Drax, Iberdrola Amend Deal After EU Ruling Suspends UK Capacity Market

December 03 2018 - 4:49AM

Dow Jones News

By Adam Clark

U.K. power company Drax Group PLC (DRX.LN) said Monday it has

amended the terms of its purchase of a portfolio of assets from

Spain's Iberdrola SA (IBE.MC), after a European Union ruling

threatened contractual payments from the British government.

In November, a European Union court decision forced the

suspension of the capacity market, which the U.K. uses to ensure

electricity supplies at times of stress. The U.K. government said

it is working with the EU's state-aid investigation into the

market, but payments have been suspended.

Drax said contracted capacity payments make up a significant

proportion of the earnings of a portfolio of pumped storage, hydro

and gas-fired generation which it bought from Iberdrola for 702

million ($894.9 million) in October.

Drax and Iberdrola have agreed a risk-sharing mechanism in

respect to GBP36 million worth of capacity payments for the period

from Jan. 1 to Sept. 30 of 2019. If less than 100% of those

payments are received and the portfolio's gross profit falls below

expectations, Iberdrola will pay Drax GBP26 million. However,

Iberdrola will also have the opportunity to earn up to GBP26

million if the portfolio performs better than expected.

Drax said its full-year earning outlook remains in line with

previous expectations, despite the loss of GBP7 million in capacity

payments scheduled in 2018 due to the EU ruling.

At 0905 GMT, Drax shares were up 5.60 pence, or 1.4%, at 396.20

pence.

Write to Adam Clark at adam.clark@dowjones.com;

@AdamDowJones

(END) Dow Jones Newswires

December 03, 2018 04:34 ET (09:34 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

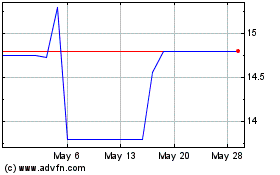

Drax (PK) (USOTC:DRXGY)

Historical Stock Chart

From Feb 2025 to Mar 2025

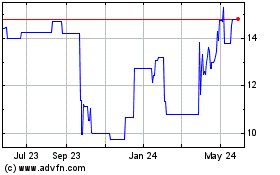

Drax (PK) (USOTC:DRXGY)

Historical Stock Chart

From Mar 2024 to Mar 2025