0001688126

false

0001688126

2023-10-03

2023-10-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

October

3, 2023

Date

of Report (date of earliest event reported)

THE CRYPTO COMPANY

(Exact name of registrant as specified in its charter)

| Nevada |

|

000-55726 |

|

46-4212105 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

| 23823

Malibu Road, #50477,

Malibu,

CA |

|

90265 |

| (Address

of principal executive offices) |

|

(Zip

code) |

(424)

228-9955

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| None |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐

Emerging growth company

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Item 1.01. Entry Into a Material Definitive Agreement.

Intellectual

Property Assignment Agreement

On

October 3, 2023, The Crypto Company (the “Company”) entered into an Intellectual Property Assignment Agreement (the “IP

Agreement”) with AllFi Technologies, Inc., a Delaware corporation (“AllFi Technologies”), pursuant to which the Company

assigns to AllFi Technologies: (i) a sublicense of code instance managed by TelBill, LLC under the Code Licensing Commerical Agreement

dated as of August 29, 2023, by and between the Company and TelBill, LLC (“Code Licensing Commerical Agreement”), (ii) one

runtime SaaS license for use by AllFi Technologies in the conduct of its coupon business for a term of 12 months in accordance with the

Company’s sublicense right under Section 2.1 of the Code Licensing Commerical Agreement in exchange for a fee to be mutually agreed

to by the Company and AllFi Technologies through the use of such SaaS license, and (iii) one runtime SaaS license for use by AllFi Technologies

in the conduct of its banking and marketplace business for a term of 12 months in accordance with the Company’s sublicense right

under Section 2.1 of the Code Licensing Commerical Agreement in exchange for a fee to be mutually agreed to by the Company and AllFi

Technologies through the use of such SaaS license.

The

Company and AllFi Technologies have made customary representations, warranties, and covenants in the IP Agreement

The

above description of the IP Agreement does not purport to be complete and is qualified in its entirety by the full text of such IP Agreement,

a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated by reference herein.

Subscription

Agreement

On

October 3, 2023, the Company entered into a Subscription Agreement (the “Subscription Agreement”) with AllFi Technologies,

pursuant to which the Company has agreed to purchase from AllFi Technologies an aggregate of 501 shares of AllFi Technologies’

common stock, which represents 50.1% of the current issued and outstanding shares of AllFi Technologies, for a purchase price of $100,000.

Upon the execution of the Subscription Agreement, the Company became a shareholder of AllFi Technologies.

The

Company and AllFi Technologies have made customary representations, warranties, and covenants in the Subscription Agreement.

The

Subscription Agreement has been adopted by the sole director of AllFi Technologies and the board of directors of the Company.

The

foregoing description of the Subscription Agreement does not purport to be complete and is qualified in its entirety by the full text

of such Subscription Agreement, a copy of which is filed as Exhibit 10.2 to this Current Report on Form 8-K and incorporated by

reference herein.

Item

3.02 Unregistered Sales of Equity Securities.

In

connection with the Company’s investment in AllFi Technologies as described above in Item 1.01, on October 7, 2023, the Company

sold an aggregate of 22,104,583 shares of the Company’s restricted common stock to AllFi Holdings LLC (the “Investor”),

for a total purchase price of $1.00, pursuant to a Subscription Agreement by and between the Company and the Investor (the “Subscription

Agreement”).

The

Company claims an exemption from registration for the issuance and sale of the Company’s restricted common stock to the Investor

described above pursuant to Section 4(a)(2) and/or Rule 506 of Regulation D of the Securities Act of 1933, as amended (the “Securities

Act”) since the shares were issued to “accredited investors”, and no directed selling efforts were made in the United

States by the Company, a distributor, any of their respective affiliates, or any person acting on behalf of any of the foregoing. The

securities are subject to transfer restrictions, and the certificates evidencing the securities contain an appropriate legend stating

that such securities have not been registered under the Securities Act and may not be offered or sold absent registration or pursuant

to an exemption therefrom. The securities were not registered under the Securities Act and such securities may not be offered or sold

in the United States absent registration or an exemption from registration under the Securities Act and any applicable state securities

laws.

Item 9.01. Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

THE

CRYPTO COMPANY |

| |

|

|

| Date:

October 10, 2023 |

By: |

/s/

Ron Levy |

| |

Name: |

Ron

Levy |

| |

Title:

|

Chief

Executive Officer, Chief Operating Officer and Secretary |

Exhibit

10.1

INTELLECTUAL

PROPERTY ASSIGNMENT AGREEMENT

This

INTELLECTUAL PROPERTY ASSIGNMENT AGREEMENT (“IP Assignment”), dated as of October 3, 2023 is made by The Crypto Company

(“Assignor”), a Nevada corporation, located at 23823 Malibu Road, #50477, Malibu, CA 90265, in favor of ALLFI TECHNOLOGIES,

INC. (“Assignee”), a Delaware corporation, located at 23523 Malibu Road, #50477, Malibu, CA 90265 pursuant to a Subscription

Agreement between Assignor and Assignee, dated as of October 3, 2023 (the “Subscription Agreement”).

WHEREAS,

under the terms of the Subscription Agreement, Assignor has conveyed, transferred, and assigned to Assignee, among other assets, certain

intellectual property of Assignor;

WHEREAS,

as a result of Assignor entering into the Subscription Agreement with Assignee, the ownership of Assignee shall be split as follows:

Assignor (50.1%) and AllFi Holdings LLC (49.9%); and

WHEREAS,

Assignor is the majority owner of Assignee and shall derive the benefit of the IP assigned hereby.

NOW

THEREFORE, the parties agree as follows:

1.

Assignment by Assignor. For good and valuable

consideration, the receipt and sufficiency of which are hereby acknowledged, Assignor hereby irrevocably conveys, transfers, and assigns

to Assignee, and Assignee hereby accepts, all of Assignor’s right, title, and interest in and to the following (collectively, the

“Assigned IP”):

(a)

the trademark registrations and applications set forth on Schedule 1 hereto and all issuances, extensions, and renewals thereof (the

“Trademarks”), together with the goodwill of the business connected with the use of, and symbolized by, the Trademarks;

provided that, with respect to the United States intent-to-use trademark applications set forth on Schedule 1 hereto, the transfer

of such applications accompanies, pursuant to the Subscription Agreement, the transfer of Assignor’s business, or that portion

of the business to which the trademark pertains, and that business is ongoing and existing;

(b)

the copyright registrations, applications for registration, and exclusive copyright licenses set forth on Schedule 1 hereto and all issuances,

extensions, and renewals thereof (the “Copyrights”);

(c)

all rights of any kind whatsoever of Assignor accruing under any of the foregoing provided by applicable law of any jurisdiction, by

international treaties and conventions, and otherwise throughout the world;

(d)

any and all royalties, fees, income, payments, and other proceeds now or hereafter due or payable with respect to any and all of the

foregoing;

(e)

any and all claims and causes of action with respect to any of the foregoing, whether accruing before, on, or after the date hereof,

including all rights to and claims for damages, restitution, and injunctive and other legal and equitable relief for past, present, and

future infringement, dilution, misappropriation, violation, misuse, breach, or default, with the right but no obligation to sue for such

legal and equitable relief and to collect, or otherwise recover, any such damages;

(f)

1 runtime SaaS license for use by Assignee in the conduct of its coupon business for a term of 12 months in accordance with Assignor’s

sublicense right under Section 2.1 of the Code Licensing Commerical Agreement dated as of August 29, 2023, by and between Assignor and

TelBill, LLC in exchange for a fee to be mutually agreed to by Assignor and Assignee that occurs through the use of such SaaS license;

(g)

1 runtime SaaS license for use by Assignee in the conduct of its banking and marketplace business for a term of 12 months in accordance

with Assignor’s sublicense right under Section 2.1 of the Code Licensing Commerical Agreement dated as of August 29, 2023, by and

between Assignor and TelBill, LLC in exchange for a fee to be mutually agreed to by Assignor and Assignee through the use of such SaaS

license; and

(h)

Sublicense of TelBill Instance (System) purchased by TCC.

2.

Recordation and Further Actions. Assignor hereby

authorizes the Commissioner for Trademarks in the United States Patent and Trademark Office, the Register of Copyrights in the United

States Copyright Office, and the officials of corresponding entities or agencies in any applicable jurisdictions to record and register

this IP Assignment upon request by Assignee. Following the date hereof, and at Assignee’s sole cost and expense, Assignor shall

take such steps and actions, and provide such cooperation and assistance to Assignee and its successors, assigns, and legal representatives,

including the execution and delivery of any affidavits, declarations, oaths, exhibits, assignments, powers of attorney, or other documents,

as may be necessary to effect, evidence, or perfect the assignment of the Assigned IP to Assignee, or any assignee or successor thereto.

3.

Terms of the Subscription Agreement. The parties

hereto acknowledge and agree that this IP Assignment is entered into pursuant to the Subscription Agreement, to which reference is made

for a further statement of the rights and obligations of Assignor and Assignee with respect to the Assigned IP. The representations,

warranties, covenants, agreements, and indemnities contained in the Subscription Agreement shall not be superseded hereby but shall remain

in full force and effect to the full extent provided therein. In the event of any conflict or inconsistency between the terms of the

Subscription Agreement and the terms hereof, the terms of the Subscription Agreement shall govern.

4.

Counterparts. This IP Assignment may be executed

in counterparts, each of which shall be deemed an original, but all of which together shall be deemed one and the same agreement. A signed

copy of this IP Assignment delivered by facsimile, e-mail, or other means of electronic transmission shall be deemed to have the same

legal effect as delivery of an original signed copy of this IP Assignment.

5.

Successors and Assigns. This IP Assignment shall

be binding upon and shall inure to the benefit of the parties hereto and their respective successors and assigns.

6.

Governing Law. This IP Assignment and any claim,

controversy, dispute, or cause of action (whether in contract, tort, or otherwise) based upon, arising out of, or relating to this IP

Assignment and the transactions contemplated hereby shall be governed by, and construed in accordance with, the laws of the United States

and the State of Nevada, without giving effect to any choice or conflict of law provision or rule (whether of the State of Nevada or

any other jurisdiction).

[signature

page follows]

IN

WITNESS WHEREOF, Assignor has duly executed and delivered this IP Assignment as of the date first above written.

| |

The

Crypto Company |

| |

|

|

| |

By:

|

|

| |

Name: |

Ron

Levy |

| |

Title: |

President |

| |

Address

for Notices: |

| ACKNOWLEDGMENT |

|

STATE

OF CALIFORNIA

COUNTY

OF LOS ANGELES |

)

)SS.

) |

On

the 3rd day of October, 2023, before me personally appeared Ron Levy personally known to me (or proved to me on the basis of satisfactory

evidence) to be the person whose name is subscribed to the foregoing instrument, who, being duly sworn, did depose and say that he executed

the same in his authorized capacity as the President of The Crypto Company, the Nevada corporation described, and acknowledged the instrument

to be the free act and deed of The Crypto Company for the uses and purposes mentioned in the instrument.

| |

|

| |

Notary

Public |

| |

Printed

Name: |

| |

|

| My

Commission Expires: |

|

| |

|

| |

|

| AGREED

TO AND ACCEPTED: |

AllFi

Technologies, Inc. |

| |

|

| |

By:

|

|

| |

Name:

|

Ron

Levy |

| |

Title:

|

Director |

| |

Address

for Notices: |

| ACKNOWLEDGMENT |

|

STATE

OF CALIFORNIA

COUNTY

OF LOS ANGELES |

)

)SS.

) |

On

the 3rd day of October, 2023, before me personally appeared Ron Levy, personally known to me (or proved to me on the basis of satisfactory

evidence) to be the person whose name is subscribed to the foregoing instrument, who, being duly sworn, did depose and say that he executed

the same in his authorized capacity as a director of AllFi Technologies, Inc., the corporation described, and acknowledged the instrument

to be the free act and deed of AllFi Technologies, Inc. for the uses and purposes mentioned in the instrument.

| |

|

| |

Notary

Public |

| |

Printed

Name: |

| |

|

| My

Commission Expires: |

|

| |

|

| |

|

Schedule

1

ASSIGNED

IP

Sublicense

of code instance managed by TelBill under the Code Licensing Commerical Agreement

dated as of August 29, 2023, by and between Assignor and TelBill LLC.

1

runtime SaaS license for use by Assignee in the conduct of its coupon business for a term of 12 months in accordance with Assignor’s

sublicense right under Section 2.1 of the Code Licensing Commerical Agreement dated as of August 29, 2023, by and between Assignor and

TelBill, LLC in exchange for a fee to be mutually agreed to by Assignor and Assignee for every coupon redemption that occurs through

the use of such SaaS license.

1

runtime SaaS license for use by Assignee in the conduct of its banking and marketplace business for a term of 12 months in accordance

with Assignor’s sublicense right under Section 2.1 of the Code Licensing Commerical Agreement dated as of August 29, 2023, by and

between Assignor and TelBill, LLC in exchange for a fee to be mutually agreed to by Assignor and Assignee for every coupon redemption

that occurs through the use of such SaaS license.

Exhibit

10.2

SUBSCRIPTION

AND ACCREDITED INVESTOR AGREEMENT

ALLFI

TECHNOLOGIES, INC.

NOTICES

THIS

SUBSCRIPTION AND ACCREDITED INVESTOR AGREEMENT (THIS “AGREEMENT”) IS BEING PROVIDED ON A CONFIDENTIAL BASIS TO A LIMITED

NUMBER OF ACCREDITED INVESTORS SOLELY FOR THE PURPOSE OF SUCH ACCREDITED INVESTORS’ MAKING AN INVESTMENT IN ALLFI, INC. (THE “COMPANY”).

THIS AGREEMENT MAY ONLY BE USED BY SUCH ACCREDITED INVESTORS (AND THOSE WHO ASSIST IN EACH ACCREDITED INVESTOR’S INVESTMENT DECISION)

TO EVALUATE AN INVESTMENT IN THE COMPANY. THEREFORE, IT MAY NOT BE REPRODUCED OR USED FOR ANY OTHER PURPOSE, NOR MAY IT OR ITS CONTENTS

BE DISCLOSED WITHOUT THE PRIOR WRITTEN CONSENT OF THE COMPANY. EACH PROSPECTIVE INVESTOR ACCEPTING THIS AGREEMENT AGREES TO BE BOUND

BY THE FOREGOING TERMS.

THE

SHARES HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR THE SECURITIES LAWS

OF ANY STATES, AND THE INTERESTS ARE BEING OFFERED AND SOLD IN RELIANCE ON EXEMPTIONS FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES

ACT AND SUCH LAWS. THE INTERESTS HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION (THE “SEC”)

OR ANY STATE SECURITIES COMMISSION OR OTHER REGULATORY AUTHORITY, NOR HAVE ANY SUCH AUTHORITIES PASSED UPON OR ENDORSED THE MERITS OF

THE OFFERING OR THE ACCURACY OR ADEQUACY OF THIS THIS AGREEMENT AND THE SUBSCRIPTION DOCUMENTS (HEREINAFTER DEFINED). ANY REPRESENTATION

TO THE CONTRARY IS UNLAWFUL.

THE

INTERESTS ARE SUBJECT TO RESTRICTIONS ON TRANSFERABILITY AND RESALE AND MAY NOT BE TRANSFERRED OR RESOLD EXCEPT AS PERMITTED UNDER THE

SECURITIES ACT AND APPLICABLE STATE SECURITIES LAWS, PURSUANT TO REGISTRATION OR EXEMPTION THEREFROM, AND IN ACCORDANCE WITH THE RESTRICTIONS

CONTAINED IN THE CERTIFICATE OF INCORPORATION AND BYLAWS OF THE COMPANY. THERE IS NO PUBLIC MARKET FOR THE INTERESTS AND NONE IS EXPECTED

TO DEVELOP IN THE FUTURE. INVESTORS MAY BE REQUIRED TO BEAR THE FINANCIAL RISKS OF THIS INVESTMENT FOR AN INDEFINITE PERIOD.

INVESTMENT

IN THE COMPANY IS SUITABLE ONLY FOR “ACCREDITED INVESTORS” WITHIN THE MEANING OF REGULATION D PROMULGATED BY THE SEC UNDER

THE SECURITIES ACT AND REQUIRES THE FINANCIAL ABILITY AND WILLINGNESS TO ACCEPT THE HIGH RISKS AND LACK OF LIQUIDITY INHERENT IN AN INVESTMENT

IN THE COMPANY.

IN

MAKING AN INVESTMENT DECISION, INVESTORS MUST REPLY ON THEIR OWN EXAMINATION OF THE COMPANY AND THE TERMS OF THE OFFERING, INCLUDING

THE MERITS AND RISKS INVOLVED. THIS AGREEMENT AND THE SUBSCRIPTION DOCUMENTS ARE PROVIDED FOR ASSISTANCE ONLY AND IS NOT INTENDED TO

BE AND MUST NOT ALONE BE TAKEN AS THE BASIS FOR AN INVESTMENT DECISION. PROSPECTIVE INVESTORS SHOULD NOT CONSTRUE THE CONTENTS OF THIS

AGREEMENT AS LEGAL, TAX OR FINANCIAL ADVICE. EACH PROSPECTIVE INVESTOR SHOULD CONSULT HIS OWN PROFESSIONAL ADVISORS AS TO THE LEGAL,

TAX, FINANCIAL OR OTHER MATTERS RELEVANT TO THE SUITABILITY OF AN INVESTMENT IN THE COMPANY FOR SUCH INVESTOR.

NO

PERSON HAS BEEN AUTHORIZED TO MAKE REPRESENTATIONS, OR GIVE ANY INFORMATION, WITH RESPECT TO INTERESTS IN THE COMPANY, EXCEPT THE INFORMATION

CONTAINED HEREIN AND THE OTHER SUBSCRIPTION DOCUMENTS. PROSPECTIVE INVESTORS ARE INVITEDTO ASK QUESTIONS CONCERNING THE COMPANY AND TO

OBTAIN ANY ADDITIONAL INFORMATION THEY CONSIDER APPROPRIATE TO MAKE AN INFORMED INVESTMENT DECISION.

STATEMENTS

IN THIS AGREEMENT ARE MADE AS OF THE DATE OF THE INITIAL DISTRIBUTION OF THIS AGREEMENT UNLESS STATED OTHERWISE, AND NEITHER THE DELIVERY

OF THIS AGREEMENT, NOR ANY SALE HEREUNDER, SHALL UNDER ANY CIRCUMSTANCES CREATE AN IMPLICATION THAT THE INFORMATION CONTAINED HEREIN

IS CORRECT AS OF ANY TIME SUBSEQUENT TO SUCH DATE.

REFERENCES

HEREIN TO PAST RETURNS WITH RESPECT TO ANY INVESTMENT OR INVESTMENT PROGRAM ARE NO INDICATION OF FUTURE PERFORMANCE.

THIS

IS NOT AN OFFER TO SELL OR SOLICITATION OF ANY OFFER TO BUY THE INTERESTS IN ANY JURISDICTION TO ANY PERSON TO WHOM IT IS UNLAWFUL TO

MAKE AN OFFER OR SALE.

Subscription

Agreement for

AllFi

Technologies, Inc.

This

Subscription and Accredited Investor Agreement (the “Subscription Agreement’) is made by and between AllFi Technologies,

Inc., a Delaware corporation (the “Company”), and the subscriber (the “Subscriber”) specified on

the Omnibus Signature Page included herewith (the “Omnibus Signature Page”).

For

consideration of the intellectual property assigned to the Company by Subscriber under that certain Intellectual Property Assignment

Agreement dated as of the date hereof, the Company is issuing Subscriber a 50.1% interest in the Company (the “Shares”).

Shares will be issed only to subcribers that are “accredited investors” (as such term is defined in Regulation D as

promulgated under the Securities Act).

Article

I

Subscription

Section

1.1 Subscription. The Subscriber hereby subscribes to receive an issuance of 501 Shares in exchange for $100,000 and be admitted

as a shareholder in the Company. The Subscriber has enclosed herewith a fully executed Omnibus Signature Page in Appendix I to this Subscription

Agreement (if the Subscriber is an individual) or Appendix II to this Subscription Agreement (if the Subscriber is an entity, trust or

IRA account).

Section

1.2 Acceptance of Subscription; Conditions to Acceptance. The Subscriber understands and acknowledges that the Company will

rely on this Subscription Agreement and that the Subscriber has no right to cancel, assign, terminate or revoke this Subscription Agreement,

but that the Company will have a right to refuse to accept this Subscription Agreement for any reason or no reason, including if, in

its sole discretion, the Company believes that the Company is not a suitable investment for the Subscriber. If not accepted, this Subscription

Agreement will be null and void and the Subscriber will not be admitted as a shareholder of the Company. The Subscriber also understands

that this Subscription Agreement will not be binding on the Company until accepted, that the acceptance or rejection of subscriptions

will be in the sole discretion of the Company and that subscriptions need not be accepted in the order received. If the Company accepts

the Subscriber’s subscription, the Company will execute the Omnibus Signature Page executed and submitted by the Subscriber.

Section

1.3 Majority Owner Working Capital Contribution. TCC as the holder of a majority of the issued and outstanding shares of the

Company, hereby agrees that in addition to the purchase of 50.1% of the shares of the Company hereunder TCC shall contribute at least

$50,000 cash to the working capital of the Company within 180 days of the date hereof should the Company fail to become cash flow positive

by such date. TCC, at its sole discretion, may decide the form of this cash contribution.

Section

1.4 Closing. The issuance the Subscriber’s Shares will be deemed to have occurred on the date the Subscriber’s

subscription is accepted by the Company (the “Closing Date”).

Section

1.5 Certificate of Incorporation and Bylaws. From and after the Closing Date, the Subscriber hereby accepts, adopts and agrees

to, and agrees to be bound by, each and every term, condition and provision contained in the Company’s Certificate of Incorporation

and Bylaws attached as Exhibit A hereto (the “Certificate of Incorporation and Bylaws”) and to perform all obligations

therein imposed upon the Subscriber in the Subscriber’s capacity as a shareholder of the Company. From and after the Closing Date,

the Subscriber agrees to execute, acknowledge, and swear to such counterparts of the Certificate of Incorporation and Bylaws as the Company

may direct. The Subscriber hereby agrees to maintain the confidentiality of the contents of this Subscription Agreement and of the Subscription

Documents (hereinafter defined). For purposes of this Agreement, “Subscription Documents” means the Certificate of Incorporation

and Bylaws and such other documents the Subscriber received from the Company.

Article

II

Representations,

Warranties, Covenants, Acknowledgments, Risk Factors

Section

2.1 The Subscriber hereby makes the following representations, warranties, covenants and acknowledgements to the Company and agrees

to indemnify the Company, all shareholders of the Company, the directors of the Company (the “Directors”), the officers

of the Company and their respective agents and affiliates against, and hold them harmless from and pay all damages, judgments, claims

and liabilities which may be incurred as a result of any misrepresentation by the Subscriber or by any non-performance by the Subscriber

of any covenant or agreement herein contained, including without limitation that which may arise under federal and/or state income tax

and/or securities laws:

(a)

Power and Authority. The Subscriber is authorized to enter into this Subscription Agreement, the Certificate of Incorporation

and Bylaws, and such other agreements, certificates, or other instruments as are provided to or executed by or on behalf of the Subscriber

in connection with its obligations under the Certificate of Incorporation and Bylaws or in connection with this subscription, to perform

its obligations under each Subscription Document, and to consummate the transactions that are the subjects of any Subscription Document.

The signature of the individual signing any Subscription Document as, or on behalf of, the Subscriber is binding upon the Subscriber.

(b)

Compliance with Laws and Other Instruments. The execution and delivery of this Agreement and the Certificate of Incorporation

and Bylaws by or on behalf of the Subscriber and the consummation of the transactions contemplated in the this Agreement and the Certificate

of Incorporation and Bylaws do not and will not conflict with or result in any violation of or default under any provision of any charter,

bylaws, trust agreement, limited liability company agreement or other organizational document, as the case may be, of the Subscriber

or any agreement, certificate or other instrument to which the Subscriber is a party or by which the Subscriber or any of its properties

is bound, or any permit, franchise, judgment, decree, statute, rule, regulation or other law applicable to the Subscriber or the business

or properties of the Subscriber.

(c)

Investor Information. Please review and complete the following questions related to your status as an investor. If you have marked

“Yes” to any of the investor categories set forth below, you agree to, at the Company’s request, provide the Company

with additional information supporting such self-certification.

| |

(i) |

If

you are a natural person or a grantor trust for income tax purposes (or you are investing through your self-directed Individual Retirement

Account and you are the owner of the account), do you meet either or both of the following criteria? |

| |

(A) |

you

(or the grantor, in the case of a grantor trust) are a natural person whose individual net worth1, or joint net worth

with your spouse, at the time of the investment exceeds $1,000,000; |

| |

|

|

| |

|

____

Yes ____ No |

| |

|

|

| |

(B) |

you

(or the grantor, in the case of a grantor trust) are a natural person who had an individual income2 in excess of $200,000

in each of the two most recent years, or joint income with your spouse in excess of $300,000 in each of those years and reasonably

expects individual income (exclusive of spouse) in excess of $200,000 in the current year, or joint income (inclusive of spouse)

in excess of $300,000 in the current year; |

| |

|

|

| |

|

____

Yes ____ No |

1

For purposes of Rule 501 of Regulation D, your net worth excludes the value of your primary residence, and any indebtedness that

is secured by the primary residence, up to the fair market value of the residence, shall not be included as a liability. 17 CFR §

230.501(a)(5).

2

Individual income is income made exclusive of your spouse. 17 CFR § 230.501(a)(6).

| |

(C) |

you

(or the grantor, in the case of a grantor trust) hold in good standing one or more professional certifications or designations or

credentials from an accredited educational institution that the Securities and Exchange Commission has designated as qualifying an

individual for accredited investor status; |

| |

|

|

| |

|

____

Yes ____ No |

| |

|

|

| |

(D) |

you

are an individual holding in good standing any of the general securities representative license (Series 7), the investment adviser

representative license (Series 65), or the private securities offerings representative license (Series 82); or |

| |

|

|

| |

|

____

Yes ____ No |

| |

|

|

| |

(E) |

____

none of the above apply. |

| |

(ii) |

If

you are an entity or a non-grantor trust for income tax purposes, do you meet at least one of the following criteria? |

| |

(A) |

you

are a corporation, partnership, limited liability company or similar business trust with total assets in excess of $5,000,000 that

was not formed for the specific purpose of investing in the Company; |

| |

|

|

| |

|

____

Yes ____ No |

| |

|

|

| |

(B) |

you

are a personal (non-business) trust, other than an employee benefit trust, with total assets in excess of $5,000,000 that was not

formed for the specific purpose of investing in the Company and whose decision to invest in the Company has been directed by a person

who has such knowledge and experience in financial and business matters that you are capable of evaluating the merits and risks of

the investment; |

| |

|

|

| |

|

____

Yes ____ No |

| |

|

|

| |

(C) |

you

are licensed, or subject to supervision, by U.S. Federal or state examining authorities as a “bank,” “savings and

loan association,” “insurance company,” “small business investment company,” “broker,”

“dealer,” “investment company,” “investment advisor,” “business development company,”

“private business development company,” “Small Business Investment Company,” “Rural Business Investment

Company,” “employee benefit plan,” “family office,” or “family client” (as such terms are

used and defined or described in Rule 501(a) of Regulation D as promulgated under the Securities Act) or is an account for which

a bank or savings and loan association is subscribing in a fiduciary capacity; |

| |

|

|

| |

|

____

Yes ____ No |

| |

|

|

| |

(D) |

you

are an entity in which each of the equity owners is either (a) a natural person that has, or a grantor trust whose grantor has, either

(i) a net worth (individually or jointly with spouse) exceeding $1,000,000, or (ii) had an individual income in excess of $200,000

in each of the two most recent years or joint income with your spouse in excess of $300,000 in each of those years and has a reasonable

expectation of reaching the same income level in the current year, or (b) a non-natural person that satisfies one or more of the

categories set forth above; |

| |

|

|

| |

|

____

Yes ____ No |

| |

(E) |

you

are an entity of a type not listed in (A)-(D) above, not formed for the specific purpose of investing in the Company, owning investments

in excess of $5,000,000; |

| |

|

|

| |

|

____

Yes ____ No |

| |

|

|

| |

(F) |

you

are a family office (as defined in rule 202(a)(11)(G)–1 under the Investment Advisers Act of 1940) that has assets under management

in excess of $5 million, the family office was not formed for the specific purpose of making this investment and whose prospective

investments are directed by a person who has such knowledge and experience in financial and business matters that such family office

is capable of evaluating the merits and risks of the prospective investment; or |

| |

|

|

| |

|

____

Yes ____ No |

| |

|

|

| |

(G) |

____

none of the above apply. |

(d)

Investment Intent. The Subscriber is acquiring the Shares for its own account for investment, and not with a view to any distribution,

resale, subdivision or fractionalization thereof in violation of the Securities Act or any other applicable domestic or foreign securities

law, and the Subscriber has no present plans to enter into any contract, undertaking, agreement or arrangement for any such distribution,

resale, subdivision or fractionalization.

(e)

Information and Access. The Subscriber hereby acknowledges that it has received and reviewed all material information regarding

the Company and the Offering described herein in order to make its investment decision in the Shares. The Subscriber has received a copy

of the following documents:

| |

(i) |

the

Certificate of Incorporation and Bylaws of the Company as attached hereto as Exhibit A; and |

| |

|

|

| |

(iii) |

all

other Subscription Documents. |

The

Subscriber has carefully reviewed and is familiar with the terms of the Certificate of Incorporation and Bylaws and each other Subscription

Document given to the Subscriber. The Company has made available to the Subscriber or its attorneys, accountants and other representatives

all agreements, documents, records and books that the Subscriber or its attorneys, accountants and other representatives have requested

relating to an investment in the Company. The Subscriber and its attorneys, accountants and other representatives have had a full opportunity

to ask questions of and receive answers from the Company or a person acting on behalf of the Company, concerning the terms and conditions

of this investment, and all questions asked by the Subscriber and its attorneys, accountants and other representatives have been adequately

answered to the full satisfaction of the Subscriber and its attorneys, accountants and other representatives.

(f)

Illiquidity. The Subscriber understands that substantial restrictions will exist on transferability of Shares in the Company,

that no market for resale of any such Shares exists and none is likely to develop, and that the Subscriber may not be able to liquidate

its investment in the Company. The Subscriber understands that any instruments representing Shares in the Company may bear legends restricting

the transfer thereof.

(g)

Risk Factors. The Subscriber understands that investment in the Company is speculative

and entails a very high degree of risk and understands fully the risks associated with the operation of the Company and the Subscriber’s

investment in the Company, including, without limitation, the risks identified in clauses (j)

through (x), inclusive, below.

(h)

Economic Loss and Sophistication. The Subscriber is able to bear the economic risk of losing its entire investment in the Company.

The Subscriber’s overall commitment to investments which are not readily marketable is not disproportionate to its net worth. The

Subscriber’s investment in the Company will not cause such overall commitment to become excessive. The Subscriber has such knowledge

and experience in financial and business matters that it is capable of evaluating the risks and merits of this investment.

(i)

No Registration of Shares. The Subscriber acknowledges and agrees that, based in part upon its representations contained herein

and in reliance upon applicable exemptions, no Shares acquired by the Subscriber have been or will be registered under the Securities

Act or the securities laws of any other domestic or foreign jurisdiction. Accordingly, no such Shares may be offered for sale, sold,

pledged, hypothecated or otherwise transferred in whole or in part except in accordance with the terms of the Certificate of Incorporation

and Bylaws and in compliance with all applicable laws, including securities laws. The Subscriber acknowledges that it has been advised

that the Company has no obligation and does not intend to cause any Shares in the Company to be registered under the Securities Act or

any other securities laws or to comply with any exemption under the Securities Act or any other securities law which would permit the

Subscriber to sell the Subscriber’s Shares in the Company.

(j)

Investment Risk. The Subscriber acknowledges and agrees: (i) that investment in early-stage startup companies involves a high

degree of risk and should only be considered by those who can afford the loss of their entire investment; (ii) the investment in the

Company’s Shares should only be undertaken by persons whose financial resources are sufficient to enable them to indefinitely retain

an illiquid investment, and (iii) that the Subscriber should consider all of the information provided to such potential investor regarding

the Company as well as the risk factors contained here, in addition to the other information provided in the Subscription Documents.

(k)

Business Projections Only Estimates. The Subscriber acknowledges and agrees: (i) there can be no assurance that the Company will

meet any projections contained in the Subscription Documents, (ii) there can be no assurance that the Company will be able to find sufficient

demand for its Project as it has a unique business model without any history nor is there any assurance on the accuracy of its internal

estimates including those related to the cost of product, product pricing, output potential or the output of the planned facilities,

and (ii) if there is limited acceptance of its business and/or services, then the Company’s financial results will be negatively

impacted.

(l)

New Entity With No Operating History. The Company was formed on September 11, 2023 and has no operating history. Therefore, no

assurance can be made about future results of operations.

(m)

Financing Risk. The Company might not obtain sufficient financing to meet its operating needs and fulfill its plans, in which

case it will cease operating and investors will lose the entirety of their investment. If the Company cannot raise those funds for whatever

reason, including reasons relating to the Company itself or to the broader economy, it may not have sufficient funds to operate and your

investment may be worthless.

(n)

Start-up risk. Further, any speculative discussion about business relationships, is just that speculative. There is no certainty

as to whether any business relationships will occur until formalized in writing, and, even then, there is no guarantee that those relationships

will be successful or beneficial to the Company.

(o)

Intellectual Property The Company and its subsidiaries will need to rely on intellectual property that has been developed by or

is owned by Subscriber or one or more of its affiliates. It is contemplated that the Company will enter into a, Intellectual Property

Assignment Agreement with the owner of such intellectual property pursuant to which the Company will have rights to use such intellectual

property in exchange for the Shares herein.

(p)

Related Party Agreements. The Company depends on a number of agreements. Conflicts of interest could arise with respect to such

agreements that could be detrimental to the Company.

(q)

Insurance Risk. The Company does not currently have any insurance in place for the Company or its officers. There can be no assurance

that insurance will be available or sufficient to cover any risks faced by the Company. If the Company suffers an uninsured loss, all

or a substantial portion of the Company’s funds may be lost. In addition, all of the assets of the Company may be at risk in the

event of an uninsured liability to third parties.

(r)

Management and Operation. The business and affairs of the Company shall be managed by or under the direction of the Board of Directors.

No shareholder of the Company will have the right to participate in the management or operation of the Company’s business. The

Board of Directors may exercise all the powers of the Company whether derived from law or the organizational documents of the Company,

except when shareholder approval is expressly required by the Certificate of Incorporation and Bylaws or by nonwaivable provisions of

the Delaware Limited Liability Company Act. The Board of Directors has the power and authority to authorize the Company’s officers

to manage the affairs and carry on the operations of the Company.

(s)

Principal Place of Business; Organization. The address set forth in the Omnibus Signature Page is the Subscriber’s correct

principal place of business (or residence if a natural person), and the Subscriber has no present intention of moving its principal place

of business (or residence if a natural person) to any other domestic or foreign jurisdiction. The state and country set forth on the

Omnibus Signature Page are the Subscriber’s correct state and country of organization (if the Subscriber is not a natural person).

(t)

Taxes.

| |

(i) |

The

Subscriber acknowledges and agrees that no assurances have been made to the Subscriber regarding the tax advantages that may inure

to the benefit of the investor shareholders of the Company, nor has any assurance been made that existing tax laws and regulations

will not be modified in the future, thus denying the investor shareholders of the Company all or a portion of the tax benefits which

may be currently available under existing tax laws and regulations, or that some of the deductions claimed by the Company or the

allocation of items or income, gain, loss, deduction, or credit among the participants may not be challenged by the Internal Revenue

Service. |

| |

|

|

| |

(ii) |

The

Subscriber is not subject to backup withholding under the Internal Revenue Code. |

| |

|

|

| |

(iii) |

(A)

the Subscriber certifies that, if the Subscriber is an individual, the Subscriber is not a nonresident alien for the purposes of

United States federal income taxation or, if the Subscriber is a corporation, partnership, trust or estate, the Subscriber is not

a foreign corporation, foreign partnership, foreign trust, or foreign estate (as those terms are defined in the Internal Revenue

Code and regulations promulgated thereunder), (B) the Subscriber declares under penalties of perjury that the foregoing certification

and the name, identifying number, home address (in the case of an individual) or office address (in the case of an entity), and place

of incorporation (in the case of a corporation) of the Subscriber is to the best of the Subscriber’s knowledge and belief true,

correct and complete, and (C) the Subscriber agrees to inform the Company if the Subscriber becomes a nonresident alien or a foreign

person at any time during the three (3) year period immediately following the date of this Subscription Agreement. |

(u)

Compliance with Anti-Terrorism and Anti-Money Laundering Laws and Regulations. The Subscriber and all of its beneficial owners

(if the Subscriber is an entity) are in compliance with all laws, statutes, rules and regulations relating to anti-terrorism or anti-money

laundering laws of any federal, state or local government in the United States of America applicable to such person(s) or entity(ies),

including without limitation, the USA Patriot Act, Pub. L, No. 107-56 (October 26, 2001), Executive Order No. 13224, 66 Fed. Reg. 49079

(Sept. 23, 2001) and all other similar requirements contained in the rules and regulations of the Office of Foreign Asset Control (“OFAC”),

the Department of Treasury and in any enabling legislation or other Executive Orders in respect thereof. Neither the Subscriber nor any

of its beneficial owners (if the Subscriber is an entity) is listed on the Specifically Designated Nationals and Blocked Persons List

maintained by OFAC and/or on any other lists of terrorist or terrorist organizations maintained and made publicly available by any governmental

department, agency or other entity.

(v)

No Other Representations; No Public Solicitation. No oral or written representations have been made or oral or written information

furnished to the Subscriber that are in any way inconsistent with the information contained in this Agreement and the Subscription Documents.

The Subscriber has received no materials other than the items set forth in Section 2.1(e) of this Subscription Agreement. The Subscriber

is not subscribing for the Shares as a result of or in connection with any advertisement, article, notice, or other communications published

in any newspaper, magazine, or similar media, or broadcast over television or radio, in each case regarding the Company or investments

in securities generally, or any seminar or meeting to which the Subscriber was invited by any general solicitation or general advertising,

or any solicitation of a subscription by a person not previously known to the Subscriber.

(w)

ERISA Plan Assets. The Subscriber is not (i) an “employee benefit plan” within the meaning of Section 3(3) of Employee

Retirement Income Security Act of 1974, as amended (“ERISA”), subject to Title I of ERISA; (ii) a “plan”

(as defined in Section 4975(e)(1) of the Internal Revenue Code (the “Code”), including without limitation, an individual

retirement account), subject to Section 4975 of the Code; or (iii) an entity whose underlying assets include plan assets by reason of

investment by a plan described in (i) or (ii) above in such entity, including but not limited to, an insurance company general account,

an insurance company separate account or a collective investment fund. No portion of the assets of the Subscriber constitute “plan

assets” under ERISA or Section 4975 of the Code.

(x)

Reliance; Effect and Time of Representations. The Subscriber’s representations, agreements and acknowledgements set forth

in this Subscription Agreement are true, and have been complied with, as of the date of the Subscriber’s execution of this Subscription

Agreement and shall be true, and shall have been complied with, as of the Closing Date. The Subscriber acknowledges that this Subscription

Agreement and any other information which it has provided concerning the Subscriber and its financial position will be relied on by the

Company in determining, among other things, whether the Offering of Shares in the Company meets the conditions for exemptions from the

registration provisions of federal securities laws and state securities laws of various states, and the information contained herein

and therein is true, complete and correct. The Subscriber acknowledges that the Company, and each respective shareholder thereof, has

relied and will rely upon the representations and agreements of, and information furnished by, the Subscriber set forth in this Subscription

Agreement and that all such representations, agreements, and furnished information shall survive the Closing Date and the execution of

the Subscription Documents. If in any respect such representations, agreements, and furnished information shall not be true, or shall

not have been complied with, as of any date set forth in the preceding sentence, the Subscriber shall promptly give written notice of

such fact to the Company and shall specify which representations, agreements, and furnished information are not true or have not been

complied with and the reasons therefor.

Article

III

Miscellaneous

Section

3.1 No Assignment. The Subscriber agrees not to transfer or assign this subscription or any interest herein without the prior

written consent of the Company in its sole discretion, and any purported transfer or assignment without such prior written consent shall

be void.

Section

3.2 Amendments. This Subscription Agreement may be modified or amended only with the written consent of the Company and the

Subscriber, except that modifications, amendments, waivers, consents, or other matters relating to the Certificate of Incorporation and

Bylaws shall not be deemed modifications or amendments of this Subscription Agreement.

Section

3.3 Gender, Number, etc. All pronouns used herein shall be deemed to refer to the masculine, feminine or neuter gender as

the identity of the applicable person may require, and words using the singular or plural number shall be deemed to include respectively

the plural or singular number as applicable. Unless otherwise specified, all references in this Subscription Agreement to Articles, Sections,

or paragraphs shall refer to provisions in this Subscription Agreement. As used in this Subscription Agreement, the words “herein,”

“hereof,” “hereto,” or derivatives shall refer to this entire Subscription Agreement, and the word

“or” shall mean “and/or.”

Section

3.4 Governing Law, Binding Effect, and Severability. This Subscription Agreement shall be enforced, governed and construed

in all respects in accordance with the laws of the State of Delaware applicable to contracts executed and performable solely in such

state. This Subscription Agreement and the rights and obligations set forth herein shall be binding upon, and shall inure to the benefit

of, the Subscriber, the Company and their respective successors and permitted assigns. If any provision of this Subscription Agreement,

or the application of such provision to any circumstance, shall be invalid under the applicable law of any jurisdiction, the remainder

of this Subscription Agreement or the application of such provision to other persons or circumstances or in other jurisdictions shall

not be affected thereby.

Section

3.5 Entire Agreement. This Subscription Agreement (including the appendices hereto) and the Certificate of Incorporation and

Bylaws constitute the entire agreement, and supersede all prior agreements or understandings, among the parties hereto with respect to

the Offering and ownership of Shares.

Section

3.6 Counterparts. This Subscription Agreement may be executed and delivered in one or more separate counterparts (including

by facsimile transmission), each of which when so executed shall be deemed to be an original and all of which taken together shall constitute

one and the same agreement.

[signatures

on following page]

APPENDIX

I

OMNIBUS

SIGNATURE PAGE

FOR

SUBSCRIBERS THAT ARE ENTITIES

Ladies

and Gentlemen:

The

undersigned Subscriber for shareholdership interests (Shares) in AllFi Technologies, Inc. (Company) hereby submits to you this Omnibus

Signature Page which constitutes the signature page for (a) the Subscription Agreement, and (b) the Certificate of Incorporation and

Bylaws (as defined in the Subscription Agreement).

The

Subscriber subscribes to the Company for a total of 501 Shares in exchange for $100,000.

Print

Entity Name in which Shares should be registered

Mailing

Address

| |

|

|

|

|

| City |

|

State |

|

State

of Residence |

| |

|

|

|

|

| Zip

Code |

|

Tax

ID Number |

|

Phone

Number |

| |

|

|

|

|

| E-Maill

Address of Principal Contact |

|

|

|

|

IN

WITNESS WHEREOF, the undersigned has executed this Omnibus Signature Page this 3rd day of October, 2023.

SUBSCRIBER:

Name

of Subscriber: __________________________________________________________

Signature

of Authorized Signatory: _______________________________________________

Print

Name: __________________________________________________________________

Title/Description

of Signing Authority: _____________________________________________

ACCEPTED

this 3rd day of October, 2023:

| AllFi

Technologies, Inc. |

|

| |

|

|

| By:

|

|

|

| Name: |

|

|

| Title: |

|

|

Exhibit

A

Certificate

of Incorporation and Bylaws

(See

attached)

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

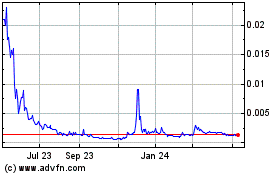

Crypto (PK) (USOTC:CRCW)

Historical Stock Chart

From Nov 2024 to Dec 2024

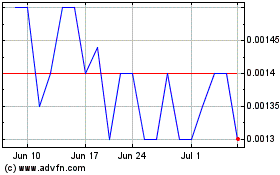

Crypto (PK) (USOTC:CRCW)

Historical Stock Chart

From Dec 2023 to Dec 2024