UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): June 29, 2023

| Fuse Group Holding Inc. |

| (Exact Name of Registrant as Specified in its Charter) |

| Nevada | | 333-202948 | | 47-1017473 |

| (State of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| 805 W. Duarte Rd., Suite 102

Arcadia, CA 91007 (Address of principal executive offices) |

| |

| (626) 977-0000 |

| (Registrant’s telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| None | | N/A | | N/A |

Item 1.01 Entry into a Definitive Material Agreement.

On June 29, 2023, Fuse Group Holding Inc. (the “Company”), entered into a Convertible Promissory Notes Purchase Agreement (the “Agreement”) with Liu Marketing (M) Sdn. Bhd., a company organized under the laws of Malaysia (the “Purchaser”). Pursuant to the Agreement, the Company sold a Convertible Promissory Note to the Purchaser with a principal amount of $50,000 (the “Note”). The Note bears interest at the rate of 3% per annum, which are payable on June 29 of 2024 and 2025. The Note will mature on the date that is twenty-four months from the date that the purchase price of the Note is paid to the Company. Any outstanding principal and interest on the Note may be converted to the shares of common stock of the Company at the holder’s option at a conversion price of $0.45 per share at any time until the total outstanding balance of the Note is paid. The Note was sold to the Purchaser pursuant to an exemption from registration under Regulation S, promulgated under the Securities Act of 1933, as amended.

The foregoing description of the Agreement and Note does not purport to be complete and is qualified in its entirety by reference to the complete text of each such document, a copy of which is filed as an exhibit hereto and is incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement of a Registrant.

See Item 1.01 above, which is incorporated herein by reference.

Item 3.02 Unregistered Sales of Equity Securities

On June 30, 2023, the Company received a written notice from Liu Marketing (M) SDN BHD (the “Lender”), pursuant to certain Convertible Promissory Notes made by the Company in favor of Lender on February 15, 2022, March 23, 2022, June 9, 2022, July 1, 2022, August 19, 2022, October 6, 2022, November 7, 2022, December 16, 2022, January 30, 2023, February 24, 2023, April 10, 2023 and May 29, 2023 (the “Notes”), that the Lender elected to convert all of the Notes balances (including principal and interest of the Notes) of $716,767 for 1,592,816 shares of common stock of the Company (the “Shares”) at the conversion price of $0.45 per share. The details of the Notes have been disclosed in the interim reports and/or periodic reports of the Company filed with SEC. The Shares will be issued to the Lender pursuant to an exemption from registration under Regulation S, promulgated under the Securities Act of 1933, as amended.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Fuse Group Holding Inc.

|

|

|

|

|

|

Date: July 6, 2023

|

By:

|

/s/ Umesh Patel

|

|

|

|

|

Umesh Patel

|

|

|

|

Chief Executive Officer

|

NONE

false

0001636051

0001636051

2023-06-29

2023-06-29

Exhibit 10.1

CONVERTIBLE PROMISSORY NOTES PURCHASE AGREEMENT

This Convertible Promissory Notes Purchase Agreement (“Agreement”) is made and effective the June 29, 2023,

| BETWEEN: |

Fuse Group Holding Inc. (the “Company”), a corporation organized and existing under the laws of the Nevada, with its head office located at: |

| |

|

| |

805 W. Duarte Rd. Suite 102 Arcadia CA 91007 |

| |

|

| AND: |

Each purchaser identified on the signature pages hereto (each, including its successors and assigns, a “Purchaser” and collectively the “Purchasers”). |

WHEREAS, Purchasers desire to purchase from the Company notes in the aggregate sum of Fifty Thousand Dollars USD ($50,000) be evidenced by 3% Convertible Notes.

In consideration of the mutual covenants and conditions herein contained, the parties hereby agree, represent and warrant as follows:

| |

a.

|

The Company will authorize the issue of its 3% Convertible Promissory Notes (hereinafter called “Notes”) to the Purchasers in the aggregate principal amount of $50,000 to be dated on June 29, 2023 to mature on that is twenty-four (24) months after the Purchase Price Date, as defined in the Notes, to bear interest on the unpaid principal thereof at the rate of 3% per annum until maturity, payable on June 29 of 2024 and 2025, respectively, commencing on Purchase Price Date, and after maturity at the rate of 3% per annum until Notes are fully paid, and to be substantially in the form of Exhibit A attached hereto.

|

| |

b.

|

For the purposes of calculating interest for any period for which the interest shall be payable, such interest shall be calculated on the basis of a 30-day month and a 365-day year. The Company will promptly and punctually pay to Notes Holders (the “Holders”) the interest on the Notes held by Holders without presentment of the original copies of the Notes. In the event that any of the Holders shall sell or transfer the Notes, it shall notify the Company of the name and address of the transferee and send the assignment notice to the Company for approval. In the event the Company defaults on any installment of interest or principal of any Note and fails to cure such defaults within 90 days after the written notice from such Holder of the Note, then the Holder, at its option, may declare the entire principal and the interest accrued thereon for such Note immediately due and payable and may proceed to enforce the collection thereof.

|

| |

c.

|

The Company will also authorize and reserve sufficient shares of its common stock (hereinafter called “Shares”) as may be required for issuance upon conversion of the Notes pursuant to the conversion terms hereinafter stated.

|

| |

d.

|

The Purchasers have the right at any time after the date of this Agreement until the outstanding balance has been paid in full, at its election, to convert (“Conversion”) all or any portion of the outstanding balance of the Notes into shares of Common Stock of the Company. Conversion notices in the form attached the Notes (each, a “Conversion Notice”) may be effectively delivered

|

Convertible Promissory Note Agreement

to the Company by any method set forth in the “Notices” Section of this Agreement. The Company shall deliver the conversion shares from any conversion to Holder in accordance with the Notes. Subject to adjustment as set forth in this Agreement, the price at which the Purchasers have the right to convert all or any portion of the outstanding balance into Common Stock of the Company is $0.45 per share of Common Stock (the “Conversion Price”).

| |

2.

|

SALE AND PURCHASE OF NOTES

|

The Company will sell the Notes to the Purchasers listed on the signature pages of this Agreement, each of whom agrees to purchase the principal amount of the Notes set opposite his/her/its names, subject to the terms and conditions hereof and in reliance upon the representations and warranties of the Company contained herein, at the purchase price of 100% of the principal amount.

| |

2.

|

REPRESENTATIONS AND WARRANTIES BY THE COMPANY

|

| |

a.

|

Company is a corporation duly organized and existing in good standing under the laws of the State of Nevada has the corporate power to carry on in the business as it is now being conducted.

|

| |

b.

|

The Company has the requisite corporate power and authority to enter into and to consummate the transactions contemplated by this Agreement and Notes and otherwise to carry out its obligations hereunder and thereunder.

|

| |

c.

|

There is no action or proceeding pending or, to the knowledge of the Company, threatened against the Company before any court or administrative agency, the determination of which might result in any material adverse change in the business of the Company.

|

| |

d.

|

The Company is not a party to any contract or agreement or subject to any restriction which materially and adversely affects its business, property or assets, or financial condition, and neither the execution nor delivery of this Agreement, nor the confirmation of the transactions contemplated herein, nor the fulfillment of the terms hereof, nor the compliance with the terms and provisions hereof and of the Notes, will conflict with or result in the breach of the terms, conditions or provisions or constitute a default, under the Articles of Incorporation of the Company or of any Agreement or instrument to which the Company is now a party.

|

| |

e.

|

The Company has not declared, set aside, paid or made any dividend or other distributions with respect to its capital stock and has not made or caused to be made directly or indirectly, any payment or other distribution of any nature whatsoever to any of the holders of its capital stock except for regular salary payments for services rendered and the reimbursement of business expenses.

|

| |

f.

|

There are no outstanding options or rights to purchase shares of the Company and no outstanding securities with the right of conversion into shares of the Company.

|

| |

g.

|

The Company owns or possesses adequate licenses or other rights to use, all patents, trademarks, trade names, trade secrets, and copyrights used in its business. No one has asserted to the Company that its operations infringe on the patents, trademarks, trade secrets or other rights utilized in the operation of its business.

|

| |

h.

|

The Company is not, and is not an affiliate of, and immediately after receipt of payment for the Notes, will not be or be an affiliate of, an “investment company” within the meaning of the Investment Company Act of 1940, as amended.

|

Convertible Promissory Note Agreement

| |

3.

|

REPRESENTATIONS AND WARRANTIES BY THE PURCHASERS

|

Each of the Purchasers represents and warrants that:

| |

a.

|

Each of the Purchasers is either an individual or an entity duly incorporated or formed, validly existing and in good standing under the laws of the jurisdiction of its incorporation or formation with full right, corporate, partnership, limited liability company or similar power and authority to enter into and to consummate the transactions contemplated by this Agreement and otherwise to carry out its obligations hereunder and thereunder. The execution and delivery of this Agreement and performance by the Purchaser of the transactions contemplated by this Agreement have been duly authorized by all necessary corporate, partnership, limited liability company or similar action, as applicable, on the part of the Purchaser. This Agreement has been duly executed by the Purchaser, and when delivered by the Purchaser in accordance with the terms hereof, will constitute the valid and legally binding obligation of such Purchaser, enforceable against it in accordance with its terms.

|

| |

b.

|

Each of the Purchasers is acquiring the Note for its own account and has no direct or indirect arrangement or understandings with any other persons to distribute or regarding the distribution of the Note or Shares (this representation and warranty not limiting the Purchaser’s right to sell the Note and Shares in compliance with applicable federal and state securities laws). Each of the Purchaser is acquiring the Note as principal, not as nominee or agent, and not with a view to or for distributing or reselling the Note or Shares or any part thereof in violation of the Securities Act or any applicable state securities law.

|

| |

c.

|

Each of the Purchasers is a non-U.S. person (as such term is defined in Rule 902 of Regulation S under the Securities Act) and is not acquiring the Note for the account or benefit of a U.S. person. Each of the Purchasers will not, within one year of the date of the issuance of Note or the Shares to such Purchaser, (i) make any offers or sales of the Note or Shares in the United States or to, or for the benefit of, a U.S. person (in each case, as defined in Regulation S) other than in accordance with Regulation S or another exemption from the registration requirements of the Securities Act, or (ii) engage in hedging transactions with regard to the Shares unless in compliance with the Securities Act. Neither such Purchaser nor any of such Purchaser’s affiliates or any person acting on his/her or their behalf has engaged or will engage in directed selling efforts (within the meaning of Regulation S) with respect to the Note or Shares, and all such persons have complied and will comply with the offering restriction requirements of Regulation S in connection with the offering of the Note or Shares outside of the United States.

|

| |

d.

|

Each of the Purchasers, either alone or together with his/her/its representatives, has such knowledge, sophistication and experience in business and financial matters so as to be capable of evaluating the merits and risks of the prospective investment in the Note, and has so evaluated the merits and risks of such investment. Each of the Purchasers are able to bear the economic risk of an investment in the Note or the Shares and, at the present time, is able to afford a complete loss of such investment.

|

| |

e.

|

Each of the Purchasers has a net worth in excess of $1,000,000 exclusive of its/his/her residences and that each of the Purchasers is an “accredited investor” as defined in Rule 501(a) under the Securities Act at the time such Purchaser was offered the Note and as of the date hereof.

|

| |

f.

|

Each of the Purchasers hereby represents that he/she/it has satisfied his/her/itself as to the full observance by such Purchaser of the laws of the jurisdictions applicable to such Purchaser in connection with the purchase of the Note or the execution and delivery by such Purchaser. Each of the Purchaser’s subscription and payment for, and continued beneficial ownership of, the Note or the Shares will not violate any securities or other laws of such Purchaser’s jurisdiction applicable to such Purchaser.

|

Convertible Promissory Note Agreement

| |

g.

|

Each of the Purchasers understands that the Note or the Shares have not been, and will not be, registered under the Securities Act or applicable securities laws of any state or country and therefore the Note or the Shares cannot be sold, pledged, assigned or otherwise disposed of unless they are subsequently registered under the Securities Act and applicable state securities laws or exemptions from such registration requirements are available. The Company shall be under no obligation to register the Notes or Shares under the Securities Act and applicable state securities laws, and any such registration shall be in the Company’s sole discretion.

|

| |

h.

|

Each of the Purchasers acknowledges that he/she/it has had the opportunity to review the information of the Company and the SEC reports filed by the Company and has been afforded (i) the opportunity to ask such questions as he/she/it has deemed necessary of, and to receive answers from, representatives of the Company concerning the terms and conditions of the offering of the Note and the merits and risks of investing in the Note; (ii) access to information about the Company and its financial condition, results of operations, business, properties, management and prospects sufficient to enable it to evaluate his/her/its investment; and (iii) the opportunity to obtain such additional information that the Company possesses or can acquire without unreasonable effort or expense that is necessary to make an informed investment decision with respect to the investment

|

| |

i.

|

Each of the Purchasers is not purchasing the Note as a result of any advertisement, article, notice or other communication regarding the Notes published in any newspaper, magazine or similar media or broadcast over television or radio or presented at any seminar or any other general solicitation or general advertisement.

|

| |

a.

|

Upon conversion of the Notes, all accrued and unpaid interest on the principal amount converted shall be paid in cash to the Holder by the Company.

|

| |

b.

|

In case the Company shall at any time divide its outstanding shares of Common Stock of the Company (“Common Stock”) into a greater number of shares, the conversion price in effect immediately prior to such subdivision should be proportionately reduced, and, conversely, in the case of outstanding shares of Common Stock of the Company shall be combined into a smaller number of shares, the actual conversion price in effect immediately prior to such combination shall be proportionately increased.

|

| |

c.

|

No fractional share of Common Stock shall be issued upon conversion of any of the Notes. If any Holder of the Notes shall have converted all the Notes held by him/her/it other than a principal amount so small that less than a whole share of Common Stock would be issuable upon conversion thereof, the Company may elect to prepay such balance, with interest accrued thereon to the date fixed for prepayment or leave the same outstanding until the maturity of the Note.

|

| |

d.

|

In any reclassification of outstanding shares of Common Stock (other than a change in stated value or from no par to par value) or in the case of any consolidation or merger of the Company with any other company and the other company will be the surviving company, the Company shall place a condition precedent to such transaction, so that each Holder of the Notes then outstanding shall have the right thereafter to convert his/her/its Note into the corresponding amount of shares and other securities upon such reclassification, consolidation or merger as if such Note had been converted immediately prior to such reclassification, consolidation or merger.

|

Convertible Promissory Note Agreement

| |

a.

|

The Company covenants that so long as the Notes are outstanding, it will deliver to the Holders thereof as soon as practical, the quarterly or annual report of the Company filed with SEC including consolidated financial statements. The public filing with SEC shall be considered that such report has been delivered to the Holders.

|

| |

b.

|

The Company covenants that, so long as any of the Notes are outstanding, it will permit any Holder of the Notes to visit and inspect, at the Holder's expense, any of the property of the Company, including its books and records, and to discuss affairs, finances and accounts with its officers, provided such visit should be in normal business hours with reasonable advance notice. The Holders agree that each of them will keep any business information of the Company in confidence and will not trade the Company’s shares when it has any material non-public information of the Company.

|

| |

c.

|

The Company covenants that, without the written consent of the Holders of more than 51% in principal amount of the Notes, it will not:

|

i Create or suffer to exist any mortgage, pledge, encumbrance, lien or charge of any kind on any of its properties or assets, whether now owned or hereafter acquired except for (i) mortgages, encumbrances, liens or charges which are now in existence; (ii) mortgages, liens, charges and encumbrances (a) for taxes, assessments or governmental charges or levies on property of the Company if the same shall not be due or delinquent or thereafter can be paid without penalty, or being contested in good faith and by appropriate proceedings; (b) of mechanics and material men for sums not yet due or being contested in good faith and by appropriate proceedings; or (c) in connection with workers' compensation, unemployment insurance and other state employment legislation.

| |

a.

|

The default on any installment payment of interest or principal of any Note and fails to cure such default within 90 days after the written notice from the Holder of such Note will be considered as an event of default. The Holder of such Note may, at its option, declare the entire principal and interest accrued thereon immediately due and payable and may proceed with collection due to such event of default.

|

| |

b.

|

If the Company has made a material misrepresentation in connection with this Agreement or with the transactions contemplated by this Agreement, or if any proceeding involving the Company is commenced under any receivership, bankruptcy, insolvency, such event shall be deemed a default which will immediately entitled Holders of the Notes, at their option and without notice, to declare the entire amount of interest accrued thereon immediately due and payable and proceed to enforce the collection thereof.

|

| |

a.

|

Any and all notices or other communications or deliveries required or permitted to be provided hereunder shall be in writing and shall be deemed given and effective on the earliest of: (a) the date of transmission, if such notice or communication is delivered via facsimile at the facsimile number or email attachment at the email address as set forth on the signature pages attached hereto at or prior to 5:30 p.m. (California time) on a business day, (b) the next business day after the date of transmission, if such notice or communication is delivered via facsimile at the facsimile number or email attachment at the email address as set forth on the signature pages attached hereto on a day that is not a business day or later than 5:30 p.m. (California time) on any business day, (c) the second (2nd) business day following the date of mailing, if sent by U.S. nationally recognized overnight courier service or (d) upon actual receipt by the party to whom such notice

|

Convertible Promissory Note Agreement

| |

|

is required to be given. The address for such notices and communications shall be as set forth on the signature pages attached hereto. |

| |

b.

|

This Agreement may not be modified, amended or terminated except by written agreement executed by all the parties hereto.

|

| |

c.

|

The waiver of any breach or default hereunder shall not be considered valid unless in writing and signed by the party such waiver is sought and no waiver shall be deemed a waiver of any subsequent breach or default of same.

|

| |

d.

|

The paragraph headings contained herein are for the purpose of convenience only and are not intended to define or limit the contents of such.

|

| |

e.

|

The validity, construction, interpretation and enforceability of this Agreement and the Notes executed pursuant to this Agreement shall be determined and governed by the laws of the State of California. Any disputes that arise under this Agreement, shall be heard only in the state or federal courts located in the City of Los Angeles, State of California.

|

| |

f.

|

This Agreement may be executed in one or more counterparts, each of which shall be deemed an original.

|

IN WITNESS WHEREOF, the parties hereto have caused this Convertible Promissory Notes Purchase Agreement to be duly executed by their respective authorized signatories as of the date first indicated above.

| FUSE GROUP HOLDING INC. |

Address for Notice: |

| |

|

|

|

By:

|

/s/ Umesh Patel

|

Fax:

|

| |

Name: Umesh Patel

Title: Chief Executive Officer

|

|

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK

SIGNATURE PAGE FOR PURCHASER FOLLOWS]

Convertible Promissory Note Agreement

[PURCHASER SIGNATURE PAGES TO CONVERTIBLE PROMISSORY NOTES PURCHASE AGREEMENT]

IN WITNESS WHEREOF, the undersigned have caused this Convertible Promissory Notes Purchase Agreement to be duly executed by their respective authorized signatories as of the date first indicated above.

Name of Purchaser: Liu Marketing (M) SDN BHD

Signature of Authorized Signatory of Purchaser: /s/ Liu Jun

Name of Authorized Signatory: Liu Jun

Title of Authorized Signatory: Chief Executive Officer

Email Address of Authorized Signatory:

Facsimile Number of Authorized Signatory:

Address for Notice to Purchaser: Kuala Lumpur, Malaysia

Address for Delivery of Notes to Purchaser (if not same as address for notice): Subscription Amount: $50,000

EIN Number: (Malaysia Taxpayer Identification Number)

Convertible Promissory Note Agreement

Exhibit 10.2

CONVERTIBLE PROMISSORY NOTE

| Effective Date: June 29,2023 |

U.S. $50,000.00 |

FOR VALUE RECEIVED, FUSE GROUP HOLDING INC., a Nevada corporation (“Borrower”), promises to pay to LIU MARKETING (M) SDN. BHD., a corporation registered in Malaysia,(“Lender”), $50,000 on the date that is twenty-four (24) months after the Purchase Price Date (the “Maturity Date”) in accordance with the terms set forth herein and to pay interest on the Outstanding Balance at the rate of three percent (3%) per annum from the Purchase Price Date until the same is paid in full. All interest calculations hereunder shall be computed on the basis of a 365-day year comprised of twelve (12) thirty (30) day months, shall be payable in accordance with the terms of this Note. This Convertible Promissory Note (this “Note”) is issued and made effective as of June 29, 2023 (the “Effective Date”). This Note is issued pursuant to that certain Convertible Notes Purchase Agreement dated June 29, 2023, as the same may be amended from time to time, by and between Borrower and Lender (the “Purchase Agreement”). Certain capitalized terms used herein are defined in Attachment 1 attached hereto and incorporated herein by this reference.

The purchase price for this Note shall be $50,000.00 (the “Purchase Price”) in original principal balance. The Purchase Price shall be payable by Lender by wire transfer of immediately available funds in U.S. Dollars to the designated account by the Borrower.

1.1. Payment. All payments owing hereunder shall be in lawful money of the United States of America or Conversion Shares (as defined below), as provided for herein, and delivered to Lender at the address or bank account furnished to Borrower for that purpose.

1.2. Prepayment. Notwithstanding the foregoing, Borrower shall have the right to prepay all or any portion of the Outstanding Balance.

| |

2.

|

Lender Optional Conversion.

|

2.1. Conversions. Lender has the right at any time after the Purchase Price Date until the Outstanding Balance has been paid in full, at its election, to convert (“Conversion”) all or any portion of the Outstanding Balance into shares (“Conversion Shares”) of fully paid and non-assessable common stock, $0.001 par value per share (“Common Stock”), of Borrower as per the following conversion formula: the number of Conversion Shares equals the amount being converted (the “Conversion Amount”) divided by the Conversion Price (as defined below). Conversion notices in the form attached hereto as Exhibit A (each, a “Conversion Notice”) may be effectively delivered to Borrower by any method set forth in the “Notices” Section of the Purchase Agreement. Borrower shall deliver the Conversion Shares from any Conversion to Lender in accordance with Section 6 below.

2.2. Conversion Price. Subject to adjustment as set forth in this Note, the price at which Lender has the right to convert all or any portion of the Outstanding Balance into Common Stock is $0.45 per share of Common Stock (the “Conversion Price”).

| |

3.

|

Defaults and Remedies.

|

3.1. Defaults. The following are events of default under this Note (each, an “Event of Default”): (a) Borrower fails to pay any principal or interest when due and payable hereunder; (b) Borrower fails to deliver any Conversion Shares in accordance with the terms hereof; (c) a receiver, trustee or other similar official shall be appointed over Borrower, or a material part of its assets and such appointment

shall remain uncontested for 90 days or shall not be dismissed or discharged within 180 days (d) Borrower files a petition for relief under any bankruptcy, insolvency or similar law (domestic or foreign); (e) an involuntary bankruptcy proceeding is commenced or filed against Borrower.

3.2. Remedies. At any time following the occurrence of any Event of Default and upon written notice given by Lender to Borrower, the Borrower has 45 days (the “Grace Period”) from the date of the notice from Lender to cure such default. If the default is not cured after the Grace Period, Lender may accelerate this Note by written notice to Borrower, with the Outstanding Balance becoming immediately due and payable in cash. For the avoidance of doubt, Lender may continue making Conversions at any time following an Event of Default until such time as the Outstanding Balance is paid in full.

4. Waiver. No waiver of any provision of this Note shall be effective unless it is in the form of a writing signed by the party granting the waiver. No waiver of any provision or consent to any prohibited action shall constitute a waiver of any other provision or consent to any other prohibited action, whether or not similar. No waiver or consent shall constitute a continuing waiver or consent or commit a party to provide a waiver or consent in the future except to the extent specifically set forth in writing.

5. Adjustment of Conversion Price upon Subdivision or Combination of Common Stock. Without limiting any provision hereof, if Borrower at any time on or after the Effective Date subdivides (by any stock split, stock dividend, recapitalization or otherwise) one or more classes of its outstanding shares of Common Stock into a greater number of shares, the Conversion Price in effect immediately prior to such subdivision will be proportionately reduced. Without limiting any provision hereof, if Borrower at any time on or after the Effective Date combines (by combination, reverse stock split or otherwise) one or more classes of its outstanding shares of Common Stock into a smaller number of shares, the Conversion Price in effect immediately prior to such combination will be proportionately increased. Any adjustment pursuant to this Section 5.1 shall become effective immediately after the effective date of such subdivision or combination.

6. Method of Conversion Share Delivery. On or before the close of business on the tenth (10th) Trading Day following the date of delivery of a Conversion Notice (the “Delivery Date”), Borrower shall deliver to Lender via reputable overnight courier, a certificate representing the number of shares of Common Stock equal to the number of Conversion Shares to which Lender shall be entitled, registered in the name of Lender. The Conversion Shares shall include a restrictive securities legend on ground that such shares have not been registered with SEC under the Securities Act of 1933 and therefore they cannot be sold, pledged, assigned or otherwise disposed of unless they are subsequently registered under the Securities Act and applicable state securities laws or exemptions from such registration requirements are available.

7. Governing Law; Venue. This Note shall be construed and enforced in accordance with, and all questions concerning the construction, validity, interpretation and performance of this Note shall be governed by, the internal laws of the State of California, without giving effect to any choice of law or conflict of law provision or rule (whether of the State of California or any other jurisdiction) that would cause the application of the laws of any jurisdiction other than the State of Utah. The provisions set forth in the Purchase Agreement to determine the proper venue for any disputes are incorporated herein by this reference. Any disputes that arise under this Note, shall be heard only in the state or federal courts located in the City of Los Angeles, State of California.

8. Cancellation. After repayment or conversion of the entire Outstanding Balance, this Note shall be deemed paid in full, shall automatically be deemed canceled, and shall not be reissued.

9. Amendments. The prior written consent of both parties hereto shall be required for any change or amendment to this Note.

10. Assignments. Borrower may not assign this Note without the prior written consent of Lender, subject to compliance with securities laws and regulations. This Note may not be offered, sold, assigned or transferred by Lender without the consent of Borrower and in compliance with securities laws and regulations.

11. Notices. Whenever notice is required to be given under this Note, unless otherwise provided herein, such notice shall be given in accordance with the subsection of the Purchase Agreement titled “Notices.”

12. Severability. If any part of this Note is construed to be in violation of any law, such part shall be modified to achieve the objective of Borrower and Lender to the fullest extent permitted by law and the balance of this Note shall remain in full force and effect.

[Remainder of page intentionally left blank; signature page follows]

IN WITNESS WHEREOF, Borrower has caused this Note to be duly executed as of the Effective Date.

BORROWER:

Fuse Group Holding Inc.

By: /s/Umesh Patel

Name: Umesh Patel

Title: Chief Executive Officer

ACKNOWLEDGED, ACCEPTED AND AGREED:

LENDER: LIU MARKETING (M) SDN. BHD.

By:

By: /s/Liu Jun

Name: Liu Jun

Title: Chief Executive Officer

[Signature Page to Secured Convertible Promissory Note]

ATTACHMENT 1

DEFINITIONS

For purposes of this Note, the following terms shall have the following meanings:

| |

1.

|

“Outstanding Balance” means as of any date of determination, the Purchase Price, as reduced or increased, as the case may be, pursuant to the terms hereof for payment, Conversion, offset, or otherwise, accrued but unpaid interest under this Note.

|

| |

2.

|

“Purchase Price Date” means the date the Purchase Price is delivered by Lender to Borrower.

|

| |

3.

|

“Trading Day” means any day on which the OTC Markets (or such other principal market for the Common Stock) is open for trading.

|

[Remainder of page intentionally left blank]

Attachment 1 to Convertible Note, Page 1

EXHIBIT A

|

Fuse Group Holding Inc.

Attn: Umesh Patel

805 W. Duarte Rd., Suite 102

Arcadia, CA 91007

|

Date: |

CONVERSION NOTICE

The above-captioned Lender hereby gives notice to Fuse Group Holding Inc., a Nevada corporation (the “Borrower”), pursuant to that certain Convertible Promissory Note made by Borrower in favor of Lender on June 29, 2023 (the “Note”), that Lender elects to convert the portion of the Note balance set forth below into fully paid and non-assessable shares of Common Stock of Borrower as of the date of conversion specified below. Said conversion shall be based on the Conversion Price set forth below. In the event of a conflict between this Conversion Notice and the Note, the Note shall govern. Capitalized terms used in this notice without definition shall have the meanings given to them in the Note.

| |

A.

|

Date of Conversion:

|

| |

B.

|

Conversion #:

|

| |

C.

|

Conversion Amount:

|

| |

D.

|

Conversion Price:

|

| |

E.

|

Conversion Shares:(C divided by D)

|

| |

F.

|

Remaining Outstanding Balance of Note:

|

Deliver all such certificated shares to Lender via reputable overnight courier after receipt of this Conversion Promissory Notice (by facsimile transmission or otherwise) to:

Sincerely,

Lender: LIU MARKETING (M) SDN. BHD.

By:

Name: Liu Jun

Exhibit A to Convertible Promissory Note, Page 1

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

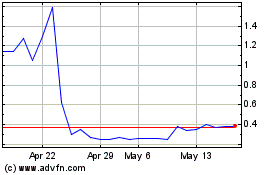

Fuse (QB) (USOTC:FUST)

Historical Stock Chart

From Apr 2024 to May 2024

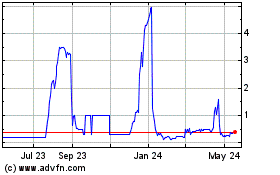

Fuse (QB) (USOTC:FUST)

Historical Stock Chart

From May 2023 to May 2024