UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

| For the month of: June 2024 |

| |

| Commission File Number: 001-15160 |

Brookfield

Corporation

(Name of Registrant)

Brookfield

Place

Suite 100

181 Bay Street, P.O. Box 762

Toronto, Ontario, Canada M5J 2T3

(Address of Principal Executive Offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Exhibits 99.1 and 99.2 of this Form 6-K shall

be incorporated by reference as exhibits to the Registration Statement of Brookfield Corporation and Brookfield Finance Inc. on Form F-10

(File Nos. 333-279601 and 333-279601-02).

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

BROOKFIELD CORPORATION |

| |

|

| Date: June 18, 2024 |

By: |

/s/ Swati Mandava |

| |

|

Name: |

Swati Mandava |

| |

|

Title: |

Managing Director, Legal & Regulatory |

Exhibit 99.1

A final base shelf prospectus containing

important information relating to the securities described in this document has been filed with the securities regulatory authorities

in each of the provinces of Canada.

The final base shelf prospectus, any applicable

shelf prospectus supplement and any amendment to the documents are accessible through SEDAR+. Copies of the documents may be obtained

from Merrill Lynch Canada Inc. by calling 416-369-7400 or by emailing dg.can_dcm@bankofamerica.com.

This document does not provide full disclosure of all material

facts relating to the securities offered. Investors should read the final base shelf prospectus, any applicable shelf prospectus supplement

and any amendment to the documents for disclosure of those facts, especially risk factors relating to the securities offered, before

making an investment decision.

BROOKFIELD FINANCE INC.

US$450,000,000 5.675% NOTES DUE 2035

US$200,000,000 5.968% NOTES DUE 2054

FINAL TERM SHEET

June 17, 2024

| Issuer: |

Brookfield Finance Inc. |

| |

|

| Guarantor: |

Brookfield Corporation |

| |

|

| Guarantee: |

The Notes (as defined below) will be fully and unconditionally

guaranteed as to payment of principal, premium (if any) and interest and certain other amounts by Brookfield Corporation. |

| |

|

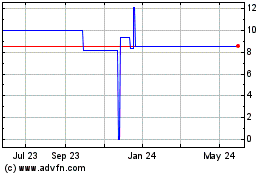

| Guarantor’s Ticker: |

BN |

| |

|

| Security: |

5.675% Senior Unsecured Notes due January 15, 2035 (the “2035

Notes”)

5.968% Senior Unsecured Notes due March 4, 2054 (the “2054

Notes” and, together with the 2035 Notes, the “Notes”) |

| |

|

| Format: |

SEC registered |

| |

|

| Size: |

2035 Notes: US$450,000,000

2054 Notes: US$200,000,000

The 2054 Notes will be in addition to and form part of the same

series of notes as the US$750,000,000 aggregate principal amount of Brookfield Finance Inc.’s 5.968% notes due 2054, which

were originally issued on March 4, 2024 (the “Original 2054 Notes”). After giving effect to this offering, there

will be a total of US$950,000,000 aggregate principal amount of notes of this series issued and outstanding. |

| Trade Date: |

June 17, 2024 |

| |

|

| Expected Settlement Date: |

June 21, 2024 (T+3) |

| |

|

| Maturity Date: |

2035 Notes: January 15, 2035

2054 Notes: March 4, 2054 |

| |

|

| Coupon: |

2035 Notes: 5.675%

2054 Notes: 5.968% (interest on the 2054 Notes will accrue from

March 4, 2024) |

| |

|

| Interest Payment Dates: |

2035 Notes: January 15 and July 15, commencing January 15,

2025

2054 Notes: March 4 and September 4, commencing September 4,

2024 |

| |

|

| Price to Public: |

2035 Notes: 99.994%

2054 Notes: 101.435% of principal amount plus accrued interest

of US$3,547,644.44 from March 4, 2024 |

| |

|

| Benchmark Treasury: |

[The Spread to Benchmark Treasury, and any disclosure

relating to the Spread to Benchmark Treasury, has been removed in accordance with subsection 9A.3(4) of National Instrument

44-102 – Shelf Distributions (“NI 44-102”).] |

| |

|

| Benchmark Treasury Price & Yield: |

[The Spread to Benchmark Treasury, and any disclosure

relating to the Spread to Benchmark Treasury, has been removed in accordance with subsection 9A.3(4) of NI 44-102.] |

| |

|

| Spread to Benchmark Treasury: |

[The Spread to Benchmark Treasury, and any disclosure

relating to the Spread to Benchmark Treasury, has been removed in accordance with subsection 9A.3(4) of NI 44-102.] |

| |

|

| Yield: |

2035 Notes: 5.675%

2054 Notes: 5.864% |

| |

|

| Denominations: |

Initial denominations of US$2,000 and subsequent

multiples of US$1,000 |

| |

|

| Covenants: |

Change of control (put @ 101%)

Negative pledge

Consolidation, merger, amalgamation and sale of substantial assets |

| Redemption Provisions: |

|

| |

|

| Make-Whole

Call: |

2035 Notes: Prior to October 15, 2034 (three months prior

to maturity), treasury rate plus 25 basis points

2054 Notes: Prior to September 4, 2053 (six months prior

to maturity), treasury rate plus 25 basis points |

| |

|

| Par

Call: |

2035 Notes: At any time on or after October 15, 2034 (three

months prior to maturity), at 100% of the principal amount of the Notes to be redeemed

2054 Notes: At any time on or after September 4, 2053 (six

months prior to maturity), at 100% of the principal amount of the Notes to be redeemed |

| |

|

| Use of Proceeds: |

The net proceeds from the sale of the Notes will

be used for general corporate purposes |

| |

|

| CUSIP/ISIN: |

2035 Notes: 11271L AM4 / US11271LAM46

2054 Notes: 11271L AL6 / US11271LAL62 |

| |

|

| Joint Book-Running Managers1: |

Deutsche Bank Securities Inc.

BofA Securities, Inc.

Citigroup Global Markets Inc.

Morgan Stanley & Co. LLC |

| |

|

| Co-Managers: |

Banco Bradesco BBI S.A.

BNP Paribas Securities Corp.

Desjardins Securities Inc.

Itau BBA USA Securities, Inc.

Mizuho Securities USA LLC

MUFG Securities Americas Inc.

National Bank of Canada Financial Inc.

Natixis Securities Americas LLC

Santander US Capital Markets LLC

SG Americas Securities, LLC |

1

This offering will be made in Canada by Merrill Lynch Canada Inc., a broker-dealer

affiliate of BofA Securities, Inc.

Capitalized terms used and not defined herein

have the meanings assigned in the Issuer and the Guarantor’s Prospectus Supplement, dated June 17, 2024 to the Short Form Base

Shelf Prospectus dated May 31, 2024.

Under Rule 15c6-1 under the Exchange

Act, trades in the secondary market generally are required to settle in one business day unless the parties to any such trade expressly

agree otherwise. Accordingly, purchasers who wish to trade the Notes prior to the delivery of the Notes hereunder may be required, by

virtue of the fact that the Notes initially will settle in T+3, to specify an alternative settlement cycle at the time of any such trade

to prevent a failed settlement. Purchasers of the Notes who wish to trade the Notes prior to their date of delivery hereunder should

consult their own advisors.

The 2035 Notes will be issued as a separate

series of debt securities under an eleventh supplemental indenture to be dated as of the date of the issuance of the 2035 Notes (the

“Eleventh Supplemental Indenture”) to the base indenture dated as of June 2, 2016 (the “Base Indenture”)

(together with the Eleventh Supplemental Indenture, the “2035 Indenture”), between Brookfield Finance Inc., Brookfield Corporation,

as guarantor, and Computershare Trust Company of Canada, as trustee. The 2054 Notes will be issued on the same terms and conditions as

the Original 2054 Notes, except for the issue date and the issue price, under the Base Indenture and the tenth supplemental indenture,

dated as of March 4, 2024 (the “Tenth Supplemental Indenture”), as supplemented by a supplemental indenture thereto

(the “Supplemented Tenth Supplemental Indenture” and together with the Base Indenture, the “2054 Indenture”).

The 2035 Indenture and the 2054 Indenture are together referred to as the “Indenture”. The foregoing is a summary of certain

of the material attributes and characteristics of the Notes, which does not purport to be complete and is qualified in its entirety by

reference to the Indenture.

No PRIIPs or UK PRIIPs key information document

(KID) has been prepared as European Economic Area or UK retail investors are not targeted.

Exhibit 99.2

Execution Version

Brookfield Finance Inc.

5.675% Notes Due 2035

5.968% Notes Due 2054

Underwriting Agreement

New York, New York

June 17, 2024

To the Representatives named in

Schedule I hereto of the several

Underwriters named in

Schedule II hereto

Ladies and Gentlemen:

Brookfield Finance Inc., a corporation organized

under the laws of Ontario (“BFI”), proposes to sell to the several underwriters named in Schedule II hereto

(the “Underwriters”), for whom you (the “Representatives”) are acting as representatives, the principal

amount of its debt securities identified in Schedule I hereto (the “Notes”), to be issued under an indenture,

dated as of June 2, 2016 (the “Base Indenture”), as supplemented by a Supplemented Tenth Supplemental Indenture

and an Eleventh Supplemental Indenture identified in Schedule I hereto (the “Supplemental Indentures” and,

collectively with the Base Indenture, the “Indenture”), among BFI, Brookfield Corporation (formerly, Brookfield Asset

Management Inc.), a corporation organized under the laws of Ontario (the “Parent”), as guarantor, and Computershare

Trust Company of Canada, as trustee (the “Trustee”). The Notes will be fully and unconditionally guaranteed as to

payment of principal, premium, if any, and interest by the Parent pursuant to the Indenture (the “Guarantees”). The

Notes and the Guarantees are collectively referred to herein as the “Securities”. To the extent there are no additional

Underwriters listed on Schedule I other than you, the term Representatives as used herein shall mean you, as Underwriters, and the

terms Representatives and Underwriters shall mean either the singular or plural as the context requires. Any reference herein to the

Registration Statement, the U.S. or Canadian Base Prospectus, the U.S. or Canadian Preliminary Prospectus or the U.S. or Canadian Final

Prospectus shall be deemed to refer to and include the documents incorporated by reference therein; and any reference herein to the terms

“amend,” “amendment” or “supplement” with respect to the Registration Statement, the U.S. or Canadian

Base Prospectus, the U.S. or Canadian Preliminary Prospectus or the U.S. or Canadian Final Prospectus shall be deemed to refer to and

include the filing of any document incorporated or deemed to be incorporated therein by reference. Certain terms used herein are defined

in Section 24 hereof.

1. Representations

and Warranties. BFI and the Parent, jointly and severally, represent and warrant to, and agree with, each Underwriter as set forth

below in this Section 1.

(a) Each

of BFI and the Parent meets the requirements under the securities laws, rules, regulations, instruments and orders applicable in each

of the provinces of Canada (“Canadian Securities Law”) as interpreted and applied by the securities regulatory authorities

(the “Qualifying Authorities”) in each of the provinces of Canada (the “Qualifying Provinces”)

for the use of a short form shelf prospectus with respect to the Securities and for the distribution of securities under the rules and

procedures established in National Instrument 44-101 - Short Form Prospectus Distributions (“NI 44-101”)

and National Instrument 44-102 - Shelf Distributions (“NI 44-102” and together with NI 44-101, the “Canadian

Shelf Procedures”); a preliminary short form base shelf prospectus and a final short form base shelf prospectus relating to

US$3,500,000,000 aggregate principal amount of, among other things, debt securities of BFI and guarantees of BFI’s debt securities

by the Parent (collectively, the “Shelf Securities”) have been filed in the English and French languages, as applicable,

with the Qualifying Authorities; receipts under National Policy 11-202 - Process for Prospectus Reviews in Multiple Jurisdictions

(a “Receipt”) have been issued by the Ontario Securities Commission (the “Principal Regulator”)

on behalf of itself and the other Qualifying Authorities in respect of such short form base shelf prospectus and any amendment thereto;

a preliminary prospectus supplement relating to the Securities has been filed with the Qualifying Authorities; and no order suspending

the distribution of the Securities has been issued by any of the Qualifying Authorities and no proceeding for that purpose has been initiated

or, to the knowledge of BFI or the Parent, threatened by any of the Qualifying Authorities. The final short form base shelf prospectus

filed with the Qualifying Authorities for which a Receipt has been obtained, as most recently amended or supplemented (excluding any

supplement relating only to a prior offering of Securities) prior to the date of this Agreement, is hereinafter called the “Canadian

Base Prospectus”; the preliminary prospectus supplement relating to the Securities, which excludes certain pricing information

and other final terms of the Securities, and provided to the Underwriters for purposes of marketing the Securities and filed with the

Qualifying Authorities in the English and French languages, as applicable, pursuant to the Canadian Shelf Procedures and Canadian Securities

Law, together with the Canadian Base Prospectus, including all documents incorporated therein by reference, is hereinafter referred to

as the “Canadian Preliminary Prospectus”; the prospectus supplement relating to the Securities to be filed, in the

English and French languages, as applicable, with the Qualifying Authorities pursuant to the Canadian Shelf Procedures and Canadian Securities

Law in accordance with Section 5(a) hereof, and which includes the pricing and other information excluded from the Canadian

Preliminary Prospectus (the “Canadian Final Supplement”), together with the Canadian Base Prospectus, including all

documents incorporated therein by reference, is hereinafter called the “Canadian Final Prospectus”;

(b) Each

of BFI and the Parent meets the general eligibility requirements for use of Form F-10 (“Form F-10”) under

the Act, and BFI and the Parent have prepared and filed a registration statement on Form F-10 (File Nos. 333-279601-02 and 333-279601)

providing for the registration of the Shelf Securities under the Act and the rules and regulations of the Commission thereunder.

BFI and the Parent have filed appointments of agent for service of process for BFI and the Parent on Form F-X (collectively, the

“Form F-X”) with the Commission in conjunction with the filing of such registration statement; such registration

statement, and including any amendments thereto filed prior to the Execution Time, including the Canadian Base Prospectus with such deletions

therefrom and additions thereto as are permitted or required by Form F-10 and the applicable rules and regulations of the Commission

and including exhibits to such registration statement and all documents incorporated by reference in the prospectus contained therein,

each in the form heretofore delivered or to be delivered to the Representatives, have been declared effective by the Commission in such

form; BFI and the Parent have filed with the Commission, pursuant to General Instruction II.L. of Form F-10, a preliminary prospectus

supplement relating to the offering of the Securities; no other document with respect to such registration statement has heretofore been

filed or transmitted for filing with the Commission, except for any documents filed with the Commission subsequent to the date of such

effectiveness in the form heretofore delivered to the Representatives; and no stop order suspending the effectiveness of such registration

statement has been issued and no proceeding for that purpose has been initiated or, to the knowledge of BFI and the Parent, threatened

by the Commission. The various parts of such registration statement, including all exhibits thereto and the documents incorporated by

reference in the prospectus contained in the registration statement at the time such part of the registration statement became effective,

each as amended at the time such part of the registration statement became effective and including any post-effective amendment thereto

and any prospectus supplement relating to the Securities that is filed with the Commission pursuant to General Instruction II.L. of Form F-10,

are hereinafter collectively called the “Registration Statement”; any reference to any amendment to the Registration

Statement shall be deemed to refer to and include any documents incorporated by reference therein after the effective date of the initial

Registration Statement; the base prospectus filed as part of the Registration Statement relating to the Shelf Securities, contained in

the Registration Statement at the Execution Time, is hereinafter called the “U.S. Base Prospectus”; any preliminary

prospectus supplement relating to the offering of the Securities filed with the Commission pursuant to General Instruction II.L. of Form F-10

under the Act, together with the U.S. Base Prospectus, which is used prior to the filing of the U.S. Final Prospectus, is hereinafter

called the “U.S. Preliminary Prospectus”; the final prospectus supplement relating to the offering of the Securities

to be filed with the Commission pursuant to General Instruction II.L. of Form F-10 after the Execution Time in accordance with Section 5(a) hereof,

together with the U.S. Base Prospectus, is hereinafter called the “U.S. Final Prospectus”;

(c) The

documents which are incorporated by reference in the Canadian Preliminary Prospectus and the U.S. Preliminary Prospectus as of the date

of this Agreement, when they were filed with the Qualifying Authorities, conformed in all material respects to the disclosure requirements

of Canadian Securities Law as interpreted and applied by the Qualifying Authorities; any further documents filed with the Qualifying

Authorities and incorporated by reference in the Canadian Final Prospectus and the U.S. Final Prospectus, when such documents are filed

with the Qualifying Authorities, will conform in all material respects to the disclosure requirements of Canadian Securities Law as interpreted

and applied by the Qualifying Authorities; and no such documents were filed with the Qualifying Authorities since the Qualifying Authorities’

close of business on the Business Day immediately prior to the date of this Agreement and prior to the execution of this Agreement, other

than any other marketing materials required to be filed under Canadian Securities Law;

(d) On

each Effective Date, the Registration Statement did, and when the U.S. Final Prospectus is first filed in accordance with General Instruction

II.L. of Form F-10 and on the Closing Date (as defined herein), the U.S. Final Prospectus and the Canadian Final Prospectus (and

any amendments and supplements thereto) will, comply in all material respects with the applicable requirements of the Act, Canadian Securities

Law, and the Trust Indenture Act and the respective rules thereunder; no order preventing or suspending the use of the Registration

Statement, the U.S. Preliminary Prospectus, the Canadian Preliminary Prospectus, the U.S. Final Prospectus, the Canadian Final Prospectus

or any Issuer Free Writing Prospectus used outside of Canada has been issued by the Commission or the Qualifying Authorities; on each

Effective Date and at the Execution Time, the Registration Statement did not and will not contain any untrue statement of a material

fact or omit to state any material fact required to be stated therein or necessary in order to make the statements therein not misleading;

on the Effective Date and on the Closing Date the Indenture did or will comply in all material respects with the applicable requirements

of the Trust Indenture Act and the rules thereunder; and on the date of any filing in accordance with General Instruction II.L.

of Form F-10 or in accordance with Canadian Securities Law and on the Closing Date, each of the U.S. Preliminary Prospectus, the

U.S. Final Prospectus (together with any supplement or amendment thereto), the Canadian Preliminary Prospectus and the Canadian Final

Prospectus (together with any supplement or amendment thereto) contains or will contain full, true and plain disclosure of all material

facts relating to BFI, the Parent and the Securities and does not include any untrue statement of a material fact or omit to state a

material fact necessary in order to make the statements therein, in the light of the circumstances under which they were made, not misleading;

provided, however, that BFI and the Parent make no representations or warranties as to the information contained in or

omitted from the Registration Statement, the U.S. Preliminary Prospectus, the U.S. Final Prospectus (including any supplement or amendment

thereto), the Canadian Preliminary Prospectus or the Canadian Final Prospectus (including any supplement or amendment thereto) in reliance

upon and in conformity with information furnished in writing to BFI or the Parent by or on behalf of any Underwriter through the Representatives

specifically for inclusion in the Registration Statement, the U.S. Preliminary Prospectus, the U.S. Final Prospectus (including any supplement

or amendment thereto), the Canadian Preliminary Prospectus or the Canadian Final Prospectus (including any supplement or amendment thereto),

it being understood and agreed that the only such information furnished by or on behalf of any Underwriter consists of the information

described as such in Section 8(b) hereof;

(e) At

the Execution Time and on the Closing Date (i) the Disclosure Package and (ii) each electronic road show (if any), when taken

together as a whole with the Disclosure Package, does not and will not contain any untrue statement of a material fact or omit to state

any material fact necessary in order to make the statements therein, in the light of the circumstances under which they were made, not

misleading. The preceding sentence does not apply to statements in or omissions from the Disclosure Package based upon and in conformity

with written information furnished to BFI or the Parent by any Underwriter through the Representatives specifically for use therein,

it being understood and agreed that the only such information furnished by or on behalf of any Underwriter consists of the information

described as such in Section 8(b) hereof;

(f) (i) At

the earliest time after the filing of the Registration Statement that BFI, the Parent or another offering participant made a bona fide

offer of the Securities and (ii) as of the Execution Time (with such date being used as the determination date for purposes of this

clause (ii)), neither BFI nor the Parent was or is an Ineligible Issuer (as defined in Rule 405), without taking account of

any determination by the Commission pursuant to Rule 405 that it is not necessary that BFI or the Parent be considered an Ineligible

Issuer;

(g) Each

Issuer Free Writing Prospectus, including the final term sheet prepared and filed pursuant to Section 5(c) hereto, does

not include any information that conflicts with the information contained in the Registration Statement, including any document incorporated

therein by reference and any prospectus supplement deemed to be a part thereof that has not been superseded or modified. The foregoing

sentence does not apply to statements in or omissions from any Issuer Free Writing Prospectus based upon and in conformity with written

information furnished to BFI or the Parent by any Underwriter through the Representatives specifically for use therein, it being understood

and agreed that the only such information furnished by or on behalf of any Underwriter consists of the information described as such

in Section 8(b) hereof;

(h) Neither

BFI nor the Parent, nor any of the Parent’s subsidiaries, has sustained since the date of the latest audited financial statements

included or incorporated by reference in each of the Disclosure Package, the U.S. Final Prospectus and the Canadian Final Prospectus

any loss or interference with its business from fire, explosion, flood or other calamity, whether or not covered by insurance, or from

any labor dispute or court or governmental action, order or decree, which loss or interference is materially adverse to the Parent and

its subsidiaries, on a consolidated basis, otherwise than as set forth or contemplated in each of the Disclosure Package, the U.S. Final

Prospectus and the Canadian Final Prospectus; and, since the respective dates as of which information is given in each of the Registration

Statement, the Disclosure Package, the U.S. Final Prospectus and the Canadian Final Prospectus, otherwise than as set forth or contemplated

in each of the Disclosure Package, the U.S. Final Prospectus and the Canadian Final Prospectus, there has not been any change in the

capital stock of the Parent (other than pursuant to stock dividends, conversions of securities, director, officer or employee stock options,

the Parent’s dividend re-investment plan, normal course issuer bids and other director, officer or employee benefit plans and agreements

described or referred to in each of the Disclosure Package, the U.S. Final Prospectus and the Canadian Final Prospectus), any material

increase in the long-term debt of the Parent and its subsidiaries on a consolidated basis, or any change, or any development involving

a prospective change, in or affecting the general affairs, management, financial position or results of operations of the Parent and

its subsidiaries, which change has (or, in the case of prospective changes, will have) a Material Adverse Effect;

(i) Each

of BFI, the Parent and the Parent’s material subsidiaries has been duly amalgamated, formed or incorporated and is validly existing

in good standing under the laws of the jurisdiction in which it is chartered or organized with full corporate or limited partnership

power and authority to own or lease, as the case may be, and to operate its properties and conduct its business as described in each

of the Disclosure Package, the U.S. Final Prospectus and the Canadian Final Prospectus, and is duly qualified to do business as a foreign

corporation and is in good standing under the laws of each jurisdiction which requires such qualification, except where the failure to

be duly qualified and in good standing would not individually or in the aggregate have a Material Adverse Effect;

(j) The

Parent has the authorized capitalization as set forth in each of the Disclosure Package, the U.S. Final Prospectus and the Canadian Final

Prospectus, and all of the issued and outstanding shares of the Parent have been duly and validly authorized and issued and are fully

paid and non-assessable, all of the issued and outstanding shares or analogous securities of each material subsidiary have been duly

and validly authorized and issued and are fully paid and non-assessable and, except as set forth in each of the Disclosure Package, the

U.S. Final Prospectus and the Canadian Final Prospectus, the Parent (directly or indirectly) owns all of issued and outstanding shares

or other voting, equity or participating securities of each of its material subsidiaries, in each case free and clear of any Encumbrance

(other than Encumbrances granted in respect of liabilities reflected in each of the Disclosure Package, the U.S. Final Prospectus and

the Canadian Final Prospectus) and no person has any agreement or option, or right or privilege (whether pre-emptive or contractual)

capable of becoming an agreement or option, for the purchase of any unissued shares or other voting, equity or participating securities

of the Parent, except as otherwise described in each of the Disclosure Package, the U.S. Final Prospectus and the Canadian Final Prospectus;

(k) The

authorized capital of BFI consists of (i) an unlimited number of common shares, of which 4,606,261 common shares are issued and

outstanding as of the date hereof, (ii) an unlimited number of preference shares designated as Class A Preference Shares, issuable

in series, which consists of 6,400,000 Class A Preference Shares – Series 1, of which 6,400,000 Class A Preference

Shares – Series 1 are issued and outstanding as of the date hereof and (iii) an unlimited number of preference shares

designated as Class B Preference Shares, issuable in series, which consists of 54,262,400 Class B Preference Shares –

Series 1, of which 54,262,400 Class B Preference Shares – Series 1 are issued and outstanding as of the date hereof,

and all of the issued and outstanding shares of BFI have been duly and validly authorized and issued and are fully paid and non-assessable.

The Parent (directly or indirectly) owns all of the issued and outstanding shares or other voting, equity or participating securities

of BFI, in each case free and clear of any Encumbrance (other than Encumbrances granted in respect of liabilities reflected in each of

the Disclosure Package, the U.S. Final Prospectus and the Canadian Final Prospectus) and no person has any agreement or option, or right

or privilege (whether pre-emptive or contractual) capable of becoming an agreement or option, for the purchase of any unissued shares

or other voting, equity or participating securities of BFI (other than Encumbrances granted in respect of liabilities reflected in each

of the Disclosure Package, the U.S. Final Prospectus and the Canadian Final Prospectus);

(l) Except

as disclosed in each of the Disclosure Package, the U.S. Final Prospectus and the Canadian Final Prospectus, the Parent and each of its

material subsidiaries has good and marketable title to all of its material assets including all material licenses, free and clear of

all Encumbrances (other than Encumbrances granted in respect of liabilities reflected in each of the Disclosure Package, the U.S. Final

Prospectus and the Canadian Final Prospectus), which are material to the Parent and its subsidiaries, on a consolidated basis;

(m) This

Agreement has been duly authorized, executed and delivered by BFI and the Parent;

(n) The

Base Indenture has been duly authorized, executed and delivered in accordance with its terms by BFI and the Parent and constitutes a

valid and legally binding instrument, enforceable against BFI and the Parent in accordance with its terms, subject, as to enforcement,

to bankruptcy, insolvency, reorganization and other laws of general applicability relating to or affecting creditors’ rights and

to general equity principles; the Tenth Supplemental Indenture has been duly authorized, executed and delivered in accordance with its

terms by BFI and the Parent, constitutes a valid and legally binding instrument, enforceable against BFI and the Parent in accordance

with its terms, subject, as to enforcement, to bankruptcy, insolvency, reorganization and other laws of general applicability relating

to or affecting creditors’ rights and to general equity principles; each of the Supplemental Indenture to the Tenth Supplemental

Indenture and the Eleventh Supplemental Indenture has been duly authorized by BFI and the Parent and, at the Closing Date for the Securities,

when duly executed and delivered in accordance with its terms by BFI and the Parent, assuming due authorization, execution and delivery

thereof in accordance with its terms by the Trustee, will constitute a valid and legally binding instrument, enforceable against BFI

and the Parent in accordance with its terms, subject, as to enforcement, to bankruptcy, insolvency, reorganization and other laws of

general applicability relating to or affecting creditors’ rights and to general equity principles; the Indenture has been duly

qualified under the Trust Indenture Act and is substantially in the form, save for any indenture supplements relating to a particular

issuance of debt securities, filed as an exhibit to the Registration Statement; and the Indenture conforms, and the Securities will conform,

to the descriptions thereof contained in each of the Disclosure Package, the U.S. Final Prospectus and the Canadian Final Prospectus;

(o) The

Notes have been duly authorized by BFI for issuance and sale pursuant to this Agreement and the Indenture, and when executed by BFI and

authenticated by the Trustee in accordance with the terms of the Indenture and delivered against payment of the purchase price therefor,

will conform in all material respects to the description thereof contained in each of the Disclosure Package, the U.S. Final Prospectus

and the Canadian Final Prospectus and will constitute valid and legally binding obligations of BFI, enforceable against BFI in accordance

with their terms, subject, as to enforcement, to bankruptcy, insolvency, reorganization and other laws of general applicability relating

to or affecting creditors’ rights and to general equity principles; the 2054 Notes (as defined in Schedule I hereto), when issued,

will form part of the same series as BFI’s 5.968% Notes due 2054, issued on March 4, 2024 (the “Original 2054 Notes”),

and will be fully fungible with the Original 2054 Notes. Upon completion of this offering, the aggregate principal amount of the 2054

Notes and the Original 2054 Notes issued and outstanding will be $950,000,000;

(p) The

Guarantees have been duly authorized by the Parent, and when the Notes have been executed and authenticated in the manner provided for

in accordance with the provisions of the Indenture and issued and delivered against payment of the purchase price therefor, the Guarantees

will constitute valid and legally binding agreements of the Parent, enforceable against the Parent in accordance with their terms, subject,

as to enforcement, to bankruptcy, insolvency, reorganization and other laws of general applicability relating to or affecting creditors’

rights and to general equity principles;

(q) The

issue and sale of the Securities and the execution of and compliance by BFI and the Parent with all of the provisions of the Securities,

the Indenture, this Agreement, and the consummation of the transactions therein contemplated will not conflict with or result in a breach

or violation of any of the terms or provisions of, or constitute a default under, any indenture, mortgage, deed of trust, loan agreement

or other agreement or instrument to which BFI or the Parent or any of the Parent’s material subsidiaries is a party or by which

BFI or the Parent or any of the Parent’s material subsidiaries is bound or to which any of the property or assets of BFI or the

Parent or any of the Parent’s material subsidiaries is subject, nor will such action result in any violation of the provisions

of the articles or by-laws of BFI or the Parent or any of the Parent’s material subsidiaries, or any statute or any order, rule or

regulation of any court or governmental agency or body having jurisdiction over BFI or the Parent or any of the Parent’s material

subsidiaries or any of its or their properties; and no consent, approval, authorization, order, registration, clearance or qualification

of or with any such court or governmental agency or body is required for the issue and sale of the Securities or the consummation by

BFI or the Parent of the transactions contemplated by this Agreement or the Indenture, except such as have been, or will have been prior

to the Closing Date, obtained under Canadian Securities Law, the Act and the Trust Indenture Act and such consents, approvals, authorizations,

orders, registrations, clearances or qualifications as may be required under state securities or Blue Sky laws in connection with the

purchase and distribution of the Securities by the Underwriters as contemplated herein and in the Disclosure Package, the U.S. Final

Prospectus and the Canadian Final Prospectus;

(r) The

statements in each of the Disclosure Package, the U.S. Final Prospectus and the Canadian Final Prospectus, as amended or supplemented,

set forth under the captions “Certain Canadian Federal Income Tax Considerations,” “Certain United States Federal Income

Tax Considerations” and “Eligibility for Investment,” insofar as they purport to constitute summaries of matters of

Canadian federal income tax law or United States federal income tax law (as applicable) or legal conclusions with respect thereto, fairly

and accurately summarize the matters described therein in all material respects, subject to the qualifications, assumptions and restrictions

referred to therein;

(s) The

statements in each of the Disclosure Package, the U.S. Final Prospectus and the Canadian Final Prospectus, as amended or supplemented,

set forth under the captions “Description of Debt Securities” and “Description of the Notes,” insofar as they

purport to constitute a summary of the terms of the Securities, and set forth under the captions “Plan of Distribution” and

“Underwriting,” insofar as they purport to describe the documents referred to therein, fairly and accurately summarize the

matters described therein in all material respects, subject to the qualifications, assumptions and restrictions referred to therein;

(t) Neither

BFI nor the Parent nor any of the Parent’s material subsidiaries is in violation of its certificate of incorporation, certificate

of formation, by-laws, partnership agreement or operating agreement, as applicable. Neither BFI nor the Parent nor any of the Parent’s

subsidiaries, is in default (or with the giving of notice or lapse of time would be in default) in the performance or observance of any

obligation, agreement, covenant or condition contained in any indenture, mortgage, deed of trust, loan agreement, lease or other agreement

or instrument to which it is a party or by which it or any of its properties may be bound, except such violations or defaults which would

not individually or in the aggregate have a Material Adverse Effect;

(u) Other

than as set forth in each of the Disclosure Package, the U.S. Final Prospectus and the Canadian Final Prospectus, there are no legal

or governmental actions or proceedings pending against or to which BFI or the Parent or any of the Parent’s subsidiaries is a party

or of which any property of BFI or the Parent or any of the Parent’s subsidiaries is the subject which, if determined adversely

to BFI or the Parent or any of the Parent’s subsidiaries, would individually or in the aggregate be reasonably likely to have a

Material Adverse Effect; and, to BFI’s and the Parent’s knowledge, there are no such actions or proceedings threatened or

contemplated;

(v) Neither

BFI nor the Parent are, and, after giving effect to the offering and sale of the Securities, and the application of the proceeds thereof

as described in the Disclosure Package, the U.S. Final Prospectus and the Canadian Final Prospectus, neither will be, required to register

as an “investment company,” as such term is defined in the Investment Company Act;

(w) No

stamp or other issuance or transfer taxes or duties and no withholding or other taxes (excluding taxes on net income, profits or gains)

are payable by or on behalf of the Underwriters to Canada or any political subdivision or taxing authority thereof or therein in connection

with (A) the issuance, sale and delivery by BFI of the Notes outside Canada to or for the respective accounts of the Underwriters

or (B) the sale and delivery of the Notes outside Canada by the Underwriters to the initial purchasers thereof (assuming (i) the

Underwriters are not, and are not deemed to be, resident in Canada for purposes of the Income Tax Act (Canada); (ii) the

Underwriters do not hold or use the Notes in the course of carrying on business in Canada for purposes of the Income Tax Act (Canada);

(iii) neither the Underwriters nor any of the Underwriters’ directors, officers, employees, servants, agents or third party

service providers have performed or will perform any services or any other activities in Canada in connection with the Notes; (iv) each

Underwriter will perform the contemplated services in respect of the Notes in the ordinary course of a business carried on by it that

includes the performance of such a service for a fee; and (v) the amount of any fees, charges or other consideration for services

to be paid to the Underwriters in respect of the Notes is reasonable in the circumstances);

(x) To

the best of BFI’s and the Parent’s knowledge, there is no existing law or regulation of or proposed change to the laws or

regulations of Canada that would give rise to a “Redemption for Changes in Canadian Withholding Taxes” as described in the

Canadian Preliminary Prospectus and the U.S. Preliminary Prospectus;

(y) The

Parent has complied in all material respects with the currently applicable provisions of the Sarbanes-Oxley Act of 2002, as amended,

and the corporate governance rules of the New York Stock Exchange and the Toronto Stock Exchange, and, to the knowledge of the Parent,

the Parent’s directors and executive officers, in their capacities as such, have complied in all material respects with the currently

applicable provisions of the Sarbanes-Oxley Act of 2002, as amended, and the corporate governance rules of the New York Stock Exchange

and the Toronto Stock Exchange;

(z) The

Parent maintains disclosure controls and procedures as required by Rule 13a-15 or Rule 15d-15 under the Exchange Act and as

contemplated by the certifications required under Form 52-109F1 and Form 52-109F2 under National Instrument 52-109 –

Certification of Disclosure in Issuers’ Annual and Interim Filings, (“NI 52-109”) and such controls and

procedures are effective to ensure that all material information concerning the Parent is made known, on a timely basis, to the individuals

responsible for the preparation of the Parent’s filings with the Commission and the Qualifying Authorities. The Parent maintains

systems of internal accounting controls sufficient to provide reasonable assurance that (A) transactions are executed in accordance

with management’s general or specific authorizations; (B) transactions are recorded as necessary to permit preparation of

financial statements in conformity with International Financial Reporting Standards as issued by the International Accounting Standards

Board and to maintain asset accountability; (C) access to assets is permitted only in accordance with management’s general

or specific authorization; and (D) the recorded accountability for assets is compared with the existing assets at reasonable intervals

and appropriate action is taken with respect to any differences. The Parent’s internal control over financial reporting is effective

and the Parent is not aware of (a) any significant deficiency or material weaknesses in the design or operation of internal control

over financial reporting (as such term is defined by Rules 13a-15(f) and 15d-15(f) under the Exchange Act and, in Canada,

under NI 52-109) which are reasonably likely to adversely affect the Parent’s ability to record, process, summarize and report

financial information or (b) any fraud, whether or not material, that involves management or other employees who have a significant

role in the Parent’s internal controls over financial reporting;

(aa) Deloitte

LLP, who have audited certain financial statements of the Parent and its consolidated subsidiaries and delivered their report with respect

to the audited consolidated financial statements included in the Disclosure Package, the U.S. Final Prospectus and the Canadian Final

Prospectus, are independent auditors with respect to the Parent within the meaning of the Act and the applicable published rules and

regulations thereunder adopted by the Commission and the Public Company Accounting Oversight Board (United States) and within the meaning

of the rules of professional conduct of the Chartered Professional Accountants of Ontario as required by applicable Canadian Securities

Law;

(bb) The

consolidated historical financial statements and schedules (including the Historical Financial Statements) of the Parent and its consolidated

subsidiaries incorporated by reference in each of the Disclosure Package, the U.S. Final Prospectus, the Canadian Final Prospectus and

the Registration Statement present fairly, in all material respects, the financial condition, results of operations and cash flows of

the Parent as of the dates and for the periods indicated, comply as to form, in all material respects, with applicable accounting requirements

and have been prepared in conformity with International Financial Reporting Standards as issued by the International Accounting Standards

Board. There have been no changes in the consolidated assets or liabilities of the Parent from the position thereof as set forth in the

latest balance sheet date included in the Historical Financial Statements, except changes arising from transactions in the ordinary course

of business which, in the aggregate, have not been material to the Parent and except for changes that are disclosed in each of the Disclosure

Package, the U.S. Final Prospectus and the Canadian Final Prospectus;

(cc) The

Parent and each of its material subsidiaries holds all requisite material licences, registrations, qualifications, permits and consents

necessary or appropriate for carrying on its business as currently carried on and all such licences, registrations, qualifications, permits

and consents are valid and subsisting and in good standing in all material respects and none of the same contains any burdensome term,

provision, condition or limitation except such licenses or other similar rights the absence of which would not have a Material Adverse

Effect;

(dd) BFI

and the Parent and each of the Parent’s material subsidiaries have (i) accurately completed and filed on a timely basis all

necessary tax returns, reports and notices, except insofar as the failure to file such tax returns or notices would not result in a Material

Adverse Effect, and (ii) paid or accounted for or made provision for all applicable taxes of whatever nature to the date hereof

to the extent such taxes have become due or have been alleged to be due, except assessments against which appeals have been or will be

promptly taken and as to which adequate reserves have been provided, except where the failure to do so would not have a Material Adverse

Effect; neither BFI nor the Parent are aware of any material tax deficiencies or material interest or penalties accrued or accruing,

or alleged to be accrued or accruing, thereon with respect to BFI, the Parent or any of the Parent’s material subsidiaries which

have not otherwise been provided for by BFI or the Parent and the Parent’s subsidiaries, on a consolidated basis;

(ee) Each

of BFI and the Parent is a reporting issuer not in default or the equivalent thereof under the applicable securities laws of each province

of Canada that recognizes such concept; each of BFI and the Parent is in compliance with or is exempt from its timely disclosure obligations

under the applicable securities laws in all of the provinces of Canada, the Exchange Act and under the rules of the Toronto Stock

Exchange and the New York Stock Exchange, as applicable;

(ff) No

order, ruling or determination having the effect of suspending the sale or ceasing the trading of any securities of the Parent has been

issued or made by the Commission or by any securities commission in Canada or stock exchange or any other regulatory authority and is

continuing in effect and no proceedings for that purpose have been instituted or are pending or, to the best of the Parent’s knowledge,

contemplated or threatened by any such authority or under any Applicable Securities Laws;

(gg) BFI

and the Parent shall use the net proceeds received by BFI from the sale of the Securities in the manner specified or to be specified

in each of the Disclosure Package, the U.S. Final Prospectus and the Canadian Final Prospectus under the heading “Use of Proceeds”;

(hh) Neither

the Parent nor any of the Parent’s subsidiaries nor, to the knowledge of BFI or the Parent, any director, officer, agent or employee

of the Parent or any of its subsidiaries is aware of or has taken any action, directly or indirectly, that could result in a sanction

for violation by such persons of the Foreign Corrupt Practices Act of 1977, the Bribery Act of 2010 of the United Kingdom (the “UK

Bribery Act”) or the Corruption of Foreign Public Officials Act (Canada), each as may be amended, or, except as previously

disclosed to the Underwriters, any similar law of any other relevant jurisdiction, or the rules or regulations thereunder; and the

Parent and the Parent’s subsidiaries have instituted and maintain policies and procedures designed to ensure compliance therewith.

No part of the proceeds of the offering will be used, directly or indirectly, in violation of the Foreign Corrupt Practices Act of 1977,

the UK Bribery Act or the Corruption of Foreign Public Officials Act (Canada), each as may be amended, or similar law of any other

relevant jurisdiction, or the rules or regulations thereunder;

(ii) The

operations of the Parent and the Parent’s subsidiaries are and have been conducted (i) at all times and in all material respects

in compliance with applicable financial recordkeeping and reporting requirements and (ii) at all times in compliance with the money

laundering statutes and the rules and regulations thereunder and any related or similar rules, regulations or guidelines, issued,

administered or enforced by any governmental agency (collectively, the “Money Laundering Laws”) and no action, suit

or proceeding by or before any court or governmental agency, authority or body or any arbitrator involving the Parent or any of the Parent’s

subsidiaries with respect to the Money Laundering Laws is pending or, to the best knowledge of BFI or the Parent, threatened;

(jj) Neither

the Parent nor any of the Parent’s subsidiaries nor, to the knowledge of BFI or the Parent, any director, officer, agent or employee

of the Parent or any of the Parent’s subsidiaries (i) is, or is controlled by or is acting on behalf of, an individual or

entity that is currently the subject of any sanctions administered or enforced by the United States (including any sanctions administered

or enforced by the Office of Foreign Assets Control of the U.S. Department of the Treasury, the U.S. Department of State or the Bureau

of Industry and Security of the U.S. Department of Commerce), Canada (including sanctions administered or enforced by Global Affairs

Canada or Public Safety Canada), the European Union, His Majesty’s Treasury, the United Nations Security Council or other relevant

sanctions authority (collectively, “Sanctions” and such persons, “Sanctioned Persons” and each

such person, a “Sanctioned Person”), (ii) is located, organized or resident in a country or territory that, from

time to time, is, or whose government is, the subject or target of Sanctions that broadly prohibit dealings with that government, country

or territory (collectively, the “Sanctioned Countries” and each, a “Sanctioned Country”), or (iii) will

directly, or knowingly indirectly, use the proceeds of this offering, or lend, contribute or otherwise make available such proceeds to

any subsidiary, joint venture partner or other individual or entity in any manner that would result in a violation of any Sanctions by,

or could result in the imposition of Sanctions against, any individual or entity (including any individual or entity participating in

the offering, whether as underwriter, advisor, investor or otherwise); and

(kk) Each

of BFI’s, the Parent’s and their respective subsidiaries’ information technology assets and equipment, computers, systems,

networks, hardware, software, websites, applications, and databases (collectively, “IT Systems”) are adequate for,

and operate and perform in all material respects as required in connection with the operation of the business of BFI, the Parent and

their respective subsidiaries as currently conducted and, to the best of BFI’s, the Parent’s and their respective subsidiaries’

knowledge, are free and clear of all material bugs, errors, defects, Trojan horses, time bombs, malware and other corruptants. BFI, the

Parent and their respective subsidiaries have implemented and maintained commercially reasonable controls, policies, procedures, and

safeguards to maintain and protect their material confidential information and the integrity, continuous operation, redundancy and security

of all IT Systems and data (including all personal, personally identifiable, sensitive, confidential or regulated data (“Personal

Data”)) used in connection with their businesses, and, to the best of BFI’s, the Parent’s and their respective

subsidiaries’ knowledge there have been (i) no breaches, violations, outages or unauthorized uses of or accesses to the same,

except for those that have been remedied without material cost or liability or the duty to notify any other person, and (ii) no

incidents under internal review or investigations relating to the same, except where such breach, violation, outage, unauthorized use

or access, or incidents under internal review or investigation relating to the same, would not be reasonably expected to have, individually

or in the aggregate, a Material Adverse Effect. BFI, the Parent and their respective subsidiaries are presently in material compliance

with all applicable laws or statutes and all applicable judgments, orders, rules and regulations of any court or arbitrator or governmental

or regulatory authority having jurisdiction over BFI, the Parent and their respective subsidiaries, and all internal policies and contractual

obligations relating to the privacy and security of IT Systems and Personal Data and to the protection of such IT Systems and Personal

Data from unauthorized use, access, misappropriation or modification.

Any certificate signed by any officer of BFI or

the Parent, respectively, and delivered to the Representatives or counsel for the Underwriters in connection with the offering of the

Securities shall be deemed a representation and warranty by BFI or the Parent, respectively, as to matters covered thereby, to each Underwriter.

2. Purchase

and Sale. Subject to the terms and conditions and in reliance upon the representations and warranties herein set forth, BFI agrees

to sell to each Underwriter, and each Underwriter agrees, severally and not jointly, to purchase from BFI, at the Price to Public and

Reopening Price to Public, as applicable, set forth in Schedule I hereto, the principal amount of the Notes set forth opposite

such Underwriter’s name in Schedule II hereto. On the Closing Date, BFI will pay, as an underwriting commission in

respect of the public distribution of the Securities, to the Underwriters, the commission set forth in Schedule I hereto

(the “Underwriting Commission”). Such Underwriting Commission may be paid by BFI to the Underwriters by setting off

the Underwriting Commission payable by BFI to the Underwriters against the amount payable by the Underwriters to BFI as the purchase

price for the Securities.

3. Delivery

and Payment. Delivery of and payment for the Securities shall be made on the date and at the time specified in Schedule I

hereto or at such time on such later date not more than three Business Days after the foregoing date as the Representatives shall

designate, which date and time may be postponed by agreement between the Representatives and BFI or as provided in Section 9

hereof (such date and time of delivery and payment for the Securities being herein called the “Closing Date”).

Delivery of the Securities shall be made to the Representatives for the respective accounts of the several Underwriters against payment

by the several Underwriters through the Representatives of the purchase price thereof to or upon the order of BFI by wire transfer payable

in same-day funds to an account specified by BFI. Delivery of the Securities shall be made through the facilities of The Depository Trust

Company unless the Representatives shall otherwise instruct.

4. Offering

by Underwriters.

(a) The

several Underwriters will only offer the Securities for sale to the public as set forth in the U.S. Final Prospectus and the Canadian

Final Prospectus.

(b) The

Underwriters shall offer the Securities for sale to the public directly and through banking and selling group members, only as permitted

by and in compliance with Applicable Securities Laws, upon the terms and conditions set forth in the Canadian Final Prospectus and the

U.S. Final Prospectus, as applicable, and in this Agreement. Each of the Underwriters hereby severally represents, warrants and covenants

and will require each banking and selling group member to represent, warrant and covenant to the Underwriters that: (a) other than

the Canadian Final Prospectus and the June 2024 Marketing Materials (modified as permitted by sections 9A.3(2) and 9A.3(3) of

NI 44-102), it has not provided and will not without the prior written approval of BFI and the Representatives provide any information

in respect of the Securities to any potential investors of the Securities resident in Canada including, without limitation: (i) marketing

materials in respect of the Securities; and (ii) a standard term sheet in respect of the Securities; and (b) it will provide

a copy of the Canadian Base Prospectus and any applicable shelf prospectus supplement and amendment that has been filed with any marketing

materials (including the June 2024 Marketing Materials) that are provided to a potential investor of the Securities resident in

Canada.

(c) The

Underwriters propose to offer the Securities initially at the price set forth in Schedule I hereto. After a reasonable effort

has been made to sell all of the Securities at the price set forth in Schedule I hereto, the Underwriters may subsequently

reduce and thereafter change, from time to time, the price at which the Securities are offered; provided that the Securities are

not at any time offered at a price greater than the price set forth in Schedule I hereto. Any decrease in the price at which

the Securities are offered will not decrease the amount of the net proceeds of the offering to BFI.

(d) The

Underwriters will not solicit offers to purchase or sell Securities so as to require registration thereof or the filing of a prospectus,

registration statement or other notice or document with respect thereto under the laws of any jurisdiction other than the Qualifying

Provinces and the United States, or which could subject BFI or the Parent to reporting obligations in any such jurisdiction or result

in the listing of BFI’s or the Parent’s securities on any exchange other than an exchange where such securities are listed

as of the date hereof, and will require each banking and selling group member to agree with the Underwriters not to so solicit or sell;

provided that the Underwriters and the banking and selling groups may offer and sell the Securities outside of the Qualifying

Provinces and the United States if such offer and sale is conducted in compliance with the securities laws of such jurisdictions and

does not require BFI or the Parent to file any prospectus, registration statement or other notice or document in connection with such

offer and sale or subject BFI or the Parent to reporting obligations in any such jurisdiction or result in the listing of BFI’s

or the Parent’s securities on any exchange other than an exchange where such securities are listed as of the date hereof.

(e) Each

Underwriter shall notify the Representatives, and the Representatives shall notify BFI and the Parent, in writing, of the aggregate principal

amount of Securities sold in each of the Qualifying Provinces as soon as possible after the distribution of the Securities has been completed,

and in any event no later than 30 days following the date on which such distribution has been completed.

(f) For

the avoidance of doubt, Deutsche Bank Securities Inc., BofA Securities, Inc., Citigroup Global Markets Inc., Morgan Stanley &

Co. LLC, Banco Bradesco BBI S.A., BNP Paribas Securities Corp., Desjardins Securities Inc., Itau BBA USA Securities, Inc.,

Mizuho Securities USA LLC, MUFG Securities Americas Inc., National Bank of Canada Financial Inc., Natixis Securities Americas LLC, Santander

US Capital Markets LLC and SG Americas Securities, LLC are not acting as underwriters of the Securities in any province or territory

of Canada and no action on their part in their capacity as underwriters of the offering of Securities in the United States will create

any impression or support any conclusion that they are acting as underwriters of the Securities in any province or territory of Canada.

Merrill Lynch Canada Inc., a broker-dealer affiliate of BofA Securities, Inc., will be acting as underwriter of the Securities in

the provinces of Canada.

5. Agreements.

BFI and the Parent jointly and severally agree with each of the several Underwriters that:

(a) Prior

to the termination of the offering of the Securities, neither BFI nor the Parent will file any amendment of the Registration Statement

or supplement (including the U.S. Final Prospectus, the Canadian Final Prospectus or any U.S. or Canadian Preliminary Prospectus) to

the U.S. or Canadian Base Prospectus as the case may be, unless BFI has furnished you a copy for your review prior to filing and will

not file any such proposed amendment or supplement to which you reasonably object. BFI and the Parent will prepare a supplement to the

Canadian Base Prospectus in accordance with the requirements of Canadian Securities Law and a supplement to the U.S. Base Prospectus

consisting of the supplement to the Canadian Base Prospectus modified as required or permitted by Form F-10, in each case in a form

approved by the Representatives and (i) BFI will file such supplement to the Canadian Base Prospectus with the Qualifying Authorities

pursuant to Canadian Securities Law not later than the close of business on the second Business Day following the execution and delivery

of this Agreement or, if applicable, such earlier time as may be required by Canadian Securities Law, and (ii) BFI and the Parent

will file such supplement to the U.S. Base Prospectus with the Commission pursuant to General Instruction II.L. of Form F-10 not

later than the Commission’s close of business on the next Business Day following such filing with the Qualifying Authorities or,

if applicable, such earlier time as may be required by such General Instruction II.L. of Form F-10 or as may be required by Canadian

Securities Law; to make no further amendment or supplement to the Registration Statement, the U.S. Base Prospectus, the Canadian Base

Prospectus, the U.S. Preliminary Prospectus or the Canadian Preliminary Prospectus after the date of this Agreement and prior to the

Closing Date unless such amendment or supplement is approved by the Representatives after reasonable notice thereof (which approval shall

not be unreasonably withheld); to advise the Representatives promptly of any such amendment or supplement relating to, or affecting,

the Securities after such Closing Date and furnish the Representatives with copies thereof; to file promptly with the Qualifying Authorities

all necessary marketing materials required to be filed under Canadian Securities Law and all documents required to be filed by BFI and

the Parent with the Qualifying Authorities that are deemed to be incorporated by reference into the Canadian Base Prospectus and the

U.S. Base Prospectus and with the Commission all reports and any definitive proxy or information statements required to be filed by BFI

or the Parent with the Commission pursuant to Section 13(a), 13(c) or 15(d) of the Exchange Act, in each case, for so

long as the delivery of a prospectus is required in connection with the offering or sale of such Securities, and during such same period

to advise the Representatives, promptly after it receives notice thereof, of the time when any amendment to the Canadian Base Prospectus,

the U.S. Base Prospectus or the Registration Statement has been filed or becomes effective or any supplement to the Canadian Base Prospectus,

the U.S. Base Prospectus, the Canadian Final Prospectus, the U.S. Final Prospectus or any amended prospectus has been filed with the

Qualifying Authorities or the Commission, of the issuance by any Qualifying Authority or the Commission of any stop order or of any order

preventing or suspending the use of any prospectus, relating to the Securities, of the suspension of the qualification of such Securities

for offering or sale in any jurisdiction, of the initiation or threatening of any proceeding for any such purpose, or of any request

by any Qualifying Authority or the Commission for the amending or supplementing of the Canadian Base Prospectus, the U.S. Base Prospectus,

the Registration Statement, the Canadian Final Prospectus, the U.S. Final Prospectus or for additional information relating to the Securities,

the Canadian Base Prospectus, the U.S. Base Prospectus, the Registration Statement, the Canadian Final Prospectus or the U.S. Final Prospectus;

and, in the event of the issuance of any such stop order or of any such order preventing or suspending the use of any prospectus relating

to the Securities or suspending any such qualification, to use promptly its best efforts to obtain its withdrawal.

(b) BFI

shall deliver to the Representatives’ counsel prior to or contemporaneously, as nearly as practicable, with the filing with the

Qualifying Authorities of the Canadian Final Supplement for the offering of the Securities, a copy of the following for each of the Representatives

and Representatives’ counsel:

(i) the

Canadian Final Prospectus, in the English and French languages as filed with the Qualifying Authorities, signed and certified as required

by Canadian Securities Law;

(ii) all

documents, in the English and French languages, incorporated by reference, or containing information incorporated by reference, into

the Canadian Final Prospectus, and any other document required to be filed by BFI or the Parent prior to the filing of the Canadian Final

Supplement under the laws of the Qualifying Provinces in compliance with Canadian Securities Law in connection with the distribution

of the Securities, if such documents have not previously been delivered to the Representatives’ counsel, which documents may be

delivered in electronic form;

(iii) an

opinion dated the date of the Canadian Final Supplement, in form and substance satisfactory to the Representatives acting reasonably,

of Lavery, de Billy, L.L.P. addressed to BFI, the Parent, the Representatives and counsel to BFI and the Parent and the Representatives,

to the effect that the French version of the Canadian Final Prospectus and the documents incorporated by reference therein, in each case,

and except for certain financial statements, auditors reports, accounting or statistical information (including the Historical Financial

Statements) and other numerical data (collectively, the “Financial Information”), is in all material respects a complete

and proper translation of the English version thereof; and

(iv) an

opinion dated the date of the Canadian Final Supplement, in form and substance satisfactory to the Representatives acting reasonably,

of Deloitte LLP, auditors for the Parent, addressed to BFI, the Parent, the Representatives and counsel for BFI, the Parent and the Representatives,

to the effect that the Financial Information contained or incorporated by reference in the French version of the Canadian Final Supplement,

and the documents incorporated by reference therein, is, in all material respects, a complete and proper translation of the Financial

Information contained or incorporated by reference in the English version thereof.

(c) BFI

and the Parent shall prepare a final term sheet, containing solely a description of final terms of the Securities and the offering thereof,

in the form approved by you and attached as Schedule IV hereto and to file such term sheet pursuant to Rule 433(d) within

the time required by such Rule.

(d) If,

at any time prior to the filing of the U.S. Final Prospectus or the Canadian Final Prospectus, any event occurs as a result of which

the Disclosure Package or the Canadian Preliminary Prospectus would include any untrue statement of a material fact or omit to state

any material fact necessary to make the statements therein in the light of the circumstances under which they were made or the circumstances

then prevailing not misleading, BFI will (i) notify promptly the Representatives so that any use of the Disclosure Package and the

Canadian Preliminary Prospectus may cease until they are amended or supplemented; (ii) amend or supplement the Disclosure Package

and the Canadian Preliminary Prospectus to correct such statement or omission; and (iii) supply any amendment or supplement to you

in such quantities as you may reasonably request.

(e) If,

at any time when a prospectus relating to the Securities is required to be delivered under the Act (including in circumstances where

such requirement may be satisfied pursuant to Rule 172) or under Canadian Securities Law, any event occurs as a result of which

the U.S. Final Prospectus or the Canadian Final Prospectus as then supplemented would include any untrue statement of a material fact

or omit to state any material fact necessary to make the statements therein in the light of the circumstances under which they were made

at such time not misleading, or if it shall be necessary to amend the Registration Statement, file a new registration statement or amend

or supplement the U.S. Final Prospectus or Canadian Final Prospectus to comply with the Act or the Exchange Act or the respective rules thereunder

or to comply with Canadian Securities Law, including in connection with the use or delivery of the U.S. Final Prospectus or the Canadian

Final Prospectus, (i) BFI promptly will notify the Representatives of any such event, (ii) BFI and the Parent promptly will

prepare and file with the Commission, subject to the second sentence of paragraph (a) of this Section 5,

an amendment or supplement or new registration statement which will correct such statement or omission or effect such compliance, (iii) BFI

and the Parent promptly will each use its respective best efforts to have any amendment to the Registration Statement or new registration

statement declared effective as soon as practicable in order to avoid any disruption in the use of the U.S. Final Prospectus or, in the

case of the Canadian Final Prospectus, use its respective best efforts to obtain a Receipt for any amendment to the Canadian Final Prospectus

from the Principal Regulator as soon as practicable in order to avoid any disruption in the use of the Canadian Final Prospectus and

(iv) BFI promptly will supply any amended or supplemented U.S. Final Prospectus and Canadian Final Prospectus to you in such quantities

as you may reasonably request.

(f) As

soon as practicable, the Parent will make generally available to its security holders and to the Representatives an earnings statement

or statements of the Parent and its subsidiaries which will satisfy the provisions of Section 11(a) of the Act and Rule 158.

(g) BFI

and the Parent will furnish to the Representatives and counsel for the Underwriters, without charge, signed copies of the Registration

Statement and of the Canadian Final Prospectus (including exhibits thereto) and to each other Underwriter a copy of the Registration

Statement (without exhibits thereto) and of the Canadian Final Prospectus and, so long as delivery of a prospectus by an Underwriter

or dealer may be required by the Act (including in circumstances where such requirement may be satisfied pursuant to Rule 172) or

by Canadian Securities Law, as many copies of the U.S. Preliminary Prospectus, the U.S. Final Prospectus, the Issuer Free Writing Prospectus,

the Canadian Preliminary Prospectus, the Canadian Final Prospectus and any amendment or supplement thereto as the Representatives may

reasonably request. BFI and the Parent will pay the expenses of printing or other production of all documents relating to the offering.

(h) Each

of BFI and the Parent agrees that, unless it has or shall have obtained the prior written consent of the Representatives, and each Underwriter,

severally and not jointly, agrees with BFI and the Parent that, unless it has or shall have obtained, as the case may be, the prior written

consent of BFI or the Parent, it has not made and will not make any offer relating to the Securities that would constitute an Issuer

Free Writing Prospectus or that would otherwise constitute a “free writing prospectus” (as defined in Rule 405) required

to be filed by BFI or the Parent with the Commission or retained by BFI or the Parent under Rule 433, other than a free writing

prospectus containing the information contained in the final term sheet prepared and filed pursuant to Section 5(c) hereto;

provided that the prior written consent of the parties hereto shall be deemed to have been given in respect of the Free Writing

Prospectuses included in Schedule III hereto and any electronic road show. Any such free writing prospectus consented to

by the Representatives or BFI or the Parent is hereinafter referred to as a “Permitted Free Writing Prospectus.” Each

of BFI and the Parent agrees that (x) it has treated and will treat, as the case may be, each Permitted Free Writing Prospectus

as an Issuer Free Writing Prospectus and (y) it has complied and will comply, as the case may be, with the requirements of Rules 164

and 433 applicable to any Permitted Free Writing Prospectus, including in respect of timely filing with the Commission, legending and

record keeping.

(i) BFI

and the Parent will not, without the prior written consent of the Representatives, offer, sell, contract to sell, pledge, or otherwise

dispose of (or enter into any transaction which is designed to, or might reasonably be expected to, result in the disposition (whether

by actual disposition or effective economic disposition due to cash settlement or otherwise) by BFI or the Parent or any affiliate of

BFI or the Parent or any person in privity with BFI or the Parent or any affiliate of BFI or the Parent), directly or indirectly, including

the filing (or participation in the filing) of a registration statement with the Commission in respect of, or establish or increase a

put equivalent position or liquidate or decrease a call equivalent position within the meaning of Section 16 of the Exchange Act,