CAVU Resources, Inc.: Oil Production, Operational and Corporate

Developments

TULSA, OK--(Marketwired - Mar 20, 2014) - CAVU Resources. Inc.

(OTC Pink: CAVR) (PINKSHEETS: CAVR) (CAVU), which trades as (OTC

Pink: CAVR) issued an update regarding key production, operational

and corporate developments.

CAVU Resources Two, LP,

Chisholm Lease - After weather related damage that caused

several technical issues, equipment failures and the lease to be

out of production, the company now has three wells back on line

with over 3,000 barrels of oil produced in the four months prior to

the shutdown. We have been replacing all damaged production

equipment and installing new state of the art monitoring and

security equipment with final repairs being completed this

week. While it is still too early to determine the stable flow

levels of the wells, initial flows have been relatively strong and

as production progresses we will provide shareholder updates. The

Chisholm B-3 turned out to be non productive and was

plugged.

Brown Lease, Nowata Oklahoma -

CAVU owns 50% of this multi-well project in the Bartlesville Zone

in northeast Oklahoma. We have spent the last five months

reworking and developing the existing 12 well lease; the project is

being developed in three phases. Phase I called for the rework of 6

gas and injection wells, and five of the wells are

completed. Four of these wells have been reworked and are

producing gas and one is a disposal well. Phase II calls for

the planned drilling program of 18 new oil wells with Phase III

converting 6 of the existing wells into injection wells with plans

to utilize an Enhanced Oil Recovery (EOR) technology

protocol.

The first well of Phase II has

been drilled, however harsh weather conditions throughout the

Midwest forced a temporary shutdown in the Company's drilling

operations. The well has been cemented, and production casing

run, logged and perforated and a 450-barrel Frac was completed on

Friday. The initial results showed excellent porosity and with the

installation of the production equipment starting next week we will

see the initial oil production results over the next 30 days. With

the break in the weather, the project is back on-schedule with 4

Phase I wells currently producing gas at 30 to 40 MCF per day, and

18 additional Phase II oil wells forecasted to be operational in

the coming months. Current production follows a successful

revitalization program that includes access roads, tank battery and

well sites; repair or replacement of electrical systems;

installation of a triplex injection pump for proper wastewater

disposal; and completion of a Manual Integrity Test (MIT) required

for state inspection approval.

With our infrastructure now in

place and our Phase I wells producing, we move into Phase II and

III, where we will use proven injection methods to increase gas

production, and pressure up the oil zone to support the 18

additional wells planned.

The Bartlesville zone is a

sandstone layer that sourced up to 53,000 barrels of oil a day area

wide during its peak production in the late 1900s. While

concentrated production efforts by major oil companies has depleted

some of the oil and much of the gas drive, geological data supports

that much of the oil is still in place but will not move to the

producing well bores without some type of energy input. According

to Kim Drew, Consulting Geologist with CAVU Energy Services, Inc.,

"Recent core data of these old Bartlesville fields indicate that

only 10 to 30 percent of the original oil in place has been

produced by the initial production and years of slow pumping. The

shallow depth of the sand and lack of any drive mechanism has

caused from 70 to 90 percent of the oil to remain in place.

"The key to success in this area of Oklahoma is optimizing

production from the many hydrocarbon-bearing zones, which includes

the coal seams. With most wells encountering about a dozen zones

that have known production in this area, the drilling risk is

extremely low. Production rates in this area range from 2 to 5

barrels of oil per day (BOPD) per well. Initial flow rates can

be higher for a short duration before settling into this range with

the quality of crude being excellent (33° to 42° API oil). Natural

gas is the fallback position in this area due to shallow Excello

shale that blankets the area as do several methane gas bearing coal

seams. As such, natural gas is almost always produced in a well in

this area with production rates ranging from 5,000 to 200,000 cubic

feet of gas per day (5 to 200 MCFD).

"Since most of this gas is produced from coal seams, initial

production rates are actually lower and increase over the first few

months because coal seams must "dewater," where water in place in

the coal seam is brought to the surface freeing up the gas to begin

coming to surface through the well bore. As a result, a typical

scenario would be for a well to produce from a coal seam and after

dewatering for about a month to start giving up its natural gas.

The flow rate of between 950 to 1050 BTU gas will usually start

around 5 MCFD and increases as the water comes off with most wells

settling in around 30-50 MCFD. In the project area, there is an

estimated 98% completion rate and 100% discovery of gas, making it

one of the lowest risk exploration areas in the country."

Located in Nowata County, Oklahoma, this project is situated on

the Northeastern edge of the Northeast Oklahoma Shelf, which has

proven to be prolific in coal bed methane gas since it was

developed beginning in the early 1990s. The properties are

surrounded by leases operated by some of the major players in the

field such as Newfield Exploration, Mid-Continent, Inc., Energy

Quest Resources and Endeavor Energy.

FILO SWDW #1, LP

- We completed the initial work over of the Kansas lease, but the

existing well proved to be non productive and was plugged. We

currently are exploring better locations to which to move our

processing equipment. We have recently entered into negotiations to

acquire an existing commercial well that is in the newly active

Scoop Play in South Central Oklahoma. CAVU has invested $1

million in equipment and is working with private investors to

complete the funding required for this acquisition.

St. Louis Lease

- We recently surveyed the existing 19 well site and put together a

plan for reworking and developing the lease. This lease is in

the prolific Hunton oil-bearing zone and wells in the surrounding

leases have averaged as much as 60 barrels a day. CAVU is in

the process of forming a partnership to fund the development of

this lease.

Hogshooter Lease

- The Company sold this lease back to the original owners, as it

was viewed as a secondary, less productive property. This

transaction had a positive balance sheet effect of reducing debt

and settling any outstanding issues.

Envirotek/Energy

Revenue America, Inc. Note - As of December 31, 2013 due to

non-payment we have decided to write down our current note due from

the Energy Revenue America, Inc. to zero as it has been deemed

unrecoverable. We will continue to pursue all actions to monetize

our outstanding note either thru a discounted sale or exploring

partnerships to assist in recovering the assets; recapitalizing and

expanding the existing pipeline operations in Northeast

Oklahoma.

Capital Structure

Simplification - The Company has taken steps to simplify its

capital structure and reduce debt. Holders of approximately

$600,000 in notes have converted into limited partnership interests

in CAVU Resources Two, LP (Chisholm Lease). Secondly, the

Company has begun a staged process of eliminating its Preferred

Series B shares. The majority of the holders have exchanged

their Series B Preferred shares and all A and B shareholders have

canceled the $10.00 liquidation feature. The Company and Principals

intend to eliminate the remaining Series B Preferred shares in the

near future. The company plans to renegotiate its existing long and

short-term debt once its wells are producing positive cash flow to

eliminate the balance of the Company debt.

Billy Robinson, CAVU Chairman and President, stated, "We are

elated to be back in production after weather and technical issues

had us shut down since Thanksgiving on both the CAVU Two ("Chisholm

Lease") and the Brown lease with the final work being completed we

will have both of these in production. I believe we repaired

and replaced all affected equipment and our mechanical and advanced

monitoring system issues are behind us. We now have effective

and productive projects that will contribute to the further

development of CAVU."

Louis Silver, CAVU CEO, summarized, "Our management team has

been working diligently in three main areas -- oil and gas

operations, capital raising, and strategic focus. Great

progress has been made at CAVU Two and Brown lease, due to the

relentless hard work of Billy Robinson, who endured incredibly

difficult operating conditions and succeeded. We look forward

to Chisholm providing significant ongoing revenue

production. We are excited at the prospects of the new Brown

Lease, St. Louis Lease and our future Salt Water Disposal project.

Less important assets have been divested in order to focus our

human resources on more productive projects. We believe that

simplification of the capital structure will inure to the long-term

benefit of CAVU and its shareholders. Finally, we are

constantly involved in the process of securing capital funding for

our projects under the best possible terms and in a manner that

minimizes shareholder dilution. Rest assured that your

management team's goals are consistent with its shareholders."

About CAVU Resources, Inc. CAVU was formed with the goal of

becoming a recognized regional player in the independent oil and

natural gas industry by growing the company's oil and natural gas

reserves. CAVU is a natural resource company engaged in the

acquisition, exploration and development of oil and natural gas

properties. The Company operates in the upstream segment of the oil

and gas industry with planned activities including the drilling,

completion and operation of oil and gas wells in Oklahoma, Kansas

and Louisiana. CAVU's minority owned operating subsidiary, CAVU

Energy Services, Inc., licensed Oil and Gas Operating Company

manages the company's properties in Oklahoma with plans to operate

targeted leases in Kansas, Texas and Louisiana. More

information is available at the company's website at

http://www.cavu-resources.com.

Cautionary Note: This report contains forward-looking

statements, particularly those regarding cash flow, capital

expenditures and investment plans. Resource estimates, unless

specifically noted, are considered speculative. By their nature,

forward-looking statements involve risk and uncertainties because

they relate to events and depend on factors that will or may occur

in the future. Actual results may vary depending upon exploration

activities, industry production, commodity demand and pricing,

currency exchange rates, and, but not limited to, general economic

factors. Cautionary Note to U.S. investors: The U.S. Securities and

Exchange Commission specifically prohibits the use of certain

terms, such as "reserves" unless such figures are based upon actual

production or formation tests and can be shown to be economically

and legally producible under existing economic and operating

conditions.

CONTACT: William Robinson, President 302 East 10th Street Tulsa,

OK 74120 Ph: 855-766-4695 ext 700

Email: cavu76@icloud.com Louis E. Silver, CEO 302 East 10th Street

Tulsa, OK 74120 Ph: 855-766-4695 ext 701

info@cavu-resources.com

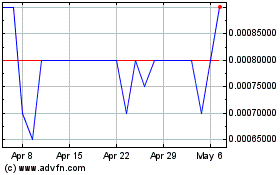

CAVU Resources (PK) (USOTC:CAVR)

Historical Stock Chart

From Dec 2024 to Jan 2025

CAVU Resources (PK) (USOTC:CAVR)

Historical Stock Chart

From Jan 2024 to Jan 2025