately 225,000 pallets per

month from 14 injection molding machines of which 12 are located in Bettendorf, IA and 2 located in Palmyra, MO. In addition, Greystone

outsources production for pallets produced by injection molding machines as necessary to accommodate overflow. Greystone’s injection

molding machine production as of May 31, 2023 consists of the following:

| |

● |

37”

X 32” rackable pallet, |

| |

● |

40”

X 32” rackable pallet, |

| |

● |

37”

X 37” rackable pallet, |

| |

● |

44”

X 56” can pallet, |

| |

● |

48”

X 48” rackable pallet, |

| |

● |

48”

X 40” rackable pallet, |

| |

● |

48”

X 44” rackable pallet, |

| |

● |

48”

X 40” nestable pallet with or without detachable runners, |

| |

● |

45”

X 45” nestable pallet with or without detachable bottom deck, |

| |

● |

24”

X 40” display pallet, |

| |

● |

48”

X 40” monoblock (one-piece) pallet, |

| |

● |

Half-barrel

keg stackable pallet, |

| |

● |

Slim

keg stackable pallet, |

| |

● |

36”

X 36” rackable pallet, |

| |

● |

48”

X 45” monoblock pallet, |

| |

● |

48”

X 45” drum pallet, and |

| |

● |

48”

X 40” mid duty pallet. |

In

April 2023, Greystone opened a facility in Jasper, IN, through the purchase of equipment, including robotics, that uses an extrusion

process to produce plastic pallets. Recycled plastic will be used in the process consistent with Greystone’s green standards. The

pallets created from this extrusion process are robotically welded producing pallets in unusual sizes, including 30”X30”,

60”X60” and also 96” X 48” designs.

The

principal raw materials used in manufacturing Greystone’s plastic pallets are in abundant supply, and some of these materials may

be obtained from recycled plastic containers. At the present time, these materials are being purchased from local and national suppliers.

If available, materials may also be purchased from international suppliers.

Pallet

Industry

Pallets

are devices used for moving and storing freight. A pallet is used as a base for assembling, storing, stacking, handling, and transporting

goods as a unit load. A pallet is constructed to facilitate the placement of a lift truck’s forks between the levels of a platform

so it may be moved easily.

Pallets

are used worldwide for the transportation of goods and they are primarily made of wood. An estimated 80-90 percent of all U.S. commerce

is carried on pallets, which amounts to an estimated 2.6 billion pallets in circulation daily in the United States. The manufacture of

wood pallets is estimated to consume more than 45 percent of total U.S. hardwood lumber production. “Pallets move the world,”

says Dr. Marshall S. “Mark” White, an emeritus professor at Virginia Tech University and director of the William H. Sardo

Jr. Pallet and Container Research Laboratory and Center for Packaging and Unit Load Design.

The

largest industry users of pallets such as the food, chemical, pharmaceutical, beverage and dairy industries are populated with large

public or private entities for which profitable financial performance is paramount. The trend for pallets is expected to expand because

of overall pallet demand resulting from growth in the U.S. economy and the current U.S. government administration’s efforts to

move manufacturing capacity back to the U.S. The operating issues presented by wood pallets have been tolerated to date as there has

been no viable alternative in sufficient size for replacement. A report on the market for pallets in North America by Zoe Biller, an

industry analyst for Freedonia Group, provided the following on wood and plastic pallets:

Wood:

Although not highlighted in her report, Biller estimates that about 60% of wooden pallets are used and about 40% are new. Those percentages

could shift in favor of new pallets going forward because the industry has been reporting a shortage of quality used pallets, known as

cores, for the last year or so. “The core shortage appears to be real and it is going to be part of what’s going on going

forward,” Biller said. “But it should correct itself in the long term as end users buy new pallets that replenish the pool.”

Nearly

five years ago, Costco announced that it was going entirely to a block pallet. Biller believes Costco’s decision is a symptom of

the overall trend towards block pallets rather than a driver. “Costco is part of a broader trend towards pallets that are easier

to use, especially in an automated system or with pallet jacks,” Biller said. Block pallets fit both of those bills. She adds,

“There’s also a bigger trend to turn products and processes that aren’t a core business to a third party and pallet

management is definitely part of that trend.”

Plastic:

The move towards plastic appears to be driven by companies that can control their pallet pools and take advantage of plastics’

longevity as well as “growing sanitation concerns related to wood pallets,” Biller said. “Food safety regulations may

have something to do with it going forward.” Asked if she was surprised by any of the results, Biller said she was surprised by

how far the pallet market declined during the recession. “A big part of the market advance is the need to bring the number of pallets

available for use to required levels,” she said.

According

to Bob Trebilcock of Modern Materials Handling Magazine, one important bullet point for pallet users from the Freedonia report’s

executive summary was that plastic pallets have seen their strongest advances in percentage terms ever and will continue to record above

average growth.

According

to Persistence Market Research, rising demand for alternative pallet types is anticipated to boost

the growth of plastic pallets in the global pallets market.

In

a June 2018 article, Persistence Market Research published an article that non-wood pallets are likely to experience a massive increase

in demand across the globe. Among these, plastic pallets are expected to be the most attractive option. The major reason behind the increase

in popularity of and demand for plastic pallets is due to the ease with which these can be cleaned. In addition, they are made of recycled

materials. This is a very attractive benefit for companies working towards becoming more environmentally friendly. This factor is creating

a positive impact on the plastic pallets market.

Another

factor which is driving the growth of plastic pallets is the adoption of pallets by new users. The pallet utilization in various regions

across the globe is typically low compared to the size of their manufacturing, warehousing, and construction sectors. However, in the

coming years, greater numbers of potential pallet users will strive to become more competitive on a global scale by improving operating

efficiencies and reducing product damage in shipments through the use of plastic pallets.

The

increase in trade volume especially in the Middle East and African regions is also anticipated to fuel the growth of the plastic pallets

market. Gulf Cooperation Council countries, located in between the Far East and Europe, can be considered as the gateway to the world’s

most progressive markets such as India and China. The transport and logistics sector in the Middle East region is showing substantial

growth rates with a long-term positive outlook. The plastic pallets market is thus expected to witness significant growth and is a vital

link in supply chain and storage.

With

a huge incremental opportunity, the global pallets market is projected to grow at more than 5% Compound Annual Growth Rate (“CAGR”)

during the period of assessment.

During

the period 2012 – 2016, the global pallets market expanded at a CAGR of 4.7%. However, during the forecast period – that

is between 2018 and 2025 – the market is anticipated to grow at a CAGR of 5.4% owing to increasing demand for better and safe transportation

coupled with the rise in demand for pallets from various industries like food, agriculture, chemicals etc. The global pallets market

is projected to represent an incremental opportunity of more than $25 billion between 2018 and 2025.

Types

of Pallets

The

most common size pallet is the 48” x 40” 4-way pallet, known as the GMA (Grocery Manufacturer Association) pallet, “GMA

48 x 40 Pallet,” or “GMA Block Pallet.” The GMA pallet acts as a commodity in the pallet industry, as price is often

determined by availability. As wood pallets move through their life cycle from a new pallet to a used pallet, they are repaired and put

back in service until they are sent to a landfill or used as wood compost.

Pallets

are the primary interface between the packaged product and today’s highly automated material handling equipment. Although pallets

are not the most glamorous part of the warehouse, they are important because users have expectations based on specifications and wood

pallets lack critical manufacturing details that determine performance. The end user becomes frustrated when these pallets do not perform

to expectation. Shipments can be damaged or rejected entirely resulting in significant product and revenue losses. This angst is aggravated

when new multi-million-dollar automated systems are in use.

Employees

As

of May 31, 2023, Greystone had full-time equivalents (“FTE’s” is a unit of measure that translates number of weekly

hours worked by all employees where 40 hours per week is a single person) of approximately 179 full time employees. A temporary personnel

service provides additional production personnel on an as needed basis of which there were FTE’s of approximately 109 employees

as of May 31, 2023.

Marketing

and Customers

Greystone’s

primary focus is to provide quality plastic pallets to its existing customers while continuing its marketing efforts to broaden its customer

base. Greystone’s existing customers are primarily located in the United States and engaged in the beverage, pharmaceutical and

other industries. Greystone has generated, and plans to continue to generate, interest in its pallets by attending trade shows sponsored

by industry segments that would benefit from Greystone’s products. Greystone hopes to gain wider product acceptance by marketing

the concept that the widespread use of plastic pallets could greatly reduce the destruction of trees on a worldwide basis. Greystone

sells to customers through contract distributors or by direct contract through its President and other employees.

Greystone’s

customers generally either have a recurring need for pallets such as a distributor and an end-user who acquires pallets for a closed

loop distribution system or end users who acquire pallets for internal warehouse use. The latter group of customers may or may not have

a recurring demand for pallets each year. Accordingly, revenues from customers that qualify as substantial in any one year may vary.

During fiscal years 2023 and 2022, Greystone derived a substantial portion of its revenue from three customers. These customers accounted

for approximately 73% and 76% of total sales in fiscal years 2023 and 2022, respectively. Greystone’s recycled plastic pallets

are designed to meet the respective customer’s needs and are the only pallets approved for use by these customers. There is no

assurance that Greystone will retain these customers’ business at the same level, or at all. The loss of a material amount of business

from one of these customers could have a material adverse effect on Greystone.

Competition

Greystone’s

primary competitors are a large number of small, privately held firms that sell wood pallets in very limited geographic locations. Greystone

believes that it can compete with manufacturers of wood pallets by emphasizing the cost savings realized over the longer life of its

plastic pallets, as well as the environmental benefits (principally elimination from landfill and recycling) of its plastic pallets as

compared to wood pallets. Greystone also competes with three large and approximately ten small manufacturers of plastic pallets. Some

of Greystone’s competitors may have substantially greater financial and other resources than Greystone and, therefore, may be able

to commit greater resources than Greystone in the areas of product development, manufacturing and marketing. However, Greystone believes

that its proprietary designs coupled with the competitive pricing of its products gives Greystone an advantage over other plastic pallet

manufacturers.

Government

Regulation

Although

Greystone recycles approximately 60 million pounds of post-consumer plastic per year which would otherwise be destined for the landfill,

business operations of Greystone are subject to existing and potential federal, state and local environmental laws and regulations pertaining

to the handling and disposition of wastes (including solid and hazardous wastes) or otherwise relating to the protection of the environment.

In addition, both the plastics industry and Greystone are subject to existing and potential federal, state, local and foreign legislation

designed to reduce solid wastes by requiring, among other things, plastics to be degradable in landfills, minimum levels of recycled

content, various recycling requirements, disposal fees and limits on the use of plastic products.

Patents

and Trademarks

Greystone

seeks to protect its technical advances by pursuing national and international patent protection for its products and methods when appropriate.

Management

Plastic Pallet Summation

For

over 30 years, both timber prices and landfill fees have increased and have compelled businesses to modify the way pallets are managed.

Businesses can evaluate and improve their pallet management systems and reduce associated waste by utilizing recycled plastic pallets.

According

to the U.S. Environmental Protection Agency, deforestation is a significant contributor to global carbon dioxide gas emissions. Deforestation

leads to CO2 emissions because the carbon sequestered in trees is emitted into the atmosphere and not counter-balanced by re-growth of

new trees. Additionally, estimates are that up to 20 percent of total pallet wood waste ends up in land fill.

ESG,

an acronym for environmental, social and governance, consists of three broad categories or areas of interest of what is termed “socially

responsible investors.” Within each ESG category are various specific related concerns that may or may not be pertinent in a given

situation depending on the specific investment being examined. The environmental category concerns include pollution or waste material

that a company produces and factors related to climate change. The environmental circumstances surrounding deforestation imply that continued

and growing interest in ESG compliance will lead companies to strongly consider the change to plastic pallets. Use of recycled plastics

to produce pallets, as Greystone does, demonstrates commitment to ESG by reducing plastic disposition to landfills.

Greystone’s

management believes that the gradual shifting trend from wood to 100 percent recyclable plastic pallets will continue, with the primary

limiting factors being a front-end higher price and some regulatory limits to certain applications of pallet use. The savings come in

recyclability and significantly longer life which lowers the cost per trip dramatically. Greystone intends to continue to conduct research

on pallet design for strength and coefficient of friction, on the materials used to make the plastic pallets as required to meet market

demands and to improve its existing products. Plastic pallets reduce wood waste, are hygienic, weigh less which lowers fuel consumption

and transport costs and are fully recyclable.

Item

1A. Risk Factors.

Our

business could be affected by changes in the availability of raw materials.

Greystone

uses a proprietary mix of raw materials to produce its plastic pallets. Such raw materials are generally readily available, and some

may be obtained from a broad range of recycled plastic suppliers and unprocessed waste plastic. At the present time, these materials

are being purchased from local and national suppliers. If available, these materials may also be purchased from international suppliers.

The availability of Greystone’s raw materials could change at any time for various reasons. For example, the market demand for

Greystone’s raw materials could suddenly increase, or the rate at which plastic materials are recycled could decrease, affecting

both availability and price. Additionally, the laws and regulations governing the production of plastics and the recycling of plastic

containers could change and, as a result, affect the supply of Greystone’s raw materials. Any interruption in the supply of raw

materials or components could have a material adverse effect on Greystone. Furthermore, certain potential alternative suppliers may have

pre-existing exclusive relationships with Greystone’s competitors and others that may preclude Greystone from obtaining raw materials

from such suppliers.

Greystone’s

business could be affected by competition and rapid technological change.

Greystone

currently faces competition from many companies that produce wooden pallets at prices that are substantially lower than the prices Greystone

and other companies that manufacture plastic pallets charge for their plastic pallets. It is anticipated that the plastic pallet industry

will be subject to intense competition and rapid technological change. Greystone could potentially face additional competition from recycling

and plastics companies, many of which have substantially greater financial and other resources than Greystone and, therefore, are able

to spend more than Greystone in areas such as product development, manufacturing and marketing. Competitors may develop products that

render Greystone’s products or proposed products uneconomical or result in products being commercialized that may be superior to

Greystone’s products. In addition, alternatives to plastic pallets could be developed, which would have a material adverse effect

on Greystone.

We

are dependent on a few large customers.

Greystone

derives a large portion of its revenue from a few large customers and expects that this trend will continue in the foreseeable future.

Three customers currently account for approximately 73% of its total sales in fiscal year 2023 (76% in fiscal year 2022). There is no

assurance that Greystone will retain these customers’ business at the same level, or at all. The loss of a material amount of business

from one of these customers would have a material adverse effect on Greystone.

We

may not be able to effectively protect Greystone’s patents and proprietary rights.

Greystone

relies upon a combination of patents and trade secrets to protect its proprietary technology, rights and know-how. There can be no assurance

that such patent rights will not be infringed upon, that Greystone’s trade secrets will not otherwise become known to or independently

developed by competitors, that non-disclosure agreements will not be breached, or that Greystone would have adequate remedies for any

such infringement or breach. Litigation may be necessary to enforce Greystone’s proprietary rights or to defend Greystone against

third-party claims of infringement. Such litigation could result in substantial cost to, and a diversion of effort by, Greystone and

its management and may have a material adverse effect on Greystone. Greystone’s success and potential competitive advantage is

dependent upon its ability to exploit the technology under these patents. There can be no assurance that Greystone will be able to exploit

the technology covered by these patents or that Greystone will be able to do so exclusively.

Our

business could be affected by changes or new legislation regarding environmental matters.

Greystone’s

business is subject to changing federal, state and local environmental laws and regulations pertaining to the discharge of materials

into the environment, the handling and disposition of waste (including solid and hazardous waste) or otherwise relating to the protection

of the environment. As is the case with manufacturers in general, if a release of hazardous substances occurs on or from Greystone’s

properties or any associated off-site disposal location, or if contamination from prior activities is discovered at any of Greystone’s

properties, Greystone may be held liable. No assurances can be given that additional environmental issues will not require future expenditures.

In addition, the plastics industry is subject to existing and potential federal, state, local and foreign legislation designed to reduce

solid wastes by requiring, among other things, plastics to be degradable in landfills, minimum levels of recycled content, various recycling

requirements and disposal fees and limits on the use of plastic products. Also, various consumer and special interest groups have lobbied

from time to time for the implementation of these and other similar measures. Although Greystone believes that the legislation promulgated

to date and such initiatives to date have not had a material adverse effect on it, there can be no assurance that any such future legislative

or regulatory efforts or future initiatives would not have a material adverse effect.

Our

business could be subject to potential product liability claims.

The

testing, manufacturing and marketing of Greystone’s products and proposed products involve inherent risks related to product liability

claims or similar legal theories that may be asserted against Greystone, some of which may cause Greystone to incur significant defense

costs. Although Greystone currently maintains product liability insurance coverage that it believes is adequate, there can be no assurance

that the coverage limits of its insurance will be adequate under all circumstances or that all such claims will be covered by insurance.

In addition, these policies generally must be renewed every year. While Greystone has been able to obtain product liability insurance

in the past, there can be no assurance it will be able to obtain such insurance in the future on all of its existing or future products.

A successful product liability claim or other judgment against Greystone in excess of its insurance coverage, or the loss of Greystone’s

product liability insurance coverage could have a material adverse effect upon Greystone.

Greystone

currently depends on certain key personnel.

Greystone

is dependent on the experience, abilities and continued services of its current management. In particular, Warren Kruger, Greystone’s

President and CEO, has played a significant role in the development, management and financing of Greystone. The loss or reduction of

services of Warren Kruger or any other key employee could have a material adverse effect on Greystone. In addition, there is no assurance

that additional managerial assistance will not be required, or that Greystone will be able to attract or retain such personnel.

Greystone’s

executive officers and directors control a large percentage of Greystone’s outstanding common stock and all of Greystone’s

2003 preferred stock, which entitles them to certain voting rights, including the right to elect a majority of Greystone’s Board

of Directors.

Greystone’s

executive officers and directors (and their affiliates), in the aggregate, own approximately 44.7% of Greystone’s outstanding common

stock and have approximately 50.6% of the voting power. Therefore, Greystone’s executive officers and directors can have significant

influence with respect to the outcome of matters submitted to Greystone’s shareholders for approval (including the election and

removal of directors and any merger, consolidation or sale of all or substantially all of Greystone’s assets) and to control Greystone’s

management and affairs. In addition, two of Greystone’s directors (including one who also serves as Greystone’s chief executive

officer) own all of Greystone’s outstanding 2003 preferred stock, with each owning 50%. The terms and conditions of Greystone’s

2003 preferred stock provide that such holder has the right to elect a majority of Greystone’s Board of Directors. Such concentration

of ownership may have the effect of delaying, deferring or preventing a change in control, impeding a merger, consolidation, takeover

or other business combination or discouraging a potential acquirer from making a tender offer or otherwise attempting to obtain control,

which in turn could have an adverse effect on the market price of Greystone’s common stock.

Our

common stock is a “penny stock” under SEC rules. It may be more difficult to sell securities classified as “penny stock.”

Our

common stock is a “penny stock” under applicable SEC rules (generally defined as non-exchange traded stock with a per-share

price below $5.00). Unless we successfully list our common stock on a national securities exchange, or maintain a per-share price above

$5.00, these rules impose additional sales practice requirements on broker-dealers that recommend the purchase or sale of penny stocks

to persons other than those who qualify as “established customers” or “accredited investors.” For example, broker-dealers

must determine the appropriateness for non-qualifying persons of investments in penny stocks. Broker-dealers must also provide, prior

to a transaction in a penny stock not otherwise exempt from the rules, a standardized risk disclosure document that provides information

about penny stocks and the risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer

quotations for the penny stock, disclose the compensation of the broker-dealer and its salesperson in the transaction, furnish monthly

account statements showing the market value of each penny stock held in the customer’s account, provide a special written determination

that the penny stock is a suitable investment for the purchaser, and receive the purchaser’s written agreement to the transaction.

Legal

remedies available to an investor in “penny stocks” may include the following:

| |

●

|

If

a “penny stock” is sold to the investor in violation of the requirements listed above, or other federal or states securities

laws, the investor may be able to cancel the purchase and receive a refund of the investment. |

| |

|

|

| |

●

|

If

a “penny stock” is sold to the investor in a fraudulent manner, the investor may be able to sue the persons and firms

that committed the fraud for damages. |

These

requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a security that becomes

subject to the penny stock rules. The additional burdens imposed upon broker-dealers by such requirements may discourage broker-dealers

from effecting transactions in our securities, which could severely limit the market price and liquidity of our securities. These requirements

may restrict the ability of broker-dealers to sell our common stock and may affect your ability to sell our common stock.

Many

brokerage firms will discourage or refrain from recommending investments in penny stocks. Most institutional investors will not invest

in penny stocks. In addition, many individual investors will not invest in penny stocks due, among other reasons, to the increased financial

risk generally associated with these investments.

For

these reasons, penny stocks may have a limited market and, consequently, limited liquidity. We can give no assurance at what time, if

ever, our common stock will not be classified as a “penny stock” in the future.

Substantial

future sales of shares of our common stock could cause the market price of our common stock to decline.

The

market price of shares of our common stock could decline as a result of substantial sales of our common stock, particularly sales by

our directors, executive officers and significant stockholders, a large number of shares of our common stock becoming available for sale

or the perception in the market that holders of a large number of shares intend to sell their shares.

Greystone’s

stock trades in a limited public market and is subject to price volatility. There can be no assurance that an active trading market will

develop or be sustained.

There

has been a limited public trading market for Greystone’s common stock and there can be no assurance that an active trading market

will develop or be sustained. The trading price of Greystone’s common stock could be subject to significant fluctuations in response

to variations in quarterly operating results or even mild expressions of interest on a given day. Accordingly, Greystone’s common

stock should be expected to experience substantial price changes in short periods of time. Even if Greystone is performing according

to its plan and there is no legitimate company-specific financial basis for this volatility, it must still be expected that substantial

percentage price swings will occur in Greystone’s common stock for the foreseeable future. In addition, the limited market for

Greystone’s common stock may restrict Greystone’s shareholders ability to liquidate their shares.

Greystone

does not expect to declare or pay any dividends on its common stock in the foreseeable future.

Greystone

has not declared or paid any dividends on its common stock. Greystone currently intends to retain future earnings to fund the development

and growth of its business, to repay indebtedness and for general corporate purposes, and, therefore, does not anticipate paying any

cash dividends on its common stock in the foreseeable future. Pursuant to the terms and conditions of certain loan documentation with

International Bank of Commerce and the terms and conditions of Greystone’s 2003 preferred stock, Greystone is restricted in its

ability to pay dividends to holders of its common stock.

Greystone

may issue additional equity securities, which would lead to further dilution of Greystone’s issued and outstanding stock.

The

issuance of additional common stock or securities convertible into common stock would result in further dilution of the ownership interest

in Greystone held by existing shareholders. Greystone is authorized to issue, without shareholder approval, an additional 20,700,000

shares of preferred stock, $0.0001 par value per share, in one or more series, which may give other shareholders dividend, conversion,

voting and liquidation rights, among other rights, which may be superior to the rights of holders of Greystone’s common stock.

In addition, Greystone is authorized to issue, without shareholder approval, over 4.9 billion additional shares of its common stock and

securities convertible into common stock.

We

may not have sufficient insurance coverage and an interruption of our business or loss of a significant amount of property could have

a material adverse effect on our financial condition and operations.

We

currently do not maintain any insurance policies against loss of key personnel. We do maintain insurance coverage for business interruption

as well as product liability claims. In addition, we do maintain director and officer insurance coverage. If any event were to occur

which required our insurance coverage to be applicable as well as a loss of key personnel, our business, financial performance, and financial

position may be materially and adversely affected.

We

could become involved in claims or litigations that may result in adverse outcomes.

From

time-to-time we may be involved in a variety of claims or litigations. Such proceeding may initially be viewed as immaterial but could

prove to be material. Litigations are inherently unpredictable and excessive verdicts do occur. Given the inherent uncertainties in litigation,

even when we can reasonably estimate the amount of possible loss or range of loss and reasonably estimable loss contingencies, the actual

outcome may change in the future due to new developments or changes in approach. In addition, such claims or litigations could involve

significant expense and diversion of management’s attention and resources from other matters.

Security

breaches of confidential customer and employee information may adversely affect our business.

Our

business requires the collection, transmission and retention of large volumes of customer and employee data, including personally identifiable

information, in various information technology systems that are maintained internally and by third parties with whom we contract to provide

services. The integrity and protection of that employee data is critical to us. Our customers and employees have a high expectation that

we and our service providers will adequately protect their personal information. The information, security and privacy requirements imposed

by governmental regulation are increasingly demanding. Our systems may not be able to satisfy these changing requirements and customer

and employee expectations or may require significant additional investments or time in order to do so. Efforts to hack or breach security

measures, failures of systems or software to operate as designed or intended, viruses, operator error or inadvertent releases of data

all threaten our information systems and records. A breach in the security of our service providers’ information technology systems

could lead to an interruption in the operation of our systems, resulting in operational inefficiencies and a loss of profits. A significant

theft, loss or misappropriation of, or access to, customers’ or other proprietary data or other breach of our information technology

systems could result in fines, legal claims or proceedings, including regulatory investigations and actions, or liability for failure

to comply with privacy and information security laws, which could disrupt our operations, damage our reputation and expose us to claims

from customers and employees, any of which could have a material adverse effect on our financial condition and results of operations.

As

a result of being a public company, we are subject to additional reporting and corporate governance requirements that require additional

management time, resources, and expense.

As

a public company we are obligated to file with the SEC annual and quarterly information and other reports that are specified in the Securities

Exchange Act of 1934, as amended (the “Exchange Act”). We are also subject to other reporting and corporate governance requirements

under the Sarbanes-Oxley Act of 2002, as amended, and the rules and regulations promulgated thereunder, all of which impose significant

compliance and reporting obligations upon us and require us to incur additional expense in order to fulfill such obligations.

If

we fail to maintain effective internal control over financial reporting, the price of our securities may be adversely affected.

Our

internal control over financial reporting may have weaknesses and conditions that could require correction or remediation, the disclosure

of which may have an adverse impact on the price of our common stock. We are required to establish and maintain appropriate internal

control over financial reporting. Failure to establish those controls, or any failure of those controls once established, could adversely

affect our public disclosures regarding our business, prospects, financial condition or results of operations. In addition, management’s

assessment of internal control over financial reporting may identify weaknesses and conditions that need to be addressed in our internal

control over financial reporting or other matters that may raise concerns for investors. Any actual or perceived weaknesses and conditions

that need to be addressed in our internal control over financial reporting or disclosure of management’s assessment of our internal

control over financial reporting may have an adverse impact on the price of our common stock.

We

are required to comply with certain provisions of Section 404 of the Sarbanes-Oxley Act and if we fail to continue to comply, our business

could be harmed and the price of our securities could decline.

Rules

adopted by the SEC pursuant to Section 404 of the Sarbanes-Oxley Act require an annual assessment of internal control over financial

reporting, and for certain issuers an attestation of this assessment by the issuer’s independent registered public accounting firm.

The standards that must be met for management to assess the internal control over financial reporting as effective are evolving and complex,

and require significant documentation, testing, and possible remediation to meet the detailed standards. We expect to incur significant

expenses and to devote resources to Section 404 compliance on an ongoing basis. It is difficult for us to predict how long it will take

or costly it will be to complete the assessment of the effectiveness of our internal control over financial reporting for each year and

to remediate any deficiencies in our internal control over financial reporting. As a result, we may not be able to complete the assessment

and remediation process on a timely basis. In the event that our Chief Executive Officer or Principal Financial Officer determines that

our internal control over financial reporting is not effective as defined under Section 404, we cannot predict how regulators will react

or how the market prices of our securities will be affected; however, we believe that there is a risk that investor confidence and the

market value of our securities may be negatively affected.

Shares

eligible for future sale may adversely affect the market.

From

time to time, certain of our stockholders may be eligible to sell all or some of their shares of common stock by means of ordinary brokerage

transactions in the open market pursuant to Rule 144 promulgated under the Securities Act, subject to certain limitations. In general,

pursuant to Rule 144, non-affiliate stockholders may sell freely after six months, subject only to the current public information requirement.

Affiliates may sell after six months, subject to the Rule 144 volume, manner of sale (for equity securities), current public information,

and notice requirements. Of the approximately 28,000,000 shares of our common stock outstanding as of May 31, 2023, approximately 15,000,000

shares are tradable without restriction. Given the limited trading of our common stock, resale of even a small number of shares of our

common stock pursuant to Rule 144 or an effective registration statement may adversely affect the market price of our common stock.

We

do not have any long-term contracts with our suppliers or with our customers, and we do not have many written contracts with our customers,

and if we can’t maintain these relationships or if we or our suppliers experience manufacturing problems or delays, our financial

results will be negatively affected.

We

do not have any long-term contracts with our suppliers or with our customers for our current or planned products. We also do not have

many written contracts with our customers. There can be no assurance that these suppliers will continue to sell to us on prior or current

terms, or at all and likewise there can also be no assurance that our customers will continue to purchase from us or that we can obtain

customers to purchase our planned products. We may not be able to maintain our relationships with our suppliers and customers, or we

may be unable to find alternate suppliers or customers in a timely fashion. Should this occur, our revenues and results of operations

will be negatively affected. Additionally, we or our suppliers may encounter unforeseen delays or shortfalls in manufacturing, and our

suppliers’ production processes may have to change to accommodate any significant future expansion of our manufacturing capacity,

which may increase our or our suppliers’ manufacturing costs, delay production of our current and planned products, reduce our

product gross margin and adversely impact our business. If we are unable to keep up with demand for our current and planned products

by maintaining our relationships with our suppliers or successfully manufacturing and shipping our products in a timely manner, our revenue

could be impaired, market acceptance for our current and planned products could be adversely affected and our customers might instead

purchase our competitors’ products. In addition, developing manufacturing procedures for new products may require developing specific

production processes for those products. Developing such processes could be time consuming and any unexpected difficulty in doing so

can delay the introduction of a product.

An

unexpected interruption in our warehousing facilities or if there is a lack of capacity at our warehousing facilities, it could reduce

our sales and margins.

We

store products in our warehouses that we then ship to customers or distributors. If we run out of capacity, we won’t be able to

store as many products and may not be able to maintain all products in an efficient manner. Additionally, if there is any unexpected

interruption to our warehousing facilities, for any reason, such as loss of certifications or licenses, as a result of weather, terrorism

or acts of war, fire, earthquake, or other national disaster, a work stoppage or other labor-related disruption, electrical outages,

or other events, it could result in significant reductions to our sales and margins and could have a material adverse effect on our business,

financial condition or results of operations.

Any

interruption to our distribution channels for our products could adversely affect our sales and results of operations.

Any

interruption to our distribution channels for our products for any reason, such as disruption of distribution channels as a result of

weather, terrorism or acts of war, fire, earthquake, or other national disaster, a work stoppage or other labor-related disruption, could

adversely affect our sales and results of operations.

Item

1B. Unresolved Staff Comments.

None.

Item

2. Properties.

Greystone’s

operations are performed at:

| |

● |

Two

primary buildings for a total of 120,000 square feet of manufacturing and warehouse space located on approximately 3 acres of land

in Bettendorf, Iowa. These buildings are leased from Greystone Real Estate, L.L.C. (“GRE”) which is owned by Robert B.

Rosene, Jr., a director of Greystone. The manufacturing and warehouse space is sufficiently equipped and designed to accommodate

the manufacturing of plastic pallets and is also used for grinding, processing and pelletizing recycled plastic. The lease has a

primary term through July 31, 2032, with an option by Greystone to extend for 5 years, and initially provides for monthly rent of

$44,500 with escalations of 5% every 5 years. |

| |

|

|

| |

● |

Three

buildings owned by Greystone located within a 30-mile radius of its primary facility for an additional 95,000 square feet of warehouse

space. These buildings are currently used for warehousing inventory and grinding operations. |

| |

|

|

| |

● |

Facility

in Palmyra, MO, housing two of Greystone’s injection molding machines. Production in this facility will be outsourced to the

lessor with terms to be determined. |

| |

|

|

| |

● |

Facility

in Jasper, IN, housing Greystone’s extrusion processing machines. Production in this facility will be outsourced to the lessor

with terms to be determined. |

We

believe that these facilities are adequate for our current and near-term needs.

Item

3. Legal Proceedings.

From

time to time, we may be involved in various claims and legal actions arising in the ordinary course of business. To the knowledge of

our management, there are no legal proceedings currently pending against us which we believe would have a material effect on our business,

financial position or results of operations and, to the best of our knowledge, there are no such legal proceedings contemplated or threatened.

Item

4. Mine Safety Disclosures.

Not

applicable.

PART

II

Item

5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market

Information

Greystone’s

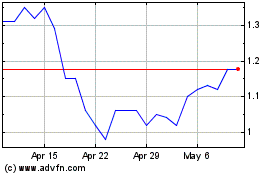

common stock is traded on the OTCQB under the symbol “GLGI.” The following table sets forth the range of high and low per

share bid quotations for Greystone’s common stock during the time periods indicated. Quotations reflect inter-dealer prices, without

retail mark-up, markdown or commission and may not represent actual transactions. The source of the foregoing quotations was the Financial

Industry Regulatory Composite Feed or other qualified inter dealer quotation medium as provided by OTC Market Group, Inc.:

| Quarter Ended | | |

High | | |

Low | |

| August

31, 2021 | | |

$ | 1.47 | | |

$ | 0.98 | |

| November

30, 2021 | | |

$ | 1.35 | | |

$ | 0.82 | |

| February

28, 2022 | | |

$ | 1.16 | | |

$ | 0.80 | |

| May 31,

2022 | | |

$ | 1.00 | | |

$ | 0.67 | |

| August

31, 2022 | | |

$ | 0.85 | | |

$ | 0.70 | |

| November

30, 2022 | | |

$ | 0.87 | | |

$ | 0.69 | |

| February

28, 2023 | | |

$ | 0.72 | | |

$ | 0.44 | |

| May 31,

2023 | | |

$ | 0.82 | | |

$ | 0.57 | |

| August

31, 2023 (1) | | |

$ | 1.02 | | |

$ | 0.77 | |

(1)

Reflects activity through August 11, 2023 only.

Holders

As

of May 31, 2023, Greystone had approximately 211 common stockholders of record.

Dividends

Greystone

paid no cash dividends to its common stockholders during the last two fiscal years and does not plan to pay any cash dividends in the

near future. The loan agreement dated July 29, 2022 (the “IBC Loan Agreement”), as amended, among Greystone, GSM and International

Bank of Commerce (“IBC”) prohibits Greystone from declaring or paying any dividends to its common stockholders without IBC’s

prior written consent. See Note 5 to the consolidated financial statements for additional information. In addition, accrued preferred

stock dividends must be paid before a dividend on common stock may be declared or paid, as set forth in the Certificate of Designation,

Preferences, Rights and Limitations relating to the preferred stock. See Note 11 to the consolidated financial statements and “Liquidity

and Capital Resources” in Item 7 of this Form 10-K for additional information.

Greystone

paid dividends on its 2003 preferred stock in the amounts of $446,644 and $243,082 during fiscal years 2023 and 2022, respectively.

Item

6. [Reserved].

Item

7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Cautionary

Statement Regarding Forward-Looking Information

This

Annual Report on Form 10-K includes “forward-looking statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements concern Greystone’s plans,

expectations and objectives for future operations. All statements, other than statements of historical facts, included in this Form 10-K

that address activities, events or developments that Greystone expects, believes or anticipates will or may occur in the future are forward-looking

statements. The words “believe,” “plan,” “intend,” “anticipate,” “estimate,”

“project,” and similar expressions are intended to identify forward-looking statements. These forward-looking statements

include, among others, such things as:

| ● |

expansion and growth of Greystone’s business and operations |

| ● |

future

financial performance; |

| ● |

future acquisitions and developments; |

| ● |

potential sales of products; |

| ● |

future

financing activities; and |

| ● |

business strategy. |

These

forward-looking statements are based on assumptions that Greystone believes are reasonable based on current expectations and projections

about future events and industry conditions and trends affecting Greystone’s business. However, whether actual results and developments

will conform to Greystone’s expectations and predictions is subject to a number of risks and uncertainties that could cause actual

results to differ materially from those contained in the forward-looking statements, including those factors discussed under the section

of this Form 10-K entitled “Risk Factors.” In addition, Greystone’s historical financial performance is not necessarily

indicative of the results that may be expected in the future and Greystone believes that such comparisons cannot be relied upon as indicators

of future performance.

Results

of Operations

General

The

consolidated financial statements include Greystone and its two wholly owned subsidiaries, Greystone Manufacturing, L.L.C. (“GSM”),

and Plastic Pallet Production, Inc. (“PPP”), and one variable interest entity, Greystone Real Estate, L.L.C. (“GRE”).

Effective July 29, 2022, GRE was no longer deemed to be a beneficiary of Greystone and, accordingly, was deconsolidated on the effective

date as discussed further in Note 1 to the consolidated financial statements.

Greystone’s

primary business is the manufacturing of plastic pallets utilizing recycled plastic and selling the pallets through one of its wholly

owned subsidiaries, GSM.

As

of May 31, 2023 and 2022, Greystone had FTE’s of approximately 179 and 217 employees, respectively. Temporary personnel from a

personnel service entity are utilized as needed. There were FTE’s of approximately 109 and 81 temporary personnel as of May 31,

2023 and 2022, respectively. Greystone’s in-house production capacity for its injection molding machines capable of producing pallets

is approximately 225,000 plastic pallets per month, or 2,700,000 per year. Production levels will vary proportionately as a result of

the pallet design, machine downtime or customer restrictions for maintaining stringent sizing on certain pallets.

Year

Ended May 31, 2023 Compared to Year Ended May 31, 2022

Sales

Sales

were $60,758,962 for fiscal year 2023 compared to $74,170,351 for fiscal year 2022 representing a decrease of $13,411,389, or about 18%.

Fiscal year 2023 was a turn-around period to recover from declining sales as customers shied away from inflationary pricing during the

pandemic period. As raw material pricing returned to relatively normal historic levels during the second quarter of fiscal year 2023,

the Company focused its efforts on rebuilding relations with existing customers as well as seeking new customers. The achievement of

a 4.90% increase in gross margin over fiscal year 2022 was significant despite an approximate 25% decrease in number of pallets sold. Timing

also impacted sales in fiscal year 2023 as a result of a customer who provides its own material incurring delays in transporting certain

material to Greystone. The delays of transporting of such certain material began at the end of the fourth quarter and we expect the delays

to resolve in fiscal year 2024.

Greystone

had three customers who accounted for approximately 73% and 76% of total sales in fiscal years 2023 and 2022, respectively. Customers

that account for significant sales may vary in any one year. Generally, customers purchasing substantial quantities to replace or add

pallets to their inventory consistently comprise a significant portion of sales. Any customer(s) needing a substantial quantity of pallets

to fulfill a specific need may vary from year to year.

Cost

of Sales

Cost

of sales was $51,427,409 (85% of sales) and $66,395,792 (89% of sales) in fiscal years 2023 and 2022, respectively. The decrease in the

ratio of cost of sales to sales (the “ratio”) in fiscal year 2023 from fiscal year 2022 was the result of several factors,

including a decline in the price of raw materials toward relatively historic levels and stabilization of production personnel offset

somewhat by the effect of Greystone’s inflexible fixed production costs on decreased levels of production.

Selling,

General and Administrative Expenses

Selling,

general and administrative (SGA) expenses were $5,100,170, (8.4% of sales) for fiscal year 2023 compared to $5,200,387 (7.0% of sales)

for fiscal year 2022, representing a decrease of $100,217. Legal expenses of approximately $494,000 during fiscal year 2022 were primarily

attributable to an arbitration proceeding which was terminated with prejudice in fiscal year 2022. The decrease in legal fees in fiscal

year 2023 was primarily offset by increases in personnel costs.

Other

Income (Expenses)

During

fiscal years 2023 and 2022, Greystone received $4,911,863 and $241,814, respectively, reimbursement from the Department of Treasury for

refundable tax credits against certain employment taxes pursuant to the Employee Retention Credit (“ERC”) under the Coronavirus

Aid, Relief, and Economic Security Act (“CARES Act”).

As

a result of the deconsolidation of GRE, the Company recognized a gain of $569,997 in fiscal year 2023 which was attributable to a deferred

gain from Greystone’s sell and leaseback of the building to GRE in the prior years.

In

fiscal year 2021, Greystone received a Paycheck Protection Program loan in the amount of $3,034,000 from the Small Business Administration

(“SBA”) under the CARES Act which provided emergency loans to qualifying businesses. During fiscal year 2022, the SBA provided

forgiveness of the Paycheck Protection Program loan plus accrued interest resulting in a gain of $3,068,497.

Other

income for fiscal years 2023 and 2022 included:

| | |

2023 | | |

2022 | |

| Interest income | |

$ | 317,797 | | |

$ | 1,472 | |

| Gain (loss) on disposition of property, plant and equipment | |

| (2,972 | ) | |

| 22,336 | |

| Other | |

| 10,774 | | |

| 15,427 | |

| Total Other Income | |

$ | 325,599 | | |

$ | 39,235 | |

Interest

expense was $1,189,034 in fiscal year 2023 compared to $841,701 in fiscal year 2022 for an increase of $347,333. This increase is primarily

attributable to the increase in the prime rate of interest which was 8.25% as of May 31, 2023, compared to 5.50% as of May 31, 2022.

Provision

for Income Taxes

The

provision for income taxes was $2,461,700 in fiscal year 2023 compared to $535,417 in fiscal year 2022. The effective tax rate differs

from federal statutory rates due to net income from GRE which, as a limited liability company, is not taxed at the corporate level, state

income taxes, income which is not subject to income tax in fiscal year 2022, charges which have no income tax benefit and changes in

the valuation allowance.

Based

upon a review of its income tax filing positions, Greystone believes that its positions would be sustained upon an audit by the Internal

Revenue Service and does not anticipate any adjustments that would result in a material change to its financial position. Therefore,

no reserves for uncertain income tax positions have been recorded.

Net

Income

Net

income was $6,388,108 in fiscal year 2023 compared to $4,546,600 in fiscal year 2022 for an increase of $1,841,508 for the reasons discussed

above.

Net

Income Attributable to Common Stockholders

After

deducting preferred dividends and income attributable to non-controlling interests, the net income attributable to common stockholders

was $5,842,828, or $0.21 per share, in fiscal year 2023 compared to $3,938,478, or $0.14 per share, in fiscal year 2022 for the reasons

discussed above.

Liquidity

and Capital Resources

General

A

summary of Greystone’s cash flows for the year ended May 31, 2023, was as follows:

| Cash provided by operating activities | |

$ | 3,871,618 | |

| Cash used in investing activities | |

$ | (9,127,176 | ) |

| Cash provided by financing activities | |

$ | 2,808,252 | |

The