0001338929false--12-31FY2023false0.001400000100000100000200000100000020000003500000000000.0010.0010.0011000000400000100000325680000013389292023-01-012023-12-310001338929ahro:SeriesZPreferredStockMember2023-01-012023-12-310001338929ahro:CommonStocksMember2023-01-012023-12-310001338929srt:BoardOfDirectorsChairmanMember2023-01-012023-12-310001338929ahro:PromissoryNotesMember2023-01-012023-12-310001338929us-gaap:OptionMember2022-01-012022-12-310001338929ahro:WarrantsMember2022-01-012022-12-310001338929ahro:WarrantsMember2023-01-012023-12-310001338929us-gaap:OptionMember2023-01-012023-12-310001338929us-gaap:ConvertibleNotesPayableMember2023-01-012023-12-310001338929us-gaap:ConvertibleNotesPayableMember2022-01-012022-12-310001338929ahro:EmploymentAgreementsMemberahro:ChristopherGiordanoMember2017-02-012017-02-140001338929ahro:EmploymentAgreementsMemberahro:PaulSerbiakMember2016-12-012016-12-300001338929ahro:PendingLitigation3Member2023-01-012023-12-310001338929ahro:PendingLitigation2Member2023-01-012023-12-310001338929us-gaap:PendingLitigationMember2023-01-012023-12-310001338929us-gaap:InvestorMemberus-gaap:ConvertibleNotesPayableMember2015-08-012015-08-310001338929srt:ChiefExecutiveOfficerMember2017-12-310001338929us-gaap:InvestorMemberus-gaap:ConvertibleNotesPayableMember2015-08-310001338929ahro:AHOriginalsIncMemberahro:PromissoryNotesPayableMember2019-06-180001338929srt:ChiefExecutiveOfficerMember2022-12-310001338929srt:ChiefExecutiveOfficerMember2023-12-310001338929us-gaap:InvestorMemberus-gaap:ConvertibleNotesPayableMember2022-12-310001338929us-gaap:InvestorMemberus-gaap:ConvertibleNotesPayableMember2023-12-310001338929ahro:AHOriginalsIncMemberahro:PromissoryNotesPayableMember2019-06-012019-06-180001338929ahro:AccruedInterestMember2023-12-310001338929ahro:RelatedPartyPrincipalAmountMember2023-12-310001338929ahro:GoliathMember2023-06-200001338929ahro:GoliathMember2023-06-012023-06-200001338929ahro:MaybacksMember2023-04-012023-04-260001338929ahro:GoliathLicenseMember2023-12-310001338929ahro:MaybacksCustomersMember2023-12-310001338929srt:MinimumMemberahro:UnsecuredDebtsMember2023-12-310001338929ahro:UnsecuredDebtsMembersrt:MaximumMember2023-12-310001338929ahro:SecuredPromissoryNoteMember2023-01-012023-12-310001338929ahro:SecuredPromissoryNoteMember2023-06-300001338929ahro:SecuredPromissoryNoteMember2023-12-310001338929us-gaap:ConvertibleNotesPayableMember2022-12-310001338929us-gaap:ConvertibleNotesPayableMember2023-12-310001338929us-gaap:SeriesDPreferredStockMember2023-06-012023-06-200001338929us-gaap:SeriesCPreferredStockMemberahro:PostAdAgencyPayoutMember2023-01-012023-12-310001338929us-gaap:SeriesCPreferredStockMemberahro:FourtyChannelsMember2023-01-012023-12-310001338929ahro:PreferredStocksMember2023-06-200001338929us-gaap:SeriesCPreferredStockMember2023-01-012023-12-310001338929us-gaap:SeriesBPreferredStockMember2023-01-012023-12-310001338929us-gaap:SeriesCPreferredStockMember2023-04-260001338929ahro:PreferredStocksMember2014-09-300001338929us-gaap:SeriesDPreferredStockMember2023-06-200001338929us-gaap:SeriesBPreferredStockMember2014-09-300001338929ahro:CommonStockSharesMember2022-01-012022-12-310001338929ahro:CommonStockSharesMember2023-01-012023-12-310001338929srt:MinimumMember2023-01-012023-12-310001338929srt:MaximumMember2023-01-012023-12-310001338929us-gaap:FairValueInputsLevel3Member2023-12-310001338929us-gaap:FairValueInputsLevel2Member2023-12-310001338929us-gaap:FairValueInputsLevel1Member2023-12-310001338929us-gaap:FairValueInputsLevel3Member2022-12-310001338929us-gaap:FairValueInputsLevel2Member2022-12-310001338929us-gaap:FairValueInputsLevel1Member2022-12-310001338929ahro:RoyaltiesMember2022-01-012022-12-310001338929ahro:RoyaltiesMember2023-01-012023-12-310001338929ahro:WebsitesMember2022-01-012022-12-310001338929ahro:CustomerlistsMember2022-01-012022-12-310001338929ahro:LicenseAgreementtMember2022-01-012022-12-310001338929ahro:WebsitesMember2023-01-012023-12-310001338929ahro:CustomerlistsMember2023-01-012023-12-310001338929ahro:LicenseAgreementtMember2023-01-012023-12-310001338929ahro:PatentMember2022-01-012022-12-310001338929ahro:PatentMember2023-01-012023-12-310001338929ahro:TridentMember2022-12-310001338929ahro:TridentMember2023-12-310001338929ahro:CameraMember2022-12-310001338929ahro:CameraMember2023-12-310001338929ahro:ForkliftMember2022-12-310001338929ahro:ForkliftMember2023-12-310001338929us-gaap:FurnitureAndFixturesMember2022-12-310001338929us-gaap:FurnitureAndFixturesMember2023-12-310001338929ahro:ForkliftMember2023-01-012023-12-310001338929us-gaap:FurnitureAndFixturesMember2023-01-012023-12-310001338929ahro:EquipmentsMember2023-01-012023-12-3100013389292023-06-012023-06-200001338929ahro:CommonStocksIssuablekMember2023-12-310001338929ahro:AccumulatedDeficitMember2023-12-310001338929us-gaap:AdditionalPaidInCapitalMember2023-12-310001338929us-gaap:CommonStockMember2023-12-310001338929ahro:SeriesDPreferredStocksMember2023-12-310001338929ahro:SeriesCPreferredStocksMember2023-12-310001338929ahro:SeriesBPreferredStocksMember2023-12-310001338929ahro:AccumulatedDeficitMember2023-01-012023-12-310001338929ahro:CommonStocksIssuablekMember2023-01-012023-12-310001338929us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001338929us-gaap:CommonStockMember2023-01-012023-12-310001338929ahro:SeriesDPreferredStocksMember2023-01-012023-12-310001338929ahro:SeriesCPreferredStocksMember2023-01-012023-12-310001338929ahro:SeriesBPreferredStocksMember2023-01-012023-12-310001338929ahro:CommonStocksIssuablekMember2022-12-310001338929ahro:AccumulatedDeficitMember2022-12-310001338929us-gaap:AdditionalPaidInCapitalMember2022-12-310001338929us-gaap:CommonStockMember2022-12-310001338929ahro:SeriesDPreferredStocksMember2022-12-310001338929ahro:SeriesCPreferredStocksMember2022-12-310001338929ahro:SeriesBPreferredStocksMember2022-12-310001338929ahro:CommonStocksIssuablekMember2022-01-012022-12-310001338929ahro:AccumulatedDeficitMember2022-01-012022-12-310001338929us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001338929us-gaap:CommonStockMember2022-01-012022-12-310001338929ahro:SeriesDPreferredStocksMember2022-01-012022-12-310001338929ahro:SeriesCPreferredStocksMember2022-01-012022-12-310001338929ahro:SeriesBPreferredStocksMember2022-01-012022-12-3100013389292021-12-310001338929ahro:CommonStocksIssuablekMember2021-12-310001338929ahro:AccumulatedDeficitMember2021-12-310001338929us-gaap:AdditionalPaidInCapitalMember2021-12-310001338929us-gaap:CommonStockMember2021-12-310001338929ahro:SeriesDPreferredStocksMember2021-12-310001338929ahro:SeriesCPreferredStocksMember2021-12-310001338929ahro:SeriesBPreferredStocksMember2021-12-3100013389292022-01-012022-12-310001338929us-gaap:SeriesDPreferredStockMember2022-12-310001338929us-gaap:SeriesDPreferredStockMember2023-12-310001338929us-gaap:SeriesCPreferredStockMember2022-12-310001338929us-gaap:SeriesCPreferredStockMember2023-12-310001338929us-gaap:SeriesBPreferredStockMember2023-12-310001338929us-gaap:SeriesBPreferredStockMember2022-12-3100013389292022-12-3100013389292023-12-3100013389292024-05-2200013389292023-06-30iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2023 |

|

☐ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

For the transition period from _____ to _____ |

|

Commission file number 000-52047 |

AUTHENTIC HOLDINGS, INC. |

(Exact name of registrant as specified in its charter) |

Nevada | | 11-3746201 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

50 Division Street Somerset NJ | | 08873 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (732) 695-4389

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | | Name of Each Exchange On Which Registered |

N/A | | N/A |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 par value |

(Title of class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the last 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-K (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated Filer | ☒ | Smaller reporting company | ☒ |

| | Emerging Growth Company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter of 2023 was $1,963,367

Indicate the number of shares outstanding of each of the registrant’s classes of common stock as of the latest practicable date. 2,240,073,721 common shares as of May 22, 2024.

TABLE OF CONTENTS

Forward Looking Statements

This annual report on Form 10-K and the documents incorporated by reference herein contain forward-looking statements that are not statements of historical fact and may involve a number of risks and uncertainties. These statements related to analyses and other information that are based on forecasts of future results and estimates of amounts not yet determinable. These statements may also relate to our future prospects, developments and business strategies.

We have used the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “will,” “plan,” “predict,” “project” and similar terms and phrases, including references to assumptions, in this annual report on Form 10-K and our incorporated documents to identify forward-looking statements. These forward-looking statement are made based on expectations and beliefs concerning future events affecting us and are subject to uncertainties and factors relating to our operations and business environment, all of which are difficult to predict and many of which are beyond our control, that could cause our actual results to differ materially from those matters expressed in or implied by these forward-looking statements. The following factors are among those that may cause actual results to differ materially from our forward-looking statements:

| · | General economic and industry conditions; |

| · | Out history of losses, deficits and negative operating cash flows; |

| · | Our limited operating history; |

| · | Industry competition; |

| · | Environmental and governmental regulation; |

| · | Protection and defense of our intellectual property rights; |

| · | Reliance on, and the ability to attract, key personnel; |

| · | Other factors including those discussed in “Risk Factors” in this annual report on Form 10-K and our incorporated documents. |

You should keep in mind that any forward-looking statement made by us in this annual report or elsewhere speaks only as of the date on which we make it. New risks and uncertainties arise from time to time, and it is impossible for us to predict these events or how they may affect us. We have no duty to, and do not intend to, update or revise the forward-looking statements in this annual report after the date of filing, except as may be required by law. In light of these risks and uncertainties, you should keep in mind that any forward-looking statement made in this annual report or elsewhere might not occur.

In this annual report on Form 10-K, the terms “Authentic Holdings, Inc.” “Company,” “we,” “us” and “our” refer to Authentic Holdings, Inc. and its subsidiaries.

PART I

Item 1. Business

General Overview

Authentic Holdings Inc. (formerly Global Fiber Technologies, Inc.) was incorporated in Nevada on March 25, 2005. We are a multi-faceted media and merchandising company with operating subsidiaries and license rights, described below.

On June 18, 2019, we completed the acquisition of assets from AH Originals, Inc. (“AHO”), a corporation controlled by the same owner group of our company for the consideration of 6,400,000 shares of our common stock to be issued and the issuance of a promissory note of $447,150 that bears 3% interest per annum and has a one-year term with eight options to extend the maturity date for six-month periods. In addition, we issued to AHO 200,000 common shares of Authentic Heroes, Inc. (“AHI”), a subsidiary created by us to hold the purchased assets.

The Authentic Heroes, Inc. subsidiary has patented technology that takes the original event worn apparel from an iconic individual and creates “Fan-wear” collectibles containing fibers from that original. All of the Fan-Wear items have an embedded QR Code that registers the items on our Blockchain for their provenance and immutability.

The Authentic Heroes subsidiary is also in the business of creating vinyl records for distribution into retail department stores and online sales and has pressed 150,000 Vinyls to date under the heading of “Old is Gold” Christmas.

The Authentic Heroes subsidiary also has completed an NFT Platform on the Ethereum Blockchain capable of housing millions of NFTs. The NFT platform has minted 500,000 NFTs as part of free music NFT given away with its “Old is Gold” Christmas album.

On April 26, 2023, we entered into a Membership Interest Purchase Agreement (the “Purchase Agreement”) with Maybacks Global Entertainment LLC, an Arizona limited liability company (“Maybacks”), and the members of Maybacks. As a result of the transaction, Maybacks became our wholly owned subsidiary.

Maybacks is looking to capitalize on the “cutting the cord” phenomenon and take advantage of its low operating costs and ability to offer free TV and channel access for established organizations at a fraction of what cable and satellite dish companies charge.

Maybacks is an Over the Air and platform driven television network. Maybacks has grown from a 25-channel network to a 56-channel network in the past year. With 56 channels, Maybacks broadcasts various programs that include movies, sports, serial television shows and live events. All of Maybacks’ programming is sourced from its own fully owned library. Maybacks generates revenue through the placement of insert advertisements, revenue share programs, Vast Tags as well as channel access fees and barter.

Maybacks has three full-time employees and outsources all if its logistics and broadcasting to a third party known as Wise DV.

Maybacks has agreements with several other networks are looking to carry Maybacks’ programing in exchange for revenue share programs.

There are many Over the Air and platform driven television networks with greater financial resources and experience in running, such as Sling TV, which is owned by DISH Network as well as many other independent networks. We plan to compete with many firms, including corporations with large divisions, many of these companies have greater financial, technical, or marketing resources, longer operating histories, greater brand recognition or larger customer bases than we do and are able to respond more effectively to changing business and economic conditions than we can.

There are no assurances that we will be able to compete against these larger rivals and gain market share. We have realized revenues during the quarter ended September 30, 2023, and for the year ended December 31, 2023, and we are hopeful more advertising agreements are signed and more ad pressions sold to generate future revenue for our company. While these are signs that progress in our company has been made, we are not profitable and still face several challenges, including those presented as ‘Risk Factors” in this Annual Report on Form 10-K.

On June 20, 2023, the Company closed an Asset Purchase Agreement (the “Asset Agreement”) with Goliath Motion Picture Promotions owned by Priscella Cooper (the “Seller”). On the Closing Date, pursuant to the Asset Agreement, the Company acquired various full-length motion pictures and serial television shows (the “Assets”).

Since execution, however, the fulfillment of the Asset Agreement has not been possible because the Assets could not be entirely conveyed to the Company as intended by the parties. Therefore, on May 10, 2024, the parties entered into an Amended Asset Purchase Agreement, to be effective as of December 31, 2023, to convert the purchase of Assets to a license to use those Assets for a period of 10 years.

As a result of the license of the Assets, the Company plans to “tokenize” all the titles, namely 14,000 plus full-length motion pictures and serial television shows. The Company is currently using the non-tokenized library for content distribution on its own TV Network known as Maybacks. It is the Company’s intention to start the tokenization process within thirty (30) days of this filing and have the “Alpha” version completed within 90 days from its start date. Once the first 1000 movies are tokenized it is the Company’s intention to market those movies on its own Video on Demand and Linear Television platforms. In addition, the Company plans to aggressively market its tokenized platform to other TV networks as well as major film production and distribution companies.

The Company intends to fund operations through increased sales and debt and/or equity financing arrangements, which may be insufficient to fund expenditures or other cash requirements, until the Company generates positive cash flow from operations. However, the Company’s financial statements show an accumulated deficit of $37,302,081 as of December 31, 2023, with a net working capital deficit of $$4,261,894 and limited cash resources. These factors raise doubts about the Company’s ability to continue as a going concern within the next year.

The Company's ability to continue as a going concern depends on its ability to repay or settle its current indebtedness, generate positive cash flow, and raise capital through equity and debt financing or other means on favorable terms. If the Company cannot obtain additional funds when required or on favorable terms, management may be necessary to restructure the Company or cease operations.

Our address is 50 Division Street Suite 500, Somerset NJ 08873. Our corporate website is http://globalfibertechnologies.com/.

The Company has never declared bankruptcy or been in receivership. The Company has earned minimal revenues and has limited cash on hand. The Company has sustained losses since inception and has primarily relied upon the sale of its securities and loans from related parties and outside parties for funding.

Competition

ECO Tek 360 is in the uniform and related products segment, we will compete with many firms, including corporations with large divisions, many of these companies have great financial, technical, or marketing resources, longer operating histories, greater brand recognition or larger customer bases than we do and may be able to respond more effectively to changing business and economic conditions than we can. The nature and degree of competition varies with the customer and the market. Industry statistics are not available.

Competitive pricing may require us to reduce our future prices, which would impact future profitability or result in lost sales. Our competitors, many of whom have greater resources than we do, may be better able to withstand these price reductions and lost sales.

Maybacks Global Entertainment. There are many Over the Air and platform driven television networks with greater financial resources and experience in running, such as Sling TV, which is owned by DISH Network as well as many other independent networks. We plan to compete with many firms, including corporations with large divisions, many of these companies have greater financial, technical, or marketing resources, longer operating histories, greater brand recognition or larger customer bases than we do and are able to respond more effectively to changing business and economic conditions than we can.

Goliath Motion Pictures There are many companies in the Movie Production and Movie Distribution businesses with greater financial resources and experience in running, such as Lionsgate, New Line Pictures and Universal Films, as well as large corporations with large divisions, many of these companies have greater financial, technical, or marketing resources, longer operating histories, greater brand recognition or larger customer bases than we do and are able to respond more effectively to changing business and economic conditions than we can.

Authentic Heroes, Inc There are many companies in the collectible clothing business with greater financial resources and experience in running, such as Fanatics, Nike and Mitchell and Ness, as well as many other independent merchandise companies. We plan to compete with many firms, including corporations with large divisions, many of these companies have greater financial, technical, or marketing resources, longer operating histories, greater brand recognition or larger customer bases than we do and are able to respond more effectively to changing business and economic conditions than we can.

Seasonality

We do not have a seasonal business cycle in any of our businesses

Employees

We have three full time employees at Maybacks Global Entertainment. Our officers and directors furnish their time to the development of the Company at no cost and intend to do whatever work is necessary in order to generate revenues. We do not foresee hiring any employees in the near future.

Government Regulation

The Company’s operations are subject to certain foreign, federal, state, and local regulatory requirements relating to, among others, environmental, waste management, labor and health and safety matters. Management believes that the Company’s business is operated in material compliance with all such regulations.

The Maybacks subsidiary and Goliath license agreement are guided by rules and regulations set by the Federal Communications Commission. FCC regulations law includes technical parameters for these facilities, as well as content issues like copyright, profanity, and localism or regionalism. Maybacks maintains strict standards as to what it broadcasts and maintaining its compliance with FCC’s Communication Act.

Research and Development

We have not incurred any research and development expenditures over the last two fiscal years.

Intellectual Property

On May 2, 2022, Authentic Heroes, Inc. (“Authentic Heroes”), a wholly owned subsidiary of Global Fiber Technologies, Inc., (the “Company”), entered into a License Agreement (the “License Agreement”) with the Company’s Chief Executive Officer and Director, Paul Serbiak (“Serbiak”).

Pursuant to the License Agreement, Serbiak agreed to provide Authentic Heroes with an exclusive license to use certain of Serbiak’s intellectual property rights, including Patent No. US 10,781,539 B2 entitled “AUTHENTICATABLE ARTICLES, FABRIC AND METHOD OF MANUFACTURE” and of the invention therein described, for products in the sports and music memorabilia business.

In exchange for such license, Authentic Heroes agreed to (i) pay Serbiak $100 within ten business days of License Agreement and a fee of $10,000 on or before January 1, 2023, (ii) pay Serbiak royalties of 1% of the revenue generated from the sale of the products amounting to at least $3,000,000 in revenue at year three of the License Agreement and another 1% of the revenue generated from the sale of the products amounting to at least $10,000,000 in revenue at year five (5) of the License Agreement. If Authentic Heroes fails to achieve at least $3,000,000 in revenue at year three or $10,000,000 in revenue at year five from this date of the License Agreement, then the exclusive license shall be a non-exclusive license.

The patent is at the core our manufacturing process. In addition, we utilize trade secrets in combination with our patented manufacturing process that allows what we believe are market advantages.

WHERE YOU CAN FIND MORE INFORMATION

You are advised to read this Form 10-K in conjunction with other reports and documents that we file from time to time with the SEC. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to reports filed or furnished pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended, are available from the SEC website at www.sec.gov.

Item 1A. Risk Factors

Investing in our common stock involves a high degree of risk. Our business, reputation, results of operations, financial condition and stock price can be affected by a number of factors, whether currently known or unknown, including those described below. When any one or more of these risks materialize from time to time, our business, reputation, results of operations, financial condition and stock price can be materially and adversely affected.

Because of the following factors, as well as other factors affecting the Company’s results of operations and financial condition, past financial performance should not be considered to be a reliable indicator of future performance, and investors should not use historical trends to anticipate results or trends in future periods. This discussion of risk factors contains forward-looking statements.

You should carefully consider the risks and uncertainties described below, together with all of the other information in this report, including the consolidated audited financial statements and the related notes appearing at the end of this annual report on Form 10-K, with respect to any investment in shares of our common stock. If any of the following risks actually occurs, our business, financial condition, results of operations and future prospects would likely be materially and adversely affected. In that event, the market price of our common stock could decline, and you could lose part or all of your investment. These statements, like all statements in this report, speak only as of the date of this report (unless another date is indicated) and we undertake no obligation to update or revise the statements in light of future development.

Risks Related to Our Financial Condition

There is a substantial doubt about our ability to continue as a going concern. The report of our independent auditors that accompanies our consolidated financial statements includes an explanatory paragraph indicating there is a substantial doubt about our ability to continue as a going concern, citing our need for additional capital for the future planned expansion of our activities and to service our ordinary course activities (which may include servicing of indebtedness). The inclusion of a going concern explanatory paragraph in the report of our independent auditors will make it more difficult for us to secure additional financing or enter into strategic relationships on terms acceptable to us, if at all, and likely will materially and adversely affect the terms of any financing that we might obtain. Our financial statements do not include any adjustments that may result from the outcome of this uncertainty.

We have incurred significant losses in prior periods, and losses in the future could cause the quoted price of our common stock to decline or have a material adverse effect on our financial condition, our ability to pay our debts as they become due, and on our cash flows. To date, we have generated limited revenues from our operations, and we have incurred significant losses in prior periods. For the years ended December 31, 2023 and 2022, we incurred a net loss of $1,658,,455 and $1,157,783, respectively, and, as of such dates, we had an accumulated deficit of $38,038,768 and $36,380,313, respectively.

We had net cash used in operating activities of $227,228 for the year ended Decembre 31, 2023. At December 31, 2023, we had a working capital deficit of $4,998,581. Any losses in the future could cause the quoted price of our common stock to decline or have a material adverse effect on our financial condition, our ability to pay our debts as they become due, and on our cash flows.

At December 31, 2023, we do not have sufficient cash resources or current assets to pay our obligations. This circumstance represents a significant risk to our business and shareholders and results in: (1) making it more difficult for us to satisfy our obligations; (2) impeding us from obtaining additional financing in the future for working capital, capital expenditures and general corporate purposes; and (3) making us more vulnerable to a downturn in our business and limits our flexibility to plan for, or react to, changes in our business.

The time required for us to become profitable under our current business structure is highly uncertain, and we cannot assure you that we will achieve or sustain profitability or generate sufficient cash flow from operations to meet our planned capital expenditures, working capital and debt service requirements. If required, our ability to obtain additional financing from other sources also depends on many factors beyond our control, including the state of the capital markets and the prospects for our business. The necessary additional financing may not be available to us or may be available only on terms that would result in further dilution to the current owners of our common stock.

We intend to seek interim short-term financing to continue full legal compliance with its SEC filings, and to bring on the necessary personnel to begin its future development activities. Our working capital needs will be met largely from the sale of debt and public equity securities, including in this offering, until such time that funds provided by operations, if ever, are sufficient to fund working capital requirements. The accompanying financial statements do not include any adjustments relating to the recoverability or classification of recorded assets and liabilities that might result should our company be unable to continue as a going concern.

Our cash expenses are large relative to our cash resources and cash flow. At December 31, 2023, we had $0 in cash and continue to have limited cash resources available to us. Consequently, we have been required either to sell new shares of our common stock or convertible promissory notes to raise the cash necessary to pay ongoing expenses and to make new investments, which actions could lead to continuing dilution in the interest of our existing shareholders.

We will require additional capital to fund our operations and if we do not obtain additional capital, we may be required to substantially limit our operations. Our business does not presently generate the cash needed to finance our current and anticipated operations and we need to obtain additional financing to finance our operations, until such time that we are able to conduct profitable revenue-generating activities.

Anticipated, but as yet unproven, revenue from sponsorships, television, licensing, special events and market reservations are expected to provide sufficient working capital for on-going operations. Our capital requirement in connection with our growth plans requires substantial working capital to fund our business.

We require short-term financing, as well as financing over the next 12 months, to satisfy our anticipated capital needs.

Through the date of this Annual Report, smaller investments have been obtained to meet certain our ongoing expenses. We cannot assure you that adequate financing will be available on acceptable terms, if at all. Our failure to raise additional financing, including through this offering, in a timely manner would adversely affect our ability to pursue our business plan and could cause us to delay launching our league and our proposed business plan.

Our quarter-to-quarter performance may vary substantially, and this variance, as well as general market conditions, may cause our stock price to fluctuate greatly and even potentially expose us to litigation. We have been unable to generate significant revenues under our our business plan and we cannot accurately estimate future revenue and operating expenses based on historical performance. Our quarterly operating results may vary significantly based on many factors, including:

| - | Fluctuating demand for our potential products; |

| | |

| - | Announcements or implementation by our competitors of new products; |

| | |

| - | Amount and timing of our costs related to our marketing efforts or other initiatives; |

| | |

| - | Timing and amounts relating to the expansion of our operations; |

| | |

| - | Our ability to enter into, renegotiate or renew key agreements; |

| | |

| - | Timing and amounts relating to the expansion of our operations; or |

| | |

| - | Economic conditions specific to our industry, as well as general economic conditions. |

Our current and future expense estimates are based, in large part, on estimates of future revenue, which is difficult to predict. We expect to make significant operating and capital expenditures in connection with the development of our plan of business. We may be unable to, or may elect not to, adjust spending quickly enough to offset any unexpected revenue shortfall. If our increased expenses were not accompanied by increased revenue in the same quarter, our quarterly operating results would be harmed.

The COVID-19 pandemic could have a material adverse impact on our business, results of operations and financial condition. In December 2019, a novel strain of coronavirus was reported to have surfaced in Wuhan, China. In January 2020, the World Health Organization declared the COVID-19 outbreak a “Public Health Emergency of International Concern.” This worldwide outbreak has resulted in the implementation of significant governmental measures, including lockdowns, closures, quarantines and travel bans intended to control the spread of the virus. Companies are also taking precautions, such as requiring employees to work remotely, imposing travel restrictions and temporarily closing businesses and facilities. These restrictions, and future prevention and mitigation measures, have had an adverse impact on global economic conditions and are likely to have an adverse impact on consumer confidence and spending, which could materially adversely affect the supply of, as well as the demand for, our products. Uncertainties regarding the economic impact of COVID-19 is likely to result in sustained market turmoil, which could also negatively impact our business, financial condition and cash flows.

Should the adverse impacts described above (or others that are currently unknown) occur, whether individually or collectively, our company would expect to experience, among other things, an inability to produce revenues and cash flows sufficient to conduct operations, meet the terms of our existing debt covenants and other requirements under our financing arrangements or service our outstanding debt. Such a circumstance could, among other things, exhaust our liquidity (and ability to access liquidity sources) or trigger an acceleration to pay a significant portion or all of our then-outstanding debt obligations, which we may be unable to do.

Risks Related to our Business

If we are unable to build and maintain our brand of information, our operating results may be adversely affected. The lack of awareness of our brands, among consumers require us to build and maintain a strong brand identity to attract and retain a broad viewer base. We must continue to expand into new markets to build brand awareness. Also important are effective consumer communications, such as marketing, customer service, and public relations. The role of social media by potential consumers is an important factor in our brand perception. If our efforts to create compelling viewing and/or otherwise promote and maintain our brand are not successful, our ability to attract and retain consumers may be adversely affected. Such a result would likely lead to a decline in attendance of our audience, and in the future, impact our viewership, which would adversely affect our operating results.

Any incidents affecting our network and information systems or other technologies could have an adverse impact on our business, reputation and results of operations. Our business operations rely heavily on network and information systems and other technology systems, including cloud computing. Incidents affecting these systems, including cyber-attacks, viruses, other destructive or disruptive software or activities, process breakdowns, outages, or accidental release of information could result in a disruption of our operations, improper disclosure of personal data of clients, subscribers, or employees, or other privileged or confidential information, or unauthorized access to our digital content or any other type of intellectual property. It is common for a company such as ours to be subjected to continuous attempted cyber-attacks and other malicious efforts that could cause cybersecurity incidents, and we have in the past experienced, and expect to continue to experience cybersecurity incidents, although we have not identified any such incidents that we have determined to be material to our operations as of the date of this report. Any such incident could damage our reputation and may require us to expend substantial resources on litigation, regulatory investigation, and remediation costs, and could therefore have a material adverse effect on our business and results of operations. We continue to work closely with our outside advisors to prevent cybersecurity incidents, and to invest in maintaining and improving cybersecurity resilience. The company’s cybersecurity risks and mitigation actions are monitored by our Chief Executive Officer and reported to our Board of Directors. Nevertheless, because of the nature of the threats and the cloud computing environment, there can be no assurance that our preventative efforts can fully prevent or mitigate all such incidents or be successful in avoiding harm to our business in the future.

A significant portion of our library revenues comes from a small number of titles, a portion of which we may be limited in our ability to exploit. We depend on a limited number of titles in any given fiscal quarter for the majority of the revenues generated by our library. In addition, many of the titles in our library are not presently distributed and generate substantially no revenue. Additionally, our rights to the titles in our library vary; in some cases, we have only the right to distribute titles in certain media and territories for a limited term. If we cannot acquire new product and the rights to popular titles through production, distribution agreements, acquisitions, mergers, joint ventures or other strategic alliances, or renew expiring rights to titles generating a significant portion of our revenue on acceptable terms, any such failure could have a material adverse effect on our business, financial condition, operating results, liquidity and prospects.

Our success depends on external factors in the streaming network industry. Our success depends on the commercial success of our channels and programs they contain, which is unpredictable. Generally, the popularity of our programs depends on many factors, including the critical acclaim they receive, the format of their initial release, their talent, their genre and their specific subject matter, audience reaction, the quality and acceptance of motion pictures or television content that our competitors release into the marketplace at or near the same time, critical reviews, the availability of alternative forms of entertainment and leisure activities, general economic conditions and other tangible and intangible factors, many of which we do not control and all of which may change. We cannot predict the future effects of these factors with certainty. Our success will depend on the experience and judgment of our management to select and develop new investment and production opportunities. We cannot assure that our channels and programming will obtain favorable reviews or ratings or that broadcasters will license the rights to broadcast any of our television programs in development or renew licenses to broadcast programs in our library. Additionally, we cannot assure that any original programming content will appeal to our distributors and subscribers. The failure to achieve any of the foregoing could have a material adverse effect on our business, financial condition, operating results, liquidity and prospects.

Our business depends on the appeal of our content to distributors and subscribers, which is difficult to predict. Our business depends in part upon viewer preferences and audience acceptance of our network programming. These factors are difficult to predict and are subject to influences beyond our control, such as the quality and appeal of competing programming, general economic conditions and the availability of other entertainment activities. We may not be able to anticipate and react effectively to shifts in tastes and interests in markets. A change in viewer preferences could cause our programming to decline in popularity, which could jeopardize renewal of affiliation agreements with distributors. In addition, our competitors may have more flexible programming arrangements, as well as greater amounts of available content, distribution and capital resources and may be able to react more quickly than we can to shifts in tastes and interests.

If our programming does not gain the level of audience acceptance we expect, or if we are unable to maintain the popularity of our programming, we may have a diminished negotiating position when dealing with distributors, which could reduce our revenue and earnings. We cannot ensure that we will be able to maintain the success of any of our current programming. This could materially adversely impact our business, financial condition, operating results, liquidity and prospects.

We compete with other programming services, including cable programming, national broadcast television, local broadcast television stations and SVOD to secure desired programming, the competition for which has increased as the number of programming services has increased. Other programming services that are affiliated with programming sources such as movie or television studios or film libraries may have a competitive advantage over us in this area. Some of these competitors have exclusive contracts with motion picture studios or independent motion picture distributors or own film libraries.

We must successfully respond to rapid technological changes and alternative forms of delivery or storage to remain competitive. The entertainment industry continues to undergo significant developments as advances in technologies and new methods of product delivery and storage (including the emergence of alternative distribution platforms), and certain changes in consumer behavior driven by these developments emerge. New technologies affect the demand for our content, the manner in which our content is distributed to consumers, the sources and nature of competing content offerings and the time and manner in which consumers acquire and view our content. New technologies also may affect our ability to maintain or grow our business and may increase our capital expenditures. We and our distributors must adapt our businesses to shifting patterns of content consumption and changing consumer behavior and preferences through the adoption and exploitation of new technologies.

For instance, such changes may impact the revenue we are able to generate from traditional distribution methods by decreasing the viewership of our networks on systems of cable operators, satellite television providers and telecommunication companies, or by decreasing the number of households subscribing to services offered by those distributors. If we cannot successfully exploit these and other emerging technologies, our appeal to targeted audiences might decline which could have a material adverse effect on our business, financial condition, operating results, liquidity and prospects.

Protecting and defending against intellectual property claims may have a material adverse effect on our business. Our ability to compete depends, in part, upon successful protection of our intellectual property. We attempt to protect proprietary and intellectual property rights to our productions through available copyright and trademark laws and licensing and distribution arrangements with reputable international companies in specific territories and media for limited durations. Despite these precautions, existing copyright and trademark laws afford only limited practical protection in certain countries where we distribute our products. As a result, it may be possible for unauthorized third parties to copy and distribute our productions or certain portions or applications of our intended productions, which could have a material adverse effect on our business, financial condition, operating results, liquidity and prospects.

Litigation may also be necessary to enforce our intellectual property rights, to protect our trade secrets, or to determine the validity and scope of the proprietary rights of others or to defend against claims of infringement or invalidity. Any such litigation, infringement or invalidity claims could result in substantial costs and the diversion of resources and could have a material adverse effect on our business, financial condition, operating results, liquidity and prospects.

Our business involves risks of liability claims for content of material, which could adversely affect our business, results of operations and financial condition. As a distributor of media content, we may face potential liability for defamation, invasion of privacy, negligence, copyright or trademark infringement (as discussed above), and other claims based on the nature and content of the materials distributed. These types of claims have been brought, sometimes successfully, against producers and distributors of media content. Any imposition of liability that is not covered by insurance or is in excess of insurance coverage could have a material adverse effect on our business, financial condition, operating results, liquidity and prospects.

Piracy of films and television programs could adversely affect our business over time. Piracy is extensive in many parts of the world and is made easier by the availability of digital copies of content and technological advances allowing conversion of films and television content into digital formats. This trend facilitates the creation, transmission and sharing of high quality unauthorized copies of motion pictures and television content. The proliferation of unauthorized copies of these products has had and will likely continue to have an adverse effect on our business, because these products reduce the revenue we receive from our products. In order to contain this problem, we may have to implement elaborate and costly security and anti-piracy measures, which could result in significant expenses and losses of revenue. We cannot assure you that even the highest levels of security and anti-piracy measures will prevent piracy.

In particular, unauthorized copying and piracy are prevalent in countries outside of the U.S., Canada and Western Europe, whose legal systems may make it difficult for us to enforce our intellectual property rights. While the U.S. government has publicly considered implementing trade sanctions against specific countries that, in its opinion, do not make appropriate efforts to prevent copyright infringements of U.S. produced motion pictures and television content, there can be no assurance that any such sanctions will be enacted or, if enacted, will be effective. In addition, if enacted, such sanctions could impact the amount of revenue that we realize from the international exploitation of our content.

Our activities are subject to a variety of laws and regulations relating to privacy and child protection, which, if violated, could subject us to an increased risk of litigation and regulatory actions. In addition to our company websites and applications, we use third-party applications, websites, and social media platforms to promote our projects and engage consumers, as well as monitor and collect certain information about users of our online forums. A variety of laws, rules and regulations have been adopted in recent years aimed at protecting all individuals, including children who use the internet such as the Children's Online Privacy and Protection Act of 1998 (“COPPA”). COPPA sets forth, among other things, a number of restrictions on what website operators can present to children under the age of 13 and what information can be collected from them. There are also a variety of laws and regulations governing individual privacy with respect to the acquisition, storage, disclosure, use and protection of personal data, including under the European Union General Data Protection Regulation and various other domestic and international privacy and data security laws and regulations, which are continually evolving. If our activities were to violate any applicable current or future laws and regulations, we could be subject to litigation and regulatory actions, including fines and other penalties.

Our networks business is limited by regulatory constraints which may adversely impact our operations. Although our networks business generally is not directly regulated by the FCC, under the Communications Act of 1934 and the 1992 Cable Act, there are certain FCC regulations that govern our network business. Furthermore, to the extent that regulations and laws, either presently in force or proposed, hinder or stimulate the growth of the cable television and satellite industries, our network business will be affected. As we continue to expand internationally, we also may be subject to varying degrees of local government regulations.

Regulations governing our network businesses are subject to the political process and have been in constant flux historically. Further material changes in the law and regulatory requirements must be anticipated. We cannot assure you that we will be able to anticipate material changes in laws or regulatory requirements or that future legislation, new regulation or deregulation will not have a materially adverse effect on our business, financial condition, operating results, liquidity and prospects.

If we fail to effectively manage our growth, and effectively develop our business, our business will be harmed. Failure to manage growth of operations could harm our business. To date, a significant amount of activities and resources have been directed at developing our business plan and potential related products. In order to effectively manage growth, we must:

| - | Continue to develop an effective planning and management process to implement our business strategy; |

| | |

| - | Hire, train and integrate new personnel in all areas of our business; and |

| | |

| - | Increase capital investments. |

We cannot assure you that we will be able to accomplish these tasks or effectively manage our growth.

We are dependent upon our key executives for future success. Our future success to a significant extent depends on the continued services of our executive officers, Christopher Giordano, our President, and Paul Serbiak, our CEO. The departure of Mr. Giordano or Mr. Serbiak could materially adversely affect our ability to implement our business strategy. Currently, we do not maintain for our benefit, any key-man life insurance on our key executives.

If we are unable to recruit and retain key personnel, our business may be harmed. If we are unable to attract and retain key personnel, our business may be harmed. Our failure to enable the effective transfer of knowledge and facilitate smooth transitions with regard to our key employees could adversely affect our long-term strategic planning and execution.

Our business plan is not based on independent market studies. We have not commissioned any independent market studies concerning our business plans. Rather, our plans for implementing our business strategy and achieving profitability are based on the experience, judgment and assumptions of our management. If these assumptions prove to be incorrect, we may not be successful in our business operations.

Our Board of Directors may change our policies without shareholder approval. Our policies, including any policies with respect to investments, leverage, financing, growth, debt and capitalization, will be determined by our Board of Directors or officers to whom our Board of Directors delegate such authority. Our Board of Directors will also establish the amount of any dividends or other distributions that we may pay to our shareholders. Our Board of Directors or officers to which such decisions are delegated will have the ability to amend or revise these and our other policies at any time without shareholder vote. Accordingly, our shareholders will not be entitled to approve changes in our policies, which policy changes may have a material adverse effect on our financial condition and results of operations.

We are subject to the risks frequently experienced by smaller reporting companies. The likelihood of our success must be considered in light of the risks frequently encountered by smaller reporting companies. These risks include our potential inability to:

| - | Establish product sales and marketing capabilities. |

| | |

| - | Identify, attract, retain, and motivate qualified personnel. |

| | |

| - | Maintain our reputation and build trust with consumers. |

| | |

| - | Attract sufficient capital resources to develop our business. |

Our company has a limited history with respect to its newly established sports and music memorabilia business structure, as well as its platform tv and movie business. As our company moves forward with its sports and music memorabilia-related business operations, as well as the Maybacks tv and movie platform, we will be subject to risks and difficulties frequently encountered by early-stage business enterprises, such as our company.

Unanticipated problems, expenses and delays are frequently encountered in establishing a new business, along with developing new products and services. We may not be successful in addressing some or all of those risks, in which case there could be a material negative effect on our business and the value of our common stock that could also cause our company to reduce, curtail or cease operations. Our company may never become profitable if revenue is lower and operating expenses are higher than anticipated.

Risks Related to Our Organization and Structure

Our holding company structure makes us dependent on our subsidiaries for our cash flow and could serve to subordinate the rights of our shareholders to the rights of creditors of our subsidiaries, in the event of an insolvency or liquidation of any such subsidiary. Our company acts as a holding company and, accordingly, substantially all of our operations are conducted through our subsidiaries. Such subsidiaries will be separate and distinct legal entities. As a result, substantially all of our cash flow will depend upon the earnings of our subsidiaries. In addition, we will depend on the distribution of earnings, loans or other payments by our subsidiaries. No subsidiary will have any obligation to provide our company with funds for our payment obligations. If there is an insolvency, liquidation or other reorganization of any of our subsidiaries, our shareholders will have no right to proceed against their assets. Creditors of those subsidiaries will be entitled to payment in full from the sale or other disposal of the assets of those subsidiaries before our company, as a shareholder, would be entitled to receive any distribution from that sale or disposal.

Risks Related Our Securities

The outstanding shares of our Class B Convertible Preferred Stock preclude current and future owners of our common stock from influencing any corporate decision. Our President, Christopher Giordano, and our CEO, Paul Serbiak, own all of the 400,000 outstanding shares of our Class B Convertible Preferred Stock. The Class B Convertible Preferred Stock has the following voting rights: each share of Class B Convertible Preferred Stock votes together with our common stock as a single class and is entitled to 10,000 votes per share. Mr. Giordano and Mr. Serbiak will, therefore, be able to control the management and affairs of our company, as well as matters requiring the approval by our shareholders, including the election of directors, any merger, consolidation or sale of all or substantially all of our assets, and any other significant corporate transaction. (See “Security Ownership of Certain Beneficial Owners and Management”).

We have established preferred stock, which our Board of Directors can designate and issue without shareholder approval. We have outstanding 600,000 shares of preferred stock, with 400,000 shares as Class B Convertible Preferred Stock, 100,000 shares as Class C Preferred Stock and 100,000 shares as Class D Preferred stock. We have remaining 400,000 shares of preferred stock authorized but undesignated. These shares of undesignated preferred stock may be issued by our Board of Directors from time to time, in one or more series, each series of which shall have such voting powers, full or limited, or no voting powers, and such preferences and relative, participating, optional or other special rights and such qualifications, limitations or restrictions thereof as adopted by our Board of Directors. Our Board of Directors is able to designate the powers and preferences of any such series of preferred stock without shareholder approval.

We have approximately $1,388,536 in currently convertible debt instruments, the existence and/or conversion of which could cause a reduction in the market price for our common stock. As of the date of this Annual Report, we have approximately $1,388,536 in currently convertible debt instruments, the conversion terms of which require share issuances at below-market prices. All such shares constitute an overhang on the market for our common stock and, if and when issued, will be issued without transfer restrictions, pursuant to certain exemptions from registration, and could reduce prevailing market prices for our common stock. Also, in the future, we may also issue securities in connection with our obtaining needed capital or an acquisition transaction. The amount of shares of our common stock issued in connection with any such transaction could constitute a material portion of our then-outstanding shares of common stock.

Our failure to reserve sufficient shares of common stock could be considered an event of default. We have existing convertible promissory notes with a covenant to reserve sufficient shares of common stock with our transfer agent for the potential conversion of these securities. As of the date of this Annual Report, the calculated shares issuable under the assumed conversion of the promissory notes is greater than the amount of shares that we have reserved with respect to such convertible promissory notes. As a result, the holders of such convertible promissory notes could declare an event of default and the principal and accrued interest would become immediately due and payable. Additionally, the holders of such convertible promissory notes have additional remedies, including penalties against our company.

We may seek capital that may result in shareholder dilution or that may have rights senior to those of our common stock. From time to time, we may seek to obtain additional capital, either through equity, equity-linked or debt securities. The decision to obtain additional capital will depend on, among other factors, our business plans, operating performance and condition of the capital markets. If we raise additional funds through the issuance of equity, equity-linked or debt securities, those securities may have rights, preferences or privileges senior to the rights of our common stock, which could negatively affect the market price of our common stock or cause our shareholders to experience dilution.

Shares eligible for future sale may adversely affect the market. From time to time, certain of our shareholders may be eligible to sell all or some of their shares of common stock by means of ordinary brokerage transactions in the open market pursuant to Rule 144, promulgated under the Securities Act, subject to certain limitations. In general, a non-affiliate stockholder who has satisfied a six-month holding period may, under certain circumstances, sell its shares, without limitation. Any substantial sale of the our common stock pursuant to Rule 144, pursuant to any resale prospectus may have a material adverse effect on the market price of our common stock.

We do not intend to pay dividends on our common stock. We intend to retain earnings, if any, to provide funds for the implementation of our business strategy. We do not intend to declare or pay any dividends in the foreseeable future. Therefore, there can be no assurance that holders of our common stock will receive cash, stock or other dividends on their shares of our common stock, until we have funds which our Board of Directors determines can be allocated to dividends.

Our common stock has been, and may in the future be, a “Penny Stock” and subject to specific rules governing its sale to investors. The SEC has adopted Rule 15g-9 which establishes the definition of a “penny stock,” for the purposes relevant to our Common Stock, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require that a broker or dealer approve a person’s account for transactions in penny stocks; and the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

In order to approve a person’s account for transactions in penny stocks, the broker or dealer must obtain financial information and investment experience objectives of the person; and make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which, in highlight form sets forth the basis on which the broker or dealer made the suitability determination; and that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors sell shares of our common stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

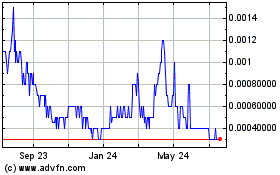

There is limited trading activity in our common stock and there is no assurance that an active market will develop in the future. Although our common stock is currently quoted on the OTC Pink marketplace of OTC Link (an interdealer electronic quotation system operated by OTC Markets Group, Inc.) under the symbol “AHRO”, trading of our common stock may be extremely sporadic. For example, several days may pass before any shares may be traded. As a result, an investor may find it difficult to dispose of, or to obtain accurate quotations of the price of our common stock. There can be no assurance that a more active market for our common stock will develop, or if one should develop, there is no assurance that it will be sustained. This severely limits the liquidity of our common stock, and would likely have a material adverse effect on the market price of our common stock and on our ability to raise additional capital.

The market for our common stock may be volatile; you could lose all or part of your investment in company. The market price of our common stock may fluctuate substantially and will depend on a number of factors many of which are beyond our control and may not be related to our operating performance. These fluctuations could cause you to lose all or part of your investment in the company, since you might be unable to sell your securities at or above the price you pay for shares. Factors that could cause fluctuations in the market price of our common stock include, but are not limited to, the following:

| - | price and volume fluctuations in the overall stock market from time to time; |

| | |

| - | volatility in the market prices and trading volumes of sports and music memorabilia stocks; |

| | |

| - | changes in operating performance and stock market valuations of other sports and music memorabilia-related companies generally, or those in our industry, in particular; |

| | |

| - | sales of shares of our common stock by us or our shareholders; |

| | |

| - | failure of securities analysts to maintain coverage of us, changes in financial estimates by securities analysts who follow our company, or our failure to meet these estimates or the expectations of investors; |

| | |

| - | the financial projections we may provide to the public, any changes in those projections or our failure to meet those projections; |

| | |

| - | announcements by us or our competitors of new products or services; |

| | |

| - | the public’s reaction to our press releases, other public announcements and filings with the SEC; |

| | |

| - | rumors and market speculation involving us or other companies in our industry; |

| | |

| - | actual or anticipated changes in our operating results or fluctuations in our operating results; |

| | |

| - | actual or anticipated developments in our business, our competitors’ businesses or the competitive landscape generally; |

| | |

| - | litigation involving us and/or our industry, or investigations by regulators into our operations or those of our competitors; |

| - | developments or disputes concerning our intellectual property or other proprietary rights; |

| | |

| - | announced or completed acquisitions of businesses or technologies by us or our competitors; |

| | |

| - | new laws or regulations or new interpretations of existing laws or regulations applicable to our business; |

| | |

| - | changes in accounting standards, policies, guidelines, interpretations or principles; |

| | |

| - | any significant change in our management; and |

| | |

| - | general economic conditions and slow or negative growth of our markets. |

In addition, in the past, following periods of volatility in the overall market and the market price of a particular company’s securities, securities class action litigation has often been instituted against these companies. This litigation, if instituted against us, could result in substantial costs and a diversion of our management’s attention and resources.

Compliance with the reporting requirements of federal securities laws can be expensive. We are a public reporting company in the United States, and accordingly, subject to the information and reporting requirements of the Exchange Act and other federal securities laws, and the compliance obligations of the Sarbanes-Oxley Act. The costs of preparing and filing annual and quarterly reports and other required information with the SEC, furnishing audited reports to shareholders and preparing any registration statements from time to time, if any, are substantial.

Applicable regulatory requirements, including those contained in and issued under the Sarbanes-Oxley Act of 2002, may make it difficult for us to retain or attract qualified officers and directors, which could adversely affect the management of our business and our ability to obtain or retain listing of our common stock. We may be unable to attract and retain those qualified officers, directors and members of board committees required to provide for effective management because of the rules and regulations that govern publicly held companies, including, but not limited to, certifications by principal executive officers. The enactment of the Sarbanes-Oxley Act has resulted in the issuance of a series of related rules and regulations and the strengthening of existing rules and regulations by the SEC, as well as the adoption of new and more stringent rules by the stock exchanges. The perceived increased personal risk associated with these changes may deter qualified individuals from accepting roles as directors and executive officers.

Further, some of these changes heighten the requirements for board or committee membership, particularly with respect to an individual’s independence from the corporation and level of experience in finance and accounting matters. While certain board and committee requirements may not apply to us as an OTC listed company, we intend to explore voluntarily complying with some of these requirements. We may have difficulty attracting and retaining directors with the requisite qualifications. If we are unable to attract and retain qualified officers and directors, the management of our business and our ability to obtain or retain listing of our shares of common stock on any stock exchange (assuming we elect to seek and are successful in obtaining such listing) could be adversely affected.

If we fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results or detect fraud, and, consequently, investors could lose confidence in our financial reporting and this may decrease the trading price of our common stock. We must maintain effective internal controls to provide reliable financial reports and detect fraud. We have been assessing our internal controls to identify areas that need improvement. We are in the process of implementing changes to internal controls, but have not yet completed implementing these changes. Failure to implement these changes to our internal controls or any others that it identifies as necessary to maintain an effective system of internal controls could harm our operating results and cause investors to lose confidence in our reported financial information. Any such loss of confidence would have a negative effect on the trading price of our stock.

A material weakness in internal controls may remain undetected for a longer period, because of our exemption from the auditor attestation requirements under Section 404(b) of Sarbanes-Oxley. Our Annual Report on Form 10-K does not include an attestation report of our independent registered public accounting firm regarding internal control over financial reporting. Our management’s report was not subject to attestation by our registered public accounting firm, pursuant to rules of the SEC that permit us to provide only management’s attestation with respect thereto. As a result, any material weakness in our internal controls may remain undetected for a longer period.

Our Articles of Incorporation allows for our board to create new series of preferred stock without further approval by our shareholders, which could adversely affect the rights of the holders of our common stock, including purchasers of the Offered Shares. Our board of directors has the authority to issue shares of our preferred stock, with such relative rights and preferences as the board of directors may determine, without further shareholder approval. As a result, our board of directors could authorize the issuance of a series of preferred stock that would grant to holders the preferred right to our assets upon liquidation and the right to receive dividend payments before dividends are distributed to the holders of our common stock. In addition, our board of directors could authorize the issuance of a series of preferred stock that has greater voting power than our common stock or that is convertible into our common stock, which could decrease the relative voting power of our common stock or result in dilution to our existing shareholders.

Future issuances of debt securities and equity securities could negatively affect the market price of shares of our common stock and, in the case of equity securities, may be dilutive to existing shareholders. In the future, we may issue debt or equity securities or incur other financial obligations, including stock dividends. Upon liquidation, it is possible that holders of our debt securities and other loans and preferred stock would receive a distribution of our available assets before common shareholders. We are not required to offer any such additional debt or equity securities to existing shareholders on a preemptive basis. Therefore, additional common stock issuances, directly or through convertible or exchangeable securities, warrants or options, would dilute the holdings of our existing common shareholders and such issuances, or the perception of such issuances, could reduce the market price of shares of our common stock.

As an issuer of penny stock, the protection provided by the federal securities laws relating to forward-looking statements does not apply to us. Although federal securities laws provide a safe harbor for forward-looking statements made by a public company that files reports under the federal securities laws, this safe harbor is not available to issuers of penny stocks. As a result, we will not have the benefit of this safe harbor protection, in the event of any legal action based upon a claim that the material provided by us contained a material misstatement of fact or was misleading in any material respect because of our failure to include any statements necessary to make the statements not misleading. Such an action could hurt our financial condition.

Item 1B. Unresolved Staff Comments

As a “smaller reporting company”, we are not required to provide the information required by this Item.

Item 1C. Cybersecurity

We rely on our information technology to operate our business. As such, we have policies and processes designed to protect our information technology systems, some of which are managed by third parties, and resolve issues in a timely manner in the event of a cybersecurity threat or incident.

We have designed our business applications and hosting services to minimize the impact that cybersecurity incidents could have on our business and have identified back-up systems where appropriate. We seek to further mitigate cybersecurity risks through a combination of monitoring and detection activities, use of anti-malware applications, employee training, quality audits and communication and reporting structures, among other processes. We engage a third-party consultant to assist us with our cybersecurity risk management framework, including the monitoring and detection of cybersecurity threats and responding to any cybersecurity threats or incidents. Our third-party consultant team is managed by our Chief Executive Officer who reports to the board of directors.

As of December 31, 2023, we have not identified an indication of a cybersecurity incident that would have a material impact on our business and consolidated financial statements.

Item 2. Properties