NetworkNewsWire

Editorial Coverage: The impressive increase of electric

vehicles (EV) is creating a significant increase in demand battery

minerals, a demand that is fueling growth for mining companies,

especially for those with operations in Indonesia, one of the

world’s top producers of battery minerals.

Bolt Metals Corporation (CSE: BOLT) (OTCQB: PCRCF)

(XFRA: NXFE) (BOLT

Profile), one of the companies working in Indonesia,

recently announced a name change as it rebrands itself a leading

resource developer in this growing market. Several leading auto

makers are contributing to the surging EV market as they focus on

manufacturing quality electric vehicles. For the third year in a

row, Honda Motor Company Ltd. (NYSE: HMC) has

earned the Kelley Blue Book Plug-in Hybrid Car Best Buy with its

Honda Clarity model. Tesla Inc. (NASDAQ: TSLA) has

seen impressive success with its Tesla Model 3, which is one of the

best-selling cars in Europe. Toyota Motor Corporation

(NYSE: TM) just announced plans to build a new electric

vehicle plant in China. And Toyota is partnering with

Panasonic Corp ADR (OTC: PCRFY) to establish Prime

Planet Energy & Solutions, Inc., a joint venture specializing

in automotive prismatic batteries.

- Growth of EV industry expected to create two- or three-fold

increases in demand for battery minerals over the next decade.

- Home to 25% of the world’s nickel resources, Indonesia is

essential source of key minerals.

- China leads world EV-battery production; critical market for

battery minerals.

- Indonesia recognizes opportunity, focused on developing own EV

industry.

To view an infographic of this editorial, click here.

Electric Vehicles Drive Battery Metal

Market

The last decade saw significant trends in technology; some of

the most significant interest and growth was focused on the EV

industry. Once a pipe dream of green technologists, electric

vehicles enjoyed tremendous growth in the past decade. By 2018,

global EV sales had reached 2 million units, and that number is

expected to double to 4 million in 2020. In addition, the

once-lofty price of these vehicles is falling, and their battery

packs could be cheaper than equivalent combustion-engine models as

early as 2022.

This momentum is causing huge growth in the market for the

metals used in EV batteries. Industry experts

predict that the EV market will need around 1.3 million tons of

nickel each year by 2030, compared with 600,000 tons in 2018.

Cobalt is facing a similar rise in demand, with experts predicting

a 332% increase in global supply from its 2017 levels, to 314,000

tons per annum.

Changing Brands for a Changing Market

This growing market is driving changes in companies working in

the industry, a movement reflected in the changing strategies and

branding of business-savvy mining companies such as

Bolt Metals

Corp. (CSE: BOLT) (OTCQB: PCRCF) (XFRA: NXFE). Bolt

Metals recently announced a name change from Pacific Rim Cobalt

Corp., which is part of the company’s rebranding campaign.

To outsiders, name changes like this can look like little more

than window dressing. But for observant investors, and for those on

the inside of these changes, they often represent significant

shifts in focus. While Bolt Metals isn’t dividing or merging with

another company, its name change reflects a steady shift in line

with global markets.

“Rebranding the company is an important step in our emergence as

a resource developer in Asia’s expanding electric vehicle supply

chain,” said Bolt Metals CEO Ranjeet Sundher. “The company remains

focused on acquiring and developing production-grade, battery-metal

projects within the Asia Pacific region, while employing a

vertically integrated ‘mineral‐to‐market’ strategy to leverage

these assets to their fullest.”

Bolt Metals has been transitioning from its initial position as

a cobalt producer and moving into a broader position as a

battery-cathode material supplier. BOLT’s Cyclops mining project in northern Indonesia, a rich

source of cobalt and nickel, plays a significant part in this

transition.

But it’s the mine’s location, as much as its resources, that is

creates potential for the Cyclops project, a new direction for

Bolts Metals and a reflection of bigger changes in the EV

market.

Indonesia: The New Electric Vehicle Hub?

Indonesia boasts a rich supply of the mineral resources that the

EV industry needs. The country provides 25% of the world’s nickel

reserves as well as other metals such as cobalt. These are crucial

metals in the production of EV batteries and, therefore, in the

entire supply chain for these vehicles.

Bolt Metals’ Cyclops mining operation is designed to tap into

these valuable resources. Throughout 2019, the company has been

involved in surveys and test drilling, in addition to assessing

existing records on the mineral resources at a site in Papua

Province, on the north coast of Indonesia. This concentrated

research has confirmed the

presence of significant high-quality deposits near ground

surface at the site. TAs Bolt Metals moves forward with plans for

extraction, testing and processing, the company does so secure in

the knowledge that the minerals are not only present but easily

accessible.

The richness of Indonesia’s mineral deposits isn’t the only

reason for the country’s growing prominence in the EV supply chain.

Indonesia’s location on the rim of the Pacific gives the country a

straight nautical transport route to Japan, a major player in

developing new technology, and China. China is developing its own

battery industry, focused on becoming a leader in the production of

power cells to be used in all sorts of products. Both countries

represent significant markets for EV minerals, markets to which

Indonesia can easily cater because of its favorable geographic

location.

The Indonesian government is leveraging its advantages as it

actively works to strengthen its EV industry. Last year, Indonesian

president Joko Widodo signed a decree outlining

the government’s support for Indonesian EV production. The plan

includes reduced tariffs for companies importing equipment for EV

production, thereby making it easier for the industry to grow. New

regulations are creating a profitable space for companies such as

Bolt Metals.

Feeding the Chinese Battery Market

While domestic EV plays a critical part in Indonesia’s strategy,

the country is still open and welcoming to other markets. In fact,

several major Chinese companies are following a similar path to

Bolts Metal, investing in the Indonesian mineral industry to ensure

the supplies they need for battery production.

The significance of China in the global battery market cannot be

overstated. According to

research by Benchmark Mineral Intelligence, 88 out of 115

lithium-ion-battery megafactories around the world are located in

China. The country has carefully positioned itself as the center of

the global technology supply chain. Previously China’s power has

been most obvious in consumer electronics, but it is becoming

increasingly evident that the country is playing an important role

in the rise of EV, as reflected in deals such as

the that between Tesla and Chinese battery maker Contemporary

Amperex Technology Co Ltd.

For companies operating in Indonesia, such as Bolt Metals, this

represents a double opportunity. First, companies can become

involved in the foundation of an integrated EV market within

Indonesia, in which minerals can be delivered quickly and easily to

a fast-growing market. Second, companies can become involved in

exporting to China, perhaps the largest market for these minerals

in the world.

With rich mineral deposits and two substantial markets, Bolt

Metals and other battery-mineral companies in Indonesia are

anticipating a bright future.

A Critical Industry

The burgeoning EV industry is at the center of this bright

future, with the top auto makers around the world rising to the

challenge of producing high-quality, eco-friendly vehicles.

Honda Motor Company Ltd.’s (NYSE: HMC) Honda

Clarity has been available for three years — and has earned the

Kelley Blue Book Plug-in Hybrid Car Best Buy all three years

(http://nnw.fm/9uZGz). “Launched new for the

2018 model year, the Honda Clarity is offered in three very

distinct variants: pure electric, fuel cell, and PHEV,” Kelley

noted when announcing the honor. “While this jack-of-all-trades

assortment of powertrains may sound like Honda has made

compromises, just the opposite is true — the Clarity was engineered

as a clean-sheet design with each of those unique models in mind.

As a result, driving dynamics are excellent, cargo space and

interior utility impressive, and passenger concessions are few and

far between.”

Tesla Inc. (NASDAQ: TSLA) has seen impressive

success with its Tesla Model 3, which is one of the best-selling

cars in Europe. “Until recently European auto executives regarded

Tesla with something like bemusement,” a recent New York

Times article reported (http://nnw.fm/6duIU). “The electric car upstart from

California was burning cash, struggling with production problems,

and hedge funds were betting it would fail. The car executives are

not laughing anymore. Almost overnight, the Tesla Model 3 has

become one of the best-selling cars in Europe. In December, only

the Volkswagen Golf and Renault Clio sold more, according to data

compiled by JATO Dynamics, a market research firm.”

Recognizing the EV wave of the future, Toyota Motor

Corporation (NYSE: TM) recently announced plans to partner

with First Automobile Works (FAW) to build an electric vehicle

plant in Tianjin, China (http://nnw.fm/i9cHu). The two companies will invest

about $1.22 billion in the plant, which is expected to produce

200,000 battery-only, plug-in hybrid and fuel-cell vehicles

annually. This news follows the launch of care maker’s C-HR and

IZOA models, the first battery-electric vehicles to launch in China

under the Toyota brand.

Toyota is also partnering with Panasonic Corp.

ADR (OTC: PCRFY) to establish Prime

Planet Energy & Solutions Inc., a joint venture specializing in

automotive prismatic batteries (http://nnw.fm/buM6E). The joint venture will focus on

developing highly competitive, cost-effective batteries that offer

excellent quality and performance in terms of capacity, output and

durability. The joint venture will supply batteries not only to

Toyota but also to all customers.

With the demand for electric vehicles increasing significantly,

mineral producers are seizing the opportunities found in a growing

battery industry.

For more information on Pacific Rim Cobalt Corp., visit Pacific Rim

Cobalt Corp. (CSE:BOLT) (OTCQB:PCRCF) (XFRA:NXFE)

About NetworkNewsWire

NetworkNewsWire

(“NNW”) is a financial news and content distribution company, one

of 40+ brands within the InvestorBrandNetwork (“IBN”), that

provides: (1) access to a network of wire

solutions via NetworkWire to

reach all target markets, industries and demographics in the most

effective manner possible; (2) article and

editorial syndication to 5,000+ news outlets; (3)

enhanced press release solutions to ensure maximum

impact; (4) social media distribution via IBN

millions of social media followers; and (5) a full

array of corporate communications solutions. As a multifaceted

organization with an extensive team of contributing journalists and

writers, NNW is uniquely positioned to best serve private and

public companies that desire to reach a wide audience comprising

investors, consumers, journalists and the general public. By

cutting through the overload of information in today’s market, NNW

brings its clients unparalleled visibility, recognition and brand

awareness. NNW is where news, content and information converge.

To receive SMS text alerts from NetworkNewsWire, text

“STOCKS” to 77948 (U.S. Mobile Phones Only)

For more information, please visit https://www.NetworkNewsWire.com

Please see full terms of use and disclaimers on the

NetworkNewsWire website applicable to all content provided by NNW,

wherever published or re-published: http://NNW.fm/Disclaimer

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

NetworkNewsWire is part of the InvestorBrandNetwork

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by NNW are

solely those of NNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable NNW for any investment

decisions by their readers or subscribers. NNW is a news

dissemination and financial marketing solutions provider and are

NOT registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, NNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer’s filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer’s securities, including, but not

limited to, the complete loss of your investment.

NNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and NNW undertakes no

obligation to update such statements.

Source:

NetworkNewsWire

Contact:

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

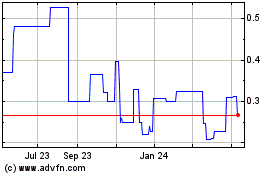

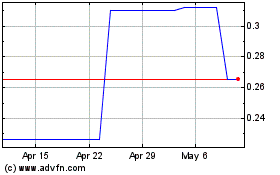

Bolt Metals (QB) (USOTC:PCRCF)

Historical Stock Chart

From Nov 2024 to Dec 2024

Bolt Metals (QB) (USOTC:PCRCF)

Historical Stock Chart

From Dec 2023 to Dec 2024