AB InBev Nears Deal for Sale of SABMiller's Chinese Beer Business

March 01 2016 - 4:10PM

Dow Jones News

Anheuser-Busch InBev NV is nearing a deal for the sale of

SABMIller PLC's Chinese beer business to China Resources Beer

Holdings Co., as the Belgian brewer seeks Chinese regulatory

approval for its pending acquisition of its biggest rival.

Under terms being discussed, China's government-controlled

brewer would acquire SABMiller's 49% interest in the joint venture

known as CR Snow, which makes the world's No. 1-selling beer by

volume, according to people familiar with talks. Financial terms

are still being negotiated, the people said. China Resources and

SABMiller have been partners since 1994.

AB InBev had been expected to arrange for the sale of

SABMiller's stake in Snow since announcing last year its roughly

$108 billion takeover of SABMiller, but people familiar with the

company's plan in January said it would try to keep the stake and

maintain operational control over the company. Ultimately, it

decided to sell rather than keep Snow because holding on to the

business could have slowed the regulatory approval process, said a

person familiar with the company's strategy.

The approach is similar to the tactic AB InBev pursued in the

U.S. and Europe. In the U.S., AB InBev negotiated a sale of

SABMiller's interest in MillerCoors LLC to Molson Coors Brewing Co.

In Europe, it is in talks to sell Asahi Group Holdings Ltd. rights

to SABMiller's Peroni and Grolsch brands.

China Resources had the first option to buy SABMiller's interest

in CR Snow. It is unclear if the Hong Kong-listed company would

seek another joint venture partner. The Chinese brewer last year

decided to focus on beer by exiting its retail and food

businesses.

Taking over Snow would make China Resources the largest brewer

in China with a 30% market share, according to industry tracker

Seema International Ltd. AB InBev has an estimated 18% market share

in China, while Tsingtao Brewery has 22%, Beijing Yanjing Brewery

Co. has 13% and Carlsberg A/S has 6%.

Bloomberg first reported the pending sale.

Snow's position as the world's biggest beer hasn't added up to

big profits for China Resources, which said its beer profits

declined 19% to $97.9 million in 2014 from $121.3 million in

2013.

China is one of the world's most challenging beer markets

because beer prices are so depressed. Earnings before interest and

taxes per hectoliter in China are $2, a fraction of the global

average of $19 per hectoliter, according to Seema

International.

Industry beer volumes declined by 6% last year in China. The

decline marks a reversal from prior years when per capita

consumption in the country rose to 45 liters from 7 liters over a

25-year span, according to Deutsche Bank.

Without Snow, AB InBev's China business would continue to focus

on its Budweiser and Harbin brands. Volumes of higher-priced beers

like those brands fared better last year than lower-priced beers.

AB InBev said its beer volumes in China increased 0.4% in 2015, and

revenue rose about 8% to $4.2 billion from $3.9 billion in

2014.

During a call with analysts last week, AB InBev Chief Executive

Carlos Brito said the company expects the beer industry in China to

remain under pressure this year as the economy pressures

blue-collar consumers. "We are very happy to see that our business

is more skewed towards those segments that are growing," Mr. Brito

said.

Write to Tripp Mickle at Tripp.Mickle@wsj.com

(END) Dow Jones Newswires

March 01, 2016 15:55 ET (20:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

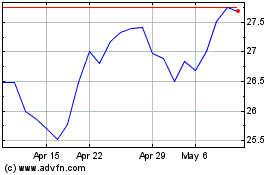

Carlsburg AS (PK) (USOTC:CABGY)

Historical Stock Chart

From Jun 2024 to Jul 2024

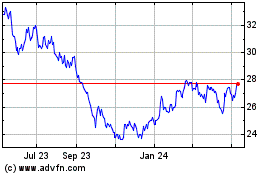

Carlsburg AS (PK) (USOTC:CABGY)

Historical Stock Chart

From Jul 2023 to Jul 2024