Form 8-K - Current report

October 17 2023 - 4:30PM

Edgar (US Regulatory)

0000895665

false

0000895665

2023-10-17

2023-10-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event Reported): October 17, 2023 (October 12, 2023)

Clearday,

Inc.

(Exact

Name of Registrant as Specified in Charter)

| Delaware |

|

0-21074 |

|

77-0158076 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

Number) |

8800

Village Drive, Suite 106, San Antonio, TX 78217

(Address

of Principal Executive Offices) (Zip Code)

(210)

451-0839

(Registrant’s

telephone number, including area code)

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 |

|

CLRD |

|

OTCQX |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

4.02 Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review.

On

October 12, 2023, the Board of Directors (the “Board”) of Clearday, Inc. (the “Company”) concluded that the Company’s

previously issued financial statements contained within its Quarterly Report on Form 10-Q for the quarter ended March 31, 2023 should

no longer be relied upon due to errors in such financial statements. Therefore, restatements of such prior financial statements are required.

Accordingly, the Company intends to restate the aforementioned financial statements by amending its Quarterly Report on Form 10-Q for

the quarter ended March 31, 2023 as soon as reasonably practicable.

The

errors in such financial statements were discovered during the course of management’s review of the Company’s financial statements

and agreements, including the preparation of its financial statements to be contained within its Quarterly Report on Form 10-Q for the

quarter ended March 31, 2023. The errors were unintentional and the Company has implemented new measures to ensure that this type of

error does not occur again. There is no compensation payable by the Company to any of its executives that is subject to claw-back as

a consequence of such restatement.

The

estimated material impact of these restatements on the Company’s unaudited interim condensed consolidated financial statements

for the three months ended March 31, 2023 is expected to be the following:

| 1. | Real

estate property and equipment, net increase by approximately $93,800 |

| 2. | Total

current liabilities increased by a net amount of $447,470, primarily due to

the increase of accrued interest of approximately $423,329 related to an obligation that

is in default; an increase in accrued expenses of approximately $23,782 and an increase in

due to related parties of $30,359. Such amounts also increased total liabilities by $447,470. |

| 3. | Total

deficit increased by a net amount of $383,686. |

| 4. | Total

operating expenses increased by a net amount of $28,611, which increased the net

amount of the operating loss by the same amount, primarily due to decreased consulting

fees and an increase in the amount of employment related taxes such as required withholdings

for federal income tax and employee and employer contributions for FICA (Social Security

and Medicare) taxes, and federal and state unemployment tax. |

| 5. | Total

other (income)/expenses increased by a net amount of $567,087, primarily due to

increased interest expense of $165,800 and the increase of other expenses by $487,227,

offset by a decrease on the loss on the sale of fixed assets by $85,940. |

| 6. | Net

loss from continuing operations increased by a net amount of $595,698. |

| 7. | The

non-controlling interest in subsidiaries increased by 273,128 primarily by the correction

(increase) of the accrual for preferred stock in such subsidiaries by such amount. |

| 8. | Total

deficit increased by a net amount of $353,327. |

Additionally, the restated financial

statements will delete an erroneous reference to an off-balance sheet arrangement.

The

Audit Committee and Company management have discussed the matters disclosed in this Current Report on Form 8-K with Turner, Stone &

Company L.L.P. (“Turner Stone”), the Company’s independent registered public accounting firm. The Company is assessing

the impact of these misstatements to the Company’s internal controls over financial reporting.

Turner

Stone has furnished a letter to the Securities and Exchange Commission pursuant to Item 4.02(c), which is attached as Exhibit 7.1 to

this Current Report on Form 8-K, stating that Turner, Stone & Company L.L.P., (“Turner Stone”), the Company’s independent

registered public accounting firm. agrees with the disclosures made in this Current Report on Form 8-K in as far as they pertain to Turner,

Stone & Company L.L.P., (“Turner Stone”), the Company’s independent registered public accounting firm.

The

information in this Item 4.02 is furnished solely pursuant to Item 4.02. Consequently, such information is not deemed “filed”

for the purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liabilities of that section. Moreover,

the information in this Item 4.02 shall not be deemed to be incorporated by reference into any filings of the Company under

the Securities Act of 1933.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

*

Certain schedules and exhibits have been omitted pursuant to Item 601(b)(2) of Regulation S-K. A copy of any omitted schedule and/or

exhibit will be furnished to the SEC upon request.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

CLEARDAY,

INC. |

| |

|

|

| |

By: |

/s/

James Walesa |

| |

Name:

|

James

Walesa |

| |

Title: |

Chief

Executive Officer |

| |

|

|

| Dated

October 17, 2023 |

|

|

Exhibit

7.1

Your

Vision Our Focus

October

17, 2023

Securities

and Exchange Commission

450

5th Street N.W.

Washington,

D.C. 20549

RE:

Current Report on Form 8-K filed by Clearday, Inc. on October 17, 2023

We

have been furnished with a copy of the response to Item 4.02 of Form 8-K for the event that occurred on October 17, 2023, to be filed

by Clearday, Inc. We agree with the statements made in response to that Item insofar as they relate to our Firm.

Very

truly yours

/s/

Turner, Stone & Company, L.L.P.

| Turner,

Stone & Company, L.L.P. Accountants and Consultants |

|

| 12700

Park Central Drive, Suite 1400 |

|

| Dallas,

Texas 75251 |

|

| Telephone:

972-239-1660 ∕ |

|

| Facsimile:

972-239-1665 |

|

| Toll

Free: 877-853-4195 |

|

| Web

site: turnerstone.com |

INTERNATIONAL

ASSOCIATION OF ACCOUNTANTS AND AUDITORS |

v3.23.3

Cover

|

Oct. 17, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 17, 2023

|

| Entity File Number |

0-21074

|

| Entity Registrant Name |

Clearday,

Inc.

|

| Entity Central Index Key |

0000895665

|

| Entity Tax Identification Number |

77-0158076

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

8800

Village Drive

|

| Entity Address, Address Line Two |

Suite 106

|

| Entity Address, City or Town |

San Antonio

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78217

|

| City Area Code |

(210)

|

| Local Phone Number |

451-0839

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.001

|

| Trading Symbol |

CLRD

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

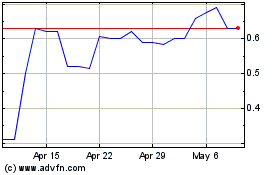

Clearday (CE) (USOTC:CLRD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Clearday (CE) (USOTC:CLRD)

Historical Stock Chart

From Nov 2023 to Nov 2024