BioStem Technologies

Reports Second Quarter 2022

Operating and Financial Results

POMPANO BEACH, FL -- August 23,

2022 -- InvestorsHub

NewsWire -- BioStem Technologies Inc. (OTC: BSEM), a

leading regenerative medicine company focused on the development,

manufacture, and commercialization of placental derived biologics,

today reported financial results for the quarter ended June 30,

2022.

Jason Matuszewski, Chief Executive

Officer of BioStem Technologies Inc. said, "We made strong

operational and financial progress in the second quarter of 2022.

We continue along our rapid growth trajectory with gross revenue of

$2.2 million and an 82% gross margin for the quarter. This is a

result of our highly experienced commercial team that we continue

to build out to match the pace of our growth and expanding product

portfolio around our BioRetain Process."

Business Updates:

-

Continued transition from an indirect

salesforce to a direct salesforce along with the implementation of

sales training programs for more compelling product

messaging

-

BioRetain®: BioStem's Operations, Research, and

Development teams continue to develop the proprietary processing

technology called BioRetain®, which will help preserve the biologic

qualities of the Company's products. The company will soon be

engaging with several market development focus groups, industry

thought leaders and key stakeholders.

-

VENDAJE®, VENDAJE AC® and VENDAJE Optic®: BioStem Will be expanding its product offering

in the second half of the year with VENDAJE AC® and VENDAJE Optic®. This will allow the company to become a

recognized leader in Advanced Wound Care, Surgical, and Plastic

& Dermatology.

Three-months Ending June 30, 2022, - Financial Results

Summary

-

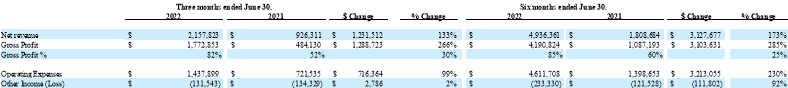

Net

revenue of $2.158 million for the quarter ended June 30, 2022, up

133%, compared to net revenue of $0.926 million for the quarter

ended June 30, 2021.

-

Gross

profit for the quarter ended June 30, 2022, was $1.773 million, or

82% of revenue, compared to $0.484 million, or 52% of net revenue,

for the quarter ended June 30, 2021, an increase of $1.289 million,

or 266%.

-

Net

income of $0.203 million for the quarter ended June 30, 2022,

compared to a net loss of ($0.372) million for the quarter ended

June 30, 2021, an improvement of $0.575 million and 155% over the

quarter ended June 30, 2021.

-

Adjusted EBITDA of $0.591 million, or 27% of

net revenue, for the quarter ended June 30, 2022, compared to

Adjusted EBITDA loss of ($0.166) million, or (18%) of net revenue,

for the quarter ended June 30, 2021, an improvement of $0.757

million or 455%. See the GAAP to Adjusted EBITDA reconciliation

below.

Six-Months Ending June 30, 2022, - Financial Results

Summary:

-

Net

revenue of $4.936 million year-to-date June 30, 2022, up 173%,

compared to net revenue of $1.809 million for the six-months ended

June 30, 2021.

-

Gross

profit for the six-months ended June 30, 2022, was $4.191 million,

or 85% of revenue, compared to $1.088 million, or 60% of net

revenue, for the six months ended June 30, 2021, an increase of

$3.104 million, or 285%.

-

Net

loss of ($0.654) million year-to-date June 30, 2022, compared to a

net loss of ($0.433) million for the six-months ended June 30,

2021, an increase in net loss of $0.221 million and 51% over the

six-months June 30, 2021.

-

Adjusted EBITDA of $2.141 million, or 43% of

net revenue, for the six-months ended June 30, 2022, compared to

Adjusted EBITDA of $0.127 million, or 7% of net revenue, for the

six-months ended June 30, 2021, an improvement of $2.014 million or

1,588%.

See the GAAP to Adjusted EBITDA

reconciliation below.

Quarter and Year-to

Date ending June 30, 2022 -

Results:

The following table represents net

revenue, gross margin, operating expenses, and other income (loss)

for the three and six-months ended June 30, 2022, and June 30,

2021, respectively:

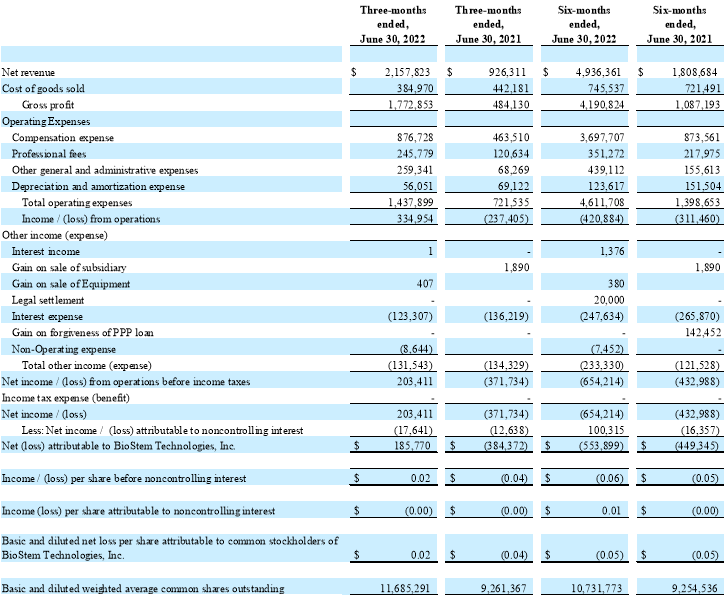

Statement of

Operations Highlights-Year to Date June 30, 2022:

Net revenue for the six-months ended

June 30, 2022, was

$4.936 million, compared to $1.809 million for the quarter ended

June 30, 2021, an increase of $3.128 million, or 173%. The increase in

sales was driven primarily by the expansion of our distribution

network, resulting in increased sales of our Vendaje product. Since

CMS granted a Q-Code in September 2021, we've seen additional

market acceptance and additional sales volume.

Gross profit for the six-months ended

June 30, 2022, was $4.191 million, or 85% of net revenue, compared to $1.088

million, or 60% of net revenue, for the quarter ended June 30, 2021, an increase of $3.104

million, or 285%. The increase in gross profit resulted primarily

from increased sales volume due to the strength in our Vendaje

products as well as a shift in product mix to our higher gross

margin products.

Operating expenses for the six-months

ended June 30, 2022, were $4.612 million, compared to $1.399

million for the six-months ended June 30, 2021, an increase of

$3.213 million or 230%. Increase in operating expenses is primarily

driven by additional headcount, additional marketing expense,

investments in a direct sales force, and increases in share-based

compensation related to the conversion of debt and accrued salaries

at a discount to the fair value of equity on the date of

conversion.

Total other (expense) income, net, for the

six-months ended June

30, 2022, were ($0.233)

million, compared to ($0.122) million for the six-months

ended June 30, 2021, an

increase in expense of $0.111 million or 92%. The six months

ended June 30, 2021, contains the benefit of the one-time PPP loan

forgiveness of $0.142 million.

Net loss for the six-months ended June

30, 2022, was ($0.654)

million, or ($0.06) per

share, compared to of ($0.433)

million, or ($0.05) per share, for the

six-months ended June 30, 2021, an increase to net loss of ($0.221)

million, or ($0.01) per share.

Statement of

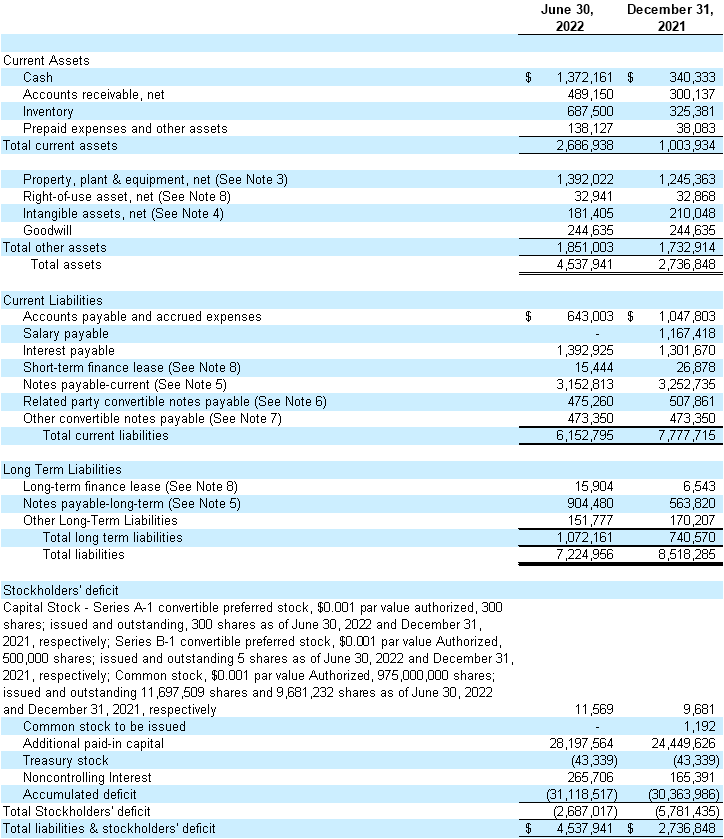

Cashflows and Balance Sheet Highlights:

Cashflows provided by operations was

$0.664 million for the six-months ended June 30, 2022, compared to

cashflows provided by operations of $0.118 million for the

six-months ended June 30, 2021. The increase in cash provided

by operations is due to management's continued discipline over

operating expenses as well as to an increase in product

sales.

The Company maintained cash on hand as

of June 30, 2022, $1.372 million compared to $0.270 million as of

June 30, 2021.

The Company continues to strengthen

its balance sheet. The Company converted $3.318 million of

liabilities to common stock during the six-months ended June 31,

2022.

BIOSTEM TECHNOLOGIES INC. CONSOLIDATED BALANCE

SHEETS

(UNAUDITED)

BIOSTEM TECHNOLOGIES INC. CONSOLIDATED

STATEMENTS OF OPERATIONS

(UNAUDITED)

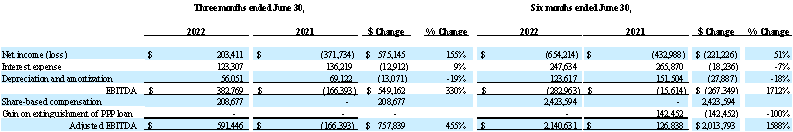

NON-GAAP FINANCIAL MEASURES

Our management uses financial measures

that are not in accordance with generally accepted accounting

principles in the United States, or GAAP, in addition to financial

measures in accordance with GAAP to evaluate our operating results.

These non-GAAP financial measures should be considered supplemental

to, and not a substitute for, our reported financial results

prepared in accordance with GAAP. Our management uses Adjusted

EBITDA to evaluate our operating performance and trends and make

planning decisions. Our management believes Adjusted EBITDA helps

identify underlying trends in our business that could otherwise be

masked by the effect of the items that we exclude. Accordingly, we

believe that Adjusted EBITDA provides useful information to

investors and others in understanding and evaluating our operating

results, enhancing the overall understanding of our past

performance and future prospects, and allowing for greater

transparency with respect to key financial metrics used by our

management in its financial and operational

decision-making.

The following is a reconciliation of

GAAP net income (loss) to non-GAAP EBITDA and non-GAAP Adjusted

EBITDA for each of the periods presented:

About BioStem Technologies,

Inc. (OTC

PINK: BSEM): BioStem Technologies is a leading innovator

focused on harnessing the natural properties of perinatal tissue in

the development, manufacture, and commercialization of allografts

for regenerative therapies. The Company is focused on manufacturing

products that change lives, leveraging its proprietary BioRetain®

processing method. BioRetain® has been developed by applying the

latest research in regenerative medicine, focused on maintaining

growth factors and preserving tissue structure. BioStem

Technologies' quality management system and standard operating

procedures have been reviewed and accredited by the American

Association of Tissue Banks ("AATB"). These systems and procedures

are established per current Good Tissue Practices ("cGTP") and

current Good Manufacturing Processes ("cGMP"). Our portfolio of

quality brands includes VENDAJETM, VENDAJETM AC, and VENDAJETM OPTIC. Each BioStem Technologies

placental allograft is processed at the Company's FDA registered

and AATB accredited site in Pompano Beach,

Florida.

Forward-Looking

Statements: Except for statements of historical fact,

this release also contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

These forward-looking statements relate to expectations or

forecasts of future events. Forward-looking statements may be

identified using words such as "forecast," "intend," "seek,"

"target," "anticipate," "believe," "expect," "estimate," "plan,"

"outlook," and "project" and other similar expressions that predict

or indicate future events or trends or that are not statements of

historical matters. Forward-looking statements with respect to the

operations of the Company, strategies, prospects and other aspects

of the business of the Company are based on current expectations

that are subject to known and unknown risks and uncertainties,

which could cause actual results or outcomes to differ materially

from expectations expressed or implied by such forward-looking

statements. These factors include, but are not limited to: (1) the

impact of any changes to the reimbursement levels for the Company's

products; (2) the Company faces significant and continuing

competition, which could adversely affect its business, results of

operations and financial condition; (3) rapid technological change

could cause the Company's products to become obsolete and if the

Company does not enhance its product offerings through its research

and development efforts, it may be unable to effectively compete;

(4) to be commercially successful, the Company must convince

physicians that its products are safe and effective alternatives to

existing treatments and that its products should be used in their

procedures; (5) the Company's ability to raise funds to expand its

business; (6) the Company has incurred significant losses since

inception and may incur losses in the future; (7) changes in

applicable laws or regulations; (8) the possibility that the

Company may be adversely affected by other economic, business,

and/or competitive factors;

(9) the Company's ability to maintain production of its

products in sufficient quantities to meet demand; and (10) the COVID-19 pandemic and

its impact, if any, on the Company's fiscal condition and results

of operations; You are cautioned not to place undue reliance upon

any forward-looking statements, which speak only as of the date

made. Although it may voluntarily do so from time to time, the

Company undertakes no commitment to update or revise the

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by applicable

securities laws.

BioStem

Technologies, Inc.

Phone:

954-380-8342

Website: http://www.biostemtechnologies.com

Email: info@biostemtech.com

Twitter:

@BSEM_Tech

Facebook:

BioStem Technologies

Investor Relations:

Russo

Partners, LLC

Maxim

Jacobs, CFA

12 West

27th Street, 4th Floor

New York,

NY 10001

T:

646-942-5591

Maxim.Jacobs@russopartnersllc.com