UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C.

20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE

13a-16 or 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2016

Commission File Number 001-35001

AVALON RARE METALS

INC.

(Translation of registrant’s name into English)

130 Adelaide Street West

Suite #1901

Toronto, Ontario M5H 3P5

(Address of principal

executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F

Form 20-F [X] Form 40-F [

]

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Note: Regulation S-T Rule 101(b)(1) only permits the

submission in paper of a Form 6-K if submitted solely to provide an attached

annual report to security holders.

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

Note: Regulation S-T Rule 101(b)(7) only permits the

submission in paper of a Form 6-K if submitted to furnish a report or other

document that the registrant foreign private issuer must furnish and make public

under the laws of the jurisdiction in which the registrant is incorporated,

domiciled or legally organized (the registrant’s “home country”), or under the

rules of the home country exchange on which the registrant’s securities are

traded, as long as the report or other document is not a press release, is not

required to be and has not been distributed to the registrant’s security

holders, and, if discussing a material event, has already been the subject of a

Form 6-K submission or other Commission filing on EDGAR.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of

1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

AVALON RARE METALS INC.

| |

/s/ R. James

Andersen |

| Date: January 19, 2016 |

R. James Andersen |

| |

Chief Financial Officer and VP Finance

|

EXHIBIT INDEX

|

Suite 1901 - 130 Adelaide Street West |

| Toronto, ON Canada M5H 3P5 |

| Telephone: (416) 364-4938 Fax: (416) 364-5162

|

| Email: ir@avalonraremetals.com |

| http://www.avalonraremetals.com

|

NOTICE OF ANNUAL AND

SPECIAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the annual and special meeting (the

"Meeting") of the shareholders of Avalon Rare Metals Inc. (the "Company") will

be held at The Toronto Board of Trade, Room A/B/C/D (located on the fourth

floor), 1 First Canadian Place, Toronto, Ontario, M5X 1C1 at 4:30 p.m. (Toronto

time) on Wednesday, February 24, 2016, for the following purposes:

| (1) |

to receive the audited financial statements of the

Company for the financial year ended August 31, 2015 together with the

report of the auditors thereon (the “Annual Financial

Statements”); |

| |

|

| (2) |

to elect the directors of the Company for the ensuing

year; |

| |

|

| (3) |

to appoint the auditors of the Company for the ensuing

year and to authorize the directors of the Company to fix the remuneration

of the auditors; |

| |

|

| (4) |

to consider and, if deemed advisable, to approve a

special resolution, with or without variation, authorizing the Company to

amend its articles to effect a change of name of the Company from “Avalon

Rare Metals Inc.” to “Avalon Advanced Materials Inc.”, or such other name

as the board of directors of the Company in its discretion may resolve and

as may be acceptable to applicable regulatory authorities, if

required; |

| |

|

| (5) |

to consider and, if deemed advisable, to adopt, with or

without variation, an ordinary resolution approving By-law No.2 of the

Company pertaining to advance notice for the nomination of directors of

the Company; and |

| |

|

| (6) |

to transact such other business as may properly be

brought before the Meeting or any adjournment

thereof. |

As described in the notice and access notification mailed to

non-registered shareholders of the Company, the Company has decided to deliver

the accompanying information circular to non-registered shareholders by posting

it to the website hosted by the Company’s transfer agent, TMX Equity

Transfer Services at

https://noticeinsite.tmxequity.com/AvalonRareMetalsASM2016. The use of

this alternative means of delivery is more environmentally friendly as it will

help reduce paper use and it will also reduce the Company’s printing and mailing

costs. Due to certain requirements of the Canada Business Corporations

Act, the Company is sending a paper copy of the complete proxy package,

including this notice of Meeting and accompanying information circular, and the

Annual Financial Statements and related management’s discussion and analysis to

registered shareholders. The accompanying information circular and the Annual

Financial Statements and related management’s discussion and analysis are also

available on SEDAR at www.sedar.com and on the Company’s web site at

http://www.avalonraremetals.com/investors/regulatory_filings/.

Shareholders may request paper copies of the accompanying

information circular at no cost on-line at

https://noticeinsite.tmxequity.com/AvalonRareMetalsASM2016 or by calling

toll-free at 1-844-559-4938.

Particulars of the foregoing matters are set forth in the

accompanying information circular. The directors of the Company have fixed the

close of business on January 12, 2016 as the record date for the determination

of the shareholders of the Company entitled to receive notice of, and to vote

at, the Meeting.

Shareholders who are unable to attend the Meeting in person are

requested to complete, date, sign and return the accompanying form of proxy in

the enclosed return envelope. All instruments appointing proxies to be used at

the Meeting or at any adjournment thereof must be deposited with TMX Equity

Transfer Services, 200 University Avenue, Suite 300, Toronto, Ontario, Canada

M5H 4H1, fax number: (416) 595-9593 not less than 48 hours, Saturdays,

Sundays and holidays excepted, prior to the time of the holding of the Meeting

or any adjournment thereof. Late proxies may be accepted or rejected by the

Chair of the Meeting in his or her discretion, and the Chair is under no

obligation to accept or reject any particular late proxy.

DATED at Toronto, Ontario this

12th day of January, 2016.

BY ORDER OF THE BOARD

|

| Donald S. Bubar |

| President and Chief Executive Officer

|

|

Suite 1901 - 130 Adelaide Street West |

| Toronto, ON Canada M5H 3P5 |

| Telephone: (416) 364-4938 Fax: (416) 364-5162 |

| Email: ir@avalonraremetals.com |

| http://www.avalonraremetals.com |

INFORMATION CIRCULAR

As at and dated January 12, 2016

(unless otherwise noted)

GENERAL PROXY INFORMATION

Solicitation of Proxies

This information circular (this “Information Circular”) is

furnished in connection with the solicitation of proxies by the management and

the directors of AVALON RARE METALS INC. (the "Company") for use at the annual

and special meeting of the shareholders of the Company (the "Meeting") to be

held at The Toronto Board of Trade, Room A/B/C/D (located on the fourth floor),

1 First Canadian Place, Toronto, Ontario, M5X 1C1 at 4:30 p.m. (Toronto time) on

Wednesday, February 24, 2016, and at all adjournments thereof for the purposes

set forth in the accompanying notice of the Meeting (the "Notice of Meeting").

The solicitation of proxies will be made primarily by mail, using notice and

access for Non-Registered Shareholders (as defined below), and may be

supplemented by telephone or other personal contact by the directors, officers

and employees of the Company. Directors, officers and employees of the Company

will not receive any extra compensation for such activities. The Company may

also retain, and pay a fee to, one or more professional proxy solicitation firms

to solicit proxies from the shareholders of the Company in favour of the matters

set forth in the Notice of Meeting. The Company may pay brokers or other persons

holding common shares of the Company in their own names, or in the names of

nominees, for their reasonable expenses for sending proxies and this Information

Circular to beneficial owners of common shares and obtaining proxies therefrom.

The cost of the solicitation will be borne directly by the Company.

No person is authorized to give any information or to make any

representation other than those contained in this Information Circular and, if

given or made, such information or representation should not be relied upon as

having been authorized by the Company. The delivery of this Information Circular

shall not, under any circumstances, create an implication that there has not

been any change in the information set forth herein since the date hereof.

Non-Registered Shareholders

Only registered shareholders of the Company, or the persons

they appoint as their proxies, are entitled to attend and vote at the Meeting.

However, in many cases, common shares beneficially owned by a person (a

"Non-Registered Shareholder") are registered either:

| (a) |

in the name of an intermediary (an "Intermediary") with

whom the Non-Registered Shareholder deals in respect of the common shares

(Intermediaries include, among others: banks, trust companies, securities

dealers or brokers, trustees or administrators of a self-administered

registered retirement savings plan, registered retirement income fund,

registered education savings plan and similar plans);

or |

| Avalon Rare

Metals Inc. |

Page 1

|

| Information

Circular as of and dated January 12, 2016 |

|

| (b) |

in the name of a clearing agency (such as The Canadian

Depository for Securities Limited, in Canada, and the Depository Trust

Company, in the United States) of which the Intermediary is a

participant. |

In accordance with the requirements of National Instrument

54-101 (“NI 54-101”) of the Canadian Securities Administrators, the Company is

generally required to distribute copies of the Notice of Meeting, this

Information Circular and its form of proxy or voting instruction form, as

applicable, (collectively the "Meeting Materials") to the Intermediaries and

clearing agencies for onward distribution to Non-Registered Shareholders. The

Company has elected to deliver this Information Circular to Non-Registered

Shareholders by distributing a notification of meeting, along with the form of

proxy or voting instruction form, as applicable, (together, the “Mailed

Materials”) to the Intermediaries and clearing agencies for onward distribution

to Non-Registered Shareholders, and posting this Information Circular on the

website maintained by TMX Equity Transfer Services (“Equity”) at

https://noticeinsite.tmxequity.com/AvalonRareMetalsASM2016. See “Notice

and Access”, below, for further information. Intermediaries are required to

forward the Mailed Materials to Non-Registered Shareholders unless the

Non-Registered Shareholders have waived the right to receive them.

Intermediaries often use service companies to forward the Mailed Materials to

Non-Registered Shareholders. Notwithstanding the foregoing, there are two kinds

of Non-Registered Shareholders, namely: (i) those who object to their name being

made known to the issuers of the securities they own (called “OBOs” for

Objecting Beneficial Owners); and (ii) those who do not object to their name

being made known to the issuers of the securities they own (called “NOBOs” for

Non-Objecting Beneficial Owners). Subject to the provisions of NI 54-101,

issuers can request and obtain a list of their NOBOs from Intermediaries via

their transfer agents and use the NOBO list for distribution of proxy-related

materials directly to NOBOs. The Company intends to take advantage of those

provisions of NI 54-101 that permit it to deliver the Mailed Materials directly

to its NOBOs, through Equity, who have not waived the right to receive them. As

a result, NOBOs in Canada can expect to receive the Mailed Materials from

Equity. The voting instruction forms are to be completed and returned to Equity

in accordance with the instructions provided by Equity either in the envelope

provided by Equity or by facsimile. In this regard, Equity is required to follow

the voting instructions properly received from NOBOs. Equity will tabulate the

results of the voting instruction forms received from NOBOs with respect to the

common shares represented by the voting instruction forms they receive.

The Meeting Materials are being sent to both registered

shareholders and Non-Registered Shareholders. If you are a Non-Registered

Shareholder, and the Company or its agent has sent these materials directly to

you, your name and address and information about your holdings of common shares

have been obtained in accordance with applicable securities regulatory

requirements from the Intermediary holding the common shares on your behalf.

By choosing to send these materials to you directly, the

Company (and not the Intermediary holding the common shares on your behalf) has

assumed responsibility for (i) delivering these materials to you, and (ii)

executing your proper voting instructions. Please return your voting

instructions as specified in the request for voting instructions.

Generally, OBOs who have not waived the right to receive Mailed

Materials will either:

| (a) |

be given a voting instruction form which is not signed by

the Intermediary and which, when properly completed and signed by the OBO

and returned to the Intermediary or its service company, will constitute

voting instructions which the Intermediary must follow. Typically, the

voting instruction form will consist of a one page pre-printed form.

Sometimes, instead of the one page pre-printed form, the voting instruction form will consist

of a regular printed proxy form accompanied by a page of instructions which

contains a removable label with a bar-code and other information. In order for

the form of proxy to validly constitute a voting instruction form, the OBO must

remove the label from the instructions and affix it to the form of proxy,

properly complete and sign the form of proxy and submit it to the Intermediary

or its service company in accordance with the instructions of the Intermediary

or its service company; or |

| Avalon Rare Metals Inc.

|

Page 2 |

| Information Circular as of and dated

January 12, 2016 |

|

| (b) |

be given a form of proxy which has already been signed by

the Intermediary (typically by a facsimile, stamped signature), which is

restricted as to the number of common shares beneficially owned by the OBO

but which is otherwise not completed by the Intermediary. Because the

Intermediary has already signed the form of proxy, this form of proxy is

not required to be signed by the OBO when submitting the proxy. In this

case, the OBO who wishes to submit a proxy should properly complete the

form of proxy and deposit it with TMX Equity Transfer Services, 200

University Avenue, Suite 300, Toronto, Ontario, Canada M5H

4H1. |

The Company intends to pay for an Intermediary to deliver the

Mailed Materials to OBOs.

In either case, the purpose of these procedures is to permit

Non-Registered Shareholders to direct the voting of the common shares they

beneficially own. Should a Non-Registered Shareholder who receives either a

voting instruction form or a form of proxy wish to attend the Meeting and vote

in person (or have another person attend and vote on behalf of the

Non-Registered Shareholder), the Non-Registered Shareholder should strike out

the names of the persons named in the form of proxy and insert the

Non-Registered Shareholder's (or such other person's) name in the blank space

provided or, in the case of a voting instruction form, follow the directions

indicated on the form. In either case, Non-Registered Shareholders should

carefully follow the instructions of their Intermediaries and their service

companies, Equity or Broadridge, as applicable, including those regarding when

and where the voting instruction form or the proxy is to be delivered.

Notice and Access

Under the notice and access rules adopted by the Canadian

Securities Administrators, public companies are permitted to advise their

shareholders of the availability of this Information Circular on an

easily-accessible website, rather than mailing paper copies.

The use of this alternative means of delivery is more

environmentally friendly as it will help reduce paper use and the Company’s

carbon footprint, and it will also reduce the Company’s printing and mailing

costs. The Company has therefore decided to deliver this Information Circular to

Non-Registered Shareholders by posting it on Equity’s website at

https://noticeinsite.tmxequity.com/AvalonRareMetalsASM2016. This

Information Circular will also be available on SEDAR at www.sedar.com and

on the Company’s website at

http://www.avalonraremetals.com/investors/regulatory_filings/.

Non-Registered Shareholders who wish to receive paper copies of

this Information Circular may request paper copies on-line at

https://noticeinsite.tmxequity.com/AvalonRareMetalsASM2016 or by calling

toll-free at 1-844-559-4938.

Requests for paper copies must be received at least five

business days in advance of the Proxy Deposit Deadline (as defined below) in

order to receive this Information Circular in advance of the Proxy Deposit

Deadline and the Meeting. This Information Circular will be sent to such

shareholders within three business days of their request, if such requests are

made before the Proxy Deposit Deadline. Those shareholders with existing instructions on their account to

receive a paper copy of the Meeting Materials will receive a paper copy of this

Information Circular.

| Avalon Rare Metals Inc.

|

Page 3 |

| Information Circular as of and dated

January 12, 2016 |

|

Due to certain requirements of the Canada Business

Corporations Act (the “Act”), the Company is sending a paper copy of the

complete proxy package, including the Notice of Meeting, this Information

Circular, and the Annual Financial Statements and related management’s

discussion and analysis to registered shareholders. The Annual Financial

Statements and related management’s discussion and analysis are also available

on SEDAR at www.sedar.com and on the Company’s web site at

http://www.avalonraremetals.com/investors/regulatory_filings/.

Appointment and Revocation of Proxies

The persons named in the form of proxy accompanying this

Information Circular are directors and/or officers of the Company. A shareholder

of the Company has the right to appoint a person or company (who need not be a

shareholder), other than the persons whose names appear in such form of proxy,

to attend and act for and on behalf of such shareholder at the Meeting and at

any adjournment thereof. Such right may be exercised by either striking out the

names of the persons specified in the form of proxy and inserting the name of

the person or company to be appointed in the blank space provided in the form of

proxy, or by completing another proper form of proxy and, in either case,

delivering the completed and executed proxy to TMX Equity Transfer Services, 200

University Avenue, Suite 300, Toronto, Ontario, Canada M5H 4H1 in time for use

at the Meeting in the manner specified in the Notice of Meeting.

A registered shareholder of the Company who has given a proxy

may revoke the proxy at any time prior to use by: (a) depositing an instrument

in writing, including another completed form of proxy, executed by such

registered shareholder or by his or her attorney authorized in writing or by

electronic signature or, if the registered shareholder is a corporation, by an

officer or attorney thereof properly authorized, either: (i) at the principal

office of the Company, 130 Adelaide Street West, Suite 1901, Toronto, Ontario,

Canada M5H 3P5, not less than 48 hours, Saturdays, Sundays and holidays

excepted, prior to the time of the holding of the Meeting or any adjournment

thereof (the “Proxy Deposit Deadline”), (ii) with TMX Equity Transfer Services,

200 University Avenue, Suite 300, Toronto, Ontario, Canada M5H 4H1, by the Proxy

Deposit Deadline, or (iii) with the chair of the Meeting on the day of the

Meeting or any adjournment thereof; (b) transmitting, by telephone or electronic

means, a revocation that complies with paragraphs (i), (ii) or (iii) above and

that is signed by electronic signature, provided that the means of electronic

signature permits a reliable determination that the document was created or

communicated by or on behalf of such shareholder or by or on behalf of his or

her attorney, as the case may be; or (c) in any other manner permitted by law

including attending the Meeting in person. Late proxies may be accepted or

rejected by the Chair of the Meeting in his or her discretion, and the Chair is

under no obligation to accept or reject any particular late proxy.

A Non-Registered Shareholder who has submitted a proxy may

revoke it by contacting the Intermediary through which the Non-Registered

Shareholder's common shares are held and following the instructions of the

Intermediary respecting the revocation of proxies.

Exercise of Discretion by Proxies

The common shares represented by an appropriate form of proxy

will be voted or withheld from voting on any ballot that may be conducted at the

Meeting, or at any adjournment thereof, in accordance with the instructions of

the shareholder thereon, and if the shareholder specifies a choice on any matter

to be acted upon, the common shares of such shareholder will be voted

accordingly. In the absence of instructions, such common shares will be voted FOR each of the

matters referred to in the Notice of Meeting as specified thereon.

| Avalon Rare Metals Inc. |

Page 4 |

| Information Circular as of and dated January 12, 2016 |

|

The enclosed form of proxy, when properly completed and signed,

confers discretionary authority upon the persons named therein to vote on any

amendments to or variations of the matters identified in the Notice of Meeting

and on other matters, if any, which may properly be brought before the Meeting

or any adjournment thereof. At the date hereof, management of the Company knows

of no such amendments or variations or other matters to be brought before the

Meeting. However, if any other matters which are not now known to management of

the Company should properly be brought before the Meeting, or any adjournment

thereof, the common shares represented by such proxy will be voted on such

matters in accordance with the judgment of the person named as proxy therein.

Signing of Proxy

The form of proxy must be signed by the shareholder of the

Company or the duly appointed attorney of the shareholder of the Company

authorized in writing or, if the shareholder of the Company is a corporation, by

a duly authorized officer of such corporation. A form of proxy signed by the

person acting as attorney of the shareholder of the Company or in some other

representative capacity, including an officer of a corporation which is a

shareholder of the Company, should indicate the capacity in which such person is

signing and should be accompanied by the appropriate instrument evidencing the

qualification and authority to act of such person, unless such instrument has

previously been filed with the Company. A shareholder of the Company or his or

her attorney may sign the form of proxy or a power of attorney authorizing the

creation of a proxy by electronic signature provided that the means of

electronic signature permits a reliable determination that the document was

created or communicated by or on behalf of such shareholder or by or on behalf

of his or her attorney, as the case may be.

VOTING SECURITIES AND PRINCIPAL HOLDERS

THEREOF

Description of Share Capital

The Company is authorized to issue an unlimited number of

common shares without par value and 25,000,000 preferred shares without par

value. There are 160,339,206 common shares and no preferred shares of the

Company issued and outstanding as at January 12, 2016.

At an annual meeting of the Company, on a show of hands, every

registered holder of common shares present in person and entitled to vote and

every proxyholder duly appointed by a registered shareholder who would have been

entitled to vote shall have one vote and, on a poll, every registered

shareholder present in person or represented by proxy or other proper authority

and entitled to vote shall have one vote for each share of which such

shareholder is the registered holder. Common shares represented by proxy will

only be voted if a ballot is called for. A ballot may be requested by a

registered shareholder or proxyholder present at the Meeting or required because

the number of votes attached to common shares represented by proxies that are to

be voted against a matter is greater than 5% of the votes that could be cast at

the Meeting.

Record Date

The directors of the Company have fixed January 12, 2016 as the

record date for the determination of the shareholders of the Company entitled to

receive notice of, and to vote at, the Meeting. Shareholders of the Company of record at the close of business on January 12,

2016 will be entitled to vote at the Meeting.

| Avalon Rare Metals Inc.

|

Page 5 |

| Information Circular as of and dated

January 12, 2016 |

|

Ownership of Securities of the Company

To the knowledge of the directors and executive officers of the

Company, no person or company beneficially owns, directly or indirectly, or

exercises control or direction over, voting securities carrying more than 10% of

the outstanding voting rights of the Company.

The officers of the Company and the individuals nominated by

management for election as directors collectively own or control, directly or

indirectly, in the aggregate, 4,414,334 common shares of the Company,

representing approximately 2.75% of the outstanding common shares as at January

12, 2016.

PARTICULARS OF MATTERS TO BE ACTED

UPON

| 1. |

Presentation of Financial

Statements |

At the Meeting, the Chair of the Meeting will present to

shareholders the financial statements of the Company for the year ended August

31, 2015 and the auditors’ report thereon, which have been approved by the board

of directors of the Company (the “Board”). No vote of the shareholders of the

Company is required with respect to this item of business.

The Board currently consists of six directors. The table below

and the notes thereto state the names of the seven persons nominated by

management for election as directors, all other positions and offices with the

Company now held by them, their principal occupations or employment for the

preceding five years, the period or periods of service as directors of the

Company and the number of voting securities of the Company beneficially owned,

directly or indirectly, or over which control or direction is exercised by each

of them as of the date hereof.

Majority Voting Policy

The Board has adopted a policy providing that in an uncontested

election of directors, any nominee who receives a greater number of votes

‘‘withheld’’ than votes ‘‘for’’ will tender his or her resignation to the Chair

of the Board promptly following the shareholders’ meeting. The Compensation,

Governance and Nominating Committee (the “CGN Committee”) of the Board will

consider the offer of resignation and will make a recommendation to the Board on

whether to accept it. In considering whether or not to accept the resignation,

the CGN Committee will consider all factors deemed relevant by members of such

Committee. The CGN Committee will be expected to accept the resignation except

in situations where the considerations would warrant the applicable director

continuing to serve on the Board. The Board will make its final decision and

announce it in a press release within 90 days following the Meeting. A director

who tenders his or her resignation pursuant to this policy will not participate

in any meeting of the Board or the CGN Committee at which the resignation is

considered.

| Avalon Rare Metals Inc.

|

Page 6 |

| Information Circular as of and dated

January 12, 2016 |

|

Advance Notice By-Law

On January 12, 2016, the Board approved, effective upon

shareholder approval at the Meeting, the adoption by the Company of By-law No. 2

relating to the nomination of directors by shareholders of the Company in

certain circumstances.

Proxies received appointing directors and/or officers of the

Company will be voted FOR the election of the nominees named in the table below,

unless the shareholder has specified in the proxy that the common shares are to

be withheld from voting in respect thereof. Management has no reason to believe

that any of the nominees will be unable to serve as a director but, if a nominee

is for any reason unavailable to serve as a director, proxies appointing

directors and/or officers of the Company will be voted in favour of the

remaining nominees and may be voted for a substitute nominee, unless the

shareholder has specified in the proxy that the common shares are to be withheld

from voting in respect of the election of directors.

Name, Province/State

and Country of

Residence |

Position

with

the Company |

Present

Principal Occupation,

Business or Employment for

the Past Five

Years |

Director

Since |

Common

Shares

Beneficially

Owned, Directly

or Indirectly or

Controlled or

Directed* |

|

Donald Bubar Ontario, Canada |

President and CEO |

President and CEO of the Company |

February 17, 1995 |

3,275,600 |

|

Brian MacEachen (1)

Nova Scotia, Canada |

Director |

Business owner-operator, Executive Consultant and Chief

Financial Officer of Zonte Metals Inc.; Former President and Chief

Executive Officer of Linear Metals Corporation from January 2008 to April

2012 and Executive Vice President of Brigus Gold Corp. from October 2009

to July 2012 |

November 16, 1998 |

340,000 |

|

Alan Ferry (1)(2)

Ontario, Canada |

Director |

Self-employed businessperson, Lead Director of Guyana

Goldfields Inc. |

February 24, 2000 |

225,000 |

|

Peter McCarter (1)(2)

Ontario, Canada |

Director |

Retired mining executive |

November 16, 2007 |

80,000 |

|

Phil Fontaine

Ontario, Canada |

Director |

Retired; Special Advisor to the Royal Bank of Canada

since September 2009 and Senior Advisor to Norton Rose Fulbright LLP since

March 2010; prior thereto, National Chief of the Assembly of First Nations |

September 8, 2009 |

10,000 |

| Avalon Rare Metals Inc.

|

Page 7 |

| Information Circular as of and dated

January 12, 2016 |

|

Name, Province/State

and Country of

Residence |

Position with

the Company |

Present

Principal Occupation,

Business or Employment for

the Past Five

Years |

Director Since |

Common Shares

Beneficially

Owned, Directly

or Indirectly or

Controlled

or

Directed* |

|

Kenneth G. Thomas (2)

Ontario, Canada |

Director |

President, Ken Thomas & Associates Inc. since July

2012; Director, Continental Gold Limited since June 2012; and Director,

Candente Gold Corporation since December 2012; prior thereto, Senior Vice

President, Projects, Kinross Gold Corporation from December 2009 to June

2012 and Global Managing Director and Director, Hatch from November 2005

to November 2009 |

February 25, 2014 |

49,000 |

|

Jane Pagel

Ontario, Canada |

Not Applicable |

Self-employed businessperson; Interim President and CEO

Sustainable Development Technology Canada June 2014 - June 2015; President

and CEO Ontario Clean Water 2010-2014; SVP and Principal Jaques Whitford

2000-2009, acquired by Stantec, Principal 2009-2010 |

Not Applicable |

Nil |

Notes:

* As provided by the respective director as at

January 12, 2016.

(1) Member of the

Company’s Audit Committee.

(2) Member of the

Company’s CGN Committee. |

Each director elected at the Meeting will hold office until the

next annual meeting or until his or her successor is duly elected or appointed.

No proposed director (including any personal holding company of

a proposed director):

| (a) |

is, as at the date of this Information Circular, or has

been, within the preceding 10 years, a director, chief executive officer

or chief financial officer of any company (including the Company)

that: |

| |

(i) |

was the subject of a cease trade or similar order

(including a management cease trade order whether or not such person was

named in the order) or an order that denied the relevant company access to

any exemption under securities legislation, that was in effect for a

period of more than 30 consecutive days, (an “Order”) that was issued

while the proposed director was acting in the capacity as director, chief

executive officer or chief financial officer, other than Peter McCarter,

who was a director and officer of Compressario Corporation when it became

subject to cease trade orders that were issued in 2003 by the Ontario, British Columbia and Alberta

Securities Commissions for failure to file financial statements; or |

| Avalon Rare Metals Inc.

|

Page 8 |

| Information Circular as of and dated

January 12, 2016 |

|

| |

(ii) |

was subject to an Order that was issued after the

proposed director ceased to be a director, chief executive officer or

chief financial officer and which resulted from an event that occurred

while that person was acting in the capacity as director, chief executive

officer or chief financial officer. |

| (b) |

is, as at the date of this Information Circular, or has

been, within the preceding 10 years, a director or executive officer of

any company (including the Company) that, while that person was acting in

that capacity, or within a year of that person ceasing to act in that

capacity became bankrupt, made a proposal under any legislation relating

to bankruptcy or insolvency or was subject to or instituted any

proceedings, arrangement or compromise with creditors or had a receiver,

receiver manager or trustee appointed to hold its assets; or |

| |

|

| (c) |

has, within the 10 years before the date of this

Information Circular, became bankrupt, made a proposal under any

legislation relating to bankruptcy or insolvency or become subject to or

instituted any proceedings, arrangement or compromise with creditors or

had a receiver, receiver manager or trustee appointed to hold the assets

of the proposed director; or |

| |

|

| (d) |

has been subject to: |

| |

(i) |

since December 31, 2000, any penalties or

sanctions imposed by a court relating to securities legislation or by a

securities regulatory authority or has entered into a settlement agreement

with a securities regulatory authority; or |

| |

|

|

| |

(ii) |

any other penalties or sanctions imposed by a court or

regulatory body that would likely be considered important to a reasonable

securityholder in deciding whether to vote for a proposed

director; |

| 3. |

Appointment of Auditors |

Deloitte LLP have been the auditors of the Company since

December 16, 2013. Shareholders will be asked to consider and, if thought

advisable, to pass an ordinary resolution to appoint Deloitte LLP to serve as

auditors of the Company until the next annual meeting of shareholders and to

authorize the directors of the Company to fix their remuneration.

The appointment of Deloitte LLP as auditors of the Company

until the next annual meeting of the shareholders and the authorization of the

directors to fix their remuneration must be authorized and approved by an

ordinary resolution of the shareholders. An ordinary resolution is a resolution

passed by by at least a majority (50%+1) of the votes cast by shareholders who

voted by proxy or in person in respect of that resolution at the Meeting.

The Board unanimously recommends that shareholders vote FOR the

ordinary resolution to appoint the auditors and authorize the directors to fix

their remuneration. Unless the shareholder directs that his or her common shares

are to be withheld from voting in connection with the appointment of auditors,

the persons named in the enclosed form of proxy intend to vote FOR the

appointment of Deloitte LLP, to serve as auditors of the Company until the next

annual meeting of the shareholders and to authorize the directors to fix their

remuneration.

| Avalon Rare Metals Inc.

|

Page 9 |

| Information Circular as of and dated

January 12, 2016 |

|

| 4. |

Approval of Name

Change |

At the Meeting, shareholders will be asked to consider and, if

deemed advisable, approve a special resolution, with or without variation,

authorizing the Company to amend its articles to effect a change of name of the

Company from “Avalon Rare Metals Inc.” to “Avalon Advanced Materials Inc.”, or

such other name as the Board in its discretion may resolve and as may be

acceptable to applicable regulatory authorities, including the Toronto Stock

Exchange (the “TSX), if required.

The Board feels that the current name of “Avalon Rare Metals

Inc.” is too closely associated with “rare earths” and fails to adequately

convey the Company’s diversified specialty metals and minerals asset base. Many

investors do not realize that the Company is no longer exclusively focused on

rare earths and that current activities are now focused on its other advanced

materials assets, notably lithium and tin-indium. The Company does not intend to

change the ticker symbol (“AVL”) under which its common shares are currently

listed on the TSX.

The amendment to the Company’s articles implementing the change

of the Company’s name must be authorized and approved by a special resolution of

the shareholders. A special resolution is a resolution passed by a majority of

not less than two-thirds (66⅔%) of the votes cast by shareholders who voted by

proxy or in person in respect of that resolution at the Meeting.

The Board may determine not to implement the special resolution

authorizing the name change at any time after the Meeting and after receipt of

necessary regulatory approvals, but prior to the name change becoming effective,

without further action on the part of the shareholders of the Company.

The Board unanimously recommends that shareholders vote FOR the

special resolution to change the Company’s name. Unless the shareholder

directs that his or her common shares are to be voted against the resolution

with respect to the change of the Company’s name, the persons named in the

enclosed form of proxy intend to vote FOR the resolution.

At the Meeting, shareholders will be asked to vote on the

following special resolution:

“Be it resolved as a special resolution that:

1. the name of the Company is hereby changed from “Avalon Rare

Metals Inc.” to “Avalon Advanced Materials Inc.”, or such other name that the

Board deems appropriate and as may be approved by applicable regulatory

authorities, including the TSX, if the Board considers it to be in the best

interests of the Company to implement such a name change, and that the articles

of the Company be amended to reflect such change, such amendment to take effect

once the Company’s Articles of Continuance are altered to reflect the name

change;

2. any director or officer of the Company is hereby authorized,

for or on behalf of the Company, to execute and deliver all documents and

instruments and to take such other actions as such director or officer may

determine to be necessary or desirable to implement this special resolution and

the matters authorized hereby, such determination to be conclusively evidenced

by the execution and delivery of any such documents or instruments and the

taking of any such actions; and

3. notwithstanding that this resolution has been duly passed by

the shareholders of the Company, the Board is hereby authorized and empowered,

if it decides not to proceed with this resolution, to revoke this resolution in whole or in part at any time prior to it being

given effect without further notice to, or approval of, the shareholders.”

| Avalon Rare Metals Inc.

|

Page 10 |

| Information Circular as of and dated

January 12, 2016 |

|

| 5. |

Approval of By-Law

No.2 |

On January 12, 2016, the Board approved the adoption by the

Company of By-law No. 2 relating to the provision of advance notice of

nominations of directors of the Company ("By-law No. 2"). A complete copy of

By-law No. 2 is attached as Schedule "B" hereto.

The Company believes that adopting By-law No.2 is considered to

be good corporate governance. ByLaw No.2 provides a clear process for

shareholders to follow for director nominations and sets out a reasonable time

frame for nominee submissions and the provision of accompanying information. The

purpose of By-law No.2 is to treat all shareholders fairly by ensuring that all

shareholders receive adequate notice of the nominations to be considered at a

meeting and can thereby exercise their voting rights in an informed manner. In

addition, By-law No.2 should assist in facilitating an orderly and efficient

meeting process. The full text of By-Law No.2 is set forth in Schedule "B"

attached hereto.

Pursuant to the provisions of the Act, By-Law No.2 will not

become effective unless approved by an ordinary resolution of the shareholders.

An ordinary resolution is a resolution passed by by at least a majority (50%+1)

of the votes cast by shareholders who voted by proxy or in person in respect of

that resolution at the Meeting.

The Board unanimously recommends that shareholders vote FOR the

adoption of By-law No.2. Unless the shareholder directs that his or her

common shares are to be voted against the resolution with respect to the

adoption of By-Law No.2, the persons named in the enclosed form of proxy intend

to vote FOR the resolution.

At the Meeting, the shareholders will be asked to consider and,

if deemed advisable, to adopt the following resolution in order to approve

By-law No. 2:

“Be it resolved that:

1. By-law No. 2 of the Company, in the form attached to the

Information Circular dated January 12, 2016, is hereby approved, ratified and

confirmed as a by-law of the Company; and

2. any director or officer of the Company is hereby authorized,

for or on behalf of the Company, to execute and deliver all documents and

instruments and to take such other actions as such director or officer may

determine to be necessary or desirable to implement the adoption of By-Law No.2

and the matters authorized hereby, such determination to be conclusively

evidenced by the execution and delivery of any such documents or instruments and

the taking of any such actions.”

OTHER MATTERS WHICH MAY COME BEFORE THE

MEETING

The management knows of no matters to come before the Meeting

other than as set forth in the Notice of Meeting. However, if other matters are

not known to the management should properly come before the Meeting, the

accompanying proxy will be voted on such matters in accordance with the best

judgment of the persons voting the proxy.

| Avalon Rare Metals Inc.

|

Page 11 |

| Information Circular as of and dated

January 12, 2016 |

|

STATEMENT OF EXECUTIVE COMPENSATION

| A. |

Named Executive

Officers |

For the purposes of this Information Circular, a named

executive officer (“Named Executive Officer”) of the Company means each of the

following individuals:

| (a) |

a chief executive officer (“CEO”) of the

Company; |

| |

|

| (b) |

a chief financial officer (“CFO”) of the

Company; |

| |

|

| (c) |

each of the Company’s three most highly compensated

executive officers, or the three most highly compensated individuals

acting in a similar capacity, other than the CEO and CFO, at the end of

the most recently completed financial year whose total compensation was

individually, more than $150,000, as determined in accordance with

subsection 1.3(6) of Form 51-102F6, for that financial year; and |

| |

|

| (d) |

each individual who would be a Named Executive Officer

under paragraph (c) above but for the fact that the individual was neither

an executive officer of the Company, nor acting in a similar capacity, at

the end of the financial year. |

For the fiscal year ended August 31, 2015, the Company had five

Named Executive Officers, namely, its CEO and President, Donald Bubar, its CFO

and Vice President, Finance, R. James Andersen, its Senior Vice President,

Metallurgy and Technology Development, David Marsh, its Vice President, Sales

and Marketing, Pierre Neatby, and its Vice President, Exploration, William

Mercer.

| B. |

Compensation Discussion and

Analysis |

Compensation, Governance and Nominating

Committee

The Compensation, Governance and Nominating Committee (the “CGN

Committee”) of the Board is responsible for making recommendations to the Board

with respect to the compensation of the executive officers of the Company as

well as, among other things, with respect to the Company’s stock option plan

(the “Stock Option Plan”) and any other employee benefits and/or plans and with

respect to directors’ compensation. The Board (exclusive of the CEO, who is also

a member of the Board) reviews such recommendations and gives final approval to

the compensation of the executive officers. See also Schedule A – Corporate

Governance Disclosure hereto.

The CGN Committee currently consists of Peter McCarter (Chair),

Alan Ferry and Kenneth G, Thomas, each of whom are independent, pursuant to

National Instrument 52-110 – Audit Committees. Each of Messrs. McCarter,

Ferry and Thomas has direct and extensive experience in corporate management and

compensation issues in either the mining industry and/or the financial industry.

Mr. McCarter was previously the Executive Vice-President, Corporate Affairs for

Aur Resources Inc. (“Aur”), a publicly listed international mining company, in

which role he had responsibility for managing Aur’s human resources matters. Mr.

Ferry is a member of the committee responsible for compensation matters of

Guyana Goldfields Inc. and GPM Metals Inc., which are publicly listed mineral

exploration or mining companies. Dr. Thomas served as Senior Vice President,

Projects, Kinross Gold Corporation from December 2009 to June 2012, Global

Managing Director and Director, Hatch from November 2005 to November 2009 and

Chief Operating Officer, Crystallex International Corporation from April 2003 to

October 2005. In addition he served in senior roles at Barrick Gold Corporation from 1987

to 2001, including Senior Vice President, Technical Services, during which times

he was responsible for determining the compensation of those employees whom he

directly and indirectly supervised, which numbered in excess of several dozen.

This experience relating to executive compensation matters collectively provides

members of the CGN Committee with a suitable perspective to make decisions on

the appropriateness of the Company’s compensation policies and practices.

| Avalon Rare Metals Inc.

|

Page 12 |

| Information Circular as of and dated

January 12, 2016 |

|

The CGN Committee has not to date felt it necessary to engage

any compensation consultant or advisor to assist it in the performance of its

duties.

Compensation Objectives and Structure

The overall compensation objective adopted by the CGN Committee

is to ensure that executive compensation is fair and reasonable, rewards

management performance and is, by being competitive, sufficient to attract and

retain experienced and talented executives. Due to the nature of the mineral

industry, executive talent has significant mobility and, as a result,

competition for experienced executives in the past has been great. The Company’s

compensation policies are designed to recognize the foregoing. The foregoing

objective also recognizes the fundamental value added by a motivated and

committed management team in accomplishing the Company’s principal corporate

objectives.

Historically, the compensation provided by the Company to its

executive officers, including the CEO, has had three components: base salary,

bonuses and long term incentive compensation in the form of stock options (see

“Stock Option Plan”). Bonus compensation is a cash component of management

compensation in order to permit the recognition of outstanding individual

efforts, performance, achievements and/or accomplishments by members of the

Company’s management team. Any specific bonus amounts are awarded on the

recommendation of the CGN Committee and ultimately at the discretion of the

Board, with bonus amounts for members of the Company’s management team other

than the CEO being based primarily on the recommendations of the CEO. The

appropriateness and amount of any bonuses to the CEO and/or management team

members has to date been considered annually by the CGN Committee and Board on a

discretionary basis as no formal bonus plan based on quantitative and/or

qualitative benchmarks has been established for the Company as yet.

Base salary is the principal component of each executive

officer’s overall compensation and reflects the fixed component of pay that

compensates the relevant executive officer for fulfilling his or her day to day

roles and responsibilities. The CGN Committee typically reviews the base salary

levels and considers the individual performance of the CEO and of each other

executive officer and historically has compared executive compensation for other

companies operating in the mineral industry. It is important that the Company’s

CEO and other members of its senior management team are paid competitive base

salaries that are in keeping with that offered by comparable companies within

the industry. The CGN Committee also noted that in the setting of base salaries

in prior years, companies operating in the rare earths industry have faced

unique and relatively difficult additional challenges that need to be addressed,

particularly in the financing, marketing and metallurgical processing areas,

than do other companies in the mining sector, such as gold and base metal

companies.

Historically, in setting the salary and bonus, if any, to be

awarded to the CEO for each year, the CGN Committee, in addition to reviewing

peer group data, has reviewed the achievements of the CEO for the prior year and

looked at the overall performance of the Company in terms of the achievement of

its corporate objectives, including the acquisition and advancement of projects.

Also typically included in such overall assessment are specific initiatives

undertaken in the year by the Company that have advanced the growth and progress of the Company and the

enhancement of shareholder value during the year, including the reflection of

such in the Company’s share price. In setting the compensation of the executive

officers of the Company, other than the CEO, the CGN Committee has historically

reviewed with the CEO, the CEO’s evaluation of each executive officer’s

performance during the year as well as the responsibilities, experience and

qualifications of such executive officer and comparable industry compensation

data. More recently, however, the overall financial condition of the Company and

the overall depressed nature of the junior resource sector in Canada and

elsewhere has significantly factored into the setting of the cash remuneration

levels of the Company’s senior management and, in particular, has resulted in

there being no or minimal increases in the cash remuneration of senior

management for the calendar years 2014 – 2016. Given the nature of the Company

as an exploration and development stage resource company without existing

mineral production and without any attendant revenues derived thereon,

compensation has in the past been generally based on comparative, qualitative or

subjective measures, rather than quantitative benchmarks. No specific

benchmarks, weights or percentages are assigned to any of the measures or

objectives upon which the executive compensation is generally based.

| Avalon Rare Metals Inc.

|

Page 13 |

| Information Circular as of and dated

January 12, 2016 |

|

Annual salary adjustments, if any, have historically been made

on a calendar year basis, typically being determined towards the end of each

calendar year and made effective January 1 of the following year.

Compensation Risk Management

The CGN Committee evaluates the risks, if any, associated with

the Company’s compensation policies and practices. Implicit in the mandate of

the Board is that the Company’s policies and practices respecting compensation,

including those applicable to the Named Executive Officers, be designed in a

manner which is in the best interests of the Company and its shareholders.

In particular, the Company’s executive compensation policies

incorporate a balanced compensation program design (see “Compensation Objectives

and Structure”) and include elements of fixed and variable compensation and

short and longer term incentives.

The base salary component of the compensation provided by the

Company to its executive officers is set annually. The bonus component of the

compensation provided by the Company to its executive officers is discretionary,

is currently based on qualitative or subjective measures rather than

quantitative benchmarks, and is subject to the prior approval of the CGN

Committee. Discretionary assessment of the performance of executive officers by

the Committee ensures that bonus awards align with both perceived and actual

performance and the risks associated with such performance and any bonus award.

The stock option component of the compensation provided by the

Company to its executive officers is both “longer term” and “at risk” and,

accordingly, is directly linked to the achievement of longer term value

creation. Since the benefits of such compensation, if any, are generally not

realized by the executive officers until a significant period of time has passed

and that there are typically deferred vesting provisions attached to each option

grant (see “Stock Option Plan” below), the incentive for executive officers to

take inappropriate or excessive risks with regard to their compensation that are

financially beneficial to them at the expense of the Company and its

shareholders is limited.

The CGN Committee believes that it is unlikely that an

executive officer would take inappropriate or excessive risks at the expense of

the Company and its shareholders that would be beneficial to them with regard to

their short term compensation when their longer term compensation might be put

at risk from their actions. Due to the size of the Company, the CGN Committee is

able to monitor and consider any risks which may be associated with the Company’s compensation

policies and practices. Risks, if any, may be identified and mitigated through

regular meetings of the Board during which financial and other information

relating to the Company are reviewed, and which includes senior executive

compensation. The CGN Committee has not identified any risks arising from the

Company’s compensation policies and practices that it believes would be

reasonably likely to have a material adverse effect on the Company.

| Avalon Rare Metals Inc.

|

Page 14 |

| Information Circular as of and dated

January 12, 2016 |

|

Although the Company has not as yet adopted any specific

policies in this regard, in the event that a director or an executive officer

purchases financial instruments that are designed to hedge or offset a decrease

in the market value of the Company’s equity securities granted as compensation

or held, directly or indirectly by the director or the executive officer, such

purchases must be disclosed in insider reporting filings. To date, no such

purchases have been disclosed by any director or executive officer of the

Company.

Base Salary and Bonus

The CGN Committee, in respect of the setting of salaries for

the Named Executive Officers for 2015, recommended to the Board and the Board

determined that, there would be no salary increases for the Named Executive

Officers in 2015 or 2016. This determination recognized the then current

financial situation of the Company and the overall depressed nature of the

junior resource sector in Canada.

Further, each of the Named Executive Officers agreed, for the

seven month period commencing November 2014 through to May 2015, to be granted,

in lieu of receiving 20% of their respective salaries (25% in the case of Mr.

Bubar) during such period, additional stock options, being in the case of Mr.

Bubar, options to purchase 150,000 common shares of the Company, in the case of

Messrs. Andersen and Marsh, options to purchase 125,000 common shares and in the

case of Messrs. Mercer and Neatby, options to purchase 100,000 common shares.

All of the foregoing options were granted effective November 24, 2014, have an

exercise price of $0.22 per share, have a five year term and vested

immediately.

In addition, each of the Named Executive Officers has agreed,

for the seven month period commencing June 2015 through to December 2015, to be

granted, in lieu of receiving 20% of their respective salaries during such

period (25% in the case of Mr. Bubar), additional stock options or vacation

days, being in the case of Mr. Bubar, 38 vacation days, in the case of Messrs.

Andersen and Mercer, 30 vacation days, in the case of Mr. Marsh, 13 vacation

days and options to purchase 70,000 common shares and in the case of Mr. Neatby,

options to purchase 100,000 common shares. All of the foregoing options were

granted effective August 7, 2015, have an exercise price of $0.21 per share,

have a five year term and vested immediately.

In addition, each of the Named Executive Officers has agreed,

for the eight month period commencing January 2016 through to August 2016, to be

granted, in lieu of receiving 20% of their respective salaries during such

period (25% in the case of Mr. Bubar), additional stock options, being in the

case of Mr. Bubar, options to purchase 150,000 common shares of the Company, in

the case of Messrs. Andersen and Marsh, options to purchase 125,000 common

shares and in the case of Messrs. Mercer and Neatby, options to purchase 100,000

common shares. All of the foregoing options were granted effective January 12,

2016, have an exercise price of $0.12 per share, have a five year term and

vested immediately.

No discretionary bonuses were awarded to any Named Executive

Officers of the Company for 2015.

| Avalon Rare Metals Inc.

|

Page 15 |

| Information Circular as of and dated

January 12, 2016 |

|

Options

The CGN Committee is of the view that the granting of options

is an appropriate method of providing long-term incentives to senior management

of the Company and, in general, aligns the interests of senior management with

those of the shareholders by enabling senior management to participate in and be

rewarded by an increase in the market price of the Company’s common shares.

Participation in the Stock Option Plan also provides a significant incentive to

the participants to enter into and subsequently to continue their employment

with the Company, particularly when the Company may not have the financial

resources and/or pension and other benefit plans to attract and retain

experienced personnel. In addition, the CGN Committee is of the view that the

Company’s compensation mix must be consistent with industry norms which supports

the provision by the Company of a longer term compensation incentive. This

longer term compensation incentive is best realized by providing compensation

linked to share price performance such as options. The number and terms of

options previously granted to the named executives have been and are expected to

continue to be taken into account, as well as the number and terms of options

granted by peer group companies in determining whether and in what quantity new

option grants should be made in any year. Also, as discussed under “Base Salary

and Bonus” above, additional options have been granted to members of senior

management in lieu of receipt by them of certain specified cash salary amounts.

The Company’s current objective under the Stock Option Plan is

to allot to the CEO options to purchase 1,000,000 common shares, to the CFO and

Senior Vice President options to purchase 600,000 common shares and to officers

at the Vice President level options to purchase 400,000 common shares (the

“target allotments”). The foregoing allotments do not include the additional

options granted to the Named Executive Officers on November 24, 2014, August 7,

2015, and January 12, 2016, as described under “Base Salary and Bonus” above,

and the 150,000 options granted to the CEO and CFO on January 6, 2014 in lieu of

an annual salary increase for that year.

In the past, the Company had typically granted all of an

employee’s option allotment at the commencement of the employee’s employment,

with such options to vest periodically over the first four years of a five year

option term. During the 2012 calendar year, the Company switched to a

methodology of annual grants of one fifth of the employee’s target allotment (on

a discretionary basis). Accordingly, over the next two years, as the number of

options granted under the former methodology are exercised or expire, each

employee may have more or less than their target allotment at any given time.

Over the next two years, all stock options granted in the ordinary course to

each employee will gravitate toward the employee’s target allotment. The

methodology applied by the Company permits exceptions to be made, for example,

to recognize exceptional employee contributions and to permit flexibility in

negotiating employment contracts.

Circumstances Triggering Termination and

Change of Control Benefits

As noted below under the heading “Employment Contracts”, there

are certain circumstances that trigger payments and other benefits to the CEO

upon termination and change of control. The CGN Committee views such provisions

as not only being fair and necessary to protect the CEO, but also to encourage

the CEO to pursue those transactions such as mergers or take-overs that are

beneficial to the Company and its shareholders, but that may result in the

termination of the CEO’s employment with the Company.

| Avalon Rare Metals Inc.

|

Page 16 |

| Information Circular as of and dated

January 12, 2016 |

|

Stock Option Plan

The Stock Option Plan, approved by shareholders on February 25,

2014, is a fixed percentage plan that provides that the maximum number of

options which may be outstanding at any time under the Stock Option Plan and any

other compensation arrangement of the Company is 10% of the Company’s issued and

outstanding common shares. Eligible Participants under the Stock Option Plan

include insiders or employees of the Company or any of its subsidiaries, and any

other person or company engaged to provide ongoing management, consulting or

advisory services to the Company.

The Company maintains the Stock Option Plan in order to provide

effective incentives to directors, officers and senior management personnel of

the Company and to enable the Company to attract and retain experienced and

talented individuals in those positions by permitting such individuals to

directly participate in an increase in share value created for the Company’s

shareholders.

Incentive options granted under the Stock Option Plan entitle

the purchase of shares at a price and for the length of time determined by the

Board provided that the price cannot be lower than the market price of the

common shares on the Toronto Stock Exchange (the “TSX”) on the day prior to or

on the day of the grant and the expiry date cannot be more than 10 years after

the date of the grant. Further, the policies of the TSX also provide that the

said exercise price of any options so granted cannot be reduced without

shareholder approval.

Options under the Stock Option Plan are typically granted in

such numbers as reflect the level of responsibility of the particular optionee

and his or her contribution to the business and activities of the Company.

Options may also be granted under the Stock Option Plan to consultants. Options

granted under the Stock Option Plan typically have a five year term and are

typically made cumulatively exercisable by the holders thereof in equal

proportions of the aggregate number of shares subject to the options over

specified time periods. Historically, after an initial grant, options have been

re-granted upon such having been exercised. In the event a take-over bid (within

the meaning of the Securities Act (Ontario)) is made for the common

shares of the Company, then all unvested options thereupon become exercisable by

the holder. Options terminate immediately upon an optionee’s employment with the

Company being terminated (unless otherwise determined by the Board) or unless

such termination is a result of death, disability or retirement, in which case

termination occurs 12 months from the occurrence of the relevant event (subject

to the earlier expiry of the options in the normal course). The terms of the

Stock Option Plan further provide that the exercise price at which common shares

may be issued under the Stock Option Plan cannot be less than the current market

price of the common shares when the relevant options are granted.

As at January 12, 2016, 10,425,000 common shares, being 6.50%

of the currently issued common shares of the Company, were issuable pursuant to

unexercised options granted to such date under the Stock Option Plan.

Incentives to Participants under the Stock Option Plan may also

be provided by the granting of stock appreciation rights. Stock appreciation

rights, which can be attached to an option at the discretion of the Company at

any time, entitle a Participant in the Stock Option Plan to elect, in lieu of

exercising an outstanding Option, to receive the number of common shares

equivalent in value to the difference between his or her option exercise price

and the then existing market value of the shares multiplied by the number of

common shares over which he or she could otherwise exercise his or her option.

No stock appreciation rights have been granted under the Stock Option Plan to

date.

| Avalon Rare Metals Inc.

|

Page 17 |

| Information Circular as of and dated

January 12, 2016 |

|

The rules of the TSX require that all unallocated options,

rights or other entitlements under plans such as the Stock Option Plan must be

re-approved by a majority of the relevant issuer’s directors and by shareholders

every three years after institution of the relevant plan. Under the policies of

the TSX, if the Company wishes to make certain amendments to the Stock Option

Plan, it must obtain shareholder approval.

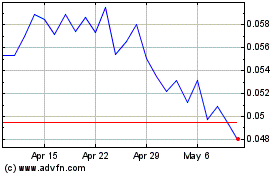

The following graph and table compares the yearly percentage

change in the cumulative total shareholder return of the common shares for the

period from August 31, 2010 to August 31, 2015 with the cumulative total return

of the S&P/TSX Composite Total Return Index for the same period. The graph

and table assume $100 invested in common shares on August 31, 2010 and in the

S&P/TSX Composite Total Return Index, which assumes dividend reinvestment.

Cumulative Total Return on $100

Investment

There is no direct correlation between the market performance

of the Company’s common shares and executive compensation except that any

increase in the market price of the common shares will increase the value of any

options held by the relevant executives. The CGN Committee and the Board

generally evaluate performance by reference to the achievement of corporate

objectives rather than by short term changes in the Company’s common share

price, which typically has in the past been significantly influenced by overall

economic, market and industry conditions. Indirectly, however, the Board

determined that there would be no salary increases for the Named Executive

Officers in 2015, in recognition of the then current financial situation of the

Company and the overall depressed nature of the junior resource sector in

Canada. See discussion under “Base Salary and Bonus” above for further

details.

Comparison of Cumulative Total Return

| Month / Year |

August

31, 2010 |

August

31, 2011 |

August

31, 2012 |

August

31, 2013 |

August

31, 2014 |

August

31, 2015 |

| Avalon Rare Metals Inc. |

$100.00 |

$142.48 |

$57.19 |

$27.12 |

$15.03 |

$5.56 |

| S&P/TSX Composite Total Return Index |

$100.00 |

$109.91 |

$105.96 |

$115.78 |

$147.19 |

$134.41 |

| Avalon Rare Metals Inc.

|

Page 18 |

| Information Circular as of and dated

January 12, 2016 |

|

| D. |

Summary Compensation

Table |

The table below contains a summary of the compensation paid to

the Named Executive Officers during the three most recently completed financial

years.

Name and

Principal

Position |

Year |

Salary ($) |

Share

based

awards

($) |

Option-

based

awards (1)

($) |

Non-Equity incentive

plan compensation

($)

|

Pension

Value (2)

($)

|

All other

compensation(3)

($)

|

Total

compensation

($)

|

|

|

|

Annual

incentive

plans |

Long-term

incentive

plans |

|

|

Donald Bubar(4)

President and CEO |

2015 |

316,667 |

Nil |

52,812 |

Nil |

Nil |

Nil |

1,023 |

370,502 |

| 2014 |

400,000 |

Nil |

137,373 |

Nil |

Nil |

Nil |

1,938 |

539,311 |

| 2013 |

400,000 |

Nil |

395,546 |

Nil |

Nil |

Nil |

923 |

796,469 |

R. James Andersen

CFO and VP, Finance |

2015 |

250,000 |

Nil |

30,761 |

Nil |

Nil |

Nil |

Nil |

280,761 |

| 2014 |

300,000 |

Nil |

79,283 |

Nil |

Nil |

Nil |

Nil |

379,283 |

| 2013 |

300,000 |

Nil |

211,521 |

Nil |

Nil |

Nil |

Nil |

511,521 |

David Marsh

Senior VP, Metallurgy

and Technology

Development |

2015 |

295,532 |

Nil |

36,602 |

Nil |

Nil |

Nil |

Nil |

332,134 |

| 2014 |

356,667 |

Nil |

51,263 |

Nil |

Nil |

Nil |

Nil |

407,930 |

| 2013 |

350,000 |

Nil |

Nil |

50,000(5) |

Nil |

Nil |

923 |

400,923 |

William Mercer

VP, Exploration |

2015 |

210,758 |

Nil |

18,048 |

Nil |

Nil |

Nil |

Nil |

228,806 |

| 2014 |

256,667 |

Nil |

33,869 |

Nil |

Nil |

Nil |

Nil |

290,536 |

| 2013 |

243,845 |

Nil |

Nil |

Nil |

Nil |

Nil |

923 |

244,768 |

Pierre Neatby

VP, Sales and Marketing |

2015 |

216,667 |

Nil |

30,279 |

Nil |

Nil |

Nil |

748 |

247,694 |

| 2014 |

256,667 |

Nil |

24,735 |

Nil |

Nil |

Nil |

748 |

282,150 |

| 2013 |

250,000 |

Nil |

141,014 |

Nil |

Nil |

Nil |

630 |

391,644 |

| Notes: |

| (1) |

These amounts represent the “grant date fair value” of

options granted to the respective Named Executive Officer, which have been

determined by using the Black-Scholes model, a mathematical valuation

model that ascribes a value to an option based on a number of factors in

valuing the option-based awards, including the exercise price of the

option, the price of the underlying security on the date the option was

granted, and assumptions with respect to the volatility of the price of

the underlying security and the risk-free rate of return. Calculating the

value of options using this methodology is very different from a simple

“in-the-money” value calculation. In fact, options that are well

out-of-the-money can still have a significant “grant date fair value”