NetworkNewsWire

Editorial Coverage: Even though medical marijuana had been

legal in some U.S. states for more than a decade, the substance

didn’t gain much recognition until Colorado set the market on its

head in 2012 by making adult-use marijuana legal. Since then, other

states have followed suit, while in 2018, Canada went all-in to

become the first developed nation with weed legalized at the

federal level. Not surprisingly, North American companies and

investors were tripping over themselves trying to capitalize on the

massive burgeoning market. In all market segments, plenty of

lessons were learned as everyone from companies to investors to

lawmakers worked to organize a brand new market; lessons that the

new generation of multistate operators such as Red White

& Bloom Brands Inc. (CSE: RWB) (OTCQX: RWBYF) (Profile) have leveraged to more efficiently

execute their business models. RWB is following in the footsteps of

large first movers such as Curaleaf

Holdings Inc. (CSE: CURA) (OTCQX: CURLF), Green

Thumb Industries Inc. (CSE: GTII) (OTCQX: GTBIF),

Trulieve

Cannabis Corp. (CSE: TRUL) (OTCQX: TCNNF) and Cresco

Labs (CSE: CL) (OTCQX: CRLBF), companies that survived

the early days to hold valuations in the billions of dollars.

- Grand View Research forecasts the global legal marijuana market

to grow 14.3% annually to reach $84 billion by 2028.

- RWB is emerging as a dominant MSO, with licenses, cultivation

space and dispensaries in top U.S. markets.

- Products are already in more than 700 dispensaries; its PV

products are no. 1 selling vape in Michigan.

- RWB has acquired licensing, branding rights of High Times

dispensaries and High Times cannabis-based CBD and THC

products.

Click here to view

the custom infographic of Red White & Bloom Brands Inc.

editorial.

Learn from Elders to Capture Chunk of $84 Billion

Market

The green rush is in full swing,

including medical marijuana now being legal in 36 U.S. states and

recreational marijuana legal in 16 more plus Washington, DC. A

recent

survey by Pew Research indicates that 91% of Americans say

marijuana should be legal for use by adults in some form, which

begs the question about when Congress will take up the issue to

overturn federal prohibition. To that point, market analysts at

Grand View Research see legalization and better understanding of

therapeutic benefits as key drivers in the global legal marijuana

market growing 14.3% annually to reach $84 billion

by 2028.

While most think that trumpeting first-mover status is the

optimal position, that isn’t always necessarily true. Look what

happened to MySpace and AIM (AOL Instant Messenger) as they faded

to irrelevance as Snapchat, TikTok and Instagram exploded in

popularity to challenge incumbent platforms. Second movers can

enjoy advantages as they learn from pioneering entities that paved

the way. Specific to the cannabis business, there is no shortage of

companies that learned from sad experience the price to pay for

expanding too fast, overpaying for acquisitions, or building a

business a mile wide and a foot deep.

Red White &

Bloom Brands Inc. (CSE: RWB) (OTCQX: RWBYF) is a compelling mix

of old and new that is methodically building a commanding position

in the United States. as a multi-state operator ("MSO"). In fact,

the company refers to itself as a “super state operator,” a

reflection of its strategy to remain hyperfocused on dominating

specific markets before expanding to others, which ensures it

doesn’t get spread too thin. The company has the capital to move

aggressively after raising $44.5

million this month, part of which went to retire $7.7 million

in debt.

Headquartered in Toronto, Canada, Red White & Bloom’s

business is initially targeting seven states with lucrative

cannabis markets: California, Arizona, Oklahoma, Florida, Illinois,

Michigan and Massachusetts. About 91% of the $24.6 billion global

cannabis market was generated in the United States in 2020, with

these states instrumental in market share.

Cumulatively across the states, the company owns, or has

agreements for, licenses (cultivation, processor and distribution),

millions of square feet of cultivation space for CBD (cannabidiol)

and cannabis, and dispensaries (either open or leases that will be

retail locations), in addition to distribution networks that have

their popular brands in 700+ dispensaries.

A House of Premium Brands

Red White & Bloom is employing strategic brand acquisitions

and partnerships to become a top-three player in U.S. cannabis, as

well as its nonpsychoactive cousin hemp. RWB’s model is derisked by

leveraging longstanding and popular brands.

In the world of marijuana, arguably the most recognizable brand

is 46-year-old High Times(R), which is a portfolio brand of RWB

after an acquisition deal last year. Per the agreement, RWB has

licensing and branding rights of High Times dispensaries and High

Times cannabis-based CBD and THC products in Michigan, Illinois and

Florida. The company also acquired branding of High Times

hemp-derived CBD products nationally in the U.S. carrying the

Culture(R) brand.

RWB’s portfolio also contains Platinum Premium Cannabis Products

("PV"). As the name implies, Platinum CBD and THC

(tetrahydrocannabinol, the cannabinoid responsible for the high

feeling from ingesting cannabis) products are premium goods

manufactured to the highest industry standards for safety and

purity.

Mid-American Growers is also an important part of the portfolio,

a brand that began as an eight-acre greenhouse half a century ago

and which has grown into a 3.6 million-square-foot,

state-of-the-art technology and R&D facility under glass.

Mid-American product bag includes CBD Icy Relief Salve, CBD Icy

Relief Roll-on and CBD Gummies. This dovetails with RWB’s upcoming

PURA H&W of CBD cosmetics.

Impressive Core Markets

RWB is staring down a long list of catalysts, many of which are

centered on its core markets of Michigan and Illinois. Michigan is

the fastest-growing cannabis market in the country, with sales

topping $1 billion less than one year after legal recreational

marijuana sales started in 2019.

This is a growth springboard opportunity for RWB, which recently

received its prequalification for a cannabis license in Michigan.

The licensing paves the way for RWB to take control of eight stores

open currently, with two more awaiting licenses and eight more

turnkey ready that will be branded High Times. PV is sold in

200-plus dispensaries and is the top-selling vape in the state.

Furthermore, the company is prequalified for a processing license

for oils, edibles and concentrates, and is planning three indoor

cultivation facilities, including one under construction.

The Illinois market is booming after adult-use was legalized in

June 2019, and RWB is moving forward in this space as well. The

company recently signed a

definitive agreement to acquire the issued and outstanding

shares of Cannabis Capital Partners Inc., an arm’s length Ontario

special purpose vehicle with rights to concurrently purchase

medically and recreationally approved THC cultivation center

licenses in Illinois. Assets also include a 23,572-square-foot

active cultivation and manufacturing operation as well as the

associated inventory and the real estate assets, include two acres

of land.

Currently a $1.2 billion market and growing, Illinois’ approach

to the cannabis market remains fragmented. RWB aims to maintain and

expand the existing cultivation license but could be in line for

significant expansion if given the green light to utilize its 3.6

million-square-foot greenhouse located only a couple hours from the

existing licensed facility. The much larger facility could easily

add significant revenue via 100,000 pounds of product produced at

sub-$500 per pound cash cost and sold at $2,500 per pound

wholesale. PV and High Times products would be launched as

well.

C$32 Million in Sales and “Just Getting

Started”

As impressive as the existing asset list is, the fact remains

that RWB is still in its infancy, with some deals only recently

being finalized that will serve as key inflection points. Early

this month, RWB reported adjusted sales for Q1 2021 of C$32.2

million, up 2.4% from Q4 2020. Removing the forex effects of the

strengthening Canadian dollar, the gain was 5.5%. The company also

reached positive earnings before interest, taxes, depreciation and

amortization (EBITDA) of $460,000 for the first quarter.

The kicker is that those financial results don’t include the RWB

assets in Michigan that are not yet migrated under the corporate

umbrella, the Florida acquisition which took place at the end of

April, nor did the results include the Illinois assets, which are

still waiting on regulatory approval to close before being added to

RWB’s books.

“Those assets when coupled with the significant market share of

our Platinum brands, makes us a significant player in Michigan —

and we’re actually just getting started,” commented Brad

Rogers, RWB Chairman and CEO, in a recent news release. The

company added that it remains active in looking for new

acquisitions, is expanding its cultivation footprint in Florida and

plans to have new Florida retail stores open during 2H 2021 as

well.

Investors Love MSOs

While an upstart such as Red White & Bloom is still a

microcap, Wall Street and Bay Street have shown their interest in

MSOs. The rationale is simple insomuch that majors are whipping up

big revenue numbers as the markets continue to emerge, which makes

them good long-term holds.

Curaleaf

Holdings Inc. (CSE: CURA) (OTCQX: CURLF) is a top provider of

cannabis consumer products and industry-leading service product

selection and accessibility across the medical and adult-use

markets. Curaleaf brands

includes its eponymous products, as well as Select and Grassroots.

The company has operations in 23 states with 106 dispensaries, 23

cultivation sites and more than 30 processing sites; the company

employs more than 4,800 team members, while also being the largest

vertically integrated cannabis company in Europe. During Q1,

Curaleaf reported $260 million in sales, putting it on track to top

$1 billion this year.

Green Thumb

Industries Inc. (CSE: GTII) (OTCQX: GTBIF) manufactures and

distributes a portfolio of branded cannabis products including

Beboe, Dogwalkers, Dr. Solomon’s, incredibles, Rythm and the Feel

Collection. The Chicago-based

company also owns and operates national retail cannabis stores

called Rise(TM), has 14 manufacturing facilities, licenses for 103

retail locations and operations across 12 U.S. markets. During the

first quarter, Green Thumb reported a revenue surge of 89.5%

year-over-year to $194.4 million.

Trulieve

Cannabis Corp. (CSE: TRUL) (OTCQX: TCNNF) is primarily a

vertically integrated seed-to-sale company and is the first and

largest fully licensed medical cannabis company in the state of

Florida. Trulieve

cultivates and produces all of its products in house and

distributes those products to Trulieve-branded dispensaries

throughout the state as well as directly to patients via home

delivery. The company is also a licensed operator in California,

Massachusetts, Connecticut, Pennsylvania and West Virginia.

Trulieve generated $619 million in revenue in the last year, but

its recent acquisition of Harvest Health will put it over the $1

billion mark annually.

Cresco Labs

(CSE: CL) (OTCQX: CRLBF) is one of the U.S.’s largest

vertically integrated MSOs. Employing a consumer-packaged goods

approach, Cresco is the

biggest wholesaler of branded cannabis products in the country,

with brands including Cresco(TM), High Supply(TM), Mindy's

Edibles(TM), Good News, Remedi, Wonder Wellness Co.(TM and FloraCal

Farms(R). Cresco’s national dispensary operates under the moniker

Sunnyside. For Q1, Cresco reported revenue of $178.4 million, up

168.8% from the year prior quarter. Indicating the expectations of

more growth, management provided guidance of annualized revenue

run-rate of more than $1 billion by the end of 2021.

Some critics have knocked the legal cannabis market as getting

off to a slower-than-expected start over the last few years.

Perhaps that is true, but the type of results the aforementioned

companies are producing indicate that the U.S. cannabis market is

alive and well, which could easily lead to some consolidation in

the coming years as bigger companies look to immediate expand their

footprint through acquisitions.

For more information about Red White & Bloom Brands, please

visit Red White &

Bloom Brands.

About NetworkNewsWire

NetworkNewsWire

(“NNW”) is a financial news and content distribution company, one

of 50+ brands within the InvestorBrandNetwork (“IBN”), that

provides: (1) access to a network of wire

solutions via InvestorWire to

reach all target markets, industries and demographics in the most

effective manner possible; (2) article and

editorial syndication to 5,000+ news outlets; (3)

enhanced press release solutions to ensure maximum

impact; (4) social media distribution via IBN

millions of social media followers; and (5) a full

array of corporate communications solutions. As a multifaceted

organization with an extensive team of contributing journalists and

writers, NNW is uniquely positioned to best serve private and

public companies that desire to reach a wide audience comprising

investors, consumers, journalists and the general public. By

cutting through the overload of information in today’s market, NNW

brings its clients unparalleled visibility, recognition and brand

awareness. NNW is where news, content and information converge.

To receive SMS text alerts from NetworkNewsWire, text

“STOCKS” to 77948 (U.S. Mobile Phones Only)

For more information, please visit https://www.NetworkNewsWire.com

Please see full terms of use and disclaimers on the

NetworkNewsWire website applicable to all content provided by NNW,

wherever published or re-published: http://NNW.fm/Disclaimer

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

NetworkNewsWire is part of the InvestorBrandNetwork

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by NNW are

solely those of NNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable NNW for any investment

decisions by their readers or subscribers. NNW is a news

dissemination and financial marketing solutions provider and are

NOT registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, NNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer’s filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer’s securities, including, but not

limited to, the complete loss of your investment.

NNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and NNW undertakes no

obligation to update such statements.

Source:

NetworkNewsWire

Contact:

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

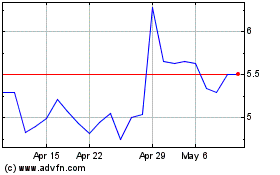

Curaleaf (QX) (USOTC:CURLF)

Historical Stock Chart

From Nov 2024 to Dec 2024

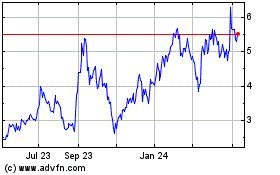

Curaleaf (QX) (USOTC:CURLF)

Historical Stock Chart

From Dec 2023 to Dec 2024