NOTICE

OF SPECIAL MEETING OF SHAREHOLDERS

To Be Held June 23, 2020

|

TO

THE SHAREHOLDERS OF ELITE PHARMACEUTICALS, INC.:

NOTICE

IS HEREBY GIVEN that a special meeting of shareholders (the “virtual Special Meeting”) of Elite Pharmaceuticals, Inc.,

a Nevada corporation will be held on June 23, 2020, at 10:30 a.m., Easter Daylight Time. The meeting will be held virtually via

live webcast at https://web.lumiagm.com/289761342. Shareholders will NOT be able to attend the Special Meeting in-person.

The virtual Special Meeting will be held for the following purposes:

|

|

(1)

|

To

again vote on the amendment of our Articles of Incorporation to increase the number of shares of common stock the Company is authorized

to issue from 995,000,000 shares to 1,445,000,000 shares and to file a new amendment to our Articles of Incorporation reflecting

such approval;

|

|

|

(2)

|

To

approve a proposal to grant discretionary authority to adjourn the virtual Special Meeting, if necessary, to solicit additional

proxies in the event that there are not sufficient votes at the time of the virtual Special Meeting to approve Proposal 1;

|

|

|

(3)

|

To

transact such other business as may properly come before the virtual Special Meeting or any adjournments or postponement thereof.

|

Our

Board of Directors has fixed the close of business on April 27, 2020 as the record date for the determination of the Shareholders

entitled to notice of, and to vote at, the virtual Special Meeting.

YOUR

VOTE IS IMPORTANT. Whether or not you plan to attend the virtual Special Meeting, we urge you to submit your vote as soon

as possible to ensure your shares are represented. Returning the proxy does not deprive you of your right to attend the virtual

Special Meeting and to vote your shares at this meeting. The proxy statement explains proxy voting and the matters to be voted

on in more detail. The proxy statement and related materials are being mailed to you commencing on or about May 12, 2020.

|

Important

Notice Regarding the Availability of Proxy Materials for the Special Shareholders’ Meeting

to

Be Held Virtually, Via Live Webcast at https://web.lumiagm.com/289761342,

at

10:30 a.m., Eastern Daylight Time on Tuesday, June 23, 2020.

|

|

|

|

The

proxy statement, the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2019 and Quarterly Report

on Form 10-Q for quarter ended December 31, 2019 are available at https://elite.irpass.com/shareholder_meeting.

|

|

|

By order

of the Board of Directors

|

|

|

|

|

Date:

April 29, 2020

|

By:

|

/s/ Nasrat

Hakim

|

|

|

|

Nasrat

Hakim

President

and Chief Executive Officer

|

|

|

ELITE

PHARMACEUTICALS, INC.

|

|

|

|

165 Ludlow Avenue

|

|

|

|

Northvale, New

Jersey 07647

|

|

|

|

|

|

|

|

PROXY STATEMENT

|

|

Important

Notice Regarding the Availability of Proxy Materials for the

virtual

Special Meeting of Shareholders to be held on June 23, 2020:

This

Proxy Statement, the proxy card, our Annual Report on Form 10-K for the fiscal year ended March 31, 2019 and our Quarterly Report

on Form 10-Q for quarter ended December 31, 2019 (together, the “Proxy Materials”) are available on the internet at:

https://elite.irpass.com/shareholder_meeting. Please note that, while our Proxy Materials are available at this website, no other

information contained on our website is incorporated by reference in or considered to be a part of this Proxy Statement. We are

hosting this Special Meeting virtually as part of our effort to maintain a safe and healthy environment for our directors, members

of management and Shareholders who wish to attend the Special Meeting, and in light of the COVID-19 pandemic, our Board believes

that hosting a virtual Special Meeting is in our best interest and the best interests of our Shareholders.

This

Proxy Statement is being furnished to Shareholders in connection with the virtual Special Meeting of Shareholders of Elite to

be held on June 23, 2020 at 10:30 a.m. Eastern Daylight Time and any adjournment thereof (the “virtual Special Meeting”).

This Special Meeting will be a virtual-only meeting via live webcast. You will not be able to attend the Special Meeting in person.

You will be able to attend the virtual Special Meeting by accessing at https://web.lumiagm.com/289761342 password: “elite2020”

(case sensitive) and following the instructions set forth below in “Meeting Attendance”.

Execution

and return of the enclosed proxy card is being solicited by and on behalf of the Board of Directors of the Company (the “Board

of Directors”). The costs incidental to soliciting and obtaining proxies, including the cost of reimbursing banks and brokers

for forwarding proxy materials to their principals, will be paid by us. Proxies may be solicited, without extra compensation,

by our officers and employees, both in person and by mail, telephone, facsimile and other methods of communication.

INFORMATION CONCERNING THE MEETING

INFORMATION

CONCERNING SOLICITATION AND VOTING

General

This

Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors for our virtual Special

Meeting of Shareholders to be held on June 23, 2020, and any adjournments thereof. You are receiving the Proxy Materials because

you own shares of Common Stock or shares of Series J Preferred Stock that entitle you to vote at the virtual Special Meeting.

By use of the proxy, you can vote, whether or not you attend the virtual Special Meeting. This Proxy Statement describes the matters

we would like you to vote on and provides information on those matters so you can make an informed decision.

The

information included in this Proxy Statement relates to the proposals to be voted on at the virtual Special Meeting, the voting

process and other required information.

Purpose

The

purpose of the virtual Special Meeting is:

|

|

(1)

|

To

again vote on the amendment of our Articles of Incorporation to increase the number of

shares of common stock the Company is authorized to issue from 995,000,000 shares to

1,445,000,000 shares (“Proposal No. 1”);

|

|

|

(2)

|

To

approve a proposal to grant discretionary authority to adjourn the virtual Special Meeting,

if necessary, to solicit additional proxies in the event that there are not sufficient

votes at the time of the virtual Special Meeting to approve Proposal 1 (“Proposal

No. 2”); and

|

|

|

(3)

|

To

transact such other business as may properly come before the virtual Special Meeting

or any adjournments or postponement thereof.

|

As

described below, we are again seeking approval from our Shareholders of the prior amendment to our Articles of Incorporation to

increase the number of shares of common stock our company is authorized to issue from 995,000,000 shares to 1,445,000,000 shares

(the “Share Increase Amendment”). A proposal to approve this amendment was included as Proposal No. 2 (the “Original

Amendment Proposal”) in the Proxy Statement (the “Annual Meeting Proxy Statement”) for our prior Annual Shareholders’

Meeting held on December 4, 2019 (the “Annual Meeting”). The Original Amendment Proposal was approved by Shareholders

at the Annual Meeting. Following such approval, the Share Increase Amendment was filed with the Secretary of State of Nevada and

became effective.

In

preparation for the Annual Meeting, we and our advisers assessed whether the Original Amendment Proposal was routine or non-routine

under applicable New York Stock Exchange (“NYSE”) rules. That determination is based on the particular facts and circumstances

associated with a proposal to increase the number of authorized shares; some share increase proposals are considered routine and

others are considered non-routine. Based on our assessment, we indicated in the Annual Meeting Proxy Statement that the Original

Amendment Proposal was a non-routine matter under NYSE rules and that, accordingly, brokers holding shares in “street name”

on behalf of beneficial owners did not have discretionary authority to vote those shares on the Original Amendment Proposal without

direction from the beneficial owners. However, Broadridge Financial Solutions (“Broadridge”) later determined that

the Original Amendment Proposal was a routine matter under NYSE rules. As such, the proxy cards prepared by Broadridge and sent

to its brokers (who, in turn, sent the ballots to their clients) clearly indicated that the Original Amendment Proposal was routine.

The proxy cards specifically included the statement: “If you do not provide us with your voting instructions, we will vote

your shares at our discretion on those proposals we are permitted to vote on by New York Stock Exchange rules.” As a result,

the vote on the Original Amendment Proposal was conducted properly as a routine matter (with brokers using discretionary authority

to vote in favor of the Original Amendment Proposal) and shareholder votes were tabulated correctly. The Share Increase Proposal

was approved by the requisite vote under Chapter 78 of the Nevada Revised Statutes and our Articles of Incorporation and Bylaws.

We

are confident that the vote on the Original Amendment Proposal was entirely proper and the Share Increase Amendment was therefore

adopted by our Shareholders and is now effective. However, we recognize the inconsistent description of the nature of the proposal

under NYSE rules in the Prior Proxy Statement and the proxy card. In an abundance of caution, we have determined to permit Shareholders

to again approve the Share Increase Amendment, this time with a consistent classification of the proposal as routine in all solicitation

materials and proxy cards. We have not issued any of the additional shares authorized by the Share Increase Amendment, and unless

and until the Share Increase Amendment is again approved by our Shareholders, we do not intend to issue or reserve for issuance

any such additional shares.

Meeting

Attendance

Shares

Registered in Your Name. If you were a Shareholder of record at the close of business on the Record Date, you do not need

to do anything in advance to attend and/or vote your shares electronically at the virtual Special. To attend the meeting, go to

https://web.lumiagm.com/289761342, click on “I have a login,” enter the control number found on your proxy card you

previously received, and enter the password “elite2020” (the password is case sensitive). Then, follow the instructions

on the screen. We encourage you to access the meeting prior to the start time leaving ample time for the check in. Whether or

not you attend the meeting, we urge you to mail in your proxy.

Shares

Registered in the Name of a Broker, Bank or Other Nominee. If your shares are registered in the name of your broker, bank

or other agent, you are the “beneficial owner” of those shares and those shares are considered as held in “street

name.” If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have

received a proxy card and voting instructions with these proxy materials from that organization rather than directly from us.

Simply complete and mail the proxy card to ensure that your vote is counted. You may be eligible to vote your shares electronically

over the Internet or by telephone. A large number of banks and brokerage firms offer Internet and telephone voting. If your bank

or brokerage firm does not offer Internet or telephone voting information, please complete and return your proxy card in the self-addressed,

postage-paid envelope provided.

To

vote electronically at the virtual Special Meeting, you must first obtain a valid legal proxy from your broker, bank or other

agent and then register in advance to attend the virtual Special Meeting. Follow the instructions from your broker or bank included

with these proxy materials, or contact your broker or bank to request a legal proxy form.

After

obtaining a valid legal proxy from your broker, bank or other agent, to then register to attend the virtual Special Meeting, you

must submit proof of your legal proxy reflecting the number of your shares along with your name and email address to American

Stock Transfer & Trust Company, LLC. Requests for registration should be directed to proxy@astfinancial.com or to facsimile

number 718-765-8730. Written requests can be mailed to:

American

Stock Transfer & Trust Company LLC

Attn:

Proxy Tabulation Department

6201

15th Avenue

Brooklyn,

NY 11219

Requests

for registration must be labeled as “Legal Proxy” and be received No later than 5:00 p.m., Eastern Daylight Time,

on June 16, 2020.

You

will receive a confirmation of your registration by email after we receive your registration materials. You may attend the virtual

Special Meeting at https://web.lumiagm.com/289761342 password: “elite2020” (case sensitive) and vote your shares during

the meeting. Follow the instructions provided to vote. We encourage you to access the meeting prior to the start time leaving

ample time for the check in.

Record

Date and Voting Rights

The

holders of our Common Stock and our Series J Preferred Stock as of April 27, 2020 (the “Record Date”) are entitled

to vote at the virtual Special Meeting. Each share of Common Stock entitles the holder of record thereof at the close of business

on the Record Date to one vote on each of the matters to be voted upon at the virtual Special Meeting. Each share of Series J

Preferred Stock entitles the holder of record thereof to the number of votes equal to the number of shares of Common Stock into

which such share of Series J Preferred Stock is convertible (6,574,621 shares of Common Stock per whole share of Series J Preferred

Stock), on each of the matters to be voted upon at the virtual Special Meeting. As of the Record Date, we had outstanding 840,404,367

shares of Common Stock (excluding 100,000 treasury shares), and 24.03443452410 shares of Series J Preferred Stock that were convertible

into 158,017,321 shares of Common Stock. Accordingly, the maximum number of votes entitled to be cast at the virtual Special Meeting

on each of the matters to be voted upon is 998,421,688.

Shareholders

vote at the virtual Special Meeting by casting ballots (at the meeting or by proxy) which will be tabulated by a person who is

appointed by the Board of Directors before the virtual Special Meeting to serve as inspector of election at the virtual Special

Meeting and who has executed and verified an oath of office.

Quorum;

Abstentions; Vote Required

A

quorum must exist for the transaction of business at the virtual Special Meeting (other than a motion to adjourn the virtual Special

Meeting). The presence at the virtual Special Meeting, by remote communication or by proxy, of the holders of a majority of the

voting power of the shares of capital stock of Elite issued and outstanding and entitled to vote at the virtual Special Meeting,

will constitute a quorum for the transaction of business at the virtual Special Meeting. Abstentions are counted as present and

entitled to vote for purposes of determining a quorum. If you submit a properly executed proxy card, even if you abstain from

voting, your shares will be considered part of the quorum.

Assuming

that a quorum is present, approval of Proposal No. 1 will require the affirmative vote of the holders of a majority of the voting

power of the shares of our capital stock outstanding as of the Record Date, or at least 499,210,845 votes. If you abstain, your

abstention will have the same effect as a vote against this proposal.

Assuming

that a quorum is present, approval of Proposal No. 2 will require that the number of votes cast in favor of the Proposal must

exceed the number of vote cast in opposition to the Proposal. Abstentions with regard to this proposal are not considered to have

been voted on this proposal and therefore will not have any effect on the vote for such proposals.

Solicitation

Solicitation

of proxies may be made by our directors, officers and regular employees by mail, telephone, facsimile transmission or other electronic

media and in person for which they will receive no additional compensation. The expenses of preparing, printing and assembling

the materials used in the solicitation of proxies on behalf of the Board of Directors will be borne by us. Upon request, we will

reimburse the reasonable fees and expenses of banks, brokers, custodians, nominees and fiduciaries for forwarding proxy materials

to, and obtaining authority to execute proxies from, beneficial owners for whose accounts they hold shares of Common Stock.

Voting

of Proxies

If

the enclosed form of proxy is properly signed and returned, the shares represented thereby will be voted as specified in the proxy.

If you do not specify in the proxy how your shares are to be voted, the shares will be voted as recommended by the Board of Directors:

FOR Proposals No. 1 and No. 2.

Voting

of shares held in Brokerage Accounts

If

you hold your shares at a brokerage firm, you should instruct your broker how you would like to vote your shares by using the

written instruction form provided by your broker. Brokers holding shares of record in “street name” for a client have

the discretionary authority to vote on some matters (“routine” matters) if they do not receive timely instructions

from the client regarding how the client wants the shares voted. Both Proposal No. 1 and No. 2 are considered routine matters

and brokers will be permitted to vote in their discretion on these matters on behalf of clients who have not timely furnished

voting instructions.

If

you hold your common shares in your broker’s name and wish to vote in person at the virtual Special Meeting, you must timely

contact your broker and request a document called a “legal proxy.” Please see “Meeting Attendance; Shares

Registered in the Name of a Broker, Bank or Other Nominee” above.

Revocation

You

have the right to revoke your proxy at any time before it is voted by attending the virtual Special Meeting and voting at the

meeting or by filing with our Secretary either a written instrument revoking the proxy or another executed proxy bearing a later

date.

No

Appraisal Rights

Shareholders

entitled to vote will not have any appraisal rights in connection with any of the proposals to be voted on at the virtual Special

Meeting.

Developments

Regarding COVID-19 Could Impact The Date, Time or Location of The Meeting

We

are actively monitoring the public health and travel safety concerns relating to COVID-19 and the advisories or mandates that

federal, state, and local governments, and related agencies, may issue. If we determine that it is not possible or advisable to

hold our virtual Special Meeting as currently planned, we will announce by press release as well as through a filing with the

Securities and Exchange Commission.

Questions

on the Proposals or How to Vote

If

you have any questions regarding any of the proposals or how to vote your shares, please contact Dianne Will, Investor Relations

for Elite at 518-398-6222 (collect calls will be accepted) or via email at dianne@elitepharma.com.

Recommendations

of the Board of Directors

This

proxy solicitation is being made by the Company. The Board of Directors recommends a vote:

|

|

●

|

FOR

Proposal No. 1 - the amendment of our Articles of Incorporation to again increase

the number of shares of common stock the Company is authorized to issue from 995,000,000

shares to 1,445,000,000 shares and the filing of a new amendment to our Articles of Incorporation

reflecting such approval;

|

|

|

●

|

FOR

Proposal No. 2 - granting discretionary authority to adjourn the virtual Special

Meeting, if necessary, to solicit additional proxies in the event that there are not

sufficient votes at the time of the virtual Special Meeting to approve Proposal 1.

|

Other

Business

As

of the date of this Proxy Statement, we have no knowledge of any business other than that described in the Notice of virtual Special

Meeting that will be presented for consideration at the virtual Special Meeting and plan on limiting business solely to the proposals

described herein. If any other business should properly come before the virtual Special Meeting, the persons appointed by the

enclosed form of proxy shall have discretionary authority to vote all such proxies as they shall decide.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth certain information, as of the Record Date (except as otherwise indicated), regarding beneficial ownership

of our Common Stock and our Series J Preferred Stock by (i) each person who is known by us to own beneficially more than 5% of

each such class, (ii) each of our directors, (iii) each of our executive officers and (iv) all our directors and executive officers

as a group. On the Record Date, we had 840,404,367 shares of Common Stock outstanding (exclusive of 100,000 treasury shares) and

24.03443452410 shares of Series J Preferred Stock outstanding. On any matter presented to the holders of our Common Stock for

their action or consideration at any meeting of our Shareholders, each share of Common Stock entitles the holder to one vote and

each share of Series J Preferred Stock entitles the holder to the number of votes equal to the number of shares of Common Stock

into which such share of Series J Preferred Stock is convertible (6,574,621 per whole share).

As

used in the table below and elsewhere in this Proxy Statement, the term beneficial ownership with respect to a security consists

of sole or shared voting power, including the power to vote or direct the vote, and/or sole or shared investment power, including

the power to dispose or direct the disposition, with respect to the security through any contract, arrangement, understanding,

relationship, or otherwise, including a right to acquire such power(s) during the 60 days immediately following April 27, 2020.

Except as otherwise indicated, the Shareholders listed in the table have sole voting and investment powers with respect to the

shares indicated.

|

|

|

Amount and Nature of

Beneficial Ownership

|

|

|

Percent (%)

of Voting

|

|

|

Name and Address Of Beneficial Owner of Common Stock

|

|

Common Stock

|

|

|

Series J

Preferred

Stock

|

|

|

Securities

Beneficially

Owned (11)

|

|

|

Nasrat Hakim, President, Chief Executive Officer and Chairman of the Board of Directors*

|

|

|

107,760,381

|

(1)

|

|

|

24.03443452410

|

(2)

|

|

|

24.7

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Barry Dash, Director*

|

|

|

1,932,792

|

(3)

|

|

|

|

|

|

|

**

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jeffrey Whitnell, Director*

|

|

|

1,884,257

|

(4)

|

|

|

|

|

|

|

**

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Eugene Pfeifer, Director*

|

|

|

233,414

|

(5)

|

|

|

|

|

|

|

**

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Davis Caskey, Director*

|

|

|

746,673

|

(6)

|

|

|

|

|

|

|

**

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Carter J. Ward, Chief Financial Officer *

|

|

|

4,697,089

|

(7)

|

|

|

|

|

|

|

**

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Douglas Plassche, Executive Vice President *

|

|

|

4,133,572

|

(8)

|

|

|

|

|

|

|

**

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ashok Nigalaye, Former Director

|

|

|

50,265,539

|

(9)

|

|

|

|

|

|

|

4.7

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All Directors and Officers as a group

|

|

|

121,154,764

|

(10)

|

|

|

24.03443452410

|

(2)

|

|

|

25.9

|

%

|

|

|

*

|

The

address is c/o Elite Pharmaceuticals Inc., 165 Ludlow Avenue, Northvale, NJ 07647.

|

|

(1)

|

Includes 11,797,561 shares of Common Stock held

and 16,954,159 shares of Common Stock due and owing to Mr. Hakim as of the Record Date for compensation earned pursuant to

Mr. Hakim’s employment agreement with the Company and 79,008,661 shares of Common Stock issuable upon exercise of the

Series J Warrants.

|

|

|

|

|

(2)

|

Series J Preferred Stock has an aggregate of

158,017,321 voting rights.

|

|

|

|

|

(3)

|

Includes 1,416,011 shares of Common Stock held

and 516,781 shares of Common Stock due and owing to Dr. Dash as of the Record Date for Directors fees accrued as of such date.

|

|

|

|

|

(4)

|

Includes 1,367,476 shares of Common Stock held

and 516,781 shares of Common Stock due and owing to Mr. Whitnell as of the Record Date for Directors fees accrued as of such

date.

|

|

(5)

|

Mr. Pfeifer passed away on June 10, 2018. Includes

233,414 shares still held in Mr. Pfeifer’s account with the Company’s transfer agent.

|

|

|

|

|

(6)

|

Includes 229,892 shares of Common Stock held

and 516,781 shares of Common Stock due and owing to Mr. Caskey as of the Record Date for Directors fees accrued as of such

date.

|

|

|

|

|

(7)

|

Includes 3,771,919 shares of Common Stock held

and 775,170 shares of Common Stock due and owing to Mr. Ward as of the Record Date for salaries earned pursuant to Mr. Ward’s

employment agreement with the Company, and vested options to purchase 150,000 shares of Common Stock.

|

|

|

|

|

(8)

|

Includes 487,596 shares of Common Stock held

645,976 shares of Common Stock due and owing to Mr. Plassche as of the Record Date for salaries earned pursuant to Mr. Plassche’s

employment agreement with the Company, and vested options to purchase 3,000,000 shares of Common Stock.

|

|

|

|

|

(9)

|

Dr. Nigalaye resigned on June 5, 2015. Address

is c/o Granulation Technology Inc. 12 Industrial Road, Fairfield, NJ 07004. Includes 50,265,539 shares of Common Stock held

with the Company’s transfer agent in account(s) that is (are) beneficially owned by Dr. Nigalaye.

|

|

|

|

|

(10)

|

Relates only to current directors and officers.

Includes 19,070,455 shares of Common Stock held, 19,925,648 shares of Common Stock due and owing as of the Record Date for

director’s fees and salaries accrued as of such date, vested options to purchase 3,150,000 shares of Common Stock, and

warrants to purchase 79,008,661 shares of Common Stock.

|

|

|

|

|

(11)

|

The denominator includes 158,017,321 votes attributable

to the outstanding Series J Preferred Stock. Accordingly, the percentage of Common Stock beneficially owned by each Owner

listed in the table other than Mr. Hakim is slightly greater than the percentage listed in this column.

|

Changes

in Control

The

following information is provided with respect to any arrangements known to the Company the operation of which may at a subsequent

date result in a change of control of the Company. Each share of Series J Preferred Stock entitles the holder of record thereof

to the number of votes equal to the number of shares of Common Stock into which such share of Series J Preferred Stock is convertible.

As of the Record Date, Nasrat Hakim beneficially owns approximately 24.7% of our voting equity (calculated in accordance with

Rule 13d-3 of the Securities Exchange Act of 1934). However, pursuant to Rule 13d-3, beneficial ownership includes shares of common

stock issuable within 60 days of the date of computation of beneficial ownership.

PROPOSAL

NO. 1

approval

of amendment to our Articles of Incorporation

to

AGAIN increase the number of shares of common stock the Company is authorized

to

issue from 995,000,000 shares to 1,445,000,000 shares and tHE filING OF a new amendment

to

our Articles of Incorporation reflecting such approval

THE

BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSAL NO. 1

For

the reasons stated above in Information Concerning The Meeting; Purpose, this proposal, which was previously voted upon

and approved at Elite’s December 4, 2019 Annual Shareholder’s Meeting, is being presented again for Shareholder approval.

The language for this Proposal’s vote count has been edited for clarity. Since the date of the prior approval of the authorized

share increase, we have not issued or reserved for issuance any of the additionally authorized shares of Common Stock.

Prior

to our 2019 Annual Meeting, our Articles of Incorporation authorized us to issue up to 995,000,000 shares of Common Stock, $.001

par value, and 15,000 shares of Preferred Stock, $0.01 par value. For the reasons stated above, our Board of Directors again unanimously

adopted, subject to shareholder approval, the same amendment to our Articles of Incorporation to increase the authorized number

of shares of our Common Stock by 450,000,000 shares to 1,445,000,000 shares. Under the amendment, Article IV, Section

4.1 of our Articles of Incorporation would read as follows:

“4.1.

Authorized Capital Stock. The aggregate number of shares which this Corporation shall have authority to issue is One Billion Four

Hundred Forty Five Million Fifteen Thousand (1,445,015,000) shares, consisting of (a) One Billion Four Hundred Forty five Million

(1,445,000,000) shares of Common Stock, par value $0.001 per share (the “Common Stock”) and (b) Fifteen Thousand,

(15,000) shares of Preferred Stock, par value $0.01 per share (the “Preferred Stock”), issuable in one or more series

as hereinafter provided. A description of the classes of shares and a statement of the number of shares in each class and the

relative rights, voting power, and preferences granted to and restrictions imposed upon the shares of each class are as follows:”

The

complete text of the proposed Amendment to the Articles of Incorporation is attached as Appendix A to this Proxy Statement.

If Shareholders approve Proposal No. 1, this Amendment will be filed with the Secretary of State of Nevada, unless we determine

that such filing is not necessary.

Background

We

may issue shares of capital stock to the extent such shares have been authorized under our Articles of Incorporation.

As

of the Record Date, the total shares of Common Stock issued and outstanding and reserved for issuance upon the exercise of outstanding

warrants, options, and the conversion of outstanding shares of preferred stock totaled 1,185,257,334 shares, including, without

limitation:

|

|

●

|

158,017,321 shares issuable upon conversion of shares of our outstanding Series J of preferred stock;

|

|

|

|

|

|

|

●

|

79,008,661 shares issuable upon exercise of certain warrants;

|

|

|

|

|

|

|

●

|

840,404,367 shares of Common Stock (exclusive of 100,000 treasury shares);

|

|

|

|

|

|

|

●

|

99,566,985 shares of Common Stock reserved as per the Registration Statement on Form S-3 declared effective by the Securities and Exchange Commission on June 7, 2017;

|

|

|

|

|

|

|

●

|

5,510,000 shares reserved for issuance pursuant to options to purchase Common Stock;

|

|

|

|

|

|

|

●

|

2,750,000 shares reserved pursuant to the 2014 Equity Incentive Plan (the “2014 Plan”).

|

The

foregoing excludes an aggregate of 19,925,648 shares issuable to officers and directors as of March 31, 2020 as part of their

compensation arrangements.

Had

the Original Amendment Proposal not passed, the number of shares of Common Stock we are required to issue under the derivative

securities described above would have exceeded the number of shares of Common Stock available for future issuances.

The

terms of our 2014 Plan, the certificates of designation for the Series J Preferred Stock, the instruments governing the rights

of option and warrant holders and our Purchase Agreement with Lincoln Park Capital all provide that we will at all times reserve

and keep available out of our authorized and unissued shares of Common Stock for the sole purpose of issuance under or upon the

conversion or exercise of such securities not less than the aggregate number of shares of the Common Stock as shall from time

to time be sufficient to effect the conversion or exercise of all such outstanding securities. If at any time the number of authorized

but unissued shares of Common Stock is not sufficient to effect the issuance, conversion or exercise of such securities, we are

required to take such corporate action as may be necessary to increase our authorized but unissued shares of Common Stock to such

number of shares as shall be sufficient for such purposes, including, without limitation, using our best efforts to obtain the

requisite shareholder approval of an amendment to our Articles of Incorporation. The Share Increase Amendment accomplished this.

Proposal No. 1 simply would validate the Share Increase Amendment.

If

shareholder approval had not been obtained prior to April 28, 2021 (the “Dividend Commencement Date”) and our authorized

shares of Common Stock had not been sufficiently increased by such date, Nasrat Hakim, the holder of the Series J Preferred Stock,

would have been entitled to a dividend equal to twenty percent of the stated value ($1,000 per share) of Series J Preferred Stock

commencing on the Dividend Commencement Date. As a result of the Share Increase Amendment, Mr. Hakim is not entitled to such dividend.

In

addition, our employment agreements with Nasrat Hakim, Carter J Ward and other employees provide that we make certain payments

to them in Common Stock as part of their compensation.

We

anticipate that we may issue additional shares in connection with one or more of the following:

|

|

●

|

financing

transactions, such as private and/or public offerings of Common Stock or convertible securities to fund business and business

expansion (In this regard, we anticipate needing funding for the development and filing of products until the time when currently

filed ANDAs are approved and launched and revenues are sufficient to cover research and development costs);

|

|

|

|

|

|

|

●

|

strategic

investments;

|

|

|

|

|

|

|

●

|

corporate

transactions, such as stock splits or stock dividends;

|

|

|

|

|

|

|

●

|

Incentive

and employee benefit plans; and

|

|

|

|

|

|

|

●

|

otherwise

for corporate purposes that have not yet been identified.

|

No

Other Current Plans for Issuance of Newly Authorized Shares

Except,

as described above, we have no current plans to issue any of the our authorized shares, even if the Original Share Amendment had

not been approved.

Our

Board of Directors believes that, had the Original Share Amendment not been approved, the lack of additional authorized shares

of Common Stock available for issuance would restrict our flexibility to act in a timely manner in meeting future capital needs. In

order to provide our Board of Directors with certainty and flexibility to meet such needs, the Board of Directors believes it

is in the best interests of our Company at this time to validate the Original Share Amendment.

If

this proposal is not adopted and we were to invalidate the Original Share Amendment, management believes we would be severely

limited in our ability to raise capital, enter transactions that could be advantageous to the Company or issue stock as required

under outstanding derivative securities. Further, if we do not have available the increased authorized shares and other

funding sources are not available to us, our ability to pursue development and commercialization activities may be limited or

delayed.

If

our Shareholders approve the amendment to our Articles of Incorporation thereby validating the Original Share Amendment, we will

have 259,842,449 shares of Common Stock (exclusive of 19,925,648 shares owed to officers and directors) not reserved for any specific

use and available for future issuances.

The

additional authorized shares available as a result of the Original Share Amendment, especially if validated by approval of Proposal

No. 1, may be issued upon the approval of our Board of Directors at such times, in such amounts, and upon such terms as our Board

of Directors may determine, without further approval of the Shareholders, unless such approval is expressly required by applicable

law, regulatory agencies, or any exchange or quotation service on which our Common Stock may then be listed. The ability of our

Board of Directors to issue shares from the additional authorized shares will allow the Board, except under limited circumstances,

to perform the functions for which they are currently empowered under our Articles of Incorporation and By-Laws in executing certain

transactions, such as acquisitions, investments, or other transactions, pursuant to which such additional authorized shares could

be issued without further shareholder approval of the specific transaction.

Our

Shareholders do not have preemptive rights with respect to future issuances of additional shares of Common Stock, which means

that current Shareholders do not have a prior right to purchase any new issue of Common Stock of our Company in order to maintain

their proportionate ownership interest. As a result, the issuance of a significant amount of additional authorized

Common Stock (other than as the result of a stock split or other pro rata distribution to Shareholders) would result in a significant

dilution of the beneficial ownership interests and/or voting power of each company Shareholder who does not purchase additional

shares to maintain his or her pro rata interest. As additional shares are issued, the shares owned by our existing Shareholders

will represent a smaller percentage ownership interest in our Company. In addition, the issuance of additional shares

of our Common Stock could result in a decrease in the trading price of our Common Stock, depending on the price at which such

shares are issued.

Possible

Anti-Takeover Effects of the Proposal

Our

Board of Directors does not intend or view the increase in the number of authorized shares of our Common Stock as an anti-takeover

measure, but rather, as a means of providing greater flexibility to the Board of Directors as indicated above. Nevertheless,

the increase in our authorized shares could enable the Board of Directors to issue additional shares to render more difficult

or discourage an attempt by another person or entity to obtain control of our Company, even if the holders of our Common Stock

deem such acquisition of control of our Company to be in their best interests. The issuance of additional shares of

Common Stock in a public or private sale, merger or similar transaction would increase the number of outstanding shares and thereby

could dilute the proportionate interest of a party attempting to gain control of our Company. As of the date of this

Proxy Statement, our Board of Directors and our management are not aware of any attempt or plan to takeover or acquire our Company

or our Common Stock, and the increase in authorized shares of our Common Stock was not prompted by any takeover or acquisition

effort or threat.

As

of the date hereof, we do have certain other measures that can be deemed to be anti-takeover measures. our current Articles of

Incorporation allow us to issue shares of preferred stock without any vote or further action by our Shareholders. Our Board of

Directors has the authority to fix and determine the relative rights and preferences of preferred stock. Our Board of Directors

also has the authority to issue preferred stock without further shareholder approval. As a result, our Board of Directors could

authorize the issuance of a series of preferred stock that would grant to holders the preferred right to our assets upon liquidation,

the right to receive dividend payments before dividends are distributed to the holders of Common Stock and the right to the redemption

of the shares, together with a premium, prior to the redemption of our Common Stock. The foregoing provisions remain unchanged

in the Articles of Incorporation as anticipated to be amended pursuant to this Proposal No. 1. In addition, on November 15, 2013,

we enacted a Shareholder Rights Plan. This Plan, if triggered could deter any potential acquirer from making a hostile bid to

take over our company Also, our By-Laws provide for the classification of our Board of Directors into three classes.

Our

Board of Directors does not currently contemplate recommending the adoption of any other proposals or amendments to our Articles

of Incorporation that could be construed to affect the ability of third parties to take over or change the control of our Company.

Required

Vote

The

affirmative vote of the holders of a majority of the voting power of the outstanding shares of capital stock of Elite as of the

Record Date is required to approve this Proposal No. 1. If you abstain, your abstention will have the same effect as a vote against

this proposal. It will become effective upon the filing of an amendment to our Articles of Incorporation with the Secretary of

State of Nevada, which we intend to make promptly after the completion of the virtual Special Meeting.

OUR

BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THIS PROPOSAL TO AGAIN AMEND OUR ARTICLES OF INCORPORATION TO INCREASE

THE NUMBER OF SHARES OF COMMON STOCK THE COMPANY IS AUTHORIZED TO ISSUE FROM 995,000,000 SHARES TO 1,445,000,000 SHARES

PROPOSAL

NO. 2

GRANT

OF DISCRETIONARY AUTHORITY TO ADJOURN THE SPECIAL MEETING

IF

NECESSARY TO SOLICIT ADDITIONAL PROXIES

THE

BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSAL NO. 2

Although

it is not expected, the virtual Special Meeting may be adjourned for the purpose of soliciting additional proxies. Any such adjournment

of the virtual Special Meeting may be made without notice, other than by the announcement made at the virtual Special Meeting,

by approval of the holders of a majority of the outstanding shares of our Common Stock and Series J Preferred Stock, voting together

as a single class, present in person or by proxy and entitled to vote at the virtual Special Meeting, whether or not a quorum

exists. We are soliciting proxies to grant discretionary authority to the chairperson of the virtual Special Meeting to adjourn

the virtual Special Meeting, if necessary, for the purpose of soliciting additional proxies in favor of Proposal No. 1. The chairperson

will have the discretion to decide whether or not to use the authority granted to such person pursuant to this Proposal No. 2

to adjourn the virtual Special Meeting.

Required

Vote

To

approve the grant of discretionary authority to the chairperson of the virtual Special Meeting to adjourn the virtual Special

Meeting, if necessary, for the purpose of soliciting additional proxies in favor of Proposal No. 1, the number of votes cast in

favor of the Proposal must exceed the number of vote cast in opposition to the Proposal. Although failure to submit a proxy or

vote in person at the virtual Special Meeting, or a failure to provide your broker, nominee, fiduciary or other custodian, as

applicable, with instructions on how to vote your shares will not affect the outcome of the vote on this proposal, the failure

to submit a proxy or vote in person at the virtual Special Meeting will make it more difficult to meet the quorum requirement

under our bylaws.

OUR

BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THIS PROPOSAL

TO

GRANT DISCRETIONARY AUTHORITY TO ADJOURN THE SPECIAL MEETING

IF

NECESSARY TO SOLICIT ADDITIONAL PROXIES

HOUSEHOLDING

OF MATERIALS

In

some instances, only one copy of the proxy materials is being delivered to multiple Shareholders sharing an address, unless the

Company has received instructions from one or more of the Shareholders to continue to deliver multiple copies. The Company will

deliver promptly, upon oral or written request, a separate copy of the applicable materials to a Shareholder at a shared address

to which a single copy was delivered. If you wish to receive a separate copy of the proxy materials you may call the Company at

(201) 750-2646 or send a written request to Elite Pharmaceuticals, Inc., 165 Ludlow Avenue, Northvale, New Jersey 07647, Attention:

Secretary. If you wish to receive a separate copy of the proxy materials, and wish to receive a separate copy for each shareholder

in the future, you may call the Company at the telephone number or write the Company at the address listed above. Alternatively,

shareholders sharing an address who now receive multiple copies of the proxy materials may request delivery of a single copy,

also by calling the Company at the telephone number or writing to the Company at the address listed above.

DEADLINE

FOR SHAREHOLDER PROPOSALS FOR THE 2020 MEETING

The

Company does not currently provide a formal process for Shareholders to present proposals or for possible inclusion in the Company’s

proxy materials for presentation at the next Annual meeting of Shareholders.

You

may submit proposals on matters appropriate for shareholder action at future Annual meetings by following the rules of the Securities

and Exchange Commission and the requirements of our Amended and Restated Bylaws. We must receive proposals intended for inclusion

in next year’s proxy statement and proxy card no later than June 20, 2020. Any such proposal when submitted must be in full

compliance with applicable law, including Rule 14a-8 of the Exchange Act, and our Amended and Restated Bylaws.

Additionally,

our Amended and Restated By-Laws permit Shareholders to propose business to be considered and to nominate Directors for election

by the Shareholders at future Annual meetings. To propose business or to nominate a Director for our 2020 Annual Meeting of Shareholders

not for inclusion in next year’s proxy statement and proxy card, the Shareholder must deliver notice between 120 and 90

days before the first anniversary of the prior year’s Annual meeting setting forth the information required to be included

in such notice under our Amended and Restated Bylaws. If no Annual meeting of Shareholders was held in the previous year, a proposal

must deliver notice not later than the later of ten days after we have publicly disclosed the date of the meeting and 90 days

prior to the date of the shareholder meeting. Any such proposal or nomination when submitted must be in full compliance with our

Amended and Restated Bylaws.

Shareholders

interested in submitting such a proposal are advised to contact knowledgeable legal counsel with regard to the detailed requirements

of applicable securities laws.

If

a Shareholder gives notice of a proposal or a nomination after the applicable deadline specified above, the notice will not be

considered timely, and the Shareholder will not be permitted to present the proposal or the nomination to the Shareholders for

a vote at the meeting.

OTHER

MATTERS

We

do not expect any matters to be presented for a vote at the meeting, other than the proposals described in this Proxy Statement

and plan on limiting business solely to the proposals described herein. If you grant a proxy, the person(s) named as proxy holder,

or their nominee or substitute, will have the discretion to vote your shares on any additional matters properly presented for

a vote at the meeting.

Unless

contrary instructions are indicated in a proxy, all shares of Common Stock and Series J preferred stock represented by valid proxies

received pursuant to this solicitation (and not revoked before they are voted) will be voted FOR Proposal No. 1 and FOR Proposal

No. 2.

|

April

29, 2020

|

|

By Order

of the Board of Directors

|

|

|

|

Carter Ward, Secretary

|

SHAREHOLDERS

ARE URGED TO VOTE BY INTERNET, BY TELEPHONE, BY SIGNING AND

RETURNING

THE ENCLOSED PROXY IN THE ENCLOSED ENVELOPE OR BY VOTING AT THE MEETING.

Appendix

A

|

|

ROSS

MILLER

Secretary

of State

204

North Carson Street, Suite 1 Carson City, Nevada 89701-4520 (775) 684-5708

Website:

www.nvsos.gov

|

|

|

|

Certificate

of Amendment

(PURSUANT

TO NRS 78.385 AND 78.390)

|

|

|

USE

BLACK INK ONLY - DO NOT HIGHLIGHT

|

ABOVE

SPACE IS FOR OFFICE USE ONLY

|

Certificate

of Amendment to Articles of Incorporation

For Nevada Profit Corporations

(Pursuant

to NRS 78.385 and 78.390 - After Issuance of Stock)

1.

Name of corporation:

Elite

Pharmaceuticals, Inc.

2.

The articles have been amended as follows: (provide article numbers, if available)

NOTE:

This Certificate of Amendment is identical in all material respects to a Certificate of Amendment which was filed with the Nevada

Secretary of State on December 5, 2019. The amendment to the Corporation’s Articles of Incorporation set forth herein has

been re-adopted by the Board of Directors and stockholders of the Corporation and is being filed out of an abundance of caution,

to make sure that stockholder votes in favor of the amendment have been accurately tabulated.

The

beginning of Article IV, Section 4.1 is amended and, as amended, reads as follows:

“4.1.

Authorized Capital Stock. The aggregate number of shares which this Corporation shall have authority to issue is One Billion

Four Hundred Forty Five Million Fifteen Thousand (1,445,015,000) shares, consisting of (a) One Billion Four Hundred Forty

Five Million (1,445,000,000) shares of Common Stock, par value $0.001 per share (the “Common Stock”) and (b)

Fifteen Thousand, (15,000) shares of Preferred Stock, par value $0.01 per share (the “Preferred Stock”), issuable

in one or more series as hereinafter provided. A description of the classes of shares and a statement of the number of shares

in each class and the relative rights, voting power, and preferences granted to and restrictions imposed upon the shares of

each class are as follows:”

3.

The vote by which the stockholders holding shares in the corporation entitling them to exercise at least a majority of the voting

power, or such greater proportion of the voting power as may be required in the case of a vote by classes or series, or as may

be required by the provisions of the articles of incorporation* have voted in favor of the amendment is: ___________

|

4.

Effective date and time of filing: (optional)

|

Date:

|

|

|

Time:

|

|

|

|

(must

not be later than 90 days after the certificate is filed)

|

5.

Signature: (required)

Signature

of Officer

|

|

*

|

If

any proposed amendment would alter or change any preference or any relative or other right given to any class or series of outstanding

shares, then the amendment must be approved by the vote, in addition to the affirmative vote otherwise required, of the holders

of shares representing a majority of the voting power of each class or series affected by the amendment regardless to limitations

or restrictions on the voting power thereof.

|

IMPORTANT:

Failure to include any of the above information and submit with the proper fees may cause this filing to be rejected.

This

form must be accompanied by appropriate fees.

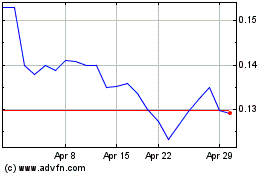

Elite Pharmaceuticals (QB) (USOTC:ELTP)

Historical Stock Chart

From Apr 2024 to May 2024

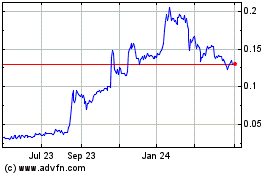

Elite Pharmaceuticals (QB) (USOTC:ELTP)

Historical Stock Chart

From May 2023 to May 2024