NetworkNewsWire

Editorial Coverage: The successful rise of fintech has inspired

a similar wave of technological innovation in the insurance sector,

as more companies are looking for ways to serve their

customers.

InsuraGuest Technologies Inc. (TSX.V: ISGI)

(ISGI

Profile) is one of the companies in

this arena, providing software that eases the provision of

insurance for specialist sectors. W.R. Berkley Corporation

(NYSE: WRB) is adapting through the reorganization of its

business, combining divisions and creating new ones as insurance

necessitates change. Berkshire Hathaway Inc. (NYSE:

BRK.A), like many other insurers, relies on data and

analytics to constantly improve its understanding of the market and

of insurance customers’ needs. Fairfax Financial Holdings

Ltd. (OTC: FRFHF) is invested in a range of insurance

companies around the world, providing the financial support for

insurtech innovations. And AON plc (NYSE: AON) is

experimenting with disruptive technology, such as blockchain in its

insurance products, and has gained industry recognition for its

work on cyber insurance.

- Insurance technology (insurtech) is on the rise, providing

innovative, integrated systems.

- The technology has attracted $16.5 billion of investment over a

decade; the rate of investment is increasing.

- To make the most of this, companies need to adapt approaches to

insurance and the way that they work with providers.

To view an infographic of this editorial, click here.

The Rise of Insurtech

Recent years have seen fintech — financial technology — become

one of the biggest buzzwords in investment. Technology is

revolutionizing the way that money works, from huge successes such

as contactless payments to intriguing experiments like

cryptocurrency. This has made finance easier to manage for

consumers and businesses, and provided countless opportunities for

investors along the way.

That heightened pace of change has taken hold in the insurance

market. In one survey,

74% of insurance companies said that they saw fintech innovations

as a challenge for their industry, while 43% were putting it at the

heart of their corporate strategies. Insurtech — insurance

technology — is the new game in town, applying the lessons learned

from fintech and the potential of modern technology to create

innovation and opportunity within the insurance sector.

Where Technology and Insurance Meet

Insurtech is currently being driven not by the big providers but

by the innovations of start-ups. Companies such as InsuraGuest Technologies Inc. (TSX.V:

ISGI) are targeting particular niches with their

insurance systems, using this approach as an opportunity to

innovate and capture a specific market before expanding their

offerings to a wider audience. The different insurance needs of

different markets allow insurtech companies to provide added value

by tailoring to specific needs of clients while building systems

that can be adapted elsewhere.

The example of InsuraGuest shows how this can work. InsuraGuest

is an insurtech company that has initiated its distribution by

catering to hospitality sector before it expands its product

offerings into revenue streams. ISGI combines insurance provision

with software as a service (SaaS) to provide hotels and vacation

rentals easy access to the insurance coverages they need to protect

their properties, both covering gaps in existing insurance packages

and making it easier to arrange and deliver new insurance

products.

Hospitality sectors are already a relatively tech-savvy. In

Europe, 59% of property

managers use a specialist property management system (PMS) and 67%

use a channel manager. But typically insurance hasn’t been

integrated into these systems, meaning that it has to be managed

separately. InsuraGuest recognized an opportunity and solved this

issue by integrating its insurance with 71 different PMSs around

the world, giving them software access to potentially deliver their

insurance coverages to millions of rooms, thus the ability to

obtain insurance melds seamlessly with other parts of the

process.

InsuraGuest integrates with the property-management system to

distribute insurance coverages that add a layer of protection for

the property on a primary basis, should a guest experience an

accident or theft while staying at an InsuraGuest member property.

Technology takes away much of the burden of arranging insurance,

and because the technology is provided in a SaaS format, member

properties are able to buy into all the support systems they need,

rather than just buying a standalone product and then being left to

make it work.

This sort of innovation is drawing serious money into insurtech.

Over the past decade, approximately $16.5 billion

has been invested in the sector, and the pace of investment is

only accelerating. The first half of 2019 alone saw $2.2 billion raised. This increase isn’t just driven

by a desire for change from the inside; there’s also outside

pressure. Ratings companies are looking at how insurers use

technology, and their assessments could seriously impact the future

of these companies.

One of the reasons why smaller, newer companies are so important

to this trend is their combination of skills and flexibility. Like

many other start-ups, InsuraGuest has created its own insurtech

software platform, one that can be adapted to deliver specialized

insurance coverage for a range of industries. By growing the skills

and technology in-house, ISGI is able to shift the design of the

platform to meet a wide variety of customers’ needs.

Innovating Alongside Partners

Though technology allows radically new ways of working, many

insurance companies aren’t using it to its full capacity. An

estimated 90% of the resources insurance companies are putting into

technology are currently going into maintaining existing approaches

instead of exploring real innovation. Insurers are trying to do old

things better rather than doing new, better things.

Companies such as InsuraGuest offer the opposite approach. By

integrating insurance and SaaS in a single flexible package, the

company is providing a new process, one that removes the friction

for the final customers of the insurance product. This could be a

critical step in selling better insurance.

Part of the more traditional thinking that may be holding

insurance companies back is that they’re treating

insurtech providers as vendors rather than partners. This

approach can lead to outdated standards and processes being applied

to both contracting and onboarding, despite the fact that this

technology is meant to push companies forward. Doing so counteracts

the disruption that is a critical benefit of insurtech. The real

successes will likely come from companies that can overcome this

habit and effectively partner with the insurtech innovators.

Sometimes these insurtech companies themselves are built around

a more modern, partnership-based model. ISGI appears to have

ventured out into new territory. InsuraGuest’s platform is set up

to deliver insurance packages directly to partners on a

business-to-business basis. The company has also created a fully

automatized agency/broker software program, allowing agents and

brokers the ability to sign up instantly online. This speeds up the

process of distributing ISGI’s platform and products, as these

agents and brokers then become channels to take InsuraGuest’s

insurance out to their own customers.

Insurtech provides numerous opportunities for companies to

improve their insurance offerings. From better-tailored insurance

packages to seamlessly integrating insurance, software and other

systems, ISGI may provide a chance to make real change in the

insurance industry. By using technology to change the way that

insurance is delivered, companies such as InsuraGuest are pulling

the industry into the future.

Transforming the Insurance Industry

As the insurance industry faces the challenge of the modern

world and seizes the opportunities that insurtech offers, many

companies are looking for ways to improve how they work in the

sector.

For some, this means organizational change to reflect shifting

markets, products and processes. W.R. Berkley Corporation

(NYSE: WRB), a large American insurance holding company,

has accomplished this through a long-term strategy of decentralized

operations, providing the company with the flexibility to respond

to ongoing change. Recent shifts in the company’s structure include

the combination of its

two healthcare-related units into one, creating a single source

for the wide range of insurance products that the healthcare market

needs. Another of its

recently formed divisions, Berkley Prime Transportation, will

be focusing on the use of technology and analytics to provide

high-quality, responsive services to the commercial transport

sector.

Holding company Berkshire Hathaway Inc. (NYSE:

BRK.A) includes insurance among its wide range of

interests, through Berkshire Hathaway Specialty Insurance and

Berkshire Hathaway Travel Protection. Between them, these companies

provide insurance covering a wide range of sectors, including

travel, professional liability, and homeowners insurance. The

company places an emphasis on the importance of

data in understanding insurance needs, and it’s this type of

careful analytic work that allows insurers to provide suitable

products at the right rate for their customers.

A specialist insurance investment company, Fairfax

Financial Holdings Ltd (OTC: FRFHF) is engaged in property

and casualty insurance through a range of subsidiaries. These

insurance and reinsurance companies work on a decentralized basis,

each with its own management team providing a focused underwriting

strategy suited to its market, giving the company valuable

flexibility. Late last year, Fairfax announced a

substantial investment from OMERS, the pension plan for

Ontario’s municipal employees, in Fairfax’s UK run-off group,

RiverStone UK.

A global professional services firm, AON plc (NYSE:

AON) provides insurance along with data services and

retirement support. Aon has been using the latest technology to

develop new insurance products, including blockchain-based agricultural insurance policies for

smallholder farmers in Sri Lanka. This use of innovative

technology to serve a specific community shows the value of

combining innovation and flexibility to reach an underserved niche.

In 2019 the company won awards from

Business Insurance magazine for its cyber-risk solutions.

While much is happening in the world of insurance, and big

companies are expanding their insurtech offerings, real innovation

still looks to depend on the flexibility of start-ups and small

firms.

For more information on InsuraGuest Technologies, visit InsuraGuest

Technologies Inc. (TSX.V: ISGI)

About NetworkNewsWire

NetworkNewsWire

(“NNW”) is a financial news and content distribution company, one

of 40+ brands within the InvestorBrandNetwork (“IBN”), that

provides: (1) access to a network of wire

solutions via NetworkWire to

reach all target markets, industries and demographics in the most

effective manner possible; (2) article and

editorial syndication to 5,000+ news outlets; (3)

enhanced press release solutions to ensure maximum

impact; (4) social media distribution via IBN

millions of social media followers; and (5) a full

array of corporate communications solutions. As a multifaceted

organization with an extensive team of contributing journalists and

writers, NNW is uniquely positioned to best serve private and

public companies that desire to reach a wide audience comprising

investors, consumers, journalists and the general public. By

cutting through the overload of information in today’s market, NNW

brings its clients unparalleled visibility, recognition and brand

awareness. NNW is where news, content and information converge.

To receive SMS text alerts from NetworkNewsWire, text

“STOCKS” to 77948 (U.S. Mobile Phones Only)

For more information, please visit https://www.NetworkNewsWire.com

Please see full terms of use and disclaimers on the

NetworkNewsWire website applicable to all content provided by NNW,

wherever published or re-published: http://NNW.fm/Disclaimer

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

NetworkNewsWire is part of the InvestorBrandNetwork

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by NNW are

solely those of NNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable NNW for any investment

decisions by their readers or subscribers. NNW is a news

dissemination and financial marketing solutions provider and are

NOT registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, NNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer’s filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer’s securities, including, but not

limited to, the complete loss of your investment.

NNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and NNW undertakes no

obligation to update such statements.

Source:

NetworkNewsWire

Contact:

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

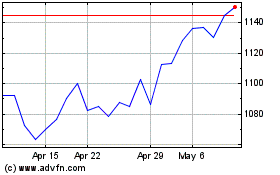

Fairfax Financial (PK) (USOTC:FRFHF)

Historical Stock Chart

From Nov 2024 to Dec 2024

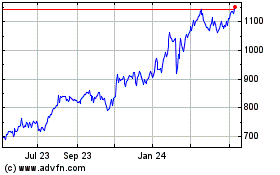

Fairfax Financial (PK) (USOTC:FRFHF)

Historical Stock Chart

From Dec 2023 to Dec 2024