UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-A/A

FOR REGISTRATION OF CERTAIN CLASSES OF SECURITIES

PURSUANT TO SECTION 12(b) OR 12(g) OF

THE SECURITIES EXCHANGE ACT OF 1934

|

|

DIRTT ENVIRONMENTAL SOLUTIONS LTD |

(Exact name of registrant as specified in its charter) |

|

Alberta, Canada |

00-0000000 |

(State or other jurisdiction of incorporation) |

(I.R.S. Employer Identification No.) |

|

7303 30th Street S.E. Calgary, Alberta |

T2C 1N6 |

(Address of principal executive offices) |

(Zip code) |

|

Securities to be registered pursuant to Section 12(b) of the Act:

|

|

Title of each class

to be so registered |

Name of each exchange on which

each class is to be registered |

Not Applicable |

Not Applicable |

If this form relates to the registration of a class of securities pursuant to Section 12(b) of the Exchange Act and is effective pursuant to General Instruction A.(c) or (e), check the following box ☐

If this form relates to the registration of a class of securities pursuant to Section 12(g) of the Exchange Act and is effective pursuant to General Instruction A.(d) or (e), check the following box. ☑

Securities Act registration statement or Regulation A offering statement file number

to which this form relates:

N/A (if applicable)

Securities to be registered pursuant to Section 12(g) of the Act:

Common Stock Purchase Rights

(Title of class)

INFORMATION REQUIRED IN REGISTRATION STATEMENT

This Form 8-A/A is filed by DIRTT Environmental Solutions Ltd. (the “Company”), to reflect the amendment to the common stock purchase rights registered on the Form 8-A filed by the Company on March 25, 2024.

Item 1. Description of Registrant’s Securities To Be Registered.

On March 22, 2024 (the “Effective Date”), the Board of Directors (the “Board”) of the Company approved (with one Board member dissenting) and adopted a shareholder rights plan by and between the Company and Computershare Trust Company of Canada, as rights agent (the “Original Rights Agreement”). In connection therewith, one right (a “Right”) was issued and attached to each common share of the Company (each, a “Common Share” and collectively, the “Common Shares”) outstanding and held of record at the close of business on April 1, 2024 (the “Record Time”) as set forth in the Original Rights Agreement and as confirmed in the Rights Agreement (as defined below). Subsequently, on August 2, 2024, the Board approved and adopted an amended and restated shareholder rights plan by and between the Company and Computershare Trust Company of Canada, as rights agent (as amended and restated, the “Rights Agreement”), which amended and restated the Original Rights Agreement and provides for an amended and restated shareholder rights plan.

The Rights Agreement is consistent with the shareholder rights plan that the Company had in place from 2014 to 2020 and the shareholder rights plan adopted by the Board on December 7, 2021. The Rights Agreement was adopted to help ensure that all shareholders of the Company are treated fairly and equally in connection with any unsolicited take-over bid or other acquisition of control of the Company (including by way of a “creeping” take-over bid). The Rights Agreement was not adopted in response to any specific proposal to acquire control of the Company, and the Board is not aware of any pending or potential take-over bid for the Company. The Rights Agreement, if approved, amends and restates the Original Rights Agreement to provide that WWT Opportunity #1 LLC (“WWT”) could purchase such number of additional Common Shares to match 22NW Fund, LP’s (“22NW”) equity ownership in the Company and such acquisition would be an “Exempt Acquisition” pursuant to the terms of the Rights Agreement (the “WWT Exempt Acquisition”). Otherwise, the Rights Agreement, if approved, would continue to have the effect of freezing the concentration of ownership in the Company by large shareholders who are “Grandfathered Persons” (as defined in the Rights Agreement), including 22NW and WWT, subject to the WWT Exempt Acquisition and certain exceptions as provided in the Rights Agreement.

The Rights. As previously disclosed, the Board authorized the issuance at the Record Time of a Right with respect to each outstanding Common Share. A Right will also be attached to each Common Share issued after the Record Time. The issuance of the Rights will not change the manner in which shareholders trade their Common Shares.

Separation of Rights; Exercisability. Subject to certain exceptions, the Rights become exercisable and trade separately from the Common Shares only upon the “Separation Time,” which occurs upon the earlier of:

•the close of business on the tenth trading day after the first date (the “stock acquisition date”) of public announcement that a person (the “Acquiring Person”), together with certain related persons (including persons “acting jointly or in concert” as defined in the Rights Agreement), acquires or announces its intention to acquire 20% or more of the voting stock (subject to certain exemptions) without complying with the Permitted Bid provisions of the Rights Agreement;

•the close of business on the tenth trading day following the date of the commencement of or first public announcement of the current intention of any Person (as defined in the Rights Agreement, and other than the Company or any Subsidiary of the Company) to commence a Take-over Bid (as defined in the Rights Agreement) (other than a Permitted Bid (as defined below) or a Competing Permitted Bid (as defined in the Rights Agreement)); or

•the close of business on the tenth trading day following the date on which a Permitted Bid or Competing Permitted Bid ceases to qualify as such.

Subject to the terms of the Rights Agreement, the Rights issued under the Rights Agreement become exercisable upon the Separation Time. The Rights Agreement will not be triggered solely by the holding of 20% or more of the

Company’s Common Shares by a shareholder and its affiliates, associates and joint actors prior to the date of the Rights Agreement, as any such person would be “grandfathered” subject to the terms of the Rights Agreement; however, subsequent purchases of Common Shares of the Company by a “grandfathered” person after the Effective Date may cause such person to become an Acquiring Person pursuant to the terms of the Rights Agreement. Following a transaction that results in a person becoming an Acquiring Person, the Rights entitle the holder thereof (other than the Acquiring Person and certain related persons) to purchase Common Shares at a significant discount to the market price at that time.

Under the Rights Agreement, a “Permitted Bid” is a take-over bid made in compliance with the Canadian take-over bid regime. Specifically, a Permitted Bid is a take-over bid that is made to all shareholders, that is open for 105 days (or such shorter period as is permitted under the Canadian take-over bid regime) and that contains certain conditions, including that no Common Shares will be taken up and paid for unless more than 50% of the Common Shares that are held by independent shareholders are tendered to the take-over bid.

Effective Date; Expiration Time. While the Rights Agreement is effective as of the Effective Date, it is subject to shareholder ratification within six months of its adoption or such other date as may be agreed to by the Toronto Stock Exchange. The Board intends to recommend the ratification of the Rights Agreement for approval by its shareholders at a special meeting of shareholders, which will be scheduled to be held within six months of the Effective Date, or such other date as may be agreed to by the Toronto Stock Exchange (the “Meeting”). If ratified by shareholders, the Rights Agreement will have an initial term of three years. If the Rights Agreement is not ratified by the Company’s shareholders at the Meeting, the Rights Agreement and all Rights issued thereunder will terminate and cease to be effective at that time.

Flip-in Event. In the event that a person or group becomes an Acquiring Person (a “Flip-in Event”), each holder of a Right (other than any Acquiring Person and certain related parties, whose Rights automatically become null and void) will have the right to receive, upon exercise, Common Shares having a value equal to two times the purchase price of the Right.

Anti-dilution Adjustments. The purchase price payable, and the number of Rights outstanding are subject to adjustment from time to time to prevent dilution including in the event of a stock dividend on, or a subdivision, consolidation, reclassification or issuance of, the Common Shares.

With certain exceptions, no adjustment in the purchase price will be required until cumulative adjustments amount to at least 1% of the purchase price.

Redemption; Exchange. In general, the Board may, with the prior approval of the holders of the Voting Shares (as defined in the Rights Agreement) or of the holders of Rights, elect to redeem the Rights in whole, but not in part, at a price of $0.00001 per Right (subject to adjustment) at any time prior to the occurrence of a Flip-in Event.

No Rights as Shareholder. Until a Right is exercised, its holder will have no rights as a shareholder of the Company, including, without limitation, the right to vote or to receive dividends.

Amendment of the Rights Agreement. The Company may from time to time amend or supplement the Rights Agreement without the consent of the holders of the Rights. However, the Company may not supplement, amend, vary, rescind or delete any of the provisions of the Rights Agreement and the Rights (whether or not such action would materially adversely affect the interests of the holders of Rights generally) without the prior approval of the holders of Voting Shares if before the Separation Time, and without the prior approval of the holders of Rights if at any time on or after the Separation Time.

The foregoing description of the Rights Agreement and the Rights does not purport to be complete and is qualified in its entirety by reference to the Rights Agreement, which is filed as Exhibit 4.1 to this Current Report and is incorporated herein by reference.

Important Additional Information

DIRTT intends to file a proxy statement and a proxy card with the U.S. Securities and Exchange Commission (the “SEC”) in connection with the Meeting. SHAREHOLDERS OF THE COMPANY ARE STRONGLY ENCOURAGED TO READ SUCH PROXY STATEMENT, ACCOMPANYING PROXY CARD AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE MEETING. Shareholders will be able to obtain the definitive proxy statement, any amendments or supplements to the proxy statement and other documents filed by the Company with the SEC at no charge on EDGAR at www.sec.gov.

Participant Information

The Company, its directors and certain of its executive officers (as set forth below) are or may be deemed to be “participants” (as defined in Section 14(a) of the Securities Exchange Act of 1934, as amended) in the solicitation of proxies from the Company’s shareholders in connection with the matters to be considered at the Meeting. Information about the compensation of our named executive officers and our non-employee directors is set forth in the sections entitled “Executive Compensation” and “Director Compensation” in the Company’s definitive proxy statement on Schedule 14A for the Company’s 2024 Annual Meeting of Shareholders, filed on March 28, 2024 (the “2024 Proxy”), commencing on pages 36 and 50, respectively, and available here. Information regarding the participants’ holdings of the Company’s securities can be found in the section entitled “Security Ownership of Certain Beneficial Owners and Management” in the 2024 Proxy on pages 54–55 and available here, and as reflected in the table below. If any filings are made by the Company with the SEC on Forms 3, 4 and 5 with respect to the participants’ holdings of the Company’s securities, the Company will update the table and such filings will be available through EDGAR at www.sec.gov. Updated information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, will be set forth in the section entitled “Security Ownership of Certain Beneficial Owners and Management” of the Company’s proxy statement on Schedule 14A and other materials to be filed with the SEC.

|

|

|

|

|

Directors (1) |

Name |

Ownership |

Date of Filing |

Filing Type |

Hyperlink |

Scott Robinson (Chair) |

273,269 |

03/28/2024 |

DEF 14A |

HERE |

Aron English (2) |

65,865,464 |

03/28/2024 |

DEF 14A |

HERE |

Shaun Noll (3) |

53,380,753 |

03/28/2024 |

DEF 14A |

HERE |

Shalima Pannikode |

— |

03/28/2024 |

DEF 14A |

HERE |

Scott Ryan |

234,375 |

03/28/2024 |

DEF 14A |

HERE |

Douglas Edwards |

156,250 |

03/28/2024 |

DEF 14A |

HERE |

Benjamin Urban |

1,280,778 |

07/05/2024 |

Form 4 |

HERE |

(1)The business address for each of the “participants” set forth in the table above is c/o DIRTT Environmental Solutions Ltd., 7303 30th Street S.E., Calgary, Alberta, Canada T2C 1N6.

(2)As reported on Schedule 13D/A filed with the SEC on January 23, 2024. 22NW, LP, as the investment manager of 22NW, may be deemed to beneficially own the 58,395,297 Common Shares owned by 22NW, inclusive of 8,440,252 Common Shares that are currently issuable upon the conversion of certain of the Company’s Debentures held by 22NW. 22NW GP, Inc., as the general partner of 22NW, may be deemed to beneficially own the 58,395,297 Common Shares owned by 22NW. 22NW Inc. (together with 22NW, 22NW GP, Inc. and 22NW, LP, the “22NW Group”), as the general partner of 22NW, LP, may be deemed to beneficially own the 58,395,297 Common Shares owned by 22NW. Aron English is the record owner of, and has the sole power to vote or direct the vote of, and the sole power to dispose or direct the disposition of, 7,470,167 Common Shares. On March 26, 2024, Mr. English filed with the SEC an amendment to his Form 4, available here, which provided an update to include an additional 22,776 Common Shares directly owned by Mr. English, revising his ownership to 7,492,943 Common Shares. Aron English, as the Portfolio Manager of 22NW, Manager of 22NW GP and President and sole shareholder of 22NW Inc., may be deemed to beneficially own the 58,395,297 Common Shares owned directly by 22NW, which, together with the Common Shares he directly beneficially owns, constitutes an aggregate of 65,865,464 Common Shares. 22NW, LP’s aggregate holdings also includes 2,181 Common Shares held by Alexander Jones and 2,272 Common Shares held by Bryson Hirai-Hadley, each of whom are employees of 22NW Group. The address of 22NW is 590 1st Ave S., Unit C1, Seattle, WA 98104.

(3)As reported on Schedule 13D/A filed with the SEC on January 18, 2024. WWT is the record owner of, and has the shared power to vote or direct the vote of, and the shared power to dispose or direct the disposition of, 53,301,893 Common Shares Shaun Noll is the record owner of, and has the sole power to vote or direct the vote of, and the sole power to dispose or direct the disposition of, 78,860 Common Shares. In addition, Shaun Noll, as the Managing Member of WWT, beneficially owns, and has the shared power to vote or direct the vote of, and the shared power to dispose or direct the disposition of, the 53,301,893 Common Shares beneficially owned by WWT. Together with the Common Shares that he directly owns, Shaun Noll may be deemed the beneficial owner of an aggregate of 53,380,753 Common Shares. The principal business address of WWT and Mr. Noll is 1440 Plymouth Ave, San Francisco, CA 94112.

For further information, please contact:

DIRTT Investor Relations at ir@dirtt.com

Item 2. Exhibits.

SIGNATURE

Pursuant to the requirements of Section 12 of the Securities Exchange Act of 1934, the registrant has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: August 2, 2024

DIRTT Environmental Solutions Ltd.

By: /s/ Fareeha Khan

Fareeha Khan

Chief Financial Officer

(Principal Financial Officer)

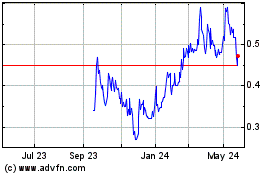

Dirtt Environmental Solu... (PK) (USOTC:DRTTF)

Historical Stock Chart

From Feb 2025 to Mar 2025

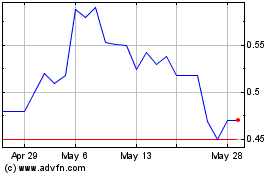

Dirtt Environmental Solu... (PK) (USOTC:DRTTF)

Historical Stock Chart

From Mar 2024 to Mar 2025