The following is a letter to Shareholders from Mark D. Schmidt,

President/CEO of Cyberlux Corporation.

Dear Fellow Cyberlux Shareholder:

I’d like to update you on the progress made in 2009, the

Company’s plans for 2010 and the challenges facing Cyberlux

Corporation as we build and transform the Company into a profitable

and sustainable business.

First, I want to express my thanks for your ongoing support as a

fellow shareholder as we continue the challenging and difficult

task of resolving past legacy issues, securing current and future

business and balancing the risk and financial outlay of each

opportunity we pursue. Cyberlux Corporation is thankful to have you

as an investor, and we appreciate the trust you have put in

Management to complete the “clean up and turnaround” effort that

has been underway for the past eighteen months. Cyberlux Management

is fully committed to completing the restructuring tasks that

remain ahead, and the issues that were created in past years are

now being systematically and judicially resolved. This effort is

only the first step in creating the value we all expect our Company

to have.

Our Management team and I realized eighteen months ago that the

Company had serious decisions to make regarding the future

viability of Cyberlux. While the Company was well-respected within

the military channels it had previously sold to, our ability to

capitalize from those prior opportunities and develop a constant

stream of revenue proved to be very difficult. We quickly realized

that competing against very large companies with their unlimited

resources placed us at a competitive disadvantage in winning

business. Furthermore, the series of false starts from earlier

products that did not make it to market had placed the Company in

significant debt with investors who had the opportunity to convert

that debt into equity. At this point, the organization was left

with two choices: either file Chapter 7 and wipe out all equity

participants as well as our suppliers, or restructure the

organization with the help of a select group of investors who had

the foresight to recognize the underlying value of the Company.

Even though we understood that this would not be an easy task,

we felt that the choice to reorganize made the most sense for our

employees, our suppliers, our existing customer base and our

shareholders. I fully understand that this course of action is only

partially complete, but as I will elaborate below, we have already

seen material success as a result of these changes. The original

plan we established more than a year ago is still our core outline

for this restructuring. We still draw capital from the same

investors, with similar non-toxic terms that had been established

almost two years ago, coupled with utilizing the same integral

members of our management team in order to ensure the successful

completion of this process.

In 2009, Cyberlux, like most small companies, had to focus on

our core business capabilities and near-term opportunities.

Cyberlux Management refocused the Company’s business model on our

competitive differentiators: product innovation, product

development and manufacturing capability, proprietary LED knowledge

and patented LED technology. To best leverage these areas of

competitive advantage, we transformed our business strategy into

one where Cyberlux operates as an OEM supplier, supporting and

supplying OEM customers who have existing contracts and ongoing

opportunities. These changes have already had a major and lasting

impact on how the business will scale over time, as well as how the

value of the Company and its underlying equity value will grow.

We have already completed several significant milestones that

will be reflected in the balance sheet during 2010. First, we have

continued to focus on driving down expenses to the lowest operating

levels possible. Astoundingly, Management has reduced the true

operating expense of Cyberlux by 84% during this time by reducing

personnel and decreasing or eliminating any non-essential operating

costs. The senior management team has continued to defer

compensation until the Company is sustainable in order to further

align expense with revenue. With this cost structure, the Company

should be well positioned for growth as our business model

continues to advance and we make revenue and profit gains during

2010.

Second, we have eliminated a costly and strategically limiting

lawsuit involving the Company’s original convertible debt

financings. Rather than risk further expense and potential

convertible debt conversions, Management settled the case in

December and is now in the process of satisfying this payable over

time. Ultimately, Management opted to reflect a payable in the

balance sheet rather than risk an uncertain outcome and

unforeseeable dilution.

Significant progress has been made in the execution of this new

business strategy. Most importantly, in December 2009, Management

entered into a supplier agreement with Spectrum Brands, one of the

largest brands in the retail industry, to deliver six products for

its Rayovac trade name. Under the terms of the agreement, Cyberlux

will supply Rayovac with existing Cyberlux LED lighting products

and technology, including LED products exclusively designed for the

Rayovac brand itself. Products designed by Cyberlux will be unique

to Rayovac, but the intellectual property owned or licensed by

Cyberlux, as well as any new proprietary technology will be owned

by Cyberlux. We are working closely with the Rayovac team to bring

additional LED lighting solutions to market, including new products

that the Rayovac brand anticipates selling to their far-reaching

retail and commercial customer base.

Furthermore, during 4Q 2009, the Company began fulfilling

product requirements for an exclusive Department of Defense (DoD),

multi-national OEM customer, thus taking another important step

towards becoming the LED OEM lighting solution provider for

third-party companies who serve the military, commercial and retail

markets. Additionally, Cyberlux began fulfilling DoD contracts for

its BrightEye products, further solidifying the Company’s

relationship with DoD OEM customers.

Cyberlux is still a relatively young company at this point and

does require the assistance of our financiers. Our goal, like most

public companies, is to minimize dilution as soon as the Company is

sustainable. That being said, without the near-term operating

capital required, we will be unable to execute our business

strategy and Cyberlux will never attain the revenue necessary to

operate without assistance from the capital markets. We believe

that the capital we receive through equity participation from our

investors is as good as a company our size can obtain. While this

equity is, in our opinion, non-toxic, we do realize it is dilutive.

The current share price has a direct correlation to the amount of

equity exercised at the time of a capital infusion, thus creating a

significant dilutive event.

We feel that the progress we’ve made justifies a higher market

capitalization than where we trade today, but we also have strong

ethical beliefs that the share price is driven by the markets.

Other than issuing material events in the form of a press release,

we do not interfere with the Company’s stock. As we grow the

business, the share price should rise accordingly. Ultimately, the

value of the Company will begin to outweigh the need for capital as

the business grows. In the near term, we can’t expect to stop

raising capital through the sale of equity, but we expect to see a

transition during the year where this goal will be possible. At

that point, we will implement the proper strategy that best aligns

our investors with the Company.

The changes we’ve made in our business strategy are accelerating

the growth of Cyberlux. Over time, these changes will enable

Cyberlux to be a sustainable company, serving important customers

with ongoing requirements for our products. This challenging

process requires every Cyberlux employee to be constantly focused

on execution, on quality and on achieving the commitments we make

to our customers and business partners. There are no shortcuts,

only unfailing day-in and day-out execution, where excellence is

achieved through the constant effort of Cyberlux employees.

Your Management sincerely thanks you for your continued

support.

Best regards, Mark D. Schmidt President/CEO Cyberlux

Corporation

About Cyberlux

Corporation

Cyberlux Corporation (OTC Bulletin Board: CYBL), a leader in

solid-state lighting innovation, has developed breakthrough LED

lighting technology that provides the most energy efficient and

cost effective portable lighting solutions available today for

military and commercial uses. The Military and Homeland Security

products provide tactical covert and visible lighting capability

and are designed as highly mobile, battery-powered lighting systems

ideal for threat detection, force and asset protection and general

expeditionary lighting needs. For more information, please visit

www.cyberlux.com.

This news release contains forward-looking statements. Actual

results could vary materially from those expected due to a variety

of risk factors, including, but not limited to, the Company’s

ability to expand its production capabilities concurrent with

product orders. The Company’s business is subject to significant

risks and uncertainties discussed more thoroughly in Cyberlux

Corporation's SEC filings, including but not limited to, its report

on Form 10-KSB for the year ended December 31, 2008 and its 10-Q

for the quarter ended September 30, 2009. The Company undertakes no

obligation to publicly release the result of any revisions to these

forward-looking statements, which may be made to reflect events or

circumstances after the date hereof or to reflect the occurrence of

unanticipated events.

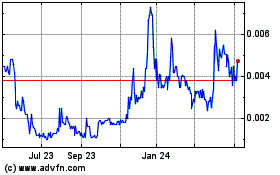

Cyberlux (PK) (USOTC:CYBL)

Historical Stock Chart

From Jun 2024 to Jul 2024

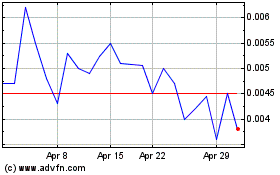

Cyberlux (PK) (USOTC:CYBL)

Historical Stock Chart

From Jul 2023 to Jul 2024