false

0000814926

0000814926

2025-01-20

2025-01-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report: January 23, 2025

(Earliest Event Date requiring this Report: January

20, 2025)

CAPSTONE

COMPANIES, INC.

(EXACT

NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

| Florida |

0-28331 |

84-1047159 |

| (State

of Incorporation or Organization) |

(Commission

File Number) |

(I.R.S.

Employer Identification No.) |

Number

144-V, 10 Fairway Drive Suite

100

Deerfield

Beach, Florida 33441

(Address of principal executive offices)

(954) 570-8889,

ext. 313

(Registrant’s telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instructions A.2. below):

| ☐ |

Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter). Emerging growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities

registered pursuant to Section 12(b) of the Act: None

| Title

of Class of Securities. |

Trading

Symbol(s). |

Name

of exchange on which registered |

| N/A |

N/A |

N/A |

The

Registrant’s Common Stock is quoted on the OTCQB Venture Market of the OTC Markets Group, Inc. under the trading symbol “CAPC.”

Item 1.01 Entry into a Material Definitive Agreement.

On January 22, 2025, Capstone Companies, Inc. (“Company”) entered into an engagement agreement (“Engagement Agreement”)

with Eschenburg Perez, CPA LLC (“EPEC”) for continued provision of outsourced chief financial officer and related accounting

services, which services are primarily provided by EPEC principal Dana Eschenburg Perez as interim/fractional chief financial officer.

Engagement Agreement provides for an hourly bill rate of $275 for following services:

-Assist with year-end audit of December 31, 2024,

subsequent Form 10Q’s for each quarter, signing and

filing as the Company’s acting chief financial/accounting

officer.

- Liaison with the Company and public auditor team

for requested schedules, supporting documentation, etc.

- Review and approve supporting audit schedules and

internal control assessments and updating

as necessary.

- Prepare technical memos regarding complex or unusual

accounting transactions, as necessary.

- Prepare, review and approve proposed journal entries

as necessary.

- Perform ad-hoc accounting duties as requested by

Chief Executive Officer.

- Oversee and review work prepared by any outsourced

Controller.

The Engagement Agreement continues the services provided

to the Company by EPEC and Ms. Perez since February 6, 2022. A copy of the Engagement Agreement is attached as Exhibit 10.2 to this Current

Report of Form 8-K (“Form 8-K”) and the above summary of the Engagement Agreement is qualified in its entirety by reference

to the Engagement Agreement filed as Exhibit 10.2 to this Form 8-K.

Item 5.02 Departure of Directors or Certain Officers;

Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Appointment of a Director. On January 20, 2025,

Brian Rosen was appointed as a non-employee director of Capstone Companies, Inc. (the “Company”). His appointment fills an

existing vacancy on the Company’s Board of Directors. The Company and Mr. Rosen signed an Offer Letter, dated January 10, 2025,

(”Offer Letter”) for his appointment as a director, which appointment was effective upon ratification by Company’s Board

of Directors Offer Letter on January 20, 2025. The Offer Letter is filed as Exhibit 10.1 to this Current Report of Form 8-K (“Form

8-K”).

Mr. Rosen served as Senior Vice President of Global

Government Affairs, Market Access & Advocacy for Novavax, Inc. (NASDAQ: NVAX), a publicly held biotechnology and vaccine company in

Gaithersburg, Maryland, from 2015 to 2023. He had responsibility for leading commercial strategy efforts instrumental to ensuring patient

access to Novavax vaccines. During the COVID-19 pandemic, he served as the point person at Novavax to lead negotiations with all relevant

domestic and international government agencies and non-government organizations. He led negotiations and secured a $1.6 billion

funding agreement with Operation Warp Speed, $388 million in funding from the Coalition for Epidemic Preparedness Innovations and a $60

million agreement with U.S. Department of Defense. From 2013 to 2015, he served in public policy, regulatory affairs and legislative

capacities with the Leukemia & Lymphoma Society, Washington, D.C. Mr. Rosen was Senior Director, Government Affairs, Advocacy and

Policy (2005 - 2011) and Director, Government Affairs (2002 - 2005) at MedImmune, a wholly owned subsidiary of AstraZenca plc (NASDAQ:

AZ), a multinational public pharmaceutical company.

Mr. Rosen has Juris Doctor from Hofstra University

School of Law (1994) and a Bachelor of Arts, History and Psychology, Tufts University, Medford, Massachusetts (1991).

Director Appointee’s Interests. There

are no family relationships between Mr. Rosen and the Company’s existing directors and officers. Mr. Rosen is an investor in

a social club/pickle ball business owned by Alexander Jacobs, the Company’s current Chief Executive Officer.

Director Compensation. The compensation of

Mr. Rosen as a director will be incentive stock-based compensation to be determined by the Compensation and Nomination Committee of the

Company’s Board of Directors in early 2025.

Outsourced Chief Financial Officer Services. As reported in Item 1.01 above,

the Company has entered into the Engagement Agreement to continue the services of EPEC and Dana Perez for chief financial/accounting officer

services.

Item 7.01 Regulation FD Disclosure.

On January 23, 2025, the Company issued a press release

announcing the appointment of Brian Rosen as a director. A copy of the press release is attached as Exhibit 99.1 to this Form 8-K.

As provided in General Instruction B.2 to Form 8-K,

the information furnished in this Item 7.01 and in Exhibit 99.1 to this Current Report on Form 8-K shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to

the liabilities of that section, and such information shall not be deemed incorporated by reference in any filing under the Securities

Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financials and Exhibits.

(d) Exhibits.

| | Exhibit Number | Exhibit

Description |

| 99.1 | Press Release, dated January 23, 2025, issued by Capstone Companies, Inc. announcing appointment of

Brian Rosen as a non-employee director |

| | 10.1 | Offer Letter, dated January 10,

2025, by Capstone Companies, Inc. and Brian Rosen |

| | 10.2 | Engagement agreement between Capstone Companies, Inc. and Eschenburg Perez CPA LLC, dated January 22, 2025 |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

CAPSTONE

COMPANIES, INC., A FLORIDA CORPORATION

By: /s/ Stewart Wallach

Stewart Wallach, Chair of Board of Directors

Dated: January 23, 2025

EXHIBIT INDEX

| Exhibit

Number | Exhibit

Description |

| 99.1 | Press Release, dated January 23, 2025, issued by Capstone Companies, Inc. announcing appointment of

Brian Rosen as a non-employee director |

| | 10.1 | Offer Letter, dated January 10,

2025, by Capstone Companies, Inc. and Brian Rosen - CERTAIN INFORMATION [INDICATED BY BRACKETS] HAS BEEN OMITTED DUE TO

ITS CONFIDENTIAL NATURE AND BECAUSE IT IS CONSIDERED "NOT MATERIAL" |

| | 10.2 | Engagement agreement between Capstone Companies, Inc. and Eschenburg Perez CPA LLC, dated January 22, 2025 |

Exhibit 99.1

FOR IMMEDIATE RELEASE

January 23, 2025

BRIAN ROSEN, COMMERCIAL

STRATEGY SENIOR EXECUTIVE, APPOINTED AS DIRECTOR OF CAPSTONE COMPANIES, INC.

Deerfield Beach,

FL (Business Wire) – Capstone Companies, Inc. (OTCQB: CAPC) announced today the appointment of Brian Rosen as a non-employee director,

effective January 20, 2025.

Mr. Rosen has extensive

experience in marketing, business development, contract negotiation and government relations as well as experience as a member of two

public companies’ management. He served as Senior Vice President, Global Market Access, Public Policy & Alliances (2021 –

2023), Senior Vice President, Commercial Strategy (2018 - 2021) and Vice President, Market Access, Policy, & Government Affairs (2015

- 2017) with Novavax, Inc. (NASDAQ: NVAX). Before Novavax, Inc., Mr. Rosen served as Chief Policy, Advocacy & Patient Services Officer

(2014 - 2015), Senior Vice President, Public Policy (2013 - 2014) and Vice President, Legislative and Regulatory Affairs (2012 - 2013)

for the Leukemia & Lymphoma Society, Washington, D.C. He also has a J.D. degree from Hofstra University School of Law.

“Brian is skilled

at pursuing new business opportunities and developing resulting revenue streams and in negotiating contracts. He has a record of accomplishment

in the pursuit of revenue generating opportunities. I believe his skills, coupled with government relations and public company experience,

will prove valuable to Capstone Companies’ efforts to establish a new business line and pursue a growth strategy for year-round

social, fitness and health programs and facilities,” said Stewart Wallach, Chair of the Company’s Board of Directors.

About Capstone

Companies, Inc. Capstone Companies, Inc. is an SEC reporting company with its common stock quoted on OTC QB market. Formerly engaged

in producing LED and Smart Mirror consumer products, Company ended its consumer product operations due to declining sales and has been

seeking to establish a new business line and revenue generating operations through internal development, merger, acquisition or a combination

of those actions. The Company currently has no revenue generating operations. The appointment of a new CEO and appointment of directors

is part of the Company’s efforts to establish revenue generating operations by bringing in new management members with experience

in industries other than the Company’s former industry as well as a proven ability to build, arrange funding or assist in creating

sustainable, new business lines.

FORWARD LOOKING

STATEMENTS. Except for statements of historical fact in this press release, the information contained above contains forward-looking

statements, which statements are characterized by words like “should,” “may,” “intend,” “expect,”

“hope,” “believe,” “anticipate” and similar words. Forward looking statements are not guarantees

of future performance and undue reliance should not be placed on them. Forward-looking statements necessarily involve known and unknown

risks and uncertainties, which may cause actual performance and financial results in future periods to differ materially from any statements

about future performance or results expressed or implied by such forward-looking statements. Capstone Companies, Inc. (“Company”)

is a public shell company without revenue generating revenues and relies on working capital funding from third parties to sustain its

corporate existence and fund the compliance requirements as an SEC reporting company with its stock quoted on the OTC QB Venture Market.

The Company is also a “penny stock” company with limited public market liquidity and no primary market makers. As such, Company

may be unable to develop a new business line, or acquire or merge with an existing operating company, or, even if a new business line

or revenue generating operation is established, to fund and successfully operate that new business line or operation. The capabilities

or prior performance or contributions of any officer or director with other companies is not to be taken as indicative of his or her

performance or contributions as an officer or director of the Company. Further, the public auditors of the Company have expressed doubt

as to the Company as a going concern. Company may be unable to obtain adequate, affordable and timely funding to sustain any new business

line or existing operations. There is substantial doubt about the Company’s ability to establish a new business line or sustain

an operation. There is no existing agreement by the Company and a third party for a merger or acquisition of a company or assets. Any

investment in the common stock of the Company is a highly risky investment that is not suitable for investors who cannot afford the total

loss of the investment and the inability to liquidate the investment. The risk factors in the Company’s Annual Report on Form 10-K

for the fiscal year ended December 31, 2023, and other filings with the SEC should be carefully considered prior to any investment decision.

The Company undertakes no obligation to update forward-looking statements if circumstances or management’s estimates or opinions

should change, except as required by applicable securities laws. The reader is cautioned not to place undue reliance on forward-looking

statements.

CONTACT information

and media inquiries:

irinquiries@capstonecompaniesinc.com

Telephone: (954)

570-8889, ext. 315

Exhibit 10.1

CERTAIN INFORMATION [INDICATED BY BRACKETS]

HAS BEEN OMITTED DUE TO ITS CONFIDENTIAL NATURE AND BECAUSE IT IS CONSIDERED "NOT MATERIAL"

Date: January 10, 2025

To: Brian Rosen

[REDACTED

ADDRESS, EMAIL ADDRESS AND TELEPHONE NUMBER]

Re: Offer Letter – Director of

Capstone Companies, Inc.

Dear Mr. Rosen:

Capstone Companies, Inc., a Florida corporation,

(“Company”) is pleased to offer to you an appointment to the Company’s Board of Directors (“Board”) as

a non-employee director, subject to your acceptance of the following terms and conditions:

1. Term. The term

of your appointment will commence upon date this offer letter is fully signed by the parties and the Board formally appoints you as a

director and end upon election of a successor (which can include your re-election as a director). Company elects directors on an annual

basis. The signed offer letter can be emailed to Stewart Wallach, Chair of the Board, at email: swallach@capstonecompanies.com.

2. Duties. Besides

serving as a director, the Board may ask that you serve as a member of the Compensation and Nomination Committee of the Board to review

and approve compensation, including incentive compensation, of officers and other directors of the Company and review and report recommendations

for prospective directors or senior officers of the Company.

3. Compensation. The Company intends to

adopt an incentive option plan in early 2025 and compensation for directors would consist of incentive stock-based compensation issued

under that plan. Company does not currently pay a cash fee to directors, but cash compensation might be considered when and if the Company

has a steady operating cash flow.

4. Directors and Officers Liability Insurance.

The Company has directors’ and officers’ liability insurance, and you would be added to the coverage upon assuming office.

5. Expenses. The Company reimburses directors’

expenses that are pre-approved by the Chair of the Board.

6. Public Company.

The Company files periodic business and financial reports and other documents with the U.S. Securities and Exchange Commission or “SEC”,

which filings may be viewed at www.sec.gov (click “Search EDGAR” and then enter the Company’s name in search box).

A director, officer and employee may not trade in the common stock of the Company without first checking to see of any restrictions on

trading of Company securities has been imposed by the Board.

8. Form 3. Within

10 days after becoming a director of the Company, you need to file a Form 3 notice with the SEC. The Company will assist you in filing

this notice, which merely notifies the SEC that you are a director and states whether you own any shares of Company stock. There is no

charge for the filing or Company assistance, but the Company does need your prompt cooperation in completing this filing, which is due

10 days after your appointment as a director.

9. Press Release.

The Company may issue a press release about your appointment as a director, which press release will be reviewed and approved by you

before any release to the public.

10. Fiduciary Duties.

A director owes a duty of care (to make informed, impartial decisions) and a duty of loyalty (to place the interests of the Company and

its public shareholders above the personal interests). Legal counsel to the Company can answer any questions about fiduciary duties.

We look forward to

working with you as a director of the Company. Please sign and date below and return this signed offer letter to the email in Section

1 above.

| CAPSTONE COMPANIES, INC. |

|

|

|

|

|

| |

|

|

|

|

|

|

|

| By: |

/s/ Stewart Wallach |

|

|

|

Date: January 10, 2025 |

| |

Stewart Wallach, Chair of the Board of Directors |

|

|

| |

|

|

|

|

|

|

|

| ACCEPTED AND AGREED BY: |

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Signature: |

/s/Brian Rosen |

|

|

|

Date: January 10, 2025 |

| |

Brian Rosen |

|

|

|

|

Exhibit 10.2

January 21, 2025

Alex Jacobs

Capstone Companies, Inc.

144-V 10 Fairway Drive, Ste. 100

Deerfield Beach, FL 33441

Dear Alex,

I am pleased to confirm the understanding of the engagement

for Eschenburg Perez, CPA LLC (Consultant) to provide to Capstone Companies, Inc. (Client) for outsourced Chief Financial Officer and

other accounting assistance. This role would be effective from January 1, 2025, and end upon mutual termination by either party, upon

a 14-day notice. Services are to include, but not necessarily limited to, providing support and guidance remotely via online access to

the accounting system, to management and accounting team in order to reach the following objectives:

- Assist with year-end audit of December 31, 2024,

subsequent 10Q’s for each quarter, signing and filing as the Company CFO.

- Liaison with the audit team for requested schedules,

supporting documentation, etc.

- Review and approve supporting audit schedules and

internal control assessments and updating as necessary.

- Prepare technical memos regarding complex or unusual

accounting transactions, as necessary.

- Prepare, review and approve proposed journal entries

as necessary.

- Perform ad-hoc accounting duties as requested by

CEO.

- Oversee and review work prepared by outsourced Controller.

Services to be billed bi-weekly at an hourly rate

of $275/hour for an estimated total billing of $35,000 for the Form 10-K filing, and $15,000 for each subsequent quarterly filing and

accounting assistance. It is my responsibility to communicate with you as soon as reasonably possible when total hours are projected to

exceed the stated fees above. Outsourced Controller fees are excluded from the quoted rates above and will be billed as a pass-through

to the Company at $85/hr with no mark up. Estimated billing for Controller services is $15,000 for the year. Detailed bi-weekly invoices

will be provided. Consultant will work under the supervision of Alex Jacobs, CEO and Stewart Wallach, Chairman of the Board, as applicable.

I appreciate the opportunity to be of service to you

and believe this letter accurately summarizes the terms of engagement. If you have any questions, please let me know. If you agree to

the terms as described, please sign below and return to me.

| Sincerely, |

|

|

|

|

|

| /s/ Dana E. Perez |

|

|

Date: January 21, 2025 |

| Dana E. Perez, CPA |

|

|

|

|

| Eschenburg Perez CPA, LLC |

|

|

|

| |

|

|

|

|

|

| /s/Alex Jacobs |

|

|

Date: January 22, 2025 |

| Alex Jacobs, Chief Executive Officer |

|

|

| Capstone Companies, Inc. |

|

|

|

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

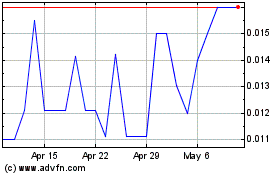

Capstone Companies (QB) (USOTC:CAPC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Capstone Companies (QB) (USOTC:CAPC)

Historical Stock Chart

From Feb 2024 to Feb 2025