GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

YEARS ENDED AUGUST 31, 2016, 2015 AND 2014

(Expressed in Canadian Dollars)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMMON SHARES

|

SHARE-BASED PAYMENTS RESERVE

|

ACCUMULATED

OTHER

|

|

|

|

WITHOUT PAR VALUE

|

|

|

|

SHARES

|

AMOUNT

|

COMPREHENSIVE INCOME(LOSS)

|

DEFICIT

|

TOTAL EQUITY

|

|

Balance, August 31, 2013

|

106,660,889

|

|

26,044,652

|

|

2,758,145

|

|

(34,388)

|

|

(21,596,079)

|

|

7,172,330

|

|

Other comprehensive loss

|

-

|

|

-

|

|

-

|

|

(36,125)

|

|

-

|

|

(36,125)

|

|

Net loss for the year

|

-

|

|

-

|

|

-

|

|

-

|

|

(3,548,518)

|

|

(3,548,518)

|

|

Balance, August 31, 2014

|

106,660,889

|

|

26,044,652

|

|

2,758,145

|

|

(70,513)

|

|

(25,144,597)

|

|

3,587,687

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive loss

|

-

|

|

-

|

|

-

|

|

(2,125)

|

|

-

|

|

(2,125)

|

|

Net loss for the year

|

-

|

|

-

|

|

-

|

|

-

|

|

(575,408)

|

|

(575,408)

|

|

Balance, August 31, 2015

|

106,660,889

|

|

26,044,652

|

|

2,758,145

|

|

(72,638)

|

|

(25,720,005)

|

|

3,010,154

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share-based compensation

|

-

|

|

-

|

|

228,625

|

|

-

|

|

-

|

|

228,625

|

|

Other comprehensive income

|

-

|

|

-

|

|

-

|

|

(2,125)

|

|

-

|

|

(2,125)

|

|

Realized other comprehensive income

|

-

|

|

-

|

|

-

|

|

74,763

|

|

-

|

|

74,763

|

|

Net loss for the year

|

-

|

|

-

|

|

-

|

|

-

|

|

(722,136)

|

|

(722,136)

|

|

Balance, August 31, 2016

|

106,660,889

|

$

|

26,044,652

|

$

|

2,986,770

|

$

|

-

|

$

|

(26,442,141)

|

$

|

2,589,281

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to consolidated financial statements.

|

GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Expressed in Canadian Dollars)

|

|

|

|

|

|

|

|

|

YEARS ENDED AUGUST 31,

|

|

|

2016

|

2015

|

2014

|

|

|

|

|

|

|

|

|

|

Operating Activities

|

|

|

|

|

|

|

|

Net loss for the year

|

$

|

(722,136)

|

$

|

(575,408)

|

$

|

(3,548,518)

|

|

Adjustments to reconcile loss to net cash used in operating

activities:

|

|

|

|

|

|

|

|

Accrual of management fees

|

|

162,000

|

|

-

|

|

-

|

|

Amortization

|

|

14,946

|

|

35,482

|

|

22,473

|

|

Gain on sale of property and equipment

|

|

-

|

|

-

|

|

(4,615)

|

|

Interest income

|

|

-

|

|

-

|

|

(4,156)

|

|

Share-based compensation

|

|

228,625

|

|

-

|

|

-

|

|

Write-off of VAT and other receivables

|

|

60,691

|

|

|

|

|

|

Write down of mineral property exploration costs

|

|

2,558

|

|

81,214

|

|

2,883,086

|

|

Realized loss on marketable securities

|

|

75,134

|

|

-

|

|

-

|

|

Non-operating effects of holding foreign currency cash balances

|

|

3,389

|

|

(702)

|

|

1,023

|

|

Change in non-cash operating assets and liabilities:

|

|

|

|

|

|

|

|

VAT and other receivables

|

|

51,157

|

|

8,844

|

|

(18,075)

|

|

Due from related parties

|

|

26,751

|

|

8,519

|

|

(2,970)

|

|

Prepaid expenses

|

|

(15,515)

|

|

4,333

|

|

826

|

|

Accounts payable and accrued liabilities

|

|

5,965

|

|

(31,795)

|

|

(101)

|

|

Due to related parties

|

|

(6,651)

|

|

231,602

|

|

-

|

|

Employment benefit obligations

|

|

(6,327)

|

|

10,335

|

|

7,120

|

|

Cash Provided By (Used In) Operating Activities

|

|

(119,413)

|

|

(227,576)

|

|

(663,907)

|

|

|

|

|

|

|

|

|

|

Investing Activities

|

|

|

|

|

|

|

|

Expenditures on mineral properties

|

|

(264,808)

|

|

(107,552)

|

|

(317,259)

|

|

Proceeds from redemption of short term investments

|

|

-

|

|

-

|

|

780,000

|

|

Purchase of property and equipment

|

|

-

|

|

-

|

|

(2,556)

|

|

Interest income

|

|

-

|

|

-

|

|

8,108

|

|

Proceeds on sale of marketable securities

|

|

8,129

|

|

-

|

|

-

|

|

Proceeds on sale of mineral property interest

|

|

666,380

|

|

-

|

|

-

|

|

Proceeds on sale of property and equipment

|

|

-

|

|

-

|

|

4,615

|

|

Cash (Used In) Provided By Investing Activities

|

|

409,701

|

|

(107,552)

|

|

472,908

|

|

|

|

|

|

|

|

|

|

Financing Activities

|

|

|

|

|

|

|

|

Proceeds received from (Repayment of) promissory note payable

|

|

(

328,254)

|

|

328,254

|

|

-

|

|

Cash (Used In) Provided By Financing Activities

|

|

(328,254)

|

|

328,254

|

|

472,908

|

|

|

|

|

|

|

|

|

|

Gain (loss) from holding foreign currency cash balances

|

|

(3,389)

|

|

702

|

|

1,023

|

|

|

|

|

|

|

|

|

|

Decrease In Cash

|

|

(41,355)

|

|

(6,172)

|

|

(192,022)

|

|

|

|

|

|

|

|

|

|

Cash, Beginning Of Year

|

|

99,235

|

|

105,407

|

|

297,429

|

|

|

|

|

|

|

|

|

|

Cash, End Of Year

|

$

|

57,880

|

$

|

99,235

|

$

|

105,407

|

|

|

|

|

|

|

|

|

|

Supplementary Cash Flow Disclosure And Non-Cash Investing And Financing Activities:

|

|

|

|

|

|

|

|

Interest paid

|

$

|

-

|

$

|

-

|

$

|

-

|

|

Income taxes paid

|

$

|

-

|

$

|

-

|

$

|

-

|

|

|

|

|

|

|

|

|

|

See accompanying notes to consolidated financial statements.

|

GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

YEARS ENDED AUGUST 31, 2016, 2015 AND 2014

(Expressed in Canadian Dollars)

1.

NATURE OF OPERATIONS AND GOING CONCERN

Golden Goliath Resources Ltd. (the “Company”) was incorporated on June 12, 1996 under the Business Corporations Act of British Columbia, Canada. The Company is a public company listed on the TSX Venture Exchange (the “TSX.V”), trading under the symbol “GNG”. The address of the Company’s corporate office and principal place of business is Suite 711, 675 West Hastings Street, Vancouver, British Columbia, Canada. The Company’s principal business activity is the acquisition and exploration of resource properties.

The Company is in the exploration stage and is in the process of evaluating its Mexican resource properties and has not yet determined whether these properties contain reserves that are economically recoverable. The recoverability of amounts shown for exploration and evaluation assets are dependent upon the discovery of economically recoverable reserves, confirmation of the Company’s interest in the underlying mineral claims, the ability of the Company to obtain necessary financing to complete the development of the properties and upon future profitable production or proceeds from the disposition thereof. Managements’ plan in this regard is to secure additional funds through future equity financings, which either may not be available or may not be available on reasonable terms.

The consolidated financial statements have been prepared on the basis of accounting principles applicable to a going concern. This assumes the Company will operate for the foreseeable future and will be able to realize its assets and discharge its liabilities in the normal course of operations. Accordingly, they do not give effect to adjustments that would be necessary should the Company be unable to continue as a going concern and therefore be required to realize its assets and liquidate its liabilities, contingent obligations and commitments other than in the normal course of business and at amounts different from those in the financial statements. The Company has incurred operating losses since inception, has no source of operating cash flow, minimal income from short-term investments, continues to rely on the cooperation of its related parties, and there can be no assurances that sufficient funding, including adequate financing, will be available to complete the exploration of its mineral properties and to cover general and administrative expenses necessary for the maintenance of a public company. The ability of the Company to arrange additional financing in the future depends in part, on the prevailing capital market conditions and mineral property exploration success. These factors cast substantial doubt on the Company’s ability to continue as a going concern. Accordingly, the financial statements do not give effect to adjustments that would be necessary should the Company be unable to continue as a going concern and therefore be required to realize its assets and liquidate its liabilities, contingent obligations and commitments other than in the normal course of business and at amounts different from those in the financial statements.

2.

BASIS OF PRESENTATION

a)

Statement of Compliance

These consolidated financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and interpretations issued by the International Financial Reporting Interpretations Committee (“IFRIC”).

b)

Basis of Preparation

These consolidated financial statements have been prepared on a historical cost basis except for financial instruments that have been measured at fair value. These consolidated financial statements have also been prepared using the accrual basis of accounting, except for cash flow information. In the opinion of management, all adjustments (including normal recurring accruals), considered necessary for a fair presentation have been included.

GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

YEARS ENDED AUGUST 31, 2016, 2015 AND 2014

(Expressed in Canadian Dollars)

2.

BASIS OF PRESENTATION

(Continued)

c)

Foreign Currencies

The Company’s reporting currency and functional currency is the Canadian dollar. The functional currency of the Mexican subsidiary is the Canadian dollar. Transactions in United States (“US”) and Mexican (“MXN”) foreign currencies have been translated into Canadian dollars as follows:

·

Monetary items at the rate prevailing at the statement of financial position date;

·

Non-monetary items are measured at historical cost at the exchange rate in effect at the date of the transaction;

·

Revenues and expenses are translated at the exchange rate in effect at the date of the transaction; and

·

Gains or losses arising on foreign currency translation are included in the consolidated statements of operations and comprehensive loss.

d)

Significant Accounting Judgments and Estimates

The preparation of financial statements in conformity with IFRS requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. The preparation of financial statements also requires management to exercise judgment in the process of applying the accounting policies.

On an on-going basis, management evaluates its judgments and estimates in relation to assets, liabilities and expenses. Management uses historical experience and various other factors it believes to be reasonable under the given circumstances, as the basis for its judgments and estimates. Revisions to accounting estimates are recognized prospectively from the period in which the estimates are revised. Actual outcomes may differ from those estimates under different assumptions and conditions.

The following are the key estimate and assumption uncertainties that have a significant risk of resulting in a material adjustment within the next financial year.

Critical Accounting Estimates

Impairment

Assets, especially exploration and evaluation assets are reviewed for impairment whenever events or changes in circumstances indicate that their carrying amounts exceed their recoverable amounts. The assessment of the carrying amount often requires estimates and assumptions such as discount rates, exchange rates, commodity prices, future capital requirements and future operating performance.

Share-based payment transactions

The Company measures the cost of equity-settled transactions with employees by reference to the fair value of the equity instruments at the date at which they are granted. Estimating fair value for share-based payment transactions requires determining the most appropriate valuation model, which is dependent on the terms and conditions of the grant of shares. This estimate also requires determining the most appropriate inputs to the valuation model including the expected life of a share option, volatility and dividend yield and making assumptions about them. The assumptions and model used for estimating fair value for share-based payment transactions are disclosed in Note 9.

GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

YEARS ENDED AUGUST 31, 2016, 2015 AND 2014

(Expressed in Canadian Dollars)

2.

BASIS OF PRESENTATION

(Continued)

d)

Significant Accounting Judgments and Estimates

(Continued)

Critical Judgments Used in Applying Accounting Policies

Determination of going concern assumption

The preparation of these consolidated financial statements requires management to make judgments regarding the applicability of going concern assumption to the Company as discussed in Note 1.

Determination of Cash Generating Units

In performing impairment assessments, assets are grouped together into the smallest group of assets that generates cash inflows that are largely independent of the cash inflows from other assets or groups of assets. Management is required to exercise judgment in identifying these cash generating units.

Determination of functional currency

The functional currency for the Company’s subsidiaries is the currency of the primary economic environment in which the entity operates. Determination of functional currency may involve certain judgments to determine the primary economic environment and the Company reconsiders the functional currency of its entities if there is a change in events and conditions which determined the primary economic environment.

Title to mineral property interests

Although the Company has taken steps to verify title to mineral properties in which it has an interest, these procedures do not guarantee the Company’s title. Such properties may be subject to prior agreements or transfers and title may be affected by undetected defects.

Exploration and evaluation expenditures

The application of the Company’s accounting policy for exploration and evaluation expenditures requires judgment in determining whether it is likely that future economic benefits will flow to the Company, which may be based on assumptions about future events or circumstances. Estimates and assumptions made may change if new information becomes available. If, after the expenditure is capitalized, information becomes available suggesting that the recovery of the expenditure is unlikely, the amount capitalized is written off in the statement of operations in the period the new information becomes available.

Income taxes

Significant judgment is required in determining the provision for income taxes. There are many transactions and calculations undertaken during the ordinary course of business for which the ultimate tax determination is uncertain. The Company recognizes liabilities and contingencies for anticipated tax audit issues based on the Company’s current understanding of the tax law. For matters where it is probable that an adjustment will be made, the Company records its best estimate of the tax liability including the related interest and penalties in the current tax provision. Management believes they have adequately provided for the probable outcome of these matters; however, the final outcome may result in a materially different outcome than the amount included in the tax liabilities.

In addition, the Company recognizes deferred tax assets relating to tax losses carried forward to the extent there are sufficient taxable temporary differences (deferred tax liabilities) relating to the same taxation authority and the same taxable entity against which the unused tax losses can be utilized. However, utilization of the tax losses also depends on the ability of the taxable entity to satisfy certain tests at the time the losses are recouped.

GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

YEARS ENDED AUGUST 31, 2016, 2015 AND 2014

(Expressed in Canadian Dollars)

2.

BASIS OF PRESENTATION

(Continued)

Decommissioning liabilities

Judgment is required to determine if there are legal or constructive obligations to incur restoration, rehabilitation and environmental costs when there is an environmental disturbance caused by exploration, development or ongoing production of an exploration and evaluation asset. When it is determined that an obligation exists, a provision is recognized. The provision for decommissioning liabilities depends on estimates of current risk-free interest rates, future restoration and reclamation expenditures and the timing of those expenditures.

3.

SIGNIFICANT ACCOUNTING POLICIES

The accounting policies set out below for the year ended August 31, 2015 have been applied consistently to all periods presented in these consolidated financial statements.

a)

Basis of Consolidation

The consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries, Minera Delta S.A. de C.V. of Mexico, and 4247 Investments Ltd. (inactive) of British Columbia, Canada. The subsidiaries are fully consolidated from the date of acquisition, being the date on which the Company obtained control, and will continue to be consolidated until the date that such control ceases. The financial statements of the subsidiaries are prepared for the same reporting period as the Company, using consistent accounting policies. Significant inter-company balances and transactions have been eliminated on consolidation.

b)

Financial Instruments and Risk Management

Financial assets

The Company classifies its financial assets into one of the following categories, depending on the purpose for which the asset was acquired. The Company's accounting policy for each category is as follows:

Fair value through profit or loss -

This category comprises cash, short term investments and financial assets including derivatives acquired or incurred principally for the purpose of selling or repurchasing in the near term. They are carried in the statements of financial position at fair value with changes in fair value recognized in the statements of operations and comprehensive loss.

Loans and receivables -

These assets are non-derivative financial assets with fixed or determinable payments that are not quoted in an active market. They are carried at amortized cost less any provision for impairment. Significant receivables are considered for impairment when they are past due or when other objective evidence is received that a specific counterparty will default.

Held-to-maturity investments

- These assets are non-derivative financial assets with fixed or determinable payments and fixed maturities that the Company's management has the positive intention and ability to hold to maturity. These assets are measured at amortized cost using the effective interest rate method. If there is objective evidence that the investment is impaired, determined by reference to external credit ratings and other relevant indicators, the financial asset is measured at the present value of estimated future cash flows. Any changes to the carrying amount of the investment, including impairment losses, are recognized in the statements of operations and comprehensive loss.

Available-for-sale

- Non-derivative financial assets not included in the above categories are classified as available-for-sale. They are carried at fair value with changes in fair value recognized directly in equity. Where a decline in the fair value of an available-for-sale financial asset constitutes objective evidence of impairment, the amount of the loss is removed from equity and recognized in the statements of operations and comprehensive loss.

GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

YEARS ENDED AUGUST 31, 2016, 2015 AND 2014

(Expressed in Canadian Dollars)

3.

SIGNIFICANT ACCOUNTING POLICIES

(Continued)

b)

Financial Instruments and Risk Management

(Continued)

Financial assets

(Continued)

Transaction costs associated with fair value through profit or loss financial assets are expensed as incurred, while transaction costs associated with all other financial assets are included in the initial carrying amount of the asset.

All financial assets except for those at fair value through profit or loss are subject to review for impairment at least at each reporting date. Financial assets are impaired when there is objective evidence that a financial asset or a group of financial assets is impaired. Different criteria to determine impairment are applied for each category of financial assets, which are described above.

Financial liabilities

The Company classifies its financial liabilities into one of two categories, depending on the purpose for which the asset was acquired. The Company's accounting policy for each category is as follows:

Fair value through profit or loss

- This category comprises derivatives, or liabilities acquired or incurred principally for the purpose of selling or repurchasing in the near term. They are carried in the statements of financial position at fair value with changes in fair value recognized in the statements of operations and comprehensive loss.

Other financial liabilities -

This category includes promissory notes, amounts due to related parties and accounts payable and accrued liabilities, all of which are recognized at amortized cost.

The Company has classified cash as fair value through profit or loss financial assets. Investments in marketable securities are classified as available for sale. Other receivables and related party advances are classified as loans and receivables. Accounts payable and accrued liabilities, due to related parties and promissory notes payable are classified as other financial liabilities. Management did not identify any material embedded derivatives, which require separate recognition and measurement.

Disclosures about the inputs to financial instrument fair value measurements are made within a hierarchy that prioritizes the inputs to fair value measurement.

The three levels of the fair value hierarchy are:

|

|

|

|

|

Level 1

|

Unadjusted quoted prices in active markets for identical assets or liabilities;

|

|

|

Level 2

|

Inputs other than quoted prices that are observable for the asset or liability either directly or indirectly; and

|

|

|

Level 3

|

Inputs that are not based on observable market data

|

Financial instruments are exposed to credit, liquidity and market risks. Credit risk is the risk that one party to a financial instrument will cause a financial loss for the other party by failing to discharge an obligation. Liquidity risks is the risk that an entity will encounter difficulty in meeting obligations associated with financial liabilities. Market risk is that the fair value or future cash flows of a financial instrument will fluctuate because of changes in market prices. Market risk comprises three types of price risk: currency risk, interest rate risk and other price risk.

Credit risk and liquidity risk on amounts due to creditors are significant to the Company’s statement of financial position. The Company manages these risks by actively pursuing additional share capital issuances to settle its obligations in the normal course of its operating, investing and financing activities. The Company’s ability to raise share capital is indirectly related to changing metal prices and the prices of gold and silver in particular. To mitigate this market risk, management of the Company actively pursues a diversification strategy with property holdings focusing on precious metals as well as base metals.

GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

YEARS ENDED AUGUST 31, 2016, 2015 AND 2014

(Expressed in Canadian Dollars)

3.

SIGNIFICANT ACCOUNTING POLICIES

(Continued)

c)

Cash

Cash includes cash on hand, cash held in trust and demand deposits.

d)

Comprehensive Income

Other comprehensive income represents the change in net equity for the period that arises from unrealized gains and losses on available-for-sale financial instruments. Amounts included in other comprehensive income are shown net of tax. Cumulative changes in other comprehensive income are included in accumulated other comprehensive income which is presented as a category in equity.

e)

Exploration and Evaluation Assets

Exploration and evaluation expenditures include the costs associated with exploration and evaluation activities. Exploration and evaluation expenditures are capitalized as incurred. Costs incurred before the Company has obtained the legal rights to explore an area are recognized in profit or loss

.

Exploration and evaluation assets are assessed for impairment if facts and circumstances suggest that the carrying amount exceeds the recoverable amount.

Once the technical feasibility and commercial viability of the extraction of mineral resources in an area of interest are demonstrable, which management has determined to be indicated by a feasibility study, exploration and evaluation assets attributable to that area of interest are first tested for impairment and then reclassified to mining property and development assets.

As the Company currently has no operational income, any incidental revenues, including option payments, earned in connection with exploration stage activities are applied as a reduction to capitalized exploration costs with any excess accounted for as a gain on disposal.

Recoverability of the carrying amount of any exploration and evaluation assets is dependent on successful development and commercial exploitation, or alternatively, sale of the respective areas of interest. If it is determined that exploration and evaluation assets are not recoverable, the property is abandoned; or if management has determined an impairment in value, the property is written down to its estimated recoverable amount.

It is management’s judgment that none of the Company’s exploration and evaluation assets have reached the development stage and as a result are all considered to be exploration and evaluation assets.

Although the Company has taken steps to verify title to mineral properties in which it has an interest, in accordance with industry standards for the current stage of exploration of such properties, these procedures do not guarantee the Company’s title. Property may be subject to unregistered prior agreements and non-compliance with regulatory requirements. The Company is not aware of any disputed claims of title.

f)

Property and Equipment

IFRS requires that assets be disaggregated into individual components for amortization purposes and revaluation of property, plant and equipment to fair value is also permitted. The Company currently tracks individual assets with distinct useful lives and depreciates them separately. The Company elected to use the cost method and not the revaluation method due to the difficulty in determining accurate fair value information and the effort required to continually monitor fair values.

Equipment and vehicles are recorded at cost and amortized on a straight-line basis over their estimated useful lives at the following rates:

|

|

|

Equipment

|

10% - 30%

|

|

Vehicles

|

25%

|

GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

YEARS ENDED AUGUST 31, 2016, 2015 AND 2014

(Expressed in Canadian Dollars)

3.

SIGNIFICANT ACCOUNTING POLICIES

(Continued)

g)

Employee Future Benefits

The Company is subject to Mexican statutory laws and regulations governing employee termination benefits and accrues for employee future benefits based on management’s estimates of the expected payments.

These benefits consist of a one-time payment equivalent to 12 days of wages for each year of service (at the employee’s most recent salary, but not to exceed twice the legal minimum wage), payable to all employees.

Under Mexican Labour Law, the Company also provides statutorily mandated severance benefits to its employees terminated under certain circumstances. Such benefits consist of a one-time payment of three months wages plus 20 days of wages for each year of service payable upon involuntary termination without just cause.

Employee future benefits are unfunded.

h)

Impairment of Non-Financial Assets

Impairment tests on intangible assets with indefinite useful economic lives are undertaken annually at the financial year-end. Other non-financial assets, including exploration and evaluation assets, are subject to impairment tests whenever events or changes in circumstances indicate that their carrying amounts may not be recoverable. Where the carrying value of an asset exceeds its recoverable amount, which is the higher of value in use and fair value less costs to sell, the asset is written down accordingly.

The impairment test is generally carried out on the asset’s cash-generating units (CGU’s), which is the lowest group of assets in which the asset belongs for which there are separately identifiable cash inflows that are largely independent of the cash inflows from other assets. The Company has determined that each exploration and evaluation property is its own CGU as it is expected they will have separately definable cash inflows. At a later stage, if cash inflows change, the Company may group individual properties into one CGU. In the current year the Company grouped all properties in the Fresnillo agreement (Note 7) into one CGU.

Where an indicator of impairment exists, an estimate of the recoverable amount is made. Determining the recoverable amount requires the use of estimates and assumptions such as long-term commodity prices, discount rates, future capital requirements, exploration potential and operating performance. Changes in circumstances may affect these estimates and the recoverable amount.

An impairment loss is recognized in the statement of operations, except to the extent they reverse gains previously recognized in other comprehensive income or loss.

i)

Impairment of Financial Assets

At each reporting date, the Company assesses whether there is any objective evidence that a financial asset or a group of assets is impaired. A financial asset or group of financial assets is deemed to be impaired, if, and only if, there is objective evidence of impairment as a result of one or more events that has occurred after the initial recognition of the asset and that event has an impact on the estimated future cash flows of the financial asset or the group of financial assets.

j)

Share Capital

Non-monetary consideration

Agent’s warrants, stock options and other equity instruments issued as purchase consideration in non-monetary transactions other than as consideration for mineral properties are recorded at fair value determined by management using the Black-Scholes option pricing model. The fair value of the shares issued is based on the trading price of those shares on the TSX.V on the date of the agreement to issue shares as determined by the Board of Directors. Proceeds from unit placements are allocated between shares and warrants issued using the residual method.

GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

YEARS ENDED AUGUST 31, 2016, 2015 AND 2014

(Expressed in Canadian Dollars)

3.

SIGNIFICANT ACCOUNTING POLICIES

(Continued)

j)

Share Capital

(Continued)

Share-based compensation

The share option plan allows Company employees and consultants to acquire shares of the Company. The fair value of options granted is recognized as an employee or consultant expense with a corresponding increase in equity. An individual is classified as an employee when the individual is an employee for legal or tax purposes (direct employee) or provides services similar to those performed by a direct employee.

The fair value is measured at grant date, and each tranche is recognized using the graded vesting method over the period during which the options vest. The fair value of the options granted is measured using the Black-Scholes option pricing model taking into account the terms and conditions upon which the options were granted. At each financial position reporting date, the amount recognized as an expense is adjusted to reflect the actual number of share options that are expected to vest.

In situations where equity instruments are issued to non

‐

employees and some or all of the goods or services received by the entity as consideration cannot be specifically identified, they are measured at the fair value of the share

‐

based payment. Otherwise, share

‐

based compensation is measured at the fair value of goods or services received.

Share issuance costs

Costs directly identifiable with the raising of share capital financing are charged against share capital. Share issuance costs incurred in advance of share subscriptions are recorded as non-current deferred assets. Share issuance costs related to uncompleted share subscriptions are charged to operations.

k)

Earnings (Loss) Per Share

Earnings (loss) per share are calculated based on the weighted average number of shares outstanding. The Company uses the treasury stock method to compute the dilutive effect of options, warrants and other similar instruments. Under this method, the dilutive effect on earnings per share is calculated to reflect the use of the proceeds that could be obtained upon the exercise of options and warrants. It assumes that the proceeds would be used to purchase common shares at the average market price during the period. Basic and diluted losses per share are equal as the assumed conversion of outstanding options and warrants would be anti-dilutive.

l)

Income Taxes

Income tax expense comprises of current and deferred tax. Current tax and deferred tax are recognized in net income except to the extent that it relates to a business combination or items recognized directly in equity or in other comprehensive income or loss.

Current income taxes are recognized for the estimated income taxes payable or receivable on taxable income or loss for the current year and any adjustment to income taxes payable in respect of previous years. Current income taxes are determined using tax rates and tax laws that have been enacted or substantively enacted by the year-end date.

Deferred tax assets and liabilities are recognized where the carrying amount of an asset or liability differs from its tax base, except for taxable temporary differences arising on the initial recognition of goodwill and temporary differences arising on the initial recognition of an asset or liability in a transaction which is not a business combination and at the time of the transaction affects neither accounting nor taxable profit or loss.

Recognition of deferred tax assets for unused tax losses, tax credits and deductible temporary differences is restricted to those instances where it is probable that future taxable profit will be available against which the deferred tax asset can be utilized. At the end of each reporting period, the Company reassesses unrecognized deferred tax assets. The Company recognizes a previously unrecognized deferred tax asset

GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

YEARS ENDED AUGUST 31, 2016, 2015 AND 2014

(Expressed in Canadian Dollars)

3.

SIGNIFICANT ACCOUNTING POLICIES (Continued)

l)

Income Taxes

(Continued)

to the extent that it has become probable that future taxable profit will allow the deferred tax asset to be recovered.

m)

Decommissioning Liabilities

A legal or constructive obligation to incur restoration, rehabilitation and environmental costs may arise when environmental disturbance is caused by the exploration, development or ongoing production of a mineral property interest. Such costs arising from the decommissioning of plant and other site preparation work, discounted to their net present value, are provided for and capitalized at the start of each project to the carrying amount of the asset, as soon as the obligation to incur such costs arises. A pre-tax discount rate that reflects the time value of money and the risks specific to the liability are used to calculate the net present value of the expected future cash flows. These costs are charged to the statement of operations over the economic life of the related asset, through depreciation expense using either the unit-of-production or the straight-line method as appropriate. The related liability is progressively increased each period as the effect of discounting unwinds, creating an expense recognized in the statement of operations. The liability is assessed at each reporting date for changes to the current market-based discount rate, amount or timing of the underlying cash flows needed to settle the obligation.

The Company has no material restoration, rehabilitation and environmental costs as any disturbance to date is minimal.

4.

RECENT ACCOUNTING PRONOUNCEMENTS

a)

New Standard IFRS 9 “Financial Instruments”

This standard addresses classification and measurement of financial assets and replaces the multiple category and measurement models in IAS 39 for debt instruments with a new mixed measurement model having only two categories: Amortized cost and fair value through profit or loss. IFRS 9 also replaces the models for measuring equity instruments and such instruments are either recognized at the fair value through profit or loss or at fair value through other comprehensive income. Where such equity instruments are measured at fair value through other comprehensive income, dividends are recognized in profit or loss to the extent not clearly representing a return of investment: however, other gains and losses (including impairments) associated with such instruments remain in accumulated other comprehensive income indefinitely.

Requirements for financial liabilities were added in October 2010 which mainly carried forward existing requirements in IAS 39,

Financial Instruments – Recognition and Measurement,

except that fair value changes due to credit risk for liabilities designated at fair value through profit and loss would generally be recorded in other comprehensive income.

This new standard is a partial replacement of IAS 39 “Financial Instruments: Recognition and Measurement”. This new standard is effective for annual periods beginning on or after January 1, 2018.

b)

Revenue from Contracts with Customers

On May 28, 2014, the IASB issued IFRS 15, “

Revenue from Contracts with Customers”.

The new standard contains a single model that applies to contracts with customers and two approaches to recognizing revenue: at a point in time or over time. The model features a contract-based five step analysis of transactions to determine whether, how much and when revenue is recognized. New estimates and judgmental thresholds have been introduced which may affect the amount and/or timing of revenue recognized. The new standard is effective for fiscal years beginning on or after January 1, 2018 and is available for early adoption.

The Company is currently evaluating the impact of IFRS 15 on its financial statements and expects to apply the standard in accordance with its future mandatory effective date.

GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

YEARS ENDED AUGUST 31, 2016, 2015 AND 2014

(Expressed in Canadian Dollars)

3.

RECENT ACCOUNTING PRONOUNCEMENTS

(Continued)

c)

Investments in Associates and Joint Ventures

IAS 28,

“Investments in Associates and Joint Ventures”

, has been amended for conforming changes based on the issuance of IFRS 10, Consolidated Financial Statements, and IFRS 11, Joint Arrangements. The Company does not anticipate this amendment to have a significant impact on its financial statements.

d)

Intangible Assets

On May 12, 2014, the IASB issued amendments to IAS 38

“Intangible Assets”

. The amendments in IAS 38 introduce a rebuttable presumption that a revenue-based amortization method for intangible assets is inappropriate. This presumption could be overcome only when revenue and consumption of the economic benefits of the intangible asset are highly correlated or when the intangible asset is expressed as a measure of revenue.

The Company intends to adopt the amendments to IAS 38 in its financial statements for the annual period beginning on September 1, 2016. The extent of the impact of adoption of the amendments has not yet been determined.

5.

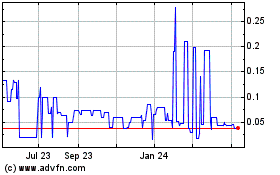

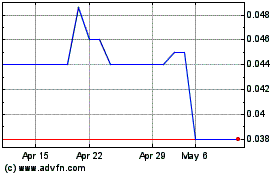

MARKETABLE SECURITIES

Marketable securities consist of $Nil (2015 – 425,000) common shares of Comstock Metals Ltd. with a fair value of $Nil (2015 - $10,625).

Marketable securities are measured at fair value with changes in fair value recorded in other comprehensive income (loss) until the investment is derecognized or impaired, at which time the gain (loss) would be recorded in net income.

In the year ended August 31, 2016, the Company sold the remaining shares in Comstock Metals Ltd. The entire amount in accumulated other comprehensive income (AOCI) was due to the net unrealized gains and losses from the initial acquisition of the shares in Comstock Metals Ltd. Accordingly upon the final sale of these shares, the Company recorded a realized loss of $75,134 (2015 - $Nil) and recorded a reclassification adjustment of $74,763 in AOCI.

6.

ACCOUNTS RECEIVABLE

Accounts receivable consists of the following:

|

|

|

|

|

|

|

AUGUST 31

|

|

|

|

2016

|

2015

|

|

|

|

|

|

|

|

Sales taxes recoverable

|

$ 1,566

|

$ 2,857

|

|

|

Other receivable

|

662

|

14,905

|

|

|

|

$ 2,228

|

$ 17,762

|

GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

YEARS ENDED AUGUST 31, 2016, 2015 AND 2014

(Expressed in Canadian Dollars)

7.

EXPLORATION AND EVALUATION ASSETS

Detailed exploration and evaluation expenditures incurred in respect to the Company’s mineral property interests owned, leased or held under option are disclosed in Note 16. Property payments made on the Company’s mineral property interests are included in the property descriptions below. Acquisition costs paid through August 31, 2016 and 2015 are as follows:

|

|

|

|

|

|

|

|

|

2016

|

2015

|

|

|

|

|

|

|

|

|

|

San Timoteo, Oro Leon, Nueva Union, La Reforma

|

$

|

69,257

|

$

|

69,257

|

|

|

Los Hilos, Las Bolas, El Manto, Don Lazaro, La Verde

|

|

187,123

|

|

187,123

|

|

|

Nopalera, Flor de Trigo

|

|

78,393

|

|

78,393

|

|

|

Total acquisition costs

|

|

334,773

|

|

334,773

|

|

|

Exploration and evaluation assets (Note 16)

|

|

2,606,046

|

|

3,010,176

|

|

|

Total exploration and evaluation assets

|

$

|

2,940,819

|

$

|

3,344,949

|

The Company has an extensive property portfolio of mining concessions, acquired mainly through staking, in the Uruachic District of Mexico covering approximately 10,000 hectares. The Company has various net smelter returns on specific claims forming a part of the Company’s properties. The net smelter returns range from 1% to 3%, which have buyouts ranging from US$250,000 to US$2,000,000.

In May 2007 and amended April 2011, the Company optioned to Comstock Metals Ltd. (“Comstock”) the right to earn up to a 75% and 60% interest respectively in the Corona and El Chamizal properties in exchange for Comstock spending $500,000 and $200,000 on the respective properties before February 8, 2014, and issuing 300,000 (300,000 common shares received) and 150,000 (25,000 common shares received) common shares respectively to the Company over a period of two years. In order to keep the option in good standing, Comstock paid $50,000 and issued an additional 200,000 common shares to the Company.

The Company has received notice from Comstock that it has spent in excess of $1,000,000 at Corona and effective April 9, 2013, the Company and Comstock entered into a joint venture agreement to further explore the property whereby Comstock will act as the operator. The Company is responsible for 40% of all exploration costs going forward. The Company has been advised that Comstock does not wish to proceed with the joint venture, as such the Company is responsible for 100% of the Corona costs.

During the year ended August 31, 2016, $29,618 (2015 - $81,214) in deferred expenditures related to certain mineral claims were written down. These write-downs were mainly related to the Company’s San Timoteo/Corona (2015 – San Timoteo/Bufalo) Property. A number of other smaller claims were written off which the Company will continue to hold but which are not viewed as priorities. Management does not currently intend to conduct any exploration activities on these non-core claims in the next year.

On November 5, 2015, the Company signed a definitive agreement with Fresnillo PLC (“Fresnillo”) granting Fresnillo an option over certain of the Company’s properties in the Uruachic mining camp. Under the terms of the agreement, Fresnillo may earn a 100% interest (subject to a 1% net smelter royalty half of which may be purchased for US$500,000) in the La Reforma, Nueva Union, Oteros, Las Bolas, Nopalera, La Barranca and Corona properties by making cash payments totaling approximately US$3,000,000 over 3 years and by paying all mining rights (property taxes) and conducting all assessment work required to keep the properties in good standing. As part of the US$3,000,000 in payments, approximately US$700,000 is due in regular instalments over 3 years in return for granting Fresnillo the right to perform exploration and assessment work to evaluate the properties. If at the end of the evaluation period they wish to continue with the acquisition of a 100% interest, a payment of US$2,300,000 is required. Fresnillo has the right to terminate this agreement at any time during the exploration period with no further payments required.

GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

YEARS ENDED AUGUST 31, 2016, 2015 AND 2014

(Expressed in Canadian Dollars)

7.

EXPLORATION AND EVALUATION ASSETS

(Continued)

As at August 31, 2016, $666,380 in payments have been received. This includes the first two required payments for the exploration rights plus reimbursement of certain exploration costs incurred by the Company. Approximately US$400,000 is due, in six month intervals, from the exploration rights at year-end in addition to the final US$2,300,000 payment.

During the year ended August 31, 2015, pursuant to a letter of intent dated July 14, 2015, Fresnillo advanced $328,254 (4,154,580 Mexican pesos) to the Company through two promissory notes in order to initiate negotiations to sign the definitive agreement. The promissory notes were unsecured, due on demand, and bore interest at the Mexican prime rate plus 5% per annum. At the signing of the definitive agreement on November 5, 2015, these promissory notes were cancelled and the amounts outstanding plus interest were applied to the cash payments schedule per the agreement.

The Company will keep an undivided 100% interest in its principal property in the District, San Timoteo, where work has been focused for the last several years. In the event that the Company’s plans change , Fresnillo has been granted a right of first refusal over this property.

8.

PROPERTY AND EQUIPMENT

|

|

|

|

|

|

|

|

|

|

|

|

EQUIPMENT

|

|

VEHICLES

|

|

LAND

|

|

TOTAL

|

|

COST

|

|

|

|

|

|

|

|

|

|

Balance August 31, 2015 and 2014

|

$

|

157,324

|

$

|

90,815

|

$

|

18,917

|

$

|

267,056

|

|

Disposals*

|

|

-

|

|

(77,044)

|

|

-

|

|

(77,044)

|

|

Balance August 31, 2016

|

$

|

157,324

|

$

|

13,771

|

$

|

18,917

|

$

|

190,012

|

|

ACCUMULATED AMORTIZATION

|

|

|

|

|

|

|

|

|

|

Balance August 31, 2014

|

$

|

116,245

|

$

|

73,695

|

$

|

-

|

$

|

189,940

|

|

Amortization

|

|

18,362

|

|

17,120

|

|

-

|

|

35,482

|

|

Balance August 31, 2015

|

$

|

134,607

|

$

|

90,815

|

$

|

-

|

$

|

225,422

|

|

Amortization

|

|

14,946

|

|

-

|

|

-

|

|

14,946

|

|

Disposals*

|

|

-

|

|

(77,044)

|

|

-

|

|

(77,044)

|

|

Balance August 31, 2016

|

$

|

149,553

|

$

|

13,771

|

$

|

-

|

$

|

163,324

|

|

CARRYING AMOUNTS

|

|

|

|

|

|

|

|

|

|

As at August 31, 2015

|

$

|

22,717

|

$

|

-

|

$

|

18,917

|

$

|

41,634

|

|

As at August 31, 2016

|

$

|

7,771

|

$

|

-

|

$

|

18,917

|

$

|

26,688

|

|

|

|

|

|

|

|

|

|

|

*Due to reduced activities in Mexico, the Company has removed fully depreciated vehicles that are no longer in use.

GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

YEARS ENDED AUGUST 31, 2016, 2015 AND 2014

(Expressed in Canadian Dollars)

9.

SHARE CAPITAL AND RESERVES

Authorized

The authorized share capital of the Company consists of an unlimited number of common shares without par value.

Issued and Fully Paid

As at August 31, 2016, the Company had 106,660,889 (2015 – 106,660,889) common shares issued and fully paid.

Warrants

As at August 31, 2016, there are no outstanding share purchase warrants. On March 26, 2016, the following share purchase warrants issued on March 28, 2013 in connection with private placements expired unexercised.

|

|

|

NUMBER OF WARRANTS

|

EXERCISE PRICE

|

|

10,833,333

|

$0.12

|

|

1,155,555

|

$0.09

|

|

11,988,888

|

|

The weighted average remaining contractual life of the warrants outstanding at August 31, 2016 was nil years (2015 – 0.57 years) and the weighted average exercise price was $Nil (2015 - $0.12).

Stock Options

The Company has a 10% rolling stock option plan for its directors, officers, employees and consultants to acquire common shares of the Company at a price determined with reference to the fair market value of the shares at the date of grant. The Company’s stock option plan provides for immediate vesting, or vesting at the discretion of the Board at the time of the option grant. Options are exercisable for a period of up to 5 years. Stock options granted to investor relations’ consultants vest over a twelve month period, with one quarter of such options vesting in each three month period.

During the year ended August 31, 2016 the company granted 3,400,000 stock options to consultants and Directors of the Company at an exercise price of $0.085 per share, expiring on July 11, 2021. The fair value of the stock options granted has been calculated using the Black-Scholes pricing model, based on the following assumptions: weighted average risk free interest rate of 1.16%, volatility factor of 125.90% and an expected life of five years.

A summary of changes in stock options is presented below:

|

|

|

|

|

|

|

|

WEIGHTED

|

|

|

|

NUMBER

|

AVERAGE

|

|

|

|

OF

|

EXERCISE

|

|

|

|

SHARES

|

PRICE

|

|

|

Balance, August 31, 2014

|

6,750,000

|

$ 0.24

|

|

|

Cancelled

|

(4,825,000)

|

0.23

|

|

|

Expired

|

(1,925,000)

|

0.25

|

|

|

Balance, August 31, 2015

|

-

|

$ -

|

|

|

Granted

|

3,400,000

|

0.085

|

|

|

Balance, August 31, 2016

|

3,400,000

|

$ 0.085

|

The weighted average remaining contractual life of the options outstanding at August 31, 2016 was 4.86 years (2015 –nil years).

GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

YEARS ENDED AUGUST 31, 2016, 2015 AND 2014

(Expressed in Canadian Dollars)

9.

SHARE CAPITAL AND

RESERVES

(Continued)

Nature and Purpose of Reserves

The reserves recorded in equity on the Company’s statements of financial position is comprised of “Share-based Payments Reserve” and is used to recognize the fair value of stock option grants prior to exercise, expiry or cancellation and the fair value of other share-based consideration paid at the date of payment.

10.

LOSS PER SHARE

The Company calculates the basic and diluted loss per common share using the weighted average number of common shares outstanding during each period and the diluted loss per share assumes that the outstanding vested stock options and share purchase warrants had been exercised at the beginning of the year.

To compute diluted earnings per share, the average number of shares outstanding is adjusted for the number of all potentially dilutive shares. As of August 31, 2016, the Company had a total of 3,400,000 (2015 – nil; 2014 – 6,750,000) stock options outstanding. As of August 31, 2016, the Company also had a total of Nil (2015 and 2014, 11,988,888 of which 1,155,555 were potentially dilutive) warrants outstanding. Dilutive options and warrants were not included in the Company’s loss per common share calculation because the result was anti-dilutive.

11.

SEGMENTED INFORMATION

The Company has one operating segment, which is mineral exploration. All mineral properties are located in Mexico. All mineral option proceeds are attributable to the Mexican mineral properties. Net loss and assets by geographic segment, at cost, are as follows:

|

|

|

|

|

|

|

|

|

|

|

CANADA

|

MEXICO

|

TOTAL

|

|

|

|

|

|

|

|

|

|

|

|

August 31, 2016

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets

|

$

|

45,407

|

$

|

55,945

|

$

|

101,352

|

|

|

Property and equipment

|

$

|

776

|

$

|

25,912

|

$

|

26,688

|

|

|

Exploration and evaluation assets

|

$

|

-

|

$

|

2,940,819

|

$

|

2,940,819

|

|

|

Value-added taxes recoverable

|

$

|

-

|

$

|

170

|

$

|

170

|

|

|

Total assets

|

$

|

46,183

|

$

|

3,022,846

|

$

|

3,069,029

|

|

|

Accounts payable and accrued liabilities

|

$

|

13,614

|

$

|

5,836

|

$

|

19,450

|

|

|

Employment benefit obligations

|

$

|

-

|

$

|

73,347

|

$

|

73,347

|

|

|

Net loss for the year

|

$

|

651,690

|

$

|

70,446

|

$

|

722,136

|

|

|

|

|

|

|

|

|

|

|

|

August 31, 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets

|

$

|

127,518

|

$

|

52,584

|

$

|

180,102

|

|

|

Property and equipment

|

$

|

7,769

|

$

|

33,865

|

$

|

41,634

|

|

|

Exploration and evaluation assets

|

$

|

-

|

$

|

3,344,949

|

$

|

3,344,949

|

|

|

Value-added taxes recoverable

|

$

|

-

|

$

|

96,484

|

$

|

96,484

|

|

|

Total assets

|

$

|

135,287

|

$

|

3,527,882

|

$

|

3,663,169

|

|

|

Accounts payable and accrued liabilities

|

$

|

6,425

|

$

|

7,060

|

$

|

13,485

|

|

|

Employment benefit obligations

|

$

|

-

|

$

|

79,674

|

$

|

79,674

|

|

|

Net loss for the year

|

$

|

390,955

|

$

|

184,453

|

$

|

575,408

|

GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

YEARS ENDED AUGUST 31, 2016, 2015 AND 2014

(Expressed in Canadian Dollars)

12.

FINANCIAL INSTRUMENTS

As at August 31, 2016 and 2015, the carrying value of the Company

’

s financial instruments approximates their fair value. Cash and marketable securities are recorded at fair value and the Company’s other financial instruments are recorded at amortized cost, which approximates fair value due to their short term nature. The Company’s financial instruments are classified into the following categories:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AUGUST 31

|

|

|

|

|

2016

|

2015

|

|

|

|

LEVEL

|

CARRYING

VALUE

|

FAIR

VALUE

|

CARRYING

VALUE

|

FAIR

VALUE

|

|

|

Fair value through profit or loss

|

|

|

|

|

|

|

|

|

|

|

|

Cash

|

1

|

$

|

57,880

|

$

|

57,880

|

$

|

99,235

|

$

|

99,235

|

|

|

Available for sale

|

|

|

|

|

|

|

|

|

|

|

|

Marketable securities

|

1

|

$

|

-

|

$

|

-

|

$

|

10,625

|

$

|

10,625

|

|

|

Loans and receivables

|

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

2

|

$

|

2,228

|

$

|

2,228

|

$

|

17,762

|

$

|

17,762

|

|

|

Due from related parties

|

2

|

$

|

3,821

|

$

|

3,821

|

$

|

30,572

|

$

|

30,572

|

|

|

Other Financial Liabilities

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities

|

2

|

$

|

19,450

|

$

|

19,450

|

$

|

13,485

|

$

|

13,485

|

|

|

Due to related parties

|

2

|

$

|

386,951

|

$

|

386,951

|

$

|

231,602

|

$

|

231,602

|

|

|

Promissory notes payable

|

2

|

$

|

-

|

$

|

-

|

$

|

328,254

|

$

|

328,254

|

There have been no transfers between levels 1 and 2, or transfers in or out of level 3 for the years ended August 31, 2016 and 2015.

Financial Instrument Risk Exposure and Risk Management

The Company is exposed in varying degrees to a variety of financial instrument related risks. The Board of Directors approves and monitors the risk management process. The overall objective of the Board is to set policies that seek to reduce risk as far as possible without unduly affecting the Company’s competitiveness and flexibility. The types of risk exposure and the way in which such exposure is managed is provided as follows:

Credit Risk

Credit risk is the risk that one party to a financial instrument will fail to fulfil an obligation and cause the other party to incur a financial loss. The Company’s credit risk to its financial assets are summarized below:

|

|

|

|

|

|

|

|

|

AUGUST 31, 2016

|

AUGUST 31, 2015

|

|

|

|

|

|

|

|

|

|

Cash

|

$

|

57,880

|

$

|

99,235

|

|

|

Marketable securities

|

$

|

-

|

$

|

10,625

|

|

|

Accounts receivable

|

$

|

2,228

|

$

|

17,762

|

|

|

Due from related parties

|

$

|

3,821

|

$

|

30,572

|

The credit risk of accounts receivable and marketable securities is assessed as low. The carrying amount of these financial assets is their maximum exposure to credit risk. The Company does not invest in asset–backed commercial papers.

GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

YEARS ENDED AUGUST 31, 2016, 2015 AND 2014

(Expressed in Canadian Dollars)

12.

FINANCIAL INSTRUMENTS

(Continued)

Liquidity Risk

Liquidity risk is the risk that the Company will encounter difficulties in meeting its financial obligations associated with its financial liabilities as they fall due. The Company ensures that there is sufficient capital in order to meet short term business requirements, after taking into account the Company’s holdings of cash.

As of August 31, 2016, the Company does not have sufficient cash and highly liquid investments on hand to meet current liabilities and its expected administrative requirements for the coming year. The Company has cash of $57,880 (2015 - $99,235) and total liabilities of $479,748 (2015 - $653,015). Accounts payable and accrued liabilities and due to related parties of $406,401 (2015 - $243,087) are due within three months. Management has assessed liquidity risk as high. (Note 1)

Market Risk

The significant market risk exposures to which the Company is exposed are foreign exchange risk, interest rate risk, and commodity price risk.

Foreign Currency Risk

The Company has operations in Canada and Mexico subject to foreign currency fluctuations. The Company’s operating expenses are incurred in Canadian dollars and Mexican pesos, and the fluctuation of the Canadian dollar in relation to this other currency will have an impact upon the profitability of the Company and may also affect the value of the Company’s assets and the amount of equity. The Company has not entered into any agreements or purchased any instruments to hedge possible currency risks.

Financial assets and liabilities denominated in Mexican Pesos and U.S. dollars were as follows:

|

|

|

|

|

|

|

|

|

AUGUST 31, 2016

|

AUGUST 31, 2015

|

|

|

U.S. Dollars

|

|

|

|

|

|

|

Financial assets

|

$

|

-

|

$

|

-

|

|

|

Financial liabilities

|

$

|

2,500

|

$

|

1,500

|

|

|

Mexican Pesos

|

|

|

|

|

|

|

Financial assets

|

$

|

316,309

|

$

|

419,906

|

|

|

Financial liabilities

|

$

|

132,766

|

$

|

131,790

|

Based on the above net exposures as at August 31, 2016, and assuming that all other variables remain constant, a 10% change in the value of the Mexican peso against the Canadian dollar would result in an increase/decrease of approximately $1,300 (2015 - $4,400) in loss from operations. Based on the above net exposures as at August 31, 2016, and assuming that all other variables remain constant, a 10% change in the value of the US dollar against the Canadian dollar would result in an increase/decrease of approximately $300 (2015 - $200) in loss from operations.

Interest Rate Risk

As at August 31, 2016, the Company has no significant exposure to interest rate risk through its financial instruments.

Other Risks

The Company's operations are in northern Mexico and are subject to various levels of political, economic and other risks and uncertainties unique to Mexico. These risks and uncertainties may include: extreme fluctuations in currency exchange rates; high rates of inflation; labor unrest; risks of war or civil unrest; expropriation and nationalization; renegotiation or nullification of existing concessions, licenses, permits and contracts; illegal mining; corruption; restrictions on foreign exchange and repatriation; hostage taking; and changing political conditions and currency controls. In addition, the Company may have to comply with multiple and potentially conflicting regulations in Canada and Mexico, including export requirements, taxes, tariffs, import duties and other trade barriers, as well as health, safety and environmental requirements. Changes, if any, in mining or

GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

YEARS ENDED AUGUST 31, 2016, 2015 AND 2014

(Expressed in Canadian Dollars)

12.

FINANCIAL INSTRUMENTS

(Continued)

Interest Rate Risk (Continued)

investment policies or shifts in political attitude in Mexico may adversely affect the Company's operations. Operations may be affected in varying degrees by government regulations with respect to matters including restrictions on production, price controls, export controls, currency controls or restrictions, currency remittance, income and other taxes, expropriation of property, foreign investment, maintenance of claims, environmental legislation, land use, land claims of local people, water use and mine safety. Failure to comply strictly with applicable laws, regulations and local practices relating to mineral rights applications and tenure could result in loss, reduction or expropriation of entitlements or the imposition of additional local or foreign parties as joint venture partners with carried or other interests.

13.

CAPITAL DISCLOSURES

The Company was formed for the purpose of acquiring exploration and development stage natural resource properties. The directors determine the Company’s capital structure and make adjustments to it based on funds available to the Company, in order to support the acquisition, exploration and development of mineral properties. The directors have not established quantitative return on capital criteria for capital management.

The Company is dependent upon external financing to fund future exploration programs and its administrative costs. The Company will spend existing working capital and raise additional amounts as needed. The Company will continue to assess new properties and to seek to acquire an interest in additional properties if management feels there is sufficient geologic or economic potential and provided it has adequate financial resources to do so.

The directors review the Company’s capital management approach on an ongoing basis and believe that this approach, given the relative size of the Company, is reasonable. The Company’s objective when managing capital is to safeguard the Company’s ability to continue as a going concern. (Note 1)

The Company considers the items included on the statement of financial position in equity as capital. The Company manages the capital structure and makes adjustments to it in light of changes in economic conditions and the risk characteristics of the underlying assets. In order to maintain or adjust the capital structure, the Company may issue new shares through private placements, sell assets to reduce debt or return capital to shareholders. There were no changes to the Company’s approach to capital management during the year. Neither the Company nor its subsidiaries are subject to externally imposed capital requirements.

14.