UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 or 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of July 2024.

Commission File Number 000-55982

C21 INVESTMENTS INC.

(Translation of registrant’s name into English)

Suite 1900-855 West Georgia St

Vancouver BC, V6C 3H4

Canada

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F

Form 20-F [X] Form 40-F [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

C21 INVESTMENTS INC. |

| |

|

| Date: July 12, 2024 |

/s/ Michael Kidd |

| |

Michael Kidd |

| |

Chief Financial Officer |

-2-

INDEX TO EXHIBITS

C21 Investments Provides MCTO Status Update

VANCOUVER, July 12, 2024 - C21 Investments Inc. (CSE: CXXI and OTCQX: CXXIF) ("C21" or the "Company"), a vertically integrated cannabis company, is providing a default status report in accordance with the alternative information guidelines set out in National Policy 12-203 - Management Cease Trade Orders ("NP 12-203").

As previously announced on May 31, 2024 (the "Announcement"), the Company applied for a management cease trade order ("MCTO") from the British Columbia Securities Commission (the "BCSC") due to an expected delay in filing of the audited consolidated financial statements for the year ended January 31, 2024 (the "Annual Financial Statements"), annual management's discussion and analysis for the same period and management certifications of annual filings (collectively, the "Annual Filings") beyond the deadline of May 31, 2024 prescribed by Canadian securities laws. The MCTO was granted by the BCSC on May 31, 2024. The MCTO prohibits the Company's management from trading in the securities of the Company until such time as the Annual Filings are filed. The MCTO does not affect the ability of any other shareholders of the Company to trade securities of the Company.

As disclosed in the Announcement, the delay in filing the Annual Filings is due to the Company's auditors requiring additional time to complete their audit of the Annual Financial Statements due, in part, to the Company having changed its financial year end from January 31 to March 31, as well the Company's recent change of auditors which occurred at the beginning of this calendar year. C21 and its auditors continue to work diligently and expeditiously towards completing the Annual Filings, which is expected to occur on or around July 19, 2024. Upon completion of the auditors' internal review process, the Annual Filings will be filed on SEDAR+ (www.sedarplus.ca).

The Company confirms that since the date of the Announcement: (i) there has been no material change to the information set out in the Announcement that has not been generally disclosed; (ii) the Company is satisfying and confirms that it intends to continue to satisfy the provisions of the "alternative information guidelines" under NP 12-203 and issue bi-weekly default status reports for so long as the delay in filing the Annual Filings is continuing, each of which will be issued in the form of a news release; (iii) there has not been any other specified default by the Company under NP 12-203; (iv) the Company is not subject to any insolvency proceedings; and (v) there is no material information concerning the affairs of the Company that has not been generally disclosed.

For further inquiries, please contact:

| Investor contact: |

Company contact: |

| |

|

| Investor Relations |

Michael Kidd |

| info@cxxi.ca |

Chief Financial Officer and Director |

| +1 833 289-2994 |

Michael.Kidd@cxxi.ca |

About C21 Investments Inc.

C21 Investments Inc. is a vertically integrated cannabis company that cultivates, processes, and distributes quality cannabis and hemp-derived consumer products in the United States. The Company is focused on value creation through the disciplined acquisition and integration of core retail, manufacturing, and distribution assets in strategic markets, leveraging industry-leading retail revenues with high-growth potential multi-market branded consumer packaged goods. The Company owns Silver State Relief and Silver State Cultivation in Nevada, including legacy Oregon brands Phantom Farms, Hood Oil and Eco Firma Farms. These brands produce and distribute a broad range of THC and CBD products from cannabis flowers, pre-rolls, cannabis oil, vaporizer cartridges and edibles. Based in Vancouver, Canada, additional information on C21 can be found at www.sedarplus.ca and www.cxxi.ca.

Cautionary Note Regarding Forward-Looking Information and Statements:

This news release contains certain "forward-looking information" within the meaning of applicable Canadian securities legislation and may constitute "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively, "Forward-Looking Statements"). Forward-Looking Statements in this news release include, but are not limited to: the Company satisfying the information guidelines set out in NP 12-203 and the filing of the Annual Filings on or about July 19, 2024 upon completion of the auditors' internal review process. Such Forward-Looking Statements represent the Company's beliefs and expectations regarding future events, plans or objectives, many of which, by their nature, are inherently uncertain and outside of the Company's control.

Forward-Looking Statements are based on assumptions, estimates, analyses and opinions of management of the Company at the time they were provided or made in light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, including: (i) the expected filing of the Annual Filings; (ii) the Company's continued ability to satisfy the information guidelines set out in NP 12-203; (iii) the duration of the MCTO; (iv) achieving the anticipated results of the Company's strategic plans; and (v) general economic, financial market, regulatory and political conditions in which the Company operates.

A variety of factors, including known and unknown risks, many of which are beyond the Company's control, could cause actual results to differ materially from the Forward-Looking Statements in this news release. Such factors include, without limitation: risks and uncertainties arising from any delay in filing the Annual Filings; the Company's ability to satisfy the requirements of NP 12-203; the revocation of the MCTO and replacement with a cease trade order; the inability to effectively manage growth; inputs, suppliers and skilled labour being unavailable or available only at uneconomic costs; the adequacy of the Company's capital resources and liquidity, including but not limited to, availability of sufficient cash flow to execute the Company's business plan (either within the expected timeframe or at all); changes in general economic, business and political conditions, including changes in the financial markets; changes in applicable laws generally and adverse future legislative and regulatory developments involving medical and recreational marijuana; the risks of operating in the marijuana industry in the United States, and those other risk factors discussed in the Company's 20F filing with the U.S. Securities and Exchange Commission and Annual Information Form filing on SEDAR+.

Although the Company believes that the assumptions and factors used in preparing, and the expectations contained in, the Forward-Looking Statements are reasonable, undue reliance should not be placed on such information and statements, and no assurance or guarantee can be given that such Forward-Looking Statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information and statements. Should assumptions underlying the Forward-Looking Statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected.

The Forward-Looking Statements contained in this news release are made as of the date of this news release, and the Company does not undertake to update any Forward-Looking Statements that are contained or referenced herein, except in accordance with applicable securities laws.

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

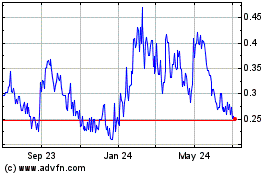

C21 Investments (QX) (USOTC:CXXIF)

Historical Stock Chart

From Jun 2024 to Jul 2024

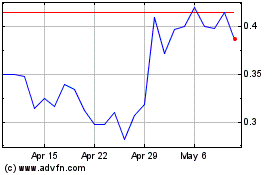

C21 Investments (QX) (USOTC:CXXIF)

Historical Stock Chart

From Jul 2023 to Jul 2024