July 23, 2021 -- InvestorsHub NewsWire -- via Digital Journal -- Clean

Vision Corporation (OTC PINK: CLNV) is

again on the move. On Wednesday, it announced that its Clean-Seas

subsidiary has expanded its portfolio of Ecuadorian cities intent

on using its waste plastic-to-energy pyrolysis technology. CLNV

noted that the Mayor of Milagro, Francisco Asan Wonsang, of

the province of Guayas, Ecuador has signed a Letter of

Intent with Clean-Seas to establish a public-private joint venture

partnership in which Clean-Seas will deploy a waste

plastic-to-energy processing plant. That deal follows a similar

agreement signed with the Mayor of

Naranjal, Ecuador announced last week.

The service is a timely one for Milagro, which like many cities

throughout Latin American, is faced with a waste crisis, as

landfills are reaching capacity. This LOI signed earlier this

month is designed to relieve the pressure on the city’s existing

infrastructure and handle the Municipal Solid Waste (MSW) stream in

an environmentally responsible way. Milagro currently collects as

much as 200 metric tons of MSW daily, and guaranteed access to this

consistent supply of feedstock provides a solid operational

foundation for Clean-Seas to attract domestic and foreign financing

for the project. Notably, CLNV expects the facility in Milagro to

generate revenue of approximately $13.5 million annually.

If so, the entire project payback can happen in less than three

years.

The better news is that CLNV expects to leverage its subsidiary

to generate tens of millions of dollars of prospective business

in Ecuador. Here’s how:

Partnerships To Drive Value

Partnerships. Clean-Seas announced a partnership with EcoLibrium

(formerly EcoVerde) for the noted and other projects throughout the

country. In a previously published article covering the deal,

Gustavo Santana, CEO of EcoLibrium, stated, “In working with

Clean-Seas we have developed a win-win scenario

for Ecuador and its people, as well as for our investors.

Projects such as this one in Milagro will provide valuable data and

an attractive ROI for proving our model in Latin

America as we continue to expand our footprint throughout the

region.”

Adding to the value within the agreement, Dan Bates, Clean

Vision Chief Executive Officer, said, “EcoLibrium has opened doors

that could have taken us years to get through on our own, fast

tracking our efforts to expand into the lucrative Latin American

market. Mr. Santiago’s vision for a cleaner and more

environmentally conscious Ecuador are perfectly aligned

with that of Clean Vision’s. His relationships, at the highest

levels of government and banking, make this an exciting business

opportunity for our companies.”

According to CLNV, the plant’s output will consist of

clean-burning diesel fuel, bio-char, and industrial oil. Also

important to the value equation, it will generate approximately

70,000 carbon credits annually. And Clean-Seas, through its

recently announced JV partnership with GGII, has an

off-take agreement in place with a multinational oil company for

its clean, sulfur-free diesel fuel, which can provide approximately

100 high paying, green jobs for the local economy.

These deals could be only the start for a surge in deal making

momentum in the back half of this year.

Bringing Power By Being Environmentally

Friendly

In fact, these newest agreement follow an already busy 2021.

Earlier this month, CLNV announced that its Clean-Seas subsidiary

has established a joint venture with Roselle Capital to develop and

deploy a revolutionary pyrolysis technology in Asia that will

transform plastic waste into valuable commodities and clean energy.

Roselle Capital specializes in brokering Asian and Western

strategic deals and is leading the expansion of a self-sustaining

medical facility known as Sabah Wellness Place. That facility is

intending to use only green energy and value-added plastic waste

conversion wherever possible. That agreement is a significant step

for Clean-Seas and CLNV, who are expecting their pyrolysis

recycling technology to become one of the most important

Eco-friendly services available.

At its core, Clean Vision Corp is a merger and acquisition

(M&A) company focused on providing sustainable and clean

technology solutions. Driven by the “3 P’s” – People, Planet,

Profit – CLNV helps bring value to its acquisitions through

consultancy services, connecting them with new vertical market

opportunities and expediting the commercialization of their

products. By creating a holding company that owns a variety of

synergistic assets, CLNV can maximize the potential of its

subsidiaries and generate multiple streams of revenue from the

sales, licensing, and developments of these companies.

They are leveraging the value of alternative energy sources and

other green technologies that have become one of the most critical

industries of today. They are taking advantage of a global

initiative to move away from carbon-based fuels, creating a cleaner

environment and providing considerable opportunities in untapped

revenue sources and job creation. CLNV’s strategy of building a

diversified portfolio focused on these industries can be more than

lucrative; it’s timely.

A Cleaner Global Future

CLNV currently has two companies within its portfolio that align

with its focus on providing industry-leading and environmentally

friendly solutions.

The first of these companies is Clean-Seas, Inc., a company

specializing in turning waste plastics into clean-burning fuels.

Now 100% owned by CLNV, the company was established in 2019,

focusing on developing novel plastic recycling technologies to

reduce the amount of waste that flows into the world’s oceans. The

world currently holds 8.3 billion tons of plastic waste, and at

current rates, only 9% of this waste will end up being recycled. To

make matters worse, 260 million tons of plastic waste were

generated in 2016 alone, and experts believe that this number will

increase to 460 million per year by 2030. With landfills across the

world already reaching capacity, this waste creates an undeniable

environmental crisis. And Clean-Seas, Inc. believes it can lead the

way in finding better solutions to these problems.

Also, Clean-Seas is focused on utilizing a modern recycling

solution called pyrolysis, a thermo-chemical treatment that can be

applied to any carbon-based product. This treatment, also known as

thermal cracking, converts inputs such as plastic into the valuable

outputs of pyrolysis oil, syngas, and char. These outputs can then

be used for various powerful and environmentally friendly

applications, including clean-burning fuels and water

purification.

Discovering optimal methods of recycling plastics has been

estimated to represent a $55 billion market opportunity by 2030.

With existing operations in 3 continents, Clean-Seas, Inc. is

already well prepared to source and deploy cutting-edge

technologies for waste-to-energy recycling. Further, the management

team behind Clean-Seas has decades of expertise working in the

renewable energy sector in developing countries. Along with

reducing carbon emissions, their operations can offer these areas

employment opportunities and other social programs.

Now wholly owned by CLNV, the company will be able to better

reach these markets and expedite the development and sourcing of

their recycling technologies.

100Bio Also Creates value

The second company in the CLNV portfolio is 100Bio. Established

in 2016, 100Bio is focused on developing and manufacturing the

world’s first plant-based Styrofoam. Containing no toxic chemicals,

100Bio’s plant-based foam is 100% biodegradable and compostable,

and has already received compostability certifications from

numerous environmental organizations.

It’s a better alternative to traditional Styrofoam, which is not

biodegradable and cannot be recycled efficiently. That means that

the 14 million tons produced annually are destined to end up in a

landfill. Still, despite the results, non-degradable Styrofoam has

remained a popular choice of packaging due to its many advantages

such as food insulation, low price, and light weight.

However, 100Bio can help change the mindset and developed a

solution that could retain these inherent advantages and still

respect the environment. Not only does its foam possess the same

packaging benefits as traditional Styrofoam, but it has also

improved upon them – their products can handle more weight, provide

more robust insulation, and protect fragile contents from damage,

all while being 100% biodegradable.

Currently, the company has five issued patents to protect its

portfolio and has since used its plant-based foam for food-based

applications such as bowls, plates, cups, and egg cartons. The

company plans to utilize the strengths of its Eco-friendly foam in

further applications such as insulation, agriculture, and

sports.

Notably, 100Bio is now 51% owned by CLNV and can benefit

significantly from its strengths in connecting businesses to

vertical markets.

Expecting Growth In Q3 and Q4

The back half of this year is setting up to be a breakout period

for the company. And despite its micro-cap size, CLNV is involved

in several big missions. Moreover, its interest in two innovative

companies that are producing long-term solutions to some of the

world’s biggest environmental crises is a value proposition not

reflected in its share price.

But, with its wholly-owned subsidiary Clean-Seas, Inc. working

to recycle plastics through pyrolysis, that may soon change. Keep

in mind, CLNV is in the right sector at the right time, and its

subsidiary technologies are expected to become one of the most

effective and highly utilized technologies in the waste sector in

the coming years.

Thus, for investors that think “big picture,” current prices may

be an entry point to consider. And with CLNV demonstrating vision

and ability to create value through accretive M&A, current

price levels are indeed compelling. The most excellent news from an

investors perspective, however, is that that CLNV may be only

getting started. And the back half of this year could be a banner

period of growth.

Disclaimers: Hawk Point Media Group, LLC. (Hawk Point Media)

is responsible for the production and distribution of this content.

Hawk Point Media is not operated by a licensed broker, a dealer, or

a registered investment adviser. It should be expressly understood

that under no circumstances does any information published herein

represent a recommendation to buy or sell a

security. Our reports/releases are a commercial

advertisement and are for general information purposes ONLY. We are

engaged in the business of marketing and advertising companies for

monetary compensation. Never invest in any stock featured on our

site or emails unless you can afford to lose your entire

investment. The information made available by Hawk

Point Media is not intended to be, nor does it constitute,

investment advice or recommendations. The contributors may buy and

sell securities before and after any particular article, report and

publication. In no event shall Hawk Point Media be liable to any

member, guest or third party for any damages of any kind arising

out of the use of any content or other material published or made

available by Hawk Point Media, including, without limitation, any

investment losses, lost profits, lost opportunity, special,

incidental, indirect, consequential or punitive damages. Past

performance is a poor indicator of future performance. The

information in this video, article, and in its related newsletters,

is not intended to be, nor does it constitute, investment advice or

recommendations. Hawk Point Media strongly urges you

conduct a complete and independent investigation of the respective

companies and consideration of all pertinent risks. Readers are

advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K,

insider reports, Forms 3, 4, 5 Schedule 13D. For some content, Hawk

Point Media, its authors, contributors, or its agents, may be

compensated for preparing research, video graphics, and editorial

content. As part of that content, readers, subscribers, and website

viewers, are expected to read the full disclaimers and financial

disclosures statement that can be found by clicking HERE.

The Private Securities Litigation Reform Act of 1995

provides investors a safe harbor in regard to forward-looking

statements. Any statements that express or involve discussions with

respect to predictions, expectations, beliefs, plans, projections,

objectives, goals, assumptions or future events or performance are

not statements of historical fact may be forward looking

statements. Forward looking statements are based on expectations,

estimates, and projections at the time the statements are made that

involve a number of risks and uncertainties which could cause

actual results or events to differ materially from those presently

anticipated. Forward looking statements in this action may be

identified through use of words such as projects, foresee, expects,

will, anticipates, estimates, believes, understands, or that by

statements indicating certain actions & quote; may, could, or

might occur. Understand there is no guarantee past performance will

be indicative of future results.

Investing in micro-cap and growth securities

is highly speculative and carries an extremely high degree of risk.

It is possible that an investors investment may be lost or impaired

due to the speculative nature of the companies

profiled.

Media Contact

Company Name: Hawk Point Media

Contact Person: KL Feigeles

Email: Send

Email

Phone: 3057806988

City: Miami Beach

State: Florida

Country: United States

Website: https://www.hawkpointmedia.com

Source - https://www.digitaljournal.com/pr/clean-vision-corp-expands-international-reach-leveraging-clean-seas-plastic-to-energy-pyrolysis-technology-otc-pink-clnv

Other stocks on the move include FERN,

NSAV,

and GAXY.

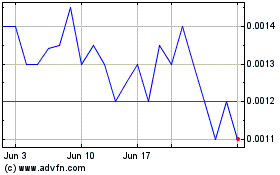

Fernhill (PK) (USOTC:FERN)

Historical Stock Chart

From Feb 2025 to Mar 2025

Fernhill (PK) (USOTC:FERN)

Historical Stock Chart

From Mar 2024 to Mar 2025