UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission File Number: 000-55607

First Mining

Gold Corp.

(Translation of registrant's name into English)

Suite 2070, 1188 West Georgia Street, Vancouver, B.C., V6E

4A2

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form

40-F ☒

DOCUMENTS FILED AS PART OF THIS FORM 6-K

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

First Mining Gold Corp. |

| |

|

(Registrant) |

| |

|

|

| |

|

|

| Date: May 28, 2024 |

|

/s/ Lisa Peterson |

| |

|

Lisa Peterson |

| |

|

Chief Financial Officer and Corporate Secretary |

| |

|

|

Exhibit 99.1

First Mining Announces

up to $5 Million Flow-Through Equity Financing

/NOT

FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES/

VANCOUVER, BC, May

28, 2024 /CNW/ - First Mining Gold Corp. ("First Mining" or the "Company") (TSX: FF) (OTCQX: FFMGF) (FRANKFURT:

FMG) is pleased to announce that it intends to complete a flow-through equity financing by way of a non-brokered private placement for

aggregate proceeds of up to $5 million (the "Offering"). The Offering will consist of up to 24,242,424 national flow-through

common shares of the Company (the "National FT Shares") at a price of $0.165 per National FT Share and 11,111,111 Quebec

flow-through common shares of the Company (the "Quebec FT Shares") at a price of $0.18 per Quebec FT Share.

The gross proceeds

raised from the Offering will be used by First Mining to fund exploration programs that qualify as "Canadian exploration expenses"

and "flow-through mining expenditures", as those terms are defined in the Income Tax Act (Canada) for the National FT

Shares and will also qualify for inclusion in the "exploration base relating to certain Quebec exploration expenses" within

the meaning of section 726.4.10 of the Taxation Act (Quebec) and in the "exploration base relating to certain Quebec

surface mining exploration expenses" within the meaning of section 726.4.17.2 of the Taxation Act (Quebec) for the Quebec

FT Shares.

The closing of the

Offering is expected to occur on or before June 14, 2024 (the "Closing Date") and is subject to the completion of formal

documentation and receipt of all applicable regulatory approvals, including the approval of the Toronto Stock Exchange (the "TSX").

The National FT Shares and Quebec FT Shares to be issued under the Offering will be subject to a statutory hold period of four months

and one day from the Closing Date.

This news release

does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities

have not been and will not be registered under the United States Act of 1933, as amended (the "U.S. Securities Act") or any

state securities laws and may not be offered or sold within the United States or to U.S. Persons (as such term is defined in Regulation

S under the U.S. Securities Act) unless registered under the U.S. Securities Act and applicable state securities laws or an exemption

from such registration is available.

About First Mining Gold Corp.

First Mining is a gold

developer advancing two of the largest gold projects in Canada, the Springpole Gold Project in northwestern Ontario, where we have commenced

a Feasibility Study and permitting activities are on-going with a draft Environmental Impact Statement ("EIS") for the project

published in June 2022, and the Duparquet Gold Project in Quebec, a PEA-stage development project located on the Destor-Porcupine Fault

Zone in the prolific Abitibi region. First Mining also owns the Cameron Gold Project in Ontario and a portfolio of gold project interests

including the Pickle Crow Gold Project (being advanced in partnership with Firefly Metals Ltd.) and the Hope Brook Gold Project (being

advanced in partnership with Big Ridge Gold Corp.).

First Mining was established

in 2015 by Mr. Keith Neumeyer, founding President and CEO of First Majestic Silver Corp.

ON BEHALF OF FIRST

MINING GOLD CORP.

Daniel W. Wilton

Chief Executive Officer and Director

Cautionary Note Regarding Forward-Looking

Statements

This news release

includes certain "forward-looking information" and "forward-looking statements" (collectively "forward-looking

statements") within the meaning of applicable Canadian and United States securities legislation including the United States Private

Securities Litigation Reform Act of 1995. These forward-looking statements are made as of the date of this news release. Forward-looking

statements are frequently, but not always, identified by words such as "expects", "anticipates", "believes",

"plans", "projects", "intends", "estimates", "envisages", "potential", "possible",

"strategy", "goals", "opportunities", "objectives", or variations thereof or stating that certain

actions, events or results "may", "could", "would", "might" or "will" be taken, occur

or be achieved, or the negative of any of these terms and similar expressions.

Forward-looking

statements in this news release relate to future events or future performance and reflect current estimates, predictions, expectations

or beliefs regarding future events. All forward-looking statements are based on First Mining's or its consultants' current beliefs as

well as various assumptions made by them and information currently available to them. There can be no assurance that such statements

will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Forward-looking

statements reflect the beliefs, opinions and projections on the date the statements are made and are based upon a number of assumptions

and estimates that, while considered reasonable by the respective parties, are inherently subject to significant business, economic,

competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results,

performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or

implied by such forward-looking statements and the parties have made assumptions and estimates based on or related to many of these factors.

Such factors include, without limitation: failure to obtain approval from the TSX for the Offering; the demand for the National FT Shares

and Quebec FT Shares not being as expected; risks related to the Company's ability to complete the Offering on the proposed terms and

timing or at all; risks related to the use of proceeds of the Offering; the Company's business, operations and financial condition potentially

being materially adversely affected by the outbreak of epidemics, pandemics or other health crises, such as COVID-19, and by reactions

by government and private actors to such outbreaks; risks to employee health and safety as a result of the outbreak of epidemics, pandemics

or other health crises, such as COVID-19, that may result in a slowdown or temporary suspension of operations at some or all of the Company's

mineral properties as well as its head office; fluctuations in the spot and forward price of gold, silver, base metals or certain

other commodities; fluctuations in the currency markets (such as the Canadian dollar versus the U.S. dollar); changes in national and

local government, legislation, taxation, controls, regulations and political or economic developments; risks and hazards associated with

the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected

formations, pressures, cave-ins and flooding); the presence of laws and regulations that may impose restrictions on mining; employee

relations; relationships with and claims by local communities, indigenous populations and other stakeholders; availability and increasing

costs associated with mining inputs and labour; the speculative nature of mineral exploration and development; title to properties.;

and the additional risks described in the Company's Annual Information Form for the year ended December 31, 2023 filed with the Canadian

securities regulatory authorities under the Company's SEDAR profile at www.sedar.com, and in the Company's Annual Report on Form

40-F filed with the SEC on EDGAR.

First Mining cautions

that the foregoing list of factors that may affect future results is not exhaustive. When relying on our forward-looking statements to

make decisions with respect to First Mining, investors and others should carefully consider the foregoing factors and other uncertainties

and potential events. First Mining does not undertake to update any forward-looking statement, whether written or oral, that may be made

from time to time by the Company or on our behalf, except as required by law.

SOURCE First Mining

Gold Corp.

View original content

to download multimedia: http://www.newswire.ca/en/releases/archive/May2024/28/c1678.html

%CIK: 0001641229

For further information: Toll Free:

1 844 306 8827, Email: info@firstmininggold.com; Paul Morris, Director, Investor Relations, Email: paul@firstmininggold.com

CO: First Mining Gold

Corp.

CNW 16:00e 28-MAY-24

First Mining Gold (QX) (USOTC:FFMGF)

Historical Stock Chart

From Jun 2024 to Jul 2024

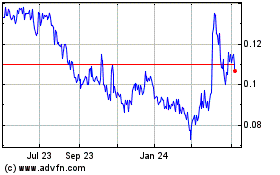

First Mining Gold (QX) (USOTC:FFMGF)

Historical Stock Chart

From Jul 2023 to Jul 2024