PART I

Cautionary Statement regarding

Forward-Looking Statements

This Annual Report on Form 10-K

of Data Call Technologies, Inc. (hereinafter the "Company", the

"Registrant", “we”, “us”, or "Data Call") includes

forward-looking statements within the meaning of Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The

Registrant has based these forward-looking statements on its current expectations and

projections about future events. These forward-looking statements are subject to known and

unknown risks, uncertainties and assumptions about the Registrant that may cause its

actual results, levels of activity, performance or achievements to be materially different

from any future results, levels of activity, performance or achievements expressed or

implied by such forward-looking statements. In some cases, you can identify

forward-looking statements by terminology such as "may," "will,"

"should," "could," "would," "expect,"

"plan," "anticipate," "believe," "estimate,"

"continue," or the negative of such terms or other similar expressions. Factors

that might cause or contribute to such a discrepancy include, but are not limited to,

those described in this Annual Report on Form 10-K and in the Registrant's other

Securities and Exchange Commission filings. Should one or more of these risks or

uncertainties materialize, or should any of our assumptions prove incorrect, actual

results may vary in material respects from those projected in the forward-looking

statements. For a more detailed discussion of the foregoing risks and uncertainties, see

"Risk Factors".

ITEM

1. DESCRIPTION OF BUSINESS.

Table of Contents

Data Call Technologies, Inc. was incorporated under the laws

of the State of Nevada as Data Call Wireless, Inc. on April 4, 2002, and is

sometimes referred to herein as "we", "us", "our", "Data Call" or the "Company."

On March 1, 2006, we changed our name to Data Call Technologies, Inc. Since our

inception, we have been engaged in the business of offering real-time

information/content via digital signage and kiosk networks to our clients, who

we consider to be our partners rather than simply as customers.

Our mission is to integrate cutting-edge information/content

delivery solutions currently deployed by the media and make this content rapidly

available to and within the control of our retail and commercial

clients/customers. The Company's services put its clients in control of

real-time news and other dynamic content, displayed within one or more

locations, as well as to thousands of local, regional and national clients,

through Digital Signage and Kiosk networks.

Our business plan is to focus on growing our client base by

continually offering real-time information/content via Digital Signage and Kiosk

networks, seeking to improve the delivery, security and variety of

information/content services to the Digital Signage and Kiosk community.

Overview - What Is Digital Signage?

LED and LCD displays are continually replacing printed

marketing materials such as signs and placards, as well as the old-fashioned

whiteboard, for product and corporate branding, marketing and assisted selling.

The appeal of instantly updating product videos and promotional messages on one

or a thousand remotely located displays is driving the adoption of this exciting

marketing tool. Digital Signage presentations are typically comprised of

repeating loops of information used to brand, market or sell the owner's

products and services. But once viewed, this information becomes repetitive and

the viewer tunes it out, resulting in low retention of the client's message. As

digital signage "comes of age," the dynamic characteristics of the digital

signage presentations has taken center-stage requiring fresh, relevant and

updated dynamic content.

Digital Signage Comes of Age

We believe that the Digital Signage industry is "coming of

age" and that Data Call through multiple industry relationships has been engaged

in the business for more than a decade. Our company has virtually been there

from the start and is in in a prime position to enjoy and benefit from our

industry's growth. A few short years ago, a business wanting to derive

commercial benefit from use of digital signage was often confronted with a

myriad of hardware and software companies, all offering their own version of

what digital signage should be. Typical customers for digital signage were

most-often offered the hardware for digital signage but without the full package

of content with which to build and tailor their systems for their target

customer base.

Those early digital signage customers often had to deal with

the fact that their digital signage hardware vendors lacked the know-how to

provide them with the "do's and don'ts" of content development. However, from

our inception, Data Call recognized that our competitors and their typical

customers lacked a key component which includes the offering of a comprehensive

content package.

Recently, as the cost of platforms supporting infrastructure

and digital displays have fallen significantly, digital signage has become more

accessible to a wider range of potential users while the growing Kiosk market

has cross-pollinated with Digital Signage. Companies in our industry have come

to understand, as we have understood almost since our inception in 2002, that

the initial, one-time, up-front cost of Data Call's integrated,

content-flexible, hardware and software package is far more customer friendly

and, as a result, far surpasses outweighs the up-front savings by not doing so.

The benefit that Data Call provides to our customers, in the form of ongoing

content development, is expected to continue to provide our customers with

desirable user friendly services.

As the cost of deployment has decreased, Data Call has

continued to focus, as well as other providers have only begun focusing, on

offering "attention-grabbing content" as a means of drawing target customers'

attention to the core message of clients, thereby keeping their target customers

engaged throughout Digital Signage and Kiosk presentations.

The Need for Speed - Active Content

Active and dynamic content is the integral part of digital

signage presentations that must be constantly updated with timely and relevant

information in order to attract and retain target customers to the product and

service offered by clients. For instance, a typical presentation may contain ten

15-second loops that provide the primary message of the presentation, but the

active dynamic content, such as that provided by Data Call, is updated with new

information throughout the day. Those seeking to add active and dynamic content

to their digital signage presentations are advised to employ Data Call's

integrated content rather than attempting to "cut and paste" broadcast content

of others into their digital signage presentation.

Our clients, by integrating Data Call's active content as a

meaningful component of their digital signage presentations, can provide the

entertainment and information content necessary to enhance the target customer's

information retention without disrupting the core message of the presentation.

Information categories provided by Data Call include news, weather, sports,

financial data and the latest traffic alerts, among others. With such a broad

range of offerings, our clients have access to the active and dynamic content

they need, regardless of the target customers and market they are addressing.

Our Business Opportunities

Our many opportunities for client development in the digital

signage industry are growing virtually exponentially. While many companies in

our industry have traditionally outsourced all or part of their content

creation, Data Call serves as a provider of dynamic active content to clients on

a tailored basis. Whether a client desires general entertainment information for

customers, such as news, sports, stock market quotes, etc. or location-specific

content, such as local weather, traffic, product sales and specials, etc., our

research has validated our long-held assumption that dynamic content draws and

retains our clients' target viewers to their digital signage and keeps them

engaged throughout the presentation.

Since our inception, management has developed strong

relationships working with the leaders in digital signage. Collaborative efforts

successfully created the data formats and means of communication to facilitate

the delivery of our dynamic content more easily and efficiently by our clients

for integration into their hardware and software products, setting industry

standards.

Partners, Not Customers

Data Call's approach to our clients is to build long-lasting

partnerships by creating client relationships that we believe are unique in the

digital signage industry. We do this because we understand that each client has

its own content requirement. In developing dynamic content for individual

digital signage clients, we have identified three content-related factors: (i)

reliability; (ii) objectivity; and (iii) ease of implementation. To address the

reliability requirement, we have elected to enter into license arrangements with

the leading providers of news, weather, sports and financial information, among

other client-desired content rather than either: (i) downloading and repackaging

content sourced from the Internet (which may be illegal); or (ii) pulling RSS

feeds (which may come and go at the provider's whim). Licensing data from these

premier providers has also served us by satisfying the second criteria,

objectivity. Because it is commonly recognized that Internet content may often

be unreliable, unverifiable and biased, we have determined that we could not

simply use unfiltered Internet content for delivery to our clients. To achieve

ease of implementation, our licensing of data facilitates the ease of delivery

to and implementation and use by our client/partners. Data Call has understood

that it's Digital Signage and Kiosk clients needed more complete service than to

endeavor the sourcing of active content from multiple vendors. As a result, our

flexible content packages permit our clients to do "one stop shopping" for all

of their dynamic content requirements by a single sublicense from us. Ease of

implementation also would require that the multiple formats of all Data Call's

data providers be distilled into a single, usable format.

We enable our clients to receive customized dynamic content

which may be displayed in a multitude of ways (banners, tickers, scrolls or

artistically integrated with the overall presentations). We have created and

produced multiple sets of common data layouts in the industry-standard XML

(extensible markup language) format inclusive of MRSS. With the advent of HTML5,

even more delivery methods have been made available to our clients, many of whom

have found these new formats to be easily integrated into their products.

Nevertheless, we have also produced customized data formats to the exact and

specific requirements of our clients/partners, which, we believe ensures a

higher level of reliability and ease of integration.

Market demand, opportunity and technology converge at a

single point in time, and Data Call is there. Our integrity continues to build

our business. Digital signage platforms are evolving to meet mass market

requirements, costs for hardware and software are falling to the point of

becoming commodities and the markets for digital signage are clarifying through

historical trial and error.

Business Operations

In August of 2013, we announced the release of our Direct

Lynk Media (DLMedia) product. The DLMedia product encapsulates the Direct Lynk

Messenger product with major enhancements and options that allow the client to

select and include in their feed images relative to the news feeds. Also in the

release, both Weather and Traffic image products have been enhanced

considerably. Other additions included within the release bring more value to

the company's clients and create more interest from new and existing clients.

The current types of data and information, for which a client

is able to subscribe to through the Direct Lynk System include:

|

Ÿ

|

Headline News top world and

national news headlines;

|

|

Ÿ

|

Business News top business

headlines;

|

|

Ÿ

|

Financial Highlights world-based

financial indicators;

|

|

Ÿ

|

Entertainment News top

entertainment headlines;

|

|

Ÿ

|

Health/Science News top

science/health headlines;

|

|

Ÿ

|

Quirky News Bits latest off-beat

news headlines;

|

|

Ÿ

|

Sports Headlines top sports

headlines;

|

|

Ÿ

|

Latest Sports Lines - latest sports

odds for NFL, NBA, NHL, NCAA Football and NCAA Basketball;

|

|

Ÿ

|

National Football League latest

game schedule, and in-game updates;

|

|

Ÿ

|

National Basketball Association -

latest game schedule, and in-game updates;

|

|

Ÿ

|

Major League Baseball - latest game

schedule, and in-game updates;

|

|

Ÿ

|

National Hockey League - latest

game schedule, and in-game updates;

|

|

Ÿ

|

NCAA Football - latest game

schedule, and in-game updates;

|

|

Ÿ

|

NCAA Men's Basketball - latest game

schedule, and in-game updates;

|

|

Ÿ

|

Professional Golf Association top

10 leaders continuously updated throughout the four-day tournament;

|

|

Ÿ

|

NASCAR top 10 race positions

updated every 20 laps throughout the race;

|

|

Ÿ

|

Major league soccer;

|

|

Ÿ

|

Traffic Mapping;

|

|

Ÿ

|

Animated Doppler Radar and Forest

Maps;

|

|

Ÿ

|

Listings of the day's horoscopes;

|

|

Ÿ

|

Listings of the birthdays of famous

persons born on each day;

|

|

Ÿ

|

Trivia;

|

|

Ÿ

|

Listings of historical events which

occurred on each day in history; and

|

|

Ÿ

|

Localized Traffic and Weather

Forecasts.

|

We currently offer our Direct Lynk Messenger and DLMedia

services to our clients and other potential customers through the Internet. Both

DLM Services are Digital Signage products and real-time information services

which provides a wide range of up-to-date information for display. Both DLM

services are able to work concurrently with customers' existing digital signage

systems. The Direct Lynk Messenger product is slowly becoming a legacy product

with the DLMedia product in the forefront.

The Digital Signage and Kiosk industry is still a relatively

new and since our inception in 2002 we have come to understand that it provides

an exciting method for advertisers, including our clients, to promote, inform,

educate, and entertain their customers regarding their business products and

services. Through Digital Signage, businesses can use a single display or a

complex, networked series of flat screen LED, LCD and even combined as video

walls as display devices to market their products and services directly at their

facilities and elsewhere to their customers and patrons in real time.

Additionally, because Digital Signage advertising takes place in real time,

businesses can change their marketing efforts literally from moment to moment

and over the course of a day or such other period as they may determine.

We believe that the ability of our clients to display in

real-time the information and content we deliver better allows our clients

companies to tailor their products, services and advertising to individual and

target-group customers, thereby advertising and offering, for example, inventory

and sales discounts that may be designed to appeal to those individual customers

and target customer groups, increasing sales and revenues. We believe that the

benefits of on-site, real-time Digital Signage displays compared to regular

print or video advertising are substantial and include, among other advantages,

being able to immediately change digitally-displayed images/advertisements

depending on our client's customers own situation, not simply being restricted

by in-store print circulars produced days, weeks or even months in advance,

which may become stale or obsolete prior to or shortly after publication and

dissemination.

We specialize in allowing clients to create their own Digital

Signage dynamic content feeds which are delivered online directly to their

chosen, electronic digital display devices at their various facilities. The only

requirements our clients must have are: (i) a supported, third-party Digital

Signage and/or Kiosk equipment solution, or similar device, which receives the

data from our servers online; and (ii) an Internet connection. Our Direct Lynk

System is supported by various, readily available third-party systems, varying

in costs from inexpensive monthly cloud-based licenses to much more extensive

and expensive content management/playback systems. Our Direct Lynk Systems allow

customers to select from the pre-determined data and information subscriptions

of those described above. We enable our clients to also select location specific

content they wish to receive based on how and where their Digital Signage

network is configured.

During the first quarter of fiscal 2014, we released our

"Playlist-Ready" content products, enhancing our ability to further accommodate

our current clients and appease new prospects. One product within the "Above the

Fold" line has received a high level of acceptance at the industry trade shows,

most recently at the Digital Signage Expo held in Las Vegas in March 2015.

In the end of 2015, we made available to our clients an

online video creation tool. This tool is simple to use no matter what the level

of computer skills a user may have. This online product requires no special

artistic training. It is also ideal for re-purposing content originally created

by a creative agency: customizing such content for local marketing, franchisee

or dealer ID, web, digital signage, or agile marketing. It can create thousands

of customized versions of a master piece of creative automatically. It has full

brand compliance features built-in and satisfies professional artist specs. The

system provides the client with the tools needed to create HD videos and video

advertising in minutes. There are two available online options "Do It Myself"

for extreme flexibility and control as the client creates HD videos and

advertising from online templates, or a "Do It For Me" automated solution that

lets the system do the work for the client. The client just needs to provide

their business name and zip code. All of our products and services can be viewed

on our website: datacalltech.com.

Dependence On A Few Major Customers

At December 31, 2016, we had over 1,000 customer/subscribers

for our Direct Lynk System, which customers are relatively small, paying

cumulatively an average monthly fee to Data Call of $10,000. We also have

several larger new potential partner/clients that are testing our Digital Link

Media products, and we expect that some or all of them may be expected to become

significant clients in the near future. During the year ended December 31, 2016,

we were dependent upon two major customers, who accounted for approximately 77%

of our revenues. During the year ended December 31, 2015, we were dependent upon

two major customers, who accounted for approximately 79% of our revenues.

Notwithstanding the forgoing, based upon recent

communications with several potential clients who are volume users and/or

wholesale distributors of digital signage content and content management

systems, we believe that during 2017, several new clients will contribute

significant revenue which should materially reduce our reliance on our three

major customers to less than 50%. As a result, we believe that that we should

become far less reliant on a few business clients for our source of revenue.

However, there can be no assurance that our belief will prove to be justified

or, if justified, that such trend will continue for any future period, if at

all.

Employees

At December 31, 2016, we had 4 full-time employees, including

our two executive officers. Depending upon our level of our growth, if any, we

expect that we may or will be required to hire additional personnel in the areas

of sales and marketing, software design, research and development and otherwise,

during 2016 and continuing into 2017. However, we will be dependent upon revenue

growth and profitability, of which there can be no assurance, to fund any

increase in staff. None of our employees are covered by a selective bargaining

agreement

Estimate Of The Amount Spent On Research And

Development Activities

Since our inception in April 2002, the majority of our

expenditures have been on research and development to create our Direct Lynk

Messenger Systems, including software and hardware development and testing

costs. The amount spent on this research and development from inception through

December 31, 2016 is approximately $2,000,000.

ITEM 1A. RISK FACTORS.

Table of Contents

Investing in our common stock, while providing investors with

an equity ownership interest, involves a high degree of risk, including the

potential loss of all or a significant portion of their investment. Shareholders

will be subject to risks inherent in our business relative to, among other

things, general economic and industry conditions, market conditions and

competition. The value of the investment may increase or decrease and could

result in a loss, the size and extent of which cannot be predicted. An investor

should carefully consider the following factors as well as other information

contained in this annual report on Form 10-K for our year-ended December 31,

2016.

This annual report on Form 10-K also contains forward-looking

statements that involve risks and uncertainties. Our actual results could differ

materially from those anticipated in the forward-looking statements as a result

of many factors, including the risk factors described below and the other

factors described elsewhere in this Form 10-K.

Since our inception, we have had a history of generating

operating losses. However, in the past two calendar years, we have reversed that

trend and have been able to generate positive cash flow from operations. As a

result, our auditors have removed the going concern from their opinion. We

anticipate being profitable in the near future. We currently expect to

significantly increase our revenues by increasing our client base and/or

generating additional revenue streams by offering new and enhanced products and

services. However, there can be no assurance that our plan will be successful,

either in whole or in part. If we fail to grow our revenues, our ability to

achieve and fulfill our business plan may be delayed, which could adversely

impact our results of operations.

Unforeseen events.

There can be no assurance that unforeseen events, such as:

(i) the length of time necessary to generate increasing market acceptance of our

Direct Lynk Systems; (ii) any unexpected material increased development costs;

(iii), the general economy in the markets where we offer our Direct Lynk

Systems.

We have competition.

There are many different sectors in the Digital Signage

industry, including but not limited to (i) content Management providers, (ii)

content Creation services, (III) hardware manufacturers, (iv) network management

providers and (v) installation service providers. These sectors are extremely

vas and well capitalized. We are in the content sector within a more specific

niche of providing subscriptions of dynamic content. We provide subscription

service of a wide variety of dynamic infotainment to the industry. As the leader

in our subsector of the industry, other companies have attempted to duplicate us

and we expect competition to increase in the future. To be competitive, we must

continue to invest significant resources in research and development, sales and

marketing and customer support. Few have sufficient resources to make these

investments or are unable to make the technological advances necessary to

continue to remain the leader, our competitive position may suffer. Increased

competition could result in price reductions, fewer customer orders, reduced

margins and loss of market share. Our failure to compete successfully against

current or future competitors could adversely affect our fussiness and financial

condition.

We rely on key management personnel.

We are highly dependent upon the services and efforts of key

persons, as follows: Tim Vance, our founder and full-time CEO and Chief

Operating Officer. Our ability to operate and implement our business plan is

heavily dependent upon the continued services of Mr. Vance to grow as

anticipated, our ability to attract, retain and motivate qualified, newly-hired,

full and part-time personnel. The loss of Mr. Vance, in particular, and our

inability, in the future to hire and retain qualified sales and marketing,

software engineers and additional management personnel, as needed, could have a

material adverse effect on our business and operations. We do not have "key man"

life insurance on Mr. Vance.

We are highly dependent upon our ability to successfully

market Direct Lynk System to subscribers.

We are dependent on the abilities of our sales and marketing

activities to generate new clients for subscriptions to our Direct Lynk Systems

and to broaden our customer base. While the number of paying subscribers for our

Direct Lynk System increased during December 31, 2016 compared to December 31,

2015, there can be no assurance that our sales and marketing efforts will be

able to market acceptance for our Direct Lynk System and increase our customer

base to a level that will permit continued profitable operations. If our sales

and marketing cannot continue to achieve market acceptance for our Direct Lynk

Systems, and increase our customer base to a level that will permit profitable

operations. If our sales and marketing efforts are unable to continue to

generate new customers, we may not be able to generate sufficient revenues to

continue with planned research and development on new products and improve our

current products.

Difficult and volatile conditions in the capital, credit

and commodities markets and general economic uncertainty have prompted companies

to cut capital spending worldwide and could continue to materially adversely

affect our business.

Disruptions in the economy and constraints in the capital

markets have caused companies to reduce or delay capital investment. Some of our

prospective customers may cancel or delay spending on the development or

roll-out of technology projects with us due to continuing economic uncertainty.

Our financial position, results of operations and cash flow could continue to be

materially adversely affected by continuing difficult economic conditions and

significant volatility in the capital. The continuing impact that these factors

might have on us and our business is uncertain and cannot be predicted at this

time. Such economic conditions have accentuated each of the risks we face and

magnified their potential effect on us and our business. The difficult

conditions in these markets and the overall economy affect our business in a

number of ways. For example:

Ÿ

Market

volatility has exerted downward pressure on our stock price, which may make it

more difficult for us to raise additional capital in the future. Economic

conditions could continue to result in our customers experiencing financial

difficulties or electing to limit spending because of the declining economy,

which may result in decreased revenue for us.

Ÿ

Difficult economic conditions have adversely affected certain industries in

particular, including the automotive and restaurant industries, in which we have

major customers. We could also experience lower than anticipated order levels

from current customers, cancellations of existing but unfulfilled orders, and

extended payment terms. Economic conditions could materially impact us through

insolvency of our suppliers or current customers.

Ÿ

Economic conditions combined with the weakness in the credit markets could

continue to lead to increased price competition for our products, and higher

overhead costs as a percentage of revenue.

If the markets in which we participate experience further

economic downturns or slow recovery, this could continue to negatively impact

our revenue generation, margins and operating expenses, and consequently have a

material adverse effect on our business, financial condition and results of

operations. If customer demand were to decline further, we might be unable to

adjust expense levels rapidly enough in response to falling demand or without

changing the way in which we operate. If revenue were to decrease further and we

were unable to adequately reduce expense levels, we might incur significant

losses that could adversely affect our overall financial performance and the

market price of our common stock.

Potential future government regulation of the Internet may

adversely affect our business.

We are dependent upon the Internet in connection with our

business operations and the delivery of content for our Direct Lynk Systems. The

United States Federal Communications Commission (the "FCC") does not currently

regulate companies that provide services over the Internet, as it does common

carriers or tele-communications service providers. Notwithstanding the current

state of the FCC's rules and regulations, the potential jurisdiction of the FCC

over the Internet is broad and if the FCC should determine in the future to

regulate the Internet, our operations, as well as those of other Internet

service providers, could be adversely. Compliance with future government

regulation of the Internet could result in increased costs and because of our

limited resources; it would have a material adverse effect on our business

operations and operating results and financial condition.

We are dependent on the security of the Internet to serve

our customers; any security breaches or other Internet difficulties could

adversely affect our business.

We offer the majority of our services through, the secure

transmission of confidential information over public networks are a critical

element of our operations. A party who is able to circumvent security measures

(hacker) could misappropriate proprietary information or cause interruptions in

our operations. If we are unable to prevent unauthorized access to our users'

information and transactions, our customer relationships could be irreparably

harmed. Although we currently have in place security measures that we feel are

adequate to protect our business and those of our customers, these measures may

not prevent future security breaches. Nature's events placed on our systems

could cause our systems to fail or cause our systems to operate at speeds

unacceptable to our users, in which event we could lose customers and experience

a material impact on our financial condition.

We must rely on other companies to maintain the Internet

infrastructure if we hope to be successful.

Our future success depends, in large part, on other companies

maintaining the Internet system infrastructure, including maintaining a reliable

network backbone that provides adequate speed, data capacity and security. If

the Internet continues to experience anticipated significant growth in the

number of users, frequency of use and amount of data transmitted, as well as the

number of malicious viruses and worms introduced onto the Internet by hackers

and others, the infrastructure of the Internet may be unable to support the

demands placed on it at any particular time or from time-to-time. Because we

rely heavily on the Internet and our limited capital, any disruption of the

Internet could adversely affect us to a greater degree than our competitors and

other users of the Internet.

Our website and systems are hosted by a third party and we

are vulnerable to disruptions or other events that are beyond our control.

Our website and systems are hosted by a third party. We are

dependent on our systems' ability to distribute information over the Internet to

customers. If our systems fail, it would harm our reputation, resulting in a

loss of current and potential future customers and could cause us to breach

existing agreements. Our success depends, in part, on the performance,

reliability and availability of our services, which in turn are dependent on our

third-party provider. Our systems and operations could be damaged or interrupted

by fire, flood, power loss, telecommunications failure, Internet breakdown,

break-in, earthquake and similar events. We would face significant damage as a

result of these events. As a result, we may be unable to develop or successfully

manage the infrastructure necessary to meet current or future demands for

reliability and scalability of our systems, which would have a negative impact

on our business and financial conditions.

Our Direct Lynk Systems use sophisticated software which

could be found to contain bugs or could be compromised by viruses. While we have

not experienced any material bugs and viruses to date, if such event could

occur, it could be costly for us to identify and repair, and until such bugs or

viruses, if any, are fixed, they could cause interruptions in our service, which

could cause our reputation to decline and/or cause us to lose clients.

Risk Factors Related to Our Common Stock

We are subject to financial reporting and other

requirements for which our accounting, other management systems and resources

may not be adequately prepared.

As a public company, we incur significant legal, accounting

and other expenses, including costs associated with reporting requirements and

corporate governance requirements, including requirements under the Dodd-Frank

Wall Street Reform and Consumer Protection Act of 2010, the Sarbanes-Oxley Act

of 2002, and rules implemented by the SEC.

If we identify significant deficiencies or material

weaknesses in our internal control over financial reporting that we cannot

remediate in a timely manner, investors and others may lose confidence in the

reliability of our financial statements, and the trading price of our common

stock and ability to obtain any necessary equity or debt financing could suffer.

In addition, if our independent registered public accounting firm is unable to

rely on our internal control over financial reporting in connection with its

audit of our financial statements, and if it is unable to devise alternative

procedures in order to satisfy itself as to the material accuracy of our

financial statements and related disclosures, it is possible that we would be

unable to file our annual report with the SEC, which could also adversely affect

the trading price of our common stock and our ability to secure any necessary

additional financing.

In addition, the foregoing regulatory requirements could make

it difficult or costly for us to obtain certain types of insurance, including

directors' and officers' liability insurance, and we may be forced to accept

reduced policy limits and coverage or incur substantially higher costs to obtain

the same or similar coverage. The impact of these events could also make it more

difficult for us to attract and retain qualified persons to serve on our board

of directors, on board committees or as executive officers.

Market prices of our equity securities can fluctuate

significantly.

The market prices of our common stock may change

significantly in response to various factors and events beyond our control,

including the following:

Ÿ

the other risk factors described in this Form 10-K;

Ÿ

changing demand for our products and services and ability to develop and

generate sufficient revenues;

Ÿ

any delay in our ability to generate operating revenue or net income;

Ÿ

general conditions in markets we operate in;

Ÿ

issuance of a significant number of shares, whether for compensation under

employee stock options, conversion of debt, potential acquisitions, additional

financing or otherwise.

There is only a limited trading market for our common

stock.

Our Common Stock is subject to quotation on the OTC market.

There has only been limited trading activity in our common stock. There can be

no assurance that a more active trading market will commence in our securities

as a result of the increasing operations of Data Call. Further, in the event

that an active trading market commences, there can be no assurance as to the

level of any market price of our shares of common stock, whether any trading

market will provide liquidity to investors, or whether any trading market will

be sustained.

State blue sky registration; potential limitations on

resale of our securities.

Our common stock, the class of the Company's securities that

is registered under the Exchange Act, has not been registered for resale under

the Securities Act of 1933 or the "blue sky" laws of any state. The holders of

such shares and persons, who desire to purchase them in any trading market that

might develop in the future, should be aware that there may be significant state

blue-sky law restrictions upon the ability of investors to resell our

securities. Accordingly, investors should consider the secondary market for the

Company's securities to be a limited one.

It is the intention of the management to seek coverage and

publication of information regarding the Company in an accepted publication

which permits a manual exemption. This manual exemption permits a security to be

distributed in a particular state without being registered if the Company

issuing the security has a listing for that security in a securities manual

recognized by the state. However, it is not enough for the security to be listed

in a recognized manual. The listing entry must contain (1) the names of issuers,

officers, and directors, (2) an issuer's balance sheet, and (3) a profit and

loss statement for either the fiscal year preceding the balance sheet or for the

most recent fiscal year of operations. Furthermore, the manual exemption is a

nonissuer exemption restricted to secondary trading transactions, making it

unavailable for issuers selling newly issued securities.

Most of the accepted manuals are those published in Standard

and Poor's, Moody's Investor Service, Fitch's Investment Service, and Best's

Insurance Reports, and many states expressly recognize these manuals. A smaller

number of states declare that they "recognize securities manuals" but do not

specify the recognized manuals. The following states do not have any provisions

and therefore do not expressly recognize the manual exemption: Alabama, Georgia,

Illinois, Kentucky, Louisiana, Montana, South Dakota, Tennessee, Vermont and

Wisconsin.

Dividends unlikely on our common stock.

We do not expect to pay dividends for the foreseeable future.

The payment of dividends, if any, will be contingent upon our future revenues

and earnings, capital requirements and general financial condition. The payment

of any dividends will be within the discretion of our board of directors. It is

our intention to retain all earnings for use in our business operations and

accordingly, we do not anticipate that the Company will declare any dividends in

the foreseeable future.

Compliance with Penny Stock Rules.

Our securities will initially be considered a "penny stock"

as defined in the Exchange Act and the rules there under, since the price of our

shares of common stock is less than $5. Unless our common stock is otherwise

excluded from the definition of "penny stock," the penny stock rules apply with

respect to that particular security. The penny stock rules require a

broker-dealer prior to a transaction in penny stock not otherwise exempt from

the rules, to deliver a standardized risk disclosure document prepared by the

SEC that provides information about penny stocks and the nature and level of

risks in the penny stock market. The broker-dealer also must provide the

customer with current bid and offer quotations for the penny stock, the

compensation of the broker-dealer and its sales person in the transaction, and

monthly account statements showing the market value of each penny stock held in

the customer's account. In addition, the penny stock rules require that the

broker-dealer, not otherwise exempt from such rules, must make a special written

determination that the penny stock is suitable for the purchaser and receive the

purchaser's written agreement to the transaction. These disclosure rules have

the effect of reducing the level of trading activity in the secondary market for

a stock that becomes subject to the penny stock rules. So long as the common

stock is subject to the penny stock rules, it may become more difficult to sell

such securities. Such requirements, if applicable, could additionally limit the

level of trading activity for our common stock and could make it more difficult

for investors to sell our common stock.

Shares eligible for future sale.

As of December 31, 2016, the Registrant had 4,832,547, shares

of common stock issued and outstanding of which 1,082,048 shares are

"restricted" as that term is defined under the Securities Act, and in the future

may be sold in compliance with Rule 144 under the Securities Act. Rule 144

generally provides that a person holding restricted securities for a period of

six months may sell every three months in brokerage transactions and/or

market-maker transactions an amount equal to the greater of one (1%) percent of

(a) the Company's issued and outstanding common stock or (b) the average weekly

trading volume of the common stock during the four calendar weeks prior to such

sale. Rule 144 also permits, under certain circumstances, the sale of shares

without any quantity limitation by a person who has not been an affiliate of the

Company during the three months preceding the sale and who has satisfied a six

month holding period. However, all of the current shareholders of the Company

owning 5% or more of the issued and outstanding common stock are subject to Rule

144 limitations on selling.

The Nevada Revised Statutes and our articles of

incorporation authorize to issue additional shares of common stock and shares of

preferred stock, which preferred stock having such rights, preferences and

privileges as our board of directors shall determine.

Pursuant to our Articles of Incorporation, as amended and

restated, we have authorized capital stock of 200,000,000 shares of common stock

and 10,000,000 shares of preferred stock. As of the December 31, 2016, we have

4,832,547 shares of common stock issued and outstanding and 800,000 shares of

preferred A stock issued and outstanding and 10,000 shares of preferred B stock

issued and outstanding. Our Board of Directors has the ability, without

shareholder approval; to issue a significant number of additional shares of

common stock without shareholder approval, which if issued would cause

substantial dilution to our then common shareholders. Additionally, shares of

preferred stock may be issued by our Board of Directors at their sole discretion

and without shareholder approval, in such classes and series, having such

rights, including voting rights and super-majority voting rights, and such

preferences and relative, participating, optional or other special rights,

powers and privileges as determined by our Board of Directors from time-to-time.

If shares of preferred stock are issued by our Board of Directors having

super-majority voting rights, or having conversion rights to convert their

preferred stock into a number of shares of common stock at a ratio of greater

that one-for-one, holders of our common stock would be subject to dilution that

may be significant.

During the quarter ended September 30, 2014 the Company

amended its Articles of Incorporation to authorize 1,000,000 shares of Series B

Preferred Stock, par value $0.001 (the "Series B Stock"), 10,000 shares of which

were issued to our CEO, Tim Vance. The Series B Stock, which may be issued in

one or more series by the terms of which may be and may include preferences as

to dividends and liquidation, conversion, redemption rights and sinking fund

provisions, has the right to vote, in the aggregate, on all shareholder matters,

equal to 51% of the total shareholder vote on any and all shareholder matters.

The Series B Stock is entitled to this super-majority, 51% voting right no

matter how many shares of common stock or other voting stock of Data Call stock

is issued and outstanding in the future. The voting rights of the Series B Stock

make a change in control without the approval of Timothy Vance, our CEO,

impossible.

ITEM 1B. UNRESOLVED STAFF

COMMENTS.

Table of Contents

None.

ITEM 2. DESCRIPTION OF PROPERTY.

Table of Contents

On January 9, 2013, the Company entered into a one-year lease agreement with

Bridwell Property Group Inc., our landlord, for office space of 700 square feet

located at 700 S Friendswood Drive, Suite E., Friendswood, TX 77546. The

property changed ownership on February 1, 2014 and the Company and the new

owner, Berkenmeier Properties, LLC mutually agreed to extend the lease for

additional years at the same monthly rent of $900. We believe that these

facilities are sufficient for our present level of operations including the

growth we anticipate during the next twelve months. In the event that we need

additional space, we believe that it will be available in the same property at

comparable rates.

ITEM 3. LEGAL PROCEEDINGS.

Table of Contents

None.

ITEM 4. MINE SAFETY DISCLOSURE.

Table of Contents

None.

PART II

ITEM 5.

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS.

Table of Contents

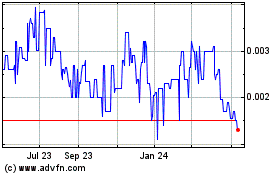

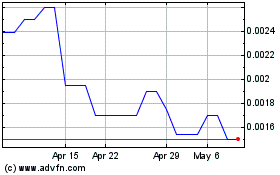

Market

Information

Our common stock is

currently quoted on the OTCQB under the symbol DCLT. Quotation of the Company's securities

on the OTCQB limits the liquidity and price of the Company's common stock more than if the

Company's shares of common stock were listed on The Nasdaq Stock Market or a national

exchange. For the periods indicated, the following table sets forth the high and low bid

prices per share of common stock. The below prices represent inter-dealer quotations

without retail markup, markdown, or commission and may not necessarily represent actual

transactions.

|

|

|

Fiscal 2016

|

|

Fiscal 2015

|

|

Fiscal 2014

|

|

|

|

High

|

|

Low

|

|

High

|

|

Low

|

|

High

|

|

Low

|

|

First Quarter ended

March 31

|

|

$

|

0.0042

|

|

$

|

0.0014

|

|

$

|

0.0040

|

|

$

|

0.0036

|

|

$

|

0.0035

|

|

$

|

0.0030

|

|

Second Quarter ended

June 30

|

|

$

|

0.0038

|

|

$

|

0.0025

|

|

$

|

0.0032

|

|

$

|

0.0029

|

|

$

|

0.0035

|

|

$

|

0.0029

|

|

Third Quarter ended

September 30

|

|

$

|

0.0028

|

|

$

|

0.0015

|

|

$

|

0.0028

|

|

$

|

0.0023

|

|

$

|

0.0040

|

|

$

|

0.0036

|

|

Fourth Quarter ended

December 31

|

|

$

|

0.0021

|

|

$

|

0.0014

|

|

$

|

0.0018

|

|

$

|

0.0015

|

|

$

|

0.0050

|

|

$

|

0.0034

|

As of December 31,

2016, our shares of common stock were held by approximately 281 stockholders of record.

Dividends

The holders of our Preferred Stock, Series A, are entitled to a dividend of

12 percent annually, subject to conversion into common stock. The undeclared

dividends of this stock are calculated, but have not been recorded.

Holders of common stock are entitled to dividends when, as, and if declared

by the Board of Directors, out of funds legally available therefore. We have

never declared cash dividends on its common stock and our Board of Directors

does not anticipate paying cash dividends in the foreseeable future as it

intends to retain future earnings to finance the growth of our businesses.

There are no restrictions in our articles of incorporation or bylaws that

restrict us from declaring dividends.

Securities

Authorized for Issuance Under Equity Compensation Plans

On December 26, 2014,

the board of directors approved the Company's 2015 Employee Incentive Plan (the

"Plan") pursuant to which the Company's board of director or a committee is

authorized to issue 25,000,000 shares.

The board of director or

committee shall determine at any time and from time to time after the

effective date of this Plan:

(i) the Eligible Participants;

(ii) the

number of shares of Common Stock issuable directly or to be granted pursuant

to an Option;

(iii) the price per share at which each Option may be

exercised or the value per share if a direct issue of stock pursuant to a

Stock Award; and

(iv) the terms on which each Option may be granted.

Such determination, as may from

time to time be amended or altered at the sole discretion of the board of

director or committee.

ITEM

6. SELECTED FINANCIAL DATA.

Table of Contents

N.A.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITIONS AND

RESULTS OF OPERATION.

Table of Contents

Results of Operations during the year ended December 31, 2016 as compared to the year

ended December 31, 2015

We had $640,613 of sales revenue for the year ended December 31, 2016,

compared to sales revenue of $605,105 for the year ended December 31, 2015, a

increase in sales revenue of $35,508 or approximately a 5.9% increase from the

prior year. We generate revenues through subscription fees received in

connection with our Direct Lynk System.

We had total costs of sales for the year ended December 31, 2016 of

$153,772 compared to total costs of sales of $151,000 for the year ended

December 31, 2015, which resulted in a gross margin of $486,841 for the year

ended December 31, 2016, compared to a gross margin of $454,105 for the year

ended December 31, 2015, a increase in gross margin of $32,736 from the

prior year, our increase in gross margin was due to our increase in

revenues.

Cost of sales as a percentage of sales was 24.0 % for the year ended

December 31, 2016, compared to 25.0% for the year ended December 31, 2015.

As we gain more customers and enter into more service agreements, we

anticipate our cost of sales will decrease as we expect to take advantage of

applicable economies of scale. Our operating expenses increased to $683,603

for the year ended December 31, 2016, compared to total expenses of $680,331

for the year ended December 31, 2015, an increase in expenses of $3,272 from

the prior period. The increase in expenses for the year of 2016 was due to

the company's ongoing efforts to expand its business opportunities. The

company had non-cash expense of $193,448, which was for common stock for its

officers and, options expense of $1,072. We had a net loss of $200,938 for

the year ended December 31, 2016, compared to a net loss of $231,681 for the

year ended December 31, 2015. While there can be no assurance regarding our

operating results in 2017, we believe that we will experience a significant

reduction in non-cash expense as well as increased operating revenues which

should result in profitable operations.

Liquidity and Capital Resources

We had current assets of $139,860 as of December 31, 2016, which

consisted of, $53,499 in cash, accounts receivable of $69,361 and $17,000 in

prepaid expense.

We had total assets of $141,591 as of December 31, 2016, compared to

$157,035 as of December 31, 2015 or a decrease of $15,444, which consisted

of current assets of $139,860, total property and equipment (net of

accumulated depreciation) of $931, which included high end flat screen

televisions, computers and software equipment responsible for running our

Direct Lynk System which is stored in our Friendswood office; and other

assets of $800, which included our deposit on our Friendswood office space.

We had total liabilities of $82,329 as of December 31, 2016, compared to

$91,355 as of December 31, 2015, a decrease of $9,026, primarily consisting

of accounts payable of $23,725 accrued expenses of $22,576, and short-term

notes of $36,028. We had positive working capital of $57,531 and an

accumulated deficit of $9,758,133 as of December 31, 2016.

Operating activities used $25,275 of cash for the year ended December 31,

2016, which was mainly due to a net loss of $200,938, common stock and

options expense of $194,520, increase in accounts receivables of $12,515,

increase in prepaid expenses of $5,630, increase in accounts payable of

$1,274, increase in accrued expenses of $793, and change in deferred revenue

of $4,057.

We had financing activities of $7,036 primarily for the pay down of

borrowings from related party during 2016 as compared to 2015 we had

financing activity of $7,036 for the pay down of borrowings from related

party.

We had no investing activities for the years ended December 31, 2016 and

2015, respectively.

Off-Balance Sheet Arrangements

As of December 31, 2016 and 2015, we did not have any off-balance sheet

arrangements as defined in Item 303(a) (4) (ii) of Regulation S-K

promulgated under the Securities Act of 1934.

Contractual Obligations and Commitments

As of December 31, 2016 and 2015, we did not have any contractual

obligations.

Critical Accounting Policies

Our significant accounting policies are described in the notes to our

financial statements for the years ended December 31, 2016 and 2015, and are

included elsewhere in this annual report.

ITEM

7A. QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT MARKET RISK.

Table of Contents

We have not entered

into, and do not expect to enter into, financial instruments for trading or hedging

purposes.

ITEM 8.

FINANCIAL STATEMENTS

AND SUPPLEMENTARY DATA.

Table of Contents

Report

of Independent Registered Public Accounting Firm

Table of Contents

To the Board of Directors & Stockholders of

Data Call Technologies, Inc.

Friendswood, Texas

We have audited the accompanying balance sheets of Data Call Technologies,

Inc. as of December 31, 2016 and 2015 and the related statements of operations,

stockholders' equity (deficit) and cash flows for each of the two years in the

two-year period ended December 31, 2016. Data Call's management is responsible

for the financial statements. Our

responsibility is to express an opinion on these financial statements based on

our audits.

We conducted our audits in accordance with standards of the Public

Company Accounting Oversight Board (United States). Those standards require

that we plan and perform the audits to obtain reasonable assurance about

whether the financial statements are free of material misstatement. The

Company is not required to have, nor were we engaged to perform, an audit of

its internal control over financial reporting. Our audits included

consideration of internal control over financial reporting as a basis for

designing audit procedures that are appropriate in the circumstances, but

not for the purpose of expressing an opinion on the effectiveness of the

Company's internal control over financial reporting. Accordingly, we express

no such opinion. An audit includes examining, on a test basis, evidence

supporting the amounts and disclosures in the financial statements,

assessing the accounting principals used and significant estimates made by

management, as well as evaluating the overall financial statement

presentation. We believe that our audits provide a reasonable

basis for our opinion.

In our opinion, the financial statements referred to above present

fairly, in all material respects, the financial position of Data Call

Technologies, Inc. as of December 31, 2016 and 2015 and the results of its

operations and its cash flows

for each of the two years in the two-year period ended December 31, 2016, in

conformity with

accounting principles generally accepted in the United States of America.

/s/ M&K CPAS, PLLC

www.mkacpas.com

Houston, Texas

April 10, 2017

|

Data Call

Technologies, Inc.

|

|

Balance Sheets

|

|

December

31, 2016 and 2015

|

|

Table of Contents

|

|

|

|

2016

|

|

2015

|

|

Assets

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

Cash

|

$

|

53,499

|

$

|

85,810

|

|

Accounts receivable

|

|

69,361

|

|

56,846

|

|

Prepaid expenses

|

|

17,000

|

|

11,370

|

|

Total current assets

|

|

139,860

|

|

154,026

|

|

|

|

|

|

|

|

Property

and equipment

|

|

128,573

|

|

128,573

|

|

Less accumulated depreciation and amortization

|

|

127,642

|

|

126,364

|

|

Net property and equipment

|

|

931

|

|

2,209

|

|

|

|

|

|

|

|

Other

assets

|

|

800

|

|

800

|

|

Total assets

|

$

|

141,591

|

$

|

157,035

|

|

|

|

|

|

|

|

Liabilities

and Stockholders' Equity (Deficit)

|

|

|

|

|

|

|

|

|

|

|

|

Current

liabilities:

|

|

|

|

|

|

Accounts payable

|

$

|

20,336

|

$

|

18,684

|

|

Accounts payable - related party

|

|

3,389

|

|

3,767

|

|

Accrued

salaries - related party

|

|

460

|

|

42

|

|

Accrued interest

|

|

22,116

|

|

21,741

|

|

Convertible short-term note payable to

related party - default

|

|

10,000

|

|

10,000

|

|

Deferred revenue - current

|

|

-

|

|

4,057

|

|

Short-term note payable to

related party - default

|

|

26,028

|

|

33,064

|

|

Total current liabilities

|

|

82,329

|

|

91,355

|

|

|

|

|

|

|

|

Total liabilities

|

|

82,329

|

|

91,355

|

|

|

|

|

|

|

|

Stockholders'

equity:

|

|

|

|

|

|

Preferred stock, $0.001 par value. Authorized 10,000,000 shares:

|

|

|

|

|

|

Series A 12% Convertible - 800,000 shares issued and outstanding

|

|

|

|

|

|

at December 31, 2016 and 2015

|

|

800

|

|

800

|

|

Preferred stock, $0.001 par value. Authorized 1,000,000 shares:

|

|

|

|

|

|

Series B - 10,000 shares issued and outstanding

|

|

|

|

|

|

at December 31, 2016 and 2015

|

|

10

|

|

10

|

|

Common stock, $0.001 par value. Authorized

200,000,000 shares:

|

|

|

|

|

|

4,832,547

shares

issued and outstanding

|

|

|

|

|

|

at December 31, 2016 and

2015, respectively.

|

|

4,833

|

|

4,833

|

|

Additional paid-in capital

|

|

9,811,752

|

|

9,617,232

|

|

Accumulated deficit

|

|

(9,758,133)

|

|

(9,557,195)

|

|

Total stockholders' equity (deficit)

|

|

59,262

|

|

65,680

|

|

Total liabilities and stockholders' equity (deficit)

|

$

|

141,591

|

$

|

157,035

|

|

|

|

|

|

|

|

The

accompanying notes are an integral part of these financial statements.

|

|

Data

Call Technologies, Inc.

|

|

Statements of Operations

|

|

Years

ended December 31, 2016 and 2015

|

|

Table of Contents

|

|

|

|

2016

|

|

2015

|

|

|

|

|

|

|

|

Revenues:

|

|

|

|

|

|

Sales

|

$

|

640,613

|

$

|

605,105

|

|

Cost of sales

|

|

153,772

|

|

151,000

|

|

Gross margin

|

|

486,841

|

|

454,105

|

|

|

|

|

|

|

|

Selling, general and administrative expenses

|

|

682,325

|

|

678,869

|

|

Depreciation and amortization expense

|

|

1,278

|

|

1,462

|

|

Total operating expenses

|

|

683,603

|

|

680,331

|

|

|

|

|

|

|

|

Other (income) expenses:

|

|

|

|

|

|

Interest income

|

|

(1,163)

|

|

(9)

|

|

Interest expense

|

|

5,339

|

|

5,464

|

|

Total expenses

|

|

687,779

|

|

685,786

|

|

|

|

|

|

|

|

Net

(loss) before income

taxes

|

|

(200,938)

|

|

(231,681)

|

|

|

|

|

|

|

|

Provision

for income taxes

|

|

-

|

|

-

|

|

Net (loss)

|

$

|

(200,938)

|

$

|

(231,681)

|

|

|

|

|

|

|

|

Net

(loss) per common share - basic and diluted:

|

|

|

|

|

|

Net

(loss) applicable to common shareholders

|

$

|

(0.04)

|

$

|

(0.05)

|

|

|

|

|

|

|

|

Weighted

average common shares:

|

|

|

|

|

|

Basic and diluted

|

|

4,832,547

|

|

4,731,543

|

|

|

|

|

|

|

|

The

accompanying notes are an integral part of these financial statements.

|

|

Data Call Technologies, Inc.

|

|

Statement

of Stockholders' Equity (Deficit)

|

|

Years ended December 31, 2016 and 2015

|

|

Table of Contents

|

|

|

|

|

|

|

|

|

Additional

|

|

|

|

Stockholders'

|

|

|

Preferred Stock

A

|

|

Preferred Stock B

|

|

Common Stock

|

|

paid-in

|

|

Accumulated

|

|

equity

|

|

|

shares

|

|

amount

|

|

shares

|

|

amount

|

|

shares

|

|

amount

|

|

capital

|

|

deficit

|

|

(deficit)

|

|

Balance year ended December 31, 2014

|

800,000

|

$

|

800

|

|

-

|

$

|

10

|

|

4,199,214

|

$

|

4,199

|

$

|

9,374,843

|

$

|

(9,325,514)

|

$

|

54,338

|

|

Shares issued for services

|

-

|

|

-

|

|

-

|

|

-

|

|

633,333

|

|

634

|

|

239,093

|

|

-

|

|

239,727

|

|

Fair value of options granted

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

3,296

|

|

-

|

|

3,296

|

|

Net loss

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

(231,681)

|

|

(231,681)

|

|

Balance year ended December 31, 2015

|

800,000

|

$

|

800

|

|

10,000

|

$

|

10

|

|

4,832,547

|

$

|

4,833

|

$

|

9,617,232

|

$

|

(9,557,195)

|

$

|

65,680

|

|

Shares issued for services

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

193,448

|

|

-

|

|

193,448

|

|

Fair value of options granted

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

1,072

|

|

-

|

|

1,072

|

|

Net loss

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

(200,938)

|

|

(200,938)

|

|

Balance year ended December 31, 2016

|

800,000

|

$

|

800

|

|

10,000

|

$

|

10

|

|

4,832,547

|

$

|

4,833

|

$

|

9,811,752

|

$

|

(9,758,133)

|

$

|

59,262

|

|

|

|

The accompanying notes are an

integral part of these financial statements.

|

|

Data

Call Technologies, Inc.

|

|

Statements of Cash Flows

|

|

Years

ended December 31, 2016 and 2015

|

|

Table of Contents

|

|

|

|

2016

|

|

2015

|

|

Cash flows from operating activities:

|

|

|

|

|

|

Net (loss)

|

$

|

(200,938)

|

$

|

(231,681)

|

|

Adjustments to reconcile net

(loss) to net cash

provided by

(used in) operating activities:

|

|

|

|

|

|

Shares issued for services

|

|

193,448

|

|

239,727

|

|

Options expense

|

|

1,072

|

|

3,296

|

|

Depreciation and

amortization of property and equipment

|

|

1,278

|

|

1,462

|

|

(Increase) decrease in operating assets:

|

|

|

|

|

|

Accounts receivable

|

|

(12,515)

|

|

57,717

|

|

Prepaid expenses

|

|

(5,630)

|

|

(8,790)

|

|

Accounts payable

|

|

1,652

|

|

(14,400)

|

|

Accounts payable

- related party

|

|

(378)

|

|

(2,223)

|

|

Accrued

expenses

|

|

375

|

|

500

|

|

Accrued expenses - related party

|

|

418

|

|

(5,419)

|

|

Deferred revenues

|

|

(4,057)

|

|

(6,084)

|

|

Net cash provided by operating activities

|

|

(25,275)

|

|

34,105

|

|

|

|

|

|

|

|

Cash flows

from investing activities

|

|

|

|

|

|

Capital expenditure for equipment

|

|

-

|

|

-

|

|

Net cash (used in) investing activities

|

|

-

|

|

-

|

|

|

|

|

|

|

|

Cash flows

from financing activities:

|

|

|

|

|

|

Principal payment on

debt - related party

|

|

(7,036)

|

|

(7,036)

|

|

Net cash (used in) financing activities

|

|

(7,036)

|

|

(7,036)

|

|

|

|

|

|

|

|

Net increase (decrease) in cash

|

|

(32,311)

|

|

27,069

|

|

Cash at

beginning of year

|

|

85,810

|

|

58,741

|

|

Cash at

end of year

|

$

|

53,499

|

$

|

85,810

|

|

|

|

|

|

|

|

Supplemental Cash Flow Information:

|

|

|

|

|

|

Cash paid for

interest

|

$

|

4,964

|

$

|

4,964

|

|

Cash paid for taxes

|

$

|

-

|

$

|

-

|

|

|

|

|

|

|

|

The

accompanying notes are an integral part of these financial statements.

|

Data

Call Technologies, Inc.

Notes to Financial Statements

December 31, 2016

Table of Contents

Note 1. Summary of Significant Accounting Policies.

Organization, Ownership and Business

Data Call Technologies, Inc. (the "Company") was incorporated under the

laws of the State of Nevada in 2002. The Company's mission is to integrate

cutting-edge information delivery solutions that are currently deployed by

the media, and put them within the control of retail and commercial

enterprises. The Company's software and services put its clients in control

of real-time advertising, news, and other content, including emergency

alerts, within one building or 10,000, local or thousands of miles away.

The Company's financial statements are presented in accordance with

accounting principles generally accepted (GAAP) in the United States. In the

opinion of management, all adjustments, consisting of normal recurring

adjustments, necessary for a fair presentation of financial position and

result of operations for the periods presented have been reflected herein.

Cash and Cash Equivalents

For purposes of the statement of cash flows, the Company considers all

highly liquid investment instruments purchased with original maturities of

three months or less to be cash equivalents. There were no cash equivalents

as of December 31, 2016 or 2015.

Revenue Recognition

Company recognizes revenues based on monthly fees for services provided

to customers. Some customers prepay for annual services and the Company

defers such amounts and amortizes them into revenues as the service is

provided. The Company recognizes revenue in accordance with ASC 605 (1) when

the price is fixed and determinable, (2) persuasive evidence of an