false

0001483646

0001483646

2024-10-30

2024-10-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(D)

OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

October 30, 2024

BLACKSTAR ENTERPRISE GROUP, INC.

(Exact name of Registrant as specified in its

charter)

| Delaware |

000-55730 |

27-1120628 |

| (State or Other Jurisdiction of Incorporation or Organization) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

4450 Arapahoe Ave., Suite 100

Boulder, CO 80303

(Address of Principal Executive Offices)

(303) 500-3210

(Registrant’s Telephone Number, Including

Area Code)

________________________________________

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

[_] Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

[_] Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

[_] Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

[_] Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| N/A |

N/A |

N/A |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter)

Emerging Growth Company /X/

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive

Agreement

On October 29, 2024, BlackStar Enterprise Group,

Inc. ("BEGI", "BlackStar", or the "Company") entered into a proposed settlement for purchase of $861,539.26 of debt owed to BlackStar's

creditors. Under the terms of the Settlement Agreement and Stipulation ("Settlement Agreement") discussed below, Continuation

Capital, Inc. ("CCI") agreed to purchase the bona fide and outstanding and unpaid creditor claims in exchange for shares of BlackStar's

common stock in a State court approved transaction in compliance with the terms of Section 3(a)(10) of the Securities Act of 1933,

as amended. The Settlement Agreement was subject to the State court fairness hearing pursuant to the requirements of Section 3(a)(10)

of the Securities Act of 1933, as amended, and was approved on October 30, 2024. Enclave Capital LLC ("Enclave") acted as placement

agent and secured Continuation Capital, Inc., a Delaware corporation, as a purchaser for BlackStar's debt.

If satisfied in full, pursuant to the Settlement

Agreement, the Company shall reduce the Company's debt obligations in exchange for the issuance of shares of Company's common

stock to CCI at a discount off the market price as disclosed in the Settlement Agreement, in one or more tranches, pursuant to

the terms of section 3(a)(l0) of the Securities Act of 1933, as amended. The Settlement Agreement allows Continuation Capital

to purchase debt that we owe to our creditors through direct purchase of the debts from our creditors and convert such debt into

shares of our common stock at a reduction of forty-two and a half percent (42.5%) off the lowest closing sale price for twenty

(20) trading days as disclosed in the Settlement Agreement prior to the date of conversion for each tranche of debt purchased.

Upon closing, the Company will immediately issue 60,200,000 freely trading shares pursuant to Section 3(a)(10) of the Securities

Act to CCI.

The Settlement Agreement contains a condition that

Continuation Capital, Inc., will not be allowed to hold more than 4.99% of BlackStar's issued and outstanding common stock at

any time. Pursuant to the Settlement Agreement, for the liabilities purchased by Continuation Capital, Inc., we may issue shares

of our common stock pursuant to an exemption from registration afforded by Section 3(a)(l0) of the Securities Act of 1933 to Continuation

Capital, Inc. No relationship exists between the Company and CCI or Enclave, other than by entry into the agreement discussed

herein.

The foregoing is a summary of the terms of the Settlement

Agreement and are qualified in their entirety by the Settlement Agreement that is attached hereto and incorporated herein as Exhibit

10.1. The Order Granting Approval of the Settlement Agreement is attached as Exhibit 10.2.

Item 3.02

Unregistered Sales of Equity Securities

Although the debt will be exchanged for shares of

common stock in tranches, it is foreseeable that the total number of securities issued in the 3(a)(10) transaction will exceed

5% of the current outstanding securities. The Company and CCI executed the Settlement Agreement in accordance with and in reliance

upon the exemption from securities registration for offers and sales to accredited investors afforded, inter alia, by section

3(a)(10) of the Securities Act of 1933, as amended. CCI understands that the Securities are being offered for exchange in reliance

on specific exemptions from the registration requirements of the 1933 Act and state securities laws and that the Company is relying

upon the truth and accuracy of, and CCI's compliance with, the representations, warranties, agreements, acknowledgments and understandings

of CCI set forth in the Settlement Agreement in order to determine the availability of such exemptions and the eligibility of

CCI to acquire the Securities.

See the disclosures under

Item 1.01 of this Current Report on Form 8-K, incorporated herein by this reference.

Item 7.01 Regulation

FD Disclosure.

Press Release

The information in this

Item 7.01 of this Current Report is furnished pursuant to Item 7.01 and shall not be deemed "filed" for any purpose, including

for the purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that Section.

The information in this

Current Report on Form 8-K shall not be deemed incorporated by reference into any filing under the Securities Act or the Exchange

Act regardless of any general incorporation language in such filing.

On November 5, 2024,

the Company issued a press release entitled "Blockchain Technology Company BlackStar Secures Institutional Investor for Debt Repayment,

Seeks Valuation and Eyes Revenue Possibilities Through IP Licensing" A copy of the press release is attached hereto as Exhibit

99.

Item 9.01

Exhibits

The following

exhibits are filed with this report on Form 8-K.

| Exhibit

Number |

|

|

Exhibit |

| 10.1 |

|

|

Settlement

Agreement |

| 10.2 |

|

|

Order

Approving Settlement Agreement |

| 99 |

|

|

Press Release |

| 104 |

|

|

Cover Page Interactive Data File (embedded

within the Inline XBRL document)

|

SIGNATURES

Pursuant to

the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf

by the undersigned, hereunto duly authorized.

BLACKSTAR

ENTERPRISE GROUP, INC.

By: /s/ Joseph Kurczodyna

_____________________________________________

Joseph

Kurczodyna, Chief Executive Officer

Date:

November 5, 2024

Exhibit 10.1

SETTLEMENT AGREEMENT AND STIPULATION

THIS SETTLEMENT AGREEMENT and STIPULATION is dated as of October 29, 2024 by and between BlackStar Enterprise Group, Inc. (“BEGI”

or the “Company”), a corporation formed under the laws of the State of Delaware, and Continuation Capital, Inc., (“CCI”),

a Delaware Corporation.

BACKGROUND:

WHEREAS, there are bona fide outstanding liabilities of the Company in the principal amount of not less than $861,539.26

(Subject to any applicable discounts pursuant to the annexed Claim Purchase Agreements) and

WHEREAS, these liabilities are in default or past due; and

WHEREAS, CCI acquired such liabilities on the terms and conditions set forth in the annexed Claim Purchase Agreement(s),

subject however to the agreement of the Company and compliance with the provisions hereof; and

WHEREAS, CCI and BEGI desire to resolve, settle, and compromise among other things the liabilities as more particularly

set forth on Schedule A and the Claims Purchase Agreements and debt instruments attached and annexed thereto and incorporated

herein (hereinafter collectively referred to as the “Claims”).

NOW, THEREFORE, the parties hereto agree as follows:

1. Defined Terms. As used in this Agreement, the following terms shall have the following

meanings specified or indicated (such meanings to be equally applicable to both the singular and plural forms of the terms defined):

"AGREEMENT" shall have the meaning specified in the preamble hereof.

“CLAIM AMOUNT” shall mean $861,539.26 (Subject to any applicable discounts pursuant to the annexed Claims

Purchase Agreements).

"COMMON STOCK" shall mean the Company's common stock, $.001 par value per share, and any shares of any other class of

common stock whether now or hereafter authorized, having the right to participate in the distribution of dividends (as and

when declared) and assets (upon liquidation of the Company).

“COURT” shall mean Circuit Courts within the Twelfth Judicial Circuit of Florida.

"DISCOUNT" shall mean forty two and one half (42.5%).

“DRS” shall have the meaning specified in Section 3b.

"DTC" shall have the meaning specified in Section 3b.

"DWAC" shall have the meaning specified in Section 3b.

"FAST" shall have the meaning specified in Section 3b.

“SALE PRICE” shall mean the Sale Price of the Common Stock on the Principal Market.

"MARKET PRICE" on any given date shall mean the lowest Sale Price during the Valuation Period.

"PRINCIPAL MARKET" shall mean the Nasdaq National Market, the Nasdaq SmallCap Market, OTC Markets, OTC Pink, the Over-the-Counter

Bulletin Board, QB marketplace, the American Stock Exchange or the New York Stock Exchange, whichever is at the time the principal

trading exchange or market for the Common Stock.

"PURCHASE PRICE" shall mean the Market Price during the Valuation Period (or such other date on which the Purchase Price

is calculated in accordance with the terms and conditions of this Agreement) less the product of the Discount and the Market

Price.

“SELLER” shall mean any individual or entity listed on Schedule A, who originally owned the Claims.

"TRADING DAY" shall mean any day during which the Principal Market shall be open for business.

“TRADING PERIOD” shall mean Trading Days during the Valuation Period.

"TRANSFER AGENT" shall mean the transfer agent for the Common Stock (and to any substitute or replacement transfer

agent for the Common Stock upon the Company's appointment of any such substitute or replacement transfer agent).

"VALUATION PERIOD" shall mean the twenty (20) day trading period preceding the share request inclusive of the day of any

Share Request pursuant to this agreement (the “trading period”); provided that the Valuation Period shall be extended as

necessary in the event that (1) the Initial Issuance is delivered in more than one tranche pursuant to Sections 3(a) though

3(c) below, in which case the Valuation Period for each issuance shall be extended to include additional trading days

pursuant to such issuance. The Valuation Period shall begin on the date of any Share Request pursuant to this Agreement, but

shall be suspended to the extent that any subsequent Initial Issuance tranche and/or additional issuance is due to be made

until such date as such Initial Issuance tranche and/or additional issuance is delivered to CCI pursuant to Section

3(b)(iii). Any

period of suspension of the Valuation Period shall be established by means of a written notice from CCI to the Company.

In the event the Settlement Shares and Settlement Fee Shares are not delivered on the same date as the Share Request or Conversion

Notice, the Valuation Period will be extended to the date the Settlement Shares and/or Settlement Fee Shares are “Delivered”.

“Delivered” shall mean the date the shares clear deposit into CCI’s brokerage account, which shall be the date CCI is able to

trade the shares free from restrictions of any kind including by CCI’s Brokerage firm, DTC, Company or Company's Transfer Agent

(the “Extended Valuation Period”). Extending the Valuation Period will not adjust the number of shares delivered but will adjust

the market price, Settlement Shares and the amount the Claim amount is reduced as a result of the conversion, and will be memorialized

by an Amended Share Request or Conversion Notice, which will be submitted to the Company or Company's Transfer Agent by CCI, if

applicable.

2. Fairness Hearing.

Upon the execution hereof, Company and CCI agree, pursuant to Section 3(a)(10) of the Securities Act of 1933 (the “Act”), to expeditiously

submit the terms and conditions of this Agreement to the Court for a hearing on the fairness of such terms and conditions, and

the issuance exempt from registration of the Settlement Shares. This Agreement shall become binding upon the parties only upon

entry of an order by the Court substantially in the form annexed hereto as Exhibit A (the “Order”).

3. Settlement

Shares. Following entry of an Order by the Court in accordance with Paragraph 2 herein and the execution by CCI and

Company of the Stipulation and Order of Dismissal (as defined below) subject to paragraph 7 herein, Company shall issue and

deliver to CCI shares of its Common Stock (the “Settlement Shares”) as follows:

a. In settlement

of the Claims, Company shall initially issue and deliver to CCI, in one or more tranches as necessary subject to paragraph

3(e) and (f) herein, shares of Common Stock (the “Initial Issuance”), subject to adjustment and ownership limitations as set

forth below, sufficient to satisfy the compromised amount at a forty two and one half percent (42.5%) discount to market (the

total amount of the claims divided by the purchase price) based on the market price during the valuation period as defined

herein through the issuance of freely trading securities issued pursuant to Section 3(a)(10) of the Securities Act (the Settlement

Shares”). The Company shall also issue to CCI, on the issuance date(s), Sixty Million Two Hundred Thousand (60,200,000)

freely trading shares pursuant to Section 3(a)(10) of the Securities Act in accordance herewith as a Settlement Fee to offset,

legal fees and costs incurred by CCI in this matter.

b. No later than

the first business day following the date that the Court enters the Order, time being of the essence, Company shall: (i) take

all reasonable action to cooperate with CCI in CCI's causing CCI's legal counsel to issue an opinion to Company's transfer

agent, in form and substance reasonably acceptable to CCI and such transfer agent, that the shares of Common Stock to be

issued as the Initial Issuance and additional issuance and shares issued as a Settlement Fee are legally issued, fully paid

and non-assessable, are exempt from registration under the Securities Act, may be issued without restrictive legend, and may

be resold by CCI without restriction; (ii) transmit via email, facsimile and overnight delivery an irrevocable and

unconditional instruction to Company’s stock transfer agent in the form annexed hereto as Exhibit B; and (iii) issue and

deliver to CCI Settlement Shares and Settlement Fee shares in one or more tranches as necessary, as Direct Registration

Systems (DRS) shares to CCI’s account with the Depository Transfer Company (DTC) or through the Fast Automated Securities

Transfer (FAST) program of DTC’s Deposit/Withdrawal Agent Commission (DWAC) system, without any legends or restrictions on

transfer, sufficient to satisfy the compromised amount along with Settlement Fee shares, through the issuance of freely

trading securities issued pursuant to Section 3(a)10 of the Securities Act. Pursuant to this agreement, CCI may deliver a

request to BEGI either directly or through

Company’s Transfer Agent pursuant to Exhibit “B” which states the dollar amount (designated in U.S. dollars)

of Common Stock to be issued to CCI (the “Share Request” or “Conversion Notice”). The date upon which

the first tranche of the Initial Issuance shares along with any shares issued as a Settlement Fee have been received into

CCI’s account and are available for sale by CCI shall be referred to as the “Issuance Date”. Additionally,

CCI shall be fully responsible for all of the Transfer Agent’s costs for each and every conversion of the Settlement

Shares and Settlement Fee Shares pursuant to this section which shall be promptly paid upon request by said Transfer Agent of

Company. The Company further irrevocably and unconditionally authorizes the Company’s Transfer Agent to provide CCI

with the Company's current Share Structure, including, but not limited to the Company’s current Issued and Outstanding

shares at any time upon the request of CCI to the Company's Transfer Agent.

c. During the

Valuation Period, the Company shall deliver to CCI, through the Initial Issuance and any required additional issuance subject

to paragraph 3(d), (e) and (f) herein that number of shares (the “Final Amount”) with an aggregate value equal to (A) the

sum of the Claim Amount, divided by (B) the Purchase Price. The parties acknowledge that the number of Settlement Shares along

with any Settlement Fee shares to be issued pursuant to this Agreement is indeterminable as of the date of its execution,

and could well exceed the current existing number of shares outstanding as of the date of its execution.

d. At the end of

the Valuation Period, if the sum of the Initial Issuance and any additional issuance is greater than the Final Amount, CCI

shall promptly deliver any remaining shares to Company or its transfer agent for cancellation.

e.

Notwithstanding anything to the contrary contained herein, it is the intention of the parties that the Settlement Shares

along with Settlement Fee shares beneficially owned by CCI at any given time shall not exceed the number of such shares that,

when aggregated with all other shares of Company then beneficially owned by CCI, or deemed beneficially owned by CCI, would

result in CCI owning more than 4.99% of all of such Common Stock as would be outstanding on such date, as determined in

accordance with Section 16 of the Exchange Act and the regulations promulgated thereunder. In compliance therewith, the

Company agrees to deliver the Initial Issuance and any additional issuances in one or more tranches.

f. For

the avoidance of doubt, the price used to determine the number of shares of Common Stock to be delivered pursuant to any

Share Request shall be rounded up to the nearest decimal place of .00001.

4. Necessary Action. At all times after the execution of this Agreement and entry of

the Order by the Court, each party hereto agrees to take or cause to be taken all such necessary action including, without limitation,

the execution and delivery of such further instruments and documents, as may be reasonably requested by any party for such purposes

or otherwise necessary to effect and complete the transactions contemplated hereby.

5. Releases. Upon receipt of all of the Settlement Shares and Settlement Fee shares for

and in consideration of the terms and conditions of this Agreement, and except for the obligations, representations, indemnifications

pursuant to paragraph 15 herein and covenants arising or made hereunder or a breach hereof, the parties hereby release, acquit

and forever discharge the other and each, every and all of their current and past officers, directors, shareholders, affiliated

corporations, subsidiaries, agents, employees, representatives, attorneys, predecessors, successors and assigns (the “Released

Parties”), of and from any and all claims, damages, cause of action, suits and costs, of

whatever nature, character or description, whether known or unknown, anticipated or unanticipated,

which the parties may now have or may hereafter have or claim to have against each other with respect to the Claims. Nothing contained

herein shall be deemed to negate or affect CCI’s right and title to any securities heretofore issued to it by Company or

any subsidiary of Company.

6. Representations. Company hereby represents, warrants and covenants to CCI as follows:

a. There are Two Billion (2,000,000,000) shares of

Common Stock of the Company authorized as of October 4, 2024, of which approximately One Billion Seven Hundred Fifty Seven

Million Three Hundred Sixteen Thousand Nine Hundred Forty-Seven (1,757,316,947) Shares of Common Stock are issued and

outstanding as of October 4, 2024; and Two Hundred Thirteen Million Three Hundred Sixty Thousand Eight Hundred Nineteen

(213,360,819) Shares of Common Stock are available for issuance pursuant hereto;

b. The shares of Common Stock to be issued pursuant to

the Order are duly authorized, and when issued will be duly and validly issued, fully paid and non-assessable, free and clear

of all liens, encumbrances and preemptive and similar rights to subscribe for or purchase securities;

c. The shares will be exempt from registration under the

Securities Act and issuable without any restrictive legend;

d. The Company shall initially reserve from its duly authorized capital

stock a number of shares of Common Stock at least equal to 2 times the greater of the number of shares that could be issued pursuant

to the terms of the Order and that Company shall initially reserve at its transfer agent, at a minimum, Two Billion Five Million

(2,500,000,000) shares during the Valuation Period in order to ensure that it can properly carry out the terms of this agreement,

which may only be released to Company once all of the Settlement Shares and Settlement Fee shares have been delivered and converted

pursuant to this agreement and Company's obligations are otherwise fully satisfied or there has otherwise been a default pursuant

to the terms of this agreement; of this reserve amount, CCI plans on converting this Settlement into that number of shares and

in many instances more shares, should the price go down. In the event that Company effectuates a reverse split of Company's Common

Stock while any obligations are owed to CCI pursuant to this Agreement by Company, then the reserve shares shall be proportionately

adjusted;

e. If at any time it appears reasonably likely that there may be insufficient authorized shares and/or reserve shares to

fully comply with the Order, Company shall promptly increase its authorized shares and/or reserve shares to ensure its

ability to timely comply with the Order; Order;

f. The execution of this Agreement and performance of the Order by Company

and CCI will not (1) conflict with, violate or cause a breach or default under any agreements between Company and any

creditor (or any affiliate thereof) related to the account receivables comprising the Claims, or (2) require any waiver,

consent, or other action of the Company or any creditor, or their respective affiliates, that has not already been obtained;

g. Without limitation, the Company hereby waives any provision in any agreement related to the account receivables comprising

the Claims requiring payments to be applied in a certain order, manner, or fashion, or providing for exclusive jurisdiction

in any court other than this Court;

h. The Company has all necessary power and authority to execute, deliver and perform all

of its obligations under this Agreement;

i. The execution, delivery and performance of this Agreement by Company has been

duly authorized by all requisite action on the part of Company and its Board of Directors (including a majority of its

independent directors), and this Agreement has been duly executed and delivered by Company;

j. Company did not enter into the transaction giving rise to the Claims in contemplation of any sale or

distribution of Company’s common stock or other securities;

k. There has been no modification, compromise, forbearance, or

waiver entered into or given with respect to the Claims. There is no action based on the Claims that is currently pending in

any court or other legal venue, and no judgments based upon the Claims have been previously entered in any legal proceeding

with the exceptions as contained in the Claim Purchase Agreements;

l. There are no taxes due, payable or withholdable as an

incident of Seller’s provision of goods and services, and no taxes will be due, payable or withholdable as a result of

settlement of the Claims;

m. Seller was not and within the past ninety (90) days has not been directly or indirectly through one or more

intermediaries in control, controlled by, or under common control with, the Company and is not an affiliate of the Company as

defined in Rule 144 promulgated under the Act;

n. Company is operational and is a non-shell company within the meaning of Rule 405 and all applicable Securities Rules

and Registration pertaining thereto;

o. Company represents that Seller is not, directly or indirectly, utilizing any of the proceeds received from CCI for

selling the Claims to provide any consideration to or invest in any manner in the Company or any affiliate of the Company;

p. Company has not received any notice (oral or written) from the SEC or Principal Market regarding a halt, limitation or

suspension of trading in the Common Stock; and

q. Seller will not, directly or indirectly, receive any consideration from or be compensated in any manner by, the

Company, or any affiliate of the Company, in exchange for or in consideration of selling the Claims;

r. Company represents that none of the services provided or to be provided which gave rise to the Claims were or are

services related to promoting the Company's Securities or that may be considered investor relations services;

s. Company

represents that each Claim being purchased pursuant hereto is a bona-fide Claim against the Company and that the invoices or

written contract(s)/promissory notes underlying each Claim are accurate representations of the nature of the debt and the

amounts owed by the Company to Seller and that the goods or services which are the subject of the Claims being purchased have

been received or rendered;

t. Company acknowledges that CCI or its affiliates may from time to time, hold outstanding

securities of the Company which may be convertible in shares of the Company’s common stock at a floating conversion rate tied

to the current market price for the stock. The number of shares of Common Stock issuable pursuant to this Agreement may

increase substantially in certain circumstances, including, but not necessarily limited to the circumstance wherein the

trading price of the Common Stock declines during the Valuation Period. The Company’s executive officers and directors have

studied and fully understand the nature of the transaction contemplated by this Agreement and recognize that they have a

potential dilutive effect. The board of directors of the Company has concluded in its good faith business judgment that such

transaction is in the best interests of the Company. The Company specifically acknowledges that its obligation to issue the

Settlement Shares along with settlement fee shares is binding upon the Company and enforceable regardless of the dilution

such issuance may have on the ownership interests of other shareholders of the Company. The Board of Directors of the Company

has further given its consent for each conversion of shares of stock pursuant to this agreement and agrees and consents that

same may occur below the par value of the Company's Common Stock if applicable.

u. None of the transactions agreements or proceedings described above is part of a plan or scheme to evade the

registration requirements of the Securities Act and BEGI and CCI are acting and has acted in an arms length capacity.

7. Continuing Jurisdiction.

Simultaneously with the execution of this Agreement, the attorneys representing the parties hereto will execute a stipulation

of dismissal substantially in the form annexed hereto as Exhibit C (the “Stipulation of Dismissal”). The parties hereto expressly

agree that said Stipulation of Dismissal shall not be filed, but shall be held in escrow by counsel for CCI, until such time that

Company has fully complied with all of its obligations pursuant to this Settlement Agreement and Stipulation. In order to enable

the Court to grant specific enforcement or other equitable relief in connection with this Agreement, (a) the parties consent to

the jurisdiction of the Court for purposes of enforcing this Agreement, and (b) each party to this Agreement expressly waives

any contention that there is an adequate remedy at law or any like doctrine that might otherwise preclude injunctive relief to

enforce this Agreement.

8. Conditions Precedent/

Default.

a. If Company shall default in promptly delivering the Settlement Shares along with any Settlement Fee shares to

CCI in the form and mode of delivery as required by Paragraphs 2, 3, 4 and 6 herein or otherwise fail in any way to fully

comply with the provisions thereof;

b. If the Order shall not have been entered by the Court on or prior to ninety (90) days

after execution of this agreement;

c. If the Company shall fail to comply with the Covenants set forth in Paragraph 14 hereof;

d. If Bankruptcy,

dissolution, receivership, reorganization, insolvency or liquidation proceedings or other proceedings for relief under any

bankruptcy law or any law for the relief of debtors or other legal proceedings for any reason shall be instituted by or

against the Company; or if the trading of the Common Stock shall have been halted, limited, or suspended by the SEC or on the

Principal Market; or trading in securities generally on the Principal Market shall have been suspended or limited; or,

minimum prices shall have been established for securities traded on the Principal Market, or CCI's selling broker, or

eligible for delivery via DTC or DWAC; or the Common Stock is for any reason not eligible or unable to be deposited and/or

cleared through CCI’s broker, brokerage account and/or clearing agent for trade without restriction on the Principal Market

pursuant to the requirements of this Agreement; or the Common Stock is no longer eligible for book transfer delivery via

DWAC; or the Company is delinquent or has not made any required Securities and Exchange Commission and/or OTC Market filings

or disclosures; or if any time after entry of Order of Court pursuant to paragraph 2 herein, the Market Price for the

Company’s Common Stock drops to at or below $.0015 (which price shall be proportionately adjusted in the event of a reverse

split); or if at any time after entry of Order of Court pursuant to paragraph 2 herein, the thirty (30) day average volume of

the trading of the Company’s Common Stock drops to at or below three million five hundred thousand (3,500,000) shares per day

as reported on OTC Markets; or there shall have been any material adverse change (i) in the Company's finances or operations,

or (ii) in the financial markets such that, in the reasonable judgment of the CCI, makes it impracticable or inadvisable to

trade the Settlement Shares along with any Settlement Fee shares; and such suspension, limitation or other action is not

cured within five (5) trading days; then the Company shall be deemed in default of the Agreement and Order and this Agreement

and/or any remaining obligations, in whole or in part, of CCI pursuant to this Agreement shall be voidable in the sole

discretion of CCI, unless otherwise agreed by written agreement of the parties;

e. In the event that the Company fails to fully comply with the conditions precedent

as specified in paragraph 8 a. through d. herein, or the Conditions Precedent are not fully met or satisfied then the Company

shall be deemed in default of the agreement and CCI, at its option and in its sole discretion, may declare Company to be in default

of the Agreement and Order, and this Agreement and/or any remaining obligations of CCI, in whole or in part pursuant to this Agreement

shall be voidable in the sole discretion of CCI, unless otherwise agreed by written agreement of the parties. In said event, CCI

shall have no further obligation to comply with the terms of this agreement and can thus opt out of making any remaining payments,

in whole or in part, if applicable, not previously made to creditors as contemplated by the Claims Purchase Agreement as referenced

in schedule A. In the event Company is declared to be in default in whole or in part, Company shall remain fully obligated to

comply with the terms of this Settlement Agreement and Stipulation for issuance of shares of stock to CCI for any amount of debt

previously purchased and paid for by CCI pursuant to the terms of this Settlement Agreement and Stipulation, Schedule A, as well

as Order Approving same along with all Settlement Fee shares required hereby, as well as any amount of debt subsequently purchased

and paid for by CCI in the event of a partial default. In CCI's sole discretion, CCI may declare a partial default pursuant to

the terms of this Agreement, including, but not limited to Company's full compliance and satisfaction of its obligations and Conditions

Precedent herein as it relates to Purchase of the Claims as more particularly set forth on Schedule A and the Claims Purchase

Agreements and debt instruments attached and annexed thereto and incorporated herein (hereinafter collectively referred to as

the “Claims”). In the event that a partial default is declared, then the remaining obligations of CCI and Company

pursuant to this Agreement, shall remain in full force and effect. In the event that Company is declared to be in default of this

Agreement prior to successful deposit and clearance of the Settlement Shares and/or Settlement Fee shares, Company shall further

remain fully obligated for issuance of all settlement fee shares pursuant to paragraph 3(a) herein.

9. Information.

Company and CCI each represent that prior to the execution of this Agreement, they have fully informed themselves of its terms,

contents, conditions and effects, and that no promise or representation of any kind has been made to them except as expressly

stated in this Agreement.

10. Ownership and Authority. Company and

CCI represent and warrant that they have not sold, assigned, transferred, conveyed or otherwise disposed of any or all of any

claim, demand, right, or cause of action, relating to any matter which is covered by this Agreement, that each is the sole owner

of such claim, demand, right or cause of action, and each has the power and authority and has been duly authorized to enter into

and perform this Agreement and that this Agreement is the binding obligation of each, enforceable in accordance with its terms.

11. No Admission. This Agreement is contractual

and it has been entered into in order to compromise disputed claims and to avoid the uncertainty and expense of the litigation.

This Agreement and each of its provisions in any orders of the Court relating to it shall not be offered or received in evidence

in any action, proceeding or otherwise used as an admission or concession as to the merits of the Action or the liability of any

nature on the part of any of the parties hereto except to enforce its terms.

12. Binding Nature. This Agreement shall

be binding on all parties executing this Agreement and their respective successors, assigns and heirs.

13. Authority to Bind. Each party to this

Agreement represents and warrants that the execution, delivery and performance of this Agreement and the consummation of the transactions

provided in this Agreement have been duly authorized by all necessary action of the respective entity and that the person executing

this Agreement on its behalf has the full capacity to bind that entity. Each party further represents and warrants that it has

been represented by independent counsel of its choice in connection with the negotiation and execution of this Agreement, and

that counsel has reviewed this Agreement. Company further represents and warrants that they have had corporate legal counsel review

and agree to the terms of this Agreement independent of counsel of their choosing to represent Company at any fairness hearing

or hearings to approve this Agreement.

14. Covenants.

a. For so long as CCI or any of its affiliates holds any shares of Common Stock, neither Company nor any of its

affiliates shall vote any shares of Common Stock owned or controlled by it, or solicit any proxies or seek to advise or

influence any person with respect to any voting securities of Company; in favor of (1) an extraordinary corporate

transaction, such as a reorganization, reverse stock split or liquidation, involving Company or any of its subsidiaries, (2)

a sale or transfer of a material amount of assets of Company or any of its subsidiaries, (3) any material change in the

present capitalization or dividend policy of Company, (4) any other material change in Company's business or corporate

structure, (5) a change in Company's charter, bylaws or instruments corresponding thereto (6) causing a class of securities

of Defendant to be delisted from a national securities exchange or to cease to be authorized to be quoted in an inter-dealer

quotation system of a registered national securities association, (7) causing a class of equity securities of Company to

become eligible for termination of registration pursuant to Section 12(g)(4) of the Securities Exchange Act of 1934, as

amended, (8) terminating its Transfer Agent (9) taking any action which would impede the purposes and objects of this

Settlement Agreement or (10) effectuating or taking any action, intention, plan or arrangement similar to any of those

enumerated above. The provisions of this paragraph may not be modified or waived without further order of the Court.

b. Immediately upon the signing of the Settlement Order by the Court, the Company shall cause to be filed a Form 8-K with the

Securities and Exchange Commission disclosing the settlement or Supplemental Information with OTC Markets or Press Release as

applicable. Furthermore, and at the written request of CCI, in the event that the Company raises their issued and outstanding

Common Stock by an additional ten percent (10%) or more, Company shall file a form 8k with the Securities and Exchange

Commission or Supplemental Information with OTC Markets as applicable. The Company shall further immediately file such

additional SEC filings and/or OTC Market disclosures as may be or are required in respect of the transactions.

c. CCI hereby covenants that they have not provided any funds or other consideration to the Company and have no intent to do so.

In no event shall any of the funds received from the sale of shares of the Company in reliance upon the Court Order be used

to provide any consideration to the Company or any affiliate of the Company.

d.

CCI and Company have utilized the services of Enclave Capital LLC as a placement agent in this transaction and CCI has not

and is not acting as a broker dealer in such capacity in this transaction pursuant to Section 15 of the Securities Exchange

Act of 1934. Enclave Capital LLC has performed due diligence on the debts associated with this transaction, participated in

the negotiation of the terms hereof and arranged for CCI to place their capital in this transaction. Continuation Capital,

Inc., through the transactions, agreements or proceedings above are not a part of a plan or scheme to evade the registration

requirements of Section 15 of the Securities Exchange Act of 1934 or any other applicable provisions.

15. Indemnification. Company covenants and agrees to indemnify, defend and hold CCI and its agents, employees, representatives,

officers, directors, stockholders, controlling persons and affiliates harmless arising from or incident or related to this Agreement,

including, without limitation, any claim or action brought derivatively or by the Seller or Shareholders of the Company and further,

harmless against any charges, claims, suits, losses, expenses, damages, obligations, fines, judgments, liabilities, costs and

expenses (including actual costs of investigation and reasonable attorney’s fees) whether brought by an individual or entity or

imposed by a court of law or by administrative action of any Federal, State or Local governmental body or agency, administrative

agency or regulatory authority related to arising in any manner out of, based upon or in connection with (a) any untrue statement

or alleged untrue statement of a material fact made by the Company or any omission or alleged omission of the Company to state

a material fact required to be stated herein or in any seller document or necessary to make the statements therein not misleading

or (b) the inaccuracy or breach of any covenant, representation or warranty made by the Company contained herein or in any seller

document or (c) any transaction, proposal or any other matter contemplated herein. The Company will promptly reimburse the indemnified

parties for all expenses (including reasonable fees and expenses of legal counsel) as incurred in connection with the investigation

of, preparation for or defense of any pending or threatened claim related to or arising in any manner out of any matter contemplated

by this Agreement, or any action or proceeding arising therefrom, whether or not such indemnified party is a formal party to any

such proceeding. This Agreement specifically includes, but is not limited to the foregoing concerning any claim that Continuation

Capital, Inc. is in violation of or has violated Section 5 of the Securities Act of 1933, as amended, for unlawful or unauthorized

sale of securities based upon Continuation Capital, Inc.’s reliance on representations of Company or misrepresentations of Company

pursuant to (a), (b) or (c) herein and/or that any payments made by CCI to Creditors were fraudulent, based upon false instruments

provided to CCI or not bona fide claims within the meaning of Section 3(a)(10) of the Securities Act of 1933 . Notwithstanding

the foregoing, the Company shall not be liable in respect of any claims that a court of competent jurisdiction has judicially

determined by final judgment (and the time to appeal has expired or the last right of appeal of has been denied) which resulted

solely or in part from the willful misconduct of an indemnified party or the willful violation of any securities law or regulations

by the indemnified party. The Company further agrees that it will not, without the prior written consent of Continuation Capital,

Inc., settle, compromise or consent to the entry of any

judgment in any pending or threatened proceeding in respect of which indemnification may be sought hereunder (whether or

not Continuation Capital, Inc. or any indemnified party is an actual or potential party to such proceeding), unless such settlement,

compromise or consent includes an unconditional release of Continuation Capital, Inc. and each other indemnified party hereunder

from all liability arising out of such proceeding. In order to provide for just and equitable contribution in any case in

which (i) an Indemnified Party is entitled to indemnification pursuant to this Indemnification Agreement but it is judicially

determined by the entry of a final judgment decree by a court of competent jurisdiction and (the time to appeal has expired

or the last right of appeal has been denied) that such indemnification may not be enforced in such case, or (ii) contribution

may be required by the Company in circumstances for which an Indemnified Party is otherwise entitled to indemnification under

the Agreement, then, and in each such case, the Company shall contribute to the aggregate losses, Claims and damages and/or

liabilities in an amount equal to the amount for which indemnification was held unavailable.

The Company further agrees that no Indemnified Party shall have any liability (whether direct or indirect, in contract or

tort or otherwise) to the Company for or in connection with CCI's agreement hereunder except for Claims that a court of

competent jurisdiction shall have determined by final judgment (and the time to appeal has expired or the last right of

appeal has been denied) resulted solely or in part from the willful misconduct of such Indemnified Party or the willful

violation of any securities laws or regulations by an Indemnified Party. The indemnity, reimbursement and contribution

obligations of the Company set forth herein shall be in addition to any liability which the Company may otherwise have an

shall be binding upon and inure to the benefit of any successors, assigns, heirs and personal representatives of the Company

or an Indemnified Party.

16. Legal Effect. The parties to this Agreement represent that each of them has been advised

as to the terms and legal effect of this Agreement and the Order provided for herein, and that the settlement and compromise stated

herein is final and conclusive forthwith, shall supersede all prior written or oral between the parties, subject to the conditions

stated herein, and each attorney represents that his or her client has freely consented to and authorized this Agreement after

having been so advised.

17. Mutual Drafting. Each party has participated jointly in the drafting of this Agreement

which each party acknowledges is the result of negotiation between the parties and through placement agent Enclave Capital LLC,

and the language used in this Agreement shall

be deemed to be the language chosen by the parties to express their mutual intent. If ambiguity or question of intent or

interpretation arises, then this Agreement will accordingly be construed as drafted jointly by the parties, and no

presumption or burden of proof will arise favoring or disfavoring any party to this Agreement by virtue of the authorship of

any of the provisions of this Agreement.

18. Waiver of Defense. Each party hereto waives a statement of decision, and the right to

appeal from the Order after its entry. Company further waives any defense based on the rule against splitting causes of action.

The prevailing party in any motion to enforce the Order shall be awarded its reasonable attorney fees and expenses in connection

with such motion. Except as expressly set forth herein, each party shall bear its own attorneys’ fees, expenses and costs.

19. Signatures. This Agreement may be signed in counterparts and the Agreement, together with its counterpart

signature pages, shall be deemed valid and binding on each party when duly executed by all parties. Facsimile and

electronically scanned signatures shall be deemed valid and binding for all purposes. This Agreement may be amended only by

an instrument in writing signed by the party to be charged with enforcement thereof. This Agreement supersedes all prior

agreements and understandings among the parties hereto with respect to the subject matter hereof. 20. Choice of Law, Etc.

Notwithstanding the place where this Agreement may be executed by either of the parties, or any other factor, all terms and

provisions hereof shall be governed by and construed in accordance with the laws of the State of Florida, applicable to

agreements made and to be fully performed in that State and without regard to the principles of conflicts of laws

thereof. Any action brought to enforce, or otherwise arising out of this Agreement shall be brought only in State Court

sitting in the Twelfth Judicial Circuit, State of Florida.

21. Exclusivity. For a period of the later of one hundred eighty (180) days from the date of the execution of this Agreement

or upon CCI’s final sale of all shares of stock issued pursuant hereto subsequent to final adjustment; (a) Company and its

representatives shall not enter into any exchange transaction under Section 3(a)(10) of the Securities Act nor directly or indirectly

discuss, negotiate or consider any proposal, plan or offer from any other party relating to any liabilities, or any financial

transaction having an effect or result similar to the transactions contemplated hereby without the express written consent of

CCI; and (b) CCI shall have the exclusive right to negotiate and execute definitive documentation embodying the terms set forth

herein and other mutually acceptable terms.

22. Inconsistency. In the event of any inconsistency between the terms of this Agreement and any other document executed

in connection herewith, the terms of this Agreement shall control to the extent necessary to resolve such inconsistency.

23. NOTICES. Any notice required or permitted hereunder shall be given in writing (unless otherwise specified

herein) and shall be deemed effectively given on the earliest of

(a) the date delivered, if delivered by personal delivery as

against written receipt therefore or by confirmed facsimile transmission,

(b) the fifth business day after deposit, postage

prepaid, in the United States Postal Service by registered or certified mail, or

(c) the second business day after mailing by domestic or international express courier, with delivery costs and

fees prepaid,

(d) delivery by email upon delivery,

Exhibit 10.2

Exhibit 99

Blockchain Technology Company BlackStar Secures Institutional Investor for Debt Repayment, Seeks

Valuation and Eyes Revenue Possibilities Through IP Licensing

BOULDER, COLORADO, Nov. 5, 2024 / BlackStar Enterprises Group, Inc. ("Blackstar") (OTC Pink: BEGI), ("the Company"). BlackStar

entered into an agreement to retire $861,539.26 of debt ("the Settlement Amount") in a transaction pursuant to 3(a)(10) of

the Securities Act. Continuation Capital, Inc. ("CCI"), a Delaware corporation, purchased the obligations from certain vendors

of the Company, which consist of accounts payable due from the Company.

Mr. Kurczodyna states that over 90% of the Company's short-term liabilities are being renegotiated or paid. He said BlackStar's

relationship with an institutional investor, CCI, strengthens the Company's balance sheet, shows a level of confidence from

the Street, and prepares the company for future funding.

Mr. Kurczodyna also stated that the next step for the Company is

a valuation of our patents and a licensing strategy. He believes that the recent SEC registration of Crypto Currency Assets

secured by Exchanged Traded Funds sends a clear signal to the Investment Banking world that digital assets trading on blockchain

will trade through Brokers as Spot Market ETFs. BlackStar's intellectual property portfolio covers all regulated registered

equity, and all forms of securities traded on blockchain through Broker-Dealers.

Other Info: BlackStar Enterprise Group, Inc. (OTC: BEGI)

WEBSITE: blackstareg.com

EMAIL: info@blackstareg.com

CONTACT Bryan P Hemphill….559-359-1480

http://www.blackstareg.com/investor-relations/

More information can be found in the Company's recently filings at the SEC web site: https://www.sec.gov/cgi-bin/browse-edgar?company=BlackStar+Enterprise&match=&filenum=&State=&Country=&SIC=&myowner=exclude&action=getcompany.

SEC Disclaimer

This press release is neither an offer to sell nor a solicitation of an offer to buy any securities in the United States

or elsewhere. This press release may contain forward-looking statements. The words or phrases "would be," "will allow," "intends

to," "will likely result," "are expected to," "will continue," "is anticipated," "estimate," "project," or similar expressions

are intended to identify "forward-looking statements." Actual results could differ materially from those projected in BlackStar's

("the Company's") business plan. The creation of subsidiaries and expansion of services into new sectors should not be construed

as an indication in any way whatsoever of the future value of the Company's common stock or its present or future financial

condition. The Company's filings may be accessed at the SEC's Edgar system at www.sec.gov. Statements made herein are as of

the date of this press release and should not be relied upon as of any subsequent date. The Company cautions readers not to

place reliance on such statements. Unless otherwise required by applicable law, we do not undertake, and we specifically disclaim

any obligation, to update any forward-looking statements to reflect occurrences, developments, unanticipated events or circumstances

after the date of such statement.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

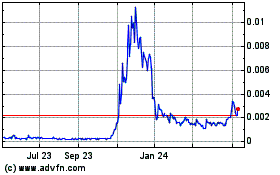

BlackStar Enterprise (PK) (USOTC:BEGI)

Historical Stock Chart

From Nov 2024 to Dec 2024

BlackStar Enterprise (PK) (USOTC:BEGI)

Historical Stock Chart

From Dec 2023 to Dec 2024