First Intercontinental Bank Completes $6.0 Million Common Stock Offering and Repays TARP Obligations

September 12 2014 - 4:34PM

Business Wire

First Intercontinental Bank (the “Bank”) (OTCMKTS: FIEB)

announced the successful completion of the offering of 1,142,855

shares of newly issued common stock at a price of $5.25 per share

to shareholders and institutional investors. The Bank also

announced that it used approximately $4.2 million of the net

proceeds of the offering to repurchase all of its Series A Fixed

Rate Non-Cumulative Perpetual Preferred Stock and Series B Fixed

Rate Non-Cumulative Perpetual Preferred Stock issued through the

U.S. Treasury’s Troubled Asset Relief Capital Purchase Program. The

Bank plans to use the remaining approximately $1.8 million in net

proceeds from the offering for organic growth and other general

corporate purposes.

“The Board of Directors and management team of the Bank are

pleased with the strong investor interest in participating in the

offering,” stated Dong Wook Kim, President and CEO of the Bank. “We

appreciate the continued support of our shareholders, and look

forward to a very bright future for the Bank.”

Alston & Bird LLP served as the Bank’s legal counsel in

connection with the offering.

First Intercontinental BankDong Wook KimPresident and

CEO770.451.7200

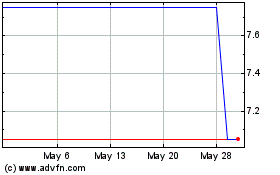

First IC (CE) (USOTC:FIEB)

Historical Stock Chart

From Nov 2024 to Dec 2024

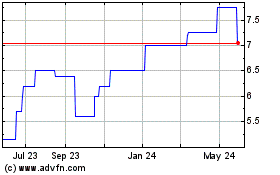

First IC (CE) (USOTC:FIEB)

Historical Stock Chart

From Dec 2023 to Dec 2024