CURRENT REPORT FOR ISSUERS SUBJECT TO THE

1934 ACT REPORTING REQUIREMENTS

FORM 8-K

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act

December 3, 2014

Date of Report

(Date of Earliest Event Reported)

DYNARESOURCE, INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

000-30371 |

|

94-1589426 |

| (State or other jurisdiction of incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

| |

|

|

|

|

222 W. Las Colinas Blvd., Suite 744 East Tower,

Irving, Texas 75039

(Address of principal executive offices (zip

code))

(972) 868-9066

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| [ ] |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| [ ] |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| [ ] |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| [ ] |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 7.01 Regulation

FD Disclosure.

In

connection with a contemplated investment in DynaResource, Inc. (the “Company”), on December 3, 2014 the Company furnished

to a prospective investor an operational status report (the “SJG Operational Status Report”) on the San Jose de Gracia

Project in Sinaloa, México. A copy of the SJG Operational Status Report is attached as Exhibit 99.1 to this report.

On

January 16, 2015 the Company furnished to a prospective investor a Pilot Production Proforma (the “SJG Pilot Production Proforma”)

for the San Jose de Gracia Project in México, covering an eight-year time frame commencing in 2015. A copy of the SJG Pilot

Production Proforma is attached as Exhibit 99.2 to this report. Of note, the SJG Pilot Production Proforma assumes a capital infusion

of $6,250,000 in year 1, and no other outside capital infusion would be required in order to accomplish the operational results

as indicated during the eight-year time frame covered by the SJG Pilot Production Proforma.

The

information set forth in this Item 7.01 of this Current Report on Form 8-K is being furnished pursuant to Item 7.01 of Form 8-K

and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference

into any of the Company’s filings under the Securities Act of 1933, as amended, or the Exchange Act, whether made before

or after the date hereof and regardless of any general incorporation language in such filings, except to the extent expressly set

forth by specific reference in such a filing. The filing of this Item 7.01 of this Current Report on Form 8-K shall not be deemed

an admission as to the materiality of any information herein that is required to be disclosed solely by reason of Regulation FD.

Item 9.01. Financial Statements

and Exhibits.

(d) Exhibits.

| Exhibit Number |

Description |

| 99.1 * |

December 3, 2014 Operational Status Report on the San Jose de Gracia Project in Sinaloa, México |

| 99.2 * |

January 16, 2015 Pilot Production Proforma for the San Jose de Gracia Project in Sinaloa, México |

_______________

* Filed herewith

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

DYNARESOURCE, INC. |

|

| |

(Registrant) |

|

| |

|

|

| By: |

/s/ K.W. Diepholz |

|

| |

Name: K.W. Diepholz |

|

| |

Titla: Chairman and CEO |

|

EXHIBIT INDEX

| Exhibit Number |

Description |

| 99.1 * |

December 3, 2014 Operational Status Report on the San Jose de Gracia Project in Sinaloa, México |

| 99.2 * |

January 16, 2015 Pilot Production Proforma for the San Jose de Gracia Project in Sinaloa, México |

_______________

* Filed herewith

Exhibit

99.1

MEMORANDUM

| December

3, 2014 |

|

|

To:

K.D. Diepholz, CEO, DynaResource, Inc.;

From:

Chip Allender, EVP, and Director of Operations, DynaResource, Inc.

Subject:

Current Operational Status Report and Future Considerations, San Jose de Gracia Project

In

the period of time since first visiting the San Jose de Gracia Project (SJG) in April, 2014 and writing my assessment report

for _____________, I have re-examined the mine and mill operations in significantly more detail and have visited the

SJG site again recently for several days. These examinations, as well as a detailed study of the pilot production data, and

my lengthy discussions with the staff and management in México and Dallas have reinforced my initial impression of the

project as a potential world-class gold project.

In

my earlier report to _________, I provided an overview technical and economic assessment of the SJG Project, and the potential

for increasing resources, profitable production, and expansion of SJG. I also gave my evaluation of the potential for return on

investment in the pilot and startup phases of the project. This Operational Status Report is focused more on the current status

of operations and the forward looking projection of those operations.

2014

– Mine Rehabilitation and Mill Refurbishing:

During

the first 9 months of 2014, the project was being prepared for startup operations. The mine at San Pablo was rehabilitated, and

the Pilot Production Facility or SJG Mill (crushing, grinding, gravity, and flotation recovery circuit) was refurbished. Test

runs of the pilot production facility were conducted in May, June and July, the flotation circuit was improved and tested in August

and September, and the Tailings Pond area was prepared for operations with the installation of an impermeable liner. During the

rehabilitation of the San Pablo mine, some mineralized tonnage was extracted and delivered to the mill for test runs. At the end

of November, the SJG Project appears ready to sustain operations, though additional improvements could enable the project to accomplish

a more efficient level of operations.

Capital

Infusion – Fast Track to Profitability:

Though

I would classify the current operations as in the “startup” phase; it is clear that a capital injection of US$2.5

to $3 million could be utilized to fast-track the startup phase to a more consistent and predictable operation. With some

adjustments and additional equipment, I expect the San Pablo Mine and the SJG Pilot Mill Facility can operate at a 150 tonnes

per day (tpd) pilot production level. At current mineralized material grades (approximately 9-11 grams per tonne or gpt) and

recovery rates (80-85%), the operation should produce from 1,200 to about 1,500 grams (35-50 ounces) gold per day. That would

equate to 900 to 1,200 ounces per month or 11,000 to 14,000 ounces annually. At that rate of pilot production, the

SJG operations would provide a solid foundation for expansion and build out, including the increase of output from

the underground operations, including the permitting and other preliminary engineering for the proposed open pit

operation, including commencing initial exploration of the North area, and, possibly including the plans by company

management to commence paying dividends to shareholders.

As

the startup pilot operations commence at San Jose de Gracia, projected output is expected to be approximately 75-100 tonnes

per day (tpd). At that level of production, the project can sustain profitability. However, at this rate, the project is

sensitive to interruptions resulting from equipment failure, parts and supply chain delays, and possibly low

grade mineralized material from test mining activities. The project could operate sporadically at less than peak efficiency

under these conditions. At its current operating rate, maintenance and repairs as well as necessary system upgrades and

expansion will be accomplished as internal cash flow allows. The capital injection mentioned above would allow the project to

upgrade its operations and fast track through the startup phase to the point of consistent, sustainable, and profitable

operations. And, looking forward, these consistent operations could then be expanded to the point where the SJG Project can

produce gold at a notable and significantly profitable pace.

Capital

Sources:

As

we have discussed, the company has several potential sources of project financing. Currently the company has targeted the following

sources:

| 1. | Current

Company Shareholders; (75 individuals own 75 % of DynaResource, Inc.); |

| 2. | A

strategic new shareholder(s) (perhaps __________); |

| 3. | Trafigura;

large commodities trading firm and the buyer of concentrate produced from SJG; |

| 4. | Kundan

Group; Indian refiner (New Delhi), and the buyer of gold dore produced from SJG; |

| 5. | Red

Kite Capital; large commodities trading firm specializing in gold financing arrangements; |

| 6. | Shenyang

Huachang Non-Ferrous Mining Co. Ltd.; Hong Kong Based mining company and a recent purchaser

of concentrate produced from SJG; |

| 7. | Fifomi;

Federal Funding Agency in México. |

Observations:

The

following are my observations concerning current operations and my suggestions for overcoming potential obstacles on our way to

achieving the goal of a profitable, small-scale operation at SJG. In addition, I have addressed the future expansion of the San

Pablo underground mine, the opening of the Tres Amigos mine, and the possibilities presented by the potential open pit operation

at SJG.

Although

the test production mining at San Pablo is just now commencing, after the earlier rehabilitation period, there is

the possibility for the test mining production to be inconsistent. The inconsistency could result primarily from equipment

breakdowns /repairs, and the insufficient supply or delayed delivery of explosives. Some of the equipment being used to mine

mineralized material, transport material, and process mineralized material is aging and requires careful maintenance and

repair. Replacement parts and equipment are available in Sinaloa but may require several days to procure, transport to SJG,

and place into service. Especially during this start up phase, current operations are at such a level that any equipment

breakdown has a negative effect on final production rate. Interruption of the flow of mineralized material from the mine to

the mill or of supplies, parts, and equipment to the SJG mine/mill complex directly and negatively affects the amount of gold

produced.

For

example, as mining operations commenced and through the end of November, the mine has produced mineralized material and

delivered it to the mill on 20 of the 30 days in the month. The average daily mine test production on those days has been

approximately 45 tonnes. Mine production has been adversely affected by equipment failures, mine ventilation issues, and

explosive supply limitations (and concerns over the scheduling of a site inspection by government explosives regulation

agents). Now, explosive supply limitations have been remedied and the main mine-portal air compressor failure has been fixed.

However, both of these issues resulted in significant downtime in both the mine and the mill and caused significantly reduced

gold production from the pilot operations.

The

average grade of mineralized material mined and processed during November has been 9.49 grams per tonne (gpt). While not as

high as grades from earlier operations (12.5 gpt during 2014 test operations; the 2003-2006 pilot production period averaged

15-20 gpt), this 9.49 gpt average grade is an economically recoverable grade for SJG. And, while the tonnage extracted from

San Pablo was not up to the goal set for pilot production (target mine production is 100 tonnes per day (tpd) for this

start-up phase, this mineralized material grade has been maintained at an acceptable level.

The

capacity of San Pablo Mine to produce gold concentrates at maximum flow for profitable gold recovery in the mill was

demonstrated during: (A) the 2003-2006 production (18,250 troy ounces gold produced from 42,000 tonnes feed

mineralized material; (B) the test mill runs earlier in the year; and (C) the initial operations in November. For the four

day period from November 18 to November 21, the mine produced nearly 400 tonnes of mineralized material at an average grade

of 12.0 gpt. That mineralized material contained 4,800 grams (154 troy ounces) gold of which about 83% or 4,000 grams (131

troy ounces) were recovered in the SJG Mill. That is, roughly, 33 troy ounces produced per day for that short

period.

The

SJG crew and I are confident that this quantity and quality of mineralized material production is sustainable and that the

goal of 35-50 ounces per day is achievable with current resources; assuming no major equipment failures, and expecting that

several areas of the operation can be upgraded.

San

Pablo – Mine Block B. The SJG management and crew have been working toward beginning the access ramp into San

Pablo Mine Block B, which is below the present mine workings (and beneath the recent workings of the 2003-2006 pilot

production period). Commencement of ramp development is currently planned for December, but it may be next year before the

ramp development is completed. Access to this mineralized material block B is critical to sustaining and increasing mine

production.

SJG

Mill. The SJG Mill is currently operating at good efficiency. During my last site visit we made several adjustments to the

process flow through the mill facility and those adjustments seem to have improved the performance and recoveries. Gold recovery

rates are good but could be improved further. We are still losing a percentage of very fine-grained gold. In order to capture

more of this fine gold, additional equipment is needed in both the gravity and flotation circuits within the plant. Specifically,

a cone-type concentrator in the gravity circuit and a second column cell in the flotation circuit are needed. Neither is particularly

expensive. The cone concentrator may have a long lead time for delivery. The column cell will be engineered and fabricated on

site by our engineers and plant staff at an estimated cost of about US$12,000. This is about 20% of the cost of prefabricated

units.

Observations

Summary and Recommendations. In summary, the development of the Block B access ramp, some equipment reliability issues (and/or

upgrades), and the other operational upgrades required in the mine and mill can be addressed completely with an injection of capital

totaling US$2.5 - $3 million. With the assistance of SJG management, I have developed a list of specific items needed to upgrade

the operation. Most of these are not expensive items, and I have not provided the list of necessary individual upgrades here.

(I can make the list available for review). The list includes the following general areas within the mine and mill.

San

Pablo Mine

Mineralized

material extraction

Mine

ventilation

Compressed

air supply

Power

generation and distribution

Water

supply

Mineralized material

transportation (trucking)

Haulage

road improvements

Mineralized

material delivery reconfiguration

San

Jose de Gracia Mill

Water

storage and distribution

Coarse

rock storage and mill feed

Crushing

and grinding

Additional

fine gold recovery equipment in the gravity circuit

Construction

of a second column flotation cell in the flotation circuit

Assay

laboratory improvements and expansion

Concentrate

drying and weighing

Equipment

Maintenance & Repairs

Regular

equipment maintenance

Emergency

repairs

Scheduling

Replacement

Parts & Supply Logistics

Potable

water and food

Crew

supplies

Parts

warehouse

Scheduling

Future

Considerations – Staged Expansion:

The

key to producing higher-grade mineralized material from San Pablo is the opening of the new ramp into Block B. Driving this

new access into the San Pablo Vein in the zone beneath the recent (2003-2006) and the existing mine workings will open up

fresh mineralized material of a higher grade and greater vein widths, as indicated by numerous drilling intercepts. Block B

represents about 35,000 tonnes of mineralized material and is part of the NI43-101–compliant resource estimate. The B

Block is estimated to contain approximately 15,000 ounces gold. Block C, which lies below Block B and is also part of the

resource estimate but has not yet been accessed, is estimated to contain 18,000 ounces. Block C is even higher grade and is a

wider vein section. Additional gold vein resources exist in unexploited blocks below Block C and could be developed in

the future.

Looking

forward, with additional test mining development funded through cash flows, opening up Block C and producing mineralized material from both

Blocks B and C would allow the production of a significantly higher rate of 250 t p d (100 tpd to 250 tpd). The result of

this size operation, at the indicated grades, could be between 1,500 and 2,500 ounces per month and 18,000 to 30,000 ounces

per year. This expansion would require additional equipment and personnel, obviously. But it also may afford the opportunity

to drive a new mine opening to the surface at a lower elevation. This would then result in shorter haulage distance from the

mine to the mill (saving haul trips, shortening trip times, and saving significantly on diesel fuel) and provide much-needed

additional ventilation to the upper workings.

This

increased pilot production to 250 tpd could then provide the profitable cash flows for the opening of and further expansion

into other mines on the SJG property. The Tres Amigos Mine would be the logical next step to expanding the underground

operation. Development of additional mineralized bodies and inserting their mining production into the project pilot

production flow could result in the expansion of underground operations to 500 tpd. This would require an expanded

crushing, grinding, and processing plant and additional mill tailings storage space. At that point, it might make sense to

move the plant and tailings impoundment to a location closer to the mines and away from the current site adjacent to SJG

village. At this increased rate of 500 tpd, SJG could be producing 40,000 to 60,000 ounces per year which would make SJG a

major underground mine producer.

Unique

Aspects – Minimal Dilution to Shareholders:

One

unique aspect of the SJG project is the opportunity to build out the project through the pilot production of positive cash

flows. The ability to internally finance development and expansion through project cash flow is unusual for a junior precious

metal mining company under the current market conditions. Junior mining companies nearly all struggle to finance their

projects and most are desperately seeking cash flow in any form. The SJG Project opportunity is afforded by the high grade

gold values currently defined at the San Pablo Mine, the existing mill facility, and secured permits to operate. The company

has financed all of the SJG development to the current startup phase with capital investments by existing shareholders

totaling approximately US$4 million. An additional infusion of approximately US$2.5-3 million would give the company the

opportunity to establish consistent and profitable pilot operations at SJG. This would in turn set the course for expansion

and increased pilot production operations. This expansion and increased pilot production could, in my view, be financed by

cash flow from operations rather than any further new capital investment; which results in no further dilution to existing

shareholders.

General

Conclusion:

I

see the opportunity for the DynaResource Companies to internally finance the SJG Project to successful startup of

pilot operations and profitability, through to the expansion of the underground mine and plant (100 tpd to 250 tpd to 500

tpd), through the development of the proposed open-pit operation (which would add 80,000 to 100,000 ounces to annual

production), and including the exploration of the North area for potential new mineralized deposits. As a consequence of

accomplishing the expansions and build out of the project through profitable cash flows and internal financings, the price

per share for DynaResource should appreciate significantly and, additionally, the company could expect to return significant

cash dividends to shareholders.

Exhibit 99.2

Mineras

de DynaResource

San

Jose

de Gracia

Project

Pilot

Production Proforma

Cash Flow

(2015-2023)

January

16, 2015

| |

Year

1 |

Year

2 |

|

Year

3 |

Year

4 |

|

Year

5 |

Year

6 |

Year

7 |

Year

8 |

|

TOTALS |

| ASSUMPTIONS |

|

|

|

|

|

|

|

|

|

|

|

|

| Production

Rate |

150

TONNES/DAY |

|

250

TONNES/DAY |

|

500

TONNES/DAY |

|

|

| Work

Days |

300 |

300 |

|

300 |

300 |

|

300 |

300 |

300 |

300 |

|

|

| Tonnes

Per Year |

35,625 |

45,000 |

|

75,000 |

75,000 |

|

150,000 |

150,000 |

150,000 |

150,000 |

|

830,625 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Mining

Cost

per tonne

(including

fuel) |

38 |

38 |

|

38 |

38 |

|

38 |

38 |

38 |

38 |

|

|

| Milling

Cost

per tonne

(including

fuel) |

23 |

23 |

|

23 |

23 |

|

23 |

23 |

23 |

23 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

Costs

per tonne |

172 |

113 |

|

112 |

112 |

|

112 |

112 |

112 |

112 |

|

|

| Operating

Costs

per ounce |

575 |

290 |

|

288 |

288 |

|

286 |

286 |

286 |

286 |

|

|

| Total

Costs

per ounce |

748 |

403 |

|

400 |

400 |

|

398 |

398 |

398 |

398 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Gold

Price

(Market) |

1,200 |

1,200 |

|

1,200 |

1,200 |

|

1,200 |

1,200 |

1,200 |

1,200 |

|

|

| Less

Buyer Discount

(7.5%) |

(90) |

(90) |

|

(90) |

(90) |

|

(90) |

(90) |

(90) |

(90) |

|

|

| Net

Gold

Price |

1,110 |

1,110 |

|

1,110 |

1,110 |

|

1,110 |

1,110 |

1,110 |

1,110 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Gold

Recovery

(%) |

80 |

90 |

|

90 |

90 |

|

90 |

90 |

90 |

90 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Mill

Grade (grams

per tonne) |

12 |

15 |

|

15 |

15 |

|

15 |

15 |

15 |

15 |

|

|

| Ounces

to Mill |

16,276 |

21,701 |

|

36,169 |

36,169 |

|

72,338 |

72,338 |

72,338 |

72,338 |

|

|

| Recovery

Ounces |

14,106 |

19,531 |

|

32,552 |

32,552 |

|

65,104 |

65,104 |

65,104 |

65,104 |

|

|

| Treatment

Costs/Refining

Costs/Penalties

(10%) |

(1,411) |

(1,953) |

|

(3,255) |

(3,255) |

|

(6,510) |

(6,510) |

(6,510) |

(6,510) |

|

|

| Net

Gold

Ounces Recovered

(From

Smelter) |

12,695 |

17,578 |

|

29,297 |

29,297 |

|

58,594 |

58,594 |

58,594 |

58,594 |

|

323,242 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| GROSS

REVENUES

(net

gold

ounces

* net

gold

price) |

14,091,797 |

19,511,719 |

|

32,519,531 |

32,519,531 |

|

65,039,063 |

65,039,063 |

65,039,063 |

65,039,063 |

|

358,798,828 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING

EXPENSES: |

|

|

|

|

|

|

|

|

|

|

|

|

| Mining

Development

via Contract

(Stock Ramp

and Other) |

1,080,000 |

- |

|

- |

- |

|

- |

- |

- |

- |

|

|

| Mining

Costs

(cost per

tonne *

tonnes per

month) |

1,353,750 |

1,810,000 |

|

2,950,000 |

2,950,000 |

|

5,800,000 |

5,800,000 |

5,800,000 |

5,800,000 |

|

|

| Milling

Costs

(cost per

tonne *

tonnes per

month) |

819,375 |

1,035,000 |

|

1,725,000 |

1,725,000 |

|

3,450,000 |

3,450,000 |

3,450,000 |

3,450,000 |

|

|

| Personnel

(Mill

and Mine

Operations) |

1,650,000 |

1,650,000 |

|

2,739,000 |

2,739,000 |

|

5,478,000 |

5,478,000 |

5,478,000 |

5,478,000 |

|

|

| Other

overhead

(no personnel) |

240,000 |

240,000 |

|

420,000 |

420,000 |

|

840,000 |

840,000 |

840,000 |

840,000 |

|

|

| Management

Fees |

360,000 |

360,000 |

|

600,000 |

600,000 |

|

1,200,000 |

1,200,000 |

1,200,000 |

1,200,000 |

|

|

| TOTAL

OPERATING

COSTS |

5,503,125 |

5,095,000 |

|

8,434,000 |

8,434,000 |

|

16,768,000 |

16,768,000 |

16,768,000 |

16,768,000 |

|

94,538,125 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| NET

OPERATING

INCOME

(LOSS) |

8,588,672 |

14,416,719 |

|

24,085,531 |

24,085,531 |

|

48,271,063 |

48,271,063 |

48,271,063 |

48,271,063 |

|

264,260,703 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| CORPORATE

OVERHEAD: |

|

|

|

|

|

|

|

|

|

|

|

|

| Mine

Concessions

Taxes |

640,000 |

470,000 |

|

470,000 |

470,000 |

|

470,000 |

470,000 |

470,000 |

470,000 |

|

|

| Ejito

Rental (Annual

Payment) |

100,000 |

100,000 |

|

100,000 |

100,000 |

|

100,000 |

100,000 |

100,000 |

100,000 |

|

|

| San

Jose

de Gracia

Community

Development

& Support |

340,000 |

120,000 |

|

120,000 |

120,000 |

|

120,000 |

120,000 |

120,000 |

120,000 |

|

|

| Corporate--Salaries

and Wages

and Benefits |

960,000 |

960,000 |

|

1,593,600 |

1,593,600 |

|

1,987,200 |

1,987,200 |

1,987,200 |

1,987,200 |

|

|

| Corporate--Legal

and Professional |

600,000 |

600,000 |

|

900,000 |

900,000 |

|

1,200,000 |

1,200,000 |

1,200,000 |

1,200,000 |

|

|

| Corporate--Other |

180,000 |

180,000 |

|

300,000 |

300,000 |

|

600,000 |

600,000 |

600,000 |

600,000 |

|

|

| Management

Fee Offset |

(360,000) |

(360,000) |

|

(600,000) |

(600,000) |

|

(1,200,000) |

(1,200,000) |

(1,200,000) |

(1,200,000) |

|

|

| TOTAL

CORPORATE

OVERHEAD |

2,460,000 |

2,070,000 |

|

2,883,600 |

2,883,600 |

|

3,277,200 |

3,277,200 |

3,277,200 |

3,277,200 |

|

23,406,000 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL

ALL EXPENSES

(OPERATING

AND CORPORATE) |

7,963,125 |

7,165,000 |

|

11,317,600 |

11,317,600 |

|

20,045,200 |

20,045,200 |

20,045,200 |

20,045,200 |

|

117,944,125 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| NET

INCOME

(LOSS) |

6,128,672 |

12,346,719 |

|

21,201,931 |

21,201,931 |

|

44,993,863 |

44,993,863 |

44,993,863 |

44,993,863 |

|

240,854,703 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| CASH

FLOWS: |

|

|

|

|

|

|

|

|

|

|

|

|

| Beginning

Cash Balance |

250,000 |

7,902,695 |

|

19,449,413 |

23,767,360 |

|

44,169,291 |

60,653,193 |

104,847,055 |

149,040,917 |

|

|

| Initial

Capital

Infusion

(12.5

% Equity

Acquisition) |

6,250,000 |

- |

|

- |

- |

|

- |

- |

- |

- |

|

|

| Capital

Improvements

from Cash

Flow |

- |

- |

|

(15,000,000) |

- |

|

(25,000,000) |

- |

- |

- |

|

|

| Sales

Receipts--gold

sales--1 month

delay |

12,465,820 |

19,511,718 |

|

31,435,547 |

32,519,531 |

|

62,329,101 |

65,039,062 |

65,039,062 |

65,039,062 |

|

|

| Capital

Improvements--Mine |

(150,000) |

(400,000) |

|

(400,000) |

(400,000) |

|

(400,000) |

(400,000) |

(400,000) |

(400,000) |

|

|

| Capital

Improvements--Mill |

(50,000) |

(400,000) |

|

(400,000) |

(400,000) |

|

(400,000) |

(400,000) |

(400,000) |

(400,000) |

|

|

| Capital

Costs--Equipment |

(2,900,000) |

- |

|

- |

- |

|

- |

- |

- |

- |

|

|

| Stock

Ramp and

Mining

Contract

Development |

(1,080,000) |

- |

|

- |

- |

|

- |

- |

- |

- |

|

|

| Expenses

(Operating

and Other,

less Stock

Ramp and

Mining

Contr) |

(6,883,125) |

(7,165,000) |

|

(11,317,600) |

(11,317,600) |

|

(20,045,200) |

(20,045,200) |

(20,045,200) |

(20,045,200) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| ENDING

CASH

BALANCE |

7,902,695 |

19,449,413 |

|

23,767,360 |

44,169,291 |

|

60,653,193 |

104,847,055 |

149,040,917 |

193,234,780 |

|

$ 193,234,780 |

| ACCOUNTS

RECEIVABLE |

1,625,977 |

1,625,977 |

|

2,709,961 |

2,709,961 |

|

5,419,922 |

5,419,922 |

5,419,922 |

5,419,922 |

|

$ 5,419,922 |

| TOTAL

CASH

AND RECEIVABLES |

9,528,671 |

21,075,390 |

|

26,477,321 |

46,879,252 |

|

66,073,115 |

110,266,977 |

154,460,839 |

198,654,702 |

|

$ 198,654,702 |

| EPS

(Earnings

per Share)

(16.5M shares) |

0.58 |

1.28 |

|

1.60 |

2.84 |

|

4.00 |

6.68 |

9.36 |

12.04 |

|

$ 12.04 |

| NPV

(Net Present

Value)(8%

discount

rate) |

$115,414,146 |

|

|

|

|

|

|

|

|

|

|

$ 115,414,146 |

| Project

IRR (Internal

Rate of

Return) |

190% |

|

|

|

|

|

|

|

|

|

|

190% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

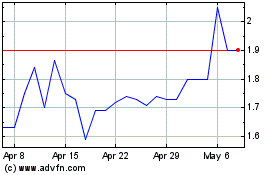

Dynaresource (QX) (USOTC:DYNR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Dynaresource (QX) (USOTC:DYNR)

Historical Stock Chart

From Jul 2023 to Jul 2024