Fresenius Places Bonds With a Volume of EUR1 Billion

November 22 2022 - 1:47AM

Dow Jones News

By Maitane Sardon

Fresenius SE & Co. said it has successfully placed bonds

with an aggregate volume of 1 billion euros ($1.02 billion) on the

market.

The German healthcare company said it has placed the debt

product, whose proceeds will be used for general corporate

purposes, across two tranches: EUR500 million bonds with a May 2026

maturity and an annual coupon of 4.25% and EUR500 million bonds

with a November 2029 maturity and an annual coupon of 5.00%.

Fresenius has applied to the Luxembourg Stock Exchange to admit

the bonds to trading and it anticipates the settlement date will be

November 28, it said late on Monday.

Write to Maitane Sardon at maitane.sardon@wsj.com

(END) Dow Jones Newswires

November 22, 2022 01:32 ET (06:32 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

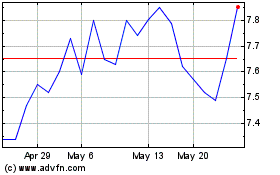

Fresenius SE and Company... (PK) (USOTC:FSNUY)

Historical Stock Chart

From Nov 2024 to Dec 2024

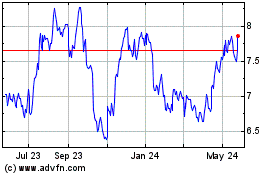

Fresenius SE and Company... (PK) (USOTC:FSNUY)

Historical Stock Chart

From Dec 2023 to Dec 2024