UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 1-A/A

Dated: July 30, 2024

REGULATION A OFFERING CIRCULAR UNDER THE SECURITIES

ACT OF 1933

Standard Dental

Labs, Inc.

(Exact name of issuer as specified in its charter)

Nevada

(State of other jurisdiction of incorporation or organization)

424 E Central Blvd, Suite 308,

Orlando, Florida, 32801

321-465-9899

(Address, including zip code, and telephone number,

including area code of issuer’s principal executive office)

Jeff Turner

7533 S Center View Ct, #4291

West Jordan, UT 84084

801-810-4465

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

| 3843 |

|

88-0411500 |

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

This Preliminary Offering Circular shall only be qualified

upon order of the Commission, unless a subsequent amendment is filed indicating the intention to become qualified by operation of the

terms of Regulation A.

This Offering Circular is following the Offering

Circular format described in Part II (a)(1)(ii) of Form 1-A.

TABLE OF CONTENTS

PART II – PRELIMINARY OFFERING CIRCULAR

- FORM 1-A: TIER II

An Offering statement pursuant to Regulation

A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary

Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the

Offering statement filed with the Securities and Exchange Commission is qualified. This Preliminary Offering Circular shall not constitute

an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer,

solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy

our obligation to deliver a Final Offering circular by sending you a notice within two business days after the completion of our sale

to you that contains the URL where the Final Offering Circular or the Offering statement in which such Final Offering Circular was filed

may be obtained.

PRELIMINARY OFFERING CIRCULAR

Dated: July 30, 2024

Subject to Completion

PURSUANT TO REGULATION A OF THE SECURITIES ACT OF 1933

Standard Dental Labs Inc.

424 E Central Blvd, Suite 308,

Orlando, Florida, 32801

400,000,000 Shares of Common Stock

at a price range of $0.01 - $0.03 per share

Minimum Investment: $5,000

Maximum Offering: $12,000,000

See The Offering - Page

3 for further details. None of the securities offered are being sold by present security holders.

Upon qualification of this Offering by the Securities and Exchange Commission, the Offering will commence within two business days of

being qualified by the Securities and Exchange Commission (“SEC”) and will terminate 365 days from the date of qualification

by the Securities and Exchange Commission, unless extended or terminated earlier by the Company.

PLEASE REVIEW ALL RISK FACTORS

BEGINNING ON PAGES 4 THROUGH 10 BEFORE MAKING AN INVESTMENT IN THIS COMPANY. AN INVESTMENT IN THIS COMPANY SHOULD ONLY BE MADE IF YOU

ARE CAPABLE OF EVALUATING THE RISKS AND MERITS OF THIS INVESTMENT AND IF YOU HAVE SUFFICIENT RESOURCES TO BEAR THE ENTIRE LOSS OF YOUR

INVESTMENT, SHOULD THAT OCCUR.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION

DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE

ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SELLING LITERATURE. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION

FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED

HEREUNDER ARE EXEMPT FROM REGISTRATION.

Because these securities are being offered on a “best efforts”

basis, the following disclosures are hereby made:

| | |

Price to Public | | |

Commissions

(1) | | |

Proceeds

to Company

(2) | | |

Proceeds

to Other Persons

(3) | |

| | |

| | |

| | |

| | |

| |

| Per Share | |

$ | 0.01-0.03 | | |

$ | 0 | | |

$ | 0.01-0.03 | | |

None | |

| Minimum Investment | |

$ | 5,000 | | |

$ | 0 | | |

$ | 5,000 | | |

None | |

| Maximum Offering | |

$ | 4,000,000

-12,000,000 | | |

$ | 0 | | |

$ | 4,000,000

-12,000,000 | | |

None | |

| |

(1) |

The Company has not

presently engaged an underwriter for the sale of securities under this Offering. |

| |

(2) |

Does not reflect payment

of expenses of this Offering, which are estimated to not exceed $32,500.00 and which include, among other things, legal fees, accounting

costs, reproduction expenses, due diligence, marketing, consulting, administrative services other costs of blue-sky compliance, and

actual out-of-pocket expenses incurred by the Company selling the Shares. This amount represents the proceeds of the offering to

the Company, which will be used as set out in “USE OF PROCEEDS TO ISSUER.” |

| |

(3) |

There are no finder’s

fees or other fees being paid to third parties from the proceeds. See “Plan of Distribution.” |

This Offering (the “Offering”) consists

of up to 400,000,000 shares of common stock (the “Company Offered Shares”) that are being offered on a “best efforts”

basis, which means that there is no guarantee that any minimum amount will be sold, at a fixed price of $0.01-0.03 per share (the “Offering

Price”) (the Offering Price will be provided via an Offering Circular Supplement within two business days following the earlier

of the date of determination of the offering price or the date such offering circular is first used after qualification in connection

with a public offering or sale in accordance with Rule 253(g)(1)), pursuant to Tier 2 of Regulation A of the United States Securities

and Exchange Commission (the “SEC”). A minimum purchase of $5,000 of the Company Offered Shares is required in this offering;

any additional purchase must be in an amount of at least $1,000. The Company Offered Shares are being offered only by the Company on

a best-efforts basis to an unlimited number of accredited investors and to an unlimited number of non-accredited investors subject to

the limitations of Regulation A. Under Rule 251(d)(2)(i)(C) of Regulation A+, non-accredited,

non-natural investors are subject to the investment limitation and may only invest funds which do not exceed 10% of the greater of the

purchaser’s revenue or net assets (as of the purchaser’s most recent fiscal year end). A non-accredited, natural person may

only invest funds which do not exceed 10% of the greater of the purchaser’s annual income or net worth (please see below on how

to calculate your net worth). The maximum aggregate amount of the Shares that will be offered is 400,000,000 Shares of Common Stock with

a Maximum Offering Price of $4,000,000 to $12,000,000, depending on the final offering price. There is no minimum number of Shares that

needs to be sold in order for funds to be released to the Company and for this Offering to close.

Upon qualification of this offering by the SEC,

the Company may issue Company Offered Shares in satisfaction of outstanding debt obligations including $830,900 of convertible notes

(the “Subject Convertible Notes”) at the Offering Price. (See “Use of Proceeds” and “Plan

of Distribution”).

Please see the “Risk Factors”

section, beginning on page 4, for a discussion of the risks associated with a purchase of the Offered Shares.

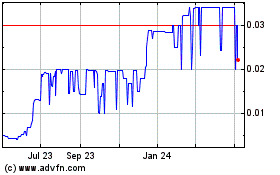

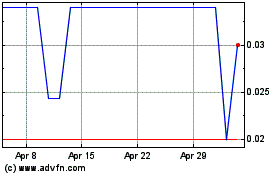

Our common stock is quoted in the over-the-counter

under the symbol “CSSI” in the OTC Pink marketplace of OTC Link. On June 25, 2024, the closing price of our common stock

was $0.0123 per share.

The Company Offered Shares will only be issued

to purchasers who satisfy the requirements set forth in Regulation A. The offering is expected to expire on the first of: (i) all of

the Shares offered are sold; or (ii) the close of business 365 days from the date of qualification by the Commission, unless sooner terminated

or extended by the Company’s CEO. Pending each closing, payments for the Shares will be paid directly to the Company. Funds will

be immediately transferred to the Company where they will be available for use in the operations of the Company’s business in a

manner consistent with the “USE OF PROCEEDS TO ISSUER” in this Offering Circular.

THIS OFFERING CIRCULAR DOES NOT CONSTITUTE

AN OFFER OR SOLICITATION IN ANY JURISDICTION IN WHICH SUCH AN OFFER OR SOLICITATION WOULD BE UNLAWFUL. NO PERSON HAS BEEN AUTHORIZED

TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS CONCERNING THE COMPANY OTHER THAN THOSE CONTAINED IN THIS OFFERING CIRCULAR, AND

IF GIVEN OR MADE, SUCH OTHER INFORMATION OR REPRESENTATION MUST NOT BE RELIED UPON.

PROSPECTIVE INVESTORS ARE NOT TO CONSTRUE THE

CONTENTS OF THIS OFFERING CIRCULAR, OR OF ANY PRIOR OR SUBSEQUENT COMMUNICATIONS FROM THE COMPANY OR ANY OF ITS EMPLOYEES, AGENTS OR

AFFILIATES, AS INVESTMENT, LEGAL, FINANCIAL OR TAX ADVICE.

NO SALE MAY BE MADE TO INVESTORS IF THE AGGREGATE

PURCHASE PRICE IS MORE THAN $75,000,000, PURSUANT TO THE TERMS OF RULE 251 OF REGULATION A TIER II SET FORTH UNDER THE SECURITIES ACT

OF 1933 (THE “ACT”). DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION

THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(d)(2)(i)(C) OF REGULATION A. FOR GENERAL

INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO WWW.INVESTOR.GOV (WHICH IS NOT INCORPORATED BY REFERENCE INTO THIS OFFERING CIRCULAR).

THE INFORMATION CONTAINED IN THIS OFFERING CIRCULAR

HAS BEEN SUPPLIED BY THE COMPANY. THIS OFFERING CIRCULAR CONTAINS SUMMARIES OF DOCUMENTS NOT CONTAINED IN THIS OFFERING CIRCULAR. COPIES

OF DOCUMENTS REFERRED TO IN THIS OFFERING CIRCULAR, BUT NOT INCLUDED AS AN EXHIBIT, WILL BE MADE AVAILABLE TO QUALIFIED PROSPECTIVE INVESTORS

UPON REQUEST.

RULE 251(D)(3)(I)(F) DISCLOSURE. RULE 251(D)(3)(I)((F)

PERMITS REGULATION A OFFERINGS TO CONDUCT ONGOING CONTINUOUS OFFERINGS OF SECURITIES FOR MORE THAN THIRTY (30) DAYS AFTER THE QUALIFICATION

DATE IF: (1) THIS OFFERING WILL BEGIN WITHIN TWO (2) DAYS AFTER THE DATE OF QUALIFICATION; (2) THE OFFERING WILL BE MADE ON A CONTINUOUS

AND ONGOING BASIS FOR A PERIOD THAT MAY BE IN EXCESS OF THIRTY (30) DAYS OF THE INITIAL QUALIFICATION DATE; (3) THE OFFERING WILL BE IN

AN AMOUNT THAT, AT THE TIME THE OFFERING CIRCULAR IS QUALIFIED, IS REASONABLY EXPECTED TO BE OFFERED AND SOLD WITHIN ONE (1) YEAR FROM

THE INITIAL QUALIFICATION DATE; AND (4) THE SECURITIES MAY BE OFFERED AND SOLD ONLY IF NOT MORE THAN THREE (3) YEARS HAVE ELAPSED SINCE

THE INITIAL QUALIFICATION DATE OF THE OFFERING, UNLESS A NEW OFFERING CIRCULAR IS SUBMITTED AND FILED BY THE COMPANY PURSUANT TO RULE

251(D)(3)(I)((F) WITH THE SEC COVERING THE REMAINING SECURITIES OFFERED UNDER THE PREVIOUS OFFERING; THEN THE SECURITIES MAY CONTINUE

TO BE OFFERED AND SOLD UNTIL THE EARLIER OF THE QUALIFICATION DATE OF THE NEW OFFERING CIRCULAR OR THE ONE HUNDRED EIGHTY (180) CALENDAR

DAYS AFTER THE THIRD ANNIVERSARY OF THE INITIAL QUALIFICATION DATE OF THE PRIOR OFFERING CIRCULAR.

This Offering is inherently risky. See “Risk

Factors” beginning on page 4.

Sales of these securities will commence within

two business days of being qualified by the SEC. The Offering will be a continuous offering pursuant to Rule 251(d)(3)(i)(F).

The Company is following the “Offering Circular”

format of disclosure under Regulation A.

AN OFFERING STATEMENT PURSUANT TO REGULATION

A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. INFORMATION CONTAINED IN THIS PRELIMINARY

OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED BEFORE THE

OFFERING STATEMENT FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR

THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR

SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF SUCH STATE. THE COMPANY MAY ELECT TO SATISFY ITS OBLIGATION

TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS DAYS AFTER THE COMPLETION OF THE COMPANY’S SALE

TO YOU THAT CONTAINS THE URL WHERE THE FINAL OFFERING CIRCULAR OR THE OFFERING STATEMENT IN WHICH SUCH FINAL OFFERING CIRCULAR WAS FILED

MAY BE OBTAINED.

NASAA UNIFORM LEGEND

FOR RESIDENTS OF ALL STATES: THE PRESENCE OF

A LEGEND FOR ANY GIVEN STATE REFLECTS ONLY THAT A LEGEND MAY BE REQUIRED BY THAT STATE AND SHOULD NOT BE CONSTRUED TO MEAN AN OFFER OR

SALE MAY BE MADE IN A PARTICULAR STATE. IF YOU ARE UNCERTAIN AS TO WHETHER OR NOT OFFERS OR SALES MAY BE LAWFULLY MADE IN ANY GIVEN STATE,

YOU ARE HEREBY ADVISED TO CONTACT THE COMPANY. THE SECURITIES DESCRIBED IN THIS OFFERING CIRCULAR HAVE NOT BEEN REGISTERED UNDER ANY

STATE SECURITIES LAWS (COMMONLY CALLED ‘BLUE SKY’ LAWS).

IN MAKING AN INVESTMENT DECISION INVESTORS

MUST RELY ON THEIR OWN EXAMINATION OF THE PERSON OR ENTITY CREATING THE SECURITIES AND THE TERMS OF THE OFFERING, INCLUDING THE MERITS

AND RISKS INVOLVED. THESE SECURITIES HAVE NOT BEEN RECOMMENDED BY ANY FEDERAL OR STATE SECURITIES COMMISSION OR REGULATORY AUTHORITY.

FURTHERMORE, THE FOREGOING AUTHORITIES HAVE NOT CONFIRMED THE ACCURACY OR DETERMINED THE ADEQUACY OF THIS DOCUMENT. ANY REPRESENTATION

TO THE CONTRARY IS A CRIMINAL OFFENSE.

NOTICE TO FOREIGN INVESTORS

IF THE PURCHASER LIVES OUTSIDE THE UNITED STATES,

IT IS THE PURCHASER’S RESPONSIBILITY TO FULLY OBSERVE THE LAWS OF ANY RELEVANT TERRITORY OR JURISDICTION OUTSIDE THE UNITED STATES

IN CONNECTION WITH ANY PURCHASE OF THE SECURITIES, INCLUDING OBTAINING REQUIRED GOVERNMENTAL OR OTHER CONSENTS OR OBSERVING ANY OTHER

REQUIRED LEGAL OR OTHER FORMALITIES. THE COMPANY RESERVES THE RIGHT TO DENY THE PURCHASE OF THE SECURITIES BY ANY FOREIGN PURCHASER.

PATRIOT ACT RIDER

The Investor hereby represents and warrants that

Investor is not, nor is it acting as an agent, representative, intermediary or nominee for, a person identified on the list of

blocked persons maintained by the Office of Foreign Assets Control, U.S. Department of Treasury. In addition, the Investor has complied

with all applicable U.S. laws, regulations, directives, and executive orders relating to anti-money laundering , including but not limited

to the following laws: (1) the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism

Act of 2001, Public Law 107-56, and (2) Executive Order 13224 (Blocking Property and Prohibiting Transactions with Persons Who Commit,

Threaten to Commit, or Support Terrorism) of September 23, 2001.

NO DISQUALIFICATION EVENT (“BAD ACTOR”

DECLARATION)

NONE OF THE COMPANY, ANY OF ITS PREDECESSORS,

ANY AFFILIATED ISSUER, ANY DIRECTOR, EXECUTIVE OFFICER, OTHER OFFICER OF THE COMPANY PARTICIPATING IN THE OFFERING CONTEMPLATED HEREBY,

ANY BENEFICIAL OWNER OF 20% OR MORE OF THE COMPANY’S OUTSTANDING VOTING EQUITY SECURITIES, CALCULATED ON THE BASIS OF VOTING POWER,

NOR ANY PROMOTER (AS THAT TERM IS DEFINED IN RULE 405 UNDER THE SECURITIES ACT OF 1933) CONNECTED WITH THE COMPANY IN ANY CAPACITY AT

THE TIME OF SALE (EACH, AN “ISSUER COVERED PERSON”) IS SUBJECT TO ANY OF THE “BAD ACTOR” DISQUALIFICATIONS

DESCRIBED IN RULE 506(D)(1)(I) TO (VIII) UNDER THE SECURITIES ACT OF 1933 (A “DISQUALIFICATION EVENT”), EXCEPT

FOR A DISQUALIFICATION EVENT COVERED BY RULE 506(D)(2) OR (D)(3) UNDER THE SECURITIES ACT. THE COMPANY HAS EXERCISED REASONABLE CARE

TO DETERMINE WHETHER ANY ISSUER COVERED PERSON IS SUBJECT TO A DISQUALIFICATION EVENT.

Continuous Offering

Under Rule 251(d)(3) to Regulation A, the following

types of continuous or delayed Offerings are permitted, among others: (1) securities offered or sold by or on behalf of a person

other than the issuer or its subsidiary or a person of which the issuer is a subsidiary; (2) securities issued upon conversion of other

outstanding securities; or (3) securities that are part of an Offering which commences within two calendar days after the qualification

date. These may be offered on a continuous basis and may continue to be offered for a period in excess of 30 days from the date of initial

qualification. They may be offered in an amount that, at the time the Offering statement is qualified, is reasonably expected to be offered

and sold within one year from the initial qualification date. No securities will be offered or sold “at the market.” The

Shares will be sold at a fixed price of $0.01 per share.

Subscriptions are irrevocable and the purchase

price is non-refundable as expressly stated in this Offering Circular. The Company, by determination of the Board of Directors, in its

sole discretion, may issue the Securities under this Offering for cash, services, in satisfaction of outstanding debt obligation, and/or

other consideration without notice to subscribers. All cash proceeds received by the Company from subscribers for this Offering will

be available for use by the Company upon acceptance of subscriptions for the Securities by the Company.

About This Form 1-A and Offering Circular

In making an investment decision, you should

rely only on the information contained in this Form 1-A and Offering Circular. The Company has not authorized anyone to provide you with

information different from that contained in this Form 1-A and Offering Circular. We are offering to sell, and seeking offers to buy

the Shares only in jurisdictions where offers and sales are permitted. You should assume that the information contained in this Form

1-A and Offering Circular is accurate only as of the date of this Form 1-A and Offering Circular, regardless of the time of delivery

of this Form 1-A and Offering Circular. Our business, financial condition, results of operations, and prospects may have changed since

that date. In compliance with Rule 257(b), the Company will make material updates to the Offering Circular by filing current reports

on Form 1-U, annual reports on Form 1-K, and semi-annual reports on Form 1-SA.

TABLE OF CONTENTS

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING STATEMENTS

The information contained in this Offering Circular

includes some statements that are not historical and that are considered forward-looking statements. Such forward-looking statements include,

but are not limited to, statements regarding our development plans for our business; our strategies and business outlook; anticipated

development of our company; and various other matters (including contingent liabilities and obligations and changes in accounting policies,

standards and interpretations). These forward-looking statements express our expectations, hopes, beliefs and intentions regarding the

future. In addition, without limiting the foregoing, any statements that refer to projections, forecasts or other characterizations of

future events or circumstances, including any underlying assumptions, are forward-looking statements. The words anticipates, believes,

continue, could, estimates, expects, intends, may, might, plans, possible, potential, predicts, projects, seeks, should, will, would and

similar expressions and variations, or comparable terminology, or the negatives of any of the foregoing, may identify forward-looking

statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained in this

Offering Circular are based on current expectations and beliefs concerning future developments that are difficult to predict. We cannot

guarantee future performance, or that future developments affecting our company will be as currently anticipated. These forward-looking

statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual

results or performance to be materially different from those expressed or implied by these forward-looking statements.

All forward-looking statements attributable to

us are expressly qualified in their entirety by these risks and uncertainties. These risks and uncertainties, along with others, are also

described below in the Risk Factors section. Should one or more of these risks or uncertainties materialize, or should any of our assumptions

prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. You should not

place undue reliance on any forward-looking statements and should not make an investment decision based solely on these forward-looking

statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future

events or otherwise, except as may be required under applicable securities laws.

OFFERING CIRCULAR SUMMARY,

PERKS AND RISK FACTORS

OFFERING CIRCULAR SUMMARY

The following summary is qualified in its entirety

by the more detailed information appearing elsewhere in this Offering Circular and/or incorporated by reference in this Offering Circular.

For full offering details, please (1) thoroughly review this Form 1-A filed with the Securities and Exchange Commission (2) thoroughly

review this Offering Circular and (3) thoroughly review any attached documents to or documents referenced in, this Form 1-A and Offering

Circular.

Unless otherwise indicated,

the terms “Standard Dental Labs”, “the Company”, “CSSI”, “we”, “our”,

and “us” are used in this Offering Circular to refer to Standard Dental Labs, Inc.

Business Overview

Standard Dental Labs Inc.,

(formerly known as Costas, Inc.) was incorporated in the State of Nevada on December 10, 1998. From inception, our company had pursued

business operations several different industries, including real estate speculation and financial technologies.

In 2017, our current sole

officer and a director, James D. Brooks, commenced an action against the company and was awarded a judgment in the Eighth Judicial District

Court, Clark County, Nevada, against our company for breach of contract, and non-payment of obligations. On September 20, 2017, the court

filed an order effective September 18, 2017, whereby Mr. Brooks, as a creditor of our company, was granted a judgment against us in the

principal amount of $1,114,500. On October 21, 2020, Mr. Brooks filed a motion requesting the appointment of a Receiver over our company.

On March 25, 2021, the Receiver filed a motion with the Court requesting approval to (i) appoint Mr. Brooks as an officer and director

of our company; and (ii) increase our authorized capital and subsequently to issue sufficient common and preferred shares on terms to

be finalized with Mr. Brooks, whereby Mr. Brooks became the controlling stockholder of our company. On February 9, 2022, an Order was

entered by the Eighth Judicial District Court, Clark County, Nevada, Case No. A-17-749977D, terminating the receivership for our company.

Our

primary operations are focused on our dental lab where we manufacture and produce several types of dental prosthetics. We provide dental

lab services to more than 50 dental practices and produce approximately 500 dental prosthetics each month. As the Company’s sole

officer and director, Mr. Brooks oversees the overall direction of the Company in relation to its plans for long-term growth.

”

section for further description of the Company). Though incorporated in 1998, the Company has a limited operating history in our current

business segment and a history of net losses. (See “Risks Related to Our Company” for additional information.)

Offering Summary

| Securities Offered |

|

Company Offered Shares: 400,000,000 shares of

common stock, par value $0.001.

|

| |

|

|

| Offering Price |

|

$0.01-0.03 per Offered Share. |

| |

|

|

|

Shares Outstanding

Before This Offering |

|

465,728,363 shares of common stock issued and outstanding as of

the date hereof. |

| |

|

|

|

Shares Outstanding

After This Offering |

|

865,728,363 shares of common stock issued and outstanding, assuming

the sale of all of the Company Offered Shares hereunder. |

| |

|

|

|

Minimum Number of Shares

to Be Sold in This Offering |

|

None |

| |

|

|

| Investor Suitability Standards |

|

The Offered Shares may only be purchased by investors residing in a state in which this Offering Circular is duly qualified who have either (a) a minimum annual gross income of $70,000 and a minimum net worth of $70,000, exclusive of automobile, home and home furnishings, or (b) a minimum net worth of $250,000, exclusive of automobile, home and home furnishings. |

| |

|

|

| Market for our Common Stock |

|

Our common stock is quoted in the over-the-counter market under the symbol “CSSI” in the OTC Pink marketplace of OTC Link. |

| |

|

|

| Termination of this Offering |

|

This offering will terminate at the earliest of (a) the date on

which the maximum offering has been sold, (b) the date which is one year from this offering circular being qualified by the SEC and

(c) the date on which this offering is earlier terminated by us, in our sole discretion, subject to the limitations set forth in

Rule 251(d)(3)(i)(F) of Regulation A. |

| |

|

|

|

Conversion of the Subject

Convertible Notes |

|

Upon qualification of this offering by the SEC, the Company may

issue Company Offered Shares in satisfaction of the Subject Convertible Notes at the Offering Price. In such an event, we would realize

approximately $830,900 in a reduction of outstanding liabilities rather can cash proceeds. |

| |

|

|

| Use of Proceeds |

|

We will apply the proceeds of this offering for sales and marketing, dental lab equipment, new lab acquisitions, general and administrative expenses, and working capital. (See “Use of Proceeds”). |

| |

|

|

| Risk Factors |

|

An investment in the Offered Shares involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investments. You should carefully consider the information included in the Risk Factors section of this Offering Circular, as well as the other information contained in this Offering Circular, prior to making an investment decision regarding the Offered Shares. |

| |

|

|

| Corporate Information |

|

Our principal executive offices are located at 424 E. Central Boulevard,

Suite 308, Orlando, Florida 32801; our telephone number is (321) 465-9899; our corporate website is located at https://sdl.care.

No information found on our Company’s website is part of this Offering Circular. |

| |

|

|

| Legal Counsel |

|

No independent counsel has been retained to represent the investors

in the Company. Each investor should retain its own counsel and other appropriate advisers as to legal, regulatory and tax matters

affecting investment in shares of common stock and its suitability for such investor. |

The Offering

| Common Stock Outstanding (1) |

|

|

465,728,363 |

|

| Common Stock in this Offering |

|

|

400,000,000 |

|

| Stock to be outstanding after the offering (2) |

|

|

865,728,363 |

|

| |

(1) |

As of the date of this

Offering Circular. |

| |

(2) |

The total number of

Shares of Common Stock assumes that the maximum number of Shares are sold in this Offering. The Company may not be able to sell the

Maximum Offering Amount. The Company will conduct one or more closings on a rolling basis as funds are received from investors. |

Investment Analysis

There is no assurance the Company will be profitable,

or that management’s opinion of the Company’s future prospects will not be outweighed by the unanticipated losses, adverse

regulatory developments and other risks. Investors should carefully consider the various risk factors below before investing in the Shares.

Continuing Reporting Requirements Under Regulation

A

Following this Tier II, Regulation A offering,

we will be required to comply with certain ongoing disclosure requirements under Rule 257 of Regulation A. We will be required to file:

(i) an annual report with the SEC on Form 1-K; (ii) a semi-annual report with the SEC on Form 1-SA; (iii) current reports with the SEC

on Form 1-U; and (iv) a notice under cover of Form 1-Z. The necessity to file current reports will be triggered by certain corporate events,

similar to the ongoing reporting obligation faced by issuers under the Exchange Act, however the requirement to file a Form 1-U is expected

to be triggered by significantly fewer corporate events than that of the Form 8-K. Parts I & II of Form 1-Z will be filed by us if

and when we decide to and are no longer obligated to file and provide annual reports pursuant to the requirements of Regulation A.

As soon as practicable, but in no event later than

one hundred twenty (120) days after the close of our fiscal year, ending December 31st, our board of directors will cause to

be mailed or made available, by any reasonable means, to each stockholder as of a date selected by the board of directors, an annual report

containing financial statements of the Company for such fiscal year, presented in accordance with GAAP, including a balance sheet and

statements of operations, company equity and cash flows, with such statements having been audited by an accountant selected by the board

of directors. The board of directors shall be deemed to have made a report available to each stockholder as required if it has either

(i) filed such report with the SEC via its Electronic Data Gathering, Analysis and Retrieval, or EDGAR, system and such report is publicly

available on such system or (ii) made such report available on any website maintained by the Company and available for viewing by the

stockholders.

Additionally, during the pendency of this offering

and following this offering, we intend to file quarterly and annual financial reports and other supplemental reports with OTC Markets,

which will be available at www.otcmarkets.com.

All of our future periodic reports, whether filed

with OTC Markets or the SEC, will not be required to include the same information as analogous reports required to be filed by companies

whose securities are listed on the NYSE or NASDAQ, for example.

RISK FACTORS

An investment in the Offered Shares involves substantial

risks. You should carefully consider the following risk factors, in addition to the other information contained in this Offering Circular,

before purchasing any of the Offered Shares. The occurrence of any of the following risks might cause you to lose a significant part of

your investment. The risks and uncertainties discussed below are not the only ones we face but do represent those risks and uncertainties

that we believe are most significant to our business, operating results, prospects and financial condition. Some statements in this Offering

Circular, including statements in the following risk factors, constitute forward-looking statements. (See “Cautionary Statement Regarding Forward-Looking Statements”).

Risks Related to Our Company

We have a limited operating

history. Our operating history is limited. There can be no assurance that our proposed plan of business can be realized in the

manner contemplated and, if it cannot be, shareholders may lose all or a substantial part of their investment. There is no guarantee

that we will ever realize any significant operating revenues or that our operations will ever be profitable.

Our company has

a limited operating history and an evolving business model which raises doubt about our ability to achieve profitability or obtain financing.

Our company only has a couple of years of operating history. Moreover, our business model will rely on the ability to make additional

acquisitions of dental labs on commercially viable terms. Our company’s ability to continue as a going concern is dependent upon

our ability to obtain adequate financing and to reach profitable levels of operations and we have a limited history of performance, earnings,

and success. There can be no assurance that we will achieve profitability or obtain future financing. Also, our business depends on our

ability to successfully purchase more advanced equipment and technology from time to time such as 3D printing and modelling technology,

which there is no assurance that we will achieve.

There

is no assurance that we will be able to acquire additional dental labs pursuant to our growth

strategy. In order to grow and achieve the level of operations and margins that we

hope to achieve, one component of our strategy

is the acquisition and integration of additional dental lab operations. While we are confident

in our ability to execute on this, there can be no assurances that we will be able to identify

suitable dental labs for acquisition, or that we will be able to acquire such labs on commercially

viable terms. If we are unable to make such additional acquisitions, or successfully integrate

any acquired labs into existing operations, our growth prospects may be limited.

Conflicts of interest between our company

and our sole officer may result in a loss of business opportunity. Our sole officer is not obligated to commit his full time and

attention to our business and, accordingly, he may encounter a conflict of interest in allocating his time between our future operations

and those of other businesses. In the course of his other business activities, he may become aware of investment and business opportunities

which may be appropriate for presentation to us as well as other entities to which he owes a fiduciary duty. As a result, he may have

conflicts of interest in determining to which entity a particular business opportunity should be presented. He may also in the future

become affiliated with entities, engaged in business activities similar to those we intend to conduct.

In general, officers and directors of a corporation

are required to present business opportunities to a corporation if:

| |

· |

the corporation could financially undertake the opportunity; |

| |

· |

the opportunity is within the corporation’s line of business; and |

| |

· |

it would be unfair to the corporation and its stockholders not to bring the opportunity to the attention of the corporation. |

We plan to adopt a code of ethics that obligates

our directors, officers and employees to disclose potential conflicts of interest and prohibits those persons from engaging in such transactions

without our consent. Despite our intentions, conflicts of interest may nevertheless arise which may deprive our company of a business

opportunity, which may impede the successful development of our business and negatively impact the value of an investment in our company.

The speculative nature of our business plan

may result in the loss of your investment. Our operations are in the start-up or stage only and are unproven. We may not be successful

in implementing our business plan to become profitable. There may be less demand for our services than we anticipate. There is no assurance

that our business will succeed, and you may lose your entire investment.

General economic factors may negatively impact

the market for our dental products. The willingness of dental practices and their patients/consumers to spend money on our products

may be dependent upon general economic conditions; and any material downturn may reduce the likelihood of such parties incurring costs

toward what some consumers may consider a discretionary expense item.

A wide range of economic and logistical factors

may negatively impact our operating results. Our operating results will be affected by a wide variety of factors that could materially

affect revenues and profitability, including the timing and cancellation of customer orders and projects, competitive pressures on pricing,

availability of personnel, and market acceptance of our services. As a result, we may experience material fluctuations in future operating

results on a quarterly and annual basis which could materially affect our business, financial condition and operating results.

If we fail to effectively and efficiently

advertise, the growth of our business may be compromised. The future growth and profitability of our business will be dependent

in part on the effectiveness and efficiency of our advertising and promotional expenditures, including our ability to (i) create greater

awareness of our services, (ii) determine the appropriate creative message and media mix for future advertising expenditures, and (iii)

effectively manage advertising and promotional costs in order to maintain acceptable operating margins. There can be no assurance that

we will experience benefits from advertising and promotional expenditures in the future. In addition, no assurance can be given that our

planned advertising and promotional expenditures will result in increased revenues, will generate levels of service and name awareness

or that we will be able to manage such advertising and promotional expenditures on a cost-effective basis.

Our success is dependent on our unproven

ability to attract qualified personnel. We depend on our ability to attract, retain and motivate our management team, consultants

and advisors. There is strong competition for qualified technical and management personnel in the dental business sector, and it is expected

that such competition will increase. Our planned growth will place increased demands on our existing resources and will likely require

the addition of technical personnel and the development of additional expertise by existing personnel. There can be no assurance that

our compensation packages will be sufficient to ensure the continued availability of qualified personnel who are necessary for the development

of our business.

We have a limited operating history with

losses, and we expect the losses to continue, which raises concerns about our ability to continue as a going concern. We have

generated minimal revenues since our inception and will, in all likelihood, continue to incur operating expenses with minimal revenues

until we are able to successfully develop our business. Our business plan will require us to incur further expenses. We may not be able

to ever become profitable. These circumstances raise concerns about our ability to continue as a going concern. We have a limited operating

history and must be considered in the start-up stage.

Our management has been able, thus far, to finance

the operations through equity financing and cash on hand. There is no assurance that our company will be able to continue to finance our

company on this basis.

Without additional financing to develop our

business plan, our business may fail. Because we have generated only minimal revenue from our business and cannot anticipate when

we will be able to generate meaningful revenue from our business, we will need to raise additional funds to conduct and grow our business.

We do not currently have sufficient financial resources to completely fund the development of our business plan. We anticipate that we

will need to raise further financing. We can provide no assurance to investors that we will be able to find such financing if required.

The most likely source of future funds presently available to us is through the sale of equity capital. Any sale of share capital will

result in dilution to existing security-holders.

We may not be able to obtain all of the licenses

necessary to operate our business, which would cause our business to fail. Our operations require licenses and permits from various

governmental authorities related to the operation of our acquired dental laboratory facilities. We believe that we will be able to obtain

all necessary licenses and permits under applicable laws and regulations for our operations and believe we will be able to comply in all

material respects with the terms of such licenses and permits. However, such licenses and permits are subject to change in various circumstances.

There can be no guarantee that we will be able to obtain or maintain all necessary licenses and permits.

If

we are unable to recruit or retain qualified personnel, it could have a material adverse effect on our operating results and stock price.

Our success depends in large part on the continued services of our sole executive officer and third-party relationships. We currently

do not have key person insurance on these individuals. The loss of these people, especially without advance notice, could have a material

adverse impact on our results of operations and our stock price. It is also very important that we be able to attract and retain highly

skilled personnel, including technical personnel, to accommodate our acquisition and expansion plans and to replace personnel who leave.

Competition for qualified personnel can be intense, and there are a limited number of people with the requisite knowledge and experience.

Under these conditions, we could be unable to recruit, train, and retain employees. If we cannot attract and retain qualified personnel,

it could have a material adverse impact on our operating results and stock price.

If we fail to effectively manage our growth

our future business results could be harmed. As we proceed with our business plan, we expect to experience significant and rapid

growth in the scope and complexity of our business. We will need to add staff to market our services, manage operations, handle sales

and marketing efforts and perform finance and accounting functions. We will be required to hire a broad range of additional personnel

in order to successfully advance our operations. This growth is likely to place a strain on our management and operational resources.

The failure to develop and implement effective systems, or to hire and retain sufficient personnel for the performance of all of the functions

necessary to effectively service and manage our potential business, or the failure to manage growth effectively, could have a materially

adverse effect on our business and financial condition.

Our internal control over financial reporting

may be ineffective. We do not have the internal infrastructure necessary, and are not required, to complete an attestation about

our financial controls that would be required under Section 404 of the Sarbanes-Oxley Act of 2002. There can be no assurances that there

are no significant deficiencies or material weaknesses in the quality of our financial controls. We expect to incur additional expenses

and diversion of management’s time when it becomes necessary to perform the system and process evaluation, testing and remediation

required to comply with the management certification and auditor attestation requirements.

If our techniques for managing risk are ineffective,

we may be exposed to unanticipated losses. In order to manage the significant risks inherent in our business, we must maintain

effective policies, procedures and systems that enable us to identify, monitor and control our exposure to market, operational, legal

and reputational risks. Our risk management methods may prove to be ineffective due to their design or implementation or as a result of

the lack of adequate, accurate or timely information. If our risk management efforts are ineffective, we could suffer losses or face litigation,

particularly from our clients, and sanctions or fines from regulators. Our techniques for managing risks may not fully mitigate the risk

exposure in all economic or market environments, or against all types of risk, including risks that we might fail to identify or anticipate.

Any failures in our risk management techniques and strategies to accurately quantify such risk exposure could limit our ability to manage

risks or to seek positive, risk-adjusted returns. In addition, any risk management failures could cause fund losses to be significantly

greater than historical measures predict. Our more qualitative approach to managing those risks could prove insufficient, exposing us

to unanticipated losses in our net asset value and therefore a reduction in our revenues.

We cannot assure that we will have the resources

to repay all of our liabilities in the future. We have liabilities and may in the future have other liabilities to affiliated

or unaffiliated lenders. These liabilities represent fixed costs, which are required to be paid regardless of the level of business or

profitability experienced by us. We cannot assure that we will not incur debt in the future, that we will have sufficient funds to repay

our indebtedness or that we will not default on our debt, jeopardizing our business viability. Furthermore, we may not be able to borrow

or raise additional capital in the future to meet our needs or to otherwise provide the capital necessary to conduct our business. We

often utilize purchase order financing from third party lenders when we are supplying or distributing consumer goods, which increases

our costs and the risks that we may incur a default, which would harm its business reputation and financial condition. We cannot assure

that we will be able to pay all of our liabilities, or that we will not experience a default on our indebtedness.

Risks Related to Securities Compliance and Regulation

We will not have reporting obligations under

Sections 14 or 16 of the Securities Exchange Act of 1934, nor will any stockholders have reporting requirements of Regulation 13D or 13G,

nor Regulation 14D. So long as our common shares are not registered under the Exchange Act, our directors and executive officers

and beneficial holders of 10% or more of our outstanding common shares will not be subject to Section 16 of the Exchange Act. Section

16(a) of the Exchange Act requires executive officers and directors and persons who beneficially own more than 10% of a registered class

of equity securities to file with the SEC initial statements of beneficial ownership, reports of changes in ownership and annual reports

concerning their ownership of common shares and other equity securities, on Forms 3, 4 and 5, respectively. Such information about our

directors, executive officers and beneficial holders will only be available through periodic reports we file with OTC Markets.

Our common stock is not registered under the Exchange

Act and we do not intend to register our common stock under the Exchange Act for the foreseeable future; provided, however, that we will

register our common stock under the Exchange Act if we have, after the last day of any fiscal year, more than either (1) 2,000 persons;

or (2) 500 stockholders of record who are not accredited investors, in accordance with Section 12(g) of the Exchange Act.

Further, as long as our common stock is not registered

under the Exchange Act, we will not be subject to Section 14 of the Exchange Act, which, among other things, prohibits companies that

have securities registered under the Exchange Act from soliciting proxies or consents from stockholders without furnishing to stockholders

and filing with the SEC a proxy statement and form of proxy complying with the proxy rules.

The reporting required by Section 14(d) of the

Exchange Act provides information to the public about persons other than the company who is making the tender offer. A tender offer is

a broad solicitation by a company or a third party to purchase a substantial percentage of a company’s common stock for a limited

period of time. This offer is for a fixed price, usually at a premium over the current market price, and is customarily contingent on

stockholders tendering a fixed number of their shares.

In addition, as long as our common stock is not

registered under the Exchange Act, our company will not be subject to the reporting requirements of Regulation 13D and Regulation 13G,

which require the disclosure of any person who, after acquiring directly or indirectly the beneficial ownership of any equity securities

of a class, becomes, directly or indirectly, the beneficial owner of more than 5% of the class.

There may be deficiencies with our internal

controls that require improvements. Our company is not required to provide a report on the effectiveness of our internal controls

over financial reporting. We are in the process of evaluating whether our internal control procedures are effective and, therefore, there

is a greater likelihood of undiscovered errors in our internal controls or reported financial statements as compared to issuers that have

conducted such independent evaluations.

Risks Related to Our Organization and Structure

As a non-listed company conducting an exempt

offering pursuant to Regulation A, we are not subject to a number of corporate governance requirements, including the requirements for

independent board members. As a non-listed company conducting an exempt offering pursuant to Regulation A, we are not subject

to a number of corporate governance requirements that an issuer conducting an offering on Form S-1 or listing on a national stock exchange

would be. Accordingly, we are not required to have (a) a board of directors of which a majority consists of independent directors under

the listing standards of a national stock exchange, (b) an audit committee composed entirely of independent directors and a written audit

committee charter meeting a national stock exchange’s requirements, (c) a nominating/corporate governance committee composed entirely

of independent directors and a written nominating/ corporate governance committee charter meeting a national stock exchange’s requirements,

(d) a compensation committee composed entirely of independent directors and a written compensation committee charter meeting the requirements

of a national stock exchange, and (e) independent audits of our internal controls. Accordingly, you may not have the same protections

afforded to stockholders of companies that are subject to all of the corporate governance requirements of a national stock exchange.

Our holding company structure makes us dependent

on our subsidiaries for our cash flow and could serve to subordinate the rights of our stockholders to the rights of creditors of our

subsidiaries, in the event of an insolvency or liquidation of any such subsidiary. Our company acts as a holding company and,

accordingly, substantially all of our operations are conducted through our subsidiaries. Such subsidiaries will be separate and distinct

legal entities. As a result, substantially all of our cash flow will depend upon the earnings of our subsidiaries. In addition, we will

depend on the distribution of earnings, loans or other payments by our subsidiaries. No subsidiary will have any obligation to provide

our company with funds for our payment obligations. If there is an insolvency, liquidation or other reorganization of any of our subsidiaries,

our stockholders will have no right to proceed against their assets. Creditors of those subsidiaries will be entitled to payment in full

from the sale or other disposal of the assets of those subsidiaries before our company, as a stockholder, would be entitled to receive

any distribution from that sale or disposal.

Risks Related to a Purchase of the Offered Shares

There is no minimum offering and no person

has committed to purchase any of the Offered Shares. We have not established a minimum offering hereunder, which means that we

will be able to accept even a nominal amount of proceeds, even if such amount of proceeds is not sufficient to permit us to achieve any

of our business objectives. In this regard, there is no assurance that we will sell any of the Offered Shares or that we will sell enough

of the Offered Shares necessary to achieve any of our business objectives. Additionally, no person is committed to purchase any of the

Offered Shares.

We may seek additional capital that may result

in stockholder dilution or that may have rights senior to those of our common stock. From time to time, we may seek to obtain

additional capital, either through equity, equity-linked or debt securities. The decision to obtain additional capital will depend on,

among other factors, our business plans, operating performance and condition of the capital markets. If we raise additional funds through

the issuance of equity, equity-linked or debt securities, those securities may have rights, preferences or privileges senior to the rights

of our common stock, which could negatively affect the market price of our common stock or cause our stockholders to experience dilution.

You may never realize any economic benefit

from a purchase of Offered Shares. Because the market for our common stock is volatile, there is no assurance that you will ever

realize any economic benefit from your purchase of Offered Shares.

We do not intend to pay dividends on our

common stock. We intend to retain earnings, if any, to provide funds for the implementation of our business strategy. We do not

intend to declare or pay any dividends in the foreseeable future. Therefore, there can be no assurance that holders of our common stock

will receive cash, stock or other dividends on their shares of our common stock, until we have funds which our Board of Directors determines

can be allocated to dividends.

Our shares of common stock are penny stock,

which may impair trading liquidity. Disclosure requirements pertaining to penny stocks may reduce the level of trading activity

in the market for our common stock and investors may find it difficult to sell their shares. Trades of our common stock will be subject

to Rule 15g-9 of the SEC, which rule imposes certain requirements on broker-dealers who sell securities subject to the rule to persons

other than established customers and accredited investors. For transactions covered by the rule, broker-dealers must make a special suitability

determination for purchasers of the securities and receive the purchaser’s written agreement to the transaction prior to sale. The

SEC also has rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks generally are equity

securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the

NASDAQ system, provided that current price and volume information with respect to transactions in that security is provided by the exchange

or system). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules,

to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the

penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation

of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock

held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must

be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or

with the customer’s confirmation.

The market price for our common stock has

been, and may continue to be, highly volatile. The market for low-priced securities is generally less liquid and more volatile

than securities traded on national stock markets. Wide fluctuations in market prices are not uncommon. No assurance can be given that

the market for our common stock will continue. The price of our common stock may be subject to wide fluctuations in response to factors

such as the following, some of which are beyond our control:

| |

· |

quarterly variations in our operating results; |

| |

|

|

| |

· |

operating results that vary from the expectations of investors; |

| |

|

|

| |

· |

changes in expectations as to our future financial performance, including financial estimates by investors; |

| |

|

|

| |

· |

reaction to our periodic filings, or presentations by executives at investor and industry conferences; |

| |

|

|

| |

· |

changes in our capital structure; |

| |

|

|

| |

· |

announcements of innovations or new services by us or our competitors; |

| |

|

|

| |

· |

announcements by us or our competitors of significant contracts, acquisitions, strategic partnerships, joint ventures or capital commitments; |

| |

|

|

| |

· |

lack of success in the expansion of our business operations; |

| |

|

|

| |

· |

announcements by third parties of significant claims or proceedings against our company or adverse developments in pending proceedings; |

| |

|

|

| |

· |

additions or departures of key personnel; |

| |

|

|

| |

· |

asset impairment; |

| |

|

|

| |

· |

temporary or permanent inability to offer our products and services; and |

| |

|

|

| |

· |

rumors or public speculation about any of the above factors. |

The terms of this offering were determined

arbitrarily. The terms of this offering were determined arbitrarily by us. The offering price for the Offered Shares does not

necessarily bear any relationship to our company’s assets, book value, earnings or other established criteria of valuation. Accordingly,

the offering price of the Offered Shares should not be considered as an indication of any intrinsic value of such securities. (See “Dilution”).

Our common stock is subject to price volatility

unrelated to our operations. The market price of our common stock could fluctuate substantially due to a variety of factors, including

market perception of our ability to achieve our planned growth, quarterly operating results of other companies in the same industry, trading

volume in our common stock, changes in general conditions in the economy and the financial markets or other developments affecting our

company’s competitors or our company itself. In addition, the over-the-counter stock market is subject to extreme price and volume

fluctuations in general. This volatility has had a significant effect on the market price of securities issued by many companies for reasons

unrelated to their operating performance and could have the same effect on our common stock.

You will suffer dilution in the net tangible

book value of the Offered Shares you purchase in this offering. If you acquire any Offered Shares, you will suffer immediate dilution,

due to the lower book value per share of our common stock compared to the purchase price of the Offered Shares in this offering. (See

“Dilution”).

As an issuer of penny stock, the protection

provided by the federal securities laws relating to forward looking statements does not apply to us. Although federal securities

laws provide a safe harbor for forward-looking statements made by a public company that files reports under the federal securities laws,

this safe harbor is not available to issuers of penny stocks. As a result, we will not have the benefit of this safe harbor protection

in the event of any legal action based upon a claim that the material provided by us contained a material misstatement of fact or was

misleading in any material respect because of our failure to include any statements necessary to make the statements not misleading. Such

an action could hurt our financial condition.

DILUTION

Dilution in net tangible book value per share to

purchasers of our common stock in this offering represents the difference between the amount per share paid by purchasers of the Offered

Shares in this offering and the net tangible book value per share immediately after completion of this offering. In this offering, dilution

is attributable primarily to our negative net tangible book value per share.

If you purchase Offered Shares in this offering,

your investment will be diluted to the extent of the difference between your purchase price per Offered Share and the net tangible book

value of our common stock after this offering. Our net tangible book value as of September 30, 2023, was $1,710,343 (unaudited), or $(0.00)

per share. Net tangible book value per share is equal to total assets minus the sum of total liabilities and intangible assets divided

by the total number of shares outstanding.

The tables below illustrate the dilution to purchasers

of Company Offered Shares in this offering, on a pro forma basis, assuming 100%, 75%, 50% and 25% of the Offered Shares are sold at a

per share price of $0.02, which represents the mid-point of the price range presented herein.

| Assuming the Sale of 100% of the Company Offered Shares |

| Assumed offering price per share | |

$ | 0.02 | |

| Net tangible book value per share as of December 31, 2023 (audited) | |

$ | 0.00 | |

| Increase in net tangible book value per share after giving effect to this offering | |

$ | 0.00 | |

| Pro forma net tangible book value per share as of December 31, 2023 (audited) | |

$ | 0.00 | |

| Dilution in net tangible book value per share to purchasers of Offered Shares in this offering | |

$ | 0.02 | |

| Assuming the Sale of 75% of the Company Offered Shares |

| Assumed offering price per share | |

$ | 0.02 | |

| Net tangible book value per share as of December 31, 2023 (audited) | |

$ | 0.00 | |

| Increase in net tangible book value per share after giving effect to this offering | |

$ | 0.00 | |

| Pro forma net tangible book value per share as of December 31, 2023 (audited) | |

$ | 0.00 | |

| Dilution in net tangible book value per share to purchasers of Offered Shares in this offering | |

$ | 0.02 | |

| Assuming the Sale of 50% of the Company Offered Shares |

| Assumed offering price per share | |

$ | 0.02 | |

| Net tangible book value per share as of December 31, 2023 (audited) | |

$ | 0.00 | |

| Increase in net tangible book value per share after giving effect to this offering | |

$ | 0.00 | |

| Pro forma net tangible book value per share as of December 31, 2023 (audited) | |

$ | 0.00 | |

| Dilution in net tangible book value per share to purchasers of Offered Shares in this offering | |

$ | 0.02 | |

| Assuming the Sale of 25% of the Company Offered Shares |

| Assumed offering price per share | |

$ | 0.02 | |

| Net tangible book value per share as of December 31, 2023 (audited) | |

$ | 0.00 | |

| Increase in net tangible book value per share after giving effect to this offering | |

$ | 0.00 | |

| Pro forma net tangible book value per share as of December 31, 2023 (audited) | |

$ | 0.00 | |

| Dilution in net tangible book value per share to purchasers of Offered Shares in this offering | |

$ | 0.02 | |

USE OF PROCEEDS

The table below sets forth the estimated proceeds

we would derive from this offering, assuming the sale of 25%, 50%, 75% and 100% of the Offered Shares and assuming the payment of no sales

commissions or finder’s fees. There is, of course, no guaranty that we will be successful in selling any of the Company Offered

Shares in this offering.

| | |

Assume

Percentage of Company Offered Shares Sold in this Offering | |

| | |

25% | | |

50% | | |

75% | | |

100% | |

| Shares Sold | |

$ | 100,000,000 | | |

| 200,000,000 | | |

| 300,000,000 | | |

| 400,000,000 | |

| Gross Proceeds | |

$ | 1,000,000

to 3,000,000 | | |

| 2,000,000

to 6,000,000 | | |

| 3,000,000

to 9,000,000 | | |

| 4,000,000

to 12,000,000 | |

| Offering Expense | |

$ | 32,500 | | |

| 32,500 | | |

| 32,500 | | |

| 32,500 | |

| Net Proceeds | |

$ | 967,500

to 2,967,500 | | |

| 1,967,500

to 5,967,500 | | |

| 2,967,500

to 8,967,500 | | |

| 3,967,500

to 11,967,500 | |

The table below sets forth

the manner in which we intend to apply the net proceeds derived by us in this offering, assuming the sale of 10%, 25%, 50%, 75% and 100%

of the Offered Shares at a per share price of $0.02, which represents the mid-point of the price range presented herein. All amounts

set forth below are estimates.

| | |

| 25% | | |

| 50% | | |

| 75% | | |

| 100% | |

| Sales and Marketing | |

$ | 196,750 | | |

$ | 396,750 | | |

$ | 596,750 | | |

$ | 796,750 | |

| Dental Lab/Lab Equipment | |

| 787,000 | | |

| 1,587,000 | | |

| 2,387,000 | | |

| 3,187,000 | |

| Lab Business Acquisition 1 | |

| 787,000 | | |

| 1,587,000 | | |

| 2,387,000 | | |

| 3,187,000 | |

| Working Capital | |

| 98,375 | | |

| 198,375 | | |

| 298,375 | | |

| 398,375 | |

| G&A Expense | |

| 98,375 | | |

| 198,375 | | |

| 298,375 | | |

| 398,375 | |

| TOTAL | |

$ | 1,967,500 | | |

$ | 3,967,500 | | |

$ | 5,967,500 | | |

$ | 7,967,500 | |

|

(1) |

Currently, we have not entered into any agreement, oral or written,

or other understanding with respect to the acquisition of any dental lab business. There is no assurance that we will be able to acquire

any other dental lab businesses. To the extent we are unable to acquire another dental lab business, proceeds allocated for such use

would be applied to sales and marketing expenses and to working capital and to expanding the existing business. |

| |

|

We

reserve the right to change the foregoing use of proceeds, should our management believe

it to be in the best interest of our company. The allocations of the proceeds of this offering

presented above constitute the current estimates of our management and are based on our current

plans, assumptions made with respect to the industry in which we operate, general economic

conditions and our future revenue and expenditure estimates. The Company, by the determination

of the Board of Directors, in its sole discretion, may issue the Securities under this Offering

for cash, services, in satisfaction of outstanding debt obligations, and/or other consideration

without notice to subscriber; provided, however, that any Offered Shares issued in

this manner shall be issued at the Offering Price. In the event any Securities are issued

for non-cash consideration, the Company will not recognize net cash proceeds to allocate

towards the uses set forth above.

Investors are cautioned that expenditures may vary

substantially from the estimates presented above. Investors must rely on the judgment of our management, who will have broad discretion

regarding the application of the proceeds of this offering. The amounts and timing of our actual expenditures will depend upon numerous

factors, including market conditions, cash generated by our operations (if any), business developments and the rate of our growth. We

may find it necessary or advisable to use portions of the proceeds of this offering for other purposes.

In the event we do not obtain the entire offering

amount hereunder, we may attempt to obtain additional funds through private offerings of our securities or by borrowing funds. Currently,

we do not have any committed sources of financing.

PLAN OF DISTRIBUTION

In General

Our

company is offering a maximum of 400,000,000 Company Offered Shares on a best-efforts basis,

at a fixed price of $0.01-0.03 per Company Offered Share; any funds derived from this offering

will be immediately available to us for our use. There will be no refunds. This offering

will terminate at the earliest of (a) the date on which the maximum offering has been sold,

(b) the date which is one year from this offering being qualified by the SEC or (c) the date

on which this offering is earlier terminated by us, in our sole discretion, subject to the

limitations set forth in Rule 251(d)(3)(i)(F) of Regulation A.

The

Company, by the determination of the Board of Directors, in its sole discretion, may issue the Securities under this Offering for cash,

services, in satisfaction of outstanding debt obligations, and/or other consideration without notice to subscriber; provided, however,

that any Offered Shares issued in this manner shall be issued at the Offering Price. In the event any Securities are issued for non-cash

consideration, the Company will not recognize net cash proceeds to allocate towards the uses set forth in the Use of Proceeds.

There is no minimum number of Company Offered Shares

that we are required to sell in this offering. All funds derived by us from this offering will be immediately available for use by us,

in accordance with the uses set forth in the Use of Proceeds section of this Offering Circular. No funds will be placed in an escrow account

during the offering period and no funds will be returned, once an investor’s subscription agreement has been accepted by us.

We intend to sell the Company Offered Shares in

this offering through the efforts of our Chief Executive Officer, James D. Brooks. Mr. Brooks will not receive any compensation for offering

or selling the Company Offered Shares. We believe that Mr. Brooks is exempt from registration as a broker-dealer under the provisions

of Rule 3a4-1 promulgated under the Securities Exchange Act of 1934 (the Exchange Act). In particular, Mr. Brooks:

| |

· |

is not subject to a statutory disqualification, as that term is defined in Section 3(a)(39) of the Securities Act; and |

| |

|

|

| |

· |

is not to be compensated in connection with his participation by the payment of commissions or other remuneration based either directly or indirectly on transactions in securities; and |

| |

|

|

| |

· |

is not an associated person of a broker or dealer; and |

| |

|

|

| |

· |

meets the conditions of the following: |

| |

· |

primarily performs, and will perform at the end of this offering, substantial duties for us or on our behalf otherwise than in connection with transactions in securities; and |

| |

|

|

| |

· |

was not a broker or dealer, or an associated person of a broker or dealer, within the preceding 12 months; and |

| |

|

|

| |

· |

did not participate in selling an offering of securities for any issuer more than once every 12 months other than in reliance on paragraphs (a)(4)(i) or (iii) of Rule 3a4-1 under the Exchange Act. |

As of the date of this Offering Circular, we have

not entered into any agreements with selling agents for the sale of the Company Offered Shares. However, we reserve the right to engage

FINRA-member broker-dealers. In the event we engage FINRA-member broker-dealers, we expect to pay sales commissions of up to 8% of the

gross offering proceeds from their sales of the Company Offered Shares. In connection with our appointment of a selling broker-dealer,

we intend to enter into a standard selling agent agreement with the broker-dealer pursuant to which the broker-dealer would act as our

non-exclusive sales agent in consideration of our payment of commissions of up to 8% on the sale of Company Offered Shares effected by

the broker-dealer.

Procedures for Subscribing

If you are interested in subscribing for Company

Offered Shares in this offering, please submit a request for information by e-mail to the company at: info@sdl.care; all relevant information

will be delivered to you by return e-mail.

Thereafter, should you decide to subscribe for

Company Offered Shares, you are required to follow the procedures described therein, which are:

| |

· |

Electronically execute and deliver to us a subscription agreement; and |

| |

|

|

| |

· |

Deliver funds directly by check or by wire or electronic funds transfer via ACH to our specified bank account. |

Acceptance of Subscriptions. Upon

our acceptance of a subscription agreement, we will countersign the subscription agreement and issue the Company Offered Shares subscribed.

Once you submit the subscription agreement and it is accepted, you may not revoke or change your subscription or request your subscription

funds. All accepted subscription agreements are irrevocable.

This Offering Circular will be furnished to prospective

investors upon their request via electronic PDF format and will be available for viewing and download 24 hours per day, 7 days per week

on our company’s page on the SEC’s website: www.sec.gov.

An investor will become a stockholder of our company

and the Company Offered Shares will be issued as of the date of settlement. Settlement will not occur until an investor’s funds

have cleared and we accept the investor as a stockholder.

By executing the subscription agreement and paying

the total purchase price for the Company Offered Shares subscribed, each investor agrees to accept the terms of the subscription agreement

and attests that the investor meets certain minimum financial standards. (See “State Qualification and Investor Suitability Standards”

below).

An approved trustee must process and forward to

us subscriptions made through IRAs, Keogh plans and 401(k) plans. In the case of investments through IRAs, Keogh plans and 401(k) plans,

we will send the confirmation and notice of our acceptance to the trustee.

Minimum Purchase Requirements

You must initially purchase at least $5,000 of

the Company Offered Shares in this offering. If you have satisfied the minimum purchase requirement, any additional purchase must be in

an amount of at least $1,000.

State Law Exemption and Offerings to Qualified Purchasers

State Law Exemption. This Offering

Circular does not constitute an offer to sell or the solicitation of an offer to purchase any Offered Shares in any jurisdiction in which,

or to any person to whom, it would be unlawful to do so. An investment in the Offered Shares involves substantial risks and possible loss

by investors of their entire investments. (See “Risk Factors”).

The Offered Shares have not been qualified under

the securities laws of any state or jurisdiction. Currently, we plan to sell the Company Offered Shares in as many states as this offering

is able to be qualified. In the case of each state in which we sell the Company Offered Shares, we will qualify the Company Offered Shares

for sale with the applicable state securities regulatory body or we will sell the Company Offered Shares pursuant to an exemption from