Harbour Energy Buys Wintershall Dea Upstream Assets for $11.2 Billion -- Update

December 21 2023 - 10:20AM

Dow Jones News

By Ian Walker

Harbour Energy said it would buy most of the upstream assets of

oil-and-gas producer Wintershall Dea for $11.2 billion in cash and

shares from its shareholders BASF and LetterOne.

The U.K. oil-and-gas company said Thursday that the deal

includes all of Wintershall Dea's upstream assets in Norway,

Germany, Denmark, Argentina, Mexico, Egypt, Libya and Algeria as

well as its carbon-dioxide capture and storage licenses in

Europe.

It excludes Wintershall Dea's assets located in Russia or those

held in joint ventures with Russian companies, as well as

Wintershall Dea's stake in WIGA Transport Beteiligungs. Earlier

this week, Russia moved to transfer the stakes that Wintershall Dea

and Austria's OMV hold in a joint venture operating the

Yuzhno-Russkoye field in Western Siberia to a new entity.

Harbour said Thursday that the deal would transform it into one

of the world's largest and most geographically diverse independent

oil and gas companies, and would boost its free cash flow and

support enhanced and sustainable shareholder returns.

"Today's announcement marks Harbour's fourth major acquisition

and the most transformational step yet in our journey to build a

uniquely positioned, large-scale, geographically diverse

independent oil and gas company," Chief Executive Linda Cook

said.

Upon completion of the acquisition, German chemicals giant

BASF--which has a 72.7% stake in Wintershall Dea--will own 46.5% of

Harbour's shares.

BASF will be able to nominate two nonexecutive directors to

Harbour's board for as long as it owns at least 25% of the

company's shares, and one director if that drops to between 25% and

10%.

The acquisition comes amid a wave of deal making in the sector.

In October, Exxon Mobil paid nearly $60 billion to buy Pioneer

Natural Resources, while Chevron earlier paid $53 billion for its

takeover of Hess. Occidental Petroleum earlier this month agreed on

a $10.8 billion deal for CrownRock.

Oil prices have slipped a little this year after sharp rises in

2022 that fueled record profits, paving the way for the merger wave

as companies look to maximize returns on their assets.

Harbour Energy shares at 1432 GMT were up 31.0 pence, or 13%, at

274.90 pence. However, they are currently down 9.9% over the year

to date.

BASF shares are up 1% at EUR48.96 and up 4.9% over the year to

date.

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

December 21, 2023 10:05 ET (15:05 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

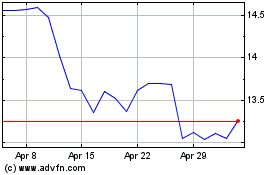

BASF (QX) (USOTC:BASFY)

Historical Stock Chart

From Jan 2025 to Feb 2025

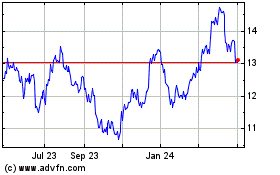

BASF (QX) (USOTC:BASFY)

Historical Stock Chart

From Feb 2024 to Feb 2025