BARON CAPITAL ANNOUNCES SHAREHOLDER UPDATES

September 28 2016 - 1:00PM

InvestorsHub NewsWire

- Reduces authorized common shares to 2.9

billion

- Freezes common share structure for 1

year

- Bars any reverse split for 1 year

- During the 3rd quarter of 2016 Baron

collected over $50,000 from its receivables, marking 9 straight

quarters the Company has collected money.

Coconut Creek, FL -- September 28, 2016 -- InvestorsHub NewsWire --

Baron Capital Enterprises, Inc. (OTCPK:

BCAP) has filed an Amendment with the State of Florida to

reduce the number of Authorized Common Shares and has created a

convertible Preferred Series B that cannot convert into Common

Shares until October 1, 2017.

During the 3rd quarter of 2016 the Company is pleased to announce

it collected over $50,000 from it receivables. This achievement

marks the 9th straight Quarter Baron has collected money owed the

Company.

Baron continues to function as a consulting firm working with

companies looking to go public, as well as public companies looking

for guidance. Baron has now turned a corner financially and will

continue to work with companies while exploring additional ways of

generating money.

Common and Preferred Share Structure updates:

As part of the revamp of Baron’s share structure, now that the

Company has begun collecting from its receivables, Baron recently

elected to eliminate its super voting Preferred Series AA. This

action caused a temporary increase in the Common Share structure

allowing Baron’s sole offer and director to convert his Preferred

shares into Common. The temporary increase in Common Shares was

part of a process which ultimately resulted in the creation a new

Preferred Series B. The Preferred Series B Amendment has now

been filed allowing the Common Share structure to be reduced once

again.

The Preferred Series B contains several positive benefits for

Common shareholders, including a caveat placed within the

conversion preferences of the Preferred Series B stating those

shares cannot be converted into Common shares at any time before

October 1, 2017.

Going forward, the total number of Authorized Common Shares after

filing the Preferred Series B Amendment shall be 2.9 Billion

shares. 530 million shares of the Authorized Common shares have

been reserved allowing Baron to use as needed, the additional

shares are not needed to raise capital as Baron has been generating

revenue since 2014.

Baron has also taken several actions by amending its By-Laws,

including by adding a special provision which expires in one (1)

year that would restrict the Company from increasing its Authorized

Common Shares, or enacting a Reverse Split on its Common

shares.

A mandate has also been added so that if Baron issues any new

shares of its Common stock, the Company must within 90 days of the

date of issuance begin purchasing an equal amount of Common shares

in the open market so the number of total outstanding shares

remains at 2,362,355,947.

Baron previously created an almost identical share freeze in 2012

which essentially locked the Common share structure for a period of

two (2) years. The share structure has in fact not changed in four

(4) years until the recent series of amendments.

Baron will continue to use newswire services, but will also begin

taking advantage of social media outlets and its own website to

disseminate Company news.

The foregoing press announcement contains forward-looking

statements that can be identified by such terminology such as

“believes,” “expects,” “potential,” “plans,” “suggests,” “may,”

“should,” “could,” “intends,” or similar expressions. Such

forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause the actual results

to be materially different from any future results, performance or

achievements expressed or implied by such statements. In

particular, management's expectations could be affected by among

other things, uncertainties relating to our success in completing

acquisitions, financing our operations, entering into strategic

partnerships, engaging management and other matters disclosed by us

in our public filings from time to time. Forward-looking statements

speak only as to the date they are made. The Company does not

undertake to update forward-looking statements to reflect

circumstances or events that occur after the date the

forward-looking statements are made.

Contact

Matthew Dwyer

954-623-3209

matt@bcapent.com

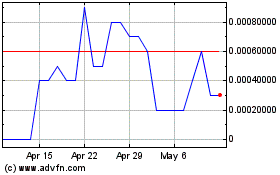

Baron Capital Enterprise (CE) (USOTC:BCAP)

Historical Stock Chart

From Nov 2024 to Dec 2024

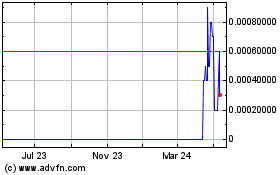

Baron Capital Enterprise (CE) (USOTC:BCAP)

Historical Stock Chart

From Dec 2023 to Dec 2024