UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) September 16, 2014

_________________________________________________________________

First Citizens BancShares, Inc.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | 001-16715 | 56-1528994 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

|

| |

4300 Six Forks Road; Raleigh, North Carolina | 27609 |

(Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (919) 716-7000

________________________________________________________________________________

|

| | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

[ ] | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

[ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

[ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

[ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.07. Submission of Matters to a Vote of Security Holders.

At a special meeting of stockholders of First Citizens BancShares, Inc. ("BancShares") held on September 16, 2014 (the "Special Meeting"), the following matters were submitted to a vote of stockholders:

| |

• | a proposal to approve the Agreement and Plan of Merger dated June 10, 2014, as amended July 29, 2014 (the "Merger Agreement"), by and between First Citizens Bancorporation, Inc. (“Bancorporation”) and BancShares, pursuant to which Bancorporation will merge with and into BancShares, with BancShares as the surviving company in the merger; |

| |

• | a proposal to approve the issuance of up to 2,605,004 shares of BancShares' Class A common stock and up to 273,526 shares of BancShares' Class B common stock in connection with the Merger Agreement; and |

| |

• | a proposal to approve an amendment to BancShares' Restated Certificate of Incorporation, as amended, to increase the authorized number of shares of BancShares' Class A common stock from 11,000,000 to 16,000,000 shares to enable the issuance of shares of the Class A common stock in the merger and to provide additional authorized shares of the Class A common stock for other uses. |

The following tables reflect the final results of the voting on the above three matters at the Special Meeting.

Merger Agreement

Approval of the Merger Agreement required that a majority of the total votes entitled to be cast by holders of the outstanding shares of BancShares' Class A common stock and Class B common stock, voting as a group, be cast in favor of the proposal. An aggregate of 84.9% of the total votes entitled to be cast by holders of the outstanding shares of both classes were cast in favor of the proposal. The votes were cast as follows:

|

| | | | | | | | | | | | |

| | Class A and Class B Voting as a Group |

Description of Matter Voted On | | Votes Cast "For" |

| | Votes Cast "Against" |

| | Abstained |

| | Broker Nonvotes |

|

Proposal to approve the Merger Agreement | | 21,314,116 |

| | 43,469 |

| | 105,821 |

| | 1,521,641 |

|

Issuance of Common Stock

Approval of the issuance of BancShares' Class A common stock and Class B common stock in connection with the Merger Agreement required that a majority of the total votes actually cast on the proposal by holders of the outstanding shares of BancShares' Class A common stock and Class B common stock, voting as a group, be cast in favor of the proposal. An aggregate of 99.7% of the total votes actually cast by holders of the outstanding shares of both classes were cast in favor of the proposal. The votes were cast as follows:

|

| | | | | | | | | | | | |

| | Votes Cast by Holders of Class A and Class B Voting as a Group |

Description of Matter Voted On | | Votes Cast "For" |

| | Votes Cast "Against" |

| | Abstained |

| | Broker Nonvotes |

|

Proposal to approve the issuance of Class A and Class B common stock in connection with the Merger Agreement | | 21,299,650 |

| | 55,513 |

| | 108,243 |

| | 1,521,641 |

|

Amendment of Restated Certificate of Incorporation

Approval of the amendment to BancShares' Restated Certificate of Incorporation required that a majority of the total votes entitled to be cast by holders of the outstanding shares of (1) BancShares' Class A common stock and Class B common stock, voting as a group, and (2) BancShares' Class A common stock, voting as a separate group, in each case be cast in favor of the proposal. An aggregate of 90.6% of the total votes entitled to be cast by holders of the outstanding shares of both classes, and 86.6% of the total votes entitled to be cast by holders of the outstanding shares of Class A common stock, were cast in favor of the proposal. The votes were cast as follows:

|

| | | | | | | | | | | |

| | Class A and Class B Voting as a Group |

Description of Matter Voted On | | Votes Cast "For" |

| | Votes Cast "Against" |

| | Abstained |

| | Broker Nonvotes |

Proposal to approve the amendment to BancShares' Restated Certificate of Incorporation | | 22,756,376 |

| | 125,070 |

| | 103,601 |

| | -0- |

|

| | | | | | | | | | | |

| | Class A Voting as a Separate Group |

Description of Matter Voted On | | Votes Cast "For" |

| | Votes Cast "Against" |

| | Abstained |

| | Broker Nonvotes |

Proposal to approve the amendment to BancShares' Restated Certificate of Incorporation | | 7,433,288 |

| | 22,654 |

| | 17,185 |

| | -0- |

The joint proxy statement/prospectus for the Special Meeting also solicited appointments of proxies with respect to a proposal to approve an adjournment or postponement of the meeting, if necessary or appropriate, to permit further solicitation of proxies if there were not sufficient votes at the time of the meeting to approve the Merger Agreement, the share issuance proposal or the amendment to BancShares' Restated Certificate of Incorporation. The joint proxy statement/prospectus indicated that, if those other matters voted on at the meeting were approved, a vote would not be taken on the adjournment proposal. Since the other matters were approved, a vote was not taken on the proposal to adjourn or postpone the meeting.

Item 8.01. Other Events

(a)Amendment to Restated Certificate of Incorporation. As reported in Item 5.07 above, at the Special Meeting BancShares' stockholders adopted and approved an amendment to BancShares' Restated Certificate of Incorporation, as previously amended, to increase the authorized number of shares of BancShares' Class A common stock from 11,000,000 to 16,000,000 shares. The amendment was described in the definitive proxy statement filed by BancShares and distributed to its stockholders in connection with the Special Meeting, and it was filed with the Delaware Secretary of State and became effective on September 16, 2014. A complete copy of BancShares' Restated Certificate of Incorporation, as so amended, is attached as an exhibit to this report.

(b)Distribution of Press Release Announcing Stockholder Approval of Merger. On September 16, 2014, BancShares and Bancorporation distributed a joint press release announcing that, at special meetings held that day, their respective stockholders had approved the proposed merger of Bancorporation with and into BancShares pursuant to the terms of the Merger Agreement. A copy of the joint press release is attached as an exhibit to this report.

Item 9.01. Financial Statements and Exhibits

The following exhibits are filed with this report.

|

| | |

Exhibit No. | | Exhibit Description |

| |

3.1 | Restated Certificate of Incorporation as amended |

99.1 | Joint press release dated September 16, 2014 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | | First Citizens BancShares, Inc. | |

| | | (Registrant) | |

| | | | |

| | | | |

Date: | September 16, 2014 | | By: /s/ GLENN D. McCOY | |

| | | Glenn D. McCoy, Chief Financial Officer | |

EXHIBIT 3.1

State of Delaware

Secretary of State

Division of Corporations

Delivered 10:20 AM 02/26/2014

FILED 10:20 AM 02/26/2014

SRV 140241425 - 2098420 FILE

Restated Certificate of Incorporation

of

First Citizens BancShares, Inc.

The present name of the corporation is First Citizens BancShares, Inc. The corporation was incorporated under the name "First Citizens BancShares, Inc." by the filing of its original Certificate of Incorporation with the Secretary of State of the State of Delaware on August 8, 1986. This Restated Certificate of Incorporation of the corporation only restates and integrates and does not further amend the provisions of the corporation's Certificate of Incorporation as theretofore amended or supplemented and there is no discrepancy between the provisions of the Certificate of Incorporation as theretofore amended and supplemented and the provisions of this Restated Certificate of Incorporation. This Restated Certificate of Incorporation was duly adopted in accordance with the provisions of Section 245 of the General Corporation Law of the State of Delaware. The Certificate of Incorporation of the corporation is hereby integrated and restated to read in its entirety as follows:

Article I

The name of the corporation is First Citizens BancShares, Inc.

Article II

The address of the corporation's registered office in the State of Delaware is 1209 Orange Street, City of Wilmington, County of New Castle, 19801, and the name of its registered agent at such address is The Corporation Trust Company.

Article III

The purpose of the corporation is to operate as a one-bank or as a multi-bank holding company and to engage in any lawful act or activity for which corporations may be organized under the General Corporation Law of Delaware.

Article IV

The aggregate number of shares which the corporation shall have authority to issue is Thirteen Million (13,000,000) shares divided into two classes. The designation, the number of authorized shares and the par value of the shares of each class are as follows:

|

| | | |

Class | Number of Shares |

| Par Value Per Share |

Class A Common | 11,000,000 |

| $1.00 |

Class B Common | 2,000,000 |

| $1.002 |

The preferences, limitations and relative rights of the shares of each class are as follows:

Class A Common - The Class A common stock has one (1) vote for each share outstanding and, as to dividends and liquidation, shall share with the Class B common stock as specified below.

Class B Common - The Class B common stock has sixteen (16) votes for each share outstanding and, as to dividends and liquidation, shall share with the Class A common stock as specified below.

Liquidation, Dividends, Spin-Offs, Distributions-In-Kind and Other Benefits (Except Voting) of Class A and Class B Common: As to liquidation, any amounts available shall be distributed between the outstanding Class A common stock and the outstanding Class B common stock pro rata, based upon the number of shares issued and outstanding of Class A common stock and Class B common stock.

Dividends, spin-offs, distributions-in-kind and all other like and similar benefits and transactions (except voting) shall be paid or distributed on the Class A common stock and the Class B common stock as declared from time to time by the Board of Directors; provided, however, that the dividends, spin-offs, distributions-in-kind and all other like and similar benefits and transactions shall be the same for each issued and outstanding share of Class A common stock and for each issued and outstanding share of Class B common stock as of the record date.

Neither Class A nor Class B common stock shall have class voting privileges except as required by law.

Fractional Shares: No certificates for fractional shares shall be issued by the corporation.

Article V

In furtherance, and not in limitation of the powers conferred upon the Board of Directors by law, the Board of Directors shall have the power to make, adopt, alter, amend and repeal, from time to time, the Bylaws of the corporation, subject to the rights of the shareholders entitled to vote with respect thereto to alter or repeal Bylaws made by the Board of Directors.

Article VI

No Director shall be personally liable to the corporation or its shareholders for monetary damages for breach of fiduciary duty as a Director for any act or omission, except that he may be liable (i) for any breach of the Director's duty of loyalty to the corporation or its shareholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) under Section 174 of the General Corporation Law of Delaware or (iv) for any transaction from which the Director derived an improper personal benefit. The corporation shall, to the full extent permitted by Section 145 of the General Corporation Law of Delaware, indemnify all persons whom it may indemnify pursuant thereto.

Article VII

The principal place of business of the corporation shall be 20 East Martin Street, City of Raleigh, County of Wake, State of North Carolina 27601.

In Witness Whereof, I have hereunto set my hand this 26th day of February, 2014.

|

| | |

| By: /s/ Frank B. Holding, Jr. | |

| Frank B. Holding, Jr. | |

| Chairman and Chief Executive Officer | |

State of Delaware

Secretary of State

Division of Corporations

Delivered 12:05 PM 04/30/2014

FILED 12:05 PM 04/30/2014

SRV 140539130 - 2098420 FILE

Certificate of Amendment

of the

Restated Certificate of Incorporation

of

First Citizens BancShares, Inc.

First Citizens BancShares, Inc. (the "Corporation"), a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware, does hereby certify:

First: That at a meeting of the Board of Directors of the Corporation, resolutions were duly adopted setting forth proposed amendments of the Corporation's Restated Certificate of Incorporation to:

| |

(1) | delete Article IV thereof in its entirety and insert a new Article IV, as set forth in Exhibit A, in its place, and |

| |

(2) | delete Article VII thereof in its entirety with no replacement. |

And, the said resolutions of the Board of Directors declared the amendments to be advisable, and directed that the amendments be submitted to a vote of the stockholders of the Corporation at the Corporation's next annual meeting of stockholders held on April 29, 2014.

A copy of new Article IV, as adopted and approved by the Board of Directors and by the stockholders of the Corporation at the annual meeting, is attached as Exhibit A to this Certificate of Amendment.

Second: That thereafter, pursuant to the resolutions of its Board of Directors, at the annual meeting of the Corporation's stockholders duly called and held on April 29, 2014, upon notice and in accordance with Section 222 of the General Corporation Law of the State of Delaware, and by the requisite vote, the stockholders of the Corporation approved and adopted the foregoing amendments.

Third: That said amendments were duly adopted in accordance with the provisions of Section 242 of the General Corporation Law of the State of Delaware.

In Witness Whereof, the Corporation has caused this Certificate of Amendment to be signed this the 29th day of April, 2014.

|

| | |

| First Citizens BancShares, Inc. | |

| | |

| By: /s/ Frank B. Holding, Jr. | |

| Frank B. Holding, Jr. | |

| Chairman and Chief Executive Officer | |

Exhibit A

to

Certificate of Amendment

Article IV

The aggregate number of shares which the corporation shall have authority to issue is Twenty-Three Million (23,000,000) shares divided into three classes. The designation, the number of authorized shares, and the par value of the shares of each class are as follows:

|

| | |

Class | Number of Shares | Par Value Per Share |

Class A Common Stock | 11,000,000 | $1.00 |

Class B Common Stock | 2,000,000 | $1.00 |

Preferred Stock | 10,000,000 | $0.01 |

Total Shares | 23,000,000 | |

Subject to the rights of the holders of any series of the Preferred Stock as set forth in a certificate of designation relating to that series, the number of authorized shares of the Preferred Stock may be increased or decreased (but not below the number of shares thereof then outstanding) by the affirmative vote of the holders of a majority in voting power of the stock of the corporation entitled to vote thereon irrespective of the provisions of Section 242(b)(2) of the General Corporation Law of Delaware, and no vote of the holders of any of the Preferred Stock voting separately as a class shall be required therefor.

The preferences, powers and rights, and the qualification, limitations and restrictions, of the shares of each class are as follows:

Class A Common Stock. The Class A Common Stock shall be subject to the express terms of the Preferred Stock and any series thereof. Except as provided below or from time to time in this Restated Certificate of Incorporation with respect to another class of the corporation's shares, or in a certificate of designation relating to a series of the Preferred Stock, or by applicable law, the holders of shares of Class A Common Stock shall be entitled to one (1) vote for each share outstanding upon all questions presented to the stockholders and, together with the Class B Common Stock, shall have the exclusive right to vote for the election of directors and for all other purposes; and, as to dividends and liquidation, the Class A Common Stock shall share with the Class B Common Stock as specified below. The Class A Common Stock shall not have class voting privileges except as required by law.

Class B Common Stock. The Class B Common Stock shall be subject to the express terms of the Preferred Stock and any series thereof. Except as provided below or from time to time in this Restated Certificate of Incorporation with respect to another class of the corporation's shares, or in a certificate of designation relating to a series of the Preferred Stock, or by applicable law, the holders of shares of Class B Common Stock shall be entitled to sixteen (16) votes for each share outstanding upon all questions presented to the stockholders and, together with the Class A Common Stock, shall have the exclusive right to vote for the election of directors and for all other purposes; and, as to dividends and liquidation, the Class B Common Stock shall share with the Class A Common Stock as specified below. The Class B Common Stock shall not have class voting privileges except as required by law.

Liquidation, Dividends, Spin-Offs, Distributions-in-Kind and other Benefits (Except Voting) of Class A and Class B Common Stock. As to liquidation, any amounts available shall be distributed between the outstanding Class A Common Stock and the outstanding Class B Common Stock pro rata, based upon the numbers of shares issued and outstanding of Class A Common Stock and Class B Common Stock.

Dividends, spin-offs, distributions-in-kind and all other like and similar benefits and transactions (except voting) shall be paid or distributed on the Class A Common Stock and the Class B Common Stock as declared from time to time by the Board of Directors; provided, however, that the dividends, spin-offs, distributions-in-kind and all other like and

similar benefits and transactions shall be the same for each issued and outstanding share of Class A Common Stock and for each issued and outstanding share of Class B Common Stock as of the record date.

Fractional Shares. No certificates for fractional shares of Class A Common Stock or Class B Common Stock shall be issued by the corporation.

The corporation's Board of Directors shall be authorized to issue shares of Preferred Stock from time to time, to create series thereof, to establish the number of shares to be included in each such series, and to fix the designations, powers, preferences and the relative, participating, optional or other rights of the shares of each series, and any qualifications, limitations or restrictions thereon, all by its resolution. Without limiting the generality of the foregoing authority, the Board of Directors shall be authorized to fix and determine with respect to each separate series:

(1) the designation of and the number of shares to constitute each series, which number may be increased or decreased (but not below the number of shares then outstanding) from time to time by the Board of Directors unless otherwise provided by the Board of Directors;

(2) the dividend rate (or method of determining such rate), if any; any conditions on which and times at which dividends are payable; any preferences over or relation which such dividends shall bear to the dividends payable on any other class or classes, or any other series, of capital stock, including the Preferred Stock; whether such dividends will be cumulative or non-cumulative; and whether the shares will be participating or nonparticipating with other shares with respect to dividends;

(3) whether shares within a series will be redeemable (at the option of the corporation or the holders of such shares or both, or upon the happening of a specified event), and, if so, the redemption prices (or the method of determining such prices) and the conditions and times upon which redemption may take place and whether for cash, property, or rights, including securities of the corporation or of another corporation;

(4) the terms and amount of any sinking, retirement, or purchase fund;

(5) the conversion or exchange rights (at the option of the corporation or the holders of such shares or both, or upon the happening of a specified event), if any, including the conversion or exchange times, prices, rates, adjustments, and other terms of conversion or exchange;

(6) the voting rights, if any, of the holders of shares of each series;

(7) any restrictions on the issuance or reissuance of additional shares of the Preferred Stock;

(8) the rights of the holders upon voluntary or involuntary liquidation, dissolution or winding up of the affairs of the corporation; any preferences over any other class or classes, or any other series, of capital stock, including Preferred Stock; and whether the shares will be participating or nonparticipating with other shares with respect to distributions of the corporation’s assets upon liquidation, dissolution or winding up of the affairs of the corporation;

(9) any limitations or restrictions on transfer; and

(10) such other powers, rights and preferences, if any, for the benefit of the holders of, or other terms or limitations, qualifications or restrictions with respect to, the shares within that series as shall not be inconsistent with the provisions of this Restated Certificate of Incorporation, as amended, or applicable law.

The number, designations, powers, preferences, and the relative, participating, optional or other rights of, and any qualifications, limitations or restrictions on, shares within any one series may differ from those of shares within any other series. Except as may otherwise be provided in this Restated Certificate of Incorporation, in a certificate of designation relating to a series of the Preferred Stock or by applicable law, holders of the Preferred Stock shall not be entitled to vote, separately or as a class, at or receive notice of any meeting of stockholders.

State of Delaware

Secretary of State

Division of Corporations

Delivered 01:17 PM 09/16/2014

FILED 01.17 PM 09/16/2014

SRV 141183589 - 2098420 FILE

Certificate of Amendment

of the

Restated Certificate of Incorporation

of

First Citizens BancShares, Inc.

First Citizens BancShares, Inc. (the “Corporation”), a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware, does hereby certify:

FIRST: That at a meeting of the Board of Directors of the Corporation, resolutions were duly adopted setting forth a proposed amendment of the Corporation’s Restated Certificate of Incorporation to delete Article IV thereof in its entirety and insert a new Article IV, as set forth in Exhibit A, in its place.

And, the said resolutions of the Board of Directors declared the amendment to be advisable, and directed that the amendment be submitted to a vote of the stockholders of the Corporation at a special meeting of the Corporation’s stockholders held on September 16, 2014.

A copy of new Article IV, as adopted and approved by the Board of Directors and by the stockholders of the Corporation at the special meeting, is attached as Exhibit A to this Certificate of Amendment.

SECOND: That thereafter, pursuant to the resolutions of its Board of Directors, at the special meeting of the Corporation’s stockholders duly called and held on September 16, 2014, upon notice and in accordance with Section 222 of the General Corporation Law of the State of Delaware, and by the requisite vote, the stockholders of the Corporation approved and adopted the foregoing amendment.

THIRD: That said amendment was duly adopted in accordance with the provisions of Section 242 of the General Corporation Law of the State of Delaware.

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to be signed this the 16th day of September, 2014.

|

| | |

| First Citizens BancShares, Inc. | |

| | |

| By: /s/ Frank B. Holding, Jr. | |

| Frank B. Holding, Jr. | |

| Chairman and Chief Executive Officer | |

Exhibit A

to

Certificate of Amendment

Article IV

The aggregate number of shares which the corporation shall have authority to issue is Twenty Eight Million (28,000,000) shares divided into three classes. The designation, the number of authorized shares, and the par value of the shares of each class are as follows:

|

| | |

Class | Number of Shares | Par Value Per Share |

Class A Common Stock | 16,000,000 | $1.00 |

Class B Common Stock | 2,000,000 | $1.00 |

Preferred Stock | 10,000,000 | $0.01 |

Total Shares | 28,000,000 | |

Subject to the rights of the holders of any series of the Preferred Stock as set forth in a certificate of designation relating to that series, the number of authorized shares of the Preferred Stock may be increased or decreased (but not below the number of shares thereof then outstanding) by the affirmative vote of the holders of a majority in voting power of the stock of the corporation entitled to vote thereon irrespective of the provisions of Section 242(b)(2) of the General Corporation Law of Delaware, and no vote of the holders of any of the Preferred Stock voting separately as a class shall be required therefor.

The preferences, powers and rights, and the qualification, limitations and restrictions, of the shares of each class are as follows:

A. Common Stock.

Class A Common Stock. The Class A Common Stock shall be subject to the express terms of the Preferred Stock and any series thereof. Except as provided below or from time to time in this Restated Certificate of Incorporation with respect to another class of the corporation’s shares, or in a certificate of designation relating to a series of the Preferred Stock, or by applicable law, the holders of shares of Class A Common Stock shall be entitled to one (1) vote for each share outstanding upon all questions presented to the stockholders and, together with the Class B Common Stock, shall have the exclusive right to vote for the election of directors and for all other purposes; and, as to dividends and liquidation, the Class A Common Stock shall share with the Class B Common Stock as specified below. The Class A Common Stock shall not have class voting privileges except as required by law.

Class B Common Stock. The Class B Common Stock shall be subject to the express terms of the Preferred Stock and any series thereof. Except as provided below or from time to time in this Restated Certificate of Incorporation with respect to another class of the corporation’s shares, or in a certificate of designation relating to a series of the Preferred Stock, or by applicable law, the holders of shares of Class B Common Stock shall be entitled to sixteen (16) votes for each share outstanding upon all questions presented to the stockholders and, together with the Class A Common Stock, shall have the exclusive right to vote for the election of directors and for all other purposes; and, as to dividends and liquidation, the Class B Common Stock shall share with the Class A Common Stock as specified below. The Class B Common Stock shall not have class voting privileges except as required by law.

Liquidation, Dividends, Spin-Offs, Distributions-in-Kind and other Benefits (Except Voting) of Class A and Class B Common Stock. As to liquidation, any amounts available shall be distributed between the outstanding Class A Common Stock and the outstanding Class B Common Stock pro rata, based upon the numbers of shares issued and outstanding of Class A Common Stock and Class B Common Stock.

Dividends, spin-offs, distributions-in-kind and all other like and similar benefits and transactions (except voting) shall be paid or distributed on the Class A Common Stock and the Class B Common Stock as declared from time to time by the Board of Directors; provided, however, that the dividends, spin-offs, distributions-in-kind and all other like and similar benefits and transactions shall be the same for each issued and outstanding share of Class A Common Stock and for each issued and outstanding share of Class B Common Stock as of the record date.

Fractional Shares. No certificates for fractional shares of Class A Common Stock or Class B Common Stock shall be issued by the corporation.

B. Preferred Stock.

The corporation’s Board of Directors shall be authorized to issue shares of Preferred Stock from time to time, to create series thereof, to establish the number of shares to be included in each such series, and to fix the designations, powers, preferences and the relative, participating, optional or other rights of the shares of each series, and any qualifications, limitations or restrictions thereon, all by its resolution. Without limiting the generality of the foregoing authority, the Board of Directors shall be authorized to fix and determine with respect to each separate series:

(1)the designation of and the number of shares to constitute each series, which number may be increased or decreased (but not below the number of shares then outstanding) from time to time by the Board of Directors unless otherwise provided by the Board of Directors;

(2)the dividend rate (or method of determining such rate), if any; any conditions on which and times at which dividends are payable; any preferences over or relation which such dividends shall bear to the dividends payable on any other class or classes, or any other series, of capital stock, including the Preferred Stock; whether such dividends will be cumulative or non-cumulative; and whether the shares will be participating or nonparticipating with other shares with respect to dividends;

(3)whether shares within a series will be redeemable (at the option of the corporation or the holders of such shares or both, or upon the happening of a specified event), and, if so, the redemption prices (or the method of determining such prices) and the conditions and times upon which redemption may take place and whether for cash, property, or rights, including securities of the corporation or of another corporation;

(4)the terms and amount of any sinking, retirement, or purchase fund;

(5)the conversion or exchange rights (at the option of the corporation or the holders of such shares or both, or upon the happening of a specified event), if any, including the conversion or exchange times, prices, rates, adjustments, and other terms of conversion or exchange;

(6)the voting rights, if any, of the holders of shares of each series;

(7)any restrictions on the issuance or reissuance of additional shares of the Preferred Stock;

(8)the rights of the holders upon voluntary or involuntary liquidation, dissolution or winding up of the affairs of the corporation; any preferences over any other class or classes, or any other series, of capital stock, including Preferred Stock; and whether the shares will be participating or nonparticipating with other shares with respect to distributions of the corporation's assets upon liquidation, dissolution or winding up of the affairs of the corporation;

(9)any limitations or restrictions on transfer; and

(10)such other powers, rights and preferences, if any, for the benefit of the holders of, or other terms or limitations, qualifications or restrictions with respect to, the shares within that series as shall not be inconsistent with the provisions of this Restated Certificate of Incorporation, as amended, or applicable law.

The number, designations, powers, preferences, and the relative, participating, optional or other rights of, and any qualifications, limitations or restrictions on, shares within any one series may differ from those of shares within any other series. Except as may otherwise be provided in this Restated Certificate of Incorporation, in a certificate of designation relating to a series of the Preferred Stock or by applicable law, holders of the Preferred Stock shall not be entitled to vote, separately or as a class, at or receive notice of any meeting of stockholders.

EXHIBIT 99.1

|

| | | |

| | |

| | | |

| |

| |

| | First Citizens Bancorporation, Inc. |

| | | |

For Immediate Release | | Contacts: | |

September 16, 2014 | Barbara Thompson | Angela English |

| First Citizens BancShares | First Citizens Bancorporation |

| 919.716.2716 | 803.931.1854 |

| | | |

SHAREHOLDERS APPROVE MERGER OF

FIRST CITIZENS BANCSHARES AND FIRST CITIZENS BANCORPORATION

RALEIGH, N.C., and COLUMBIA, S.C. - First Citizens BancShares, Inc. (NASDAQ: FCNCA) and First Citizens Bancorporation, Inc. announced that, at separate meetings today, their respective shareholders approved the proposed merger of the two companies.

Completion of the merger, which provides for Columbia, S.C.-based Bancorporation to merge into Raleigh, N.C.-headquartered First Citizens BancShares, is expected in the fourth quarter of 2014, subject to closing conditions.

The merger of the two bank subsidiaries - Bancorporation’s First Citizens Bank and Trust Company, Inc. into BancShares’ First Citizens Bank - will follow at a later time.

“We are gratified by the support of shareholders of both companies for this merger,” said Frank B. Holding Jr., chairman and CEO of First Citizens BancShares and First Citizens Bank. “Today’s votes are a crucial milestone in our progress to bring these two strong, service-oriented companies together as one of the Southeast’s premiere financial institutions.”

Jim Apple, chairman and CEO of First Citizens Bancorporation and First Citizens Bank and Trust Company, Inc., said: “We are extremely pleased that shareholders appreciate the value of this transaction and gave their approval to move forward.”

The merger agreement, announced on June 10, 2014, was previously approved by the independent members of the boards of directors of each holding company.

The combined company’s board of directors will be comprised of members from both organizations. They will be announced at a later date.

About First Citizens BancShares

First Citizens BancShares, with $22.2 billion in assets, is the financial holding company for First Citizens Bank. First Citizens Bank provides consumer, business and commercial banking, wealth, investments and insurance through a network of branch offices, internet banking, mobile banking, telephone banking and ATMs.

Headquartered in Raleigh, N.C., First Citizens Bank today has 397 offices in 17 states (Arizona, California, Colorado, Florida, Georgia, Kansas, Maryland, Missouri, New Mexico, North Carolina, Oklahoma, Oregon, Tennessee, Texas, Virginia, Washington and West Virginia) and the District of Columbia. The bank is the recipient of multiple national awards for customer satisfaction and overall stability and security. For more information, visit www.firstcitizens.com. First Citizens Bank. Forever First.

About First Citizens Bancorporation

First Citizens Bancorporation, with $8.5 billion in assets, is the parent company of First Citizens Bank and Trust Company. Headquartered in Columbia, S.C., First Citizens Bank and Trust Company offers services in commercial and retail banking through 176 offices in South Carolina and Georgia. For more information, visit www.firstcitizensonline.com.

Information on First Citizens BancShares’ and First Citizens Bancorporation’s websites is not, and shall not be deemed to be, a part of this news release or incorporated into other filings made with the SEC.

Disclosures About Forward-Looking Statements

This press release may contain forward-looking statements. Factors that could cause actual results to differ materially from those expressed in such forward-looking statements include the ability to meet all closing conditions in the merger agreement on the expected terms and schedule, delay in closing the merger, difficulties and delays in integrating the businesses of the companies or fully realizing cost savings and other benefits of the merger, changes in interest rates and capital markets and other factors detailed in First Citizens BancShares’ filings with the SEC.

###

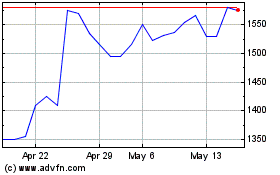

First Citizen Bancshares (PK) (USOTC:FCNCB)

Historical Stock Chart

From Jun 2024 to Jul 2024

First Citizen Bancshares (PK) (USOTC:FCNCB)

Historical Stock Chart

From Jul 2023 to Jul 2024